India Lithium Ion Batteries Market (2025-2031) | Analysis, Size, Revenue, Trends, Growth, Forecast, Industry, Outlook, Value & Segmentation

Market Forecast by Applications (Automotive, Industrial, Consumer Electronics and Others (Medical, Military, and Textile)), Materials (Lithium Cobalt Oxide, Lithium Manganese Oxide, Lithium Iron Phosphate and Others (Li Nickel Cobalt Aluminum Oxide and Li Titanate)), Power Capacity (5-25 Wh, 48-95 Wh, 18-28 KWh, 100-250 KWh and Above 300 KWh), Components (Cathode, Anode, Electrolytic Solution and Others (Foils, Anode, Electrolytic Solution)) and Competitive Landscape.

| Product Code: ETC000364 | Publication Date: Aug 2024 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

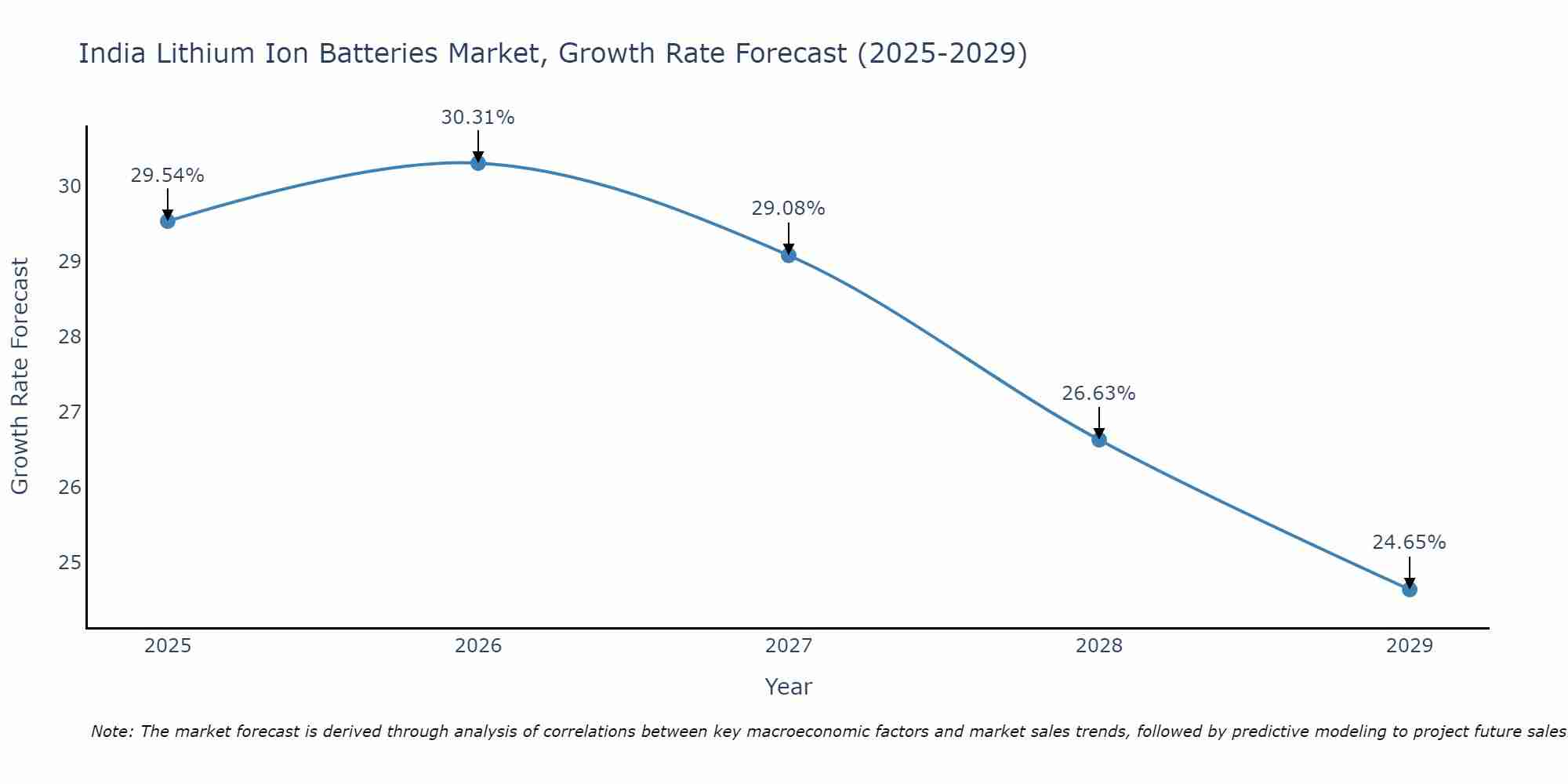

India Lithium Ion Batteries Market Size Growth Rate

The India Lithium Ion Batteries Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 30.31% in 2026, following an initial rate of 29.54%, before easing to 24.65% at the end of the period.

India Lithium Ion Batteries Market Highlights

| Report Name | India Lithium Ion Batteries Market |

| Forecast period | 2025-2031 |

| CAGR | 23% |

| Growing Sector | Lithium Ion Batteries |

Topics Covered in the India Lithium Ion Batteries Market Report

The India Lithium Ion Batteries Market report meticulously covers the market by applications, power and components. The report provides a detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers that will assist stakeholders to align their market strategies with the current and future market dynamics.

India Lithium Ion Batteries Market Synopsis

The India Lithium Ion Batteries market is expanding rapidly, owing to rising demand from the automotive, industrial, consumer electronics, and other sectors. The widespread use of diverse lithium ion materials in battery manufacture, as well as increased demand for high power capacity batteries, are major drivers of this growth. Furthermore, the usage of various components such as cathode, anode, electrolytic solution, and others provides a diverse range of applications, accelerating market expansion. Collaborations with India lithium ion battery manufacturers, as well as local innovation, result in a wide variety of lithium ion batteries. The emphasis on quality, sustainability, and consumer convenience reinforces the Indian market's commitment to providing outstanding battery solutions.

According to 6Wresearch, The India Lithium Ion Batteries Market size is anticipated to grow at a substantial CAGR of 23% during the forecast period 2025-2031. Several important reasons are propelling the Lithium Ion Batteries market in India. Customers are increasingly looking for efficient and sustainable battery technology. Battery systems that are automated are becoming increasingly popular due to their endurance and environmental benefits. Second, there is a rising recognition of the advantages of efficient battery systems, such as their efficiency, lifespan, and low maintenance needs. These systems' adaptability in a wide range of applications, including automotive, industrial, consumer electronics, and others, is driving up their market share. Overall, the Indian lithium ion battery market is expanding as a result of long-term trends, consumer preferences, product benefits, and industry practices.

However, the India Lithium Ion Batteries Market faces obstacles that may limit its growth. These include fluctuations in raw material pricing, stringent environmental regulations, and complex supply chain management. Rapid changes in battery production techniques, as well as the requirement for continual innovation, provide new obstacles. Disruptions in the worldwide supply chain for lithium-ion batteries could have a substantial influence on industry growth. To remain competitive in the Lithium Ion Batteries industry, these challenges must be overcome by strategic partnerships, R&D investments, effective supply chain management, and a flexible reaction to market complexity.

India Lithium Ion Batteries Industry: Leading Players

Key players in the market include Samsung SDI, Panasonic Corporation, LG Chem, Toshiba Corporation, Hitachi Chemical, which provide a vast range of innovative Lithium Ion Batteries solutions, catering to the evolving needs of various industries in India.

India Lithium Ion Batteries Market: Government Regulations

In the Indian lithium-ion battery business, government regulations are critical in fostering innovation, sustainability, and growth. The Indian government has launched important measures, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, to encourage the use of electric vehicles (EVs) by giving subsidies for lithium-ion battery manufacturing. Furthermore, the National Electric Mobility Mission Plan (NEMMP) establishes targets for EV adoption while encouraging the development of charging infrastructure and better battery technology. The Phased Manufacturing Programme (PMP) encourages local manufacturing of lithium-ion batteries through import taxes, creating self-reliance and bolstering the indigenous battery industry. The Energy Storage Mission, which focuses on energy security and sustainability, emphasises energy storage technology such as lithium-ion batteries to improve grid stability.

Future Insights of the India Lithium Ion Batteries Market

The future of the India lithium-ion battery industry appears bright, buoyed by rising demand for renewable energy solutions, electric vehicles, and energy storage systems. With increased government funding and activities encouraging sustainable technologies, the market is likely to expand and innovate significantly. Factors such as falling battery prices, technological breakthroughs, and a trend towards renewable energy sources are expected to accelerate the usage of lithium-ion batteries in a variety of industries. In the future years, India is expected to become a major player in the worldwide lithium-ion battery industry, aided by a quickly developing electric car market, ambitious renewable energy targets, and a focus on energy security. The expansion of electric vehicles, together with the development of charging infrastructure and smart grid technologies, will propel the demand for high-performance lithium-ion batteries in the transportation sector.

Market Segmentation by Applications

According to Dhaval, Research Manager, 6Wresearch, the Automotive segment is anticipated to witness the fastest growth in the applications category. This is due to the rising adoption and efficiency of lithium ion batteries.

Market Segmentation by Materials

Among the materials used, Lithium Iron Phosphate is a market segment projected to grow significantly. This growth is attributed to this material's superior safety and long-cycle life.

Market Segmentation by Power Capacity

The range of 100-250 KWh is anticipated to experience considerable growth. This can be ascribed to the rising demand for high power capacity batteries across numerous sectors.

Market Segmentation by Components

The Cathode market segment is expected to increase notably. The Cathode plays a critical role in determining the capacity, voltage, and energy density of lithium-ion batteries.

Market Segmentation by Regions

The Southern region is expected to be the fastest growing market sector. Rapid urbanisation and development in areas like Karnataka, Tamil Nadu, Telangana, Andhra Pradesh, and Kerala are driving the growth in this region.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Lithium-Ion Batteries Market Overview

- India Lithium-Ion Batteries Market Outlook

- Historical data of the India Lithium-Ion Batteries Market for the Period 2021-2031

- Market Size & Forecast of India Lithium-Ion Batteries Market until 2031

- Historical data of India Lithium-Ion Batteries Market for the Period 2021-2031

- India Lithium-Ion Batteries Market Size & India Lithium-Ion Batteries Market Forecast Revenues until 2031

- Historical data of India Lithium-Ion Batteries Market, By Applications for the Period 2021-2031

- Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Applications until 2031

- Historical data of India Lithium-Ion Batteries Market Revenues, By Components for the Period 2021-2031

- Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Components until 2031

- Historical data of India Lithium-Ion Batteries Market Revenues, By Power Capacity for the Period 2021-2031

- Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Power Capacity until 2031

- Historical data of India Lithium-Ion Batteries Market Revenues, By Materials for the Period 2021-2031

- Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Materials until 2031

- India Lithium-Ion Batteries Market Drivers and Restraints

- India Lithium-Ion Batteries Market Trends and Opportunities

- Industry Life Cycle and Value Chain Analysis

- Porter's Five Forces Analysis

- India Lithium-Ion Batteries Market Overview on Competitive Benchmarking

- India Lithium-Ion Batteries Market Share, by Players

- Company Profiles

- Key Recommendations

Market Covered

The report provides an exhaustive study of the following market segments:

By Regions

- Northern

- Western

- Eastern

- Southern

By Applications

- Automotive

- Industrial

- Consumer Electronics

- Others

By Materials

- Lithium Cobalt Oxide

- Lithium Manganese Oxide

- Lithium Iron Phosphate

- Others

By Power Capacity

- 5-25 Wh

- 48-95 Wh

- 18-28 KWh

- 100-250 KWh

- Above 300 KWh

By Components

- Cathode

- Anode

- Electrolytic Solution

- Others

Frequently Asked Questions About the Market Study (FAQs):

Market Forecast by Applications (Automotive, Industrial, Consumer Electronics and Others (Medical, Military, and Textile)), Materials (Lithium Cobalt Oxide, Lithium Manganese Oxide, Lithium Iron Phosphate and Others (Li Nickel Cobalt Aluminum Oxide and Li Titanate)), Power Capacity (5-25 Wh, 48-95 Wh, 18-28 KWh, 100-250 KWh and Above 300 KWh), Components (Cathode, Anode, Electrolytic Solution and Others (Foils, Anode, Electrolytic Solution)) and Competitive Landscape.

| Product Code: ETC000364 | Publication Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 118 | No. of Figures: 34 | No. of Tables: 9 |

Latest 2023 Developments of the India Lithium-Ion Batteries Market

India Lithium-Ion Batteries Market is growing rapidly with the innovation of smart batteries which are designed to easily swap from one vehicle to another which will drive sales effectively. On 24th August 2020, the new development of lithium-sulfur battery which is introduced for electric vehicles is set to provide three times more energy capacity and aims to be more cost-effective, safer, efficient, and eco-friendly. Additionally, in August 2021 startups have developed technology to recycle 1000 tonnes of lithium-ion battery waste per year on account of which lithium-ion batteries will be more environmentally friendly. PLI scheme also boosted companies to produce lithium-ion cells in the country, hoping to take advantage of ?18,000 crores worth of government subsidies announced.

Merger & Acquisition:

- LG Chem acquired Uniseal on 12th September 2018

- Philips 66 acquired stakes in Novonix on 9th August 2021

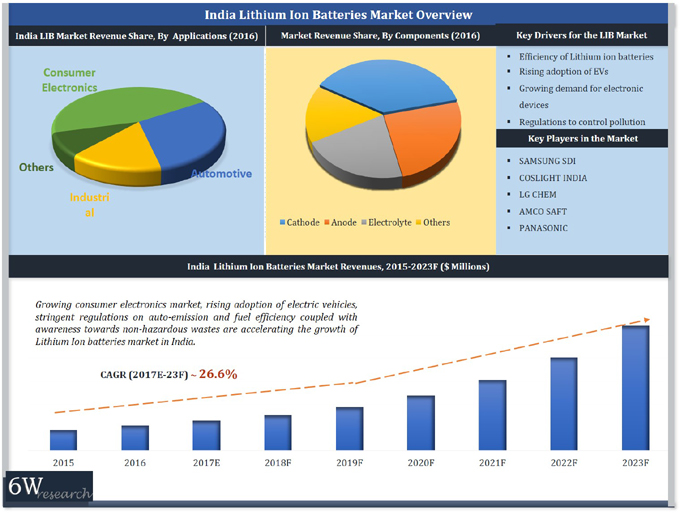

India Lithium-Ion Batteries Market Synopsis

Growing pollution concerns, rising adoption of electric vehicles, increasing income levels, and surging demand for quality and uninterrupted power are some of the key factors catalyzing the growth of the Lithium-ion batteries market in India. Further, the rising usage of smartphones and other consumer electronics products is resulting in an increase in demand for higher energy density and faster-charging solutions. Additionally, the growing consumer electronics market would drive the India Lithium-Ion Batteries market forecast period revenues owing to its lightweight, high energy, and power capacity features.

According to 6Wresearch, India Lithium-ion Batteries market size is projected to grow at a CAGR of over 27% during 2017-23. The consumer electronics segment captured the majority of the market share followed by automotive applications and others. Among various Li-ion chemistries, Lithium Cobalt Oxide (LCO) dominated the market owing to its high usage in consumer electronics.

Additionally, increasing awareness towards portable and stationary energy storage coupled with the government's push towards solar and wind projects is expected to contribute to the growth of India Li-ion Battery market share over the coming years. Moreover, government efforts towards the adoption of electric vehicles such as the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles (FAME) scheme as well as tax exemption on EVs are anticipated to provide a much-needed boost to the market.

Additionally, increasing awareness towards portable and stationary energy storage coupled with the government's push towards solar and wind projects is expected to contribute to the growth of India Li-ion Battery market share over the coming years. Moreover, government efforts towards the adoption of electric vehicles such as the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles (FAME) scheme as well as tax exemption on EVs are anticipated to provide a much-needed boost to the market.

The India Lithium-Ion Batteries market report thoroughly covers lithium-ion batteries market applications, components, material types, and power capacities. The India Lithium-Ion Batteries market outlook report provides an unbiased and detailed analysis of the ongoing India Lithium-Ion Batteries market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

India Lithium-Ion Batteries Market includes applications, material types, components, and power capacities. The potential of the lithium-ion batteries market was analyzed in 2020 and provides statistics and regional analysis of the battery industry and market size based on the analyzed information. The India lithium-ion battery market is expected to register potential growth in the upcoming six years backed by the rising adoption of electric vehicles across the country. With a spur in the declining costs of electric vehicles, lithium-ion batteries are generating a chunk of market value in the overall Indian market. Presently, India has only cell-to-pack manufacturing plants with one GWh annual production range, but, with the rising efforts of the government of the country towards increasing the manufacture of li-on batteries backed by the implementation of initiatives such as ‘Make in India’ and by providing special manufacturing zones with equipped infrastructure, cheap power, and efficient connectivity, the India lithium-ion batteries market would garner proficient revenues in the coming years.

India lithium-ion batteries market is projected to gain momentum in the coming timeframe owing to the rising expansion of the offices with the growing tech-savvy population where high use of computers and UPS systems is likely to bring in lucrative opportunities for the lithium-ion batteries deployment to power the equipment instantly. Not only the offices but the growing use of computers in BFSI and residential sectors has widened the use of UPS systems for the emergence of power backup source that tends to require the high use of lithium-ion batteries and is estimated to bolster the growth of India's lithium-ion batteries market in the coming timeframe.

Key Highlights of the Report:

• India Lithium-Ion Batteries Market Overview

• India Lithium-Ion Batteries Market Outlook

• Historical data of the Global Lithium-Ion Batteries Market for the Period 2014-2016

• Market Size & Forecast of Global Lithium-Ion Batteries Market until 2023

• Historical data of India Lithium-Ion Batteries Market for the Period 2014-2016

• India Lithium-Ion Batteries Market Size & India Lithium-Ion Batteries Market Forecast Revenues until 2023

• Historical data of India Lithium-Ion Batteries Market, By Applications for the Period 2014-2016

• Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Applications until 2023

• Historical data of India Lithium-Ion Batteries Market Revenues, By Components for the Period 2014-2016

• Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Components until 2023

• Historical data of India Lithium-Ion Batteries Market Revenues, By Power Capacity for the Period 2014-2016

• Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Power Capacity until 2023

• Historical data of India Lithium-Ion Batteries Market Revenues, By Materials for the Period 2014-2016

• Market Size & Forecast of India Lithium-Ion Batteries Market Revenues, By Materials until 2023

• India Lithium-Ion Batteries Market Drivers and Restraints

• India Lithium-Ion Batteries Market Trends and Opportunities

• Industry Life Cycle and Value Chain Analysis

• Porter's Five Forces Analysis

• India Lithium-Ion Batteries Market Overview on Competitive Benchmarking

• India Lithium-Ion Batteries Market Share, by Players

• Company Profiles

• Key Recommendations

Markets Covered

The India Lithium Ion Batteries market report provides a detailed analysis of the following market segments:

By Applications

- Automotive

- Industrial

- Consumer Electronics

- Others (Medical, Military, Textile)

By Material

- Lithium Cobalt Oxide

- Lithium Manganese Oxide

- Lithium Iron Phosphate

- Others (Li Nickel Cobalt Aluminum Oxide, Li Titanate)

By Power Capacity

- 5-25 Wh

- 48-95 Wh

- 18-28 KWh

- 100-250 KWh

- Above 300 KWh

By Components

- Cathode

- Anode

- Electrolytic Solution

- Others (Foils, Binder and Separators)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero