Saudi Arabia Fast Food Market (2017-2023) | industry, Share, Revenue, Size, Analysis, Forecast, Trends, Growth, Outlook & COVID-19 IMPACT

Market Forecast by Types (Burgers, Hamburgers & Sandwiches, Chicken, Pizza & Pasta, Asian & Latin American Fast Food, Sea Food and Others (Mediterranean, Lebanese, etc.)), Distribution Channel (Take Away Outlets, Dine-in Restaurants, Cafes & Bakeries and Others (Food trucks, Kiosks, etc.)), Regions (Central Region, Eastern Region, Western Region, and Southern Region) and Competitive Landscape

| Product Code: ETC000415 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 94 | No. of Figures: 33 | No. of Tables: 4 |

Latest 2023 Development of Saudi Arabia Fast Food Market

Saudi Arabia Fast Food Market has been experiencing significant growth in recent years. Major international fast-food chains have established a strong presence in the market and continue to expand in the forthcoming years. Some fast-food chains have introduced delivery services through online ordering and mobile applications which fulfil the growing demand for convenient food. In addition to this, some companies have introduced healthier menu options such as salads, smoothies, and grilled options to cater to health-conscious consumers. Some of the latest developments and projects in the Saudi Arabia fast food industry include the expansion of existing chains. They are opening new locations and introducing new menu items to cater to changing preferences of consumers.

Moreover, fast food chains are increasingly using technology to enhance the customer experience, such as QR scan menu boards, self-ordering kiosks, and mobile apps. Online ordering and delivery systems make it easier for customers to access their favourite foods. These developments are projected to continue in the coming years, as the fast food industry in Saudi Arabia continues to evolve and expand further. In terms of future projects, the fast-food market in Saudi Arabia is expected to continue its growth-driven rising disposable incomes and a growing young population.

Saudi Arabia Fast Food Market Synopsis

Fast foods can be prepared quickly and are gaining popularity as these are emerging as alternatives for home-cooked meals. Entry of international food chains, the presence of an expatriate population, a growing number of tourists, and changing food preferences would spur the Saudi Arabia fast food market forecast revenues over the coming years.

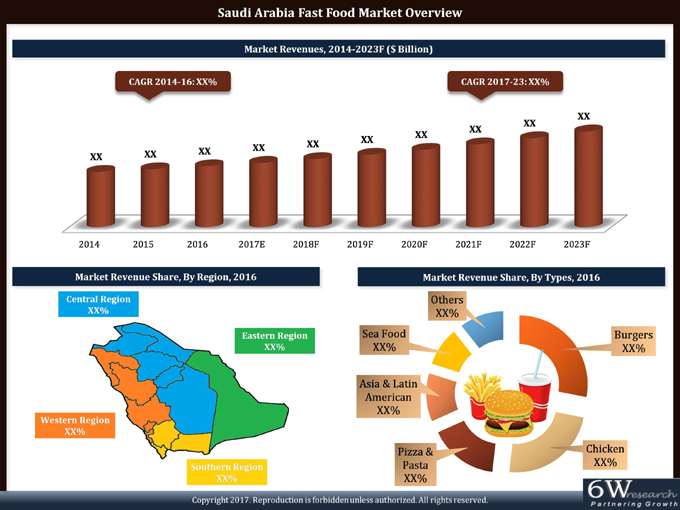

According to 6Wresearch, Saudi Arabia fast food market size is projected to grow at a CAGR of 6.9% during 2017-23. The Fast Food market is anticipated to register strong growth in the forecast period owing to high food consumption, an increase in spending on food products, and urbanization. The Fast Food market in the region is expected to grow due to the availability of a variety of fast foods from various international and national players. However, growing health concerns regarding obesity and diabetes are the major threats to the market; thus driving the companies to offer more healthy foods in their portfolio.

Takeaway outlets are the major revenue-generating distribution channels followed by full-service outlets in the country on account of better servicing and availability of different flavours. The central region including Riyadh held the highest Saudi Arabia fast food market share in 2016 as it inhabits a hefty share of expatriates and the working population of the country.

The Saudi Arabia fast food market report thoroughly covers the Saudi Arabia Fast Food market by types, distribution channels, and regions. The Saudi Arabia fast food market outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia fast food market trends, opportunities high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia fast food market is anticipated to register sound revenues in the forthcoming years on the back of the rising establishments of food courts in the country steadily. The increase in the growth of the young working population along with increasing disposable income is leading to spending high on food consumption and is estimated to instigate the growth of the fast-food market in the market. Also, social media is estimated to act as another growth proliferation factor owing to food bloggers posting tempting fast food posts, which has led to attracting a large number of consumers and is estimated to boost the growth of the Saudi Arabia fast food market in the coming timeframe.

Key Highlights of the Report:

• Saudi Arabia Fast Food Market Overview

• Saudi Arabia Fast Food Market Outlook

• Historical Data of GCC Fast Food Market Revenues and Volume for the Period 2014-2016.

• Market Size & Forecast of GCC Fast Food Market Revenues and Volume until 2023.

• Historical Data of Saudi Arabia Fast Food Market Revenues and Volume for the Period 2014-2016.

• Saudi Arabia Fast Food Market Size & Saudi Arabia Fast Food Market Forecast of Revenues and Volume until 2023.

• Historical Data of Saudi Arabia Fast Food Market Revenues, By Types for the Period 2014-2016.

• Market Size & Forecast of Saudi Arabia Fast Food Market Revenues, By Types until 2023.

• Historical Data of Saudi Arabia Fast Food Market Revenues, By Distribution Channel for the Period 2014-2016.

• Market Size & Forecast of Saudi Arabia Fast Food Market Revenues, By Distribution Channel until 2023.

• Historical Data of Saudi Arabia Fast Food Market Revenues, By Regions for the Period 2014-2016.

• Market Size & Forecast of Saudi Arabia Fast Food Market Revenues, By Regions until 2023.

• Saudi Arabia Fast Food Market Drivers and Restraints.

• Saudi Arabia Fast Food Market Trends and Developments.

• Saudi Arabia Fast Food Market Share, by Players

• Saudi Arabia Fast Food Market Overview on Competitive Landscape.

• Company Profiles.

• Key Strategic Pointers.

Markets Covered

The Saudi Arabia Fast Food Market report provides a detailed analysis of the following market segments:

By Types:

- Burgers, Hamburgers & Sandwiches

- Chicken

- Pizza & Pasta

- Asian & Latin American Fast Food

- Sea Food

- Others (the Mediterranean, Lebanese, etc.)

By Distribution Channels:

- Take Away Outlets

- Dine-in Restaurants

- Cafes & Bakeries

- Others (Food trucks, Kiosks, etc.)

By Regions:

- Central Region

- Eastern Region

- Western Region

- Southern Region

Saudi Arabia Fast Food Market: FAQs

1. Executive Summary

2. Introduction

2.1. Report Description

2.2. Key Highlights of the Report

2.3. Market Scope & Segmentation

2.4. Methodology Adopted and Key Data Points

2.5. Assumptions

3. GCC Fast Food Market Overview

3.1. GCC Fast Food Market Revenues 2014-23F

4. Saudi Arabia Fast Food Market Overview

4.1. Saudi Arabia Fast Food Market Revenues, 2014-23F

4.2. Saudi Arabia Fast Food Market Industry Life cycle

4.3. Saudi Arabia Fast Food Market Porter's Five Forces Model

4.4. Saudi Arabia Fast Food Market Revenue Share, By Types, 2016 & 2023F

4.5. Saudi Arabia Fast Food Market Revenue Share, By Distribution Channels, 2016 & 2023F

4.6. Saudi Arabia Fast Food Market Revenue Share, By Regions, 2016 & 2023F

5. Saudi Arabia Fast Food Market Dynamics

5.1. Impact Analysis

5.2. Market Drivers

5.3. Market Restraints

6. Saudi Arabia Fast Food Market Trends

6.1. Healthy & Organic Food

6.2. International Cuisine

6.3. Technological Shift

6.4. Fast Food Trucks

7. Saudi Arabia Fast Food Market Overview, By Types

7.1. Saudi Arabia Burgers, Hamburgers and Sandwiches Market Revenues, 2014-23F

7.2. Saudi Arabia Chicken Fast Food Market Revenues, 2014-23F

7.3. Saudi Arabia Pizza & Pasta Market Revenues, 2014-23F

7.4. Saudi Arabia Asian & Latin American Fast Food Market Revenues, 2014-23F

7.5. Saudi Arabia Sea Food Market Revenues, 2014-23F

7.6. Saudi Arabia Other Fast Food Market Revenues, 2014-23F

8. Saudi Arabia Fast Food Market Overview, By Distribution Channels

8.1. Saudi Arabia Fast Food Market Revenues, By taking Away Outlets, 2014-23F

8.2. Saudi Arabia Fast Food Market Revenues, By Dine-in Restaurants, 2014-23F

8.3. Saudi Arabia Fast Food Market Revenues, By Cafes & Bakeries, 2014-23F

8.4. Saudi Arabia Fast Food Market Revenues, By Other Distribution Channel, 2014-213F

9. Saudi Arabia Fast Food Market Overview, By Regions

9.1. Saudi Arabia Central Region Fast Food Market Revenue, 2014-23F

9.2. Saudi Arabia Eastern Region Fast Food Market Revenue, 2014-23F

9.3. Saudi Arabia Western Region Fast Food Market Revenue, 2014-23F

9.4. Saudi Arabia Southern Region Fast Food Market Revenue, 2014-23F

10. Saudi Arabia Fast Food Market, Key Performance Indicators

10.1. Religious Tourism

10.2. Growing Urbanization

11. Saudi Arabia Fast Food Market Opportunity Assessment

11.1. Saudi Arabia Fast Food Market Opportunity Assessment, By Types

12. Competitive Landscape

12.1. Saudi Arabia Fast Food Market Revenue Share, By Company, 2016

12.2. Competitive Benchmarking, By Types

13. Company Profiles

13.1. McDonald's Corporation

13.2. Burger King Corporation

13.3. Domino's Pizza Inc.

13.4. KFC Corporation

13.5. Pizza Hut, LLC

13.6. Herfy Food Services Company

13.7. Hardee's Food Systems Inc.

13.8. Buffalo Wild Wings, Inc.

13.9. ALBAIK Food Systems Co. Ltd

13.10. Shawarmer Food Company LLC

14. Key Strategic Pointers

15. Disclaimer

List of Figures

1. GCC Fast Food Market Revenues, 2014-2023F ($ Billion)

2. Saudi Arabia Fast Food Market Revenues, 2014-2023F ($ Billion)

3. Saudi Arabia Fast Food Market Industry Life cycle

4. Saudi Arabia Market Porter's Five Forces Model

5. Saudi Arabia Fast Food Market Revenue Share, By Types, 2016 & 2023F

6. Saudi Arabia Fast Food Market Revenue Share, By Distribution Channels, 2016 & 2023F

7. Saudi Arabia Fast Food Market Revenue Share, By Regions, 2016 & 2023F

8. Saudi Arabia AgeWise Population Statistics, 2016-2023 (Million)

9. Saudi Arabia International Tourism Footfall, 2016-2023 (Million)

10. Women Employed in the Private Sector, 2012-2016 (Thousand)

11. Number of Food Retail Outlets in Saudi Arabia

12. Saudi Arabia Burgers, Hamburgers and Sandwiches Market Revenues, 2014-2023F ($ Million)

13. Saudi Arabia Chicken Fast Food Market Revenues, 2014-2023F ($ Million)

14. Saudi Arabia Pizza & Pasta Market Revenues, 2014-2023F ($ Million)

15. Saudi Arabia Asian & Latin American Fast Food Market Revenues, 2014-2023F ($ Million)

16. Saudi Arabia Sea Food Market Revenues, 2014-2023F ($ Million)

17. Saudi Arabia Other Fast Food Market Revenues, 2014-2023F ($ Million)

18. Saudi Arabia Fast Food Market Revenues, By taking Away Outlets, 2014-2023F ($ Million)

19. Saudi Arabia Fast Food Market Revenues, By Dine-in Restaurants, 2014-2023F ($ Million)

20. Saudi Arabia Fast Food Market Revenues, By Cafes & Bakeries, 2014-2023F ($ Million)

21. Saudi Arabia Fast Food Market Revenues, By Other Distribution Channel, 2014-2023F ($ Million)

22. Saudi Arabia Central Region Fast Food Market Revenue, 2014-2023F ($ Million)

23. Saudi Arabia Eastern Region Fast Food Market Revenue, 2014-2023F ($ Million)

24. Saudi Arabia Western Region Fast Food Market Revenue, 2014-2023F ($ Million)

25. Saudi Arabia Southern Region Fast Food Market Revenue, 2014-2023F ($ Million)

26. Total Number of Pilgrims in Saudi Arabia, 2012-2016 (Million)

27. Number of Pilgrims, 2015 & 2023 (Million)

28. Domestic Vs Foreign Hajj Pilgrims, 2016

29. Consumer Spending during Hajj and Umrah, 2010-2021 ($ Billion)

30. Population in Saudi Arabia, 2016-2023 (Million)

31. Saudi Arabia Fast Food Market Opportunity Assessment, By Types

32. Saudi Arabia Fast Food Market Revenue Share, By Company, 2016

33. Future Retail Supply in Saudi Arabia, 2017-2018 (GLA 000's sq.m.)

List of Tables

1. Fees to be Paid by Saudi Arabian Company for Non-Saudi Employee (SAR)

2. Saudi Arabia Dependent Fees for Foreign Nationals (SAR)

3. Nitaqat Classification According to Nationalization

4. Upcoming Malls in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero