India Fire Safety Systems and Equipment Market (2017-2023) | Analysis, Size, Revenue, Trends, Growth, Forecast, Industry, Outlook, Value & Segmentation

Market Forecast by Types (Fire Fighting Systems and Equipment (Fire Extinguishers (Dry Chemical Fire Extinguisher, CO2 Fire Extinguisher, Clean Agent Fire Extinguisher, Foam Fire Extinguisher, Wet Chemical Fire Extinguisher, and Water Fire Extinguisher), Fire Suppression Systems (Clean Agent Fire Suppression System, CO2 Fire Suppression System, Wet Chemical Fire Suppression System, and Dry Chemical Fire Suppression System), Fire Sprinkler Systems (Wet Pipe Sprinkler System, Dry Pipe Sprinkler System, Pre-Action Sprinkler System and Deluge Sprinkler System)), Fire Detection and Alarm Systems (Smoke Detectors, Heat Detectors, Gas Detectors, Flame Detectors, and Beam Detectors) and Emergency and Exit Lighting)), Verticals (Residential, Commercial, Industrial, Hospitality, Retail, and Oil & Gas), By Regions (Northern, Eastern, Western And Southern) and Competitive Landscape

| Product Code: ETC000400 | Publication Date: Nov 2021 | Updated Date: Jun 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 127 | No. of Figures: 98 | No. of Tables: 9 | |

Latest 2024 Developments of the India Fire Safety Systems and Equipment Market

The fire safety systems and equipment market size in India is proliferating over the years. The increasing adoption of smart technologies has led to the integration of Internet of Things (IoT) enabled fire safety devices, which provide real-time monitoring and quicker response times. Additionally, the government has constricted regulations and compliance standards for fire safety in residential, commercial, and industrial sectors, driving the demand for advanced fire suppression systems, alarms, and detection equipment. Innovations in firefighting drones and robotic systems are also making strides, promising enhanced fire combat strategies, and reduced human risk. Additionally, the introduction of advanced smoke and heat detectors with AI capabilities has improved the prediction and prevention of fire incidents. These technologies are becoming increasingly integrated into both residential and commercial infrastructure, reflecting a growing awareness and prioritization of fire safety across the country.

Mergers and Acquisitions:

- On 20 May 2021, AE Industrial Partners, which specializes in aerospace, defence and government services, etc. announced the acquisition of Cross Fire & Security Co. for new fire and life safety security.

- On October 2020, Eagle Eye Network, a Texas-based company announced the acquisition of AI surveillance specialist, Uncanny Vision. This acquisition helped Eagle Eye to add AI technology, and engineering talents to its office in India.

India Fire Safety Systems and Equipment Market Synopsis

Though, fire safety systems & equipment are a mature market; however, are posting significant growth on the back of increasing safety concerns, fire incidences, and infrastructure development in the country. During 2010-14, around 121,230 fire incidences were recorded in India, resulting in more than 13,720 causalities. With the increase in the number of fire incidences in the country, the government is taking strict measures to counter such incidences; especially regulations pertaining to residential and commercial buildings (for multistoried or high rise buildings) and these factors would drive the Indian fire safety systems and equipment market forecast revenues over the coming years.

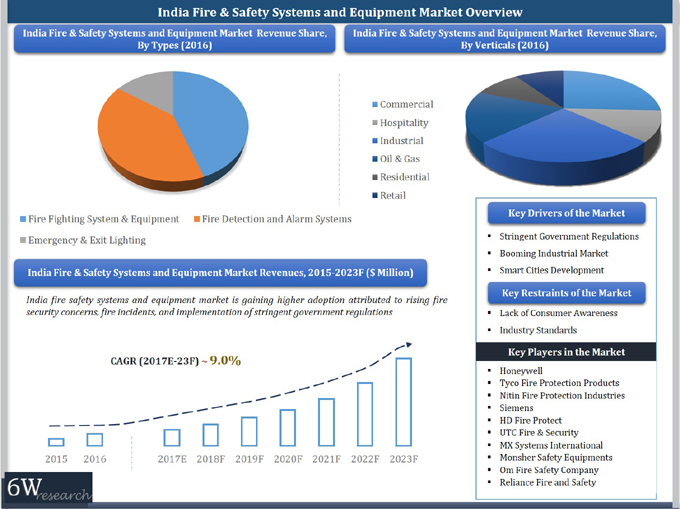

According to 6Wresearch, India fire safety systems and equipment market size is projected to grow at a CAGR of 9% during 2017-23. Over the last few years, the demand for the fire safety systems and equipment market has surged due to growing consumer awareness, which is likely to continue during the forecast period. In the overall fire safety systems and equipment market, the fire fighting segment generated the highest revenue share, followed by fire detection, and emergency & exit lighting segments.

In 2016, the western region accounted for the largest India fire safety systems and equipment market share in the country followed by the southern region. A major development in commercial and residential verticals has been witnessed across the western region. Some of the key players in India fire safety systems and equipment market include- Honeywell and Tyco. Nitin Fire Protection, Siemens, HD Fire, UTC, etc.

The India Fire safety systems and equipment market report thoroughly cover the India Fire safety systems and equipment market by types, verticals, and regions. The India fire safety systems and equipment market outlook report provides an unbiased and detailed analysis of the ongoing India fire safety Systems and equipment market trends, opportunities high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

India fire safety system and equipment market are projected to gain momentum in the years ahead on the back of the rising need to maintain safety. On the basis of the end-users, Commercial Offices is estimated to generate high sales revenues owing to The rising establishment of commercial offices with the rising growth of the tech-savvy population coupled with the increase in the shift of the population from primary to the tertiary sector, therefore, the high requirement for fire safety system and equipment to ensure a safe and fire-free environment for the employees and is estimated to benefit the growth of the India fire safety systems and equipment market in the coming years.

Government Initiatives Introduced in the India Fire Safety System and Equipment Market

One of the primary growth drivers of the India Fire Safety Systems & Equipment Market is the stringent regulations laid down by the government. The government of India has mandated fire safety systems and equipment in all commercial buildings, educational institutions, and residential complexes. Also, these guiles have boosted the overall India Fire Safety System and Equipment Market share in recent years. Further, this has led to an increased demand for fire safety products, including fire sprinklers, fire alarms, fire extinguishers, and more.

Key Players in the India Fire Safety System and Equipment Market

Several local and international companies have invested in the India fire safety systems and equipment market. Among these players, some have managed to make their mark in the industry. Companies like Tyco Fire Protection Products, Honeywell International Inc., Siemens AG, Halma PLC, and Robert Bosch GmbH are some of the leading players in the industry. Additionally, the foremost firms’ clasp extensive Asia Pacific Fire Safety System and Equipment Market share. These companies offer a range of fire safety products and services, and they have worked on some notable projects in India.

Market by Type

According to Ravi Bhandari, Research Head, 6Wresearch, the Fire extinguishers hold a significant share in the Indian fire safety systems and equipment industry. The growth of the fire extinguishers industry is because of the usability and accessibility of these fire safety measures. Fire extinguishers are versatile and can be used in any space, from homes to commercial areas, upon sighting a fire. Additionally, the dry chemical fire extinguishers are among the most popular fire extinguishers in India. Due to their effectiveness in combating fires in various kinds of combustibles, dry chemical fire extinguishers are often preferred for class A, B, C, D, and E fires. Another popular fire extinguishing system is the CO2 fire extinguisher. Carbon dioxide fire extinguishers are especially useful in combating fires in locations such as server rooms as the carbon dioxide does not leave a residue, and there is no risk of damaging electronic devices. The clean agent fire extinguishing system is also becoming increasingly popular in India, particularly because they do not cause any damage to the surroundings.

Market by Application

One of the largest applications of fire safety systems is in residential buildings. With the rapid growth of the Indian population, apartments and housing societies have become the norm. These residential buildings require fire safety systems and equipment to prevent and manage fires. Smoke detectors, fire extinguishers, and sprinkler systems are some of the equipment used in these buildings. Additionally, the factories and industrial buildings demand fire safety systems that are more robust and advanced. Furthermore, the factories and industrial buildings clasps massive India Fire Safety System and Equipment market revenues. These buildings often house flammable substances, hazardous chemicals, and electric machinery. As a result, they require advanced fire safety equipment such as fire alarms, fire suppression systems, and fireproof coatings. Industrial buildings also require a higher level of training for employees to respond quickly in case of a fire.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2013 to 2016.

- Base Year: 2016.

- Forecast Data until 2023.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data and Forecast of Global Fire Safety Systems and Equipment Market for the Period 2013-2023

- India Fire Safety Systems and Equipment Market Overview

- India Fire Safety Systems and Equipment Market Outlook

- India Fire Safety Systems and Equipment Market Size and India Fire Safety Systems and Equipment Market Forecast of Revenues until 2023

- Historical Data and Forecast of India Fire Safety Systems and Equipment Market Revenues for the Period 2013-2023

- Historical Data and Forecast of India Fire Fighting System & Equipment Market Revenues for the Period 2013-2023

- Historical Data and Forecast of India Fire Fighting System & Equipment Market Revenues, By Types (Extinguisher, Suppression, and Sprinkler) for the Period 2013-2023

- Historical Data and Forecast of India Fire Fighting System & Equipment Market Revenues, By Fire Extinguisher Types (Dry Chemical, CO2, Clean Agent, Foam Fire, Wet Chemical, and Water)

- Historical Data and Forecast of India Fire Fighting System & Equipment Market, By Fire Suppression Types (Clean Agent, CO2, Wet, and Dry) for the Period 2013-2023

- Historical Data and Forecast of India Fire Fighting System & Equipment Market, By Fire Sprinkler Types (Wet Pipe, Pre Action, Deluge, and Dry Pipe) for the Period 2013-2023

- Historical Data and Forecast of India Fire Detection and Alarm Systems Market for the Period 2013-2023

- Historical Data and Forecast of India Fire Detection and Alarm Systems Market, By Detector Types (Smoke, Heat, Gas, Flame, and Beam) for the Period 2013-2023

- Historical Data and Forecast of India Emergency & Exit Lighting Market for the Period 2013-2023

- Historical Data and Forecast of India Fire Safety Systems and Equipment Regional Market until 2023

- India Fire Safety Systems and Equipment Market Drivers and Restraints

- India Fire Safety Systems and Equipment Market Trends and Industry Life Cycle

Markets Covered:

The India fire safety systems and equipment market report provides a detailed analysis of the following market segments:

By Types:

o Fire Fighting Systems & Equipment

? Fire Extinguishers

› Dry Chemical

› CO2

› Clean Agent

› Foam Fire

› Wet Chemical

› Water

? Fire Suppression Systems

› Clean Agent (FM 200, Novec)

› Carbon Dioxide

› Wet Chemical Fire

› Dry Chemical

? Sprinkler System

› Wet Pipe

› Dry Pipe

› Pre-Action

› Deluge

o Fire Detection and Alarm Systems & Equipment

› Smoke Detectors

› Heat Detectors

› Gas Detectors

› Flame Detectors

› Beam Detectors

o Emergency and Exit Lighting

By Verticals

- Commercial

- Hospitality

- Industrial

- Oil & Gas

- Residential

- Retail

By Regions:

- Northern

- Southern

- Eastern

- Western

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Fire Safety Systems and Equipment Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Fire Safety Systems and Equipment Market Revenues & Volume, 2019 & 2029F |

| 3.3 India Fire Safety Systems and Equipment Market - Industry Life Cycle |

| 3.4 India Fire Safety Systems and Equipment Market - Porter's Five Forces |

| 3.5 India Fire Safety Systems and Equipment Market Revenues & Volume Share, By Types, 2022 & 2029F |

| 3.6 India Fire Safety Systems and Equipment Market Revenues & Volume Share, By Verticals, 2022 & 2029F |

| 4 India Fire Safety Systems and Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 India Fire Safety Systems and Equipment Market Trends |

| 6. India Fire Safety Systems and Equipment Market By Types |

| 6.1 India Fire Safety Systems and Equipment Market Revenues & Volume, By Fire Fighting Systems & Equipment, 2019 - 2029F |

| 6.2 India Fire Safety Systems and Equipment Market Revenues & Volume, By Fire Suppression Systems, 2019- 2029F |

| 6.3 India Fire Safety Systems and Equipment Market Revenues & Volume, By Fire Detection and Alarm systems & Equipment, 2019- 2029F |

| 7. India Fire Safety Systems and Equipment Market , By Verticals |

| 7.1 India Fire Safety Systems and Equipment Market , Revenues & Volume, By Commercial , 2019 - 2029F |

| 7.2 India Fire Safety Systems and Equipment Market, Revenues & Volume, By Hospitality, 2019- 2029F |

| 7.3 India Fire Safety Systems and Equipment Market, Revenues & Volume, By Industrial, 2019- 2029F |

| 7.4 India Fire Safety Systems and Equipment Market, Revenues & Volume, By Oil & Gas, 2019- 2029F |

| 7.5 India Fire Safety Systems and Equipment Market, Revenues & Volume, By Residential, 2019- 2029F |

| 7.6 India Fire Safety Systems and Equipment Market, Revenues & Volume, By Retail , 2019- 2029F |

| 8 India Fire Safety Systems and Equipment Market Imports from Major Countries |

| 9 India Fire Safety Systems and Equipment Market Key Performance Indicators |

| 10 India Fire Safety Systems and Equipment Market - Opportunity Assessment |

| 10.1 India Fire Safety Systems and Equipment Market Opportunity Assessment, By Type, 2029 |

| 10.2 India Fire Safety Systems and Equipment Market Opportunity Assessment, By Verticals, 2029 |

| 11 India Fire Safety Systems and Equipment Market - Competitive Landscape |

| 11.1 India Fire Safety Systems and Equipment Market Revenue Share, By Companies, 2022 |

| 11.2 India Fire Safety Systems and Equipment Market Competitive Benchmarking, By Operating and Technical Parameters |

| 12 Company Profiles |

| 13 Recommendations |

| 14 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero