South Africa Microwave Oven Market (2025-2031) | Outlook, Trends, COVID-19 IMPACT, Value, Revenue, Companies, Size, Share, Analysis, Industry, Forecast & Growth

Market Forecast By Structure (Built In, Counter Top), By Type (Convection, Grill, Solo), By Production (Commerical, Household) And Competitive Landscape

| Product Code: ETC267348 | Publication Date: Aug 2022 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

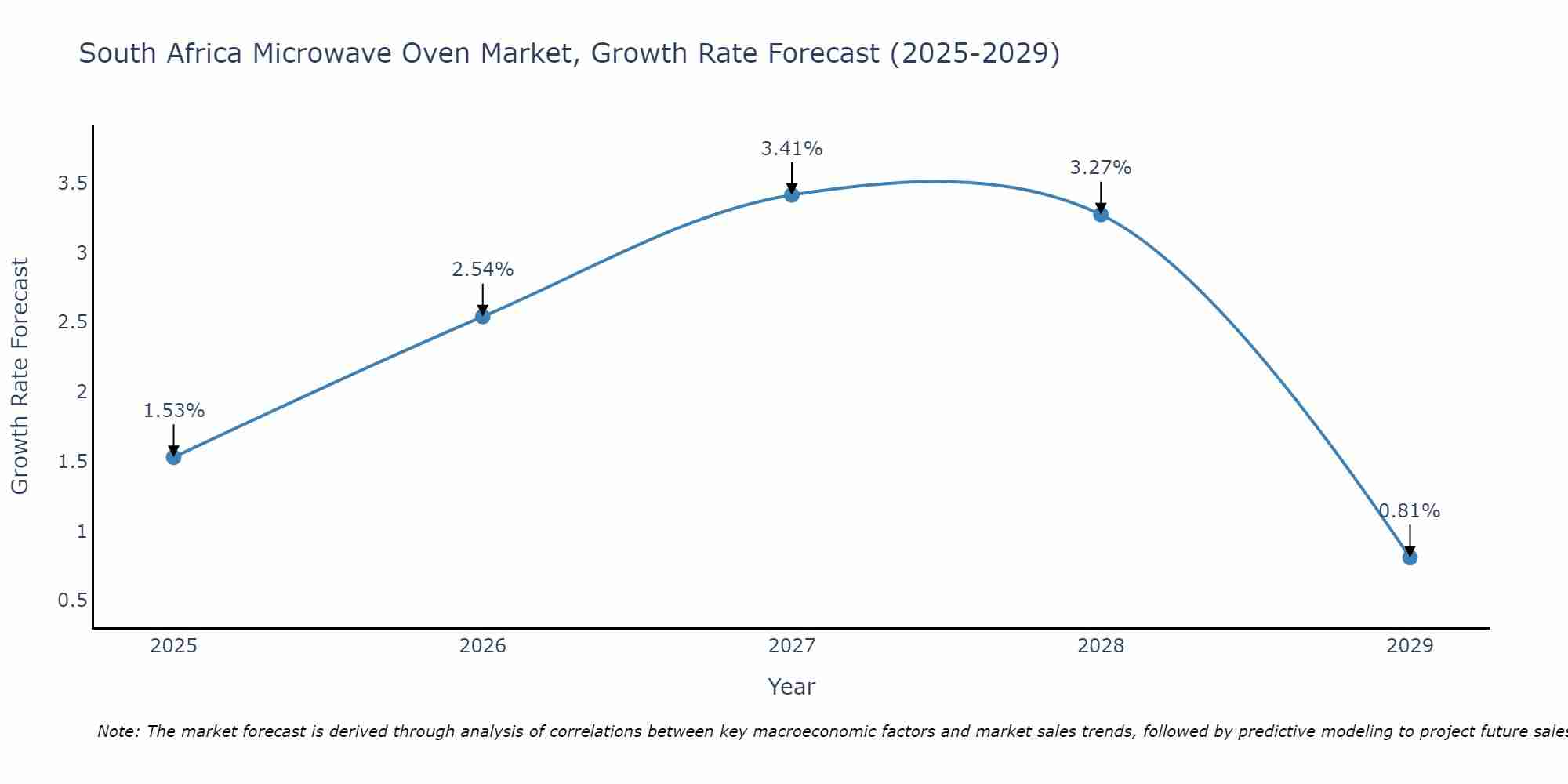

South Africa Microwave Oven Market Size Growth Rate

The South Africa Microwave Oven Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 1.53% in 2025, climbs to a high of 3.41% in 2027, and moderates to 0.81% by 2029.

South Africa Microwave Oven Market Highlights

| Report Name | South Africa Microwave Oven Market |

| Forecast period | 2025-2031 |

| CAGR | 5.8% |

| Growing Sector | Household |

Topics Covered in the South Africa Microwave Oven Market Report

South Africa Microwave Oven Market report thoroughly covers the market by structure, by type, and by production. The South Africa Microwave Oven Market report provides an unbiased and detailed analysis of the ongoing South Africa Microwave Oven Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Microwave Oven Market Synopsis

South Africa Microwave Oven Market has experienced significant success and is expected to continue growing in the future, driven by increasing urbanization and the rising demand for convenient cooking solutions. This market expansion can be attributed to several factors, including a growing middle class with higher disposable incomes and the busy lifestyles of urban populations, which prioritize quick and efficient meal preparation. Microwave ovens are favored for their ability to quickly reheat food, cook ready meals, and defrost ingredients, making them indispensable kitchen appliances in modern South African households.

According to 6Wresearch, the South Africa Microwave Oven Market size is expected to grow at a significant CAGR of 5.8% during the forecast period 2025-2031. The major driver of the South Africa microwave oven market is the growing demand for convenient and time-saving cooking solutions. As urbanization increases and lifestyles become more hectic, consumers are seeking appliances that can simplify their daily cooking routines. Microwave ovens offer quick and efficient cooking, defrosting, and reheating capabilities, making them essential kitchen appliances for many households and commercial establishments.

Additionally, rising disposable incomes and improving living standards contribute to the market's growth. Consumers are willing to invest in appliances that offer convenience, energy efficiency, and advanced features such as smart technology integration and preset cooking options. The commercial sector, including restaurants, hotels, and catering services, also fuels market demand as they require reliable and efficient cooking equipment to meet customer demands. Moreover, awareness about the benefits of microwave cooking, such as retaining nutrients and flavors in food, further drives South Africa Microwave Oven Market growth. Manufacturers are innovating with new designs, functionalities, and eco-friendly features to capture a larger market share and meet the evolving needs of consumers and businesses.

However, the South Africa microwave oven market faces challenges such as competition from alternative cooking appliances like gas stoves and electric ovens, especially in traditional cooking practices. Consumer concerns about health and safety related to microwave cooking, such as potential radiation risks and nutrient loss, also pose challenges. Additionally, economic fluctuations affecting disposable incomes, high energy consumption of some microwave models, and environmental sustainability concerns regarding electronic waste disposal are significant challenges for market growth.

South Africa Microwave Oven Industry: Leading Players

Some of the leading players in the South Africa microwave oven market include Samsung Electronics, LG Electronics, Defy Appliances (Pty) Ltd., Whirlpool Corporation, and Hisense South Africa. These companies offer a wide range of microwave oven models catering to residential and commercial customers. They compete based on factors like product innovation, energy efficiency, pricing strategies, distribution networks, and after-sales services.

Microwave Oven Market in South Africa: Government Regulations

Government regulations in the South Africa microwave oven market focus on product safety, energy efficiency, and environmental sustainability. The South African Bureau of Standards (SABS) sets safety standards and certification requirements for microwave ovens to ensure they meet minimum safety criteria before entering the market. Energy efficiency regulations aim to promote the use of energy-efficient appliances and may include labeling requirements, such as Energy Efficiency Rating labels, to guide consumers in making informed choices. Additionally, there are regulations concerning electronic waste management to mitigate environmental impacts. Manufacturers are required to comply with waste disposal and recycling guidelines for electronic products, including microwave ovens, to reduce pollution and promote sustainable practices..

Future Insights of the Market

The future of the South Africa microwave oven market share is likely to increase with several key trends expected to shape its growth. Technological advancements, such as smart features, IoT integration, and voice control capabilities, will drive product innovation and enhance user experience. Increasing consumer awareness about health and nutrition may lead to the development of microwave ovens with advanced cooking modes that preserve nutrients and flavors in food. Moreover, the growing trend of smart kitchens and connected appliances will drive market demand among tech-savvy consumers. Energy efficiency will remain a priority, leading to the introduction of more eco-friendly microwave oven models. Expansion in the commercial sector, particularly in the hospitality and food service industries, will also contribute to market growth.

Market Segmentation by Structure

According to Ravi Bhandari, Head of Research, 6Wresearch, the countertop segment currently dominates the industry due to its affordability, versatility, and widespread consumer acceptance. Countertop microwaves are popular among residential consumers and small businesses for their convenience and ease of use.

Market Segmentation by Production

On the basis of production, the household segment dominates the industry due to widespread adoption among residential consumers for cooking, reheating, and defrosting purposes. Factors such as convenience, time-saving features, and a wide range of available models contribute to the strong demand in the household segment.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Microwave Oven Market Outlook

- Market Size of South Africa Microwave Oven Market, 2024

- Forecast of South Africa Microwave Oven Market, 2031

- Historical Data and Forecast of South Africa Microwave Oven Revenues & Volume for the Period 2021 - 2031

- South Africa Microwave Oven Market Trend Evolution

- South Africa Microwave Oven Market Drivers and Challenges

- South Africa Microwave Oven Price Trends

- South Africa Microwave Oven Porter's Five Forces

- South Africa Microwave Oven Industry Life Cycle

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Structure for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Built In for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Counter Top for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Convection for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Grill for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Solo for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Production for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Commerical for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Microwave Oven Market Revenues & Volume By Household for the Period 2021 - 2031

- South Africa Microwave Oven Import Export Trade Statistics

- Market Opportunity Assessment By Structure

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Production

- South Africa Microwave Oven Top Companies Market Share

- South Africa Microwave Oven Competitive Benchmarking By Technical and Operational Parameters

- South Africa Microwave Oven Company Profiles

- South Africa Microwave Oven Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Structure

- Built In

- Counter Top

By Type

- Convection

- Grill

- Solo

By Production

- Commerical

- Household

South Africa Microwave Oven Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 South Africa Microwave Oven Market Overview |

| 3.1 South Africa Country Macro Economic Indicators |

| 3.2 South Africa Microwave Oven Market Revenues & Volume, 2021 & 2031F |

| 3.3 South Africa Microwave Oven Market - Industry Life Cycle |

| 3.4 South Africa Microwave Oven Market - Porter's Five Forces |

| 3.5 South Africa Microwave Oven Market Revenues & Volume Share, By Structure, 2021 & 2031F |

| 3.6 South Africa Microwave Oven Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.7 South Africa Microwave Oven Market Revenues & Volume Share, By Production, 2021 & 2031F |

| 4 South Africa Microwave Oven Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 South Africa Microwave Oven Market Trends |

| 6 South Africa Microwave Oven Market, By Types |

| 6.1 South Africa Microwave Oven Market, By Structure |

| 6.1.1 Overview and Analysis |

| 6.1.2 South Africa Microwave Oven Market Revenues & Volume, By Structure, 2021 - 2031F |

| 6.1.3 South Africa Microwave Oven Market Revenues & Volume, By Built In, 2021 - 2031F |

| 6.1.4 South Africa Microwave Oven Market Revenues & Volume, By Counter Top, 2021 - 2031F |

| 6.2 South Africa Microwave Oven Market, By Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 South Africa Microwave Oven Market Revenues & Volume, By Convection, 2021 - 2031F |

| 6.2.3 South Africa Microwave Oven Market Revenues & Volume, By Grill, 2021 - 2031F |

| 6.2.4 South Africa Microwave Oven Market Revenues & Volume, By Solo, 2021 - 2031F |

| 6.3 South Africa Microwave Oven Market, By Production |

| 6.3.1 Overview and Analysis |

| 6.3.2 South Africa Microwave Oven Market Revenues & Volume, By Commerical, 2021 - 2031F |

| 6.3.3 South Africa Microwave Oven Market Revenues & Volume, By Household, 2021 - 2031F |

| 7 South Africa Microwave Oven Market Import-Export Trade Statistics |

| 7.1 South Africa Microwave Oven Market Export to Major Countries |

| 7.2 South Africa Microwave Oven Market Imports from Major Countries |

| 8 South Africa Microwave Oven Market Key Performance Indicators |

| 9 South Africa Microwave Oven Market - Opportunity Assessment |

| 9.1 South Africa Microwave Oven Market Opportunity Assessment, By Structure, 2021 & 2031F |

| 9.2 South Africa Microwave Oven Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.3 South Africa Microwave Oven Market Opportunity Assessment, By Production, 2021 & 2031F |

| 10 South Africa Microwave Oven Market - Competitive Landscape |

| 10.1 South Africa Microwave Oven Market Revenue Share, By Companies, 2024 |

| 10.2 South Africa Microwave Oven Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero