UAE Building Automation Control Systems Market (2018-2024) | Revenue, Outlook, Industry, Forecast, Value, Analysis, Companies, Size, Share, Growth & Trends

Market Forecast By Product Type (HVAC (Sensors, Thermostats, Control Valves and Others), Lighting Control System (Sensors and Dimming, Relays Thermostats and Others), Electronic Security and Safety System (Video Surveillance, Fire and Safety, Access Control and Others), Energy Management System (Smart Meter and Others)), By Applications (Residential, Industrial & Manufacturing and Commercial office, Hospitality, Transportation, Retail and Others including Government, Healthcare and Education), By Regions (Abu Dhabi, Dubai and the Other Emirates including Sharjah, Ras al Khaimah, Fujairah, Umm al Quwain, and Ajman) and Competitive Landscape.

| Product Code: ETC000452 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 140 | No. of Figures: 63 | No. of Tables: 14 |

Building automation systems help in monitoring and controlling mechanical operations inside commercial buildings, residential areas, and other such premises. They operate on centralized network support with various software that controls and monitors the building's energy demand, security control as well as heating & cooling systems. Further, growing alertness towards energy saving due to rising costs would propel the demand for energy-efficient buildings in the UAE.

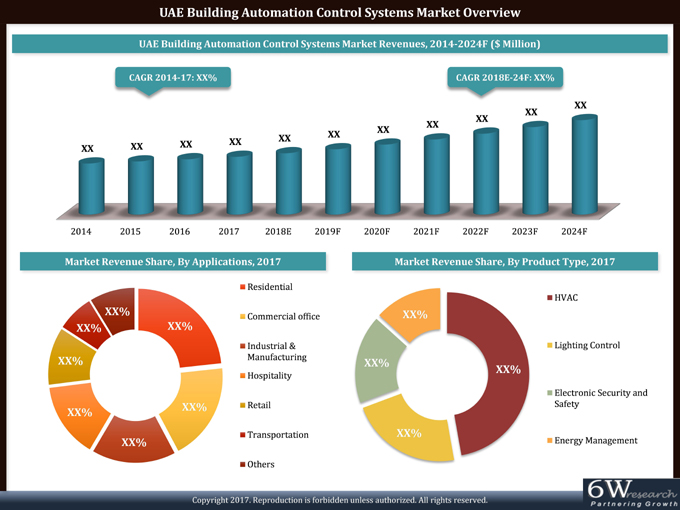

According to 6Wresearch, UAE building automation and control systems market size is projected to grow at a healthy CAGR of 7.5% during 2018-24. Increasing infrastructural development and growing investment in commercial and industrial sectors under the country's development plan - UAE Vision 2021, would act as a major growth driver for the building automation systems market over the coming years.

The Residential and commercial sectors occupied the highest UAE building automation and control systems market share in 2017, while the hospitality sector is projected to witness the highest growth rate during the forecast period on account of increasing hotel and mall construction activities in major cities such as Dubai and Abu Dhabi. Tourist footfall is predicted to increase as a result of the Dubai Expo 2020, which would act as the key growth driver for the hospitality sector in the country.

UAE building automation and control systems market report thoroughly covers the UAE building automation and control systems market by product types, applications, and regions. The UAE building automation and control systems market outlook report provides an unbiased and detailed analysis of the UAE building automation and control systems market trends, opportunities, high growth areas and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics. The UAE building automation control systems market is expected to register potential growth in the coming years owing to increased construction activities in the country along with increasing needs for safety and security. Moreover, an increase in the living standards of people along with changing infrastructure designs and modifications in the existing commercial as well as residential infrastructure is anticipated to trigger sound revenue growth of the UAE building automation control systems market in the near future. Also, with the introduction and technical developments in the internet of things (IoT), the building automation control systems are projected to witness a promising future for growth.

UAE Building automation and control systems market is anticipated to register sound revenues in the upcoming six years on the back of rising government investment in the commercial sector coupled with an increase in infrastructure such as offices and malls which require an energy-efficient system leading to low energy cost and the installation of building management systems for the same is proving evident and is expected to dictate the growth of the UAE building automation and control systems market during the forecast period. Additionally, an increase in business productivity is expected to dominate the overall prominent share in the market owing to the rise in the use of building automation system which tends to provide increased work efficiency and less breakdown and repairment cost and ensure uninterrupted work and as a result is expected to proliferate the growth of UAE building automation and control systems market in the coming timeframe.

Key Highlights of the Report:

- UAE Building Automation and Control Systems Market Overview

- UAE Building Automation and Control Systems Market Outlook

- UAE Building Automation and Control Systems Market Forecast

- Historical Data of UAE Building Automation and Control Systems Market Revenues for the Period 2014-2017

- UAE Building Automation and Control Systems Market Size and UAE Building Automation and Control Systems Market Forecast until 2024

- Historical Data of UAE Building Automation and Control Systems Market Revenues, By Type for the Period 2014-2017

- Market Size & Forecast of UAE Building Automation and Control Systems Market Revenues, By Type until 2024

- Historical Data of UAE Building Automation and Control Systems Market Revenues, By Applications for the Period 2014-2017

- Market Size & Forecast of UAE Building Automation and Control Systems Market Revenues, By Applications until 2024

- Historical Data of UAE Building Automation and Control Systems Market Revenues, By Regions for the Period 2014-2017

- Market Size & Forecast of UAE Building Automation and Control Systems Market Revenues, By Regions until 2024

- UAE Building Automation and Control Systems Market Trends and Opportunities

- Market Drivers and Restraints

- UAE Building Automation and Control Systems Market Overview on Competitive Landscape

- UAE Building Automation and Control Systems Market Share, By Players

- Company Profiles Strategic Recommendations

Markets Covered

The UAE Building Automation and Control Systems Market Report provide a detailed analysis of the following market segments:

By Product Type

- HVAC

- Sensors

- Thermostats

- Control Valves

- Others

1.Lighting Control System

- Sensors and Dimming

- Relays Thermostats

- Others

2. Electronic Security and Safety System

- Video Surveillance

- Fire and Safety

- Access Control

- Others

3. Energy Management System

- Smart Meter

- Others

By Applications

- Residential

- Industrial & Manufacturing

- Commercial office

- Hospitality

- Transportation

- Retail

- Others (Government, healthcare, and Education)

By Regions

- Abu Dhabi

- Dubai

- Other Emirates (Sharjah, Ras al Khaimah, Fujairah, Umm al Quwain, and Ajman)

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1. Report Description

2.2. Key Highlights of the Report

2.3. Market Scope and Segmentation

2.4. Methodology Adopted and Key Data Points

2.5. Assumptions

3. UAE Building Automation Control Systems Market Overview

3.1. UAE Building Automation Control Systems Market Revenues, 2014-2024F

3.2. UAE Building Automation Control Systems Market Industry Life cycle

3.3 UAE Building Automation Control Systems Market Porter's Five Forces Model

3.4. UAE Building Automation Control Systems Market Revenue Share, By Product Type, 2017 & 2024F

3.5 UAE Building Automation Control Systems Market Revenue Share, By Applications, 2017 & 2024F

3.6. UAE Building Automation Control Systems Market Revenue Share, By Regions, 2017 & 2024F

4. UAE Building Automation Control Systems Market Dynamics

4.1. Impact Analysis

4.2. Market Drivers

4.3. Market Restraints

5. UAE Building Automation Control Systems Market Trends

5.1. Use of NFC Enabled Smartphones for Access Control

5.2. High Definition Cameras for Security Systems and IP based Systems

6. UAE Building Automation Control Systems Market Overview, By Product Type

6.1. UAE HVAC System Market Overview

6.1.1. UAE HVAC System Market Revenues, 2014-2024F

6.1.2. UAE HVAC System Market Share, By Types, 2017 & 2024F

6.1.1.1. UAE Sensors System Market Revenues, 2014-2024F

6.1.1.2. UAE Thermostats System Market Revenues, 2014-2024F

6.1.1.3. UAE Control Valves System Market Revenues, 2014-2024F

6.1.1.4. UAE HVAC System Market Share, By Applications, 2017 & 2024F

6.1.1.5. UAE HVAC System Market Revenues, By Applications, 2014-2024F

6.2. UAE Lighting Control System Market Overview

6.2.1. UAE Lighting Control System Market Revenues, 2014-2024F

6.2.2. UAE Lighting Control System Market Share, By Types, 2017 & 2024F

6.2.1.1. UAE Sensors & Dimming System Market Revenues, 2014-2024F

6.2.1.2. UAE Relays Thermostats System Market Revenues, 2014-2024F

6.2.1.3. UAE Lighting Control System Market Share, By Applications, 2017 & 2024F

6.2.1.4. UAE Lighting Control System Market Share, By Applications, 2014-2024F

6.3. UAE Electronic Security and Safety System Market Overview

6.3.1. UAE Electronic Security and Safety System Market Revenues, 2014-2024F

6.3.2. UAE Electronic Security and Safety System Market Share, By Types, 2017 & 2024F

6.3.1.1. UAE Video Surveillance System Market Revenues, 2014-2024F

6.3.1.2. UAE Fire & Safety System Market Revenues, 2014-2024F

6.3.1.3. UAE Access Control System Market Revenues, 2014-2024F

6.3.1.4. UAE Electronic Security and Safety System Market Share, By Applications, 2017 & 2024F

6.3.1.5. UAE Electronic Security and Safety Systems Market Revenues, By Applications, 2014-2024F

6.4. UAE Energy Management System Market Overview

6.4.1. UAE Energy Management System Market Revenues, 2014-2024F

6.4.2. UAE Energy Management System Market Share, By Types, 2017 & 2024F

6.4.1.1. UAE Smart Meter System Market Revenues, 2014-2024F

6.4.1.2. UAE Energy Management System Market Share, By Applications, 2017 & 2024F

6.4.1.3. UAE Energy Management System Market Share, By Applications, 2014-2024F

7. UAE Building Automation Control Systems Market Overview, By Applications

7.1. UAE Residential Building Automation Systems Market Revenues, 2014-2024F

7.2. UAE Industrial & Manufacturing Building Automation Systems Market Revenues, 2014-2024F

7.3. UAE Commercial Offices Building Automation Systems Market Revenues, 2014-2024F

7.4. UAE Hospitality Building Automation Systems Market Revenues, 2014-2024F

7.5. UAE Transportation Infrastructure Building Automation Systems Market Revenues, 2014-2024F

7.6. UAE Retail Building Automation Systems Market Revenues, 2014-2024F

7.7. UAE Other Applications Building Automation Systems Market Revenues, 2014-2024F

8. UAE Building Automation Control Systems Market Overview, By Regions

8.1. Abu Dhabi Building Automation Systems Region Market Revenues, 2014-2024F

8.2. Dubai Building Automation Systems Region Market Revenues, 2014-2024F

8.3. Other Emirates Building Automation Systems Region Market Revenues, 2014-2024F

9. UAE Building Automation Control Systems Market, Key Performance Indicators

9.1. UAE Power Sector Outlook

9.2. UAE Government Spending Outlook

9.3. UAE Construction Market Outlook

9.4. UAE Hospitality Market Outlook

9.5. Dubai Expo 2020 Overview

10. UAE Building Automation Control Systems Market Opportunity Assessment

10.1. UAE Building Automation Control Systems Market Opportunity Assessment, By Product Type

10.2. UAE Building Automation Control Systems Market Opportunity Assessment, By Applications

11. Competitive Landscape

11.1. Competitive Benchmarking, By Product Type

11.2. UAE Building Automation Control Systems Market Revenue Share, By Company, 2017

11.3. UAE Building Automation HVAC System Market Revenue Share, By Company, 2017

11.4. UAE Building Automation Electronic Security and Safety System Market Revenue Share, By Company, 2017

11.5. UAE Building Automation Energy Management System Market Revenue Share, By Company, 2017

12. Company Profiles

12.1. Schneider Electric S.E

12.2. Siemens AG

12.3. Honeywell International Inc.

12.4. Johnson Controls International plc

12.5. ABB Automation LLC

12.6. Crestron Electronics, Inc.

12.7. Naffco fzco

12.8. Carel industries S.p.A.

12.9. Vacker LLC

12.10. Greentec Automation DMCC

13. Key Strategic Recommendations

14. Disclaimer

List of Figures

1. UAE Building Automation Control Systems Market Revenues, 2014-2024F ($ Million)

2. UAE Building Automation Control Systems Market Industry Life cycle

3. UAE Building Automation Control Systems Market Porter's Five Forces Model

4. UAE Building Automation Control Systems Market Revenue Share, By Product Type, 2017 & 2024F

5. UAE Building Automation Control Systems Market Revenue Share, By Applications, 2017 & 2024F

6. UAE Building Automation Control Systems Market Revenue Share, By Region, 2017 & 2024F

7. UAE Infrastructure - Construction Industry , 2016 - 2026F ($ Billion)

8. UAE Hotel and Restaurant Industry Value, 2014 - 2023F ($ Billion)

9. Dubai World Expo 2020 Project Value ($ Million)

10. World Expo 2020 Project Status

11. UAE's Manufacturing Sector Revenues Contribution to the Overall GDP, 2015 - 2023F ($ Billion)

12. The volume of Total Non - Oil Foreign Trade Between UAE & The Rest of World, 2012 - 2016 ($ Million)

13. The volume of Total Direct Foreign Trade Between UAE & The Rest of World, 2012 - 2016 ($ Million)

14. UAE HVAC System Market Revenues, 2014-2024F ($ Million)

15. UAE HVAC System Market Share, By Types, 2017 & 2024F

16. UAE Sensors System Market Revenues, 2014-2024F ($ Million)

17. UAE Thermostats System Market Revenues, 2014-2024F ($ Million)

18. UAE Control Valves System Market Revenues, 2014-2024F ($ Million)

19. UAE HVAC System Market Share, By Applications, 2017 & 2024F

20. UAE Lighting Control System Market Revenues, 2014-2024F ($ Million)

21. UAE Lighting Control System Market Share, By Types, 2017 & 2024F

22. UAE Sensors & Dimming System Market Revenues, 2014-2024F ($ Million)

23. UAE Relays Thermostats System Market Revenues, 2014-2024F ($ Million)

24. UAE Lighting Control System Market Share, By Applications, 2017 & 2024F

25. UAE Electronic Security and Safety System Market Revenues, 2014-2024F ($ Million)

26. UAE Electronic Security and Safety System Market Share, By Types, 2017 & 2024F

27. UAE Video Surveillance System Market Revenues, 2014-2024F ($ Million)

28. UAE Fire & Safety System Market Revenues, 2014-2024F ($ Million)

29. UAE Access Control System Market Revenues, 2014-2024F ($ Million)

30. UAE Electronic Security and Safety System Market Share, By Applications, 2017 & 2024F

31. UAE Energy Management System Market Revenues, 2014-2024F ($ Million)

32. UAE Energy Management System Market Share, By Types, 2017 & 2024F

33. UAE Smart Meter System Market Revenues, 2014-2024F ($ Million)

34. UAE Energy Management System Market Share, By Applications, 2017 & 2024F

35. UAE Residential Building Automation Systems Market Revenues, 2014-2024F ($ Million)

36. UAE Industrial & Manufacturing Building Automation Systems Market Revenues, 2014-2024F ($ Million)

37. UAE Commercial Offices Building Automation Systems Market Revenues, 2014-2024F ($ Million)

38. UAE Hospitality Building Automation Systems Market Revenues, 2014-2024F ($ Million)

39. UAE Transportation Infrastructure Building Automation Systems Market Revenues, 2014-2024F ($ Million)

40. UAE Retail Building Automation Systems Market Revenues, 2014-2024F ($ Million)

41. UAE Other Applications Building Automation Systems Market Revenues, 2014-2024F ($ Million)

42. Abu Dhabi Building Automation Systems Region Market Revenues, 2014-2024F ($ Million)

43. Dubai Building Automation Systems Region Market Revenues, 2014-2024F ($ Million)

44. Other Emirates Building Automation Systems Region Market Revenues, 2014-2024F ($ Million)

45. UAE Power Construction Contractor Awards, 2016-2018 ($ Million)

46. Share Of GCC Power Construction Project Value, By Country (as of 27th October 2017)

47. UAE Actual Government Spending vs Actual Government Revenues, 2012-2021F ($ Billion)

48. UAE Building Construction Contractor Awards, 2016-2017, ($ Million)

49. UAE Building Construction Projects Status, 2017

50. Abu Dhabi, Supply Breakdown, % Number of Keys, As of Q1 2017

51. Dubai, Supply Breakdown, % Number of Keys, As of Q1 2017

52. Ajman, Supply Breakdown, % Number of Keys, As of Q1 2017

53. Ras Al Khaimah, Supply Breakdown, % Number of Keys, As of Q1 2017

54. Fujairah, Supply Breakdown, % Number of Keys, As of Q1 2017

55. Sharjah, Supply Breakdown, % Number of Keys, As of Q1 2017

56. Al Ain, Supply Breakdown, % Number of Keys, As of Q1 2017

57. Abu Dhabi Western Region, Supply Breakdown, % Number of Keys, As of Q1 2017

58. UAE Building Automation Control Systems Market Opportunity Assessment, By Product Type

59. UAE Building Automation Control Systems Market Opportunity Assessment, By Applications

60. UAE Building Automation Control Systems Market Revenue Share, By Company, 2017

61. UAE Building Automation HVAC System Market Revenue Share, By Company, 2017

62. UAE Building Automation Electronic Security and Safety System Market Revenue Share, By Company, 2017

63. UAE Building Automation Energy Management System Market Revenue Share, By Company, 2017

List of Tables

1. Comparison Between NFC and other Technologies

2. UAE HVAC System Market Revenues, By Applications, 2014 -2017 ($Million)

3. UAE HVAC System Market Revenues, By Applications, 2018E - 2024F ($Million)

4. UAE Lighting Control System Market Revenues, By Applications, 2014 - 2017 ($Million)

5. UAE Lighting Control System Market Revenues, By Applications, 2018E - 2024F ($Million)

6. UAE Electronic Security and Safety System Market Revenues, By Applications, 2014 - 2017 ($Million)

7. UAE Electronic Security and Safety System Market Revenues, By Applications, 2018E - 2024F ($Million)

8. UAE Energy Management System Market Revenues, By Applications, 2014 - 2017 ($Million)

9. UAE Energy Management System Market Revenues, By Applications, 2018E - 2024F ($Million)

10. Major Building Construction Projects in UAE for Which Construction is Expected to Commence in 2017

11. Upcoming Construction Projects In Dubai

12. Upcoming Construction Projects In Abu Dhabi

13. Upcoming Construction Projects In Sharjah

14. Upcoming World Expo 2020 Projects

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero