Poland Adhesive Tapes Market (2025-2031) | Companies, Trends, Forecast, Outlook, Industry, Analysis, Growth, Size, Revenue, Share & Value

Market Forecast By Resin Types (Acrylic, Epoxy, Rubber-based, Silicone, Polyurethane, Others), By Technology Types (Water-based, Solvent-based, Hot-melt, Reactive, Others), By Baking Material (Polypropylene (PP), Polyvinyl Chloride (PVC), Paper, Others), By End-users (Automotive, Health Care, Appliances, Others) And Competitive Landscape

| Product Code: ETC003941 | Publication Date: Sep 2020 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

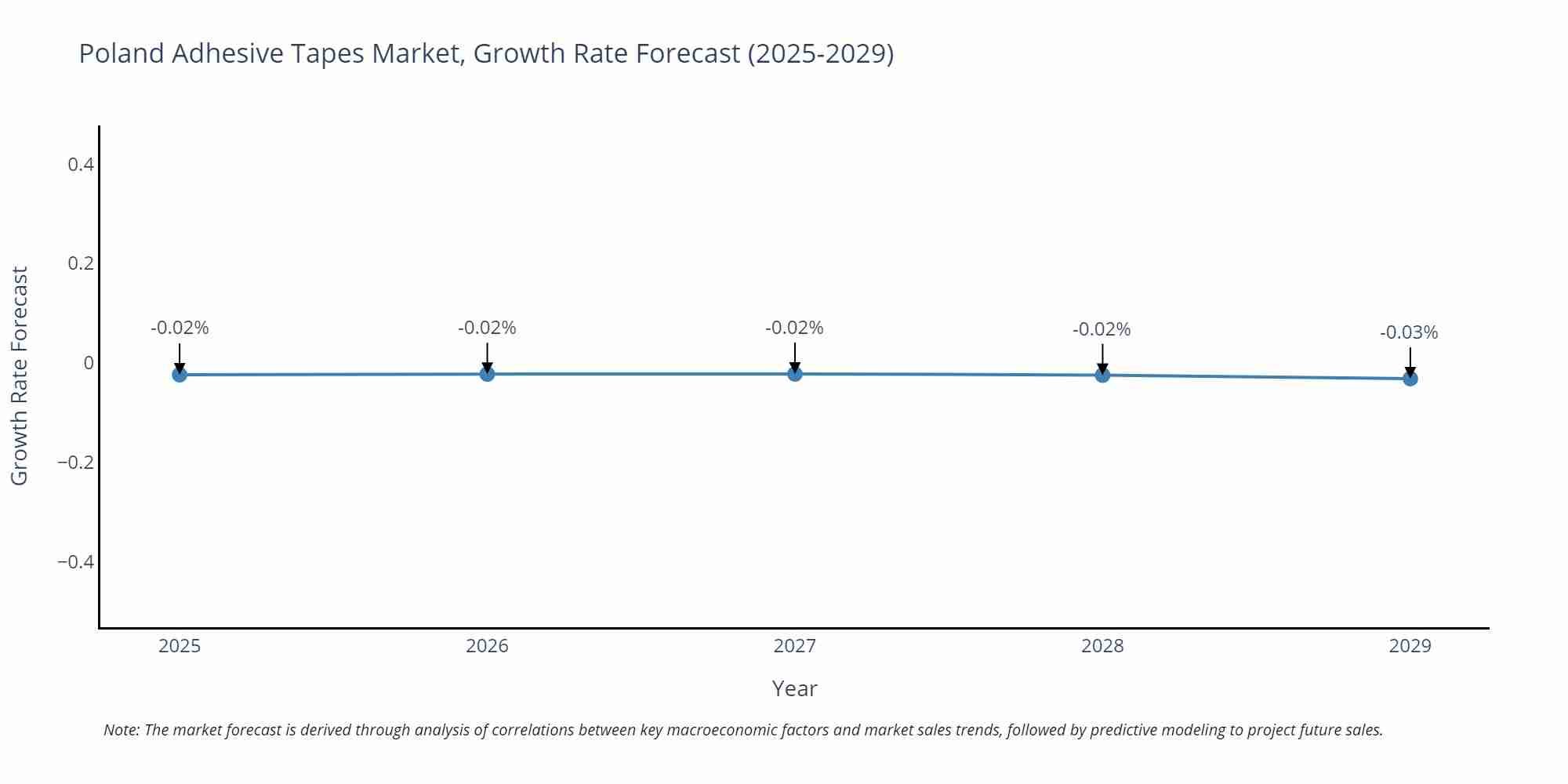

Poland Adhesive Tapes Market Size Growth Rate

The Poland Adhesive Tapes Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to -0.02% in 2027, following an initial rate of -0.02%, before easing to -0.03% at the end of the period.

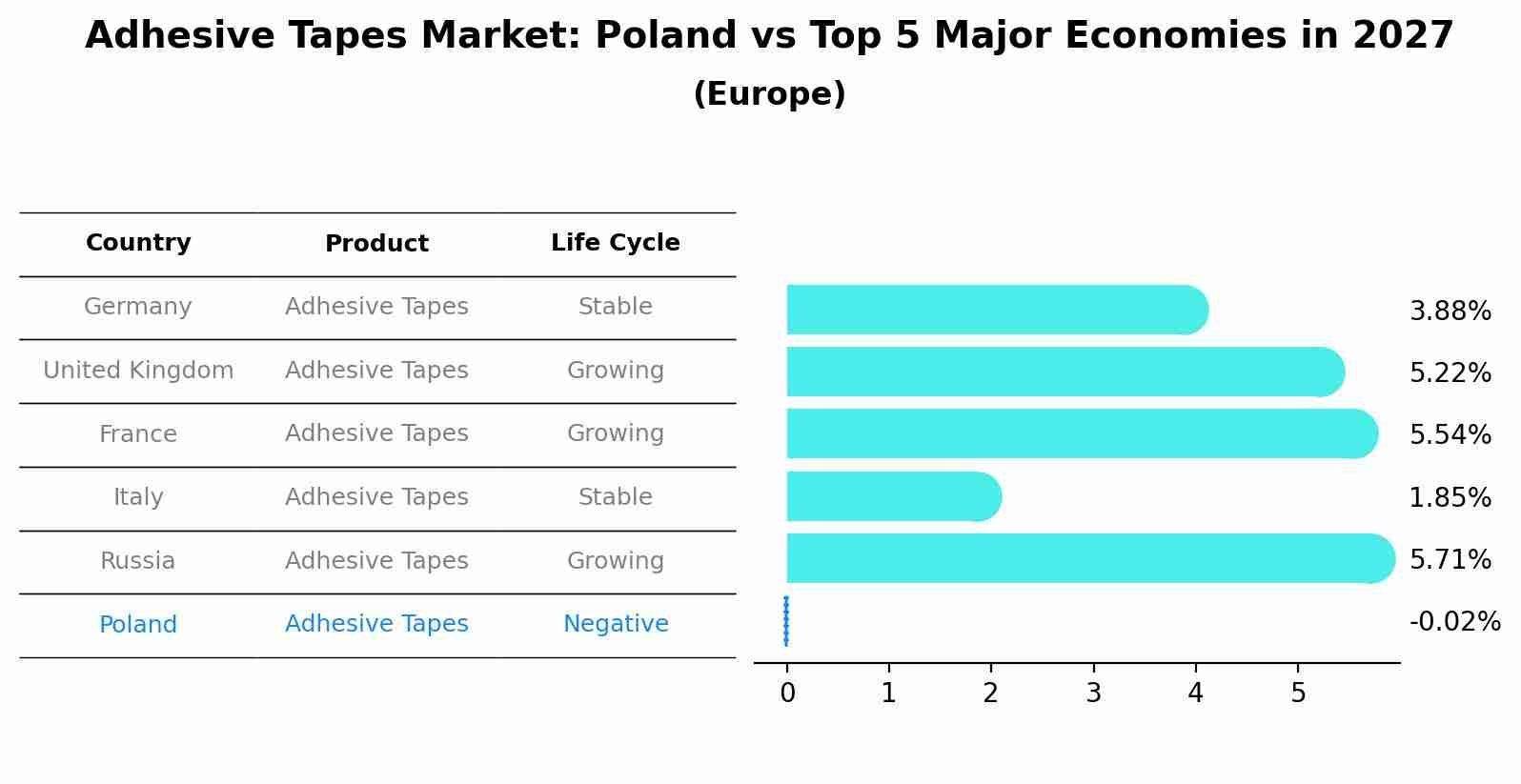

Adhesive Tapes Market: Poland vs Top 5 Major Economies in 2027 (Europe)

In the Europe region, the Adhesive Tapes market in Poland is projected to expand at a negative growth rate of -0.02% by 2027. The largest economy is Germany, followed by United Kingdom, France, Italy and Russia.

Topics Covered in the Poland Adhesive Tapes Market Report

The Poland Adhesive Tapes Market report thoroughly covers the market by Resin types, Technology types, Baking material, and End-User. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Poland Adhesive Tapes Market Synopsis

The Poland adhesive tapes market size is witnessing steady growth due to growing demand from industries like automotive, healthcare, and packaging. This market growth can be seen as a result of growing demand across industries, advancements in technology, and innovation. Development in adhesive technologies and a growing preference for high-performance tapes are driving the market forward. Moreover, the transition to green and biodegradable adhesive solutions is influencing the industry. But market dynamics could be affected by issues like volatility in raw material prices and strict environmental laws.

According to 6Wresearch, the Poland Adhesive Tapes Market is projected to grow at a CAGR of 7.1% during the forecast period of 2025-2031. This development is dominated by the increasing demand for adhesive tapes in the automobile, healthcare, construction, and packaging industries. The growing manufacturing industry in Poland and the rise of industrial automation are also fast-tracking the demand for high-performance adhesive solutions. Furthermore, increasing attention towards environment-friendly and sustainable adhesive tapes meeting rigorous environmental compliance standards is stimulating market growth. The growing demand for new, more advanced adhesive technologies that have better bonding strength and durability further boosts the growth of the industry.

Yet, there are some issues affecting the growth of the market that the industry has to address. One such key issue is the volatile raw material cost, particularly polymers and resins, which contribute a great deal to the production cost and pricing policy. Furthermore, tight government regulations on the application of some chemicals in adhesives and the move towards biodegradable products provide compliance issues to manufacturers. Further, the existence of fake adhesive products in the market threatens the revenue of major industry players. Even though these challenges face the market, ongoing developments in adhesives technologies and increasing research and development investments are projected to increase the potential of the market, guaranteeing consistent growth throughout the forecasting period.

Poland Adhesive Tapes Market Trends

The Poland adhesive tapes market is witnessing tremendous changes through developments in material technology and expanding industrial demand. Among the emerging trends in the market is the growing demand for sustainable and biodegradable adhesive tapes, fueled by stringent environmental legislations and growing consumer concern towards sustainability. Packaging, automotive, and healthcare industries are seeing growing uses of high-performance adhesive solutions featuring enhanced durability, temperature resistance, and high adhesion properties.

In addition, the adoption of advanced manufacturing processes, such as solvent-free and water-based adhesives, is becoming more popular as companies look to cut volatile organic compound emissions. Increased focus on flexible and lightweight bonding materials, especially in the construction and automotive industries, is also fueling market growth. Ongoing research and development activities aimed at improving the efficiency and cost-effectiveness of products are also likely to spur further market growth over the next few years.

Investment Opportunities in the Poland Adhesive Tapes Market

The Poland adhesive tapes market offers a plethora of investment opportunities, fueled by growing industrial uses and technology advancements. The increasing demand for high-performance adhesive solutions in major industries such as packaging, automotive, healthcare, and construction created a healthy investment climate. Opportunities exist for investors in developing environmentally friendly adhesive tapes, as regulations and consumer trends are moving towards biodegradable and recyclable materials. Additionally, R&D investments into enhancing adhesive strength, thermal stability, and shelf life can provide a boost in market competitiveness. The shift in the direction towards water-based and solvent-free adhesives represents a bright horizon for companies prioritizing eco-friendly production practices. Also, accelerating digitalization in manufacturing processes and automation in producing adhesive tapes can result in higher efficiency and lower costs. As the demand for specialized adhesive solutions grows, strategic investments in product innovation and technological advancements will be key to market expansion.

Leading Players in the Poland Adhesive Tapes Market

The Poland adhesive tapes market has several leading manufacturers who support its development with innovation in products and technology. Some of the biggest players in the market include 3M, Tesa SE, Avery Dennison Corporation, Nitto Denko Corporation, and Scapa Group. These players are engaged in growing their product portfolios to support the rising demand from the automotive, healthcare, packaging, and construction industries. 3M and Tesa SE are well known for their high-performance adhesives, providing a broad portfolio of industrial and consumer tapes. Avery Dennison Corporation deals in pressure-sensitive materials, while Nitto Denko Corporation specialises in advanced adhesive technologies for different industries. Scapa Group is renowned for its capabilities in medical and industrial adhesives. These businesses are making investments in research and development to further improve product quality, sustainability, and performance, increasing their market positioning. The Poland adhesive tapes market growth is a result of growing industrial applications, infrastructure construction, and advancements in technology.

Government Regulations

The Poland Adhesive Tapes Industry is regulated by the government to ensure product quality, environmental conservation, and consumer protection. Manufacturers have to abide by European Union regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) to help manage harmful substances in adhesives. Stringent environmental regulations also result in the use of biodegradable and eco-friendly materials, leading to businesses creating environmentally friendly alternatives. Legislations controlling industrial adhesives also address emission standards of volatile organic compounds (VOCs), where manufacturing processes need to be low-emission.

Additionally, packaging and labeling standards require explicit information on the product's composition and safety measures. Occupational safety regulations also affect the market to safeguard workers handling adhesive products. Compliance with such regulatory standards guarantees product consistency, innovation in green adhesive technology, and sustainable industrial development in the Poland adhesive tapes industry.

Future Insights of the Poland Adhesive Tapes Market

Poland's market for adhesive tapes is set to witness constant growth, driven by improvements in manufacturing technology and growing demand across industries. The growth of industrial automation and the growing usage in automotive, construction, and healthcare industries will boost the market.

Moreover, the rising importance of sustainable and environment-friendly adhesive products is likely to influence the market, as firms invest in biodegradable and solvent-free adhesive products in response to rigorous environmental regulations. Technological advancements, including high-performance and specialty adhesive tapes, are expected to improve product efficiency and durability, meeting changing industry demands. The growing use of smart packaging and electronics is also likely to propel demand for advanced adhesive solutions. Additionally, growing infrastructure development and industrialization in Poland will continue to drive market growth, setting the adhesive tapes industry up for long-term growth and diversification in the next few years.

Market Segmentation Analysis

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

Acrylic-based adhesive tapes to Dominate the Market-By Resin types

Acrylic-based adhesive tapes are poised to dominate the Poland adhesive tapes market because of their excellent adhesion characteristics, performance durability, and stability against environmental conditions like temperature changes and humidity.

Water-based Adhesive Tapes to Dominate the Market-By Technology types

Water-based adhesive technology in the Poland adhesive tapes industry is poised to expand because of its sustainability efforts, low volatile organic compound (VOC) emission, and good adhesion. The technology is highly used in the packaging, automotive, and construction industries, where sustainability and regulatory aspects are top priorities.

Polypropylene (PP)-Based to Dominate the Market-By Baking Material

The Poland adhesive tapes market is growing because of rising demand in the automotive, healthcare, and packaging sectors. Polypropylene (PP) is expected to lead the market among backing materials in the Poland adhesive tapes market because of its high strength, flexibility, and affordability. Adhesive tapes based on PP are used extensively in industries like packaging, automotive, and construction, where strength and chemical and moisture resistance are crucial.

Automotive Industry to Dominate the Market-By End-user

According to Kapil, Senior Research Analyst, 6Wresearch, the automotive industry is poised to grow among end-user groups owing to the shifting demand for light-weight and high-performance bonding solutions in automotive manufacturing. Adhesive tapes are used extensively for interior and exterior uses, such as wire harnessing, surface protection, and structural bonding, lowering the usage of mechanical fasteners and improving automobile efficiency.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Poland Adhesive Tapes Market Overview

- Poland Adhesive Tapes Market Outlook

- Market Size of Poland Adhesive Tapes Market, 2024

- Forecast of Poland Adhesive Tapes Market, 2031

- Historical Data and Forecast of Poland Adhesive Tapes Revenues & Volume for the Period 2021 - 2031

- Poland Adhesive Tapes Market Trend Evolution

- Poland Adhesive Tapes Market Drivers and Challenges

- Poland Adhesive Tapes Price Trends

- Poland Adhesive Tapes Porter's Five Forces

- Poland Adhesive Tapes Industry Life Cycle

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Resin Types for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Acrylic for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Epoxy for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Rubber-based for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Silicone for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Polyurethane for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Technology Types for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Water-based for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Solvent-based for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Hot-melt for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Reactive for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Baking Material for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Polypropylene (PP) for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Polyvinyl Chloride (PVC) for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Paper for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By End-users for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Automotive for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Health Care for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Appliances for the Period 2021 - 2031

- Historical Data and Forecast of Poland Adhesive Tapes Market Revenues & Volume By Others for the Period 2021 - 2031

- Poland Adhesive Tapes Import Export Trade Statistics

- Market Opportunity Assessment By Resin Types

- Market Opportunity Assessment By Technology Types

- Market Opportunity Assessment By Baking Material

- Market Opportunity Assessment By End-users

- Poland Adhesive Tapes Top Companies Market Share

- Poland Adhesive Tapes Competitive Benchmarking By Technical and Operational Parameters

- Poland Adhesive Tapes Company Profiles

- Poland Adhesive Tapes Key Strategic Recommendations

Market segmentation

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

By Resin Types

- Acrylic

- Epoxy

- Rubber-based

- Silicone

- Polyurethane

- Others

By Technology Types

- Water-based

- Solvent-based

- Hot-melt, Reactive

- Others

By Baking Material

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)Paper

- Others

By End-users

- Automotive

- Health Care

- Appliances

- Others

Poland Adhesive Tapes Market (2025-2031): FAQs

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero