Philippines Hair Conditioner Market (2025-2031) | Companies, Industry, Share, Value, Revenue, Size, Forecast, Growth, Analysis, Trends & Outlook

Market Forecast By Product Type (Dry Hair, Oily Hair, Normal Hair, Professional, Non-professional), By Application (Online Retail, Offline Retail, Personal Use, Personal Use, Barber shop, Hotel) And Competitive Landscape

| Product Code: ETC064428 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

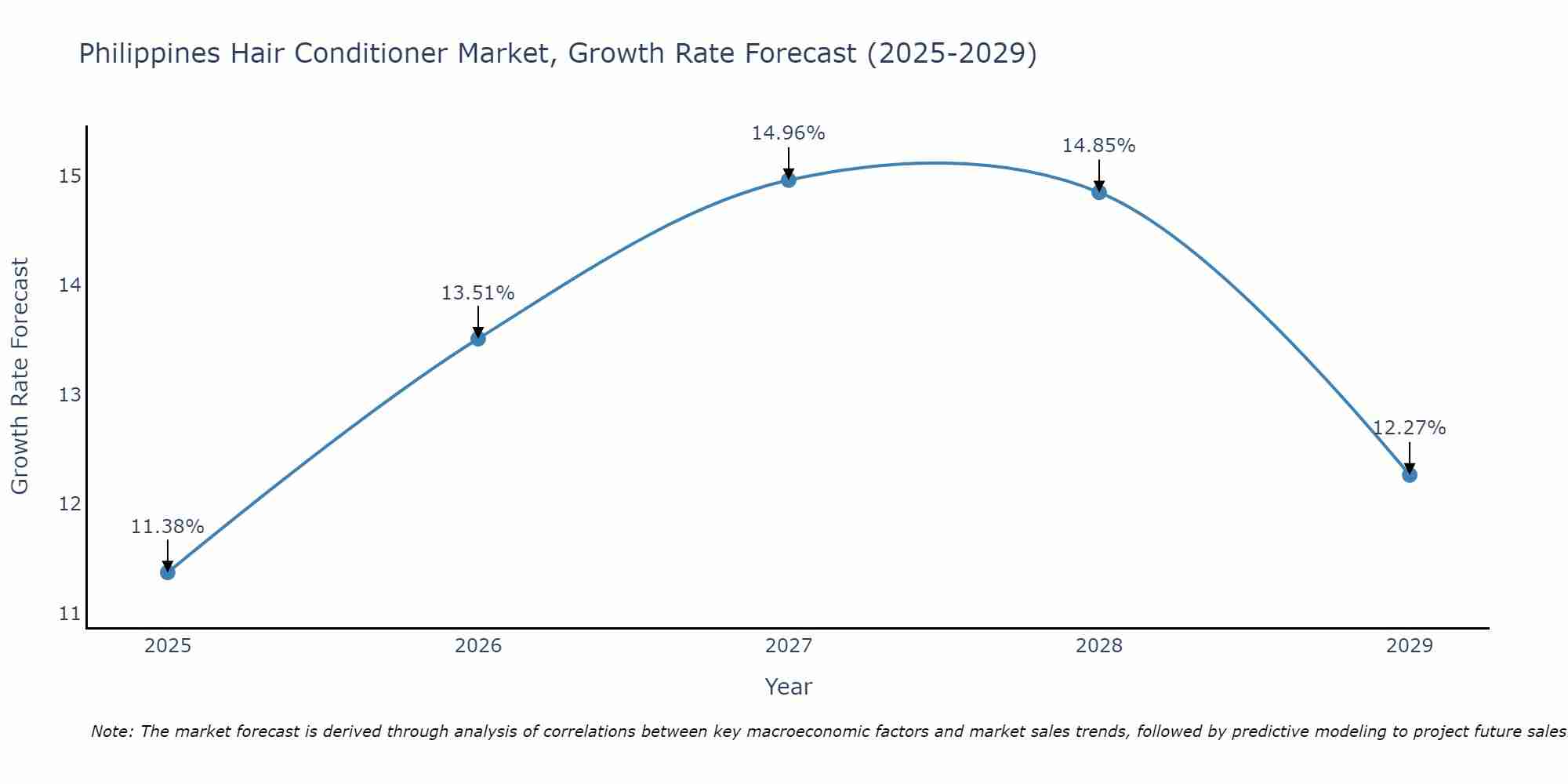

Philippines Hair Conditioner Market Size Growth Rate

The Philippines Hair Conditioner Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 11.38% in 2025, the market peaks at 14.96% in 2027, and settles at 12.27% by 2029.

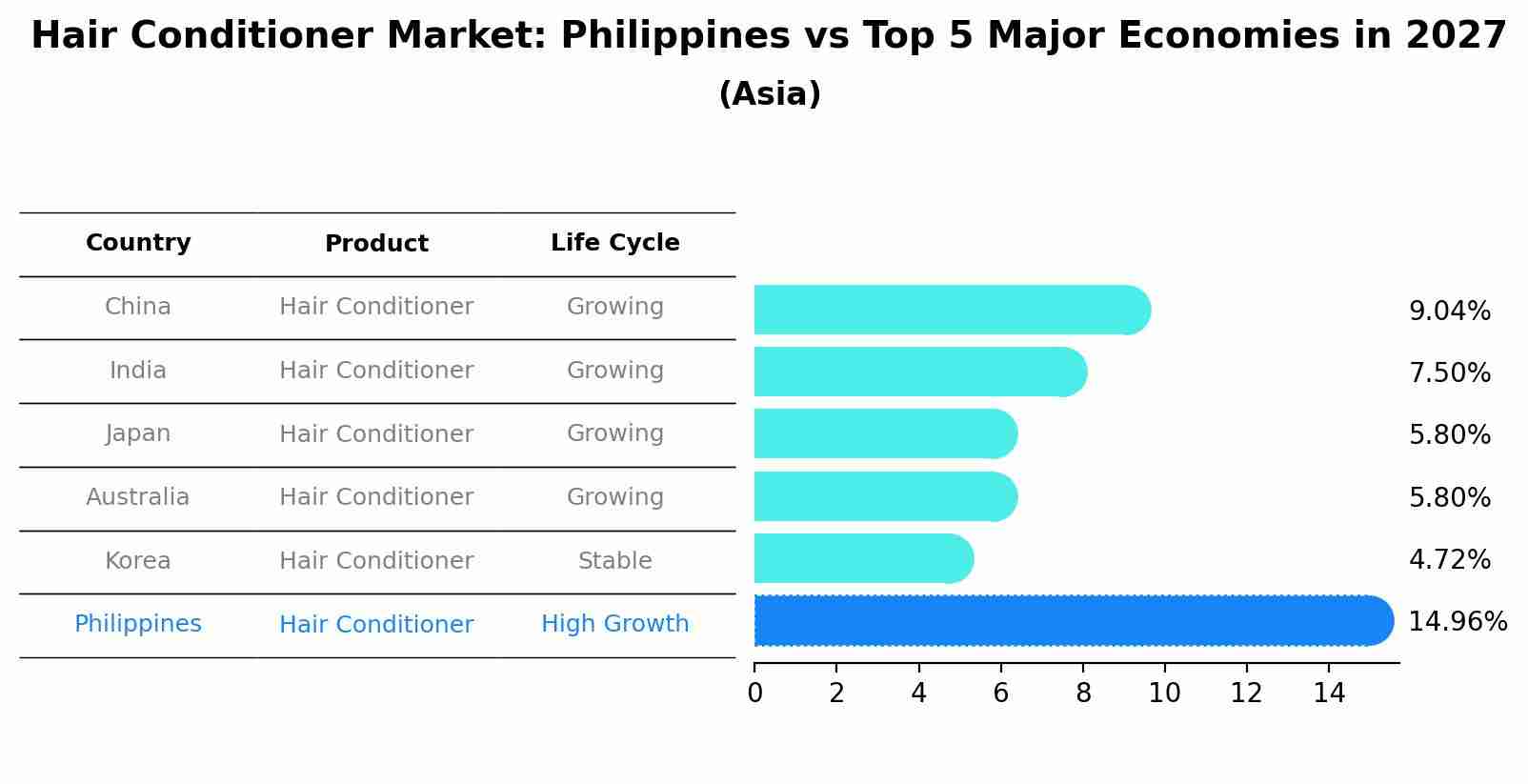

Hair Conditioner Market: Philippines vs Top 5 Major Economies in 2027 (Asia)

Philippines's Hair Conditioner market is anticipated to experience a high growth rate of 14.96% by 2027, reflecting trends observed in the largest economy China, followed by India, Japan, Australia and South Korea.

Philippines Hair Conditioner Market Highlights

| Report Name | Philippines Hair Conditioner Market |

| Forecast period | 2025-2031 |

| CAGR | 4.7% |

| Growing Sector | Offline retail |

Topics Covered in the Philippines Hair Conditioner Market Report

Philippines Hair Conditioner Market report thoroughly covers the market by product type, and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Philippines Hair Conditioner Market Synopsis

Philippines Hair Conditioner Market is a dynamic segment of the personal care industry, experiencing significant transformation due to changing consumer preferences and increasing awareness of hair care. Conditioners, which are essential for maintaining hair health and styling, have become integral to daily grooming routines in the Philippines. The tropical climate, characterized by heat and humidity, amplifies the demand for products addressing frizz, dryness, and damage. Driven by growing disposable incomes, urbanization, and digital retail expansion, the market is witnessing robust growth across both professional and non-professional categories.

According to 6Wresearch, the Philippines Hair Conditioner Market is anticipated to grow at a a CAGR of 4.7% during the forecast period 2025-2031. The market is accelerating due to several key factors, including rising disposable incomes and an increasing emphasis on personal grooming among Filipinos. The country's burgeoning middle-class population is becoming more conscious of personal care, fueled by social media influence and exposure to global beauty standards. This shift is driving demand for advanced and specialized hair care solutions, such as conditioners designed for specific hair types or concerns like damage repair, hydration, and scalp health. The growing popularity of e-commerce platforms like Shopee and Lazada has also enabled consumers to access a wider variety of products, including international brands, with competitive pricing and attractive promotions. Additionally, urbanization is playing a significant role, as city dwellers tend to adopt more comprehensive grooming routines. Salon-grade conditioners, which offer professional-quality results at home, are seeing rapid uptake among urban consumers. Overall, the combination of social influences, increasing affordability, and greater accessibility through online and offline channels is fueling unprecedented market growth.

Despite its positive trajectory, the Philippines Hair Conditioner Industry faces numerous challenges. The proliferation of counterfeit and low-quality products remains a persistent issue, undermining consumer trust and posing health risks. This problem is particularly prevalent in online marketplaces, where regulatory oversight is limited. Price sensitivity among Filipino consumers can also be a barrier, especially for premium or professional-grade products. Many households still rely on basic and affordable hair care solutions, leaving a gap in market penetration for high-end brands. Furthermore, environmental concerns related to plastic packaging and chemical ingredients are gaining traction, as eco-conscious consumers demand sustainable alternatives. Rural areas present another challenge, with limited access to a variety of products and lower awareness of advanced hair care solutions. Lastly, fluctuations in raw material costs and import duties can impact product pricing, making it difficult for manufacturers to maintain profitability while remaining competitive.

Philippines Hair Conditioner Market Trends

Philippines Hair Conditioner Market is shaped by several emerging trends that are redefining consumer preferences and product offerings. Natural and organic hair conditioners, formulated with ingredients like coconut oil, argan oil, and aloe vera, are witnessing significant demand due to their perceived safety and effectiveness. Another trend gaining traction is personalization, with brands introducing products tailored to specific hair concerns, such as curl enhancement, frizz control, and scalp nourishment. The "skinification of hair," where hair care mimics skincare routines with advanced ingredients like hyaluronic acid and peptides, is transforming the market landscape. Digital marketing and influencer collaborations have become crucial, as consumers increasingly rely on beauty vloggers and social media endorsements to make purchasing decisions. Additionally, the adoption of eco-friendly packaging and refillable options is becoming a differentiator for brands aiming to align with sustainability goals.

Investment Opportunities in the Philippines Hair Conditioner Market

Philippines Hair Conditioner Market offers robust opportunities for investors looking to capitalize on the growing demand for premium and innovative hair care products. The professional-grade segment, in particular, holds significant potential, as consumers seek salon-quality results at home. Companies can also invest in R&D to develop products catering to the specific needs of Filipinos, such as solutions for managing frizz and humidity-induced damage. Expanding distribution networks to rural areas, where penetration remains low, represents another lucrative opportunity. The rise of e-commerce presents a channel for global brands to enter the market with minimal barriers, leveraging online promotions and influencer partnerships to establish a strong foothold. Additionally, investments in sustainable packaging and eco-friendly formulations can help brands capture the growing segment of environmentally conscious consumers.

Leading Players in the Philippines Hair Conditioner Market

Philippines Hair Conditioner Market Share is dominated by a mix of international and domestic brands, each catering to diverse consumer needs. Unilever Philippines leads the market with its Dove and Sunsilk brands, offering solutions for various hair concerns like dryness and damage. Procter & Gamble’s Pantene brand is a major player in the premium segment, leveraging advanced formulations and strong marketing campaigns. L'Oréal Philippines, with its Garnier and L'Oréal Paris brands, appeals to eco-conscious consumers through its natural ingredient-based products. Local brands such as Human Nature and Zenutrients are gaining traction by emphasizing organic and cruelty-free offerings, resonating with the growing demand for sustainable products. The competitive landscape is further enriched by niche players introducing innovative and targeted solutions, ensuring a vibrant and dynamic market environment.

Government Regulations

The Philippines government has been supportive of the Philippines Hair Conditioner Industry, promoting local manufacturing and entrepreneurship through various initiatives. Efforts to enhance digital infrastructure have facilitated the rapid growth of e-commerce, making hair care products more accessible to consumers nationwide. Environmental regulations, such as guidelines on plastic waste reduction and sustainable packaging, are encouraging brands to adopt greener practices. Government campaigns promoting consumer safety and awareness are also helping to address the issue of counterfeit products, fostering trust in legitimate brands. These initiatives, combined with policies aimed at improving the ease of doing business, are creating a favorable environment for market growth.

Future Insights of the Philippines Hair Conditioner Market

Philippines Hair Conditioner Market is expected to witness sustained growth, driven by innovation, technological advancements, and evolving consumer behavior. The integration of artificial intelligence (AI) in e-commerce platforms will likely enhance personalization, enabling consumers to receive tailored product recommendations. Brands are expected to focus more on multifunctional conditioners that save time and cater to busy lifestyles. Sustainability will play a central role in shaping the future of the market, with eco-friendly formulations and recyclable packaging becoming industry standards. Collaborative efforts between local and international players are anticipated to introduce affordable yet high-quality solutions tailored to the Filipino demographic. Furthermore, the adoption of digital tools for consumer engagement and marketing will remain a critical strategy for brands aiming to thrive in this competitive market.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Professional hair conditioner to Dominate the Market-By Product Type

According to Vasu, Senior Research Analyst, 6Wresearch, the professional hair conditioner segment dominates the market within this category. This dominance stems from a growing trend toward high-quality, salon-grade products that cater to specific hair needs such as repair, hydration, and protection against humidity—a common concern in the Philippines' tropical climate.

Offline retail to Dominate the Market-By Application

The offline retail segment remains the leading category in the application segmentation. Traditional retail channels such as supermarkets, hypermarkets, and beauty specialty stores are widely preferred by Filipino consumers for hair conditioners. These outlets provide a tactile shopping experience, enabling customers to physically evaluate products, compare options, and benefit from in-store promotions.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Philippines Hair Conditioner Market Outlook

- Market Size of Philippines Hair Conditioner Market, 2024

- Forecast of Philippines Hair Conditioner Market, 2031

- Historical Data and Forecast of Philippines Hair Conditioner Revenues & Volume for the Period 2021 - 2031

- Philippines Hair Conditioner Market Trend Evolution

- Philippines Hair Conditioner Market Drivers and Challenges

- Philippines Hair Conditioner Price Trends

- Philippines Hair Conditioner Porter's Five Forces

- Philippines Hair Conditioner Industry Life Cycle

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Dry Hair for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Oily Hair for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Normal Hair for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Professional for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Non-professional for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Online Retail for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Offline Retail for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Personal Use for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Personal Use for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Barber shop for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Hair Conditioner Market Revenues & Volume By Hotel for the Period 2021 - 2031

- Philippines Hair Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- Philippines Hair Conditioner Top Companies Market Share

- Philippines Hair Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Philippines Hair Conditioner Company Profiles

- Philippines Hair Conditioner Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Product Type:

- Dry Hair

- Oily Hair

- Normal Hair

- Professional

- Non-professional

By Application:

- Online Retail

- Offline Retail

- Personal Use

- Personal Use

- Barber shop

- Hotel

Philippines Hair Conditioner Market (2025-2031) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Philippines Hair Conditioner Market Overview |

| 3.1 Philippines Country Macro Economic Indicators |

| 3.2 Philippines Hair Conditioner Market Revenues & Volume, 2021 & 2031F |

| 3.3 Philippines Hair Conditioner Market - Industry Life Cycle |

| 3.4 Philippines Hair Conditioner Market - Porter's Five Forces |

| 3.5 Philippines Hair Conditioner Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Philippines Hair Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Philippines Hair Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Philippines Hair Conditioner Market Trends |

| 6 Philippines Hair Conditioner Market, By Types |

| 6.1 Philippines Hair Conditioner Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Philippines Hair Conditioner Market Revenues & Volume, By Product Type, 2021 - 2031F |

| 6.1.3 Philippines Hair Conditioner Market Revenues & Volume, By Dry Hair, 2021 - 2031F |

| 6.1.4 Philippines Hair Conditioner Market Revenues & Volume, By Oily Hair, 2021 - 2031F |

| 6.1.5 Philippines Hair Conditioner Market Revenues & Volume, By Normal Hair, 2021 - 2031F |

| 6.1.6 Philippines Hair Conditioner Market Revenues & Volume, By Professional, 2021 - 2031F |

| 6.1.7 Philippines Hair Conditioner Market Revenues & Volume, By Non-professional, 2021 - 2031F |

| 6.2 Philippines Hair Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Philippines Hair Conditioner Market Revenues & Volume, By Online Retail, 2021 - 2031F |

| 6.2.3 Philippines Hair Conditioner Market Revenues & Volume, By Offline Retail, 2021 - 2031F |

| 6.2.4 Philippines Hair Conditioner Market Revenues & Volume, By Personal Use, 2021 - 2031F |

| 6.2.5 Philippines Hair Conditioner Market Revenues & Volume, By Personal Use, 2021 - 2031F |

| 6.2.6 Philippines Hair Conditioner Market Revenues & Volume, By Barber shop, 2021 - 2031F |

| 6.2.7 Philippines Hair Conditioner Market Revenues & Volume, By Hotel, 2021 - 2031F |

| 7 Philippines Hair Conditioner Market Import-Export Trade Statistics |

| 7.1 Philippines Hair Conditioner Market Export to Major Countries |

| 7.2 Philippines Hair Conditioner Market Imports from Major Countries |

| 8 Philippines Hair Conditioner Market Key Performance Indicators |

| 9 Philippines Hair Conditioner Market - Opportunity Assessment |

| 9.1 Philippines Hair Conditioner Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Philippines Hair Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Philippines Hair Conditioner Market - Competitive Landscape |

| 10.1 Philippines Hair Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 Philippines Hair Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero