Vietnam Hair Conditioner Market (2025-2031) | Trends, Share, Analysis, Growth, Industry, Companies, Revenue, Size, Outlook, Forecast & Value

Market Forecast By Product Type (Dry Hair, Oily Hair, Normal Hair, Professional, Non-professional), By Application (Online Retail, Offline Retail, Personal Use, Personal Use, Barber shop, Hotel) And Competitive Landscape

| Product Code: ETC064429 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

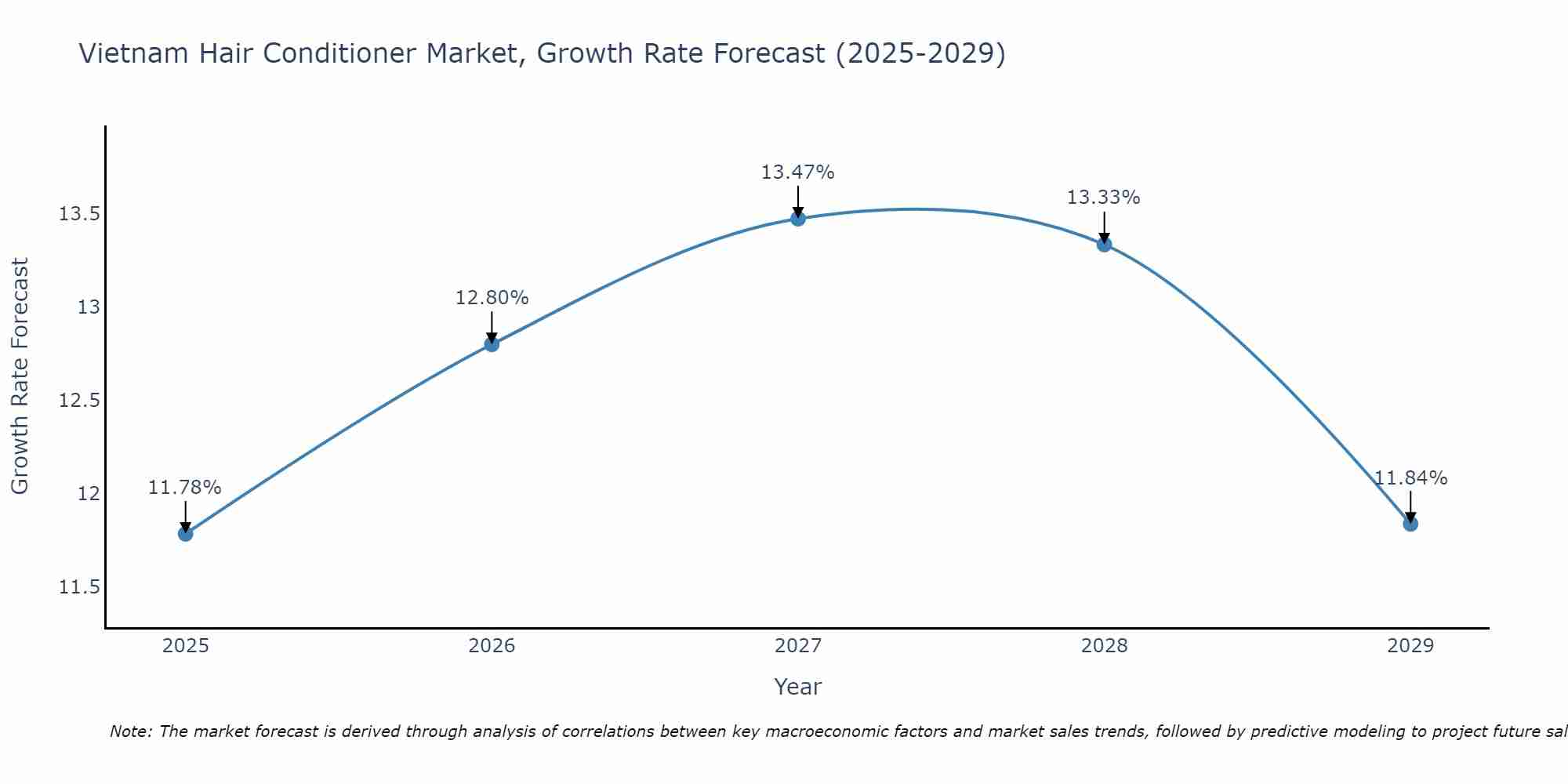

Vietnam Hair Conditioner Market Size Growth Rate

The Vietnam Hair Conditioner Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 11.78% in 2025, the market peaks at 13.47% in 2027, and settles at 11.84% by 2029.

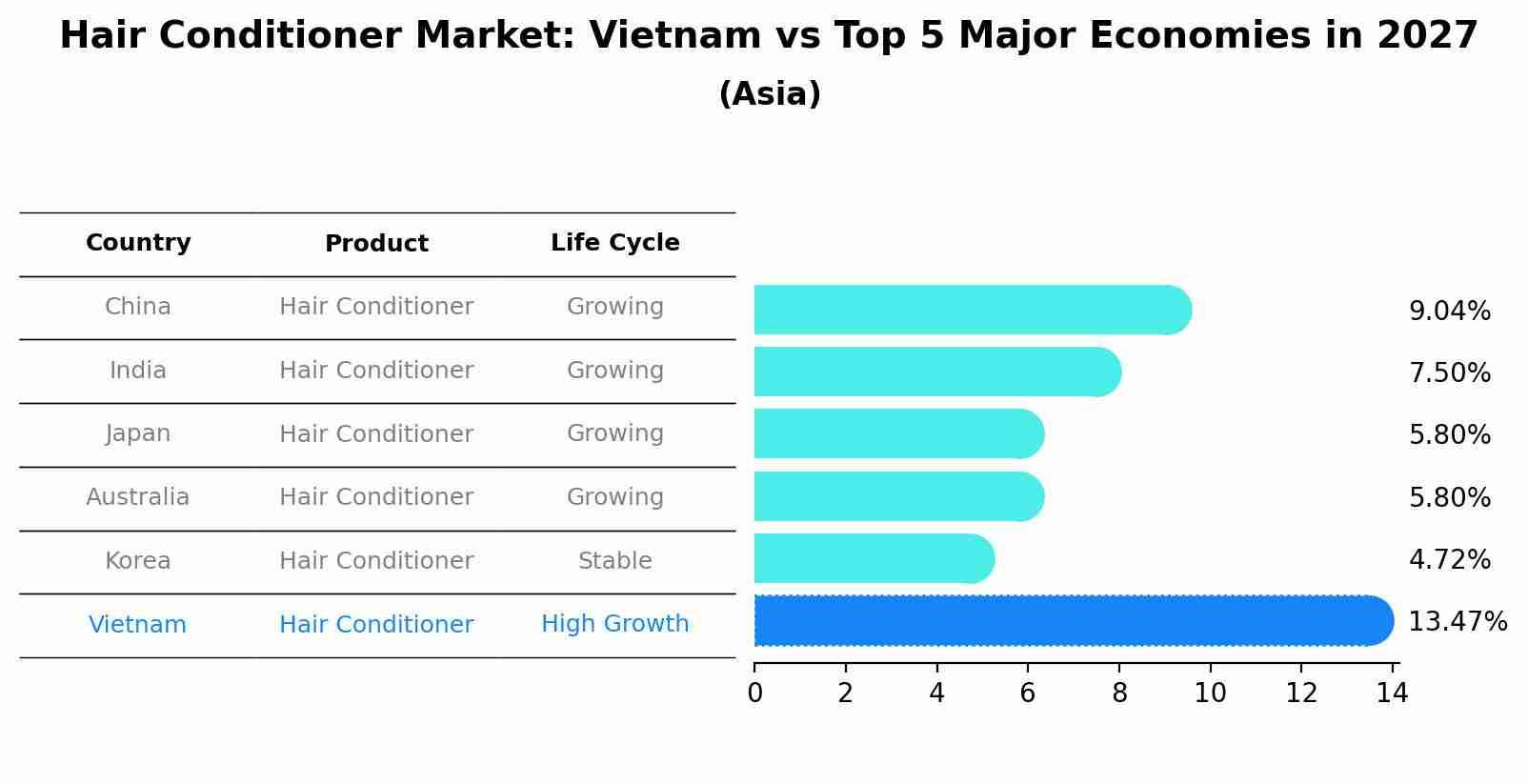

Hair Conditioner Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

Vietnam's Hair Conditioner market is anticipated to experience a high growth rate of 13.47% by 2027, reflecting trends observed in the largest economy China, followed by India, Japan, Australia and South Korea.

Vietnam Hair Conditioner Market Highlights

| Report Name | Vietnam Hair Conditioner Market |

| Forecast period | 2025-2031 |

| CAGR | 5.8% |

| Growing Sector | Personal Care |

Topics Covered in the Vietnam Hair Conditioner Market Report

Vietnam Hair Conditioner Market report thoroughly covers the market by product type, and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Hair Conditioner Market Synopsis

Vietnam Hair Conditioner Market has witnessed remarkable growth, supported by increasing consumer awareness about hair health and beauty, along with a rise in disposable incomes. Rising urbanization and the cultural significance of well-groomed appearances have catalyzed the adoption of hair conditioners across various demographic segments. The market is characterized by innovation in formulations tailored to specific hair types and needs, such as protection against pollution, repair for damaged hair, and hydration for dry hair. Furthermore, the proliferation of e-commerce platforms has made hair conditioners more accessible to remote areas.

According to 6Wresearch, the Vietnam Hair Conditioner Market is anticipated to grow at a CAGR of 5.8% during the forecast period 2025-2031. The market is significantly driven by rapid urbanization, increasing disposable incomes, and a shift in consumer preferences toward premium and specialized hair care solutions. With more individuals migrating to urban centers, there is heightened exposure to pollution and lifestyle-related hair problems, fueling the demand for conditioners that cater to specific needs like anti-pollution and damage repair. The influence of social media platforms and beauty bloggers has been instrumental in shaping consumer behavior, with individuals becoming more conscious of the importance of post-shampoo care. Furthermore, international and domestic brands have been leveraging this heightened awareness by offering innovative products, including organic, sulfate-free, and multifunctional conditioners. The increasing penetration of e-commerce platforms is another critical driver, allowing for a more extensive reach, particularly in rural areas where traditional retail options are limited.

Despite the optimistic growth prospects, the Vietnam Hair Conditioner Industry faces several challenges, including intense market competition and the prevalence of counterfeit products. The growing number of international and local brands has saturated the market, making it difficult for new entrants to establish a foothold. Counterfeit products, which are often sold at lower prices, undermine consumer trust in authentic brands and pose safety risks. Another challenge is the reliance on imported raw materials, which increases production costs and makes the market vulnerable to fluctuations in global supply chains. Additionally, some consumers remain unaware of the benefits of conditioners, limiting their usage, especially in rural areas. To overcome these challenges, manufacturers must focus on educating consumers, strengthening distribution channels, and investing in anti-counterfeiting measures.

Vietnam Hair Conditioner Market Trends

Vietnam Hair Conditioner Market is shaped by evolving consumer preferences and global beauty trends. The rising demand for natural and organic hair care products is a defining trend, as consumers seek formulations free from harmful chemicals like parabens, sulfates, and silicones. Brands are responding by introducing conditioners enriched with plant-based ingredients, essential oils, and herbal extracts, which cater to the growing segment of environmentally and health-conscious consumers. The multifunctional conditioner category is another trend gaining traction, with products offering benefits such as hydration, scalp care, UV protection, and damage repair in one formulation. Men’s grooming is emerging as a significant growth area, with an increasing number of male consumers prioritizing hair care products tailored to their needs. Digital transformation in the beauty industry is also driving trends, as brands leverage AI-powered tools for personalized product recommendations and augmented reality (AR) for virtual try-ons. Furthermore, consumers are leaning towards travel-friendly packaging options and refillable containers, reinforcing sustainability as a dominant trend in the Vietnam Hair Conditioner Industry.

Investment Opportunities in the Vietnam Hair Conditioner Market

Vietnam Hair Conditioner Market presents lucrative investment opportunities, particularly in segments aligned with consumer trends and technological advancements. The growing preference for natural and premium conditioners offers room for both established players and new entrants to carve out a niche by focusing on organic, vegan, and cruelty-free products. E-commerce expansion in Vietnam provides investors with a cost-effective way to reach rural and underserved markets, where traditional retail networks are limited. Collaborations with local influencers and social media campaigns can significantly enhance brand visibility and consumer engagement. Investing in sustainable practices, including biodegradable packaging and eco-friendly manufacturing processes, not only aligns with global sustainability goals but also appeals to a growing segment of eco-conscious consumers. Setting up local production facilities can mitigate reliance on imported raw materials, reduce costs, and improve profit margins.

Leading Players in the Vietnam Hair Conditioner Market

Vietnam Hair Conditioner Market Share is led by a blend of international and domestic brands, each catering to diverse consumer needs. Global giants such as Unilever, Procter & Gamble, and L'Oréal dominate the market with their wide-ranging product portfolios and advanced research capabilities. These companies consistently innovate to introduce conditioners that address specific hair concerns, such as dryness, damage, and scalp issues. Local players like Thorakao and X-Men have carved a niche by offering affordable and culturally relevant products tailored to Vietnamese preferences. The growing popularity of niche brands specializing in organic and herbal conditioners further enriches the competitive landscape. These brands appeal to environmentally conscious consumers by emphasizing sustainability and natural ingredients. The presence of such diverse players ensures healthy competition and continuous innovation within the Vietnam Hair Conditioner Industry.

Government Regulations

Government policies and initiatives have played a pivotal role in fostering the Vietnam Hair Conditioner Market Growth. Efforts to crack down on counterfeit goods have bolstered consumer confidence in authentic brands, creating a more reliable market environment. Trade agreements and economic partnerships have facilitated the entry of international brands into the Vietnamese market, increasing product diversity and competition. Public awareness campaigns on personal hygiene and grooming have also indirectly contributed to the rising adoption of hair care products, including conditioners. Additionally, government support for local manufacturing through tax incentives and infrastructure development has enabled domestic players to compete with global giants. Stricter regulations on cosmetic labeling and safety standards ensure higher product quality, further enhancing consumer trust and market credibility.

Future Insights of the Vietnam Hair Conditioner Market

Vietnam Hair Conditioner Market is poised for significant expansion, driven by technological advancements and shifting consumer preferences. In the future, personalized hair care solutions are expected to dominate the market, as brands increasingly leverage AI and machine learning to offer products tailored to individual hair types and concerns. Sustainability will remain a core focus, with companies exploring innovative ways to reduce their environmental footprint through green manufacturing practices, refill stations, and minimalistic packaging. The male grooming segment is projected to experience robust growth, as cultural shifts and targeted marketing campaigns encourage men to invest in specialized hair care products. The rise of omnichannel retail strategies, combining the strengths of physical stores and online platforms, will further enhance market accessibility and consumer convenience. As Vietnam continues to experience economic growth and urbanization, the increasing purchasing power of its middle-class population will sustain the demand for high-quality conditioners, cementing the country’s position as a key player in the Asia-Pacific hair care market.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Professional hair conditioner to Dominate the Market-By Product Type

According to Vasu, Senior Research Analyst, 6Wresearch, the professional hair conditioner segment leads in terms of revenue, driven by rising consumer awareness of salon-quality hair care. Professional conditioners are formulated to address specific issues such as damage repair, frizz control, and deep hydration, making them popular among urban consumers.

Offline retail to Dominate the Market-By Application

The offline retail segment dominates the Vietnam Hair Conditioner Market Share as supermarkets, beauty stores, and convenience outlets remain the preferred shopping destinations for hair care products due to their accessibility and promotional activities.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Hair Conditioner Market Outlook

- Market Size of Vietnam Hair Conditioner Market, 2024

- Forecast of Vietnam Hair Conditioner Market, 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Revenues & Volume for the Period 2021 - 2031

- Vietnam Hair Conditioner Market Trend Evolution

- Vietnam Hair Conditioner Market Drivers and Challenges

- Vietnam Hair Conditioner Price Trends

- Vietnam Hair Conditioner Porter's Five Forces

- Vietnam Hair Conditioner Industry Life Cycle

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Dry Hair for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Oily Hair for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Normal Hair for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Professional for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Non-professional for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Online Retail for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Offline Retail for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Personal Use for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Personal Use for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Barber shop for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Hair Conditioner Market Revenues & Volume By Hotel for the Period 2021 - 2031

- Vietnam Hair Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- Vietnam Hair Conditioner Top Companies Market Share

- Vietnam Hair Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Hair Conditioner Company Profiles

- Vietnam Hair Conditioner Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Product Type:

- Dry Hair

- Oily Hair

- Normal Hair

- Professional

- Non-professional

By Application:

- Online Retail

- Offline Retail

- Personal Use

- Personal Use

- Barber shop

- Hotel

Vietnam Hair Conditioner Market (2025-2031): FAQs

|

1 Executive Summary |

|

2 Introduction |

|

2.1 Key Highlights of the Report |

|

2.2 Report Description |

|

2.3 Market Scope & Segmentation |

|

2.4 Research Methodology |

|

2.5 Assumptions |

|

3 Vietnam Hair Conditioner Market Overview |

|

3.1 Vietnam Country Macro Economic Indicators |

|

3.2 Vietnam Hair Conditioner Market Revenues & Volume, 2021 & 2031F |

|

3.3 Vietnam Hair Conditioner Market - Industry Life Cycle |

|

3.4 Vietnam Hair Conditioner Market - Porter's Five Forces |

|

3.5 Vietnam Hair Conditioner Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

|

3.6 Vietnam Hair Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

|

4 Vietnam Hair Conditioner Market Dynamics |

|

4.1 Impact Analysis |

|

4.2 Market Drivers |

|

4.3 Market Restraints |

|

5 Vietnam Hair Conditioner Market Trends |

|

6 Vietnam Hair Conditioner Market, By Types |

|

6.1 Vietnam Hair Conditioner Market, By Product Type |

|

6.1.1 Overview and Analysis |

|

6.1.2 Vietnam Hair Conditioner Market Revenues & Volume, By Product Type, 2021 - 2031F |

|

6.1.3 Vietnam Hair Conditioner Market Revenues & Volume, By Dry Hair, 2021 - 2031F |

|

6.1.4 Vietnam Hair Conditioner Market Revenues & Volume, By Oily Hair, 2021 - 2031F |

|

6.1.5 Vietnam Hair Conditioner Market Revenues & Volume, By Normal Hair, 2021 - 2031F |

|

6.1.6 Vietnam Hair Conditioner Market Revenues & Volume, By Professional, 2021 - 2031F |

|

6.1.7 Vietnam Hair Conditioner Market Revenues & Volume, By Non-professional, 2021 - 2031F |

|

6.2 Vietnam Hair Conditioner Market, By Application |

|

6.2.1 Overview and Analysis |

|

6.2.2 Vietnam Hair Conditioner Market Revenues & Volume, By Online Retail, 2021 - 2031F |

|

6.2.3 Vietnam Hair Conditioner Market Revenues & Volume, By Offline Retail, 2021 - 2031F |

|

6.2.4 Vietnam Hair Conditioner Market Revenues & Volume, By Personal Use, 2021 - 2031F |

|

6.2.5 Vietnam Hair Conditioner Market Revenues & Volume, By Personal Use, 2021 - 2031F |

|

6.2.6 Vietnam Hair Conditioner Market Revenues & Volume, By Barber shop, 2021 - 2031F |

|

6.2.7 Vietnam Hair Conditioner Market Revenues & Volume, By Hotel, 2021 - 2031F |

|

7 Vietnam Hair Conditioner Market Import-Export Trade Statistics |

|

7.1 Vietnam Hair Conditioner Market Export to Major Countries |

|

7.2 Vietnam Hair Conditioner Market Imports from Major Countries |

|

8 Vietnam Hair Conditioner Market Key Performance Indicators |

|

9 Vietnam Hair Conditioner Market - Opportunity Assessment |

|

9.1 Vietnam Hair Conditioner Market Opportunity Assessment, By Product Type, 2021 & 2031F |

|

9.2 Vietnam Hair Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

|

10 Vietnam Hair Conditioner Market - Competitive Landscape |

|

10.1 Vietnam Hair Conditioner Market Revenue Share, By Companies, 2024 |

|

10.2 Vietnam Hair Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

|

11 Company Profiles |

|

12 Recommendations |

|

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero