India Fitness Equipment Market (2017-2023) | Size, Revenue, Outlook, Industry, Share, Growth, Forecast, Trends, Companies, Value & Analysis

Market Forecast By Type (Cardiovascular Training Equipment (Treadmills, Elliptical Trainer/Cross Trainer, Stationary Bikes and Others including Rowing, Stair/Stepper machines), Strength Training Equipment (Weights and Single & Multifunctional Strength Training Equipment)), By End User Applications (Health Clubs and Gyms, Residential, Commercial Buildings and Other Applications), By Regions (Northern, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC000424 | Publication Date: Nov 2021 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 109 | No. of Figures: 48 | No. of Tables: 6 |

India Fitness Equipment Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s fitness equipment import shipments in 2024 saw significant contributions from top exporting countries such as China, USA, Italy, Taiwan, and Hungary, indicating a diverse global market presence. Despite high concentration with a Herfindahl-Hirschman Index (HHI), the industry sustained steady growth with a Compound Annual Growth Rate (CAGR) of 5.11% from 2020 to 2024. Notably, the growth rate spiked to 7.55% in 2024, reflecting a positive trajectory for the fitness equipment market in India.

Latest 2021 Developments:

India Fitness Equipment Market has seen the introduction of new technologies that combine AI-powered performance tracking and interactive personal training experience with smart adjustable devices that are connected to sensors that allow users to track the content, intensity and duration of each training session. In addition, there are monitors attached to the equipment that stream workouts live or on-demand and provide users with unique options focused on user preferences. To further enhance the experience, users can choose whether to sync their workouts to a worldwide leaderboard and add a fun element of competition.

Mergers and Acquisitions:

- On August 17, 2021, Walmart - owned Flipkart has partnered with HRX.

- In June 2021 Cult.fit, Cure.fit's fitness and wellness platform acquired TREAD, a Bengaluru-based connected fitness startup. TREAD recently launched a smart fitness bike, and the acquisition will help Cult.Fit launch its hardware-at-home business vertical, which is a gamut of smart fitness hardware products including TREAD smart bikes, benches, and more.

To enquire about latest release please click here

Previous Release:

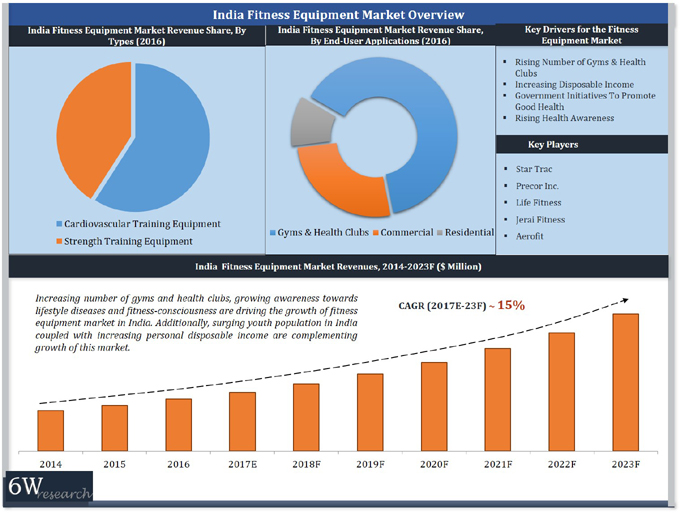

An increasing number of gyms and health clubs coupled with government efforts towards promoting physical fitness are driving the growth of the fitness equipment market in India. In 2017, the Central Government of India has ordered all its offices to facilitate gym facilities. In addition to this, the Department of Personnel and Training (DoPT) is promoting gym set-ups in offices by providing monetary compensation to offices. Additionally, growing consumer preferences towards physical fitness due to surging lifestyle diseases are further pushing the market growth. In terms of market sub-segments, treadmills and stationary bikes emerged as the most preferred cardiovascular training equipment in 2016, however, on account of a higher calorie burn ratio, elliptical cross trainers are expected to register higher growth over the coming years.

According to 6Wresearch, India fitness equipment market size is projected to grow at a CAGR of 15% during 2017-23. The Western region bagged the highest revenue share in 2016 with Maharashtra being the major contributor towards the growth of the fitness equipment market in a particular region. However, over the coming years, the Northern region is projected to exhibit the highest growth on account of higher adoption across key states including Punjab, Haryana, Delhi/NCR, and Uttarakhand.

Among different end-user applications, gyms and health clubs bagged the highest revenue share in the overall India fitness equipment market share followed by commercial applications. In-house fitness centers and health clubs are gaining popularity in the fitness equipment market. Hotels, offices, public corporations, and educational institutes are offering gym facilities within their premises. Additionally, the commercial segment is forecast to exhibit the highest growth in the India fitness equipment market forecast period.

The India fitness equipment market report thoroughly covers the market by types, end-user applications, and regions. The India Fitness equipment market outlook report provides an unbiased and detailed analysis of the ongoing India Fitness Equipment Market trends, opportunities/ high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

Fitness equipment is playing a very important role because now day everyone wants to be fit and for fitness, fitness equipment is very important is used in managing weight, an increase in physical stamina, for gaining weight or losing weight. There is common equipment such as elliptical, treadmills, etc. India's fitness equipment market is used for physical exercise and improvement in personality.

India fitness equipment market is projected to gain traction in the upcoming six years on the back of the increasing number of fitness freak population. The women joining rate in the gym is now been increasing due to several factors such as rising appearance concern, therefore, rising aspiration to maintain body coupled with rising need to adopt a healthy lifestyle due to rising prevalence of lifestyle diseases, as a result, the aforementioned factors are estimated to contribute towards the growth of the India fitness equipment market on the upcoming six years.

Key Highlights of the Report:

• Historical data of Global Fitness Equipment Market for the Period 2014-2016

• Market Size & Forecast data of Global Fitness Equipment Market until 2023

• India Fitness Equipment Market Size and India Fitness Equipment Market Forecast

• India Fitness Equipment Market Overview

• India Fitness Equipment Market Outlook

• Historical data of India Fitness Equipment Market for the Period 2014-2016

• Market Size & Forecast data of India Fitness Equipment Market until 2023

• Historical data of India Fitness Equipment Market Revenues, By Types for the Period 2014-2016

• Market Size & Forecast data of India Fitness Equipment Market Revenues, By Types for the Period 2017-2023F

• Historical data of India Fitness Equipment Market Revenues, By Applications for the Period 2014-2016

• Market Size & Forecast data of India Fitness Equipment Market Revenues, By Applications for the Period 2017-2023F

• Historical data of India Fitness Equipment Market Revenues, By Regions for the Period 2014-2016

• Market Size & Forecast data of India Fitness Equipment Market Revenues, By Regions for the Period 2017-2023F

• Market Drivers and Restraints

• India Fitness Equipment Market Trends and Opportunities

• Industry Life Cycle and Value Chain Analysis

• Porter's Five Forces Analysis

• Opportunity Assessment by Types and Applications

• India Fitness Equipment Market Overview on Competitive Benchmarking and Company Profiles

• India Fitness Equipment Market Share, by Players

• Recommendations

Markets Covered:

The India Fitness Equipment Market report provides a detailed analysis of the following market segments:

• By Types

o Cardiovascular Training Equipment

?Treadmills

?Stationery Bikes

?Elliptical Trainer/Cross Trainer

?Others (Rowing, Stair/Stepper machines)

o Strength Training Equipment

?Weights

? Single & Multifunction Strength Machines

• By End-User Applications

o Gyms & Health Clubs

o Commercial

o Residential

• By Regions

o Northern

o Southern

o Western

o Eastern

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions & Methodology

3 Global Fitness Equipment Market Overview

3.1 Global Fitness Equipment Market Revenues (2014-2023F)

3.2 Global Fitness Equipment Market Revenue Share, By Regions (2016)

4 India Fitness Equipment Market Overview

4.1 India Fitness Equipment Market Revenues (2014-2023F)

4.2 India Fitness Equipment Industry Life Cycle

4.3 India Fitness Equipment Market Opportunistic Matrix

4.4 India Fitness Equipment Market Value Chain Analysis

4.5 India Fitness Equipment Market Porter's Five Forces Model

4.6 India Fitness Equipment Market Revenue Share, By Types (2016 & 2023F)

4.7 India Fitness Equipment Market Revenue Share, By End-User Applications (2016 & 2023F)

4.8 India Fitness Equipment Market Revenue Share, By Regions (2016 & 2023F)

5 India Fitness Equipment Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

5.4 Market Opportunity

6 India Fitness Equipment Market Trends

6.1 Surging Media And e-commerce Exposure

6.2 Integration of Smart Technologies in Fitness Equipment

6.3 Partnership of Hotels with Gyms and Health Clubs

7 India Fitness Equipment Market Overview, By Types

7.1 India Fitness Equipment Market, By Cardiovascular Training Equipment Revenues (2014-2023F)

7.2 India Fitness Equipment Market, By Cardiovascular Training Equipment Revenue Share, By Types (2014-2023F)

7.2.1 India Cardiovascular Training Equipment Market Revenues, By Treadmill (2014-2023F)

7.2.2 India Cardiovascular Training Equipment Market Revenues, By Bikes (2014-2023F)

7.2.3 India Cardiovascular Training Equipment Market Revenues, By Elliptical/Cross Trainers (2014-2023F)

7.2.4 India Cardiovascular Training Equipment Market Revenues, By Others (2014-2023F)

7.3 India Fitness Equipment Market, By Strength Training Equipment Revenues (2014-2023F)

7.4 India Fitness Equipment Market, By Strength Training Equipment Revenue Share, By Types (2014-2023F)

7.4.1 India Strength Training Equipment Market Revenues, By Weights (2014-2023F)

7.4.2 India Strength Training Equipment Market Revenues, By Single & Multifunction Strength Training

Machines (2014-2023F)

8 India Fitness Equipment Market Overview, By End User Applications

8.1 India Fitness Equipment Market Revenues, By Gyms & Health Clubs (2014-2023F)

8.2 India Fitness Equipment Market Revenues, By Commercial Segment (2014-2023F)

8.3 India Fitness Equipment Market Revenues, By Residential Segment (2014-2023F)

9 India Fitness Equipment Market Overview, By Regions

9.1 India Fitness Equipment Market Revenues, By Northern Region (2014-2023F)

9.2 India Fitness Equipment Market Revenues, By Southern Region (2014-2023F)

9.3 India Fitness Equipment Market Revenues, By Eastern Region (2014-2023F)

9.4 India Fitness Equipment Market Revenues, By Western Region (2014-2023F)

10 India Fitness Equipment Market Opportunity Assessment, By Types and Applications

11 India Fitness Equipment Market Competitive Landscape

11.1 India Fitness Equipment Market, By Players' Revenue Share (2016)

11.2 India Fitness Equipment Market, By Operating Parameters

12 Company Profiles

12.1 Jerai Fitness Pvt. Ltd.

12.2 Acme Fitness Pvt. Ltd.

12.3 (Aerofit) Nityasach Fitness Pvt. Ltd.

12.4 (Star Trac) Core Health & Fitness LLC

12.5 Precor Incorporated

12.6 Life Fitness

12.7 Hoist Fitness Systems, Inc.

13 Key Strategic Notes

14 Disclaimer

List of Figures

1 Global Fitness Equipment Market Revenues, 2014-2023F ($ Billion)

2 Global Fitness Equipment Market Revenue Share, By Regions (2016)

3 India Fitness Equipment Market Revenues, 2014-2023F ($ Million)

4 India Fitness Industry Market Segments Revenue Share (2015)

5 Percentage Adoption Of Different Fitness Trends In India (2015)

6 India Fitness Equipment Market Industry Life Cycle (2016)

7 India Fitness Equipment Market Revenue Share, By Types (2016)

8 India Fitness Equipment Market Revenue Share, By Types (2023F)

9 India Fitness Equipment Market Revenue Share, By Applications (2016)

10 India Fitness Equipment Market Revenue Share, By Applications (2023F)

11 Diabetes & Heart Disease Cases In India (Million)

12 India Middle-Class Household Income Share in National Consumer Income (2017E)

13 India Residential Space Demand-Supply Overview (2015)

14 India Urban-Rural Housing Shortage, 2001-2015 (In Million)

15 India Fitness Equipment Market Revenues, By Cardiovascular Training Equipment, 2014-2023F ($ Million)

16 India Cardiovascular Training Equipment Market Revenue Share, By Types (2016)

17 India Cardiovascular Training Equipment Market Revenue Share, By Types (2023F)

18 India Cardiovascular Training Equipment Market Revenues, By Treadmill, 2014-2023F ($ Million)

19 India Cardiovascular Training Equipment Market Revenues, By Bikes, 2014-2023F ($ Million)

20 India Cardiovascular Training Equipment Market Revenues, By Elliptical/Cross Trainers, 2014-2023F ($ Million)

21 India Cardiovascular Training Equipment Market Revenues, By Others, 2014-2023F ($ Million)

22 India Fitness Equipment Market Revenues, By Strength Training Equipment, 2014-2023F ($ Million)

23 India Strength Training Equipment Market Revenue Share, By Types (2016)

24 India Strength Training Equipment Market Revenue Share, By Types (2023F)

25 India Strength Training Equipment Market Revenues, By Weights, 2014-2023F ($ Million)

26 India Strength Training Equipment Market Revenues, By Single & Multifunction Strength Machines,

2014-2023F ($ Million)

27 India Fitness Equipment Market Revenues, By Gyms & Health Clubs, 2014-2023F ($ Million)

28 Gyms & Health Clubs Revenue Share (2016 & 2023F)

29 India Fitness Equipment Market Revenues, By Commercial, 2014-2023F ($ Million)

30 Commercial Applications' Revenue Share (2016 & 2023F)

31 India Hospitality Market, By No. of Hotels, 000's (2013-2022F)

32 India Hospitality Market, By Occupancy Vs No. of Rooms (Top 8 Cities)

33 Market Size Of Private Hospitals in India ($ Billion)

34 Number Of Hospitalized Cases in India (In Million)

35 Shares in Healthcare Spending in India, 2015

36 India Fitness Equipment Market Revenues, By Residential Consumers, 2014-2023F ($ Million)

37 Residential Applications' Revenue Share, 2016 & 2023F

38 India Fitness Equipment Market Revenues, By Northern Region, 2014-2023F ($ Million)

39 Northern Region Population Distribution, India (Million)

40 India Fitness Equipment Market Revenues, By Southern Region, 2014-2023F ($ Million)

41 Southern Region Population Distribution, India (In Million)

42 India Fitness Equipment Market Revenues, By Western Region, 2014-2023F ($ Million)

43 Western Region Population Distribution, India (In Million)

44 India Fitness Equipment Market Revenues, By Eastern Region, 2014-2023F ($ Million)

45 Eastern Region Population Distribution, India (In Million)

46 India Fitness Equipment Market Opportunity Matrix, By Types (2023F)

47 India Fitness Equipment Market Opportunity Matrix, By Applications (2023F)

48 India Fitness Equipment Market Revenue Share, By Players (2016)\

List of Tables

1 Obesity Proportion in India

2 Equipment for Gym Set up in Government Offices

3 India Fitness Equipment Market Revenues-By Cardiovascular Training Equipment 2014-2023F ($ Million)

4 India Fitness Equipment Market Revenues-By Strength Training Equipment 2014-2023F ($ Million)

5 Key Upcoming Retail Projects in India

6 India Fitness Equipment Market Revenues, By Players (2016)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero