Spain Soap Market (2025-2031) | Companies, Value, Trends, Outlook, Growth, Size, Share, Industry, Revenue, Forecast, Analysis

Market Forecast By Type (Bar Soap, Liquid Soap), By Application (Household, Commercial, Other), By Distribution Channel (Modern Trade, Traditional Trade, Online) And Competitive Landscape

| Product Code: ETC021394 | Publication Date: Jun 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

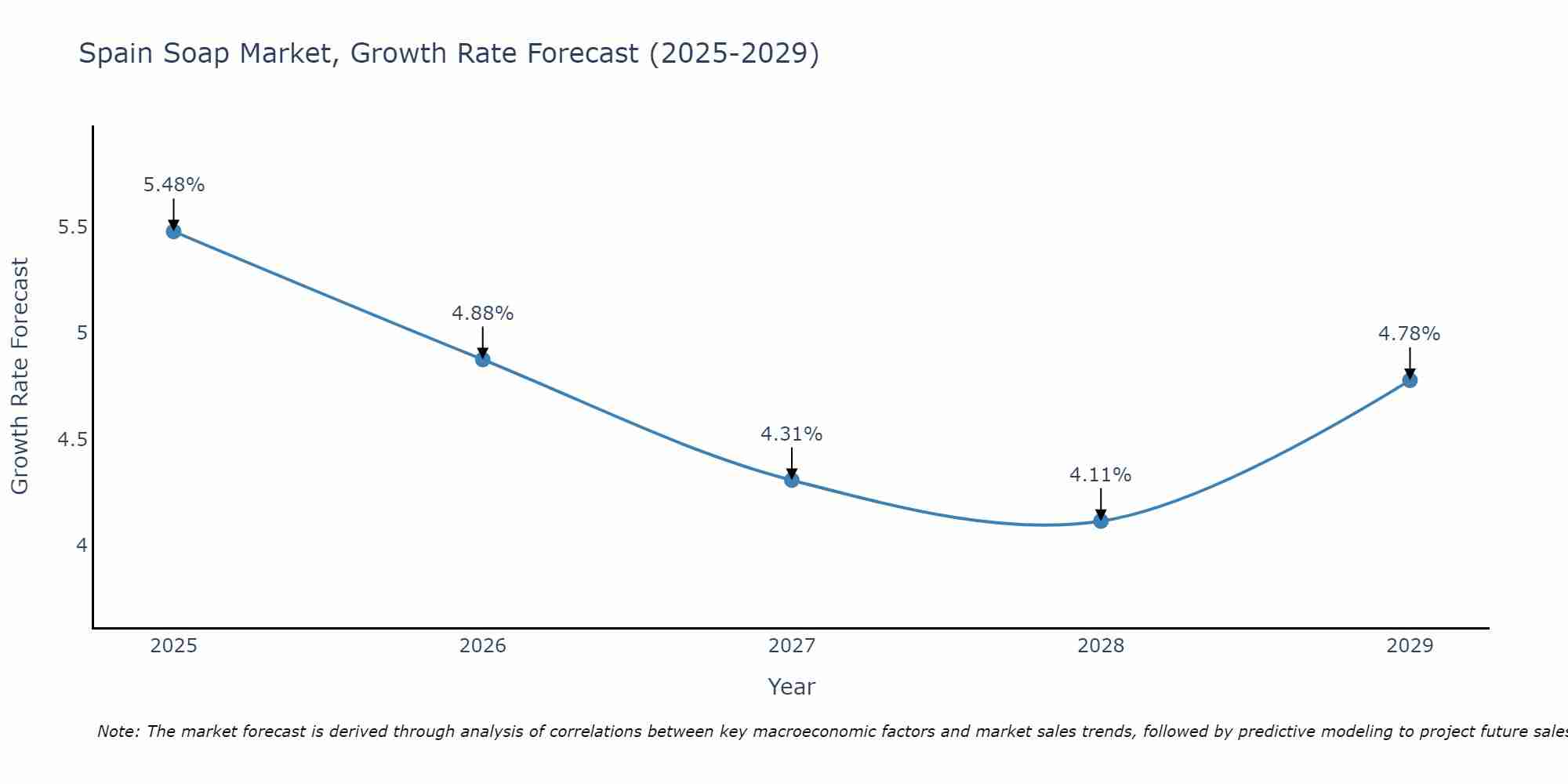

Spain Soap Market Size Growth Rate

The Spain Soap Market is projected to witness mixed growth rate patterns during 2025 to 2029. Beginning strongly at 5.48% in 2025, growth softens to 4.78% in 2029.

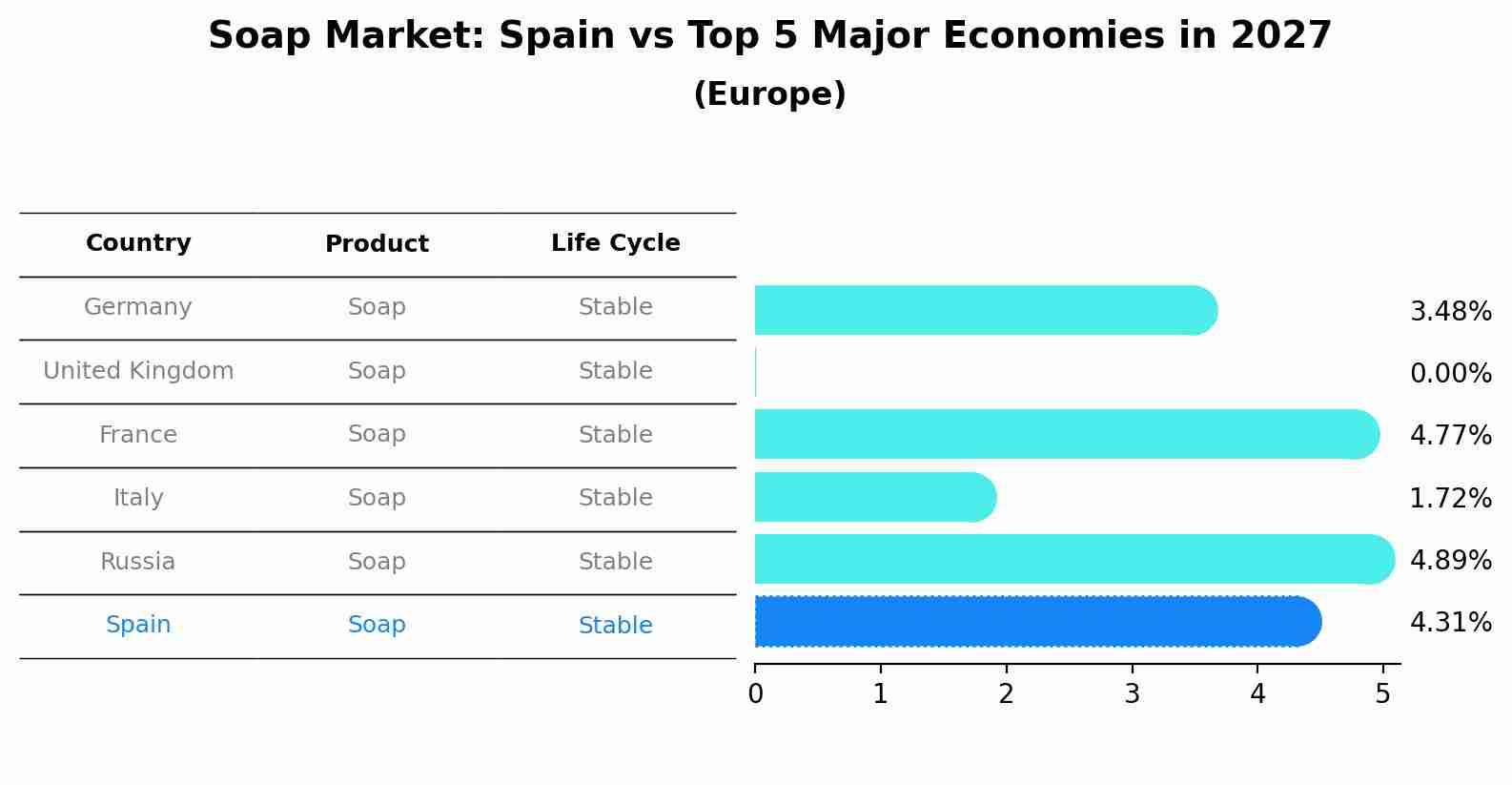

Soap Market: Spain vs Top 5 Major Economies in 2027 (Europe)

In the Europe region, the Soap market in Spain is projected to expand at a stable growth rate of 4.31% by 2027. The largest economy is Germany, followed by United Kingdom, France, Italy and Russia.

Spain Soap Market Highlights

| Report Name | Spain Soap Market |

| Forecast period | 2025-2031 |

| CAGR | 5% |

| Growing Sector | Household segment |

Topics Covered in the Spain Soap Market Report

The Spain Soap Market report thoroughly covers the market by type, By application, and By distribution channel.The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would assist stakeholders to devise and align their market strategies according to the current and future market dynamics.

Spain Soap Market Synopsis

The soap market in Spain is booming due to rising hygiene awareness and advancements in soap-making technology. This growth represents a shift from traditional soaps to more specialized and high-performance products, demonstrating Spain's commitment to enhancing cleanliness and hygiene. Consumers are increasingly seeking advanced and customized soap solutions that offer better reliability and effectiveness. This trend reflects a broader move towards incorporating innovative technologies and premium materials into soap production. As a result, Spain is establishing itself as a leader in modern soap manufacturing, focusing on optimizing hygiene and delivering superior cleanliness.

According to 6Wresearch, the Spain Soap Market size is projected to grow at a significant CAGR OF 5% during the forecast period of 2025-2031. The soap market in Spain is booming as the demand for effective, reliable, and high-performance products continues to rise. This growth is prompting companies to heavily invest in developing both specialty and eco-friendly soaps. Consumers and businesses alike are increasingly prioritizing sustainability alongside performance. As a result, there's a noticeable shift toward products that not only excel in cleanliness but also align with environmental values. Companies are focusing on innovative solutions that integrate cutting-edge technology with eco-conscious practices. This trend highlights a broader industry effort to reconcile exceptional cleaning power with a commitment to environmental responsibility, ensuring that new soap offerings are both highly effective and sustainable.

Despite the substantial growth in the Spain Soap market, several challenges persist. These include competition from inexpensive imports, which may hinder the growth of locally produced high-quality brands. Furthermore, the growing consumer preference for online shopping could pose a challenge for traditional physical stores. However, there is also an opportunity for businesses to expand their reach with the increasing adoption of e-commerce.

Spain Soap Industry Leading Players

In Spain soap industry, several key players are leading the market with innovative and high-quality products. Major companies like Procter & Gamble, Unilever, and Colgate-Palmolive dominate the sector, offering a range of popular soap brands known for their effectiveness and reliability. Local brands, such as Laboratorios Vithas and Isdin, also play a significant role, focusing on specialized and dermatologically tested soaps to meet consumer needs. These companies are not only committed to delivering superior performance but are also increasingly investing in eco-friendly and sustainable practices to align with growing consumer demand for environmentally responsible products. By combining advanced technology with a focus on sustainability, these leading players are shaping the future of the soap industry in Spain.

Soap Market in Spain Government Regulations

In Spain, the soap market is influenced by a range of government regulations designed to ensure product safety and environmental sustainability. Regulatory frameworks mandate that soaps meet strict standards for ingredients and labeling, focusing on consumer health and safety. For instance, the Spanish Agency for Consumer Affairs, Food Safety and Nutrition (AECOSAN) oversees compliance with regulations that require clear ingredient disclosure and adherence to safety protocols. Additionally, there are specific guidelines related to environmental impact, such as restrictions on certain chemicals and requirements for biodegradable packaging. The Spanish government also supports sustainability initiatives, encouraging companies to adopt eco-friendly practices and reduce their environmental footprint. These regulations are part of a broader effort to protect consumers and promote greener industry practices, reflecting Spain's commitment to balancing effective product performance with environmental responsibility.

Future Insights of the Market

The soap market in Spain is set for continued growth, driven by evolving consumer preferences and heightened environmental awareness. As sustainability becomes increasingly important, manufacturers are likely to focus on developing eco-friendly soaps that use natural ingredients and minimal packaging. Innovations in formulations and production processes will aim to enhance both effectiveness and environmental impact. The market will also see a rise in specialty soaps, catering to specific needs like skin sensitivity or hypoallergenic properties. Digital and direct-to-consumer channels will play a bigger role, as more consumers seek convenient shopping options and personalized products. Overall, the soap industry in Spain will likely prioritize blending high performance with eco-conscious practices, reflecting a broader shift towards sustainable living and responsible consumption.

Market Segmentation By Type

According to Ravi Bhandari, Research Head, 6Wresearch,liquid soap is experiencing the fastest growth compared to bar soap. This surge is driven by shifting consumer preferences for convenience, hygiene, and ease of use. Liquid soap is seen as more hygienic, especially in public spaces and shared environments, as it often comes in pump dispensers that reduce direct contact.

Market Segmentation By Applications

In the soap market in Spain, the household segment is experiencing the most significant growth. This surge is driven by increasing consumer awareness of hygiene, particularly after the global pandemic, and a growing preference for eco-friendly and natural soap products for personal and home use. Households are seeking products that are not only effective in cleanliness but also gentle on the skin and environment.

Market Segmentation By Distribution Channels

In Spain soap market, the online distribution channel is experiencing the fastest growth. This trend is driven by increasing consumer preference for convenient, on-demand shopping, with more people turning to e-commerce platforms for a wider selection of products and doorstep delivery. The COVID-19 pandemic further accelerated the shift towards online purchases, and this change in consumer behavior continues to fuel the expansion of digital platforms.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Spain Soap Market Outlook

- Market Size of Spain Soap Market, 2024

- Forecast of Spain Soap Market, 2031

- Historical Data and Forecast of Spain Soap Revenues & Volume for the Period 2021 - 2031

- Spain Soap Market Trend Evolution

- Spain Soap Market Drivers and Challenges

- Spain Soap Price Trends

- Spain Soap Porter's Five Forces

- Spain Soap Industry Life Cycle

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Bar Soap for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Liquid Soap for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Household for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Distribution Channel for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Modern Trade for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Traditional Trade for the Period 2021 - 2031

- Historical Data and Forecast of Spain Soap Market Revenues & Volume By Online for the Period 2021 - 2031

- Spain Soap Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Distribution Channel

- Spain Soap Top Companies Market Share

- Spain Soap Competitive Benchmarking By Technical and Operational Parameters

- Spain Soap Company Profiles

- Spain Soap Key Strategic Recommendations

Markets Covered

The report offers a comprehensive study of the subsequent market segments

By Type

- Bar Soap

- Liquid Soap

By Application

- Household

- Commercial

- Others

By Distribution Channel

- Modern Trade

- Traditional Trade

- Online

Spain Soap Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Spain Soap Market Overview |

| 3.1 Spain Country Macro Economic Indicators |

| 3.2 Spain Soap Market Revenues & Volume, 2021 & 2031F |

| 3.3 Spain Soap Market - Industry Life Cycle |

| 3.4 Spain Soap Market - Porter's Five Forces |

| 3.5 Spain Soap Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Spain Soap Market Revenues & Volume Share, By Application , 2021 & 2031F |

| 3.7 Spain Soap Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Spain Soap Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Spain Soap Market Trends |

| 6 Spain Soap Market, By Types |

| 6.1 Spain Soap Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Spain Soap Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Spain Soap Market Revenues & Volume, By Bar Soap, 2021 - 2031F |

| 6.1.4 Spain Soap Market Revenues & Volume, By Liquid Soap, 2021 - 2031F |

| 6.2 Spain Soap Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Spain Soap Market Revenues & Volume, By Household, 2021 - 2031F |

| 6.2.3 Spain Soap Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.2.4 Spain Soap Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.3 Spain Soap Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Spain Soap Market Revenues & Volume, By Modern Trade, 2021 - 2031F |

| 6.3.3 Spain Soap Market Revenues & Volume, By Traditional Trade, 2021 - 2031F |

| 6.3.4 Spain Soap Market Revenues & Volume, By Online, 2021 - 2031F |

| 7 Spain Soap Market Import-Export Trade Statistics |

| 7.1 Spain Soap Market Export to Major Countries |

| 7.2 Spain Soap Market Imports from Major Countries |

| 8 Spain Soap Market Key Performance Indicators |

| 9 Spain Soap Market - Opportunity Assessment |

| 9.1 Spain Soap Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Spain Soap Market Opportunity Assessment, By Application , 2021 & 2031F |

| 9.3 Spain Soap Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Spain Soap Market - Competitive Landscape |

| 10.1 Spain Soap Market Revenue Share, By Companies, 2024 |

| 10.2 Spain Soap Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero