Saudi Arabia Elevator and Escalator Market (2019-2025) | Trends, Value, Forecast, Growth, Share, Industry, Revenue, Outlook, Analysis, Size & Companies

Markets Forecast By Types (Elevator (Passenger, Cargo & Home), Escalator (Moving Stairs & Moving Walkways)), By Applications (Commercial, Industrial, Residential), By Services (Maintenance & Modernization) and Competitive Landscape.

| Product Code: ETC001008 | Publication Date: Aug 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2021 Developments:

Saudi Arabia Elevator And Escalator Market witnessed the development in the industry such as The Nippon Otis Elevator Company recently tested Otis integrated dispatch technology. The result shows that how this technology wirelessly enables service robots to interface seamlessly with its elevators and move vertically within buildings without human interaction. OTIS announced a new generation of digitally native elevators – created to give people freedom to connect and thrive in a taller, faster and smarter world.

Mergers and Acquisitions

- Kone acquired Detroite Elevator Company on June 01st, 2021.

- Advent International and Cinven acquired ThyssenKrupp’s Elevator Technology Business.

- TK Elevator acquired Accurate Elevator on June 18th, 2021.

To enquire about latest release please click here

Previous Release:-

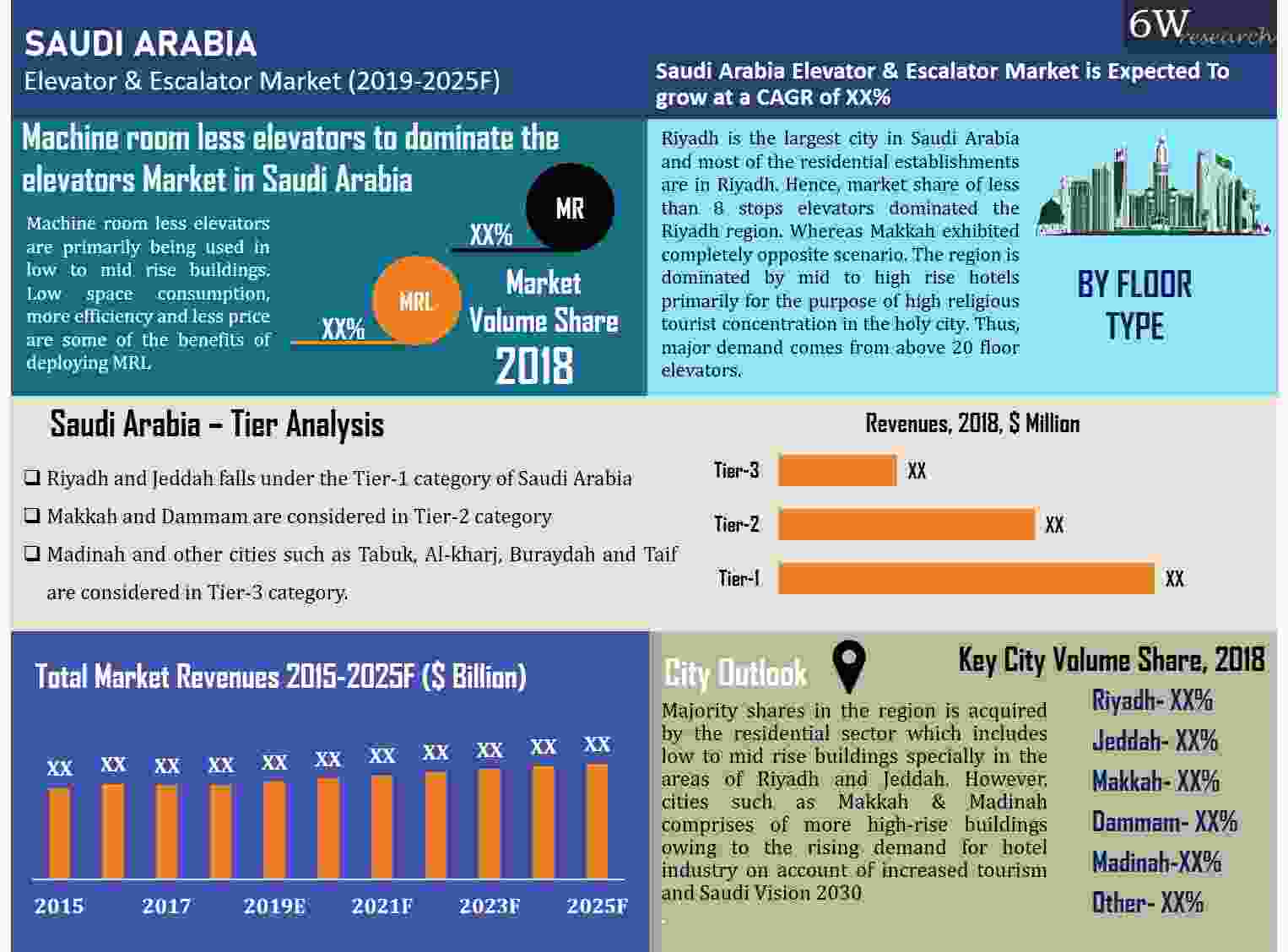

Saudi Arabia elevator and escalator market registered high installation during 2015-16 due to completion of ongoing construction projects in the country. However, in 2017 and 2018, the market saw a decline due to halt in government projects in the country, lack of funding owing to the growing fiscal deficit and decline in oil prices, that in turn, resulted in decrease in government revenues. Healthy growth is anticipated during the forecast period on account of projected growth in the construction market especially of high rise building along with upcoming new hotels & shopping malls and increasing inflow of FDI in the construction and retail sectors.

According to 6Wresearch, Saudi Arabia Elevator And Escalator Market size is projected to grow at a CAGR of 4.2% during 2019-25. The elevator segment captured major share in the overall elevators & escalators market in Saudi Arabia, wherein majority of the installations were witnessed in residential, retail, transportation and hospitality sectors. Amongst all the elevators segments, passenger elevators acquired highest revenue share of the market.

The commercial application market is the leading revenue generating segment in the Saudi Arabia elevators and escalators market owing to increase in installation of elevators and escalators in the retail and transportation market, especially of moving walkways in the retail market. Additionally, major hotel chains are expanding their presence across the country and large-scale government infrastructure development projects, such as airport expansions and development of other social infrastructure, are also strengthening the construction sector in the region. These factors would translate into an increase in demand for elevators and escalators in the country in near future.

In Saudi Arabia, the Central region held majority of the Saudi Arabia elevators and escalators market share, in terms of volume owing to increasing infrastructure development activities, especially in the commercial and residential verticals. During the forecast period, the Western region is expected to register higher growth in the market. Further, the new installation segment is the key revenue generator in the overall Saudi Arabia elevators and escalators market as urbanization and infrastructure development continue to play an important role in the region.

The Saudi Arabia elevator and escalator market report thoroughly covers market by elevator types, escalator types, services types and applications. The Saudi Arabia elevator and escalator market outlook report provides an unbiased and detailed analysis of the on-going Saudi Arabia elevator and escalator Market trends, opportunities/high growth areas and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- Saudi Arabia Elevator and Escalator Market Overview

- Saudi Arabia Elevator and Escalator Market Outlook

- Saudi Arabia Elevator and Escalator Market Forecast

- Saudi Arabia Elevator and Escalator Market Share, By Countries

- Saudi Arabia Elevator and Escalator Market Size and Historical Data of Saudi Arabia Elevator and Escalator Market Revenues & Volume for the Period 2015-2018

- Saudi Arabia Elevator and Escalator Market Forecast of Revenues & Volume until 2025

- Historical data & Forecast of Saudi Arabia Elevator and Escalator Market Revenues, By Types, Applications and Services for the Period 2015-2025F

- Historical data & Forecast of Saudi Arabia Elevator Market Revenues & Volume for the Period 2015-2025F

- Historical data & Forecast of Saudi Arabia Escalator Market Revenues & Volume for the Period 2015-2025F

- Historical data & Forecast of Saudi Arabia Elevator Market Revenues, By Types, Applications and Services for the Period 2015-2025F

- Historical data & Forecast of Saudi Arabia Escalator Market Revenues, By Types, Applications and Services for the Period 2015-2025F

- Historical data & Forecast of Saudi Arabia Elevator and Escalator Regional Market Revenues for the Period 2015-2025F

- Market Drivers, Restraints and Trends

- Saudi Arabia Elevator and Escalator Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Saudi Arabia Elevator and Escalator Market Opportunity Assessment

- Saudi Arabia Elevator and Escalator Market Share, By Players

- Saudi Arabia Elevator and Escalator Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Saudi Arabia Elevator and Escalator Market Report Covered:

The report provides a detailed analysis of the following market segments:

- By Types:

- Elevator:

- Passenger

- Cargo

- Home

- Escalator:

- Moving Stairs

- Moving Walkways

- By Applications:

- Commercial

- Industrial

- Residential

- By Services:

- Maintenance

- Modernization

- Elevator:

Other Key Reports Available:

Upcoming Market Reports:

- Africa Elevator & Escalator Market Report

- UAE Video Elevator & Escalator Market Report

- Turkey Elevator & Escalator Market Report

Frequently Asked Questions About the Market Study (FAQs):

|

1. Executive Summery |

|

2. Introduction |

|

2.1. Report Description |

|

2.2. Key Highlights of the Report |

|

2.3. Market Scope & Segmentation |

|

2.4. Research Methodology |

|

2.5. Assumptions |

|

3. Saudi Arabia Elevator and Escalator Market Overview |

|

3.1. Country Overview |

|

3.2. Saudi Arabia New Installation Elevator and Escalator Market Revenues & Volume, 2015-2025F |

|

3.2.1. Saudi Arabia New Installation Elevator and Escalator Market Revenue Share, By Types, 2018 & 2025F |

|

3.3. Saudi Arabia Elevator and Escalator Services Market Revenues, 2015-2025F |

|

3.3.1. Saudi Arabia Elevator and Escalator Services Market Revenue Share, By Types, 2018 & 2025F |

|

3.3.2. Saudi Arabia Elevator and Escalator Services Market Revenue Share, By Services Types, 2018 & 2025F |

|

3.4. Saudi Arabia Elevator and Escalator Market Revenue Share, By Applications, 2018 & 2025F |

|

3.5. Saudi Arabia Elevator and Escalator Market Revenue Share, By Regions, 2018 & 2025F |

|

3.6. Saudi Arabia Elevator and Escalator Market - Industry Life Cycle, 2018 |

|

3.7. Saudi Arabia Elevator and Escalator Market - Porter’s Five Forces |

|

4. Saudi Arabia Elevator and Escalator Market Dynamics |

|

4.1. Impact Analysis |

|

4.2. Market Drivers |

|

4.3. Market Restraints |

|

5. Saudi Arabia Elevator and Escalator Market Trends |

|

6. Saudi Arabia Elevator Market Overview |

|

6.1. Saudi Arabia New Installation Elevator Market Revenues & Volume, 2015-2025F |

|

6.1.1. Saudi Arabia New Installation Elevator Market Revenues & Volume, By Elevator Types, 2015-2025F |

|

6.2. Saudi Arabia Elevator Services Market Revenues, 2015-2025F |

|

6.2.1. Saudi Arabia Elevator Services Market Revenues, By Services Types, 2015-2025F |

|

6.3. Saudi Arabia Elevator Market Revenue Share, By Applications, 2018 & 2025F |

|

6.3.1. Saudi Arabia Elevator Market Revenues, By Applications, 2015-2025F |

|

7. Saudi Arabia Escalator Market Overview |

|

7.1. Saudi Arabia New Installation Escalator Market Revenues & Volume, 2015-2025F |

|

7.1.1. Saudi Arabia New Installation Escalator Market Revenues & Volume, By Escalator Types, 2015-2025F |

|

7.2. Saudi Arabia Escalator Services Market Revenues, 2015-2025F |

|

7.2.1. Saudi Arabia Escalator Services Market Revenues, By Service Types, 2015-2025F |

|

8. Saudi Arabia Elevator and Escalator Market Overview, By Applications |

|

8.1. Saudi Arabia Commercial Application Elevator and Escalator Market Revenues, 2015-2025F |

|

8.2. Saudi Arabia Industrial Application Elevator and Escalator Market Revenues, 2015-2025F |

|

8.3. Saudi Arabia Residential Application Elevator and Escalator Market Revenues, 2015-2025F |

|

9. Saudi Arabia Elevator and Escalator Market Key Performance Indicators |

|

9.1. Saudi Arabia Government Spending Outlook |

|

9.2. Saudi Arabia Residential Sector Outlook |

|

9.3. Saudi Arabia Commercial Sector Outlook |

|

9.4. Saudi Arabia Industrial Sector Outlook |

|

10. Saudi Arabia Elevator and Escalator Market Opportunity Assessment |

|

10.1. Saudi Arabia Elevator and Escalator Market Opportunity Assessment, By Applications, 2025F |

|

11. Saudi Arabia Elevator and Escalator Market Competitive Landscape |

|

11.1. Saudi Arabia Elevator and Escalator Market Competitive Benchmarking, By Product Types |

|

11.2. Saudi Arabia Elevator and Escalator Market Revenue Share, By Company, 2018 |

|

12. Company Profiles |

|

13. Key Strategic Recommendations |

|

14. Disclaimer |

|

List of Figures |

|

Figure1. Saudi Arabia New Installation Elevator and Escalator Market Revenues & Volume, 2015-2025F ($ Million, Units) |

|

Figure2. Saudi Arabia New Installation Elevator and Escalator Market Revenue Share, By Types, 2018 & 2025F |

|

Figure3. Saudi Arabia Elevator and Escalator Services Market Revenues, 2015-2025F ($ Million) |

|

Figure4. Saudi Arabia Elevator and Escalator Services Market Revenue Share, By Types, 2018 & 2025F |

|

Figure5. Saudi Arabia Elevator and Escalator Market Revenue Share, By Applications, 2018 & 2025F |

|

Figure6. Saudi Arabia New Installation Elevator Market Revenues & Volume, 2015-2025F ($ Million, Units) |

|

Figure7. Saudi Arabia New Installation Elevator Market Revenue Share, By Elevator Types, 2018 & 2025F |

|

Figure8. Saudi Arabia New Installation Elevator Market Volume Share, By Elevator Types, 2018 & 2025F |

|

Figure9. Saudi Arabia Elevator Services Market Revenues, 2015-2025F ($ Million, Units) |

|

Figure10. Saudi Arabia Elevator Services Market Revenue Share, By Service Types, 2018 & 2025F |

|

Figure11. Saudi Arabia Elevator Market Revenue Share, By Applications, 2018 & 2025F |

|

Figure12. Saudi Arabia New Installation Escalator Market Revenues & Volume, 2015-2025F ($ Million, Units) |

|

Figure13. Saudi Arabia New Installation Escalator Market Revenue Share, By Escalator Types, 2018 & 2025F |

|

Figure14. Saudi Arabia New Installation Escalator Market Volume Share, By Escalator Types, 2018 & 2025F |

|

Figure15. Saudi Arabia Escalator Services Market Revenues, 2015-2025F ($ Million) |

|

Figure16. Saudi Arabia Escalator Services Market Revenue Share, By Service Types, 2018 & 2025F |

|

Figure17. Saudi Arabia Commercial Application Elevator and Escalator Market Revenues, 2015-2025F ($ Million) |

|

Figure18. Saudi Arabia Industrial Application Elevator and Escalator Market Revenues, 2015-2025F ($ Million) |

|

Figure19. Saudi Arabia Residential Application Elevator and Escalator Market Revenues, 2015-2025F ($ Million) |

|

Figure20. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2015-2024F (SAR Trillion) |

|

Figure21. Saudi Arabia Government Budget Spending Outlook, 2019E (SAR Billion) |

|

Figure22. Riyadh Residential Supply, 2015-2020F (Thousand Units) |

|

Figure23. Jeddah Residential Supply, 2015-2020F (Thousand Units) |

|

Figure24. Dammam Residential Supply, 2015-2020F (Thousand Units) |

|

Figure25. Makkah Residential Supply, 2015-2020F (Thousand Units) |

|

Figure26. Riyadh Office Supply, 2015-2018 (‘000 Sq. m.) |

|

Figure27. Jeddah Office Supply, 2015-2020F (‘000 Sq. m.) |

|

Figure28. Riyadh Retail Supply, 2015-2020F (‘000 Sq. m.) |

|

Figure29. Jeddah Retail Supply, 2015-2020F (‘000 Sq. m.) |

|

Figure30. Riyadh Hotel Supply, 2014-2019E (No. of Rooms) |

|

Figure31. Jeddah Hotel Supply, 2014-2019E (No. of Rooms) |

|

Figure32. Major Upcoming Healthcare Projects in Saudi Arabia |

|

Figure33. Saudi Arabia Steel Production, 2018-2019 (Thousand Tonnes) |

|

Figure34. Upcoming Power Plant Projects in Saudi Arabia |

|

Figure35. Saudi Arabia Elevator and Escalator Market Opportunity Assessment, By Applications, 2025F |

|

Figure36. Saudi Arabia Elevator and Escalator Market Revenue Share, By Company, 2018 |

|

List Of Tables |

|

Table1. Saudi Arabia New Installation Elevator Market Revenues, By Elevator Types, 2015-2025F ($ Million) |

|

Table2. Saudi Arabia New Installation Elevator Market Volume, By Elevator Types, 2015-2025F (Units) |

|

Table3. Saudi Arabia Elevator Services Market Revenues, By Services Types, 2015-2018 ($ Million) |

|

Table4. Saudi Arabia Elevator Services Market Revenues, By Service Types, 2019E-2025F ($ Million) |

|

Table5. Saudi Arabia Elevator Market Revenues, By Applications, 2015-2018 ($ Million) |

|

Table6. Saudi Arabia Elevator Market Revenues, By Applications, 2019E-2025F ($ Million) |

|

Table7. Saudi Arabia New Installation Escalator Market Revenues, By Escalator Types, 2015-2025F ($ Million) |

|

Table8. Saudi Arabia New Installation Escalator Market Volume, By Escalator Types, 2015-2025F (Units) |

|

Table9. Saudi Arabia Escalator Services Market Revenues, By Service Types, 2015-2018 ($ Million) |

|

Table10. Saudi Arabia Escalator Services Market Revenues, By Service Types, 2019E-2025F ($ Million) |

|

Table11. Upcoming Residential Projects in Saudi Arabia |

|

Table12. List of Major Elevator & Escalator Projects Announced in Saudi Arabia |

|

Table13. List of Major Infrastructure Projects in Saudi Arabia |

|

Table14. Saudi Arabia Upcoming Petrochemical Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero