Thailand Hair Conditioner Market (2025-2031) | Revenue, Share, Analysis, Companies, Value, Size, Trends, Outlook, Industry, Growth & Forecast

Market Forecast By Product Type (Dry Hair, Oily Hair, Normal Hair, Professional, Non-professional), By Application (Online Retail, Offline Retail, Personal Use, Personal Use, Barber shop, Hotel) And Competitive Landscape

| Product Code: ETC064424 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

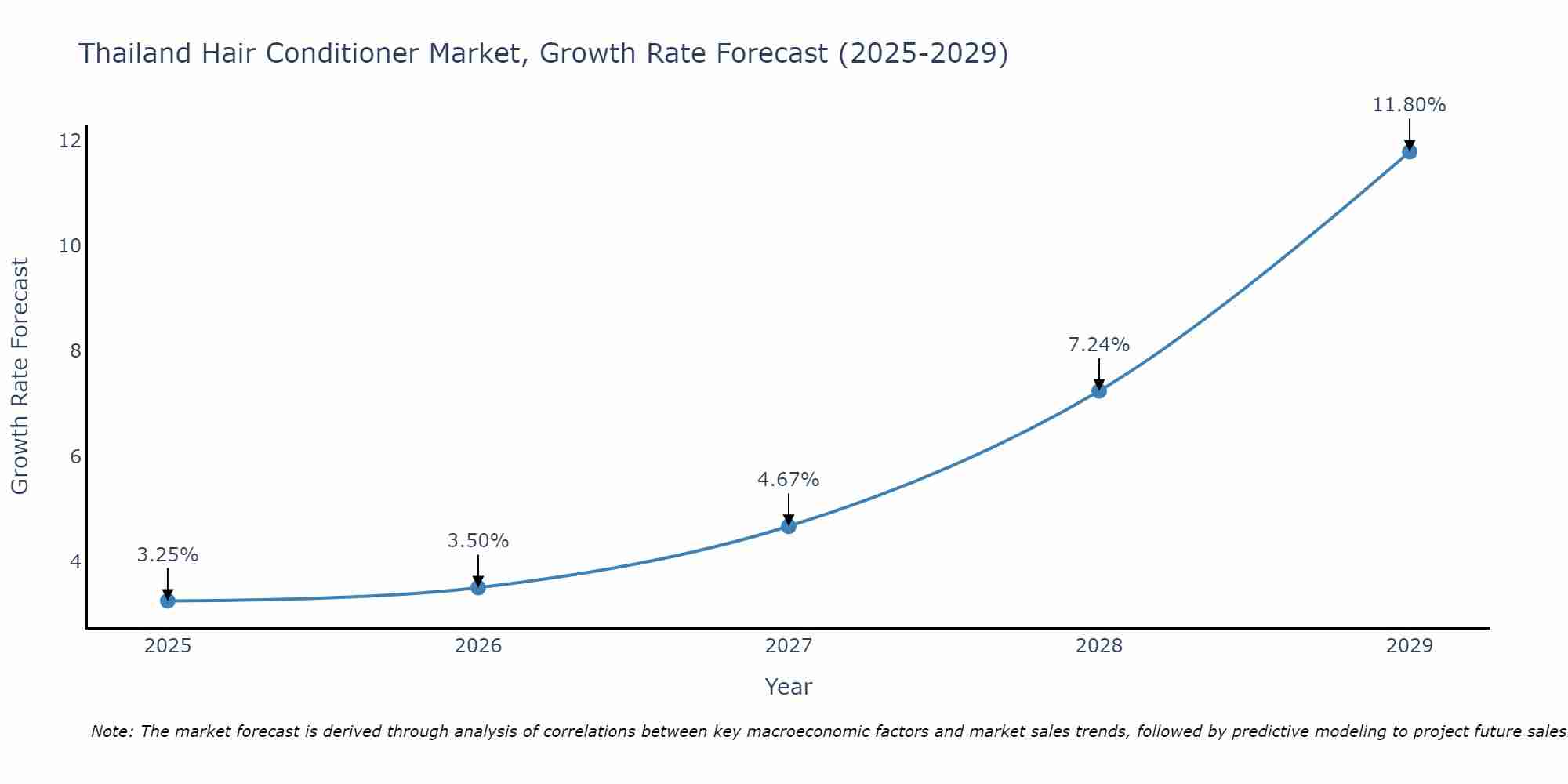

Thailand Hair Conditioner Market Size Growth Rate

The Thailand Hair Conditioner Market is likely to experience consistent growth rate gains over the period 2025 to 2029. Commencing at 3.25% in 2025, growth builds up to 11.80% by 2029.

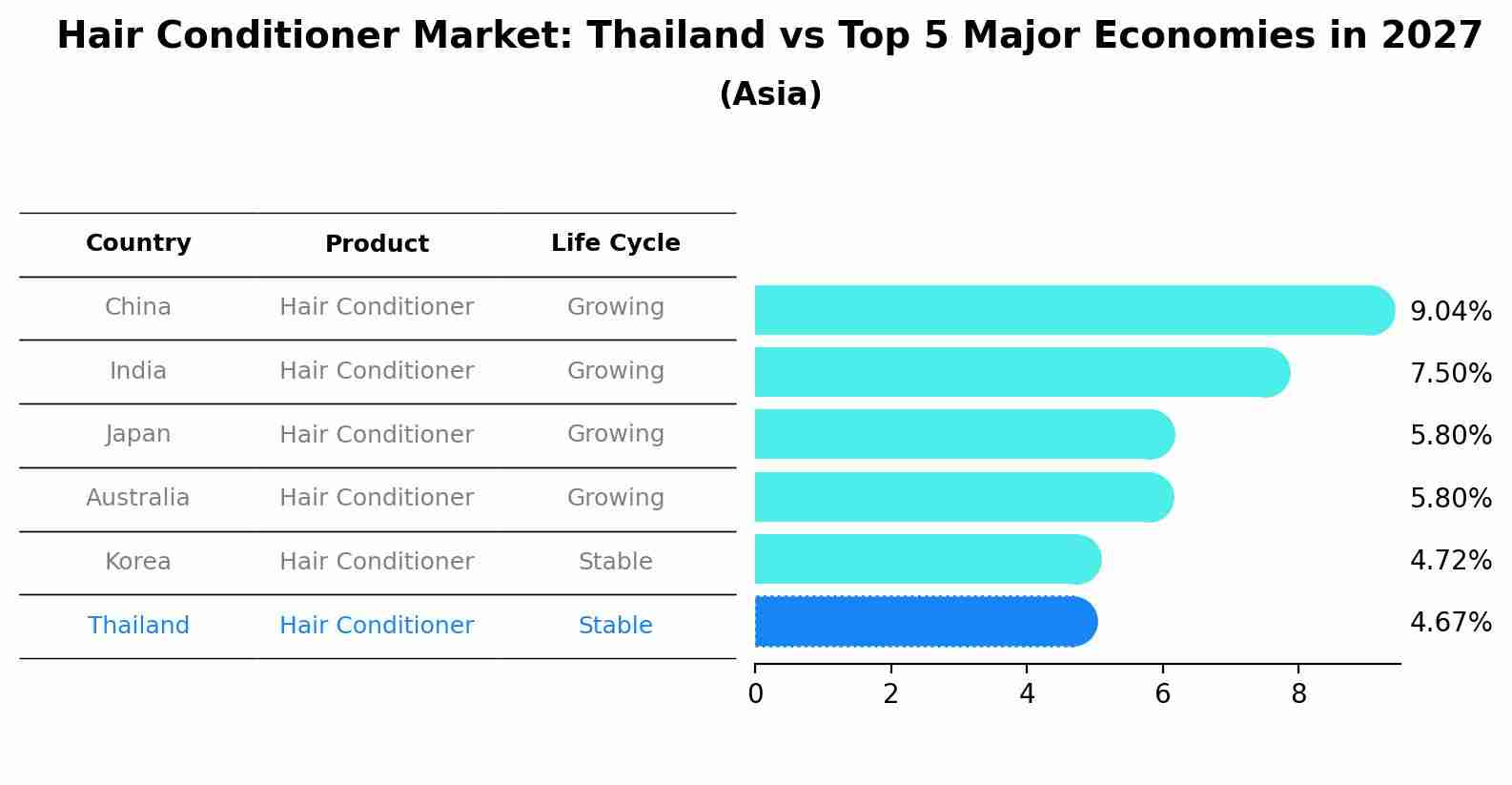

Hair Conditioner Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

The Hair Conditioner market in Thailand is projected to grow at a stable growth rate of 4.67% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Thailand Hair Conditioner Market Highlights

| Report Name | Thailand Hair Conditioner Market |

| Forecast period | 2025-2031 |

| CAGR | 5.4% |

| Growing Sector | Online Retail |

Topics Covered in the Thailand Hair Conditioner Market Report

Thailand Hair Conditioner Market report thoroughly covers the market by product type, and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Thailand Hair Conditioner Market Synopsis

Thailand Hair Conditioner Market is witnessing significant growth, fueled by increasing consumer awareness about personal grooming and hair care. With a surge in disposable income and the influence of global beauty standards, the demand for hair conditioners tailored to specific hair types and concerns has grown substantially. Urbanization and rising lifestyle aspirations have further driven the adoption of premium and professional hair care products.

According to 6Wresearch, the Thailand Hair Conditioner Market is estimated to grow at a a CAGR of 5.4% during the forecast period 2025-2031. The market is continues to flourish, driven by evolving consumer preferences, increased awareness of hair care, and a growing inclination toward premium products. Urbanization and rising disposable incomes have made personal grooming a priority for many, leading to increased demand for specialized conditioners. Products catering to specific needs, such as anti-hair fall, hydration, and color protection, have gained traction. Social media has played a vital role in influencing purchasing behavior, with beauty influencers and digital marketing campaigns emphasizing the benefits of using hair conditioners. Moreover, the hospitality industry in Thailand, buoyed by the steady influx of tourists, has contributed significantly to market expansion, as hotels increasingly adopt premium hair care amenities. The e-commerce boom further accelerates growth, offering easy access to various domestic and international brands, catering to diverse customer demands across the country.

Despite the optimistic growth prospects, the Thailand Hair Conditioner Market faces several pressing challenges that could hinder its growth potential. A significant issue is the high level of competition among local and international brands, which drives down prices and creates challenges for smaller players to sustain profitability. The prevalence of counterfeit products further complicates the market landscape, as they erode consumer trust in authentic brands. Rural areas remain a challenging market to penetrate due to limited awareness of hair care routines and the prioritization of basic needs over grooming. Additionally, environmental concerns surrounding non-biodegradable packaging materials and the chemical composition of conditioners are increasing, pressuring manufacturers to adopt sustainable practices. Supply chain disruptions, particularly in global sourcing of ingredients, have also emerged as a critical concern, causing periodic price volatility and delays in product availability.

Thailand Hair Conditioner Market Trends

Thailand Hair Conditioner Market is witnessing several transformative trends that align with global and regional consumer behaviors. The increasing demand for natural and organic hair care products is reshaping the market, with consumers gravitating toward chemical-free formulations that are gentler on the scalp and hair. Ingredients like aloe vera, tea tree oil, and coconut milk are becoming prominent in product formulations. There is also a surge in demand for gender-neutral and age-inclusive hair care products, reflecting the changing societal norms and consumer expectations. Personalized hair care solutions, enabled by AI technologies, are gaining momentum, allowing consumers to find conditioners tailored to their specific hair type and concerns.

Furthermore, sustainability remains a dominant trend, with companies exploring biodegradable packaging and waterless formulations to reduce environmental impact. The rise of online retail has also led to a proliferation of subscription-based models, providing consumers with a steady supply of personalized hair care products.

Investment Opportunities in the Thailand Hair Conditioner Market

Thailand Hair Conditioner Industry offers abundant investment opportunities for both new entrants and established players. The growing popularity of eco-friendly and organic products presents a lucrative segment for investment, as consumers increasingly prioritize environmentally conscious brands. Expanding e-commerce platforms provide a promising avenue for businesses to reach wider audiences with minimal infrastructure costs.

Collaborative marketing efforts with local influencers and partnerships with beauty salons and spas can further enhance brand visibility and consumer trust. The professional hair care segment, including premium conditioners used in salons, offers substantial growth potential as consumers seek salon-quality results at home. Investments in R&D for developing innovative formulations, such as multi-functional conditioners addressing diverse hair concerns, are likely to yield high returns. Additionally, capitalizing on Thailand’s robust hospitality sector by supplying premium hair care products to hotels can be a strategic move to secure steady revenue streams.

Leading Players in the Thailand Hair Conditioner Market

Thailand Hair Conditioner Market Share is characterized by the presence of both global and local brands. Prominent players include Unilever (Sunsilk, Dove), Procter & Gamble (Pantene, Herbal Essences), L’Oréal (L’Oréal Paris, Garnier), and local brands like Mistine, which cater to specific regional preferences. These companies dominate the market through innovative product offerings, extensive distribution networks, and impactful marketing campaigns. Strategic collaborations, continuous R&D investments, and a strong online presence further solidify their positions in the competitive landscape.

Government Regulations

Government support has played a crucial role in shaping the Thailand Hair Conditioner Market Size by fostering a conducive business environment and encouraging local production. Initiatives aimed at boosting digital infrastructure have propelled the e-commerce sector, enabling businesses to reach previously untapped markets. Environmental regulations promoting sustainable practices have pushed companies to adopt greener production methods and packaging solutions, aligning with consumer expectations. Trade agreements and export-friendly policies have also enabled domestic brands to compete globally, further strengthening the industry. Public campaigns promoting hygiene and personal grooming, particularly in rural areas, have indirectly contributed to increased demand for hair conditioners across the country.

Future Insights of the Thailand Hair Conditioner Market

The future of the Thailand Hair Conditioner Market looks promising, with sustained growth expected across various segments. The shift toward customized and multifunctional hair care products is anticipated to dominate the market landscape, driven by advancements in R&D and consumer demand for convenience. Technology-driven solutions, such as AI-enabled product recommendations, will further personalize the shopping experience, particularly in online retail.

The rise of sustainable and environmentally friendly practices will shape the industry, compelling manufacturers to innovate in terms of biodegradable packaging and plant-based formulations. Expanding market penetration in rural areas through affordable and accessible products will also broaden the consumer base. The continuous growth of Thailand’s tourism sector is likely to maintain strong demand for conditioners in the hospitality industry, solidifying its role as a critical market driver.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Dry Hair to Dominate the Market-By Product Type

According to Vasu, Senior Research Analyst, 6Wresearch, the Dry Hair segment dominates due to the high demand for moisturization and repair-focused conditioners. The hot and humid climate in Thailand exacerbates hair dryness, leading to a strong preference for hydrating formulations.

Online Retail to Dominate the Market-By Application

The growth of e-commerce platforms has made online retail the fastest-growing application segment. Convenience, discounts, and access to international brands drive this trend.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Thailand Hair Conditioner Market Outlook

- Market Size of Thailand Hair Conditioner Market, 2024

- Forecast of Thailand Hair Conditioner Market, 2031

- Historical Data and Forecast of Thailand Hair Conditioner Revenues & Volume for the Period 2021 - 2031

- Thailand Hair Conditioner Market Trend Evolution

- Thailand Hair Conditioner Market Drivers and Challenges

- Thailand Hair Conditioner Price Trends

- Thailand Hair Conditioner Porter's Five Forces

- Thailand Hair Conditioner Industry Life Cycle

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Dry Hair for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Oily Hair for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Normal Hair for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Professional for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Non-professional for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Online Retail for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Offline Retail for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Personal Use for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Personal Use for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Barber shop for the Period 2021 - 2031

- Historical Data and Forecast of Thailand Hair Conditioner Market Revenues & Volume By Hotel for the Period 2021 - 2031

- Thailand Hair Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- Thailand Hair Conditioner Top Companies Market Share

- Thailand Hair Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Thailand Hair Conditioner Company Profiles

- Thailand Hair Conditioner Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Product Type:

- Dry Hair

- Oily Hair

- Normal Hair

- Professional

- Non-professional

By Application:

- Online Retail

- Offline Retail

- Personal Use

- Personal Use

- Barber shop

- Hotel

Thailand Hair Conditioner Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Thailand Hair Conditioner Market Overview |

| 3.1 Thailand Country Macro Economic Indicators |

| 3.2 Thailand Hair Conditioner Market Revenues & Volume, 2021 & 2031F |

| 3.3 Thailand Hair Conditioner Market - Industry Life Cycle |

| 3.4 Thailand Hair Conditioner Market - Porter's Five Forces |

| 3.5 Thailand Hair Conditioner Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Thailand Hair Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Thailand Hair Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Thailand Hair Conditioner Market Trends |

| 6 Thailand Hair Conditioner Market, By Types |

| 6.1 Thailand Hair Conditioner Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Thailand Hair Conditioner Market Revenues & Volume, By Product Type, 2021 - 2031F |

| 6.1.3 Thailand Hair Conditioner Market Revenues & Volume, By Dry Hair, 2021 - 2031F |

| 6.1.4 Thailand Hair Conditioner Market Revenues & Volume, By Oily Hair, 2021 - 2031F |

| 6.1.5 Thailand Hair Conditioner Market Revenues & Volume, By Normal Hair, 2021 - 2031F |

| 6.1.6 Thailand Hair Conditioner Market Revenues & Volume, By Professional, 2021 - 2031F |

| 6.1.7 Thailand Hair Conditioner Market Revenues & Volume, By Non-professional, 2021 - 2031F |

| 6.2 Thailand Hair Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Thailand Hair Conditioner Market Revenues & Volume, By Online Retail, 2021 - 2031F |

| 6.2.3 Thailand Hair Conditioner Market Revenues & Volume, By Offline Retail, 2021 - 2031F |

| 6.2.4 Thailand Hair Conditioner Market Revenues & Volume, By Personal Use, 2021 - 2031F |

| 6.2.5 Thailand Hair Conditioner Market Revenues & Volume, By Personal Use, 2021 - 2031F |

| 6.2.6 Thailand Hair Conditioner Market Revenues & Volume, By Barber shop, 2021 - 2031F |

| 6.2.7 Thailand Hair Conditioner Market Revenues & Volume, By Hotel, 2021 - 2031F |

| 7 Thailand Hair Conditioner Market Import-Export Trade Statistics |

| 7.1 Thailand Hair Conditioner Market Export to Major Countries |

| 7.2 Thailand Hair Conditioner Market Imports from Major Countries |

| 8 Thailand Hair Conditioner Market Key Performance Indicators |

| 9 Thailand Hair Conditioner Market - Opportunity Assessment |

| 9.1 Thailand Hair Conditioner Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Thailand Hair Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Thailand Hair Conditioner Market - Competitive Landscape |

| 10.1 Thailand Hair Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 Thailand Hair Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero