Saudi Arabia Earthmoving Equipment Rental Market (2015-2021) | Forecast, Value, Industry, Companies, Outlook, Share, Growth, Analysis, Revenue, Trends & Size

Market Forecast By Earthmoving Equipment Types (Excavators, Loaders and Construction Tractors), Applications (Agriculture, Construction and Mining) and Regions (Southern, Eastern, Western and Central)

| Product Code: ETC000245 | Publication Date: Jun 2015 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 121 | No. of Figures: 56 | No. of Tables: 20 |

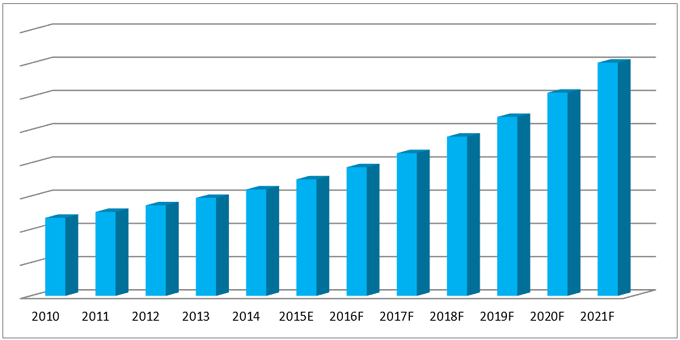

High cost of equipment, growth in public & private infrastructures, demand in mining industry and ease of availability of equipment on rent have fueled Saudi Arabia's earthmoving equipment rental market. The continuous growth in the construction industry coupled with surging government expenditure has further driven the growth of the market. In Saudi Arabia, excavator and construction tractors are the key revenue generating segments. According to 6Wresearch, Saudi Arabia's Earthmoving Equipment Rental market is projected to grow at a CAGR of 12.3% during 2015-21. Mounting construction industry in areas such as hospitality sector, IT/ITeS sector, public and infrastructures have spurred earthmoving equipment rental business in the country.In Saudi Arabia's earthmoving equipment rental market, construction application is the leading revenue generation application and is anticipated to maintain its market dominance through the forecast period. The growth registered in Saudi Arabia's construction sector has played a vital role for this application market leadership.The report thoroughly covers the market by Earthmoving Equipment Rental types, by verticals, and by regions. The report provides the unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global Earthmoving Equipment Market for the Period 2010-2014.

• Market Size & Forecast of Global Earthmoving Equipment Market until 2021.

• Historical data of Saudi Arabia Earthmoving Equipment Rental Market Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Earthmoving Equipment Rental Market Revenue until 2021.

• Historical data of Saudi Arabia Excavator Rental Market Rental Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Excavator Rental Market Revenue until 2021.

• Historical data of Saudi Arabia Loader Rental Market Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Loader Rental Market Revenue until 2021.

• Historical data of Saudi Arabia Construction Tractor Rental Market Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Construction Tractor Rental Market Revenue until 2021.

• Historical data of Saudi Arabia Motor Grader Rental Market Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Motor Grader Rental Market Revenue until 2021.

• Historical data of Saudi Arabia Earthmoving Equipment Application Rental Market Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Earthmoving Equipment Application Rental Market Revenue until 2021.

• Historical data of Saudi Arabia Earthmoving Equipment Regional Rental Market Revenue for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Earthmoving Equipment Regional Rental Market Revenue until 2021.

• Market Trends.

• Players Market Share and Competitive Landscape.

Markets Covered

The report provides the detailed analysis of the following market segments:

• Earthmoving Equipment Rental Market, By Types:

o Excavator

? Crawler/ Wheeled Excavator

? Mini Excavator

o Construction Tractor

? Bulldozer Rental/ Crawler Tractor

? Wheeled Tractor

o Loader

? Backhoe Loader

? Crawler/ Wheeled Loader

? Skid - Steer Loader

o Motor Grader

• Application

o Construction

o Mining

o Agriculture

• Region

o Southern Region

o Eastern Region

o Western Region

o Central Region

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Methodology Adopted & Key Data Points

2.5 Assumptions

3 Global Earthmoving Equipment Rental Market Overview

3.1 Global Construction Equipment Market Revenues

3.2 Global Earthmoving Equipment Market, By Region

4 Saudi Arabia Earthmoving Equipment Rental Market

4.1 Saudi Arabia Earthmoving Equipment Rental Market Revenues (2010-2021F)

4.2 Industry Life Cycle

4.3 Opportunity Matrix

4.4 Porters 5 Forces Model

4.5 Saudi Arabia Earthmoving Equipment Rental Market, By Types

4.6 Saudi Arabia Earthmoving Equipment Rental Market, By Vertical

4.7 Saudi Arabia Earthmoving Equipment Rental Market, By Region

5 Saudi Arabia Earthmoving Equipment Rental Market Dynamics

5.1 Drivers

5.1.1 Growing Construction Industry

5.1.2 Growing Tourism and Hospitality Industry

5.1.3 Growth in IT Industry

5.1.4 Growth in Automotive Industry

5.2 Restraints

5.2.1 High Cost

6 Saudi Arabia Earthmoving Equipment Rental Market Trends

6.1 Rise in Demand for Energy Efficient Equipment

6.2 Availability of Attractive Financing Options

6.3 Growing Partnership, Mergers and Joint Ventures

6.4 Growth in Mining Industry

7 Saudi Arabia Excavator Rental Market Overview

7.1 Saudi Arabia Excavator Rental Market Revenue

7.2 Saudi Arabia Excavator Rental Market, By Types

7.2.1 Saudi Arabia Wheeled Excavator Rental Market Revenue

7.2.2 Saudi Arabia Wheeled Excavator Rental Market Trend

7.2.3 Saudi Arabia Mini Excavator Rental Market Revenue

7.2.4 Saudi Arabia Mini Excavator Rental Market Trend

8 Saudi Arabia Loaders Rental Market Overview

8.1 Saudi Arabia Loaders Rental Market Revenue

8.2 Saudi Arabia Loaders Rental Market , By Types

8.2.1 Saudi Arabia Backhoe Loaders Rental Market Revenue

8.2.2 Saudi Arabia Backhoe Loaders Rental Market Trend

8.2.3 Saudi Arabia Wheeled Loaders Rental Market Revenue

8.2.4 Saudi Arabia Wheeled Loaders Rental Market Trend

8.2.5 Saudi Arabia Skid Steer Loaders Rental Market Revenue

8.2.6 Saudi Arabia Skid Steer Loaders Rental Market Trend

9 Saudi Arabia Construction Tractor Rental Market Overview

9.1 Saudi Arabia Construction Tractor Rental Revenue

9.2 Saudi Arabia Construction Tractor Rental Market, By Types

9.2.1 Saudi Arabia Bulldozer Rental Market Rental Revenue

9.2.2 Saudi Arabia Bulldozer Rentals/ Crawler Tractor Rental Market Trend

9.2.3 Saudi Arabia Wheeled Tractor Rental Market Rental Revenue

9.2.4 Saudi Arabia Wheeled Tractor Rental Market Trend

10 Saudi Arabia Motor Grader Rental Market Overview

10.1 Saudi Arabia Motor Grader Rental Revenue

10.2 Saudi Arabia Motor Grader Rental Market Trend

11 Saudi Arabia Earthmoving Equipment Application Market Overview

11.1 Saudi Arabia Excavator Rental Market, By Application

11.2 Saudi Arabia Loaders Rental Market, By Application

11.3 Saudi Arabia Construction Tractors Rental Market, By Application

11.4 Saudi Arabia Motor Grader Rental Market, By Application

12 Saudi Arabia Regional Earthmoving Equipment Rental Market Overview

12.1 Southern Region

12.2 Eastern Region

12.3 Western Region

12.4 Central Region

13 Competitive Landscape

13.1 Saudi Arabia Excavator Rental Market Revenue Share, By Company

13.2 Saudi Arabia Wheeled Loaders Rental Market Revenue Share, By Company

13.3 Saudi Arabia Bulldozer Rental Market Revenue Share, By Company

13.4 Saudi Arabia Motor Grader Rental Market Revenue Share, By Company

14 Company Profile

14.1 Al Reyami Construction Equipment Rental

14.2 Al Shuwayer Group, Al Shuwayer Group

14.3 Arabtec Construction Machinery [ACM]

14.4 Bin Quraya

14.5 FAMCO (Al-Futtaim Auto & Machinery Company LLC)

14.6 Hertz Dayim Equipment Rental Corporation

14.7 House of Equipment

14.8 Industrial Supplies Development Co. Ltd. (ISDC),

14.9 Saad Al Qahtani Contracting (SAQCO)

14.10 Suleiman Abdul-Rehman Namlah Corporation

14.11 Younes Fateh Khaja and Partners Contracting Co. (YFKCO)

14.12 Zahid Tractor & Heavy Machinery Co. Ltd.

15 Key Strategic Pointers

16 Disclaimer

List of Figures

Figure 1 Global Earthmoving Equipment Market Revenues, 2010-2014 ($ Billion)

Figure 2 Global Earthmoving Equipment Market Revenues, 2015E-2021F ($ Billion)

Figure 3 Global Earthmoving Equipment Market Share, By Region

Figure 4 Middle East Earthmoving Equipment Market Revenue, 2010-21F ($ Billion)

Figure 5 Saudi Arabia Earthmoving Equipment Rental Market Revenues, 2010-2014 ($ Million)

Figure 6 Saudi Arabia Earthmoving Equipment Rental Market Revenues, 2015E-2021F ($ Million)

Figure 7 Saudi Arabia Earthmoving Equipment Market-Industry life Cycle

Figure 8 Mark- tunity Matrix

Figure 9 Saudi Arabia Earthmoving Equipment Rental Market Share, By Type (2014-21F)

Figure 10 Saudi Arabia Earthmoving Equipment Rental Market Share, By Verticals, 2014

Figure 11 Saudi Arabia Earthmoving Equipment Rental Market Share, By Verticals, 2021

Figure 12 Saudi Arabia Construction Market, 2013-2021 ($ Million)

Figure 13 Saudi Arabia Hospitality Sector Revenue, 2012-2020F ($ Million)

Figure 14 Saudi Arabia IT Market, 2011-2021 ($ Billion)

Figure 15 Saudi Arabia Vehicles Sales, 2005-2013(Units)

Figure 16 Saudi Arabia Mining Industry Market, 2012-2021F ($ Million)

Figure 17 Saudi Arabia Excavator Rental Market Revenues, 2010-2014 ($ Million)

Figure 18 Saudi Arabia Excavator Market Revenues, 2015-2021F ($ Million)

Figure 19 Saudi Arabia Excavator Rental Market Share, By Types

Figure 20 Saudi Arabia Wheeled Excavator Rental Market Revenue, 2010-2021F ($ Million)

Figure 21 Saudi Arabia Wheeled Excavator Rental Trends ($ Per Unit)

Figure 22 Saudi Arabia Mini Excavator Rental Market Rental Revenue, 2010-2021F ($ Million)

Figure 23 Saudi Arabia Mini Excavator Rental Trends($ Per Unit)

Figure 24 Saudi Arabia Loader Rental Market Revenues, 2010-2014 ($ Million)

Figure 25 Saudi Arabia Loader Rental Market Revenues, 2015-2021F ($ Million)

Figure 26 Saudi Arabia Backhoe Loader Rental Market Revenue, 2010-2021F ($ Million)

Figure 27 Saudi Arabia Backhoe Loader Rental Trends ($ Per Unit)

Figure 28 Saudi Arabia Wheeled Loader Rental Market Revenue, 2010-2021F ($ Million)

Figure 29 Saudi Arabia Wheeled Loader Rental Trends ($ Per Unit)

Figure 30 Saudi Arabia Skid Steer Loader Rental Market Revenue, 2010-2021F ($ Million)

Figure 31 Saudi Arabia Skid Steer Loader Rental Trends ($ Per Unit)

Figure 32 Saudi Arabia Construction Tractor Rental Market Revenues, 2010-2014 ($ Million)

Figure 33 Saudi Arabia Construction Tractor Rental Market Revenues, 2015-2021F ($ Million)

Figure 34 Saudi Arabia Construction Tractor Rental Market Share, By Types

Figure 35 Saudi Arabia Bulldozer Rental Market Revenue, 2010-2021F ($ Million)

Figure 36 Saudi Arabia Bulldozer / Crawler Tractor Rental Trend ($ Per Unit)

Figure 37 Saudi Arabia Wheeled Tractor Rental Market Revenue, 2010-2021F ($ Million)

Figure 38 Saudi Arabia Wheeled Tractor Rental Trend ($ Per Unit)

Figure 39 Saudi Arabia Motor Grader Rental Market Revenue, 2010-2021F ($ Million)

Figure 40 Saudi Arabia Motor Grader Rental Trend ($ Per Unit)

Figure 41 Saudi Arabia Excavator Market Revenue, By Application, 2014 & 2021 (%)

Figure 42 Saudi Arabia Loader Market Revenue, By Application, 2014 & 2021 (%)

Figure 43 Saudi Arabia Construction Tractor Rental Market Revenue, By Application, 2014 & 2021 (%)

Figure 44 Saudi Arabia Motor Grader Rental Market Revenue, By Application, 2014 & 2021 (%)

Figure 45 Saudi Arabia Southern Earthmoving Equipment Rental Market Revenue 2010-2014 ($ Million)

Figure 46 Saudi Arabia Southern Earthmoving Equipment Rental Market Revenue 2015-21F ($ Million)

Figure 47 Saudi Arabia Eastern Earthmoving Equipment Rental Market Revenue 2010-2014 ($ Million)

Figure 48 Saudi Arabia Eastern Earthmoving Equipment Rental Market Revenue 2015-21 ($ Million)

Figure 49 Saudi Arabia Western Earthmoving Equipment Rental Market Revenue 2010-2014 ($ Million)

Figure 50 Saudi Arabia Western Earthmoving Equipment Rental Market Revenue 2015-21F ($ Million)

Figure 51 Saudi Arabia Central Earthmoving Equipment Rental Market Revenue 2010-2014 ($ Million)

Figure 52 Saudi Arabia Central Earthmoving Equipment Rental Market Revenue 2015-21F ($ Million)

Figure 53 Saudi Arabia Excavator Rental Market Revenue Share, By Company, 2014

Figure 54 Saudi Arabia Wheeled Loader Rental Market Revenue Share, By Company,2014

Figure 55 Saudi Arabia Bulldozer Rental Market Revenue Share, By Company, 2014

Figure 56 Saudi Arabia Motor Grader Rental Market Revenue Share, By Company, 2014

List of Tables

Table 1 Saudi Arabia Major Construction Activities

Table 2 Wheeled Excavator Rental Price ($ Per Unit/ Month)

Table 3 Mini Excavator Rental Price ($ Per Unit/ Month)

Table 4 Backhoe Loader Rental Price ($ Per Unit/ Month)

Table 5 Wheeled Loader Rental Price ($ Per Unit/ Month)

Table 6 Skid Steer Loader Rental Price ($ Per Unit/ Month)

Table 7 Bulldozer/Crawler Tractor Rental Price ($ Per Unit/ Month)

Table 8 Motor Grader Rental Price ($ Per Unit/ Month)

Table 9 Saudi Arabia Excavator Rental Market Revenue, By Application, 2010-2014 ($ Million)

Table 10 Saudi Arabia Excavator Rental Market Revenue, By Application, 2015-21 ($ Million)

Table 11 Saudi Arabia Loader Rental Market Revenue, By Application, 2010-2014 ($ Million)

Table 12 Saudi Arabia Loader Rental Market Revenue, By Application, 2025-21 ($ Million)

Table 13 Saudi Arabia Construction Tractor Rental Market Revenue, By Application, 2010-2014 ($ Million)

Table 14 Saudi Arabia Construction Tractor Rental Market Revenue, By Application, 2015-21 ($ Million)

Table 15 Saudi Arabia Motor Grader Rental Market Revenue, By Application, 2010-2014 ($ Million)

Table 16 Saudi Arabia Motor Grader Rental Market Revenue, By Application, 2015-21 ($ Million)

Table 17 Saudi Arabia Excavator Market Revenues of Top Players, 2014 ($ Million)

Table 18 Saudi Arabia Wheeled Loaders Rental Market Revenues of Top Players, 2014 ($ Million)

Table 19 Saudi Arabia Bulldozer Rental Market Revenues of Top Players, 2014 ($ Million)

Table 20 Saudi Arabia Motor Grader Market Revenues of Top Players, 2014 ($ Million)

Saudi Arabia is one of the key growing Earthmoving Equipment Rental Market. Growing construction and mining industries, urbanization rate and increasing tourism in the country are the key factors that are encouraging the market for rental earthmoving equipment in Saudi Arabia.

In the country, the market is primarily driven by excavator followed by construction tractor and loaders. However during forecast period, construction tractor market share is expected to decline loader.

The key players in the market include: Bin Quraya, Zahid, ISDC, Al Shuwayer Group and Nabil Talib Contracting Est., Arabtec Construction Machinery (ACM) and Al Reyami Construction Equipment Rental.

“Saudi Arabia Earthmoving Equipment Rental Market (2015-2021)“report estimates and forecast overall Saudi Arabia Earthmoving Equipment Rental market by revenue, by application, and by regions. The report also gives the insights on competitive landscape, market share by companies, market trends, company profiles, market drivers and restraints

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero