Turkey Agriculture Equipment Market (2025-2031) | Analysis, Forecast, Companies, Share, Value, Revenue, Industry, Growth, Trends, Outlook & Size

Market Forecast By Products (Tractors (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Harvesters (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Threshers (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Pumps (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Power Tillers (Up To 30 HP And 30.1 HP- 70 HP), Rotavators (Up To 30 HP, 30.1 HP- 70 HP And 70.1 HP- 130 HP) And Others Including Rice Transplanters, Weeders, Excavators And Farm Carriers)), And Competitive Landscape

| Product Code: ETC160060 | Publication Date: Feb 2022 | Updated Date: Mar 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

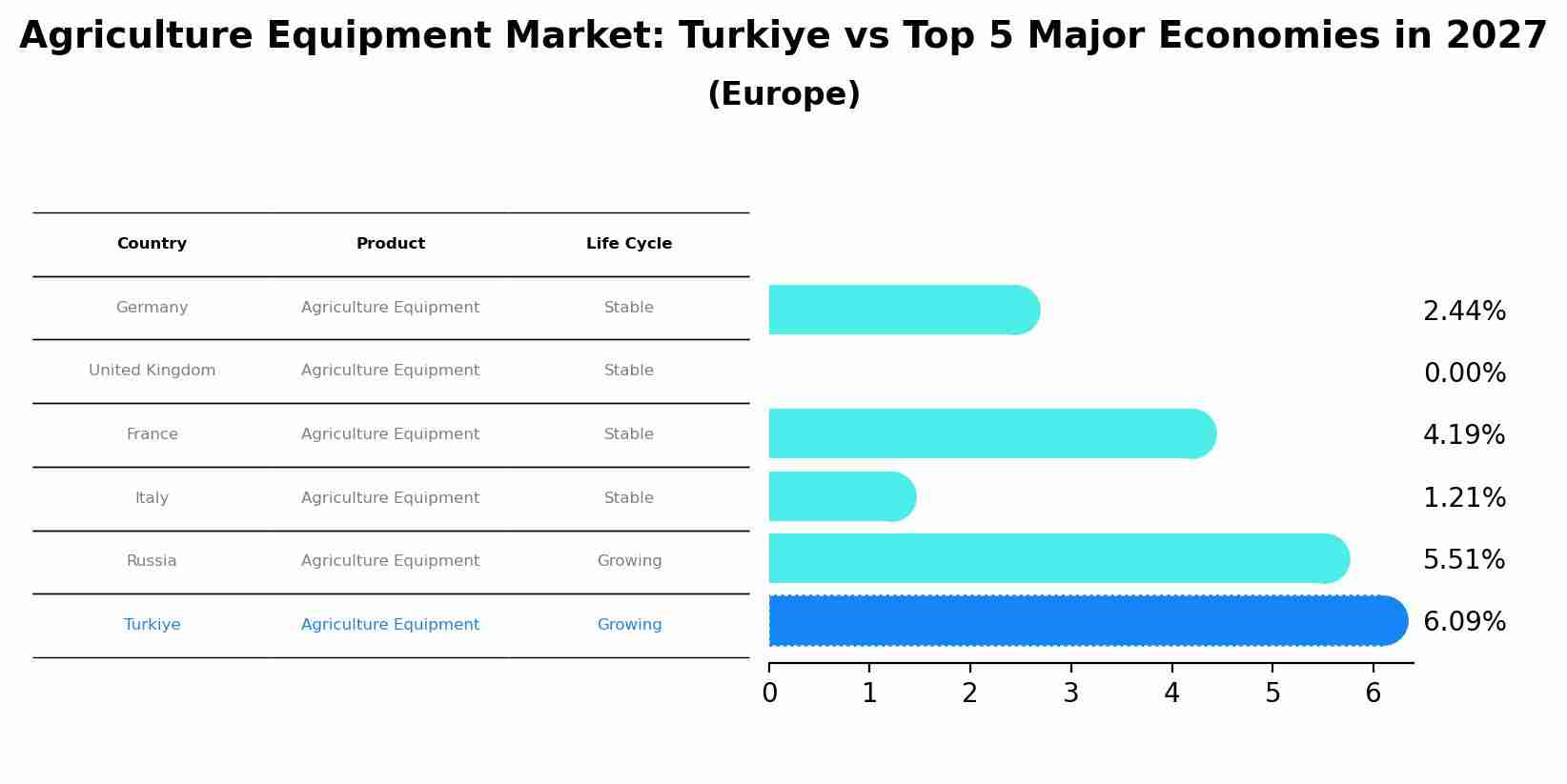

Agriculture Equipment Market: Turkiye vs Top 5 Major Economies in 2027 (Europe)

Turkiye's Agriculture Equipment market is anticipated to experience a growing growth rate of 6.09% by 2027, reflecting trends observed in the largest economy Germany, followed by United Kingdom, France, Italy and Russia.

Turkey Agriculture Equipment Market Highlights

| Report Name | Turkey Agriculture Equipment Market |

| Forecast period | 2025-2031 |

| CAGR | 8.2% |

| Growing Sector | Agriculture |

Topics Covered in the Turkey Agriculture Equipment Market Report

Turkey Agriculture Equipment Market report thoroughly covers the market by product. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Turkey Agriculture Equipment Market Synopsis

The Turkey agriculture equipment market is expected to grow between 2025 and 2031, fueled by increased food demand, technical developments in farming, and government assistance for modernization. Precision farming and mechanization will be adopted more widely in both large and small farms, increasing efficiency and output. Overcoming issues such as funding and infrastructure will be critical to growth.

According to 6Wresearch, Turkey Agriculture Equipment Market size is expected to grow at a significant CAGR of 8.2% during 2025-2031. The Turkey agriculture equipment market is driven by increased demand for mechanization as farmers seek to enhance productivity and reduce labor dependency. Government initiatives, such as subsidies and financial support programs, have encouraged the adoption of modern equipment, supporting both small and large-scale farmers. Additionally, the rising focus on precision agriculture and sustainable farming practices has fostered the integration of advanced technologies, including sensors and automation, enabling more efficient resource management. Growing agricultural exports from Turkey have further incentivized investments in modern machinery to meet international quality standards and scale production, leading to the Turkey Agriculture Equipment Market growth.

Despite these drivers, the sector faces several obstacles that could impact its growth trajectory. High initial costs associated with advanced agricultural machinery remain a significant barrier, particularly for small-scale farmers with limited financial capacity. Economic challenges, including inflation and currency depreciation, have further amplified the cost burden, making imported equipment increasingly expensive. Rural regions often suffer from inadequate infrastructure for equipment servicing and spare parts availability, resulting in prolonged downtime. Additionally, adapting to stricter environmental regulations poses a challenge, as it necessitates investments in eco-friendly equipment and practices, which may not be financially viable for many farmers.

Turkey Agriculture Equipment Market Trends

The rising demand for precision farming is one of the noteworthy trends in the Turkey agriculture equipment industry. Due to the necessity to increase productivity and lower production costs, Turkish farmers are increasingly using techniques like variable-rate technology and soil mapping. Better yields and resource management are made possible by precision farming. Furthermore, growing environmental concerns are driving a desire for sustainable farming methods. Energy-efficient tractors and equipment driven by renewable energy sources are examples of eco-friendly agricultural machinery that has become more popular as a result of this trend, allowing farmers to lessen their environmental effect without sacrificing output.

Investment Opportunities in the Turkey Agriculture Equipment Market

Numerous investment opportunities are presented by the expanding agriculture equipment industry in Turkey. In order to address Turkey's increasing need for advanced agricultural equipment, multinational businesses can collaborate with local manufacturers through partnerships and collaborations. This can expedite the transfer of information and technology and increase market penetration. Furthermore, this industry has a great demand for ongoing research and development. R&D investments can result in the development of cutting-edge, effective equipment that is customized to meet the unique requirements of Turkish farmers, increasing agricultural practices' sustainability, productivity, and cost-effectiveness nationwide.

Leading Players in the Turkey Agriculture Equipment Market

Prominent international corporations including AGCO Corporation, Kubota Corporation, and Deere & Company are among the major players in the Turkey agriculture equipment market. These companies help to increase agricultural efficiency by providing a variety of cutting-edge machinery, such as precision farming tools and tractors. Another important player is CNH Industrial N.V., which offers Turkish farmers a range of high-performance equipment. Furthermore, regional businesses like Mahindra Tractors and Escorts Group make a substantial contribution to the market by providing affordable, competitive solutions that are suited to the demands of Turkish agriculture.

Government Regulations

The Turkish government has launched a number of programs to encourage sustainable farming methods and improve the agricultural industry. One important project aimed at improving infrastructure, water management, and land use efficiency to promote sustainable agriculture is the Agricultural Reform Implementation Project. The Rural Development Program also gives farmers financial assistance so they may purchase new machinery and technologies. This program seeks to increase Turkish agriculture's overall competitiveness, decrease its negative effects on the environment, and increase production. These initiatives are consistent with the government's overarching plan to guarantee the agriculture sector's long-term viability and expansion in Turkey.

Future Insights of the Turkey Agriculture Equipment Market

Turkey's agriculture equipment market appears to have a bright future, fueled by rising food demand and altering farming practices. It is anticipated that government assistance, technological developments, and alliances with foreign businesses would accelerate market expansion. The need for environmentally friendly agricultural equipment is expected to rise in the upcoming years due to a growing emphasis on sustainable farming and increased farmer awareness. Mechanization and precision farming are also expected to increase productivity. In addition to offering chances for expansion, innovation, and the adoption of contemporary agricultural technologies throughout Turkey's farming industry, the market offers substantial investment opportunities for both domestic and foreign firms.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Tractor to dominate the Market - by Product

According to Ravi Bhandari, Research Head, 6Wresearch, tractors dominate the Turkey agriculture equipment market, owing to their versatility and importance in numerous farming tasks. They are essential to Turkish farmers because they are commonly utilized for jobs including planting, harvesting, tilling, and plowing.

Key Attractiveness

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Turkey Agriculture Equipment Market Outlook

- Turkey Agriculture Equipment Market Overview

- Turkey Agriculture Equipment Market Forecast

- Turkey Agriculture Equipment Market Size

- Turkey Agriculture Equipment Market Share, by-products

- Turkey Agriculture Equipment Market Forecast of revenues until 2031

- Historical Data of Turkey Agriculture Equipment Market Revenues and Volume, by-products for the Period 2021-2031

- Market Size & Forecast of Turkey Agriculture Equipment Market Revenues and Volume, by-products until 2031

- Turkey Tractor Market Revenue and Volume Share, By HP Range

- Historical Data of Turkey Tractor Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Turkey Tractor Market Revenues and Volume, By HP range until 2031

- Turkey Harvester Market Revenue and Volume Share, By HP Range

- Historical Data of Turkey Harvester Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Turkey Harvester Revenue and Volume Share, By HP range until 2031

- Turkey Thresher Market Revenue and Volume Share, By HP Range

- Historical Data of Turkey Thresher Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Turkey Thresher Market Revenues and Volume, By HP range until 2031

- Turkey Pumps Market Revenue and Volume Share, By HP Range

- Historical Data of Turkey Pumps Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Turkey Pumps Market Revenues and Volume, By HP range until 2031

- Turkey Power Tiller Market Revenue and Volume Share, By HP Range

- Historical Data of Turkey Power Tiller Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Turkey Power Tiller Market Revenues and Volume, By HP range until 2031

- Turkey Rotavator Market Revenue and Volume Share, By HP Range

- Historical Data of Turkey Rotavator Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Turkey Rotavator Market Revenues and Volume, By HP range until 2031

- Turkey Agriculture Equipment Market Drivers and Restraints

- Turkey Agriculture Equipment Market Trends

- Porter’s Five Forces Analysis and Market Opportunity Assessment

- Turkey Agriculture Equipment Market Share, by Companies

- Turkey Agriculture Equipment Market Overview, by Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Market Covered

The Turkey Agriculture Equipment market report provides a detailed analysis of the following market segments

By Product

- Tractors

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Harvesters

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Threshers

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Pumps

-

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Power Tillers

- Up to 30 HP

- 30.1 HP- 70 HP

- Rotavators

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- Others (Rice Transplanter, Weeders, Excavators and Farm Carriers)

Turkey Agriculture Equipment Market (2025-2031) : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Turkey Agriculture Equipment Market Overview |

| 3.1. Turkey Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 3.2. Turkey Agriculture Equipment Market Industry Life Cycle, 2018 |

| 3.3. Turkey Agriculture Equipment Market Porter’s Five Forces |

| 3.4. Turkey Agriculture Equipment Market Revenue and Volume Share, By Equipment, 2021 & 2031F |

| 4. Turkey Agriculture Equipment Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Turkey Tractor Market Overview |

| 5.1. Turkey Tractor Market Revenues and Volume, 2021-2031F |

| 5.2. Turkey Tractor Market Revenue Share, By HP Range, 2021 & 2031F |

| 5.3. Turkey Tractor Market Volume Share, By HP Range, 2021 & 2031F |

| 5.4. Turkey Tractor Market Revenues and Volume, By HP Range, 2021-2031F |

| 5.5. Turkey Tractor Market Price Trend, By HP Range, 2021-2031F |

| 6. Turkey Harvester Market Overview |

| 6.1. Turkey Harvester Market Revenues and Volume, 2021-2031F |

| 6.2. Turkey Harvester Market Revenue Share, By HP Range, 2021 & 2031F |

| 6.3. Turkey Harvester Market Volume Share, By HP Range, 2021 & 2031F |

| 6.4. Turkey Harvester Market Revenues and Volume, By HP Range, 2021-2031F |

| 6.5. Turkey Harvester Market Price Trend, By HP Range, 2021-2031F |

| 7. Turkey Thresher Market Overview |

| 7.1. Turkey Thresher Market Revenues and Volume, 2021-2031F |

| 7.2. Turkey Thresher Market Revenue Share, By HP Range, 2021 & 2031F |

| 7.3. Turkey Thresher Market Volume Share, By HP Range, 2021 & 2031F |

| 7.4. Turkey Thresher Market Revenues and Volume, By HP Range, 2021-2031F |

| 7.5. Turkey Thresher Market Price Trend, By HP Range, 2021-2031F |

| 8. Turkey Pumps Market Overview |

| 8.1. Turkey Pumps Market Revenues and Volume, 2021-2031F |

| 8.2. Turkey Pumps Market Revenue Share, By HP Range, 2021 & 2031F |

| 8.3. Turkey Pumps Market Volume Share, By HP Range, 2021 & 2031F |

| 8.4. Turkey Pumps Market Revenues and Volume, By HP Range, 2021-2031F |

| 8.5. Turkey Pumps Market Price Trend, By HP Range, 2021-2031F |

| 9. Turkey Power Tiller Market Overview |

| 9.1. Turkey Power Tiller Market Revenues and Volume, 2021-2031F |

| 9.2. Turkey Power Tiller Market Revenue Share, By HP Range, 2021 & 2031F |

| 9.3. Turkey Power Tiller Market Volume Share, By HP Range, 2021 & 2031F |

| 9.4. Turkey Power Tiller Market Revenues and Volume, By HP Range, 2021-2031F |

| 9.5. Turkey Power Tiller Market Price Trend, By HP Range, 2021-2031F |

| 10. Turkey Rotavator Market Overview |

| 10.1. Turkey Rotavator Market Revenues and Volume, 2021-2031F |

| 10.2. Turkey Rotavator Market Revenue Share, By HP Range, 2021 & 2031F |

| 10.3. Turkey Rotavator Market Volume Share, By HP Range, 2021 & 2031F |

| 10.4. Turkey Rotavator Market Revenues and Volume, By HP Range, 2021-2031F |

| 10.5. Turkey Rotavator Market Price Trend, By HP Range, 2021-2031F |

| 11. Turkey Other Agriculture Equipment Market Overview |

| 11.1. Turkey Other Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 12. Turkey Key Performance Indicators |

| 13. Turkey Agriculture Equipment Market Opportunity Assessment |

| 13.1. Turkey Agriculture Equipment Market, Opportunity Assessment, By Equipment, 2031F |

| 14. Turkey Agriculture Equipment Market Competitive Landscape |

| 14.1. Turkey Agriculture Equipment Market Revenue Share, By Companies, 2024 |

| 15. Company Profiles |

| 16. Strategic Recommendations |

| 17. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero