Myanmar Adhesive Tapes Market (2025-2031) | Industry, Forecast, Value, Trends, Revenue, Growth, Outlook, Analysis, Size, Companies & Share

Market Forecast By Resin Types (Acrylic, Epoxy, Rubber-based, Silicone, Polyurethane, Others), By Technology Types (Water-based, Solvent-based, Hot-melt, Reactive, Others), By Baking Material (Polypropylene (PP), Polyvinyl Chloride (PVC), Paper, Others), By End-users (Automotive, Health Care, Appliances, Others) And Competitive Landscape

| Product Code: ETC003934 | Publication Date: Sep 2020 | Updated Date: Mar 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

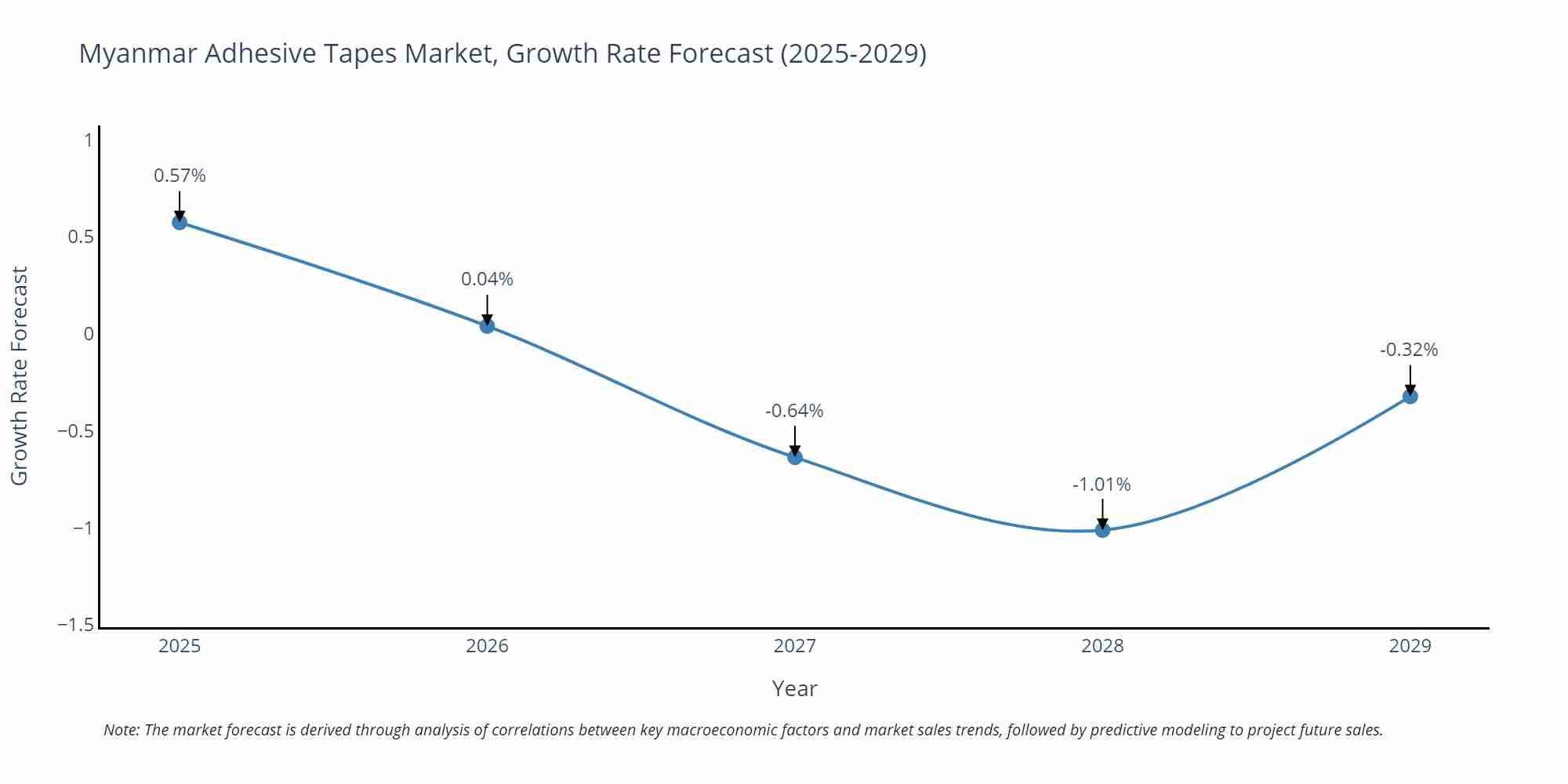

Myanmar Adhesive Tapes Market Size Growth Rate

The Myanmar Adhesive Tapes Market is projected to witness mixed growth rate patterns during 2025 to 2029. Although the growth rate starts strong at 0.57% in 2025, it steadily loses momentum, ending at -0.32% by 2029.

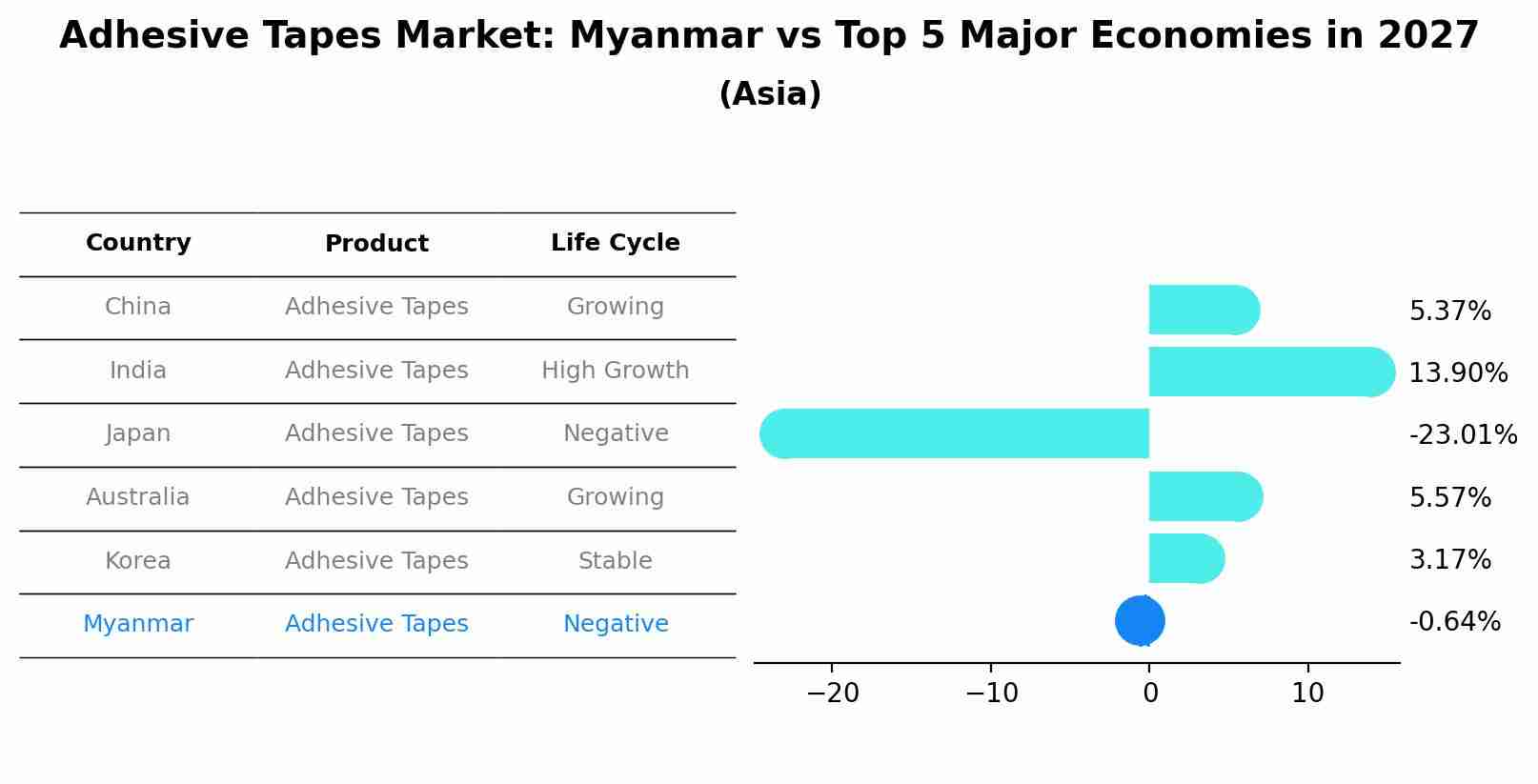

Adhesive Tapes Market: Myanmar vs Top 5 Major Economies in 2027 (Asia)

By 2027, Myanmar's Adhesive Tapes market is forecasted to achieve a negative growth rate of -0.64%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Myanmar Adhesive Tapes Market Highlights

| Report Name | Myanmar Adhesive Tapes Market |

| Forecast period | 2025-2031 |

| CAGR | 4.8% |

| Growing Sector | Automotive |

Topics Covered in the Myanmar Adhesive Tapes Market Report

Myanmar Adhesive Tapes Market report thoroughly covers the market by Resin types, Technology types, Baking materials, and end users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders devise and align their market strategies with current and future market dynamics.

Myanmar Adhesive Tapes Market Synopsis

The Myanmar adhesive tapes Industry is experiencing consistent growth on the back of growing demand from the packaging, automotive, and construction industries. Increased adoption of environmentally friendly and high-performance adhesive products is also fueling Myanmar Adhesive Tapes Market Growth. Technological advancements and regulations impacting adhesive formulation are influencing market trends. Infrastructure development and investment in manufacturing are also likely to drive consistent market growth over the next few years.

According to 6Wresearch, the Myanmar Adhesive Tapes Market Size is projected to grow at a CAGR of 4.8% during the forecast period 2025-2031. Market growth is primarily driven by increasing demand in segments such as packaging, construction, automotive, and healthcare. Increasing e-commerce has been one of the key driving forces for increased usage of adhesive tapes for safe packaging and logistics operations. Besides that, continuous infrastructural development in Myanmar, such as road expansion, commercial structures, and factories, maintains the demand for high-performance adhesive products in an upward trajectory. The automotive industry is also a huge sector that drives demand, with manufacturers utilizing increasing adhesive tapes for bonding, insulation, and vibration-damping applications instead of mechanical fasteners to maximize efficiency and minimize vehicle weight.

However, the unstable raw material prices, i.e., petroleum-based adhesives, impact the cost of production and margin. Further, low domestic capacity for production makes the country heavily reliant on imports, thereby exposing the market to foreign exchange and supply chain risks. The stringent environmental norms for solvent-based adhesives usage also create compliance issues for manufacturers. To support growth, the firms need to invest in research and development to produce green and high-performance adhesive tapes according to changing industry requirements and customer demand.

Myanmar Adhesive Tapes Market Trends

The Myanmar adhesive tape industry is experiencing some shifting trends with the spark provided by industrialization, technology development, and evolving consumer tastes. Environment-friendly adhesive tapes like water-based and solvent-free are leading the market with companies focusing more on the environment. Retail leadership in the packaging industry as well as the e-commerce boom is a gigantic area for the use of adhesive tapes, but there is a trend of rising high-strength as well as tamper-evident tapes.

In addition, advances in technology in adhesives have provided tapes with tailored characteristics such as enhanced durability, heat resistance, and adhesive capability for use in the construction and automotive sectors. Greater utilization of automation in the manufacturing process is also driving the pressure-sensitive and high-performance tapes market forward. However, risks to the market exist in terms of raw material price volatility and dependence on imports. Despite this, additional investment in industry and infrastructure will drive the market further.

Investment Opportunities in the Myanmar Adhesive Tapes Market

The Myanmar adhesive tape market provides key investment opportunities through industrialization, the development of infrastructure, and increasing demand across different industry sectors. The expansion of the use of adhesive tapes in the packaging sector, particularly with the fillip provided by growth in e-commerce and retailing, presents excellent opportunities for local production lines to be established by companies. Investment in green and environmentally friendly adhesive technologies via waterborne or solvent-free technologies is also seeing rising demand because companies and regulatory agencies are concentrating on the conservation of the environment.

Further, the automobile and building industries are also good bets with adhesive tapes utilized intensively for sealing, bonding, and insulation. Speciality high-performance adhesive products are needed more as Myanmar continues to grow in industrial base development. Local manufacturers and foreign investors can cash in on these opportunities through distribution channel establishment, new product introductions to the nation, and strategic partnerships due to market visibility and competitiveness needs.

Leading Players in Myanmar Adhesive Tapes Market

The Myanmar adhesive tapes market is dominated by some major players who lead the growth of the market by engaging in research and development, product differentiation, and strategic investment. Some of the prominent players include 3M, Tesa SE, Nitto Denko Corporation, Avery Dennison, and Henkel AG & Co. KGaA, which are market leaders by providing high-performance adhesive solutions that are customized for certain applications, including packaging, construction, automobile, and health. They invest in research and development to offer cutting-edge adhesive technologies such as high-strength, heat-resistant, and environmental tapes.

They invest in developing distribution channels and alliances to position themselves in Myanmar's growing industrial base. Domestic and regional manufacturers also sustain competition in the market by offering cheap solutions, meeting the increasing demand for speciality adhesive tapes. Market development is also being fuelled by increased industrialization and infrastructure investment. The Myanmar adhesive tapes market is growing with increasing industrial applications, technological advancements, and increasing demand.

Government Regulations

Government policies play an important role in the Myanmar adhesive tapes market by ensuring products are safe, and environmentally friendly, and maintaining industry standards. Laws on the use of dangerous chemicals employed in adhesives have compelled manufacturers to switch to substitute green products, such as water-based and solvent-free adhesives. Government agencies have also implemented control of quality to allow imported and domestic adhesive tapes to achieve world standards of safety and performance.

Import controls and trade legislation also influence the supply and price of raw materials used in adhesives, again influencing market trends. Environmental regulation, particularly recycling and disposal of waste, has led manufacturers to adopt green production processes. With the state encouraging industrialization, regulatory systems can lean towards innovations as they increase environmental and consumer protection. Adherence to such regulation is central for business firms aiming at long-term growth and competitiveness in the market.

Future Insights of the Myanmar Adhesive Tapes Industry

The Myanmar adhesive tape industry will grow due to increased industrialization, technological advancements, and increasing demand in key industries. Environmental and green adhesive solutions will be responsible for driving innovation, with producers attempting to produce water-based and solvent-free tapes based on regulatory and environmental conditions. Expansion in the e-commerce and packaging industry will also push the market, with producers aiming for high-performance adhesive solutions to facilitate safe and effective packaging.

Additionally, automotive and construction markets are likely to see increased applications of advanced adhesive tapes for adhesion, insulation, and sealing. Foreign investment and local production growth will create more market competition, suppressing dependence on imports. Despite raw material price fluctuations, the market will see healthy growth due to growth in infrastructure and consumers' demand for high-end adhesive solutions.

Market Segmentation Analysis

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

Acrylic-based adhesive tapes to Dominate the Market-By Resin types

Acrylic adhesive tapes will register a higher market among technology types in the Myanmar adhesive tape market. Acrylic adhesives have high bonding quality, good ageing characteristics, and resistance to temperature, water, and chemicals and are therefore found useful in other applications like packing, construction, and automobile segments.

Water-based adhesive tapes to Dominate Market-By technology types

Water-based adhesive tapes will be the market leader among the available technologies for Myanmar adhesive tapes. With the increasing focus on environment-friendly and low-emission adhesives, water-based adhesives free from solvents and compliant with environment-friendly regulations are in greater demand.

Polypropylene (PP)-based to Dominate the Market-By Baking Material

The Myanmar adhesive tapes market is fueled by growing industry demand, innovation, and sustainability solutions. Polypropylene (PP) based adhesive tapes will dominate the market under backing material types in Myanmar adhesive tapes market. Polypropylene is very elastic, possesses high tensile strength, and is chemically and water resistant, hence highly suitable for most applications, particularly in packaging, sealing, and industrial applications.

Automotive Industry to Dominate the Market End-user

According to Kapil, Senior Research Analyst, 6Wresearch, the automotive segment will dominate among the end-user segments in the Myanmar adhesive tapes market. The increased demand for advanced adhesive solutions in vehicle manufacturing and repair, including bonding, insulation, and surface protection, drives this segment's dominance.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Myanmar Adhesive Tapes Market Overview

- Myanmar Adhesive Tapes Market Outlook

- Market Size of Myanmar Adhesive Tapes Market, 2024

- Forecast of Myanmar Adhesive Tapes Market, 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Revenues & Volume for the Period 2021 - 2031

- Myanmar Adhesive Tapes Market Trend Evolution

- Myanmar Adhesive Tapes Market Drivers and Challenges

- Myanmar Adhesive Tapes Price Trends

- Myanmar Adhesive Tapes Porter's Five Forces

- Myanmar Adhesive Tapes Industry Life Cycle

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Resin Types for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Acrylic for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Epoxy for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Rubber-based for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Silicone for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Polyurethane for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Technology Types for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Water-based for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Solvent-based for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Hot-melt for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Reactive for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Baking Material for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Polypropylene (PP) for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Polyvinyl Chloride (PVC) for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Paper for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By End-users for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Automotive for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Health Care for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Appliances for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Myanmar Adhesive Tapes Import Export Trade Statistics

- Market Opportunity Assessment By Resin Types

- Market Opportunity Assessment By Technology Types

- Market Opportunity Assessment By Baking Material

- Market Opportunity Assessment By End-users

- Myanmar Adhesive Tapes Top Companies Market Share

- Myanmar Adhesive Tapes Competitive Benchmarking By Technical and Operational Parameters

- Myanmar Adhesive Tapes Company Profiles

- Myanmar Adhesive Tapes Key Strategic Recommendations

Market Covered

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

By Resin Types

- Acrylic

- Epoxy

- Rubber-based

- Silicone

- Polyurethane

- Others

By Technology Types

- Water-based

- Solvent-based

- Hot-melt, Reactive

- Others

By Baking Material

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)Paper

- Others

By End-users

- Automotive

- Health Care

- Appliances

- Others

Myanmar Adhesive Tapes Market (2025-2031) : FAQs

| Table of Contents |

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Myanmar Adhesive Tapes Market Overview |

| 3.1. Myanmar Country Macro Economic Indicators |

| 3.2. Myanmar Adhesive Tapes Market Revenues & Volume, 2021 & 2031F |

| 3.3. Myanmar Adhesive Tapes Market - Industry Life Cycle |

| 3.4. Myanmar Adhesive Tapes Market - Porter's Five Forces |

| 3.5. Myanmar Adhesive Tapes Market Revenues & Volume Share, By Resin Types, 2021 & 2031F |

| 3.6. Myanmar Adhesive Tapes Market Revenues & Volume Share, By Technology Types, 2021 & 2031F |

| 3.7. Myanmar Adhesive Tapes Market Revenues & Volume Share, By Baking Material, 2021 & 2031F |

| 3.8. Myanmar Adhesive Tapes Market Revenues & Volume Share, By End-users, 2021 & 2031F |

| 4. Myanmar Adhesive Tapes Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Myanmar Adhesive Tapes Market Trends |

| 6. Myanmar Adhesive Tapes Market, By Types |

| 6.1. Myanmar Adhesive Tapes Market, By Resin Types |

| 6.1.1 Overview and Analysis |

| 6.1.2. Myanmar Adhesive Tapes Market Revenues & Volume, By Resin Types, 2021 - 2031F |

| 6.1.3. Myanmar Adhesive Tapes Market Revenues & Volume, By Acrylic, 2021 - 2031F |

| 6.1.4. Myanmar Adhesive Tapes Market Revenues & Volume, By Epoxy, 2021 - 2031F |

| 6.1.5. Myanmar Adhesive Tapes Market Revenues & Volume, By Rubber-based, 2021 - 2031F |

| 6.1.6. Myanmar Adhesive Tapes Market Revenues & Volume, By Silicone, 2021 - 2031F |

| 6.1.7. Myanmar Adhesive Tapes Market Revenues & Volume, By Polyurethane, 2021 - 2031F |

| 6.1.8. Myanmar Adhesive Tapes Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2. Myanmar Adhesive Tapes Market, By Technology Types |

| 6.2.1. Overview and Analysis |

| 6.2.2. Myanmar Adhesive Tapes Market Revenues & Volume, By Water-based, 2021 - 2031F |

| 6.2.3. Myanmar Adhesive Tapes Market Revenues & Volume, By Solvent-based, 2021 - 2031F |

| 6.2.4. Myanmar Adhesive Tapes Market Revenues & Volume, By Hot-melt, 2021 - 2031F |

| 6.2.5. Myanmar Adhesive Tapes Market Revenues & Volume, By Reactive, 2021 - 2031F |

| 6.2.6. Myanmar Adhesive Tapes Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3. Myanmar Adhesive Tapes Market, By Baking Material |

| 6.3.1. Overview and Analysis |

| 6.3.2. Myanmar Adhesive Tapes Market Revenues & Volume, By Polypropylene (PP), 2021 - 2031F |

| 6.3.3 Myanmar Adhesive Tapes Market Revenues & Volume, By Polyvinyl Chloride (PVC), 2021 - 2031F |

| 6.3.4. Myanmar Adhesive Tapes Market Revenues & Volume, By Paper, 2021 - 2031F |

| 6.3.5. Myanmar Adhesive Tapes Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.4. Myanmar Adhesive Tapes Market, By End-users |

| 6.4.1. Overview and Analysis |

| 6.4.2. Myanmar Adhesive Tapes Market Revenues & Volume, By Automotive, 2021 - 2031F |

| 6.4.3. Myanmar Adhesive Tapes Market Revenues & Volume, By Health Care, 2021 - 2031F |

| 6.4.4. Myanmar Adhesive Tapes Market Revenues & Volume, By Appliances, 2021 - 2031F |

| 6.4.5. Myanmar Adhesive Tapes Market Revenues & Volume, By Others, 2021 - 2031F |

| 7. Myanmar Adhesive Tapes Market Import-Export Trade Statistics |

| 7.1. Myanmar Adhesive Tapes Market Export to Major Countries |

| 7.2. Myanmar Adhesive Tapes Market Imports from Major Countries |

| 8. Myanmar Adhesive Tapes Market Key Performance Indicators |

| 9. Myanmar Adhesive Tapes Market - Opportunity Assessment |

| 9.1. Myanmar Adhesive Tapes Market Opportunity Assessment, By Resin Types, 2021 & 2031F |

| 9.2. Myanmar Adhesive Tapes Market Opportunity Assessment, By Technology Types, 2021 & 2031F |

| 9.3. Myanmar Adhesive Tapes Market Opportunity Assessment, By Baking Material, 2021 & 2031F |

| 9.4. Myanmar Adhesive Tapes Market Opportunity Assessment, By End-users, 2021 & 2031F |

| 10. Myanmar Adhesive Tapes Market - Competitive Landscape |

| 10.1. Myanmar Adhesive Tapes Market Revenue Share, By Companies, 2024 |

| 10.2. Myanmar Adhesive Tapes Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11. Company Profiles |

| 12. Recommendations |

| 13. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero