Thailand Building Management System Market (2024-2030) | Value, Companies, Growth, Industry, Share, Revenue, Size, Trends, Forecast & Analysis

Market Forecast By Type (Solution,Services), By Solution (Facility Management, Security Management, Energy Management, Infrastructure Management, Emergency Management), By Service Type (Professional Services, Managed Services), By Application (Residential, Commercial, Industrial) And Competitive Landscape

| Product Code: ETC4468706 | Publication Date: Jul 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 21 | No. of Tables: 7 | |

Topics Covered in Thailand Building Management System Market Report

Thailand Building Management System Market Report thoroughly covers the market by type, solution, service type and application. Thailand Building Management System Market Outlook report provides an unbiased and detailed analysis of the ongoing Thailand Building Management System Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Thailand Building Management System Market Synopsis

Thailand’s commercial sector has been a significant driver of the Building Management System (BMS) market, with increasing investments in retail, hospitality, and mixed-use developments. The sector's focus on enhancing efficiency and sustainability has accelerated the adoption of BMS solutions, as businesses aim to optimize operations and reduce costs. Notable projects include the USD 1.7 billion ICONSIAM and the USD 3.5 billion The One Bangkok, both of which prioritize energy savings and operational efficiency, underscoring the importance of BMS in modern commercial developments. Moreover, Thailand’s office sector reached 9.8 million sqm in 2023, with 2.59% YoY growth with occupancy rates reaching around 85%. This growth drives the BMS market as businesses focus on energy efficiency and cost reduction bolstering the overall market.

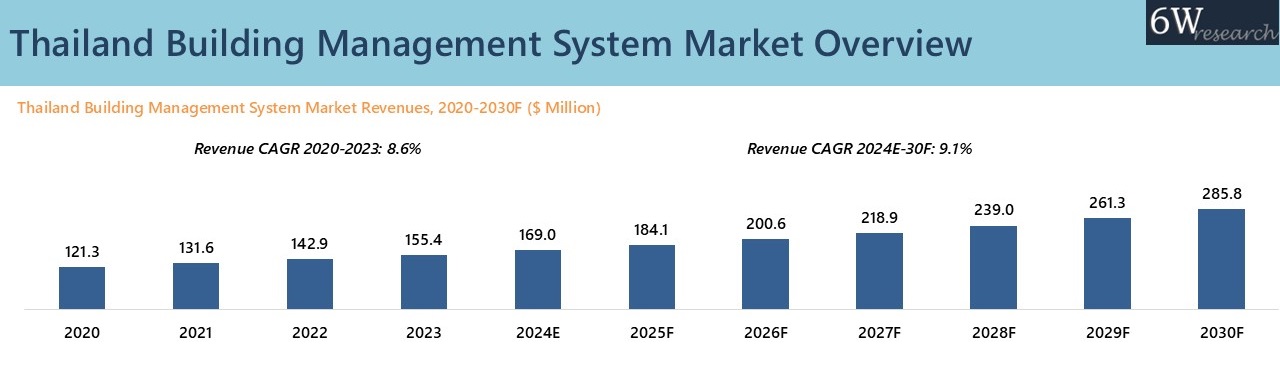

According to 6Wresearch, Thailand Building Management System Market revenues is projected to grow at a CAGR of 9.1% respectively during 2024-2030F. The building management market is expected to witness significant growth, primarily aim to develop 100 smart cities by 2024, supported by a planned $168.75 million investment. This strategic move addresses the challenges of urban expansion and a growing population, driving demand for Building Management Systems (BMS) to enhance energy efficiency and sustainability in new urban environments. Moreover, Government efforts such as the Energy Efficiency Plan (2015-2036), which targets a 30% reduction in energy intensity by 2036, and the Energy Conservation Promotion Act are pushing for green building practices. These regulations emphasize the role of BMS in optimizing energy use, reducing operational costs, and supporting sustainable development. However, implementing agencies face challenges, including limited technology assessment capabilities and a shortage of skilled professionals familiar with energy-efficient solutions. The alignment of infrastructure investments with energy efficiency goals positions the BMS market as a critical component of Thailand's sustainable growth, enhancing building performance and supporting long-term energy objectives of the country.

Market Segmentation by Type

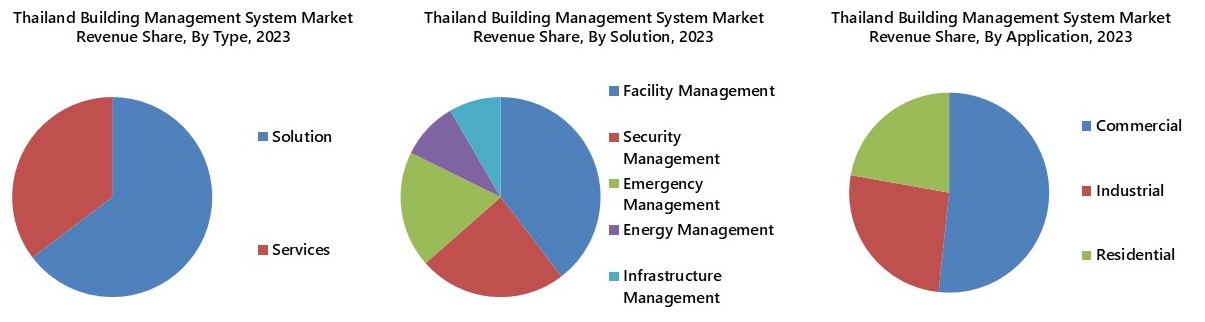

The Solution type dominated Thailand's building management system market in 2023 due to its integrated strategy, which combined software and hardware for all-encompassing building operations control. Moreover, this integration is an ideal option for companies looking for long-term advantages due to the improves energy efficiency, lowers operating costs, and takes care of early investment requirements.

Market Segmentation by Solution

Facility management has garnered the highest revenue in Thailand's BMS solution segment due to its focus on optimizing energy consumption in HVAC and lighting systems. Moreover, effective control of these systems reduces operational costs, making facility management a crucial component of BMS solutions.

Market Segmentation by Service Type

Managed services have captured the highest revenue in Thailand's BMS service segment as it offer cost efficiency through predictable, subscription-based pricing, reducing the need for significant upfront investments. These services provide continuous support with round-the-clock monitoring, maintenance, and updates, ensuring system reliability and minimizing downtime.

Market Segmentation by Application

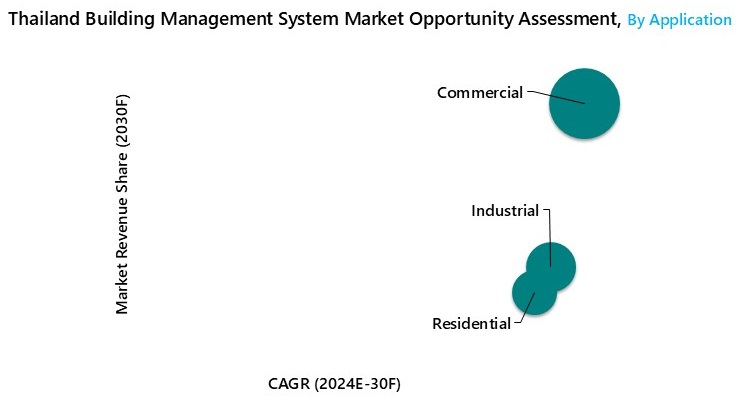

The commercial segment held the largest share in 2023 and is expected to maintain its lead due to the high penetration of Building Management Systems (BMS) in Thailand’s commercial buildings. To meet the government’s targets of achieving net zero emissions by 2065 and initiative to promote energy efficiency, commercial building owners are increasingly investing in technologies that support attaining Super Low Energy (SLE) certification.

Key Attractiveness of the Application

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Building Management System Market Overview

- Thailand Building Management System Market Outlook

- Thailand Building Management System Market Forecast

- Industry Life Cycle

- Porter’s Five Forces Analysis

- Historical Data and Forecast of Thailand Building Management System Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of Thailand Building Management System Market Revenues, By Type, for the Period 2020-2030F

- Historical Data and Forecast of Thailand Building Management System Market Revenues, By Solution, for the Period 2020-2030F

- Historical Data and Forecast of Thailand Building Management System Market Revenues, By Service Type, for the Period 2020-2030F

- Historical Data and Forecast of Thailand Building Management System Market Revenues, By Application, for the Period 2020-2030F

- Market Drivers and Restraints

- Market Evolution & Trends

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Solution

- Services

By Solution

- Facility Management

- Security Management

- Energy Management

- Infrastructure Management

- Emergency Management

By Service Type

- Professional Services

- Managed Services

By Application

- Residential

- Commercial

- Industrial

Thailand Building Management System Market (2025-2031) : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Thailand Building Management System Market Overview |

| 3.1. Thailand Building Management System Market Revenues (2020-2030F) |

| 3.2. Thailand Building Management System Market Industry Life Cycle |

| 3.3. Thailand Building Management System Market Porter’s Five Forces Model |

| 4. Thailand Building Management System Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing focus on energy efficiency and sustainability in buildings |

| 4.2.2 Government initiatives promoting smart cities and green buildings |

| 4.2.3 Growing adoption of IoT and automation technologies in building management |

| 4.3. Market Restraints |

| 4.3.1 High initial investment costs for implementing building management systems |

| 4.3.2 Lack of skilled professionals to manage and maintain these systems |

| 4.3.3 Concerns regarding data security and privacy in connected buildings |

| 5. Thailand Building Management System Market Evolution & Trends |

| 6. Thailand Building Management System Market Overview, By Type |

| 6.1. Thailand Building Management System Market Revenue Share and Revenues, By Type (2023 & 2030F) |

| 6.1.1. Thailand Building Management System Market Revenues, By Solution (2020-2030F) |

| 6.1.2. Thailand Building Management System Market Revenues, By Services (2020-2030F) |

| 7. Thailand Building Management System Market Overview, By Solution |

| 7.1. Thailand Building Management System Market Revenue Share and Revenues, By Solution (2023 & 2030F) |

| 7.1.1. Thailand Building Management System Market Revenues, By Facility Management (2020-2030F) |

| 7.1.2. Thailand Building Management System Market Revenues, By Security Management (2020-2030F) |

| 7.1.3. Thailand Building Management System Market Revenues, By Emergency Management (2020-2030F) |

| 7.1.4. Thailand Building Management System Market Revenues, By Energy Management (2020-2030F) |

| 7.1.5. Thailand Building Management System Market Revenues, By Infrastructure Management (2020-2030F) |

| 8. Thailand Building Management System Market Overview, By Services |

| 8.1. Thailand Building Management System Market Revenue Share and Revenues, By Services (2023 & 2030F) |

| 8.1.1. Thailand Building Management System Market Revenues, By Managed (2020-2030F) |

| 8.1.2. Thailand Building Management System Market Revenues, By Professional (2020-2030F) |

| 9. Thailand Building Management System Market Overview, By Application |

| 9.1. Thailand Building Management System Market Revenue Share and Revenues, By Application (2023 & 2030F) |

| 9.1.1. Thailand Building Management System Market Revenues, By Commercial (2020-2030F) |

| 9.1.2. Thailand Building Management System Market Revenues, By Industrial (2020-2030F) |

| 9.1.3. Thailand Building Management System Market Revenues, By Residential (2020-2030F) |

| 10. Thailand Building Management System Market Key Performance Indicators |

| 10.1 Energy efficiency improvement rate in buildings |

| 10.2 Percentage of buildings in Thailand using smart technologies |

| 10.3 Rate of adoption of IoT devices in building management systems |

| 10.4 Number of building management system integrators and service providers in the market |

| 10.5 Customer satisfaction and retention rates for building management system solutions |

| 11. Thailand Building Management System Market Opportunity Assessment |

| 11.1. Thailand Building Management System Market Opportunity Assessment, By Type (2030F) |

| 11.2. Thailand Building Management System Market Opportunity Assessment, By Solution (2030F) |

| 11.3. Thailand Building Management System Market Opportunity Assessment, By Services (2030F) |

| 11.4. Thailand Building Management System Market Opportunity Assessment, By Application (2030F) |

| 12. Thailand Building Management System Market Competitive Landscape |

| 12.1. Thailand Building Management System Market Revenue Ranking, By Top 3 Companies (2023) |

| 12.2. Thailand Building Management System Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Schneider Electric SE |

| 13.2 Siemens AG |

| 13.3 ABB Ltd |

| 13.4 Honeywell International Inc. |

| 13.5 Yokogawa Electric Corporation |

| 13.6 Mitsubishi Electric Corporation |

| 13.7 Ecoxplore Technologies Co., Ltd. |

| 13.8 Johnson Controls International |

| 13.9 Delta Electronics (Thailand) PCL. |

| 13.10 Azbil Corporation |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Thailand Building Management System Market Revenues, 2020-2030F ($ Million) |

| 2. Thailand Urbanization Forecast By 2050 |

| 3. Thailand Energy Price Per Unit (Baht), 2022-2024F) |

| 4. Thailand Green Building Target, 2023-2030F, (%) |

| 5. Thailand Highly Skilled Professionals, 2023 |

| 6. Thailand Minimum Labor Wages, 2022-2027F (US$) |

| 7. Thailand Building Management System Market Revenue Share, By Types, 2023 & 2030F |

| 8. Thailand Building Management System Market Revenue Share, By Solution, 2023 & 2030F |

| 9. Thailand Building Management System Market Revenue Share, By Service Type, 2023 & 2030F |

| 10. Thailand Building Management System Market Revenue Share, By Application, 2023 & 2030F |

| 11. New Office Supply In Bangkok for 2020, 2023 & 2024E, Thousand sqm |

| 12. Occupancy Rate by Location, as of Q4 2023 |

| 13. Thailand Hotel Occupancy Rate, May 2023-April 2024 |

| 14. Newly Launched Residential Units in Bangkok and Surrounding Areas (In Thousand Units), 2020-2023 |

| 15. Commercial Real Estate Construction Value (In Billion USD), 2020-2023 |

| 16. Thailand Building Management System Market Opportunity Assessment, By Type, 2030F |

| 17. Thailand Building Management System Market Opportunity Assessment, By Solution, 2030F |

| 18. Thailand Building Management System Market Opportunity Assessment, By Service Type, 2030F |

| 19. Thailand Building Management System Market Opportunity Assessment, By Application, 2030F |

| 20. Thailand Building Management System Market Revenue Share, By Companies, 2023 |

| 21. Upcoming Projects in Major Cities of Thailand |

| List of Tables |

| 1. Thailand Ongoing Smart City Project |

| 2. Thailand Building Management System Market Revenues, By Types, 2020-2030F ($ Million) |

| 3. Thailand Building Management System Market Revenues, By Solution, 2020-2030F ($ million) |

| 4. Thailand Building Management System Market Revenues, By Service Type, 2020-2030F ($ million) |

| 5. Thailand Building Management System Market Revenues, By Application, 2020-2030F ($ million) |

| 6. Upcoming Office Building in Thailand |

| 7. Thailand Upcoming Hotels, 2024-2027 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero