UAE Elevator and Escalator Market (2019-2025) | Size, Share, Revenue, Analysis, Forecast, Trend, Growth, Industry, Outlook & COVID-19 IMPACT

Markets Forecast By Types(Elevator(Passenger, Cargo & Home), Escalator(Moving Stairs & Moving Walkways)), By Applications(Commercial, Industrial, Residential), By Services(Maintenance & Modernization) and Competitive Landscape.

| Product Code: ETC001011 | Publication Date: Mar 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 105 | No. of Figures: 48 | No. of Tables: 10 | |

UAE Elevator And Escalator Market | Country-Wise Share and Competition Analysis

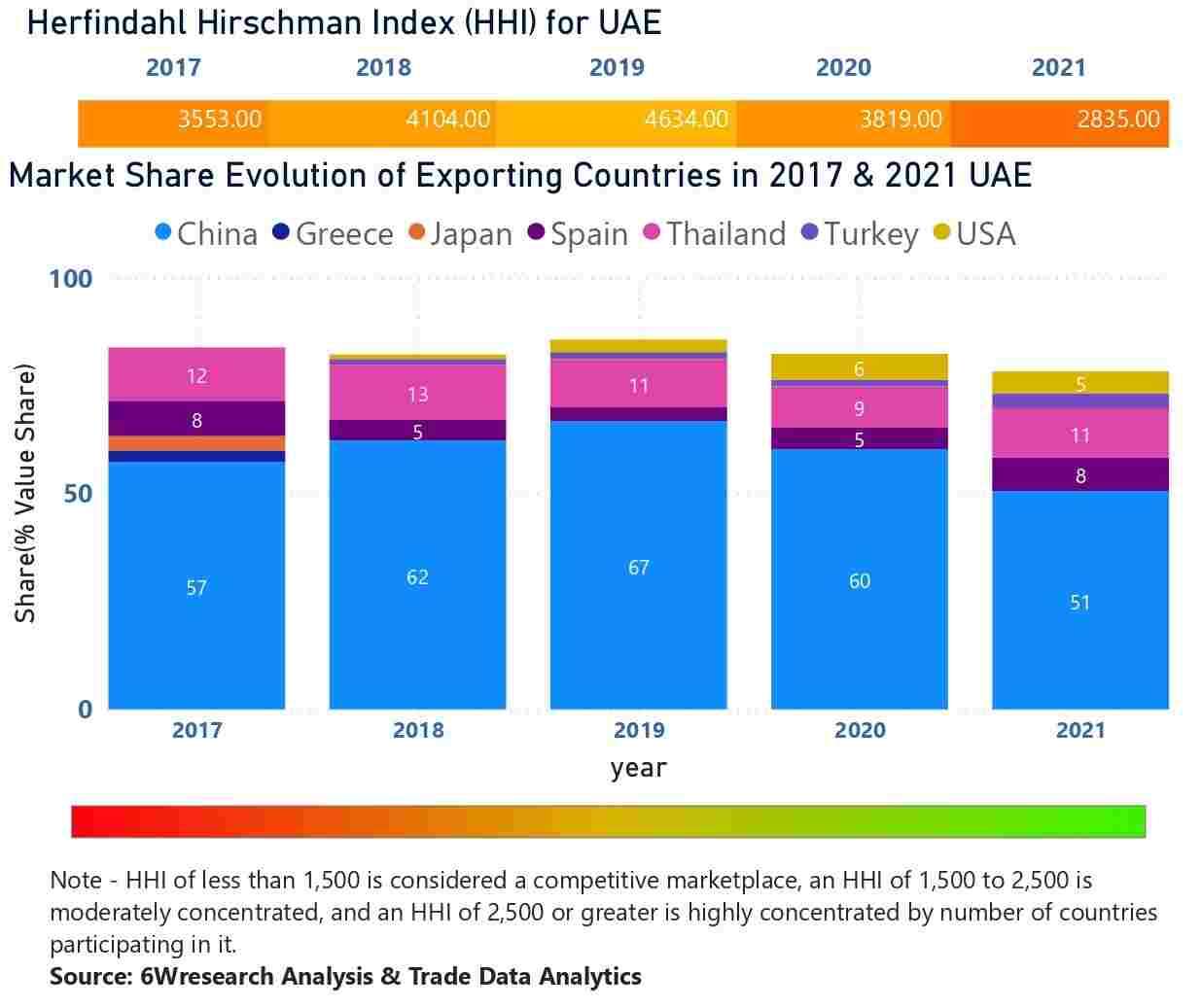

In the year 2021, China was the largest exporter in terms of value, followed by Thailand. It has registered a decline of -40.31% over the previous year. While Thailand registered a decline of -13.73% as compared to the previous year. In the year 2017, China was the largest exporter followed by Thailand. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the United Arab Emirates has a Herfindahl index of 3553 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 2835 which signifies high concentration in the market.

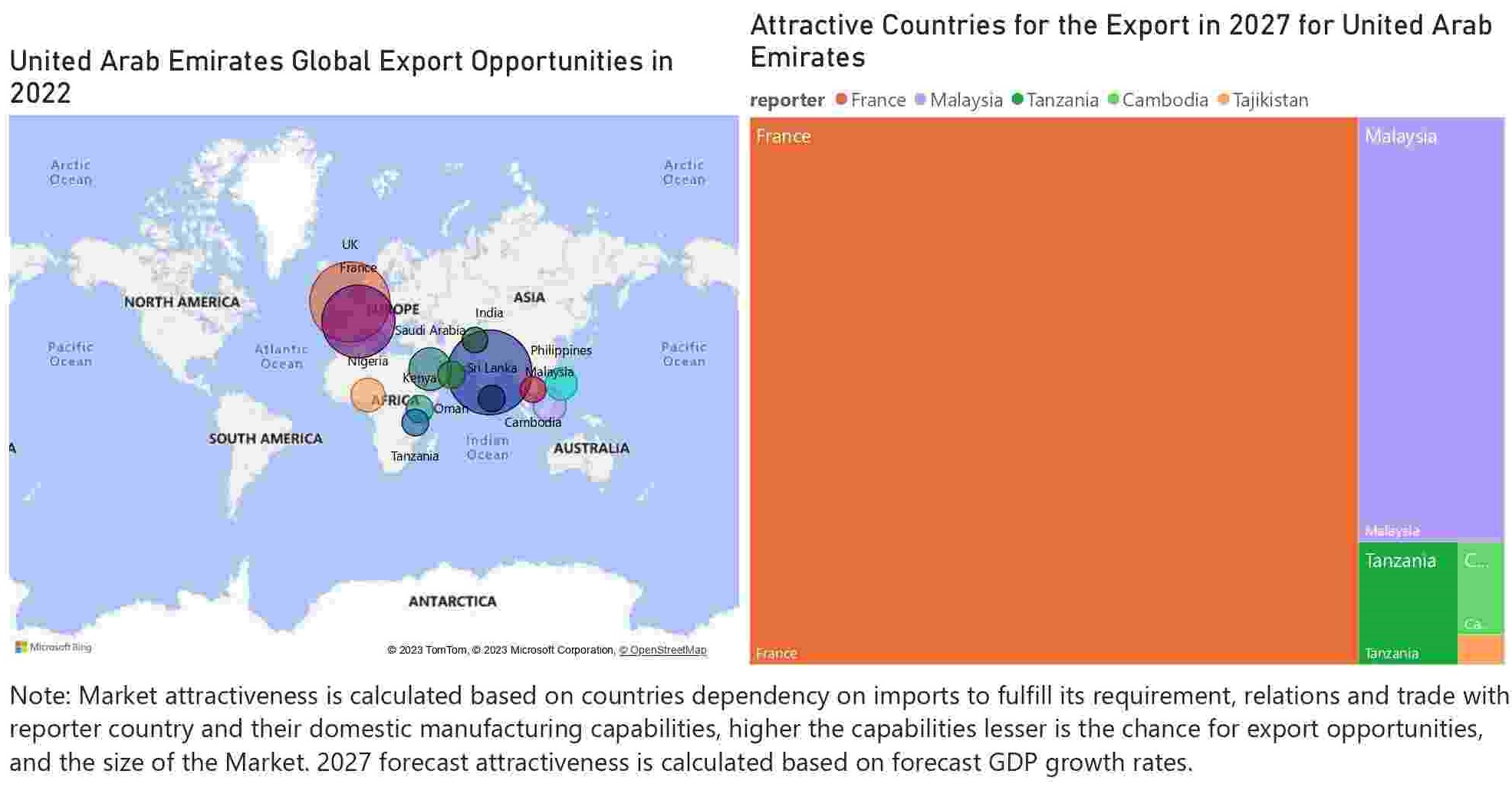

UAE Elevator And Escalator Market - Export Market Opportunities![UAE Elevator And Escalator Market - Export Market Opportunities]()

Latest Development in the UAE Elevator and Escalator Market

The UAE elevator and escalator market is anticipated to witness significant growth by 2025, owing to rapidly growing infrastructure, urbanization, and significant increased investment in modern construction projects. Also, the UAE Elevator and Escalator Market Growth is influenced by government initiatives like the UAE Vision 2021, which has developed other sustainable urban-planning programs in the country as part of improved infrastructure.

Among the key developments would include the adoption of state-of-the-art technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) in elevators and escalators so that it could be controlled automatically, made safer, and maintained predictively. Smart elevators with energy-efficient solutions are gaining popularity as construction projects become increasingly sustainable.

Moreover, mega infrastructure projects such as Expo City Dubai and massive urban development across the cities of Abu Dhabi and Dubai are steadily achieving state-of-the-art vertical transportation solutions. The market continues to experience a focus on modernization services as the older systems are upgraded to meet safety and environmental standards, thus, adapting to changing needs from the urban population. Thus, these developments closely place the UAE as a leading market for innovative aboveground elevator and escalator solutions in the near future.

UAE Elevator And escalator Market Synopsis

UAE elevator and escalator market report thoroughly covers the market by elevator types, escalator types, services types, and applications. The UAE elevator and escalator market outlook report provides an unbiased and detailed analysis of the ongoing UAE elevator and escalator Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

UAE elevator and escalator market are anticipated to record substantial growth on the back of increasing non-oil sector contribution to the GDP. Improving the economic conditions of the country, implementing strict localization targets and value-added tax (VAT) is adding to the UAE Elevator and Escalator Market Growth. Additionally, upcoming mega-events such as Expo 2020 and several government-backed initiatives have proved to be the key drivers for the widespread construction activities across several sub-segments of the UAE economy. All these factors would lead to an increase in demand for elevators & escalators in the commercial domain over the coming years.

According to 6Wresearch, UAE Elevator and Escalator Market size is projected to grow at a CAGR of 1.5% during 2019-2025. Continued investment ahead of the mega event - Expo 2020, expansion of Al Maktoum International airport, an extension of red and green lines of Dubai metro, Abu Dhabi metro, and several other commercial and residential projects, would add to the UAE Elevator and Escalator Market Revenue.

The Northern region of UAE, which includes emirates such as Dubai and Sharjah, captured the highest UAE elevator and escalator market share in 2018. However, the Southern region including Abu Dhabi, is expected to witness significant growth over the coming years as the government has launched Economic Vision 2030 for the diversification of the economy and to attract foreign investment in the non-oil sectors of the region, such as manufacturing, transportation, and tourism. However, during the forecast period, the new installation market for elevators & escalators in UAE is expected to witness sluggish growth on account of the completion of the majority of the construction projects in the country.

UAE elevator and escalator market are estimated to find its true potential in the coming timeframe owing to rising ongoing construction such as Heart of Sharjah to create tourist and trade destination including hotels, boutique, and restaurants are estimated to support the growth if the development of the hospitality sector in the country and is likely to increase the installation of the elevators and escalators which would be a major contribution for the growth for eh UAE elevator and escalator market in the coming timeframe. Also, the growing hoping centers in the country due to the rising shopping by a young population is estimated to act as another growth proliferating factor that is estimated to benefit the growth of the UAE elevator and escalator market in the country.

Key Players in the UAE Elevator And Escalator Market

The major companies operating in the UAE Elevator And Escalator Market offer a wide range of elevator and escalator solutions for various applications, including residential buildings, hospitals, hotels, airports, and commercial buildings. Some of the leading players in the market are;

- Otis Elevator Company

- KONE Corporation

- Schindler Group

- Thyssenkrupp Elevator

- Mitsubishi Electric Corporation

- Fujitec Co., Ltd.

- Toshiba Elevator and Building Systems Corporation

- Hitachi Ltd.

Market Analysis by Types

The elevator segment captured the majority of the market share in the overall UAE Elevator and Escalator Market Share wherein the majority of the installations were witnessed in the residential, retail, transportation, and hospitality sectors. Amongst all the elevator segments, passenger elevators acquired the highest revenue share of the market.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2015 to 2018.

- Base Year: 2018.

- Forecast Data until 2025.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Elevator and Escalator Market Overview

- UAE Elevator and Escalator Market Outlook

- UAE Elevator and Escalator Market Forecast

- UAE Elevator and Escalator Market Share, By Countries

- UAE Elevator and Escalator Market Size and Historical Data of UAE Elevator and Escalator Market Revenues & Volume for the Period 2015-2018

- UAE Elevator and Escalator Market Forecast of Revenues & Volume until 2025

- Historical data & Forecast of UAE Elevator and Escalator Market Revenues, By Types, Applications, and Services for the Period 2015-2025F

- Historical data & Forecast of UAE Elevator Market Revenues & Volume for the Period 2015-2025F

- Historical data & Forecast of UAE Escalator Market Revenues & Volume for the Period 2015-2025F

- Historical data & Forecast of UAE Elevator Market Revenues, By Types, Applications, and Services for the Period 2015-2025F

- Historical data & Forecast of UAE Escalator Market Revenues, By Types, Applications, and Services for the Period 2015-2025F

- Historical data & Forecast of UAE Elevator and Escalator Regional Market Revenues for the Period 2015-2025F

- Market Drivers, Restraints, and Trends

- UAE Elevator and Escalator Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- UAE Elevator and Escalator Market Opportunity Assessment

- UAE Elevator and Escalator Market Share, By Players

- UAE Elevator and Escalator Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

UAE Elevator and Escalator MarketReport Covered:

The report provides a detailed analysis of the following market segments:

By Types

- Elevator

- Passenger

- Cargo

- Home

- Escalator

- Moving Stairs

- Moving Walkways

By Applications

- Commercial

- Industrial

- Residential

By Services

- Maintenance

- Modernization

UAE Elevator and Escalator Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. UAE Elevator and Escalator Market Overview |

| 3.1. Country Overview |

| 3.2. UAE New Installation Elevator and Escalator Market Revenues & Volume, 2015-2025F |

| 3.2.1. UAE New Installation Elevator and Escalator Market Revenue Share, By Types, 2018 & 2025F |

| 3.3. UAE Elevator and Escalator Services Market Revenues, 2015-2025F |

| 3.3.1. UAE Elevator and Escalator Services Market Revenue Share, By Types, 2018 & 2025F |

| 3.3.2. UAE Elevator and Escalator Services Market Revenue Share, By Services Types, 2018 & 2025F |

| 3.4. UAE Elevator and Escalator Market Revenue Share, By Applications, 2018 & 2025F |

| 3.5. UAE Elevator and Escalator Market Revenue Share, By Regions, 2018 & 2025F |

| 3.6. UAE Elevator and Escalator Market - Industry Life Cycle, 2018 |

| 3.7. UAE Elevator and Escalator Market - Porter’s Five Forces |

| 4. UAE Elevator and Escalator Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growing urbanization and infrastructure development in the UAE |

| 4.2.2 Increasing focus on sustainability and energy efficiency in construction projects |

| 4.2.3 Rise in demand for high-rise buildings and mixed-use developments in urban areas |

| 4.3. Market Restraints |

| 4.3.1 High initial investment and maintenance costs of elevators and escalators |

| 4.3.2 Limited availability of skilled labor for installation and maintenance |

| 4.3.3 Stringent regulations and standards governing the elevator and escalator industry in the UAE |

| 5. UAE Elevator and Escalator Market Trends |

| 6. UAE Elevator Market Overview |

| 6.1. UAE New Installation Elevator Market Revenues & Volume, 2015-2025F |

| 6.1.1. UAE New Installation Elevator Market Revenues & Volume, By Elevator Types, 2015-2025F |

| 6.2. UAE Elevator Services Market Revenues, 2015-2025F |

| 6.2.1. UAE Elevator Services Market Revenues, By Services Types, 2015-2025F |

| 6.3. UAE Elevator Market Revenue Share, By Applications, 2018 & 2025F |

| 6.3.1. UAE Elevator Market Revenues, By Applications, 2015-2025F |

| 7. UAE Escalator Market Overview |

| 7.1. UAE New Installation Escalator Market Revenues & Volume, 2015-2025F |

| 7.1.1. UAE New Installation Escalator Market Revenues & Volume, By Escalator Types, 2015-2025F |

| 7.2. UAE Escalator Services Market Revenues, 2015-2025F |

| 7.2.1. UAE Escalator Services Market Revenues, By Service Types, 2015-2025F |

| 8. UAE Elevator and Escalator Market Overview, By Applications |

| 8.1. UAE Commercial Application Elevator and Escalator Market Revenues, 2015-2025F |

| 8.2. UAE Industrial Application Elevator and Escalator Market Revenues, 2015-2025F |

| 8.3. UAE Residential Application Elevator and Escalator Market Revenues, 2015-2025F |

| 9. UAE Elevator and Escalator Market Key Performance Indicators |

| 9.1. UAE Government Spending Outlook |

| 9.2. UAE Commercial Sector Outlook |

| 9.3. UAE Industrial Sector Outlook |

| 9.4. UAE Residential Sector Outlook |

| 10. UAE Elevator and Escalator Market Opportunity Assessment |

| 10.1. UAE Elevator and Escalator Market Opportunity Assessment, By Applications, 2025F |

| 11. UAE Elevator and Escalator Market Competitive Landscape |

| 11.1. UAE Elevator and Escalator Market Competitive Benchmarking, By Product Types |

| 11.2. UAE Elevator and Escalator Market Revenue Share, By Company, 2018 |

| 12. Company Profiles |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| Figure1. UAE New Installation Elevator and Escalator Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| Figure2. UAE New Installation Elevator and Escalator Market Revenue Share, By Types, 2018 & 2025F |

| Figure3. UAE Elevator and Escalator Services Market Revenues, 2015-2025F ($ Million) |

| Figure4. UAE Elevator and Escalator Services Market Revenue Share, By Types, 2018 & 2025F |

| Figure5. UAE Elevator and Escalator Market Revenue Share, By Applications, 2018 & 2025F |

| Figure6. UAE New Installation Elevator Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| Figure7. UAE New Installation Elevator Market Revenue Share, By Elevator Types, 2018 & 2025F |

| Figure8. UAE New Installation Elevator Market Volume Share, By Elevator Types, 2018 & 2025F |

| Figure9. UAE Elevator Services Market Revenues, 2015-2025F ($ Million, Units) |

| Figure10. UAE Elevator Services Market Revenue Share, By Service Types, 2018 & 2025F |

| Figure11. UAE Elevator Market Revenue Share, By Applications, 2018 & 2025F |

| Figure12. UAE New Installation Escalator Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| Figure13. UAE New Installation Escalator Market Revenue Share, By Escalator Types, 2018 & 2025F |

| Figure14. UAE New Installation Escalator Market Volume Share, By Escalator Types, 2018 & 2025F |

| Figure15. UAE Escalator Services Market Revenues, 2015-2025F ($ Million) |

| Figure16. UAE Escalator Services Market Revenue Share, By Service Types, 2018 & 2025F |

| Figure17. UAE Commercial Application Elevator and Escalator Market Revenues, 2015-2025F ($ Million) |

| Figure18. UAE Industrial Application Elevator and Escalator Market Revenues, 2015-2025F ($ Million) |

| Figure19. UAE Residential Application Elevator and Escalator Market Revenues, 2015-2025F ($ Million) |

| Figure20. UAE Actual Government Spending Vs Actual Government Revenues, 2015-2024F (SAR Trillion) |

| Figure21. UAE Government Budget Spending Outlook, 2019E (SAR Billion) |

| Figure22. Dubai Office Supply, 2015-2020 (Million Sq. m. of GLA) |

| Figure23. Abu Dhabi Office Supply, 2014-2019 (Million Sq. m. of GLA) |

| Figure24. Dubai Residential Supply, 2014-2020F (Thousand Units) |

| Figure25. Abu Dhabi Residential Supply, 2014-2020F ( Thousand Units) |

| Figure26. UAE Elevator and Escalator Market Opportunity Assessment, By Applications, 2025F |

| Figure27. UAE Elevator and Escalator Market Revenue Share, By Company, 2018 |

| List Of Tables |

| Table1. UAE New Installation Elevator Market Revenues, By Elevator Types, 2015-2025F ($ Million) |

| Table2. UAE New Installation Elevator Market Volume, By Elevator Types, 2015-2025F (Units) |

| Table3. UAE Elevator Services Market Revenues, By Services Types, 2015-2018 ($ Million) |

| Table4. UAE Elevator Services Market Revenues, By Service Types, 2019E-2025F ($ Million) |

| Table5. UAE Elevator Market Revenues, By Applications, 2015-2018 ($ Million) |

| Table6. UAE Elevator Market Revenues, By Applications, 2019E-2025F ($ Million) |

| Table7. UAE New Installation Escalator Market Revenues, By Escalator Types, 2015-2025F ($ Million) |

| Table8. UAE New Installation Escalator Market Volume, By Escalator Types, 2015-2025F (Units) |

| Table9. UAE Escalator Services Market Revenues, By Service Types, 2015-2018 ($ Million) |

| Table10. UAE Escalator Services Market Revenues, By Service Types, 2019E-2025F ($ Million) |

| Table11. Upcoming Malls in UAE |

| Table12. Upcoming Construction Projects in Dubai |

| Table13. Upcoming Hospitality Projects in UAE |

| Table14. UAE Under Construction Residential Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero