Kuwait Agriculture Equipment Market (2025-2031) | Outlook, Forecast, Analysis, Revenue, Industry, Value, Share, Trends, Growth, Size & Companies

Market Forecast By Products (Tractors (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Harvesters (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Threshers (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Pumps (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Power Tillers (Up To 30 HP And 30.1 HP- 70 HP), Rotavators (Up To 30 HP, 30.1 HP- 70 HP And 70.1 HP- 130 HP) And Others Including Rice Transplanters, Weeders, Excavators And Farm Carriers)) And Competitive Landscape

| Product Code: ETC160065 | Publication Date: Feb 2022 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

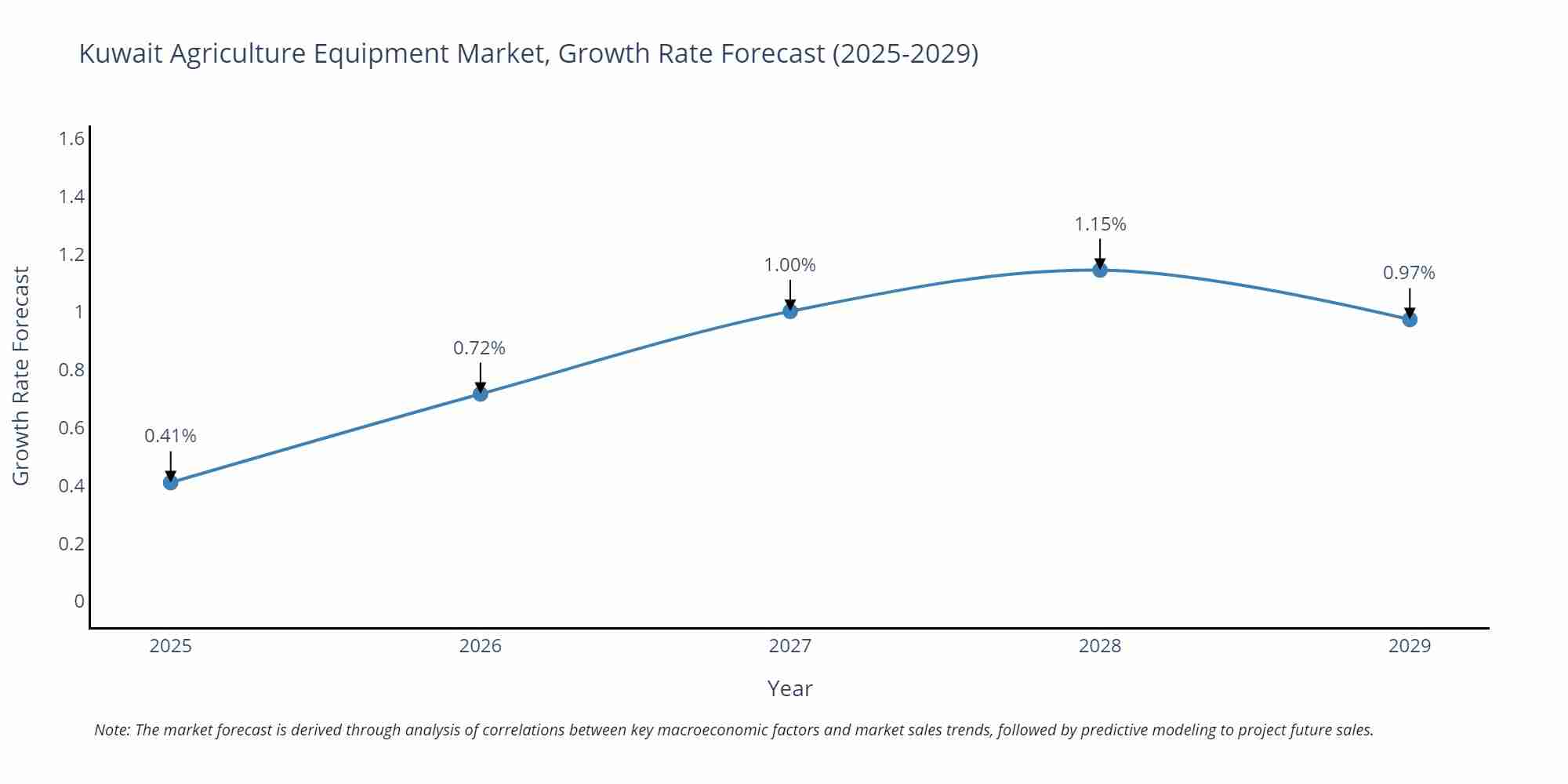

Kuwait Agriculture Equipment Market Size Growth Rate

The Kuwait Agriculture Equipment Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 1.15% in 2028, following an initial rate of 0.41%, before easing to 0.97% at the end of the period.

Kuwait Agriculture Equipment Market Highlights

| Report Name | Kuwait Agriculture Equipment Market |

| Forecast period | 2025-2031 |

| CAGR | 6.2% |

| Growing Sector | Agriculture |

Topics Covered in the Kuwait Agriculture Equipment Market Report

Kuwait Agriculture Equipment Market report thoroughly covers the market by product. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Kuwait Agriculture Equipment Market Synopsis

The Kuwait agriculture equipment market is expected to grow from 2025 and 2031, driven by the adoption of contemporary farming techniques and innovative machinery. Government initiatives, expanding demand for efficient irrigation systems, and a focus on increasing agricultural production are all critical factors to this rise, positioning the market for significant expansion in the future years.

According to 6Wresearch, Kuwait Agriculture Equipment Market size is expected to grow at a significant CAGR of 6.2% during 2025-2031. Kuwait's high reliance on food imports raises questions regarding how to lessen this reliance. The need for contemporary farming equipment has increased as a result of the boom in investments in agricultural infrastructure and cutting-edge technologies. Precision irrigation systems and cutting-edge gear are also becoming more popular as a result of the growing demand for effective farming methods to alleviate water constraint. The usage of environmentally friendly and resource-efficient technology is further encouraged by growing awareness of environmental sustainability. These factors collectively contribute to the Kuwait agriculture equipment market growth, positioning it for significant advancements in the coming years.

The Kuwait agriculture equipment market confronts a number of obstacles despite its potential for expansion. One of the main problems is the scarcity of arable land brought on by fast urbanization, which limits the use of large-scale machinery and inhibits agricultural expansion. A further obstacle is the high initial cost of contemporary agricultural equipment, which is particularly problematic for small-scale farmers who cannot afford sophisticated technology. This restricts their capacity to use contemporary farming methods and raise output. For Kuwait's agricultural equipment sector to continue expanding and developing, these issues must be resolved.

Kuwait Agriculture Equipment Market Trends

In recent years, the Kuwait agriculture equipment industry has experienced a trend toward precision farming methods. This entails integrating cutting-edge technology that maximize agricultural output, improve yield efficiency, and minimize resource waste, like GPS mapping, sensors, and drones. By enabling real-time crop and soil condition monitoring, these technologies help farmers manage their resources more effectively. Furthermore, there is a growing need for environmentally friendly and sustainable farming equipment that conserves energy and water, two essential resources. These developments are influencing Kuwaiti agriculture's future by promoting more productive and ecologically friendly farming methods.

Investment Opportunities in the Kuwait Agriculture Equipment Market

With the Kuwaiti government focusing on agriculture development, the farm equipment market offers numerous investment prospects. These include funding for the study and creation of cutting-edge technology as well as tactical alliances with regional producers to improve output capacities. Another important area for expansion is setting up distribution channels to increase market reach. Additionally, there is a growing market for old farm equipment, which presents chances for foreign businesses to enter the market and serve farmers on a budget. Due to these considerations, the market for agricultural equipment in Kuwait is a desirable opportunity for both domestic and foreign investors hoping to profit from the growth of the industry.

Leading Players in the Kuwait Agriculture Equipment Market

John Deere, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd., Kubota Corporation, and Escorts Limited are some of the major companies in the Kuwait agriculture equipment market. These companies are actively concentrating on product innovation to satisfy the changing demands of the market, providing cutting-edge equipment intended to increase farming sustainability and efficiency. Additionally, these businesses are increasing their market presence through strategic alliances with regional distributors and producers. These companies are establishing themselves as market leaders in Kuwait's expanding agricultural equipment industry by utilizing their technological know-how and establishing cooperative partnerships, meeting the need for cutting-edge farming solutions.

Government Regulations

The Kuwaiti government has actively promoted the agricultural industry through a variety of programs and regulations. Targets for boosting food self-sufficiency, promoting sustainable farming methods, and creating contemporary agricultural infrastructure are outlined in the National Development Plan 2021–2025. These initiatives aim to increase domestic production and lessen the nation's dependency on food imports. The government also offers incentives and subsidies to help farmers purchase cutting-edge equipment and technologies. This includes promoting the use of eco-friendly equipment, irrigation systems, and precision farming, all of which contribute to increased production, sustainability, and efficiency in the agricultural industry.

Future Insights of the Kuwait Agriculture Equipment Market

The future of the Kuwait agriculture equipment industry appears positive, due to an increasing emphasis on food security and sustainability. Advanced farming methods and environmentally friendly equipment will continue to be in high demand, which will present producers with chances to launch cutting-edge goods. Additionally, in an effort to satisfy the growing need for contemporary agricultural solutions, partnerships and collaborations between domestic and foreign businesses will increase. The market is expected to expand significantly over the next several years because to favorable government regulations and well-timed investments in agricultural infrastructure. All things considered, the industry offers rich prospects to stakeholders and investors, guaranteeing a prosperous future.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Tractors to dominate the Market – by Products

According to Ravi Bhandari, Research Head, 6Wresearch, tractors are anticipated to be the largest market segment in Kuwait for agricultural equipment, accounting for a sizeable portion of both revenue and volume. This is due to the growing use of mechanical farming technologies and government subsidies for tractor purchases.

Key Attractiveness

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kuwait Agriculture Equipment Market Outlook

- Kuwait Agriculture Equipment Market Overview

- Kuwait Agriculture Equipment Market Forecast

- Kuwait Agriculture Equipment Market Size

- Kuwait Agriculture Equipment Market Share, by-products

- Kuwait Agriculture Equipment Market Forecast of revenues until 2031

- Historical Data of Kuwait Agriculture Equipment Market Revenues and Volume, by-products for the Period 2021-2031

- Market Size & Forecast of Kuwait Agriculture Equipment Market Revenues and Volume, by-products until 2031

- Kuwait Tractor Market Revenue and Volume Share, By HP Range

- Historical Data of Kuwait Tractor Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Kuwait Tractor Market Revenues and Volume, By HP range until 2031

- Kuwait Harvester Market Revenue and Volume Share, By HP Range

- Historical Data of Kuwait Harvester Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Kuwait Harvester Revenue and Volume Share, By HP range until 2031

- Kuwait Thresher Market Revenue and Volume Share, By HP Range

- Historical Data of Kuwait Thresher Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Kuwait Thresher Market Revenues and Volume, By HP range until 2031

- Kuwait Pumps Market Revenue and Volume Share, By HP Range

- Historical Data of Kuwait Pumps Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Kuwait Pumps Market Revenues and Volume, By HP range until 2031

- Kuwait Power Tiller Market Revenue and Volume Share, By HP Range

- Historical Data of Kuwait Power Tiller Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Kuwait Power Tiller Market Revenues and Volume, By HP range until 2031

- Kuwait Rotavator Market Revenue and Volume Share, By HP Range

- Historical Data of Kuwait Rotavator Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Kuwait Rotavator Market Revenues and Volume, By HP range until 2031

- Kuwait Agriculture Equipment Market Drivers and Restraints

- Kuwait Agriculture Equipment Market Trends

- Porter’s Five Forces Analysis and Market Opportunity Assessment

- Kuwait Agriculture Equipment Market Share, by Companies

- Kuwait Agriculture Equipment Market Overview, by Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Market Covered

The Kuwait Agriculture Equipment market report provides a detailed analysis of the following market segments

By Product

Tractors

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

Harvesters

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

Threshers

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

Pumps

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

Power Tillers

-

- Up to 30 HP

- 30.1 HP- 70 HP

Rotavators

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- Others (Rice Transplanter, Weeders, Excavators and Farm Carriers)

Kuwait Agriculture Equipment Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Kuwait Agriculture Equipment Market Overview |

| 3.1. Kuwait Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 3.2. Kuwait Agriculture Equipment Market Industry Life Cycle, 2021 |

| 3.3. Kuwait Agriculture Equipment Market Porter’s Five Forces |

| 3.4. Kuwait Agriculture Equipment Market Revenue and Volume Share, By Equipment, 2020 & 2031F |

| 4. Kuwait Agriculture Equipment Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Kuwait Tractor Market Overview |

| 5.1. Kuwait Tractor Market Revenues and Volume, 2021-2031F |

| 5.2. Kuwait Tractor Market Revenue Share, By HP Range, 2020 & 2031F |

| 5.3. Kuwait Tractor Market Volume Share, By HP Range, 2020 & 2031F |

| 5.4. Kuwait Tractor Market Revenues and Volume, By HP Range, 2021-2031F |

| 5.5. Kuwait Tractor Market Price Trend, By HP Range, 2021-2031F |

| 6. Kuwait Harvester Market Overview |

| 6.1. Kuwait Harvester Market Revenues and Volume, 2021-2031F |

| 6.2. Kuwait Harvester Market Revenue Share, By HP Range, 2020 & 2031F |

| 6.3. Kuwait Harvester Market Volume Share, By HP Range, 2020 & 2031F |

| 6.4. Kuwait Harvester Market Revenues and Volume, By HP Range, 2021-2031F |

| 6.5. Kuwait Harvester Market Price Trend, By HP Range, 2021-2031F |

| 7. Kuwait Thresher Market Overview |

| 7.1. Kuwait Thresher Market Revenues and Volume, 2021-2031F |

| 7.2. Kuwait Thresher Market Revenue Share, By HP Range, 2020 & 2031F |

| 7.3. Kuwait Thresher Market Volume Share, By HP Range, 2020 & 2031F |

| 7.4. Kuwait Thresher Market Revenues and Volume, By HP Range, 2021-2031F |

| 7.5. Kuwait Thresher Market Price Trend, By HP Range, 2021-2031F |

| 8. Kuwait Pumps Market Overview |

| 8.1. Kuwait Pumps Market Revenues and Volume, 2021-2031F |

| 8.2. Kuwait Pumps Market Revenue Share, By HP Range, 2020 & 2031F |

| 8.3. Kuwait Pumps Market Volume Share, By HP Range, 2020 & 2031F |

| 8.4. Kuwait Pumps Market Revenues and Volume, By HP Range, 2021-2031F |

| 8.5. Kuwait Pumps Market Price Trend, By HP Range, 2021-2031F |

| 9. Kuwait Power Tiller Market Overview |

| 9.1. Kuwait Power Tiller Market Revenues and Volume, 2021-2031F |

| 9.2. Kuwait Power Tiller Market Revenue Share, By HP Range, 2020 & 2031F |

| 9.3. Kuwait Power Tiller Market Volume Share, By HP Range, 2020 & 2031F |

| 9.4. Kuwait Power Tiller Market Revenues and Volume, By HP Range, 2021-2031F |

| 9.5. Kuwait Power Tiller Market Price Trend, By HP Range, 2021-2031F |

| 10. Kuwait Rotavator Market Overview |

| 10.1. Kuwait Rotavator Market Revenues and Volume, 2021-2031F |

| 10.2. Kuwait Rotavator Market Revenue Share, By HP Range, 2020 & 2031F |

| 10.3. Kuwait Rotavator Market Volume Share, By HP Range, 2020 & 2031F |

| 10.4. Kuwait Rotavator Market Revenues and Volume, By HP Range, 2021-2031F |

| 10.5. Kuwait Rotavator Market Price Trend, By HP Range, 2021-2031F |

| 11. Kuwait Other Agriculture Equipment Market Overview |

| 11.1. Kuwait Other Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 12. Kuwait Key Performance Indicators |

| 13. Kuwait Agriculture Equipment Market Opportunity Assessment |

| 13.1. Kuwait Agriculture Equipment Market, Opportunity Assessment, By Equipment, 2031F |

| 14. Kuwait Agriculture Equipment Market Competitive Landscape |

| 14.1. Kuwait Agriculture Equipment Market Revenue Share, By Companies, 2024 |

| 15. Company Profiles |

| 16. Strategic Recommendations |

| 17. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero