Tunisia Electric Motor Market (2025-2031) | Share, Outlook, Analysis, Industry, Growth, Revenue, Companies, Trends, Size, Forecast & Value

Market Forecast By Motor Type (Alternate Current (AC) Motor, Direct Current (DC) Motor, Hermetic Motor), By Output Power, By Voltage Range (9 V & Below, 10-20 V, 21-60 V, 60 V & Above), By Application (Industrial machinery, Motor vehicles, Heating, ventilating, and cooling (HVAC) equipment, Aerospace & transportation, Household appliances, Other), By Speed (RPM) (Low-Speed Electric Motors (Less Than 1,000 RPM), Medium-Speed Electric Motors (1,001-25,000 RPM), High-Speed Electric Motors (25,001-75,000 RPM), Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)) And Competitive Landscape

| Product Code: ETC041135 | Publication Date: Jan 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Tunisia Electric Motor Market | Country-Wise Share and Competition Analysis

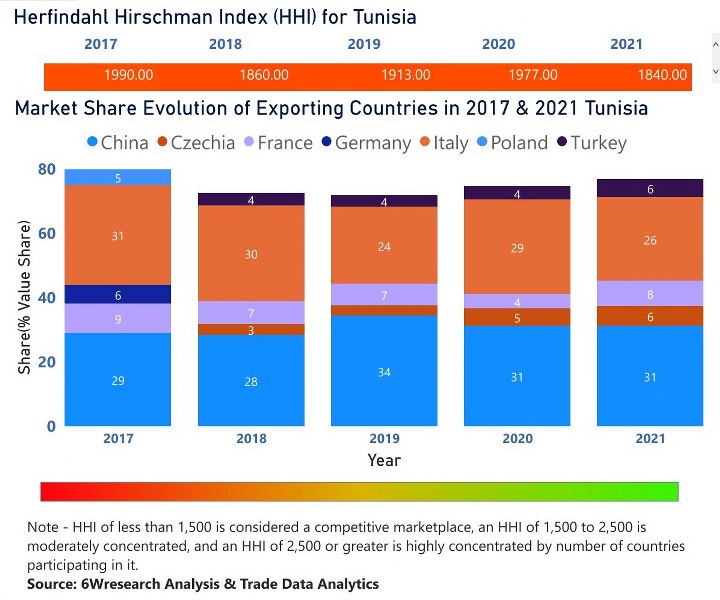

In the year 2021, China was the largest exporter in terms of value, followed by Italy. It has registered a growth of 25.46% over the previous year. While Italy registered a growth of 11.54% as compare to the previous year. In the year 2017 Italy was the largest exporter followed by China. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Tunisia has the Herfindahl index of 1990 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1840 which signifies moderately concentrated in the market.

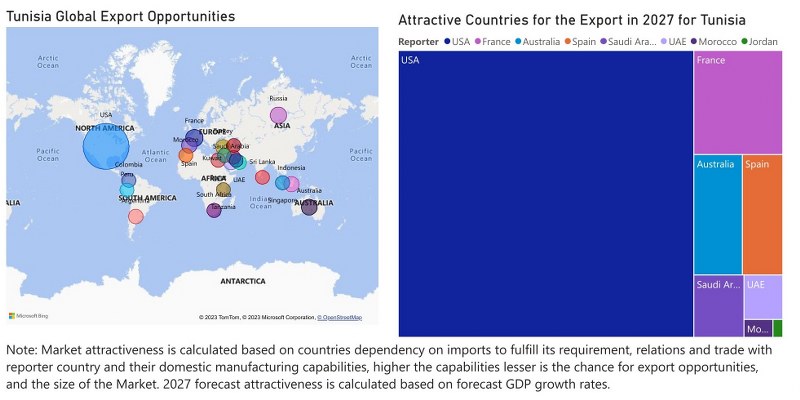

Tunisia Electric Motor Market - Export Market Opportunities

Topics Covered in the Tunisia Electric Motor Market

Tunisia Electric Motor Market report thoroughly covers the market by motor type, by voltage range, by application, and by speed. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Tunisia Electric Motor Market Synopsis

Tunisia Electric Motor Market is in a phase of rapid transformation, driven by technological advancements and government initiatives aimed at promoting sustainable economic growth. Although Tunisia electric motor industry is still in its nascent stage, it has been growing rapidly in recent years. This growth can be attributed to the increasing demand for energy-efficient and eco-friendly solutions in various industries, particularly in automotive and construction sectors.

According to 6Wresearch, the Tunisia Electric Motor Market Size is projected to grow at a CAGR of around 6% during the forecast period of 2025-2030. The government’s efforts to promote sustainable development is a significant driver of the electric motor industry growth in Tunisia. The government has been increasingly focusing on the renewable energy sector and electric vehicles to promote sustainable economic growth. Furthermore, the need to reduce import dependence on high-cost conventional fuels and energy sources has resulted in the adoption of electric motors in various sectors. Despite the growth potential of the Tunisian electric motor market, the industry faces several challenges hindering its growth. The lack of skilled workforce and insufficient research and development efforts are some of the key challenges. The high initial investment required for electric motor manufacturing is another limiting factor.

Furthermore, the absence of targeted policies, regulations, and incentives to support the manufacturing and adoption of electric motors has hindered the growth of the industry. The trend towards increased adoption of electric motors in various industries is expected to continue in Tunisia in the coming years. The rising demand for eco-friendly and energy-efficient solutions, coupled with the ever-increasing electricity costs, is fueling the adoption of electric motors in different sectors. Apart from this, the Tunisia electric motor industry presents several lucrative opportunities for local and foreign investors. The country has several advantages, including a strategic location, favorable legal and fiscal regime, and a young and dynamic workforce. Furthermore, initiatives such as the “Tunisia Solar Plan” and “Tunisia-Turkey Industrial Cooperation Initiative” are attracting foreign investors to the country. These initiatives aim to promote investment in the renewable energy and automotive sectors, which are key potential growth areas for the electric motor industry.

Government policies and schemes introduced in the Tunisia Electric Motor Market

The government has taken steps to encourage the Tunisia Electric Motor Market Growth. In 2005, the government implemented the Industrial Upgrading Program (IUP) to modernize the industrial sector and boost private sector investment. The program includes support for research and development activities, quality, and standardization programs, and reducing energy consumption in industries to enhance their competitiveness in the global market. Additionally, the government has established an Investment Promotion Agency, the Foreign Investment Promotion Agency (FIPA), which offers incentives such as tax exemptions and other preferential treatment to attract foreign investment to the country.

Leading players in the Tunisia Electric Motor Market

Tunisia Electric Motor Market has some major players, one of which is Tunisie Machines, a subsidiary of the STAFIM automotive group and a supplier of machinery, equipment, and vehicles. The company also provides electric motors with a power range between 0.18 kW and 75 kW. Another prominent player is the Tunisian branch of the world-renowned multinational corporation, ABB. ABB provides a comprehensive range of electric motors, from small motors to high voltage and high-power output motors.

Market Analysis by Application

In terms of Application, the fastest-growing segment is the HVAC equipment segment as air conditioning is essential in Tunisia, particularly during the summer months when temperatures soar. The demand for air conditioning units has increased significantly in recent years, driving the growth of this segment.

Market analysis by Motor Type

According to Shivankar, Research Manager, 6Wresearch, the hermetic motor is the fastest-growing segment since hermetic motors are used extensively in air conditioning (HVAC) equipment, which is in high demand in Tunisia due to the country’s warm climate. Hermetic motors are also used in refrigerators and freezers, which are becoming increasingly popular as the standard of living improves.

Market analysis by Speed

By Speed, the medium-speed electric motors are predicted to dominate the Tunisia Electric Motor Market Share over the forecast period as these motors are often used in small tools and machines, which are commonly used by small and medium-sized businesses in Tunisia.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Tunisia Electric Motor Market Outlook

- Market Size of Tunisia Electric Motor Market, 2024

- Forecast of Tunisia Electric Motor Market, 2031

- Historical Data and Forecast of Tunisia Electric Motor Revenues & Volume for the Period 2021 - 2031

- Tunisia Electric Motor Market Trend Evolution

- Tunisia Electric Motor Market Drivers and Challenges

- Tunisia Electric Motor Price Trends

- Tunisia Electric Motor Porter's Five Forces

- Tunisia Electric Motor Industry Life Cycle

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Motor Type for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Alternate Current (AC) Motor for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Direct Current (DC) Motor for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Hermetic Motor for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Voltage Range for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By 9 V & Below for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By 10-20 V for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By 21-60 V for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By 60 V & Above for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Industrial Machinery for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Motor Vehicles for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Heating, ventilating, and cooling (HVAC) equipment for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Aerospace & transportation for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Household Appliances for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Speed (RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Low-Speed Electric Motors (Less Than 1,000 RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Medium-Speed Electric Motors (1,001-25,000 RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By High-Speed Electric Motors (25,001-75,000 RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Tunisia Electric Motor Market Revenues & Volume By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM) for the Period 2021 - 2031

- Tunisia Electric Motor Import Export Trade Statistics

- Market Opportunity Assessment By Motor Type

- Market Opportunity Assessment By Voltage Range

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Speed (RPM)

- Tunisia Electric Motor Top Companies Market Share

- Tunisia Electric Motor Competitive Benchmarking By Technical and Operational Parameters

- Tunisia Electric Motor Company Profiles

- Tunisia Electric Motor Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Motor Type

- Alternate Current (AC) Motor

- Direct Current (DC) Motor

- Hermetic Motor

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial Machinery

- Motor Vehicles

- Heating

- Ventilating

- And Cooling (HVAC) Equipment

- Aerospace & Transportation

- Household Appliances

- Other

By Speed (RPM)

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)

Tunisia Electric Motor Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Tunisia Electric Motor Market Overview |

| 3.1. Tunisia Country Indicators |

| 3.2. Tunisia Electric Motor Market Revenues, 2021-2031F |

| 3.3. Tunisia Electric Motor Market Revenue Share, By Voltage, 2021 & 2031F |

| 3.4. Tunisia Electric Motor Market Revenue Share, By Types, 2021 & 2031F |

| 3.5. Tunisia Electric Motor Market Revenue Share, By Applications, 2021 & 2031F |

| 3.6. Tunisia Electric Motor Market Revenue Share, By End-Users, 2021 & 2031F |

| 3.7. Tunisia Electric Motor Market - Industry Life Cycle |

| 3.8. Tunisia Electric Motor Market - Porter’s Five Forces |

| 4. Tunisia Electric Motor Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Tunisia Electric Motor Market Trends |

| 6. Tunisia Electric Motor Market Overview, By Voltage |

| 6.1. Tunisia Low Voltage Electric Motor Market Revenues, 2021-2031F |

| 6.2. Tunisia Medium Voltage Electric Motor Market Revenues, 2021-2031F |

| 6.3. Tunisia High Voltage Electric Motor Market Revenues, 2021-2031F |

| 7. Tunisia Electric Motor Market Overview, By Types |

| 7.1. Tunisia Electric Motor Market Revenues, By AC Type, 2021-2031F |

| 7.2. Tunisia Electric Motor Market Revenues, By DC Type, 2021-2031F |

| 8. Tunisia Electric Motor Market Overview, By Applications |

| 8.1. Tunisia Electric Motor Market Revenues, By Pump Application, 2021-2031F |

| 8.2. Tunisia Electric Motor Market Revenues, By Fan Application, 2021-2031F |

| 8.3. Tunisia Electric Motor Market Revenues, By Conveyor Application, 2021-2031F |

| 8.4. Tunisia Electric Motor Market Revenues, By Compressors Application, 2021-2031F |

| 8.5. Tunisia Electric Motor Market Revenues, By Other Applications, 2021-2031F |

| 9. Tunisia Electric Motor Market Overview, By End-Users |

| 9.1. Tunisia Electric Motor Market Revenues, By Industrial Processing, 2021-2031F |

| 9.2. Tunisia Electric Motor Market Revenues, By Commercial HVAC, 2021-2031F |

| 9.3. Tunisia Electric Motor Market Revenues, By Automotive, 2021-2031F |

| 9.4. Tunisia Electric Motor Market Revenues, By Consumer Appliances, 2021-2031F |

| 9.5. Tunisia Electric Motor Market Revenues, By Power Generation, 2021-2031F |

| 9.6. Tunisia Electric Motor Market Revenues, By Others, 2021-2031F |

| 10. Tunisia Electric Motor Market - Key Performance Indicators |

| 11. Tunisia Electric Motor Market - Opportunity Assessment |

| 11.1. Tunisia Electric Motor Market Opportunity Assessment, By Types, 2031F |

| 11.2. Tunisia Electric Motor Market Opportunity Assessment, By Applications, 2031F |

| 12. Tunisia Electric Motor Market Competitive Landscape |

| 12.1. Tunisia Electric Motor Market Revenue Share, By Companies, 2024 |

| 12.2. Tunisia Electric Motor Market Competitive Benchmarking, By Operating & Technical Parameters |

| 13. Company Profiles |

| 14. Key Recommendations |

| 15. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero