Kuwait Access Control Systems Market (2025-2031) | Growth, Size, Companies, Forecast, Value, Revenue, Analysis, Industry, Outlook, Trends & Share

Market Forecast By Access Control Systems (Biometric (Fingerprint, Facial Recognition, Iris Scanning), Card-Based Access Control, Keypad-Based Access Control, Multi-Factor Authentication)), By Applications (Commercial (Offices, Shopping Malls, Banks), Residential (Apartments, Gated Communities), Industrial (Factories, Warehouses), Government & Defense (Military Bases, Government Buildings)), By Regions (Kuwait City, Al Ahmadi, Hawalli, Farwaniya, Jahra) And Competitive Landscape

| Product Code: ETC000267 | Publication Date: Sep 2015 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 117 | No. of Figures: 69 | No. of Tables: 21 | |

Kuwait Access Control Systems Market Highlights

| Report Name | Kuwait Access Control Systems Market |

| Forecast period | 2025-2031 |

| CAGR | 7.5% |

| Growing Sector | Biometric Access Control Systems |

Topics Covered in the Kuwait Access Control Systems Market Report

The Kuwait Access Control Systems Market report thoroughly covers the market By Access Control Systems, Applications and Regions The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Kuwait Access Control Systems Market Synopsis

Kuwait is experiencing significant growth in the deployment of access control systems due to heightened security concerns and the need to protect critical assets. The construction of new cities and expansion of existing infrastructures have led to increased demand for advanced security solutions. The market is witnessing a shift from traditional card-based systems to more sophisticated biometric technologies, reflecting a trend towards enhanced security and efficiency.

According to 6Wresearch, The Kuwait Access Control Systems Market is projected to growing at a CAGR of 7.5% during the forecast period 2025-2031. The primary driver of the Kuwait Access Control Systems Market is the escalating need for robust security solutions across various sectors, including government, commercial, and residential. The government's substantial investments in infrastructure projects, such as the development of new cities and modernization of existing facilities, have necessitated the implementation of advanced access control systems to ensure the safety and security of assets and individuals. Technological advancements, particularly in biometric access control systems, have significantly contributed to market growth. Biometric systems offer higher security levels by utilizing unique physiological characteristics, reducing the risk of unauthorized access. The declining costs of these technologies have made them more accessible, encouraging their adoption across various sectors. This trend is reflected in the Kuwait Access Control Systems Market Growth.

However, the market faces challenges such as the high initial costs associated with the installation and maintenance of advanced access control systems. Additionally, a lack of awareness about the benefits of these systems among smaller enterprises and residential users can hinder market growth. Ensuring user privacy, especially with biometric systems, also poses a challenge, necessitating strict data protection measures. The integration of access control systems with existing security infrastructure can be complex and may require significant technical expertise. Moreover, the rapid pace of technological advancements necessitates continuous upgrades, which can be resource-intensive for organizations. Despite these challenges, the increasing emphasis on security and the benefits offered by advanced access control systems are expected to drive market growth.

Kuwait Access Control Systems Market Trends

A notable trend in the Kuwait Access Control Systems Market is the growing preference for biometric access control systems. Organizations are increasingly adopting fingerprint, facial recognition, and iris scanning technologies to enhance security measures. These systems offer higher accuracy and efficiency compared to traditional methods, contributing to their rising popularity. Another significant trend is the integration of access control systems with other security solutions, such as video surveillance and intrusion detection systems. This integration provides a comprehensive security approach, allowing for real-time monitoring and response to security breaches. The adoption of cloud-based access control solutions is also gaining traction, offering benefits such as remote management, scalability, and cost-effectiveness.

Investment Opportunities in the Kuwait Access Control Systems Market

The ongoing infrastructure development projects in Kuwait present significant investment opportunities in the access control systems market. The construction of new cities and the expansion of commercial and residential spaces require advanced security solutions, creating a demand for innovative access control systems. Investors can explore opportunities in the development and deployment of biometric access control systems, which are witnessing increased adoption due to their enhanced security features. Additionally, the growing trend of integrating access control systems with other security solutions offers avenues for investment in comprehensive security platforms.

Leading Players in the Kuwait Access Control Systems Market

Prominent players in the Kuwait Access Control Systems Market include Bosch Security Systems, Honeywell International Inc., and Lenel Systems. These companies offer a wide range of access control solutions and have a strong presence in the market. They focus on continuous innovation and strategic partnerships to enhance their product offerings and expand their market share.

Government Regulations in the Kuwait Access Control Systems Market

The Kuwaiti government has implemented stringent regulations to enhance security across various sectors. These regulations mandate the adoption of advanced access control systems in critical infrastructures, including government buildings, airports, and financial institutions. Compliance with these regulations is essential for organizations to operate legally and ensure the safety of their assets and personnel. The government also emphasizes the protection of personal data, especially concerning biometric information used in access control systems. Organizations are required to implement robust data protection measures to prevent unauthorized access and misuse of personal information. Non-compliance with these regulations can result in legal penalties and damage to the organization's reputation. Furthermore, the government supports the adoption of advanced security technologies through various initiatives and funding programs.

Future Insights of the Kuwait Access Control Systems Market

The Kuwait Access Control Systems Market is poised for significant growth in the coming years. The increasing adoption of biometric technologies is expected to continue, driven by their superior security features and declining costs. The integration of access control systems with other security solutions will become more prevalent, offering comprehensive security management capabilities. The demand for cloud-based access control solutions is anticipated to rise, offering benefits such as remote access, scalability, and reduced infrastructure costs. Organizations are likely to invest in upgrading their existing access control systems to more advanced and integrated solutions to enhance security and comply with government regulations. The focus on user-friendly and customizable access control solutions will increase, catering to the specific needs of different sectors. The development of mobile-based access control applications is also expected to gain traction, providing users with convenient and flexible access management options.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Biometric Systems to Dominate the Market – By Access Control Systems

According to Ashutosh, Senior Research Analyst, 6Wresearch, Biometric access control systems, including fingerprint, facial recognition, and iris scanning, are projected to dominate the Kuwait Access Control Systems Market. The rising adoption of biometric security solutions in commercial and government sectors is driving demand. These systems offer higher security compared to traditional card-based or keypad-based access controls.

Commercial Sector to Lead the Market – By Application

The commercial sector is expected to be the largest contributor to the access control systems market in Kuwait. Offices, shopping malls, and financial institutions are investing heavily in advanced security solutions to protect assets and personnel. The growing need for secure access management in corporate environments and the banking sector is fueling demand. Moreover, rising concerns about unauthorized access and data breaches are prompting commercial establishments to integrate sophisticated access control solutions.

Kuwait City to Hold the Largest Market Share – By Region

Kuwait City is anticipated to dominate the access control systems market, driven by its high concentration of commercial buildings, government institutions, and luxury residential properties. The city’s rapid urbanization and increasing adoption of smart security solutions in offices, retail spaces, and residential complexes contribute to the demand for access control systems. Additionally, ongoing infrastructure developments and smart city initiatives are expected to further propel market growth in Kuwait City.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2031 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kuwait Access Control Systems Market Outlook

- Market Size of Kuwait Access Control Systems Market, 2024

- Forecast of Kuwait Access Control Systems Market, 2031

- Historical Data and Forecast of China Low Voltage Electric Motor Revenues & Volume for the Period 2021-2031

- Kuwait Access Control Systems Market Trend Evolution

- Kuwait Access Control Systems Market Drivers and Challenges

- China Low Voltage Electric Motor Price Trends

- China Low Voltage Electric Motor Porter's Five Forces

- China Low Voltage Electric Motor Industry Life Cycle

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Access Control Systems for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Biometric for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Card-Based Access Control for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Keypad-Based Access Control for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Multi-Factor Authentication for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Commercial for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Residential for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Industrial for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Government & Defense for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Regions for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Kuwait City for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Al Ahmadi for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Hawalli for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Farwaniya for the Period 2021-2031

- Historical Data and Forecast of Kuwait Access Control Systems Market Revenues & Volume By Jahra for the Period 2021-2031

- China Low Voltage Electric Motor Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Products

- Market Opportunity Assessment By Applications

- China Low Voltage Electric Motor Top Companies Market Share

- China Low Voltage Electric Motor Competitive Benchmarking By Technical and Operational Parameters

- China Low Voltage Electric Motor Company Profiles

- China Low Voltage Electric MotorKey Strategic Recommendations

Markets Covered

The report offers a comprehensive analysis of the following market segments

By Access Control Systems:

- Biometric (Fingerprint, Facial Recognition, Iris Scanning)

- Card-Based Access Control

- Keypad-Based Access Control

- Multi-Factor Authentication

By Applications:

- Commercial (Offices, Shopping Malls, Banks)

- Residential (Apartments, Gated Communities)

- Industrial (Factories, Warehouses)

- Government & Defense (Military Bases, Government Buildings)

By Regions:

- Kuwait City

- Al Ahmadi

- Hawalli

- Farwaniya

- Jahra

Kuwait Access Control Systems Market (2025-2031): FAQs

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Methodology Adopted and Key Data Points

2.5 Assumptions

3 Global Access Control Market Overview

3.1 Global Access Control Market Revenues (2010-2021F)

3.2 Global Access Control Market Volume (2010-2021F)

3.3 Global Access Control Market Revenue Share, By Region (2014)

4 Kuwait Access Control Market Overview

4.1 Kuwait Access Control Market Revenues (2010-2021F)

4.2 Kuwait Access Control Market Volume (2010-2021F)

4.3 Kuwait Access Control Industry Life Cycle

4.4 Kuwait Access Control Market Opportunistic Matrix

4.5 Kuwait Access Control Market Porter's Five Forces Analysis

4.6 Kuwait Access Control Market Revenue Share, By Type (2014 & 2021F)

4.7 Kuwait Access Control Market Revenue Share, By Vertical (2014 & 2021F)

4.8 Kuwait Access Control Market Revenue Share, By Region (2014 & 2021F)

5 Kuwait Access Control Market Dynamics

5.1 Market Drivers

5.1.1 Growing Unrest in the Region

5.1.2 Growing Construction Market

5.2 Market Restraints

5.2.1 Growing Demand for Video Surveillance Systems

5.2.2 Biometric Effect on Access Control Systems

6 Kuwait Access Control Market Trends

6.1 Next Generation Boom Barriers

6.2 Near Field Communication

7 Kuwait Access Control Card Readers Market Overview

7.1 Kuwait Access Control Card Reader Market Revenues & Volume (2010-2014)

7.2 Kuwait Access Control Card Reader Market Revenues & Volume (2015E-2021F)

7.3 Kuwait Access Control Card Reader Market Revenue Share, By Type (2014 & 2021F)

7.3.1 Kuwait Card Reader Access Control Market Revenues, By Type (2010-2021F)

7.4 Kuwait Card Reader Access Control Market Revenue Share, By Vertical (2014 & 2021F)

7.4.1 Kuwait Card Reader Access Control Market Revenue, By Vertical (2010-2021F)

7.5 Kuwait Access Control Card Reader Market Price Trend

7.5.1 Kuwait Contact Card Reader Access Control Market Price Trend

7.5.2 Kuwait Contactless Card Reader Access Control Market Price Trend

8 Kuwait Biometric Access Control Market Overview

8.1 Kuwait Biometric Access Control Market Revenues & Volume (2010-2014)

8.2 Kuwait Biometric Access Control Market Revenues & Volume (2015E-2021F)

8.3 Kuwait Biometric Access Control Market Revenue Share, By Type (2014 & 2021F)

8.3.1 Kuwait Biometric Access Control Market Revenues, By Type (2010-2021F)

8.4 Kuwait Biometric Access Control Market Revenue Share, By Vertical (2014 & 2021F)

8.4.1 Kuwait Biometric Access Control Market Revenues, By Vertical (2010-2021F)

8.5 Kuwait Biometric Access Control Market Price Trend

8.5.1 Kuwait Fingerprint Biometric Access Control System Price Trend

8.5.2 Kuwait IRIS Biometric Access Control System Price Trend

8.5.3 Kuwait Hand/Pam-Print Biometric Access Control System Price Trend

8.5.4 Kuwait Vein Biometric Access Control System Price Trend

9 Kuwait Other Access Control Market Overview

9.1 Kuwait Other Access Control Market Revenues & Volume (2010-2014)

9.2 Kuwait Other Access Control Market Revenues & Volume (2015E-2021F)

9.3 Kuwait Other Access Control Market Revenue Share, By Type (2014 & 2021F)

9.3.1 Kuwait Other Access Control Market Revenues, By Type (2010-2021F)

9.4 Kuwait Other Access Control Market Revenue Share, By Vertical (2014 & 2021F)

9.4.1 Kuwait Other Access Control Market Revenues, By Vertical (2010-2021F)

9.5 Kuwait Other Access Control Market Price Trend

9.5.1 Kuwait Keypad Access Control System Price Trend

9.5.2 Kuwait Electronic Locks Access Control System Price Trend

9.5.3 Kuwait Boom barrier Access Control System Price Point Trend

10 Kuwait Access Control Market Overview, By Vertical

10.1 Kuwait Banking & Financial Access Control Market Revenues (2010-2021F)

10.2 Kuwait Government & Transportation Access Control Market Revenues (2010-2021F)

10.3 Kuwait Retail & Logistics Access Control Market Revenues (2010-2021F)

10.4 Kuwait Commercial Offices Access Control Market Revenues (2010-2021F)

10.5 Kuwait Industrial & Manufacturing Access Control Market Revenues (2010-2021F)

10.6 Kuwait Residential Access Control Market Revenues (2010-2021F)

10.7 Kuwait Hospitality & Healthcare Access Control Market Revenues (2010-2021F)

10.8 Kuwait Education Access Control Market Revenues (2010-2021F)

11 Kuwait Access Control Market Overview, By Governorates

11.1 Al-Ahmadi Access Control Market Revenues (2010-2021F)

11.2 Al-Farwaniya Access Control Market Revenues (2010-2021F)

11.3 Al-Jahra Access Control Market Revenues (2010-2021F)

11.4 Al-Kuwayt Access Control Market Revenues (2010-2021F)

11.5 Al-Hawalli Access Control Market Revenues (2010-2021F)

11.6 Mubarak Al-Kabeer Access Control Market Revenues (2010-2021F)

12 Competitive Landscape

12.1 Competitive Positioning

12.2 Kuwait Access Control Market Revenue Share, By Company (2014)

12.3 Competitive Benchmarking, By Technology and Operating Parameters

13 Competitive Landscape

13.1 Bosch Security Systems, Inc.

13.2 FingerTec Worldwide Limited.

13.3 Honeywell International Inc.

13.4 Lenel Systems International Inc.

13.5 Morpho SA

14 Key Strategic Pointers

15 Disclaimer

List of Figures

Figure 1 Global Access Control Market Revenues, 2010-2014 ($ Billion)

Figure 2 Global Access Control Market Revenues, 2015E-2021F ($ Billion)

Figure 3 Global Access Control Market Volume, 2010-2021F (Thousand Units)

Figure 4 Global Access Control Market Revenue Share, By Region (2014)

Figure 5 Kuwait Access Control Market Revenues, 2010-2014 ($ Million)

Figure 6 Kuwait Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 7 Kuwait Access Control Market Volume, 2010-2014 (Thousand Units)

Figure 8 Kuwait Access Control Market Volume, 2015E-2021F (Thousand Units)

Figure 9 Kuwait Access Control Industry Life Cycle

Figure 10 Kuwait Access Control Market Revenue Share, By Type (2014)

Figure 11 Kuwait Access Control Market Revenue Share, By Type (2021F)

Figure 12 Kuwait Access Control Market Revenue Share, By Vertical (2014)

Figure 13 Kuwait Access Control Market Revenue Share, By Vertical (2021F)

Figure 14 Kuwait Access Control Market Revenue Share, By Region (2014 & 2021F)

Figure 15 Kuwait Construction Market Revenues 2010-2021F ($ Billion)

Figure 16 Kuwait Card Reader Access Control Market Revenues & Volume, 2010-2014 ($ Million and Thousand Units)

Figure 17 Kuwait Card Reader Access Control Market Revenues & Volume, 2015E-2021F ($ Million and Thousand Units)

Figure 18 Kuwait Card Reader Access Control Market Revenue Share, By Type (2014)

Figure 19 Kuwait Card Reader Access Control Market Revenue Share, By Type (2021F)

Figure 20 Kuwait Card Reader Access Control Market Revenue Share, By Vertical (2014)

Figure 21 Kuwait Card Reader Access Control Market Revenue Share, By Vertical (2021F)

Figure 22 Kuwait Contact Access Control Card Reader Market Price Trend, 2010-2021F ($ Per Unit)

Figure 23 Kuwait Contactless Access Control Card Reader System Price Trend, 2010-2021F ($ Per Unit)

Figure 24 Kuwait Biometric Access Control Market Revenues & Volume, 2010-2014 ($ Million and Thousand Units)

Figure 25 Kuwait Biometric Access Control Market Revenues & Volume, 2010-2014 ($ Million and Thousand Units)

Figure 26 Kuwait Biometric Access Control Market Revenue Share, By Type (2014)

Figure 27 Kuwait Biometric Access Control Market Revenue Share, By Type (2021F)

Figure 28 Kuwait Biometric Access Control Market Revenue Share, By Vertical (2014)

Figure 29 Kuwait Biometric Access Control Market Revenue Share, By Vertical (2021F)

Figure 30 Kuwait Fingerprint Biometric Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 31 Kuwait IRIS Biometric Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 32 Kuwait Hand/ Palm-Print Biometric Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 33 Kuwait Vein Biometric Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 34 Kuwait Other Access Control System Market Revenues & Volume, 2010-2014 ($ Million and Thousand Units)

Figure 35 Kuwait Other Access Control System Market Revenues & Volume, 2015-2021F ($ Million and Thousand Units)

Figure 36 Kuwait Other Access Control System Market Revenue Share, By Type, 2014

Figure 37 Kuwait Other Access Control System Market Revenue Share, By Type, 2021F

Figure 38 Kuwait Other Access Control System Market Revenue Share, By Vertical, 2014

Figure 39 Kuwait Other Access Control System Market Revenue Share, By Vertical, 2021F

Figure 40 Kuwait Keypad Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 41 Kuwait Electronic Lock Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 42 Kuwait Boom Barrier Access Control Market Price Trend, 2010-2021F ($ Per Unit)

Figure 43 Kuwait Banking & Financials' Access Control Market Revenues, 2010-2021F ($ Million)

Figure 44 Kuwait Government & Transportation Access Control Market Revenues, 2010-2021F ($ Million)

Figure 45 Kuwait Retail & Logistics' Access Control Market Revenues, 2010-2021F ($ Million)

Figure 46 Kuwait Commercial Offices' Access Control Market Revenues, 2010-2021F ($ Million)

Figure 47 Kuwait Industrial & Manufacturing Access Control Market Revenues, 2010-2021F ($ Million)

Figure 48 Kuwait Residential Access Control Market Revenues, 2010-2021F ($ Thousand)

Figure 49 Kuwait Hospitality & Healthcare Access Control Market Revenues, 2010-2021F ($ Million)

Figure 50 Kuwait Educational Institutions' Access Control Market, 2010-2021F ($ Million)

Figure 51 Al-Ahmadi Access Control Market Revenues, 2010-2014 ($ Million)

Figure 52 Al-Ahmadi Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 53 Al-Ahmadi Construction Spending Share, By Vertical (2015E-2021F)

Figure 54 Al-Farwaniya Access Control Market Revenues, 2010-2014 ($ Million)

Figure 55 Al-Farwaniya Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 56 Al-Farwaniya Construction Spending Share, By Vertical (2015E-2021F)

Figure 57 Al-Jahra Access Control Market Revenues, 2010-2014 ($ Million)

Figure 58 Al-Jahra Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 59 Al-Jahra Construction Spending Share, By Vertical (2015E-2021F)

Figure 60 Al-Kuwayt Access Control Market Revenues, 2010-2014 ($ Million)

Figure 61 Al-Kuwayt Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 62 Al-Kuwayt Construction Spending Share, By Vertical (2015E-2021F)

Figure 63 Hawalli Access Control Market Revenues, 2010-2014 ($ Million)

Figure 64 Hawalli Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 65 Hawalli Construction Spending Share, By Vertical (2015E-2021F)

Figure 66 Mubarak Al-Kabeer Access Control Market Revenues, 2010-2014 ($ Million)

Figure 67 Mubarak Al-Kabeer Access Control Market Revenues, 2015E-2021F ($ Million)

Figure 68 Mubarak Al-Kabeer Construction Spending Share, By Vertical (2015E-2021F)

Figure 69 Kuwait Access Control Market Revenue Share, By Company (2014)

List of Tables

Table 1 Global Access Control Market Revenues, By Region, 2010-2014 ($ Billion)

Table 2 Global Access Control Market Revenues, By Region, 2015E-2021F ($ Billion)

Table 3 Kuwait Card Reader Access Control Market Revenues, By Type, 2010-2014 ($ Million)

Table 4 Kuwait Access Control Card Reader Market Revenues, By Type, 2015E-2021F ($ Million)

Table 5 Kuwait Card Reader Access Control Market Revenues, By Vertical, 2010-2014 ($ Million)

Table 6 Kuwait Card Reader Access Control Market Revenues, By Vertical, 2015E-2021F ($ Million)

Table 7 Kuwait Biometrics Access Control Market Revenues, By Type, 2010-2014 ($ Thousand)

Table 8 Kuwait Biometrics Access Control Market Revenues, By Type, 2015E-2021F ($ Thousand)

Table 9 Kuwait Biometric Access Control Market Revenues, By Vertical, 2010-2014 ($ Thousand)

Table 10 Kuwait Biometric Access Control Market Revenues, By Vertical, 2015E-2021F ($ Thousand)

Table 11 Kuwait Other Access Control Market Revenues, By Type, 2010-2014 ($ Million)

Table 12 Kuwait Other Access Control Market Revenues, By Type, 2015E-2021F ($ Million)

Table 13 Kuwait Other Access Control Market Revenues, By Vertical, 2010-2014 ($ Million)

Table 14 Kuwait Other Access Control Market Revenues, By Vertical, 2015E-2021F ($ Million)

Table 15 Kuwait Construction Projects Value, By Vertical ($ Billion)

Table 16 List of Access Control Systems Installations in Kuwait

Table 17 Kuwait List of Under Construction and Completed Residential Projects

Table 18 Kuwait Hospitality & Healthcare Under Construction Projects, 2010-2021F ($ Million)

Table 19 Kuwait Access Control Market Revenue Share of Top 3 Players, 2014 ($ Million)

Table 20 Robert Bosch Financial Statement, 2012-2014 ($ Billion)

Table 21 Honeywell International Inc., 2011-2014 ($ Billion)

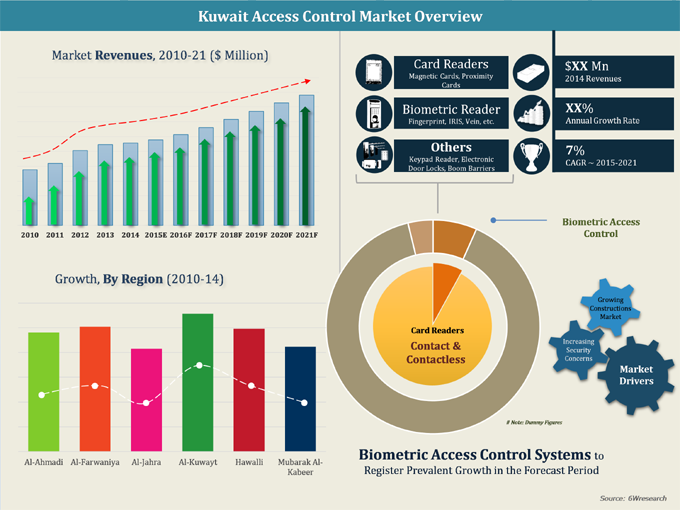

Kuwait is one of the prime growing economies amongst GCC countries. On account of growing construction market, along with rising security concerns, Kuwait witnessed sharp increase in deployment of various electronic security systems. Electronic security systems mainly consist of Video Surveillance, Access Control and Intrusion Detection Systems (IDS), where in Kuwait, video surveillance segment generated majority of the market demand. Access control systems on the contrary is emerging as a potential market in Kuwait, attributed to construction of three new cities- Silk City (Madinat Al-Hareer), Sabah Al Ahmad and Al Khiran Pearl City. Kuwait's access control market mainly comprises of card and biometric access control systems, wherein card access control systems held majority of the market share.

Biometric access control is one of the fastest growing segments in the overall access control market of Kuwait, where fingerprint modality based access control readers accounted for prevalent demand in 2014 and is further anticipated to dominate the overall sales over the next six years. Majority of the demand for access control systems has been generated from commercial office vertical.

Major companies in Kuwait's access control market include- Bosch Security Systems, FingerTec, Honeywell, Lenel Systems and Morpho (Safran).

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero