Middle East Elevator and Escalator Market Outlook (2021-2027) | Companies, Forecast, Size, Growth, Trends, COVID-19 IMPACT, Revenue, Industry, Analysis, Value & Share

Market ForecastBy Product Types (Elevator, Escalator), By Elevator Technologies (Machine Room Above, Machine Room Less), By Elevator Technologies Type (Traction, Hydraulic), By Elevator Verticals (Residential, Commercial (Healthcare, Hospitality, Office, Retail, Education, Entertainment & Mixed-Use Building), Special (Industrial & Marine), Infrastructure (Public Transport)), By Elevator Capacity (Upto 630 Kg, 631-1000 Kg, 1001-1600 Kg, 1601-2000 Kg, Above 2000 Kg), By Elevator Rise (Low rise (0-45m), Mid-rise(>45m-100m), High rise (>100m)), By Elevator Speed (Up to 1m/sec, 1.1-1.75m/sec, 1.76-2.5m/sec, 2.6-3.5m/sec, 3.6-4m/sec, Above 4m/sec), By Elevator Service Type (Maintenance, Modernization), By Elevator Type (Passenger, Cargo), By Elevator Modernization Type (Partial MOD (include Traveling Cable, Tape head, Limit Switches, Wiring, Shaft Door, Hall Fixtures, Controllers, etc.), Full MOD (include Traveling Cable, Tape head, Limit Switches, Wiring, Shaft Door, Hall Fixtures, Controllers, Door operator, Cab Design, Car Fixtures, Wire Ropes, Buffers, Machines, Backup Battery, etc.)), By Escalator Technologies (Horizontal, Inclined), By Escalator Technologies Type (Heavy Traffic, Traffic/Commercial), By Escalator Verticals (Commercial (Healthcare, Hospitality, Office, Retail, Education, Entertainment & Mixed-Use Building), Infrastructure (Public Transport)), By Escalator Service Type (Maintenance, Modernization), By Escalator Type (Horizontal, Inclined), By Escalator Modernization Type (Partial MOD (include Steps and Handrails, Chain, Comb Plates, Lighting etc.), Full MOD (include Control Panel, Drive, Controllers, Access Covers, Comb Plates, Skirts and Decking, Lighting, Dynamic Braking, Chains, Steps and Handrails etc.)), By Countries (Saudi Arabia (Western Region (Jeddah, Mecca, Medina, Taif), Central Region (Riyadh, Buraidah, Sakaka, Hail), Eastern Region (Dammam, Dhahran, Khobar, Arar)), UAE (Northern Region (Ajman, Al Fujairah, Dubai, Ras Al-Khaimah, Sharjah, Umm al-Qaywayn), Southern Region (Al Ain, Abu Dhabi)), Egypt (Northern Region (Alexandria, Beheira, Beni Suef, Cairo, Dakahlia, Damietta, Faiyum, Gharbia, Giza, Ismailia, Kafr el-Sheikh, Matruh, Minya, Monufia, North Sinai, Port Said, Qalyubia, Sharqia, South Sinai, Suez), Southern Region (Aswan, Asyut, Luxor, New Valley, Qena, Red Sea, Sohag)), Qatar (Northern Region (Lusail, Al Khor, Dukhan), Southern Region (Doha, Al Wakrah, Ash Shaqra))) And Competitive Landscape

| Product Code: ETC059997 | Publication Date: Mar 2022 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 308 | No. of Figures: 237 | No. of Tables: 143 |

Latest (2024) Development of the Middle East Elevator And Escalator Market

The Middle East elevator and escalator market is forecast to witness robust growth driven by urbanization, infrastructure development, and advancements in technology. Key markets such as Saudi Arabia, the United Arab Emirates, and Qatar are investing heavily in smart city projects, which is likely to bolster the demand for advanced vertical transportation solutions.

Furthermore, the region's focus on hosting international events and tourism initiatives, such as Expo 2020 Dubai, continues to create heightened demand for state-of-the-art elevators and escalators. Competition among major market players is expected to intensify, with an emphasis on the incorporation of energy-efficient and digital solutions to meet the region’s evolving needs.

Topics Covered in the Middle East Elevator and Escalator Market

Middle East Elevator and Escalator Market report comprehensively covers the market by countries, product types and applications. The report provides an unbiased and detailed analysis of the on-going trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align their market strategies according to the current and future market dynamics.

Middle East Elevator and Escalator Market Synopsis

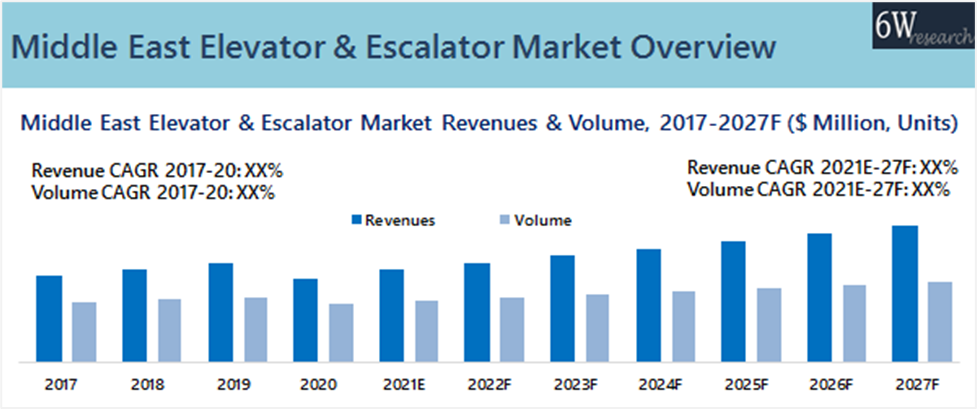

Middle Elevator and Escalator market witnessed a steady grow in the recent years owing to large scale infrastructure projects being developed for upcoming mega events such as Dubai World Expo 2020 and Qatar FIFA World Cup 2022. Furthermore, the countries in the region are aiming to diversify their economy by reducing its reliance on oil sector and investing heavily in non-oil sectors such as hospitality, transportation, infrastructure and industrial sector which surged the construction activities in the region.

Middle East elevator and escalator market saw a decline in 2020 due to Covid-19 pandemic as a result of the complete lockdown bought in force by the government to prevent the spread of coronavirus which disrupted the supply chain, manufacturing processes and put a halt to all the developmental activities across all the sectors. However, the phase of decline is expected to be temporary, and market is anticipated to recover in 2021 and return to a healthy growth rate on account of resumption of all developmental activities.

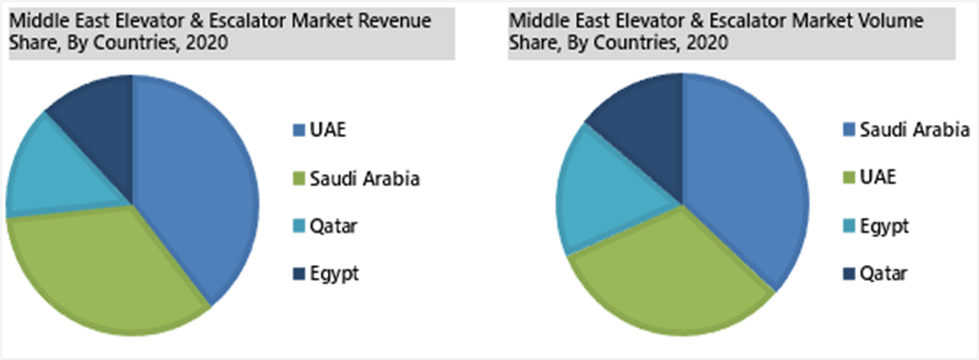

According to 6Wresearch, the Middle East Elevator and Escalator Market revenue size is projected to grow at a CAGR of 4.2% during 2021-2027F. In Middle East, UAE captured the highest market revenue share in 2020 and would also lead during the forecast period owing to government initiatives such as Dubai’s Urban Master Plan and Dubai’s Domestic tourism strategy that aims to promote business and tourism in the country. Furthermore, spurring construction of new business parks, commercial buildings and hotels such as $64 billion Dubailand Project, $28 billion Al-Maktoum International Airport Expansion and others would create a market for elevators and escalators in the coming years.

Market by Applications Analysis

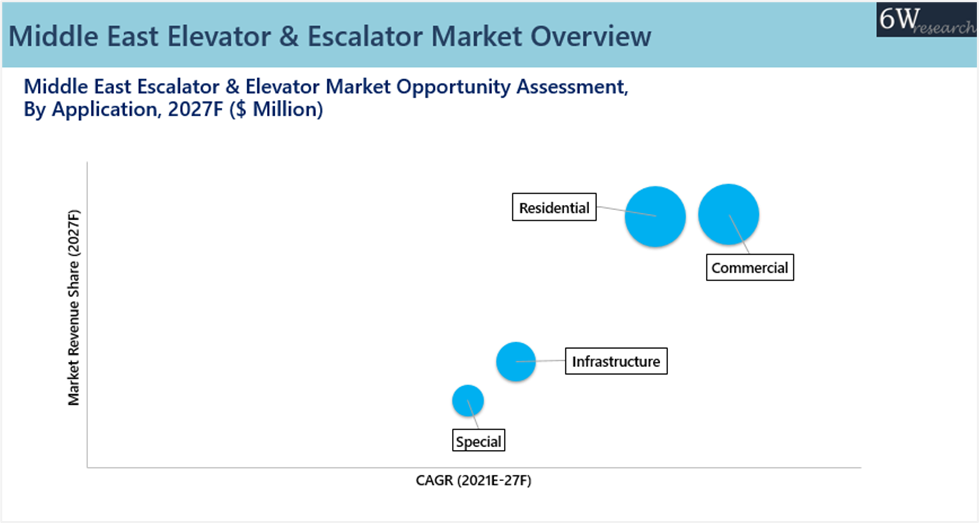

In term of applications, commercial sector captured most of the market revenue share in 2020, and the similar trend is expected in forecast period as well, owing to increasing investment in hospitality sector coupled with corporate reforms aimed to attract foreign businesses. For instance, in 2020, government of Saudi Arabia launched a marketing program named Program HQ, in a bid to attract 500 international corporates to relocate their regional headquarters to Riyadh by 2030 by offering incentives such as a 50-year tax holiday, waiving quotas for Saudi citizens and protection against any future regulations. Such initiatives would propel the demand for commercial space in the region thereby creating a market for elevator and escalator in the future.

Middle East Elevator And Escalator Market: Key Players

The Middle East Elevator And Escalator Market has several prominent players who drive innovation and set industry standards. Companies such as Otis Elevator Company, Schindler Group, KONE Corporation, and Thyssenkrupp AG are some of the key stakeholders dominating the market landscape. These companies are renowned for their advanced engineering capabilities, extensive product portfolios, and strong regional presence. They invest heavily in research and development to introduce cutting-edge technologies such as smart elevators, energy-efficient systems, and advanced safety features.

Middle East Elevator And Escalator Market: Government Initiatives

Government initiatives play a crucial role in the growth and modernization of the elevator and escalator market in the Middle East. Many regional governments are focusing on infrastructure development and urbanization, which include the construction of high-rise buildings, shopping malls, airports, and metro stations, thereby increasing the demand for vertical transportation solutions. Countries like the United Arab Emirates and Saudi Arabia have introduced ambitious vision plans such as UAE Vision 2021 and Saudi Vision 2030, emphasizing the development of smart cities and sustainable building practices. Additionally, government regulations on safety standards and energy efficiency are encouraging the adoption of state-of-the-art elevator and escalator technologies.

Key Highlights of the Report:

COVID-19 Impact on the Market.

10 Years Market Numbers.

Historical Data Starting from 2017 to 2020.

Base Year: 2020

Forecast Data until 2027.

Key Performance Indicators Impacting the Market.

Middle East Elevator and Escalator Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Middle East Elevator & Escalator Market Overview |

| 4. Impact Analysis of COVID-19 on Middle East Elevator and Escalator Market |

| 5. Middle East Elevator & Escalator Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Middle East Elevator and Escalator Market Trends & Evolution |

| 7. Middle East Elevator and Escalator Market Government Initiatives and Regulatory Developments |

| 8. Saudi Arabia Elevator & Escalator Market Overview |

| 8.1. Saudi Arabia Elevator & Escalator Market Revenues & Volume, 2017-2027F |

| 8.2. Saudi Arabia Elevator & Escalator Market Revenue Share, By Region, 2020 & 2027F |

| 8.3. Saudi Arabia Elevator & Escalator Market Revenue & Volume Share, 2020 & 2027F |

| 8.4. Saudi Arabia Elevator & Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| 8.5. Saudi Arabia Elevator Market Overview |

| 8.6. Saudi Arabia Escalator Market Overview |

| 8.7. Saudi Arabia Elevator & Escalator Market Key Performance Indicators |

| 8.8. Saudi Arabia Elevator & Escalator Market Price Trend Analysis |

| 8.9. Saudi Arabia Elevator & Escalator Market Opportunity Assesment |

| 8.10. Saudi Arabia Elevator & Escalator Market Competitive Landscape |

| 9. UAE Elevator & Escalator Market Overview |

| 9.1. UAE Elevator & Escalator Market Revenues & Volume, 2017-2027F |

| 9.2. UAE Elevator & Escalator Market Revenue Share, By Region, 2020 & 2027F |

| 9.3. UAE Elevator & Escalator Market Revenue & Volume Share, 2020 & 2027F |

| 9.4. UAE Elevator & Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| 9.5. UAE Elevator Market Overview |

| 9.6. UAE Escalator Market Overview |

| 9.7. UAE Elevator & Escalator Market Key Performance Indicators |

| 9.8. UAE Elevator & Escalator Market Price Trend Analysis |

| 9.9. UAE Elevator & Escalator Market Opportunity Assesment |

| 9.10. UAE Elevator & Escalator Market Competitive Landscape |

| 10. Qatar Elevator & Escalator Market Overview |

| 10.1. Qatar Elevator & Escalator Market Revenues & Volume, 2017-2027F |

| 10.2. Qatar Elevator & Escalator Market Revenue Share, By Region, 2020 & 2027F |

| 10.3. Qatar Elevator & Escalator Market Revenue & Volume Share, 2020 & 2027F |

| 10.4. Qatar Elevator & Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| 10.5. Qatar Elevator Market Overview |

| 10.6. Qatar Escalator Market Overview |

| 10.7. Qatar Elevator & Escalator Market Key Performance Indicators |

| 10.8. Qatar Elevator & Escalator Market Price Trend Analysis |

| 10.9. Qatar Elevator & Escalator Market Opportunity Assesment |

| 10.10. Qatar Elevator & Escalator Market Competitive Landscape |

| 11. Egypt Elevator & Escalator Market Overview |

| 11.1. Egypt Elevator & Escalator Market Revenues & Volume, 2017-2027F |

| 11.2. Egypt Elevator & Escalator Market Revenue Share, By Region, 2020 & 2027F |

| 11.3. Egypt Elevator & Escalator Market Revenue & Volume Share, 2020 & 2027F |

| 11.4. Egypt Elevator & Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| 11.5. Egypt Elevator Market Overview |

| 11.6. Egypt Escalator Market Overview |

| 11.7. Egypt Elevator & Escalator Market Key Performance Indicators |

| 11.8. Egypt Elevator & Escalator Market Price Trend Analysis |

| 11.9. Egypt Elevator & Escalator Market Opportunity Assesment |

| 11.10. Egypt Elevator & Escalator Market Competitive Landscape |

| 12. Middle East Elevator & Escalator Market - Competitive Landscape |

| 12.1. Middle East Elevators & Escalator Market Competitive Benchmarking, By Technical Parameters |

| 12.2. Middle East Elevators & Escalator Market Competitive Benchmarking, By Maintenance Contract Pricing |

| 12.3. Middle East Elevators & Escalator Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1. Otis Elevator Co. |

| 13.2. Schindler Group |

| 13.3. Kone Corporation |

| 13.4. Hyundai Elevator Co. Ltd. |

| 13.5. Toshiba Corporation |

| 13.6. Mitsubishi Electric Corporation |

| 13.7. TK Elevator |

| 13.8. Hitachi LTD |

| 13.9. Fujitec Co., LTD |

| 13.10. Orono S.C |

| 14. Key Strategic Recommendation |

| 15. Disclaimer |

| List of Figures |

| Figure 1. Middle East Elevator & Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 2. Middle East New Installation Elevator & Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 3. Middle East Elevator & Escalator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 4. Middle East Elevator & Escalator Market- Industry Life Cycle |

| Figure 5. Middle East Elevator & Escalator Market Revenue Share, By Countries, 2017 & 2027F |

| Figure 6. Value of Middle East Contracts Awarded by Countries– 2019 vs 2020 ($ Billion) |

| Figure 7. GCC Value of New Projects Awarded in Construction Sector, Q1’19-Q1’21 ($ Million) |

| Figure 8. Middle East Number of Upcoming Hotel Projects, 2021-24F |

| Figure 9. GCC Value of New Projects Awarded, 2018-2022F ($ Billion) |

| Figure 10. Average Annual Value of Construction Disputes in Middle East vs Global, 2013-2020 ( $ Million) |

| Figure 11. Average Length of Disputes in Middle East vs Global (Months) |

| Figure 12. Saudi Arabia Elevator & Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 13. Saudi Arabia Elevator & Escalator Market Revenue Share, By Region 2020 & 2027F |

| Figure 14. Saudi Arabia Elevator & Escalator Market Revenue Share, 2020 & 2027F |

| Figure 15. Saudi Arabia Elevator & Escalator New Installation Market Volume Share, 2020 & 2027F |

| Figure 16. Saudi Arabia Elevator & Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 17. Saudi Arabia New Installation Elevator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 18. Saudi Arabia New Installation Elevator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 19. Saudi Arabia New Installation Elevator Market Volume Share, By Technology 2020 & 2027F |

| Figure 20. Saudi Arabia New Installation Elevator Market Revenue Share, By Rise, 2020 & 2027F |

| Figure 21. Saudi Arabia New Installation Elevator Market Volume Share, By Rise, 2020 & 2027F |

| Figure 22. Saudi Arabia New Installation Elevator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 23. Saudi Arabia New Installation Elevator Market Volume Share, By Verticals, 2020 & 2027F |

| Figure 24. Saudi Arabia New Installation Elevator Market Revenue Share, By Speed, 2020 & 2027F |

| Figure 25. Saudi Arabia New Installation Elevator Market Volume Share, By Speed, 2020 & 2027F |

| Figure 26. Saudi Arabia New Installation Elevator Market Revenue Share, By Capacity, 2020 & 2027F |

| Figure 27. Saudi Arabia New Installation Elevator Market Volume Share, By Capacity, 2020 & 2027F |

| Figure 28. Saudi Arabia Elevator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 29. Saudi Arabia Elevator Service Market Revenue & Volume Share, By Service Type 2020 & 2027F |

| Figure 30. Saudi Arabia Elevator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 31. Saudi Arabia Elevator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, units) |

| Figure 32. Saudi Arabia Maintenance Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 33. Saudi Arabia Maintenance Elevator Market Revenue Share, By Type, 2020 & 2027F |

| Figure 34. Saudi Arabia Maintenance Elevator Market Volume Share, By Type, 2020 & 2027F |

| Figure 35. Saudi Arabia Modernization Elevator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 36. Saudi Arabia Modernization Elevator Market Revenue Share, By Type, 2020 & 2027F |

| Figure 37. Saudi Arabia Modernization Elevator Market Volume Share, By Type, 2020 & 2027F |

| Figure 38. Saudi Arabia Modernization Elevator Market Volume Share, By Modernization Type, 2020 & 2027F |

| Figure 39. Saudi Arabia New Installation Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 40. Saudi Arabia New Installation Escalator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 41. Saudi Arabia New Installation Escalator Market Volume Share, By Technology 2020 & 2027F |

| Figure 42. Saudi Arabia New installation Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 43. Saudi Arabia New installation Escalator Market Volume Share, By Verticals, 2020 & 2027F |

| Figure 44. Saudi Arabia Escalator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 45. Saudi Arabia Escalator Service Market Revenue & Volume Share, By Service Type, 2020 & 2027F |

| Figure 46. Saudi Arabia Escalator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 47. Saudi Arabia Escalator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 48. Saudi Arabia Maintenance Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 49. Saudi Arabia Maintenance Escalator Market Revenue Share, By Escalator Type, 2020 & 2027F |

| Figure 50. Saudi Arabia Maintenance Escalator Market Volume Share, By Escalator Type, 2020 & 2027F |

| Figure 51. Saudi Arabia Modernization Escalator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 52. Saudi Arabia Modernization Escalator Market Revenue Share, By Escalator Type, 2020 & 2027F |

| Figure 53. Saudi Arabia Modernization Escalator Market Volume Share, By Escalator Type, 2020 & 2027F |

| Figure 54. Saudi Arabia Modernization Escalator Market Volume Share, By Modernization Type, 2020 & 2027F |

| Figure 55. Saudi Arabia Number of Upcoming Hotel Projects, 2021-24F |

| Figure 56. Saudi Arabia Office Supply Space, Q4 2020-2023F (Million Sq.mt. GLA) |

| Figure 57. Saudi Arabia Retail Supply Stock, Q4 2020-2023F (Million Sq. mt. GLA) |

| Figure 58. Saudi Arabia Residential Supply Stock, Q4 2020-2023F (Million Units) |

| Figure 59. Saudi Arabia New Installation Elevator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 60. Saudi Arabia New Installation Escalator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 61. Saudi Arabia Service Elevator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 62. Saudi Arabia Service Escalator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 63. Saudi Arabia Escalator & Elevator Market Opportunity Assessment, By Product Type, 2027F |

| Figure 64. Saudi Arabia Escalator & Elevator Market Opportunity Assessment, By Application, 2027F |

| Figure 65. Saudi Arabia Elevator Market Volume Share, By Company, 2020 |

| Figure 66. UAE Elevator & Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 67. UAE Elevator & Escalator Market Revenue Share, By Region 2020 & 2027F |

| Figure 68. UAE Elevator & Escalator Market Revenue Share, 2020 & 2027F |

| Figure 69. UAE Elevator & Escalator New Installation Market Volume Share, 2020 & 2027F |

| Figure 70. UAE Elevator & Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 71. UAE New Installation Elevator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 72. UAE New Installation Elevator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 73. UAE New Installation Elevator Market Volume Share, By Technology 2020 & 2027F |

| Figure 74. UAE New Installation Elevator Market Revenue Share, By Rise, 2020 & 2027F |

| Figure 75. UAE New Installation Elevator Market Volume Share, By Rise, 2020 & 2027F |

| Figure 76. UAE New Installation Elevator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 77. UAE New Installation Elevator Market Volume Share, By Verticals, 2020 & 2027F |

| Figure 78. UAE New Installation Elevator Market Revenue Share, By Speed, 2020 & 2027F |

| Figure 79. UAE New Installation Elevator Market Volume Share, By Speed, 2020 & 2027F |

| Figure 80. UAE New Installation Elevator Market Revenue Share, By Capacity, 2020 & 2027F |

| Figure 81. UAE New Installation Elevator Market Volume Share, By Capacity, 2020 & 2027F |

| Figure 82. UAE Elevator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 83. UAE Elevator Service Market Revenue & Volume Share, By Service Type 2020 & 2027F |

| Figure 84. UAE Elevator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 85. UAE Elevator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 86. UAE Maintenance Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 87. UAE Maintenance Elevator Market Revenue Share, By Type 2020 & 2027F |

| Figure 88. UAE Maintenance Elevator Market Volume Share, By Type 2020 & 2027F |

| Figure 89. UAE Modernization Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 90. UAE Modernization Elevator Market Revenue Share, By Type 2020 & 2027F |

| Figure 91. UAE Modernization Elevator Market Volume Share, By Type 2020 & 2027F |

| Figure 92. UAE Modernization Elevator Market Volume Share, By Modernization Type 2020 & 2027F |

| Figure 93. UAE New Installation Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 94. UAE New Installation Escalator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 95. UAE New Installation Escalator Market Volume Share, By Technology 2020 & 2027F |

| Figure 96. UAE New installation Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 97. UAE New installation Escalator Market Volume Share, By Verticals 2020 & 2027F |

| Figure 98. UAE Escalator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 99. UAE Escalator Service Market Revenue & Volume Share, By Service Type, 2020 & 2027F |

| Figure 100. UAE Escalator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 101. UAE Escalator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 102. UAE Maintenance Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 103. UAE Maintenance Escalator Market Revenue Share, By Escalator Type 2020 & 2027F |

| Figure 104. UAE Maintenance Escalator Market Volume Share, By Escalator Type 2020 & 2027F |

| Figure 105. UAE Modernization Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 106. UAE Modernization Escalator Market Revenue Share, By Escalator Type 2020 & 2027F |

| Figure 107. UAE Modernization Escalator Market Volume Share, By Escalator Type 2020 & 2027F |

| Figure 108. UAE Modernization Escalator Market Volume Share, By Modernization Type 2020 & 2027F |

| Figure 109. UAE Number of Branded Hotel Keys, Q3 2020 – FY 2023F |

| Figure 110. Number of Hotels in Dubai & Abu Dhabi, 2018-2020 |

| Figure 111. Abu Dhabi Residential Supply, 2018-2022F (Thousand Units) |

| Figure 112. Dubai Residential Supply, 2018-2022F (Thousand Units) |

| Figure 113. Abu Dhabi and Dubai Office Supply in SQFT GLA (Million), H1-2020 – 2022F |

| Figure 114. Abu Dhabi and Dubai Retail Supply in SQFT GLA (Million), H1-2020 – 2022F |

| Figure 115. UAE New Installation Elevator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 116. UAE New Installation Escalator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 117. UAE Service Elevator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 118. UAE Service Escalator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 119. UAE Escalator & Elevator Market Opportunity Assessment, By Product Type, 2027F |

| Figure 120. UAE Escalator & Elevator Market Opportunity Assessment, By Application, 2027F |

| Figure 121. UAE Elevator Market Volume Share, By Company, 2020 |

| Figure 122. Qatar Elevator & Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 123. Qatar Elevator & Escalator Market Revenue Share, By Region 2020 & 2027F |

| Figure 124. Qatar Elevator & Escalator Market Revenue Share, 2020 & 2027F |

| Figure 125. Qatar Elevator & Escalator New Installation Market Volume Share, 2020 & 2027F |

| Figure 126. Qatar Elevator & Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 127. Qatar New Installation Elevator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 128. Qatar New Installation Elevator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 129. Qatar New Installation Elevator Market Volume Share, By Technology 2020 & 2027F |

| Figure 130. Qatar New Installation Elevator Market Revenue Share, By Rise, 2020 & 2027F |

| Figure 131. Qatar New Installation Elevator Market Volume Share, By Rise, 2020 & 2027F |

| Figure 132. Qatar New Installation Elevator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 133. Qatar New Installation Elevator Market Volume Share, By Verticals, 2020 & 2027F |

| Figure 134. Qatar New Installation Elevator Market Revenue Share, By Speed, 2020 & 2027F |

| Figure 135. Qatar New Installation Elevator Market Volume Share, By Speed, 2020 & 2027F |

| Figure 136. Qatar New Installation Elevator Market Revenue Share, By Capacity, 2020 & 2027F |

| Figure 137. Qatar New Installation Elevator Market Volume Share, By Capacity, 2020 & 2027F |

| Figure 138. Qatar Elevator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 139. Qatar Elevator Service Market Revenue & Volume Share, By Service Type 2020 & 2027F |

| Figure 140. Qatar Elevator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 141. Qatar Elevator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 142. Qatar Maintenance Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 143. Qatar Maintenance Elevator Market Revenue Share, By Type 2020 & 2027F |

| Figure 144. Qatar Maintenance Elevator Market Volume Share, By Type 2020 & 2027F |

| Figure 145. Qatar Modernization Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 146. Qatar Modernization Elevator Market Revenue Share, By Type 2020 & 2027F |

| Figure 147. Qatar Modernization Elevator Market Volume Share, By Type 2020 & 2027F |

| Figure 148. Qatar Modernization Elevator Market Volume Share, By Modernization Type 2020 & 2027F |

| Figure 149. Qatar New Installation Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 150. Qatar New Installation Escalator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 151. Qatar New Installation Escalator Market Volume Share, By Technology 2020 & 2027F |

| Figure 152. Qatar New installation Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 153. Qatar New installation Escalator Market Volume Share, By Verticals 2020 & 2027F |

| Figure 154. Qatar Escalator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 155. Qatar Escalator Service Market Revenue & Volume Share, By Service Type, 2020 & 2027F |

| Figure 156. Qatar Escalator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 157. Qatar Escalator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 158. Qatar Maintenance Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 159. Qatar Maintenance Escalator Market Revenue Share, By Escalator Type 2020 & 2027F |

| Figure 160. Qatar Maintenance Escalator Market Volume Share, By Escalator Type 2020 & 2027F |

| Figure 161. Qatar Modernization Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 162. Qatar Modernization Escalator Market Revenue Share, By Escalator Type 2020 & 2027F |

| Figure 163. Qatar Modernization Escalator Market Volume Share, By Escalator Type 2020 & 2027F |

| Figure 164. Qatar Modernization Escalator Market Volume Share, By Modernization Type 2020 & 2027F |

| Figure 165. Stock of Hotel Keys in Qatar, June 2020 – June 2021 |

| Figure 166. Qatar Number of Hotels in Pipeline , 2021E -2024F+ |

| Figure 167. Location of Hotel Projects in Qatar in Pipeline, 2021E – 2024F+ |

| Figure 168. Qatar Building Permits Issued for Residential Buildings, 2017- 2021 |

| Figure 169. Qatar Office Supply, 2018 – 2022 (Million Sqm GLA) |

| Figure 170. Number of Commercial Building Permits Issued in Qatar, 2017-2021 |

| Figure 171. Qatar New Installation Elevator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 172. Qatar New Installation Escalator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 173. Qatar Service Elevator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 174. Qatar Service Escalator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 175. Qatar Escalator & Elevator Market Opportunity Assessment, By Product Type, 2027F |

| Figure 176. Qatar Escalator & Elevator Market Opportunity Assessment, By Application, 2027F |

| Figure 177. Qatar Elevator & Escalator Market Volume Ranking, By Company, 2020 |

| Figure 178. Egypt Elevator & Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 179. Egypt Elevator & Escalator Market Revenue Share, By Region 2020 & 2027F |

| Figure 180. Egypt Elevator & Escalator Market Revenue Share, 2020 & 2027F |

| Figure 181. Egypt Elevator & Escalator New Installation Market Volume Share, 2020 & 2027F |

| Figure 182. Egypt Elevator & Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 183. Egypt New Installation Elevator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 184. Egypt New Installation Elevator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 185. Egypt New Installation Elevator Market Volume Share, By Technology 2020 & 2027F |

| Figure 186. Egypt New Installation Elevator Market Revenue Share, By Rise, 2020 & 2027F |

| Figure 187. Egypt New Installation Elevator Market Volume Share, By Rise, 2020 & 2027F |

| Figure 188. Egypt New Installation Elevator Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 189. Egypt New Installation Elevator Market Volume Share, By Verticals, 2020 & 2027F |

| Figure 190. Egypt New Installation Elevator Market Revenue Share, By Speed, 2020 & 2027F |

| Figure 191. Egypt New Installation Elevator Market Volume Share, By Speed, 2020 & 2027F |

| Figure 192. Egypt New Installation Elevator Market Revenue Share, By Capacity, 2020 & 2027F |

| Figure 193. Egypt New Installation Elevator Market Volume Share, By Capacity, 2020 & 2027F |

| Figure 194. Egypt Elevator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 195. Egypt Elevator Service Market Revenue & Volume Share, By Service Type 2020 & 2027F |

| Figure 196. Egypt Elevator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 197. Egypt Elevator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 198. Egypt Maintenance Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 199. Egypt Maintenance Elevator Market Revenue Share, By Type 2020 & 2027F |

| Figure 200. Egypt Maintenance Elevator Market Volume Share, By Type 2020 & 2027F |

| Figure 201. Egypt Modernization Elevator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 202. Egypt Modernization Elevator Market Revenue Share, By Type 2020 & 2027F |

| Figure 203. Egypt Modernization Elevator Market Volume Share, By Type 2020 & 2027F |

| Figure 204. Egypt Modernization Elevator Market Volume Share, By Modernization Type 2020 & 2027F |

| Figure 205. Egypt New Installation Escalator Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 206. Egypt New Installation Escalator Market Revenue Share, By Technology 2020 & 2027F |

| Figure 207. Egypt New Installation Escalator Market Volume Share, By Technology 2020 & 2027F |

| Figure 208. Egypt New installation Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 209. Egypt New installation Escalator Market Volume Share, By Verticals 2020 & 2027F |

| Figure 210. Egypt Escalator Service Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 211. Egypt Escalator Service Market Revenue & Volume Share, By Service Type, 2020 & 2027F |

| Figure 212. Egypt Escalator Service Market Revenues & Volume, By Maintenance, 2017-2027F ($ Million, Units) |

| Figure 213. Egypt Escalator Service Market Revenues & Volume, By Modernization, 2017-2027F ($ Million, Units) |

| Figure 214. Egypt Maintenance Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 215. Egypt Maintenance Escalator Market Revenue Share, By Escalator Type 2020 & 2027F |

| Figure 216. Egypt Maintenance Escalator Market Volume Share, By Escalator Type 2020 & 2027F |

| Figure 217. Egypt Modernization Escalator Market Revenue Share, By Verticals 2020 & 2027F |

| Figure 218. Egypt Modernization Escalator Market Revenue Share, By Escalator Type 2020 & 2027F |

| Figure 219. Egypt Modernization Escalator Market Volume Share, By Escalator Type 2020 & 2027F |

| Figure 220. Egypt Modernization Escalator Market Volume Share, By Modernization Type 2020 & 2027F |

| Figure 221. Housing Supply in Greater Cairo, 2015-2022E (Thousand Units) |

| Figure 222. Retail Supply in Greater Cairo, 2015- 2022E (GLA Sq m Million) |

| Figure 223. Office Supply in Greater Cairo, 2015- 2022E (GLA Sq m Million) |

| Figure 224. Egypt Number of Hotels in Pipeline , 2021E -2024F+ |

| Figure 225. Location of Hotel Projects in Egypt in Pipeline, 2021E – 2024F+ |

| Figure 226. Hotel Supply in Greater Cairo, 2015- 2022E (Number of Keys in Thousands) |

| Figure 227. Egypt New Installation Elevator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 228. Egypt New Installation Escalator Average Selling Price, By Technology 2017-2027F (USD/ Unit) |

| Figure 229. Egypt Service Elevator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 230. Egypt Service Escalator Average Selling Price, By Maintenance 2017-2027F (USD/ Unit) |

| Figure 231. Egypt Escalator & Elevator Market Opportunity Assessment, By Product Type, 2027F |

| Figure 232. Egypt Escalator & Elevator Market Opportunity Assessment, By Application, 2027F |

| Figure 233. Egypt Elevator Market Volume Share, By Company, 2020 |

| Figure 234. Middle East Elevator & Escalator Maintenance Contract Price, By Competitors |

| Figure 235. Price Comparison of Elevator and Escalator Maintenance Contracts Price From Local Companies |

| Figure 236. Status of the Ongoing Projects in Egypt as of 2021 ($ Million) |

| Figure 237. Projects Marked by Sector in Egypt as of 2021 ($ Million) |

| List of Tables |

| Table 1. Middle East Number of Upcoming Hotel Projects Under Different Phases of Construction, 2021-24F |

| Table 2. Middle East Upcoming Projects in Construction Sector as of 2021 ($ Million) |

| Table 3. Middle East Upcoming Projects in Construction Sector as of 2021 ($ Million) (Contd.) |

| Table 4. Middle East Elevator & Escalator Market Government Initiatives and Regulatory Developments for Construction Sector |

| Table 5. Saudi Arabia Elevator & Escalator Market Revenues, By Region 2017-2027F ($ Million) |

| Table 6. Saudi Arabia Elevator & Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 7. Saudi Arabia New Installation Machine Room Above Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 8. Saudi Arabia New Installation Machine Room Less Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 9. Saudi Arabia New Installation Machine Room Above Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 10. Saudi Arabia New Installation Machine Room Less Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 11. Saudi Arabia New Installation Elevator Market Revenues, By Rise 2017-2027F ($ Million) |

| Table 12. Saudi Arabia New Installation Elevator Market Volume, By Rise 2017-2027F (Units) |

| Table 13. Saudi Arabia New Installation Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 14. Saudi Arabia New Installation Elevator Market Volume, By Verticals 2017-2027F (Units) |

| Table 15. Saudi Arabia New Installation Elevator Market Revenues, By Speed, 2017-2027F ($ Million) |

| Table 16. Saudi Arabia New Installation Elevator Market Volume, By Speed, 2017-2027F (Units) |

| Table 17. Saudi Arabia New Installation Elevator Market Revenues, By Capacity, 2017-2027F ($ Million) |

| Table 18. Saudi Arabia New Installation Elevator Market Volume, By Capacity, 2017-2027F (Units) |

| Table 19. Saudi Arabia Maintenance Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 20. Saudi Arabia Maintenance Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 21. Saudi Arabia Maintenance Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 22. Saudi Arabia Modernization Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 23. Saudi Arabia Modernization Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 24. Saudi Arabia Modernization Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 25. Saudi Arabia Modernization Elevator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 26. Saudi Arabia New Installation Inclined Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 27. Saudi Arabia New Installation Horizontal Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 28. Saudi Arabia New Installation Inclined Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 29. Saudi Arabia New Installation Horizontal Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 30. Saudi Arabia New Installation Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 31. Saudi Arabia New Installation Escalator Market Volume, By Verticals, 2017-2027F (Units) |

| Table 32. Saudi Arabia Maintenance Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 33. Saudi Arabia Maintenance Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 34. Saudi Arabia Maintenance Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 35. Saudi Arabia Modernization Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 36. Saudi Arabia Modernization Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 37. Saudi Arabia Modernization Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 38. Saudi Arabia Modernization Escalator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 39. Saudi Arabia Under Development Hotel Rooms, 2021 |

| Table 40. UAE Elevator & Escalator Market Revenues, By Region 2017-2027F ($ Million) |

| Table 41. UAE Elevator & Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 42. UAE New Installation Machine Room Above Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 43. UAE New Installation Machine Room Less Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 44. UAE New Installation Machine Room Above Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 45. UAE New Installation Machine Room Less Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 46. UAE New Installation Elevator Market Revenues, By Rise 2017-2027F ($ Million) |

| Table 47. UAE New Installation Elevator Market Volume, By Rise 2017-2027F (Units) |

| Table 48. UAE New Installation Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 49. UAE New Installation Elevator Market Volume, By Verticals 2017-2027F (Units) |

| Table 50. UAE New Installation Elevator Market Revenues, By Speed, 2017-2027F ($ Million) |

| Table 51. UAE New Installation Elevator Market Volume, By Speed, 2017-2027F (Units) |

| Table 52. UAE New Installation Elevator Market Revenues, By Capacity, 2017-2027F ($ Million) |

| Table 53. UAE New Installation Elevator Market Volume, By Capacity, 2017-2027F (Units) |

| Table 54. UAE Maintenance Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 55. UAE Maintenance Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 56. UAE Maintenance Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 57. UAE Modernization Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 58. UAE Modernization Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 59. UAE Modernization Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 60. UAE Modernization Elevator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 61. UAE New Installation Inclined Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 62. UAE New Installation Horizontal Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 63. UAE New Installation Inclined Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 64. UAE New Installation Horizontal Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 65. UAE New Installation Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 66. UAE New Installation Escalator Market Volume, By Verticals 2017-2027F (Units) |

| Table 67. UAE Maintenance Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 68. UAE Maintenance Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 69. UAE Maintenance Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 70. UAE Modernization Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 71. UAE Modernization Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 72. UAE Modernization Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 73. UAE Modernization Escalator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 74. Qatar Elevator & Escalator Market Revenues, By Region 2017-2027F ($ Million) |

| Table 75. Qatar Elevator & Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 76. Qatar New Installation Machine Room Above Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 77. Qatar New Installation Machine Room Less Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 78. Qatar New Installation Machine Room Above Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 79. Qatar New Installation Machine Room Less Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 80. Qatar New Installation Elevator Market Revenues, By Rise 2017-2027F ($ Million) |

| Table 81. Qatar New Installation Elevator Market Volume, By Rise 2017-2027F (Units) |

| Table 82. Qatar New Installation Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 83. Qatar New Installation Elevator Market Volume, By Verticals 2017-2027F (Units) |

| Table 84. Qatar New Installation Elevator Market Revenues, By Speed, 2017-2027F ($ Million) |

| Table 85. Qatar New Installation Elevator Market Volume, By Speed, 2017-2027F (Units) |

| Table 86. Qatar New Installation Elevator Market Revenues, By Capacity, 2017-2027F ($ Million) |

| Table 87. Qatar New Installation Elevator Market Volume, By Capacity, 2017-2027F (Units) |

| Table 88. Qatar Maintenance Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 89. Qatar Maintenance Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 90. Qatar Maintenance Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 91. Qatar Modernization Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 92. Qatar Modernization Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 93. Qatar Modernization Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 94. Qatar Modernization Elevator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 95. Qatar New Installation Inclined Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 96. Qatar New Installation Horizontal Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 97. Qatar New Installation Inclined Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 98. Qatar New Installation Horizontal Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 99. Qatar New Installation Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 100. Qatar New Installation Escalator Market Volume, By Verticals 2017-2027F (Units) |

| Table 101. Qatar Maintenance Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 102. Qatar Maintenance Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 103. Qatar Maintenance Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 104. Qatar Modernization Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 105. Qatar Modernization Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 106. Qatar Modernization Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 107. Qatar Modernization Escalator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 108. Egypt Elevator & Escalator Market Revenues, By Region 2017-2027F ($ Million) |

| Table 109. Egypt Elevator & Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 110. Egypt New Installation Machine Room Above Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 111. Egypt New Installation Machine Room Less Elevator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 112. Egypt New Installation Machine Room Above Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 113. Egypt New Installation Machine Room Less Elevator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 114. Egypt New Installation Elevator Market Revenues, By Rise 2017-2027F ($ Million) |

| Table 115. Egypt New Installation Elevator Market Volume, By Rise 2017-2027F (Units) |

| Table 116. Egypt New Installation Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 117. Egypt New Installation Elevator Market Volume, By Verticals 2017-2027F (Units) |

| Table 118. Egypt New Installation Elevator Market Revenues, By Speed, 2017-2027F ($ Million) |

| Table 119. Egypt New Installation Elevator Market Volume, By Speed, 2017-2027F (Units) |

| Table 120. Egypt New Installation Elevator Market Revenues, By Capacity, 2017-2027F ($ Million) |

| Table 121. Egypt New Installation Elevator Market Volume, By Capacity, 2017-2027F (Units) |

| Table 122. Egypt Maintenance Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 123. Egypt Maintenance Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 124. Egypt Maintenance Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 125. Egypt Modernization Elevator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 126. Egypt Modernization Elevator Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 127. Egypt Modernization Elevator Market Volume, By Type, 2017-2027F (Units) |

| Table 128. Egypt Modernization Elevator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 129. Egypt New Installation Inclined Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 130. Egypt New Installation Horizontal Escalator Market Revenues, By Technology Type, 2017-2027F ($ Million) |

| Table 131. Egypt New Installation Inclined Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 132. Egypt New Installation Horizontal Escalator Market Volume, By Technology Type, 2017-2027F (Units) |

| Table 133. Egypt New Installation Escalator Market Revenues, By Verticals 2017-2027F ($ Million) |

| Table 134. Egypt New Installation Escalator Market Volume, By Verticals 2017-2027F (Units) |

| Table 135. Egypt Maintenance Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 136. Egypt Maintenance Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 137. Egypt Maintenance Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 138. Egypt Modernization Escalator Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 139. Egypt Modernization Escalator Market Revenues, By Escalator Type, 2017-2027F ($ Million) |

| Table 140. Egypt Modernization Escalator Market Volume, By Escalator Type, 2017-2027F (Units) |

| Table 141. Egypt Modernization Escalator Market Volume, By Modernization Type, 2017-2027F (Units) |

| Table 142. Ongoing Projects in Egypt ($ Million) |

| Table 143. Ongoing Projects in Egypt ($ Million) contd. |

Market Forecast by Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain and Turkey), Market Forecast By Types (Elevator, Escalator, Moving Walkways), By Services (Maintenance & Repair, New Installation, Modernization), By End-User (Residential, Commercial, Public) And Competitive Landscape

| Product Code: ETC059997 | Publication Date: May 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 90 | No. of Tables: 30 |

Middle East Elevator And Escalator Market is projected to grow over the coming years. Middle East Elevator And Escalator Market is a part of our various regional publications globally. 6W tracks Elevator And Escalator Market for over 60 countries with individual country-wise market opportunity assessment and publishes the report titled Global Elevator And Escalator Market outlook report annually.

Middle East Elevator and Escalator Market report comprehensively covers the market by Types, Services and End Users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Middle East Elevator and Escalator Market Synopsis

The Middle East Elevator and Escalator market is one of the fastest-growing markets in the world. Elevators and escalators are resourceful means to carry people up and down multiple floors and help in saving time and efforts of the people. The demand for elevators and escalators is continuously rising in the Middle East region due to various reasons. Further, some of the key growth drivers of the Middle East Elevator and Escalator market are a substantial rise in the tourism sector and increment of the construction activities such as the expansion of malls, airports, metros, hotels, etc. Also, the rapid growth of the population has led to an increase in the residential sector of the Middle East region which has directly impacted the demand for the installation of elevators and escalators in such high-rise residential complexes. Moreover, high dependency on foreign countries to obtain raw materials remains the biggest challenge for Middle East Elevator and Escalator market. In addition, high import duties and unavailability of skilled labour are some of the other factors that hinder the growth of the Elevator and Escalator market. Despite a few restraints, the Middle East Elevator and Escalator market has promising growth potential due to the rise in tourism as well as the construction sector which leads to higher demand for elevators and escalators.

According to 6Wresearch, the Middle East Elevator and Escalator market size is anticipated to register growth during 2021-2027. The Middle East Elevator and Escalator market is one of the leading markets in the world. The Middle East region is witnessing rapid growth in the demand for elevators and escalators with time. Further, various government policies targeting the improvement of the economic state of the country has impacted the demand for elevators and escalators positively. Further, Otis Saudi Arabia was selected by FAST Consortium to provide elevators and escalators for the Riyadh metro projects in the year 2017. In addition, Schindler Middle East was assigned to install elevators and escalators at several terminals of Riyadh Airport. In addition, some of the key players in the Middle East Elevator and Escalator market are ThyssenKrupp, Otis Elevators, Gulf Elevator and Escalator, KONE, Hyundai Elevator and Khaled Juffali Elevator.

Market Analysis by Geography

In the overall Middle East region, Saudi Arabia is the highest revenue-generating region in the Elevator and Escalator market. The major regions behind the growth of the Elevator and Escalator market in Saudi Arabia are the rising number of high-rise buildings, improvement of the construction sector, infrastructure development and expansion in investment. Also, Saudi Arabia’s strategy called “Vision 2030” is focused on shifting the nation’s economy from an oil-based to a non-oil-based economy which brought a huge emphasis on improving the tourism sector and bringing about change in the overall infrastructure which led to a surge in the demand for elevators and escalators. Further, UAE has promising growth prospects in the Elevator and Escalator market as the economy is strengthening the economic conditions by building infrastructure. The expansion of international airports, increase in the number of residential and commercial complexes has further led to a rise in the demand for elevators and escalators in UAE. Moreover, the increasing rate of investment, political stability and improvement of economic affairs in Qatar has given a boost to the Elevator and Escalator market. Also, an upcoming event, “FIFA 2022” which is going to be held in Qatar has resulted in government intervention and an increase in investment towards the construction of stadiums, airports, metros, high-rise buildings such as hotels, etc. These factors have increased the demand for elevators and escalators in Qatar. Additionally, the “National Development Plan 2035” introduced in Kuwait has increased the revenue-generating potential of the country as it focuses on strengthening the infrastructure and shifting the country from an oil-based to a non-oil-based economy. As a result, there was a substantial increase in the construction of high-rise buildings, airports, metros, residential and commercial complexes, etc which led to a surge in the demand for elevators and escalators in Kuwait. Furthermore, Turkey has high growth potential in the Elevator and Escalator market due to increased government spending towards constructing high-rise buildings, IT parks, restaurants and hotels.

Market Analysis by Type

The Middle East Elevator and Escalator market is divided into various segments based upon its product types, services and end-users. Further, with the expansion of economies of the Middle East region, the demand for high-tech elevators is rising across the region. Thus, the elevator segment is the leading segment of the Middle East Elevator and Escalator market. Moreover, an increase in the investment and government spending towards the up-gradation of airports, construction of metros, malls, hotels and other high-rise buildings has risen the demand for escalators in the Middle East region. Hence, the escalator segment has high growth potential in the near future. Moreover, the moving walkway segment is experiencing a slow growth rate due to a lack of technological advancements and the unavailability of raw materials. However, with the rise in the expansion of international airports and improvement of the overall infrastructure in the Middle East region, the moving walkways segment is rising at a slow yet steady pace and is expected to grow in the near future. In addition, the new installation is leading the services segmentation as increased government intervention and foreign direct investments have led to the creation of various high-rise buildings, malls, international airports, etc. These projects require a new installation of high-tech and advanced elevators and escalators to ease the movement of people. Further, to ensure the safety of individuals, regular maintenance and repair of the existing elevators and escalators become crucial. The Middle East region emphasis strongly maintaining the safety standard of the high-tech elevators and escalators. Thus, the maintenance and repair segment is also one of the highest revenue-generating segments of the Middle East Elevator and Escalator market. Additionally, due to the rapid urbanization and up-gradation of existing infrastructure in the Middle East region, the demand for high-tech, innovative and advanced elevators and escalators are increasing. Thus, the modernization segment of the Middle East Elevator and Escalator Market is expected to grow at a faster rate.

Market Analysis by End Users

The Middle East Elevator and Escalator market is influenced by both commercials as well as residential end-users. The high investment made by the government of various countries of the Middle East region for the betterment of economies has led to a great impact on the construction of high-rise buildings, hotel chains, guest houses, skyscrapers and residential buildings. In addition, the growing population in the Middle East has led to a rise in the construction of high-rise buildings and has further increased the demand for heavy elevators and escalators. Moreover, the public end-user segment has been witnessing a stagnant rise in the revenue generated from the Elevator and Escalator market in the Middle East region due to scarcity of resources such as insufficient raw materials, lack of skilled labour and unavailability of high-tech resources. However, the increase in government spending on various social projects is likely to encourage the demand for elevators and escalators in the Middle East region.

Other Related Reports:

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Middle East Elevator and Escalator Market Outlook

- Market Size of Middle East Elevator and Escalator Market, 2020

- Forecast of Middle East Elevator and Escalator Market, 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Revenues & Volume for the Period 2017 - 2027

- Middle East Elevator and Escalator Market Trend Evolution

- Middle East Elevator and Escalator Market Drivers and Challenges

- Middle East Elevator and Escalator Price Trends

- Middle East Elevator and Escalator Porter's Five Forces

- Middle East Elevator and Escalator Industry Life Cycle

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Types for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Services for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Middle East Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Saudi Arabia Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of UAE Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Qatar Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Kuwait Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Oman Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Bahrain Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Turkey Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By End-User for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Rest of Middle East Elevator and Escalator Market Revenues & Volume By Public for the Period 2017 - 2027

- Middle East Elevator and Escalator Market - Key Performance Indicators

- Middle East Elevator and Escalator Market - Import Export Trade Statistics

- Middle East Elevator and Escalator Market - Opportunity Assessment By Countries

- Middle East Elevator and Escalator Market - Opportunity Assessment By Types

- Middle East Elevator and Escalator Market - Opportunity Assessment By Services

- Middle East Elevator and Escalator Market - Opportunity Assessment By End-User

- Middle East Elevator and Escalator Market - Top Companies Market Share

- Middle East Elevator and Escalator Market - Top Companies Profiles

- Middle East Elevator and Escalator Market - Comparison of Players in Technical and Operating Parameters

- Middle East Elevator and Escalator Market - Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Types:

- Elevator

- Passenger

- Cargo

- Home

- Escalator

- Moving Stairs

- Moving Walks

- Elevator

- By Applications:

- Commercial

- Residential

- Industrial

- By Services:

- New Installations

- Maintenance

- Modernization

- By Countries:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Turkey

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share