Mexico Technical Ceramics Market (2025-2031) | Share, Revenue, Size, Forecast, Outlook, Analysis, Growth, Industry, Trends, Companies & Value

Market Forecast By Material Type (Oxide ceramics, Non-oxide ceramics), By Product Type (Monolithic ceramics, Ceramic matrix composites, Ceramic coatings, Others), By End-Use Industry (Electronics & semiconductor, Automotive, Energy & power, Industrial, Medical, Military & defense, Others) And Competitive Landscape

| Product Code: ETC045763 | Publication Date: Jan 2021 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

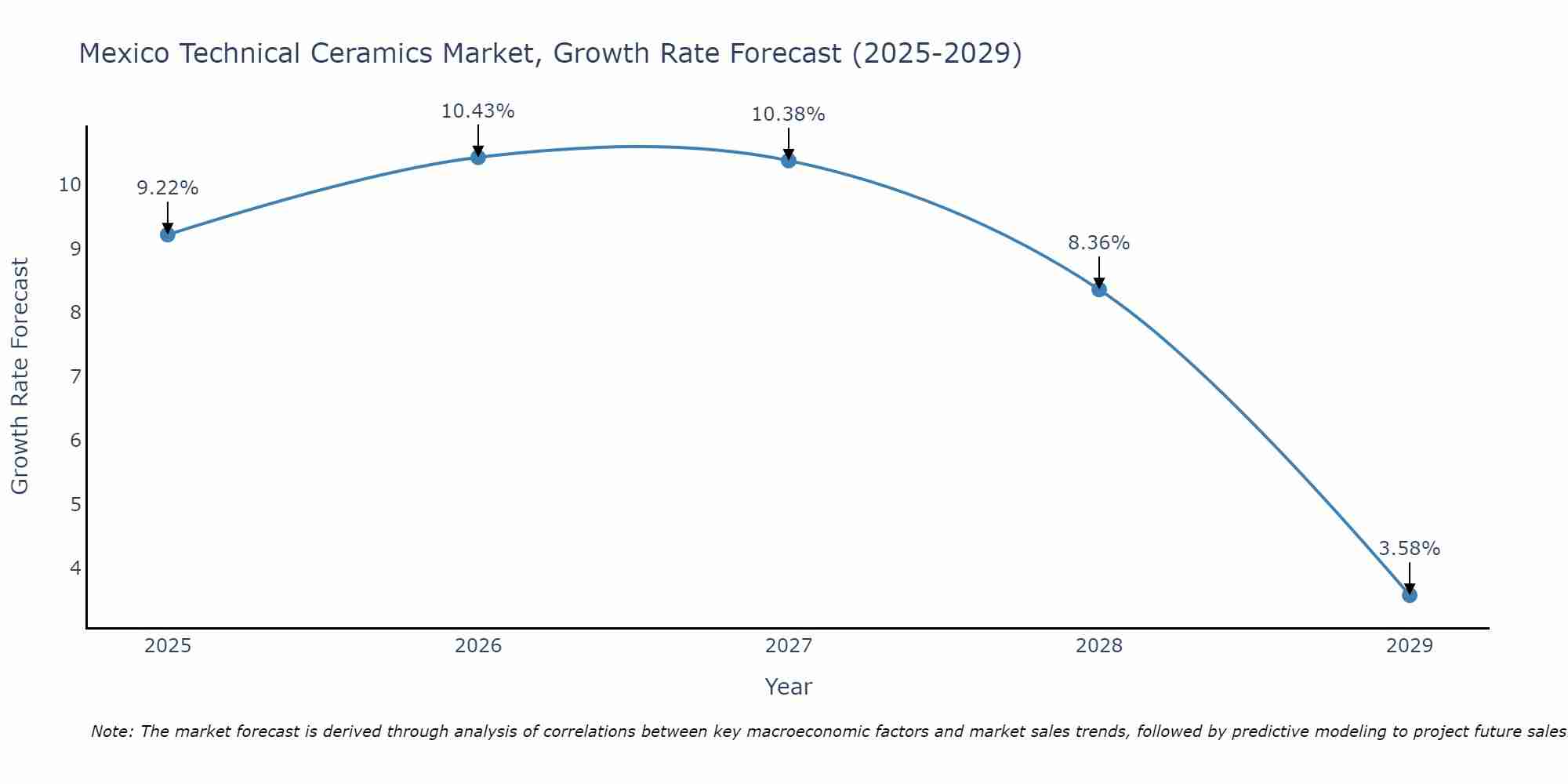

Mexico Technical Ceramics Market Size Growth Rate

The Mexico Technical Ceramics Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 10.43% in 2026, following an initial rate of 9.22%, before easing to 3.58% at the end of the period.

Mexico Technical Ceramics Market Highlights

| Report Name | Mexico Technical Ceramics Market |

| Forecast period | 2025-2031 |

| CAGR | 5.8% |

| Growing Sector | Electronics and semiconductor |

Topics Covered in the Mexico Technical Ceramics Market Report

The Mexico Technical Ceramics Market report thoroughly cover the By Material Type, Product Type and End-Use Industry. The Mexico Technical Ceramics Market outlook report provides an unbiased and detailed analysis of the on-going Mexico Technical Ceramics Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Mexico Technical Ceramics Market Synopsis

Due to rising demand from a variety of end-use industries, including automotive, electronics, and healthcare, the technical ceramics market in Mexico has been expanding significantly. Technical ceramics are widely used in applications that call for strong and effective materials because of their reputation for longevity, tolerance to high temperatures, and lightweight nature.

According to 6Wresearch, the Mexico Technical Ceramics Market revenue is expected to reach at a significant CAGR of approximately 5.8% during the forecast period 2025-2031. The technical ceramics market in Mexico is experiencing growth due to several key drivers. One significant factor is the increasing demand from industries such as automotive and electronics, which require high-performance materials that can withstand extreme conditions. Technical ceramics offer excellent durability, high-temperature stability, and resistance to wear and corrosion, making them highly sought after in these sectors. Moreover, technological advancements and innovations in production processes are enhancing the quality and capabilities of technical ceramics, further driving their adoption and boosting the Mexico Technical Ceramics Market growth.

However, the market faces challenges that could hinder its progress. The high cost of raw materials and production processes can limit accessibility for smaller enterprises, creating a barrier to market entry. Additionally, the need for highly specialized knowledge and skills in manufacturing technical ceramics requires ongoing investment in training and education. Economic fluctuations and trade policies can also impact the availability of materials and the overall market dynamics, adding to the challenges faced by manufacturers and suppliers in the industry.

Mexico Technical Ceramics Market Trends

The technical ceramics industry in Mexico is being shaped by a number of significant changes as it adjusts to changing consumer needs and technological breakthroughs. First, eco-friendly production methods and sustainability are receiving more attention. In line with international efforts to reduce carbon footprints, businesses are investing in more environmentally friendly production processes and materials. Second, there is growing interest in using smart technologies into ceramics. This entails integrating sensors and networking capabilities into ceramic goods, turning them into intelligent parts that can improve performance and usefulness across a range of applications, especially in the electronics and automotive industries.

Investment Opportunities in the Mexico Technical Ceramics Market

The technical ceramics market in Mexico offers promising investment opportunities, driven by its growth potential and rising demand across various industries. Investors can tap into the expanding automotive and electronics sectors, which are major consumers of technical ceramics due to their need for high-performance materials. These industries are constantly innovating and diversifying, providing ample room for novel ceramic applications. Furthermore, environmental regulations are increasingly pushing for the use of materials that enhance efficiency and reduce emissions, positioning technical ceramics as a sustainable choice.

Leading Players of the Mexico Technical Ceramics Market

Through innovation, quality, and strategic partnerships, a number of major players promote the expansion of the technical ceramics market in Mexico. These top businesses comprise both multinational and domestic behemoths that have made a big impact on the market. Among the well-known is Grupo Materias Cerámicas, a regional business that has established a solid reputation for providing cutting-edge ceramic solutions to meet a range of industrial demands. In the meantime, foreign firms like CoorsTek, Inc. and Kyocera Corporation have strengthened their position in the Mexican market by utilizing their cutting-edge technology and worldwide experience.

Government Regulations Introduced in the Mexico Technical Ceramics Market

The Mexican government has put in place a number of laws and guidelines designed to encourage the technical ceramics industry's expansion and sustainability. Environmental protection has received a lot of attention, and strict rules have been established to cut down on waste and emissions during the production process. In line with international sustainability goals, these restrictions incentivize manufacturers to invest in eco-friendly technologies and embrace more environmentally friendly practices. Further propelling developments in the industry are incentives the government has put in place for businesses that innovate and increase production efficiency.

Future insights of Mexico Technical Ceramics Market

Mexico Technical Ceramics industry have a bright future due to continuous technological breakthroughs and a growing emphasis on sustainable solutions. Because of their exceptional qualities and adaptability, technical ceramics are anticipated to become even more essential as industries continue to embrace more creative and effective practices. Technical ceramics' capabilities in a variety of applications will likely be further enhanced by the growing integration of IoT, robotics, and AI in industrial processes brought about by the digital transformation and Industry 4.0 programs.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Non-oxide to Dominate the Market - By Material Type

According to Ravi Bhandari, Research Head, 6wresearch, Ceramics made of non-oxide materials have been exposed to lead. They are positioned as an essential part of upcoming technical and industrial advancements due to their capacity to satisfy the exacting requirements of cutting-edge industries.

Ceramic matrix composites to Dominate the Market - By Product Type

The market is probably going to be led by ceramic matrix composites. They are becoming more and more appealing for high-demand applications because to their exceptional strength and lightweight design, which positions them as a crucial option in the development of contemporary engineering and technology.

Electronics and semiconductor to Dominate the Market - By End-Use Industry

The electronics and semiconductor sector is well-positioned to take the lead in ceramic technology adoption and innovation. Ceramics will remain essential in reaching the breakthroughs needed to satisfy industrial and consumer demands as the need for advanced electronics pushes the limits of material research.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2024 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Technical Ceramics Market Outlook

- Market Size of Mexico Technical Ceramics Market, 2024

- Forecast of Mexico Technical Ceramics Market, 2031

- Historical Data and Forecast of Mexico Technical Ceramics Revenues & Volume for the Period 2021-2031

- Mexico Technical Ceramics Market Trend Evolution

- Mexico Technical Ceramics Market Drivers and Challenges

- Mexico Technical Ceramics Price Trends

- Mexico Technical Ceramics Porter's Five Forces

- Mexico Technical Ceramics Industry Life Cycle

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Material Type for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Oxide ceramics for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Non-oxide ceramics for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Monolithic ceramics for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Ceramic matrix composites for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Ceramic coatings for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By End-Use Industry for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Electronics & semiconductor for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Energy & power for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Industrial for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Medical for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Military & defense for the Period 2021-2031

- Historical Data and Forecast of Mexico Technical Ceramics Market Revenues & Volume By Others for the Period 2021-2031

- Mexico Technical Ceramics Import Export Trade Statistics

- Market Opportunity Assessment By Material Type

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-Use Industry

- Mexico Technical Ceramics Top Companies Market Share

- Mexico Technical Ceramics Competitive Benchmarking By Technical and Operational Parameters

- Mexico Technical Ceramics Company Profiles

- Mexico Technical Ceramics Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Material Type

- Oxide ceramics

- Non-oxide ceramics

By Product Type

- Monolithic ceramics

- Ceramic matrix composites

- Ceramic coatings

- Others

By End-Use Industry

- Electronics & semiconductor

- Automotive

- Energy & power

- Industrial

- Medical

- Military & defense

- Others

Mexico Technical Ceramics Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Mexico Technical Ceramics Market Overview |

| 3.1 Mexico Country Macro Economic Indicators |

| 3.2 Mexico Technical Ceramics Market Revenues & Volume, 2021 & 2031F |

| 3.3 Mexico Technical Ceramics Market - Industry Life Cycle |

| 3.4 Mexico Technical Ceramics Market - Porter's Five Forces |

| 3.5 Mexico Technical Ceramics Market Revenues & Volume Share, By Material Type, 2021 & 2031F |

| 3.6 Mexico Technical Ceramics Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.7 Mexico Technical Ceramics Market Revenues & Volume Share, By End-Use Industry, 2021 & 2031F |

| 4 Mexico Technical Ceramics Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Mexico Technical Ceramics Market Trends |

| 6 Mexico Technical Ceramics Market, By Types |

| 6.1 Mexico Technical Ceramics Market, By Material Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Mexico Technical Ceramics Market Revenues & Volume, By Material Type, 2021 - 2031F |

| 6.1.3 Mexico Technical Ceramics Market Revenues & Volume, By Oxide ceramics, 2021 - 2031F |

| 6.1.4 Mexico Technical Ceramics Market Revenues & Volume, By Non-oxide ceramics, 2021 - 2031F |

| 6.2 Mexico Technical Ceramics Market, By Product Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Mexico Technical Ceramics Market Revenues & Volume, By Monolithic ceramics, 2021 - 2031F |

| 6.2.3 Mexico Technical Ceramics Market Revenues & Volume, By Ceramic matrix composites, 2021 - 2031F |

| 6.2.4 Mexico Technical Ceramics Market Revenues & Volume, By Ceramic coatings, 2021 - 2031F |

| 6.2.5 Mexico Technical Ceramics Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 Mexico Technical Ceramics Market, By End-Use Industry |

| 6.3.1 Overview and Analysis |

| 6.3.2 Mexico Technical Ceramics Market Revenues & Volume, By Electronics & semiconductor, 2021 - 2031F |

| 6.3.3 Mexico Technical Ceramics Market Revenues & Volume, By Automotive, 2021 - 2031F |

| 6.3.4 Mexico Technical Ceramics Market Revenues & Volume, By Energy & power, 2021 - 2031F |

| 6.3.5 Mexico Technical Ceramics Market Revenues & Volume, By Industrial, 2021 - 2031F |

| 6.3.6 Mexico Technical Ceramics Market Revenues & Volume, By Medical, 2021 - 2031F |

| 6.3.7 Mexico Technical Ceramics Market Revenues & Volume, By Military & defense, 2021 - 2031F |

| 7 Mexico Technical Ceramics Market Import-Export Trade Statistics |

| 7.1 Mexico Technical Ceramics Market Export to Major Countries |

| 7.2 Mexico Technical Ceramics Market Imports from Major Countries |

| 8 Mexico Technical Ceramics Market Key Performance Indicators |

| 9 Mexico Technical Ceramics Market - Opportunity Assessment |

| 9.1 Mexico Technical Ceramics Market Opportunity Assessment, By Material Type, 2021 & 2031F |

| 9.2 Mexico Technical Ceramics Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.3 Mexico Technical Ceramics Market Opportunity Assessment, By End-Use Industry, 2021 & 2031F |

| 10 Mexico Technical Ceramics Market - Competitive Landscape |

| 10.1 Mexico Technical Ceramics Market Revenue Share, By Companies, 2024 |

| 10.2 Mexico Technical Ceramics Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero