UAE Fitness Equipment Market (2017-2023) | Size, Growth, Revenue, Value, Analysis, Outlook, Share, Trends, Forecast, Companies & Industry

Market Forecast By Product Type (Cardiovascular Training Equipment (Treadmills, Elliptical Trainer/Cross Trainer, Stationary Bikes and Others), Strength Training Equipment (Weights and Single& Multifunctional Strength Training Equipment)), By End User Applications (Health Clubs and Gyms, Residential, Commercial Buildings and Others Applications), By Regions (Dubai and Rest of UAE) and Competitive Landscape

| Product Code: ETC000422 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 90 | No. of Figures: 37 | No. of Tables: 8 |

UAE is the largest and potential market for fitness equipment in the GCC region. Unlike, other Middle East countries UAE has a more open culture. A growing population and the presence of a huge ex-pat population have encouraged national as well as international fitness companies to invest in this market. Additionally, the rising wellness tourism industry resulted in the UAE's emergence as a major leisure and entertainment hub.

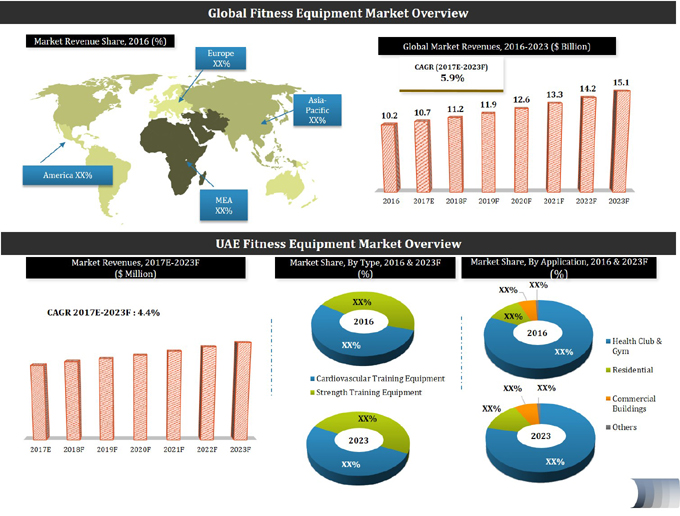

According to 6Wresearch, the UAE fitness equipment market size is projected to grow at a CAGR of 4.4% during 2017-23. Rising disposable income and increasing health concerns are resulting in the addition of a number of health clubs and gyms in the country. Further, government initiatives and the availability of fitness centers in residential and commercial buildings with discounted memberships would encourage the UAE fitness equipment market forecast period growth in the coming years.

Moreover, overweight and obesity have become a major concern in the UAE, resulting in severe health issues such as diabetes, hypertension, and cardiovascular diseases which enforces people to look after their health. In addition, the trend to have a ripped and lean body among youngsters would buoy the market of fitness equipment in the country.

The cardio training fitness equipment segment led to the overall UAE fitness equipment market share. Dubai region has the majority of health clubs and gyms accounting for extensive revenues in UAE's fitness equipment market; and is expected to increase during the forecast period as well, owing to upcoming fitness centers across the region.

The UAE fitness equipment market report thoroughly covers the market by types, applications, and regions. The UAE fitness equipment market outlook report provides an unbiased and detailed analysis of the ongoing UAE fitness equipment market trends, opportunities/high growth areas, market drivers, which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

UAE fitness equipment market is estimated to witness substantial growth during the forecast period 2017-23F on the back of the rising awareness about fitness. The increased obesity rate in the country at the fastest rate due to living of unhealthy lifestyle, genetic being the top reason, and lack of physical exercise as a result, people are now been focusing more to lose weight, therefore, increase in the rate of joining a gym and is estimated to increase the expansion of the gym setups simultaneously rise in the fitness equipment and is estimated to spur the progressive growth of the UAE fitness equipment market in the coming timeframe.

Key Highlights of the Report:

• UAE Fitness Equipment Market Size and UAE Fitness Equipment Market Forecast

• UAE Fitness Equipment Market Overview

• UAE Fitness Equipment Market Outlook

• Historical & Forecast data of UAE Fitness Equipment Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Fitness Equipment Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Cardiovascular Training Equipment Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Treadmills Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Elliptical Trainer/ Cross Trainer Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Stationary Bikes Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Others Cardiovascular Training Equipment Market Revenues for the

Period, 2014-2023

• Historical & Forecast data of UAE Strength Training Equipment Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Weights Market Revenues for the Period, 2014-2023

• Historical & Forecast data of UAE Single & Multifunctional Strength Training Equipment Market Revenues

for the Period, 2014-2023

• Historical & Forecast data of UAE Fitness Equipment Application Market Revenues for the period, 2014-2023

• Historical data of UAE Fitness Equipment Regional Market Revenues for the Period, 2014-2023

• Market Size & Forecast of UAE Fitness Equipment Market Revenue, By Region until 2023

• UAE Fitness Equipment Market Trends

• UAE Fitness Equipment Market Share, By Players

• UAE Fitness Equipment Market Overview on Competitive Benchmarking

• Company Profiles

• Recommendations

Markets Covered

The UAE Fitness Equipment Market report provides a detailed analysis of the following market segments:

• By Product Type

o Cardiovascular Training Equipment

? Treadmills

? Elliptical Trainer/Cross Trainer

? Stationary Bikes

? Others

o Strength Training Equipment

? Weights

? Single& Multifunctional Strength Training Equipment

• By End-User Applications

o Health Clubs and Gyms

o Residential

o Commercial Buildings

o Others Applications

• By Regions

o Dubai

o Rest of the UAE

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumption

3 Global Fitness Equipment Market Overview

3.1 Global Fitness Equipment Market Revenues (2014-2023F)

3.2 Global Fitness Equipment Market Revenue Share, By Region (2016 & 2023F)

4 UAE Fitness Equipment Market Overview

4.1 UAE Fitness Equipment Market Overview & Analysis

4.2 UAE Fitness Equipment Market Revenues (2014-2023F)

4.3 UAE Fitness Equipment Market Industry Life Cycle

4.4 UAE Fitness Equipment Market Opportunistic Matrix

4.5 UAE Fitness Equipment Market Porter's Five Forces Analysis

4.6 UAE Fitness Equipment Market Revenue Share, By Types (2016 & 2023F)

4.7 UAE Fitness Equipment Market Revenue Share, By Applications (2016 & 2023F)

5 UAE Fitness Equipment Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.2.1 Growing Population Of Expats

5.2.2 Social Influence On Fitness Industry

5.2.3 Growing Health Concerns In UAE

5.3 Market Restraints

5.3.1 High Cost Of Equipment and Expensive Business

6 UAE Fitness Equipment Market Trends

6.1 Separate Women Fitness Centers

6.2 Health Club Membership

6.3 Initiatives and Campaigning by Government and Private Health Club

6.4 Virtual Reality Workouts

7 UAE Fitness Equipment Market Overview, By Types

7.1 UAE Cardiovascular Training Equipment Market Revenues (2014-2023F)

7.2 UAE Cardiovascular Training Equipment Market Revenue Share, By Types (2016 & 2023F)

7.2.1 UAE Cardiovascular Training Equipment Market Revenues, By Treadmills (2014-2023F)

7.2.2 UAE Cardiovascular Training Equipment Market Revenues, By Stationary Bikes (2014-2023F)

7.2.3 UAE Cardiovascular Training Equipment Market Revenues, By Elliptical Trainer(2014-2023F)

7.2.4 UAE Cardiovascular Training Equipment Market Revenues, By Others (2014-2023F)

7.3 UAE Strength Training Equipment Market Revenues (2014-2023F)

7.4 UAE Strength Training Equipment Market Revenue Share, By Types (2016 & 2023F)

7.4.1 UAE Strength Training Equipment Market Revenues, By Weights (2016 & 2023F)

7.4.2 UAE Strength Training Equipment Market Revenues, By Single & Multifunctional Equipment (2016 & 2023F)

8 UAE Fitness Equipment Market Overview, By Applications

8.1 Personal/Home Consumer Fitness Equipment Market Revenues (2014-2023F)

8.2 Health Club/Gym Fitness Equipment Market Revenues (2014-2023F)

8.3 Commercial Buildings Fitness Equipment Market Revenues (2014-2023F)

8.4 Others applications Fitness Equipment Market Revenues (2014-2023F)

8.5 UAE Fitness Equipment Market Opportunity Assessment, By Applications

9 UAE Fitness Equipment Market, By Regions

9.1 UAE Fitness Equipment Market Revenues, By Dubai Region (2014-2023F)

9.2 UAE Fitness Equipment Market Revenues, By Rest of Dubai Region (2014-2023F)

10 UAE Fitness Equipment Market Opportunity Assessment, By Types and Applications

10.1 UAE Fitness EquipmentMarket Opportunity Assessment, By Product

10.2 UAE Fitness Equipment Market Opportunity Assessment, By Regions

11 Competitive Landscape

11.1 Market Revenue Share, By Companies (2016)

12 Company Profiles (Top Companies)

12.1 Core Health & Fitness LLC

12.2 Life Fitness, Inc.

12.3 Nautilus, Inc.

12.4 Precor Incorporated

12.5 Technogym S.p.a

13 Key Strategic Pointers

14 Disclaimer

List of Figures

1 Global Fitness Equipment Market Revenues, 2014-2023F ($ Billion)

2 Global Fitness Equipment Market Revenue Share, By Region (2016 & 2023F)

3 UAE Fitness Equipment Market Revenues, 2014-2023F ($ Million)

4 UAE Gross Domestic Product Per Capital, Constant Prices, 2014-2022F ($)

5 Mortality due to Diabetes by Gender, Middle East and North Africa Region (2015)

6 Death due to Diabetes by Age, Middle East and North Africa Region (2015)

7 UAE Fitness Equipment Market Revenue Share, By Type (2016 & 2023F)

8 UAE Fitness Equipment Market Revenues, By Region (2016 & 2023F)

9 UAE Fitness Equipment Market Revenue Share, By End Users Application (2016 & 2023F)

10 UAE Population Share, By National (2016)

11 UAE Population, 2014-2022F (In Million)

12 UAE Obesity & Overweight rankings among 20 nations in the Middle East & North Africa (2016)

13 UAE Proportional Mortality (% of total deaths, all ages), 2016

14 Population by Gender and Age Groups - Emirate of Dubai (2016)

15 UAE Cardiovascular Training Equipment Market Revenues, 2014-2023F ($ Million)

16 UAE Cardiovascular Training Equipment Market Revenue Share, By Type (2016 & 2023F)

17 UAE Treadmill Market Revenues, 2014-2023F ($ Million)

18 UAE Elliptical Trainer/ Cross Trainer Market Revenues , 2014-2023F ($ Million)

19 UAE Stationary Bike Market Revenues, 2014-2023F ($ Million)

20 UAE Other Cardiovascular Training Equipment Market Revenues, 2014-2023F ($ Million)

21 UAE Strength Training Equipment Market Revenues, 2014-2023F ($ Million)

22 UAE Strength Training Equipment Market Revenue Share, By Type (2016 & 2023F)

23 UAE Weight Market Revenues, 2014-2023F ($ Million)

24 UAE Single& Multifunctional Strength Training Equipment Market Revenues, 2014-2023F ($ Million)

25 UAE Health Club & Gym Fitness Equipment Market Revenues, 2014-2023F ($ Million)

26 UAE Residential Fitness Equipment Market Revenues, 2014-2023F ($ Million)

27 UAE Residential Buildings, 2014-2018F (000' Units)

28 UAE Commercial Building Fitness Equipment Market Revenues, 2014-2023F ($ Million)

29 UAE Office Supply, 2014-2018F (SQM GLA, In Million)

30 UAE Retail Supply, 2014-2018F (SQM GLA, In Million)

31 UAE Hotel Supply, 2014-2018F (No. of Keys)

32 UAE Other Applications Fitness Equipment Market Revenues, 2014- 2023F ($ Thousand)

33 UAE Northern Fitness Equipment Market Revenues, 2014-2023F ($ Million)

34 UAE Northern Fitness Equipment Market Revenues, 2014-2023F ($ Million)

35 UAE Fitness Equipment Market Opportunity Matrix, By Type (2023F)

36 UAE Fitness Equipment Market Opportunity Matrix, By Application (2023F)

37 UAE Fitness Equipment Market Revenue Share, By Companies (2016)

List of Tables

1 UAE Health Club Membership Packages (2016)

2 Abu Dhabi, Al Ain and Al Gharbia Residential Building Completion (2011-2015)

3 UAE Upcoming and Ongoing Residential Projects

4 List of New Hotels Under Construction in UAE

5 List of Proposed Upcoming Skyscrapers in UAE

6 UAE Fitness Equipment Company Benchmarking, By Operation (2016)

7 UAE Fitness Equipment Competitive Benchmarking, By Type and End User Application (2016)

8 UAE Fitness Equipment Market Revenues, By Players (2016)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero