Qatar Crude Oil Market (2025-2031) Outlook | Share, Trends, Value, Revenue, Size, Industry, Companies, Forecast, Growth & Analysis

Market Forecast By Derivatives (Paraffin, Pentane, Octane, Naphthene, Aromatics, Asphaltic), By Composition (Hydrocarbon Compounds, Carbon, Hydrogen, Non-Hydrocarbon Compounds, Organometallic Compounds, Sodium, Calcium), By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By End Use (Light Commercial Vehicles, Passenger Vehicles, Mining, Agriculture, Residential) And Competitive Landscape

| Product Code: ETC412657 | Publication Date: Oct 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

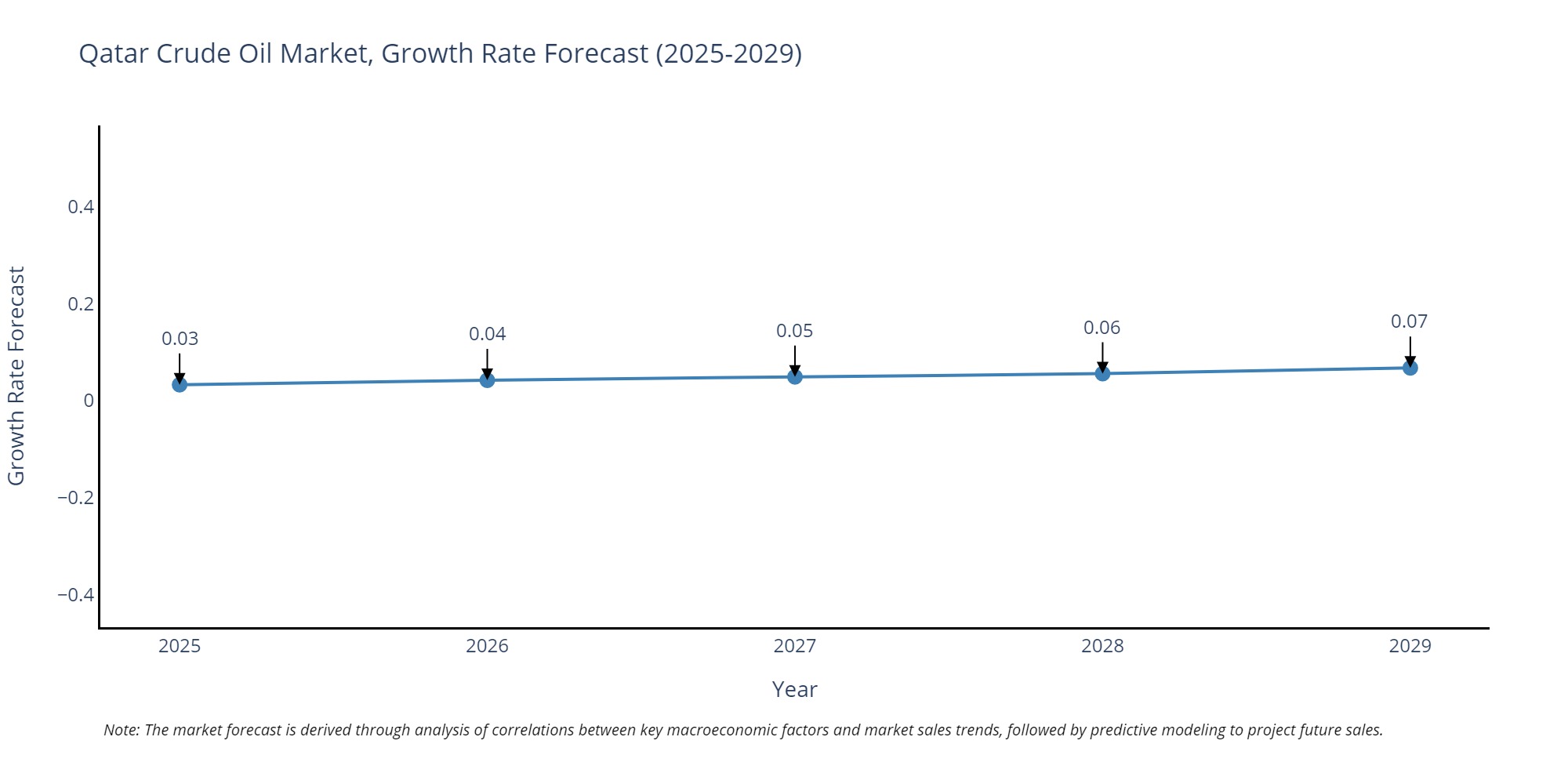

Qatar Crude Oil Market Growth Rate

By 2027, Qatar is expected to experience a Stable growth rate of 0.05% in the Crude Oil market. This growth is driven by the country has used its experience in the energy sector to guarantee steady development of 0.05% in the crude oil market, as it is one of the top exporters of LNG worldwide. While small, this rate of growth demonstrates both economic resiliency and a broader focus on upgrading the efficiency of oil extraction and production processes through technology incorporation. Qatari policymakers are being practical by protecting the sector against future fluctuations in the world market and possible changes in the demand for energy.

Emerging energy trends globally mandates that oil-exporting countries like Qatar develop robust approaches for the continued viability of their energy sectors. The projected increase suggests a strong policy framework that focuses diversification in the energy sector by operating technological innovation and environmental practices. Simultaneously, Qatar is involved in increasing its renewable energy capabilities, balancing its economic dependence on fossil fuels with environmental sustainability goals.

Qatar Crude Oil Market Synopsis

The crude oil market in Qatar remains a cornerstone of the country`s economic prosperity. Leveraging advanced extraction technologies and strategic partnerships, Qatar has established itself as a reliable global supplier. The country`s commitment to responsible resource management and investments in downstream activities further bolster its position in the international crude oil market. Qatar`s ability to adapt to shifting global energy demands and its focus on sustainable practices ensure a stable and dynamic future for its crude oil sector.

Drivers of the Market

The Qatar crude oil market continues to be influenced by several key drivers. Firstly, Qatar is a significant player in the global oil market due to its substantial oil reserves and production capacity. The market outlook depends heavily on global oil demand, which in turn is shaped by economic growth, geopolitical factors, and energy transition trends. Qatar`s strategic location and its investments in infrastructure, such as the expansion of its oil export facilities, are crucial drivers that ensure its competitiveness in the international crude oil market. Additionally, Qatar`s ability to adapt to evolving environmental regulations and its focus on sustainable practices will influence its position in the global crude oil market.

Challenges of the Market

The Qatar crude oil market faces a range of challenges in the foreseeable future. One of the most pressing issues is the ongoing global push for reduced carbon emissions and the transition to cleaner energy sources. This shift can potentially impact the demand for crude oil, affecting Qatar`s revenue. Additionally, geopolitical tensions and regional conflicts can disrupt the supply chain and export routes for Qatari crude oil, creating uncertainty in the market. Qatar also faces the challenge of maintaining aging infrastructure, which requires continuous investment and maintenance to ensure operational efficiency and safety. Lastly, market volatility, influenced by factors such as production decisions by major oil-producing nations and global economic conditions, can affect crude oil prices and revenue for Qatar.

COVID-19 Impact on the Market

The Qatar crude oil market faced unprecedented challenges due to the COVID-19 pandemic. As global travel restrictions and lockdown measures were implemented to curb the spread of the virus, the demand for crude oil plummeted significantly. This resulted in a sharp decline in oil prices and forced Qatar, like many other oil-producing nations, to adapt to a new economic reality. The country`s revenue from crude oil exports experienced a notable contraction, impacting its fiscal outlook. However, with the gradual easing of restrictions and a cautious global economic recovery, there has been a slow but steady rebound in demand for crude oil. Qatar`s strategic position in the global energy landscape, combined with its commitment to sustainable practices, positions it to navigate these challenging times and potentially leverage emerging opportunities in the post-COVID era.

Key Players in the Market

Qatar`s crude oil market is characterized by its production of high-quality crude oil, particularly from offshore fields. The leading player in this market is Qatar Petroleum, which operates and manages the country`s oil reserves and production. Qatar`s strategic location in the Gulf region positions it as a key player in the global oil market, and Qatar Petroleum`s prominence is expected to remain unchallenged in the foreseeable future.

Key Highlights of the Report:

- Qatar Crude Oil Market Outlook

- Market Size of Qatar Crude Oil Market, 2024

- Forecast of Qatar Crude Oil Market, 2031

- Historical Data and Forecast of Qatar Crude Oil Revenues & Volume for the Period 2021-2031

- Qatar Crude Oil Market Trend Evolution

- Qatar Crude Oil Market Drivers and Challenges

- Qatar Crude Oil Price Trends

- Qatar Crude Oil Porter's Five Forces

- Qatar Crude Oil Industry Life Cycle

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Derivatives for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Paraffin for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Pentane for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Octane for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Naphthene for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Aromatics for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Asphaltic for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Composition for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Carbon for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Hydrogen for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Non-Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Organometallic Compounds for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Sodium for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Calcium for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Light Distillates for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Light Oils for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Medium Oils for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Heavy Fuel Oil for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By End Use for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Light Commercial Vehicles for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Passenger Vehicles for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Mining for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Agriculture for the Period 2021-2031

- Historical Data and Forecast of Qatar Crude Oil Market Revenues & Volume By Residential for the Period 2021-2031

- Qatar Crude Oil Import Export Trade Statistics

- Market Opportunity Assessment By Derivatives

- Market Opportunity Assessment By Composition

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End Use

- Qatar Crude Oil Top Companies Market Share

- Qatar Crude Oil Competitive Benchmarking By Technical and Operational Parameters

- Qatar Crude Oil Company Profiles

- Qatar Crude Oil Key Strategic Recommendations

Qatar Crude Oil Market (2024-2030): FAQs

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero