Singapore Sugar Market (2024-2030) | Share, Revenue, Size, Analysis, Value, Growth, Forecast, Companies, Industry, Trends & Outlook

| Product Code: ETC045427 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

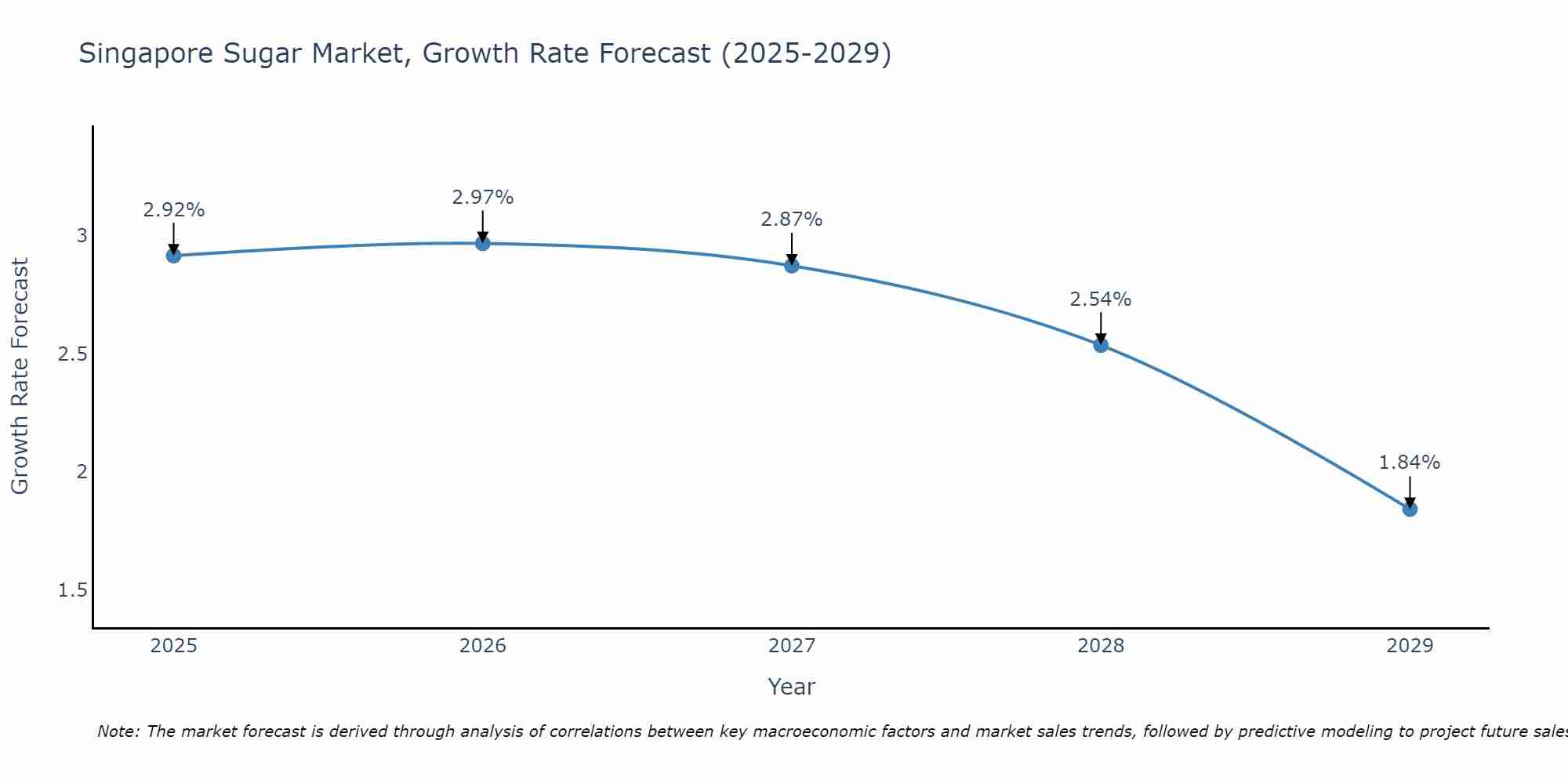

Singapore Sugar Market Size Growth Rate

The Singapore Sugar Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 2.92% in 2025, the market peaks at 2.97% in 2026, and settles at 1.84% by 2029.

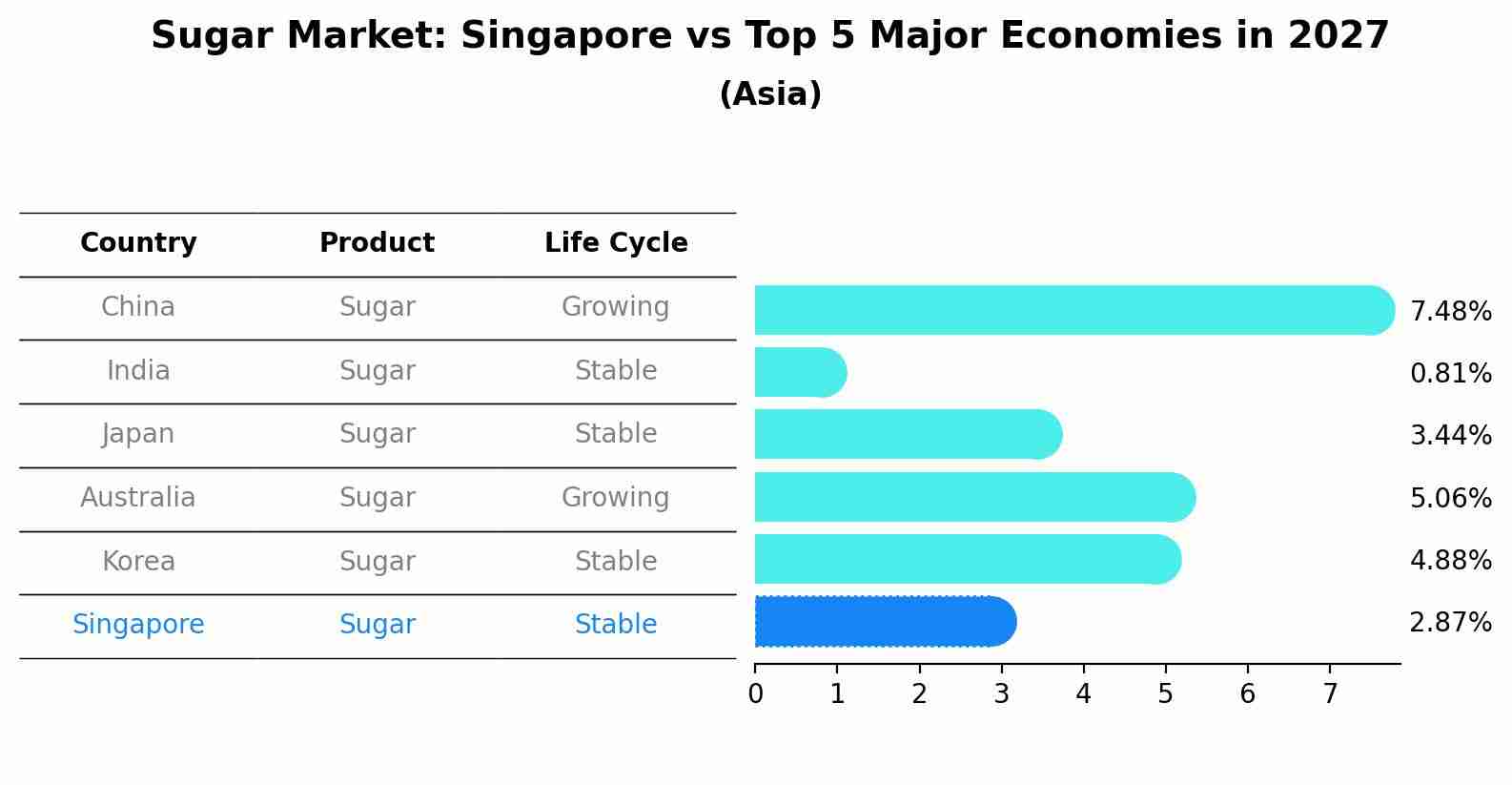

Sugar Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

The Sugar market in Singapore is projected to grow at a stable growth rate of 2.87% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Singapore Sugar Market Synopsis

The Singapore sugar market is projected to witness significant growth during the forecast period of 2020-2026. The rising demand for processed and packaged food items in Singapore, along with the increasing per capita consumption of sugar in the country, is expected to drive the market growth over the next few years. Additionally, local manufacturers are focusing on increasing their production capacity by investing in new technology and equipment which would also propel market growth. Furthermore, initiatives taken by government authorities such as providing subsidies and clearances to create a favorable environment for investments are likely to further augment industry expansion over the forecast period.

Market Drivers

Rising demand for processed & packaged food products: The rising demand for ready-to-eat meals coupled with an increase in health consciousness among consumers has led them towards opting healthier options when it comes to consuming processed foods. This has augmented sales of pre-packed snacks and confectioneries containing sugar which consequently will have a positive impact on market growth over the coming years.Increasing per capita consumption of sugar: A growing population base coupled with high disposable incomes among individuals has increased purchasing power enabling them to purchase more goods including sugary products such as cakes, pastries ETC, thus resulting in higher per capita consumption levels of sugar across Singapore households. This factor is expected to spur industry progression going forward 2020-2026 time frame.

Market challenges

High cost associated with raw materials used for producing sugar : Sugar prices have been volatile due mainly because it requires expensive raw materials like cane or beet pulp that need stringent processing before they can be converted into refined white crystalline form suitable for commercial use which further increases its price point making it difficult fro producers generating minimal profit margins.This factor might act as a hindrance towards industry development during 2020 - 2026 timeframe.

Key players

Major players operating in this market include Wilmar International Ltd., Tate & Lyle PLC, Cargill Incorporated, American Sugar Refining Inc., Amalgamated Bean Coffee Trading Company Ltd., SUGARFED (Uttar Pradesh), and other prominent companies. These major players have adopted strategies such as product launches, merger and acquisitions, collaborations, joint ventures ETC, to gain foothold in the Singapore sugar industry.

Covid-19 Impact

The outbreak of Covid 19 pandemic had an adverse effect on many industries including global manufacturing sector, resulting into shortage supply cahin disruption and closure off non essential stores leading t decrease int he overall sale os sugary product.However, this situation seems improving owing too reopening off various outlets especially restaurants alongwith gradual shift back towqards normal operating conditions whcih wioll help regain consumer confidence while boosting overall sales volume thereby stimulating revenues generated from sucar produdcts

Key Highlights of the Report:

- Singapore Sugar Market Outlook

- Market Size of Singapore Sugar Market, 2023

- Forecast of Singapore Sugar Market, 2030

- Historical Data and Forecast of Singapore Sugar Revenues & Volume for the Period 2020-2030

- Singapore Sugar Market Trend Evolution

- Singapore Sugar Market Drivers and Challenges

- Singapore Sugar Price Trends

- Singapore Sugar Porter's Five Forces

- Singapore Sugar Industry Life Cycle

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Types for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By White Sugar for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Brown Sugar for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Liquid Sugar for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Form for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Granulated Sugar for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Powdered Sugar for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Syrup Sugar for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By End -Users for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Food and Beverages for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Pharma and Personal Care for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Household for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Sources for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Sugarcane for the Period 2020-2030

- Historical Data and Forecast of Singapore Sugar Market Revenues & Volume By Sugarbeet for the Period 2020-2030

- Singapore Sugar Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By End -Users

- Market Opportunity Assessment By Sources

- Singapore Sugar Top Companies Market Share

- Singapore Sugar Competitive Benchmarking By Technical and Operational Parameters

- Singapore Sugar Company Profiles

- Singapore Sugar Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Sugar Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Sugar Market Revenues & Volume, 2020 & 2030F |

3.3 Singapore Sugar Market - Industry Life Cycle |

3.4 Singapore Sugar Market - Porter's Five Forces |

3.5 Singapore Sugar Market Revenues & Volume Share, By Types, 2020 & 2030F |

3.6 Singapore Sugar Market Revenues & Volume Share, By Form, 2020 & 2030F |

3.7 Singapore Sugar Market Revenues & Volume Share, By End -Users, 2020 & 2030F |

3.8 Singapore Sugar Market Revenues & Volume Share, By Sources, 2020 & 2030F |

4 Singapore Sugar Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Singapore Sugar Market Trends |

6 Singapore Sugar Market, By Types |

6.1 Singapore Sugar Market, By Types |

6.1.1 Overview and Analysis |

6.1.2 Singapore Sugar Market Revenues & Volume, By Types, 2020-2030F |

6.1.3 Singapore Sugar Market Revenues & Volume, By White Sugar, 2020-2030F |

6.1.4 Singapore Sugar Market Revenues & Volume, By Brown Sugar, 2020-2030F |

6.1.5 Singapore Sugar Market Revenues & Volume, By Liquid Sugar, 2020-2030F |

6.2 Singapore Sugar Market, By Form |

6.2.1 Overview and Analysis |

6.2.2 Singapore Sugar Market Revenues & Volume, By Granulated Sugar, 2020-2030F |

6.2.3 Singapore Sugar Market Revenues & Volume, By Powdered Sugar, 2020-2030F |

6.2.4 Singapore Sugar Market Revenues & Volume, By Syrup Sugar, 2020-2030F |

6.3 Singapore Sugar Market, By End -Users |

6.3.1 Overview and Analysis |

6.3.2 Singapore Sugar Market Revenues & Volume, By Food and Beverages, 2020-2030F |

6.3.3 Singapore Sugar Market Revenues & Volume, By Pharma and Personal Care, 2020-2030F |

6.3.4 Singapore Sugar Market Revenues & Volume, By Household, 2020-2030F |

6.4 Singapore Sugar Market, By Sources |

6.4.1 Overview and Analysis |

6.4.2 Singapore Sugar Market Revenues & Volume, By Sugarcane, 2020-2030F |

6.4.3 Singapore Sugar Market Revenues & Volume, By Sugarbeet, 2020-2030F |

7 Singapore Sugar Market Import-Export Trade Statistics |

7.1 Singapore Sugar Market Export to Major Countries |

7.2 Singapore Sugar Market Imports from Major Countries |

8 Singapore Sugar Market Key Performance Indicators |

9 Singapore Sugar Market - Opportunity Assessment |

9.1 Singapore Sugar Market Opportunity Assessment, By Types, 2020 & 2030F |

9.2 Singapore Sugar Market Opportunity Assessment, By Form, 2020 & 2030F |

9.3 Singapore Sugar Market Opportunity Assessment, By End -Users, 2020 & 2030F |

9.4 Singapore Sugar Market Opportunity Assessment, By Sources, 2020 & 2030F |

10 Singapore Sugar Market - Competitive Landscape |

10.1 Singapore Sugar Market Revenue Share, By Companies, 2023 |

10.2 Singapore Sugar Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero