Poland Soap Market (2025-2031) | Industry, Outlook, Growth, Share, Companies, Value, Forecast, Analysis, Trends, Size & Revenue

Market Forecast By Type (Bar Soap, Liquid Soap), By Application (Household, Commercial, Other), By Distribution Channel (Modern Trade, Traditional Trade, Online) And Competitive Landscape

| Product Code: ETC021395 | Publication Date: Jun 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

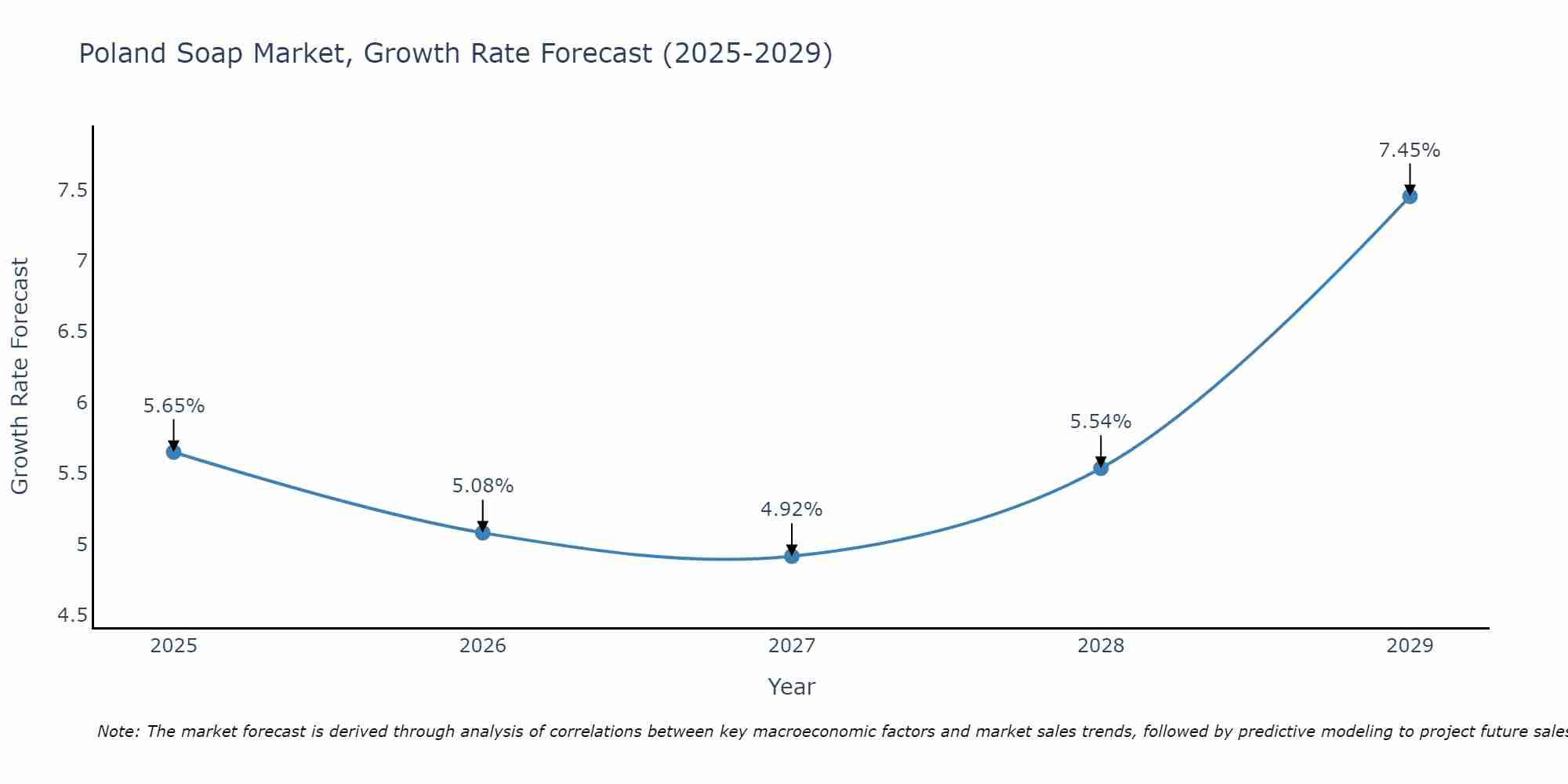

Poland Soap Market Size Growth Rate

The Poland Soap Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate starts at 5.65% in 2025 and reaches 7.45% by 2029.

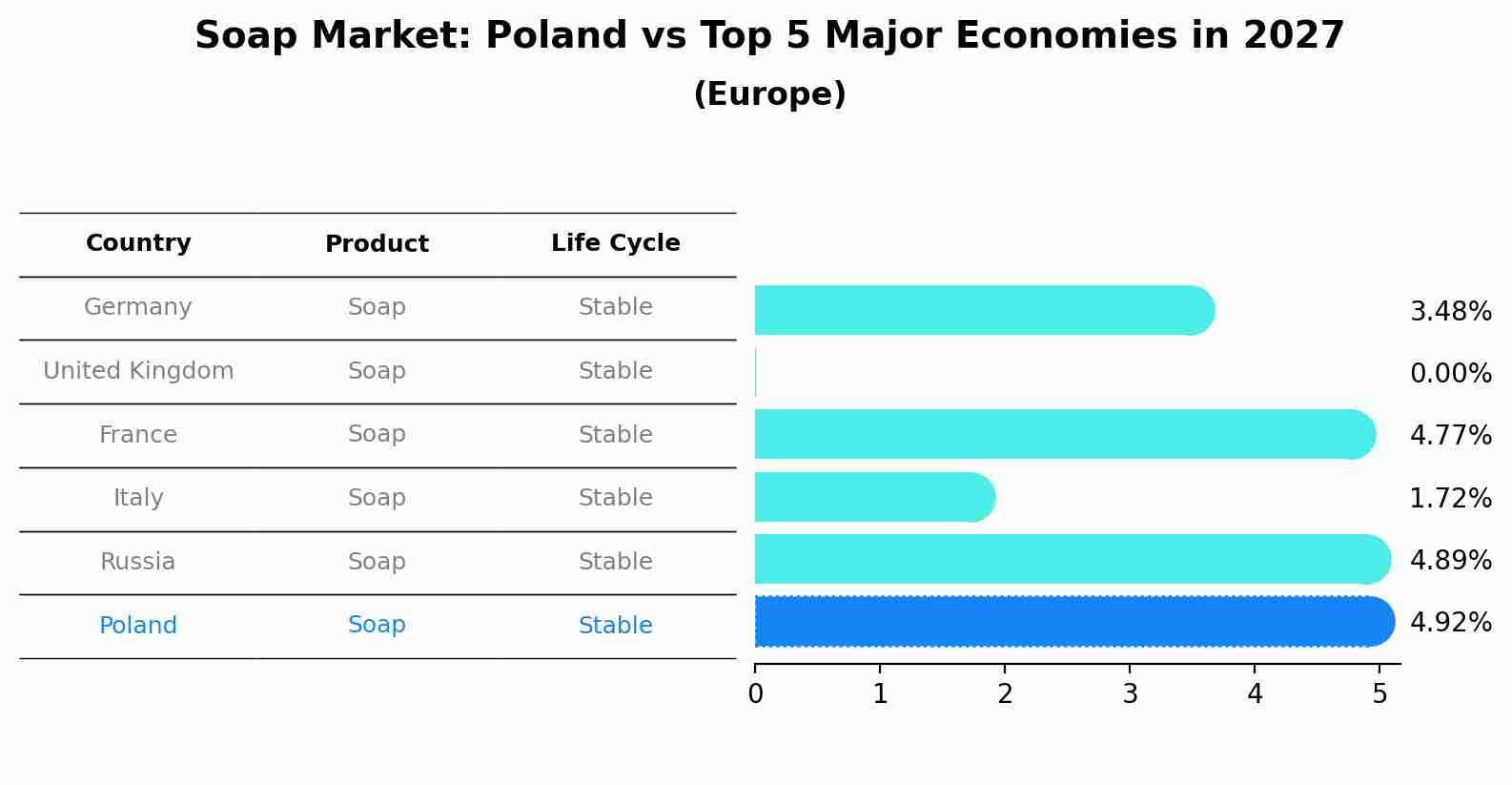

Soap Market: Poland vs Top 5 Major Economies in 2027 (Europe)

The Soap market in Poland is projected to grow at a stable growth rate of 4.92% by 2027, highlighting the country's increasing focus on advanced technologies within the Europe region, where Germany holds the dominant position, followed closely by United Kingdom, France, Italy and Russia, shaping overall regional demand.

Poland Soap Market Highlights

| Report Name | Poland Soap Market |

| Forecast period | 2025-2031 |

| CAGR | 4% |

| Growing Sector | Commercial application |

Topics Covered in the Poland Soap Market Report

The Poland Soap Market report thoroughly covers the market by type, By application, and By distribution channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would assist stakeholders to devise and align their market strategies according to the current and future market dynamics.

Poland Soap Market Synopsis

The soap market in Poland is witnessing significant growth, driven by a heightened awareness of hygiene and the evolution of soap technologies. Consumers are increasingly shifting from conventional soaps to more specialized, high-performance products that cater to their specific needs. This trend reflects a broader national emphasis on hygiene and cleanliness, as people seek advanced and personalized solutions that provide greater reliability and effectiveness. As a result, innovative technologies and premium ingredients are playing a key role in modern soap production in Poland, making the country a leader in the field. The market's focus on enhancing hygiene standards and delivering superior cleaning experiences underscores Poland's commitment to promoting health and well-being through cutting-edge manufacturing techniques.

According to 6Wresearch, the Poland Soap Market size is expected to grow at a significant CAGR OF 4% during the forecast period of 2025-2031. Poland soap market is experiencing robust growth, driven by increasing consumer demand for high-performance and reliable products. This surge is prompting companies to heavily invest in the development of specialty and eco-friendly soaps. Both consumers and businesses are placing greater emphasis on sustainability alongside product efficacy, leading to a noticeable shift towards soaps that deliver superior cleanliness while also adhering to environmental principles.

As a result, companies are focusing on innovative approaches that integrate advanced technology with eco-conscious practices. This trend highlights the industry's broader commitment to combining strong cleaning capabilities with environmental responsibility, ensuring that new soap products are not only highly effective but also environmentally friendly, catering to the evolving preferences of a more sustainability-driven market. Despite the significant growth in the Poland Soap market, several challenges remain. These include competition from inexpensive imports, which may impede the growth of locally produced high-quality brands. Additionally, the rising consumer preference for online shopping could present a challenge for traditional brick-and-mortar stores. Nevertheless, there's also an opportunity for businesses to expand their reach with the increasing adoption of e-commerce.

Poland Soap Industry Leading Players

The Poland soap industry is highly competitive, with leading players focusing on innovation, sustainability, and quality to meet the growing demand for high-performance and eco-friendly products. Major companies such as Unilever, Procter & Gamble, Henkel, and Colgate-Palmolive dominate the market, offering a wide range of soaps, from traditional bar soaps to liquid and specialty options. Local Polish brands like Pollena and Barwa are also making significant strides, capitalizing on the increasing consumer preference for natural and environmentally friendly products. These key players are investing in research and development to create soaps that not only offer superior cleaning but also align with environmental and health-conscious trends. Their strategies emphasize eco-friendly packaging, biodegradable ingredients, and reduced environmental impact, reflecting the industry's broader commitment to sustainability while delivering high-quality, reliable soap products to Polish consumers.

Soap Market in Poland Government Regulations

The soap market in Poland is shaped by various government regulations aimed at ensuring product safety, environmental sustainability, and consumer protection. Polish manufacturers must adhere to the European Union's strict standards, including the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation, which controls the use of chemicals in products to protect human health and the environment. Additionally, the EU Cosmetics Regulation governs the safety of personal care products, requiring manufacturers to meet specific labeling, packaging, and ingredient standards. Sustainability is also a key focus, with policies encouraging the use of biodegradable ingredients and recyclable packaging. Companies must comply with environmental regulations that limit harmful chemicals and promote eco-friendly production practices. These laws ensure that soap products sold in Poland meet high standards of safety, quality, and environmental responsibility, reflecting the growing consumer preference for sustainable, high-performance options.

Future Insights of the Market

The future of Poland's soap market looks promising, with continued growth expected as consumer preferences increasingly favor high-quality, sustainable products. As environmental awareness rises, the demand for eco-friendly and organic soaps is likely to surge, pushing companies to innovate with plant-based ingredients and biodegradable packaging. Technological advancements in soap formulations, including antimicrobial and skin-nourishing properties, will also shape the market, catering to health-conscious consumers. Additionally, the growing popularity of artisanal and specialty soaps, driven by a desire for unique, natural, and luxurious products, will further diversify the market. E-commerce is expected to play a key role in distribution, making it easier for consumers to access a wider range of products. Overall, the market will likely evolve to prioritize a balance between superior cleaning efficacy and environmental sustainability, reflecting broader global trends towards responsible consumerism.

Market Segmentation By Type

According to Ravi Bhandari, Research Head at 6Wresearch, liquid soap is experiencing faster growth compared to bar soap, driven by changing consumer preferences and convenience. Liquid soap’s hygienic and easy-to-use packaging, especially in public spaces, makes it more popular, particularly in the wake of heightened hygiene awareness. Consumers are increasingly drawn to liquid soap for its variety in formulations, including moisturizing, antibacterial, and eco-friendly options, which cater to specific skincare needs.

Market Segmentation By Applications

The commercial application segment is growing the most in Poland's soap market, driven by increased hygiene awareness across industries such as healthcare, hospitality, and food services. In the wake of heightened sanitation standards, businesses are prioritizing the use of high-quality soaps to ensure cleanliness and safety for employees and customers. The demand for liquid soap dispensers, antibacterial products, and eco-friendly formulations has surged in commercial spaces like offices, restaurants, and public facilities.

Market Segmentation By Distribution Channels

In Poland's soap market, the Online distribution is growing the fastest in Poland’s soap market, outpacing both modern and traditional trade channels. The convenience of e-commerce, along with a wider selection of soap products, has attracted an increasing number of consumers to online platforms. The shift towards digital shopping has been accelerated by the pandemic, which familiarized more people with buying hygiene products online.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Poland Soap Market Outlook

- Market Size of Poland Soap Market, 2024

- Forecast of Poland Soap Market, 2031

- Historical Data and Forecast of Poland Soap Revenues & Volume for the Period 2021 - 2031

- Poland Soap Market Trend Evolution

- Poland Soap Market Drivers and Challenges

- Poland Soap Price Trends

- Poland Soap Porter's Five Forces

- Poland Soap Industry Life Cycle

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Bar Soap for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Liquid Soap for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Household for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Distribution Channel for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Modern Trade for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Traditional Trade for the Period 2021 - 2031

- Historical Data and Forecast of Poland Soap Market Revenues & Volume By Online for the Period 2021 - 2031

- Poland Soap Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Distribution Channel

- Poland Soap Top Companies Market Share

- Poland Soap Competitive Benchmarking By Technical and Operational Parameters

- Poland Soap Company Profiles

- Poland Soap Key Strategic Recommendations

Markets Covered

The report offers a comprehensive study of the subsequent market segments

By Type

- Bar Soap

- Liquid Soap

By Application

- Household

- Commercial

- Others

By Distribution Channel

- Modern Trade

- Traditional Trade

Poland Soap Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Poland Soap Market Overview |

| 3.1 Poland Country Macro Economic Indicators |

| 3.2 Poland Soap Market Revenues & Volume, 2021 & 2031F |

| 3.3 Poland Soap Market - Industry Life Cycle |

| 3.4 Poland Soap Market - Porter's Five Forces |

| 3.5 Poland Soap Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Poland Soap Market Revenues & Volume Share, By Application , 2021 & 2031F |

| 3.7 Poland Soap Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Poland Soap Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Poland Soap Market Trends |

| 6 Poland Soap Market, By Types |

| 6.1 Poland Soap Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Poland Soap Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Poland Soap Market Revenues & Volume, By Bar Soap, 2021 - 2031F |

| 6.1.4 Poland Soap Market Revenues & Volume, By Liquid Soap, 2021 - 2031F |

| 6.2 Poland Soap Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Poland Soap Market Revenues & Volume, By Household, 2021 - 2031F |

| 6.2.3 Poland Soap Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.2.4 Poland Soap Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.3 Poland Soap Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Poland Soap Market Revenues & Volume, By Modern Trade, 2021 - 2031F |

| 6.3.3 Poland Soap Market Revenues & Volume, By Traditional Trade, 2021 - 2031F |

| 6.3.4 Poland Soap Market Revenues & Volume, By Online, 2021 - 2031F |

| 7 Poland Soap Market Import-Export Trade Statistics |

| 7.1 Poland Soap Market Export to Major Countries |

| 7.2 Poland Soap Market Imports from Major Countries |

| 8 Poland Soap Market Key Performance Indicators |

| 9 Poland Soap Market - Opportunity Assessment |

| 9.1 Poland Soap Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Poland Soap Market Opportunity Assessment, By Application , 2021 & 2031F |

| 9.3 Poland Soap Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Poland Soap Market - Competitive Landscape |

| 10.1 Poland Soap Market Revenue Share, By Companies, 2024 |

| 10.2 Poland Soap Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero