Saudi Arabia Software as a Service (SaaS) Market (2018-2024) | Trends, Value, Size, Companies, Industry, Share, Forecast, Revenue, Growth, Outlook & Analysis

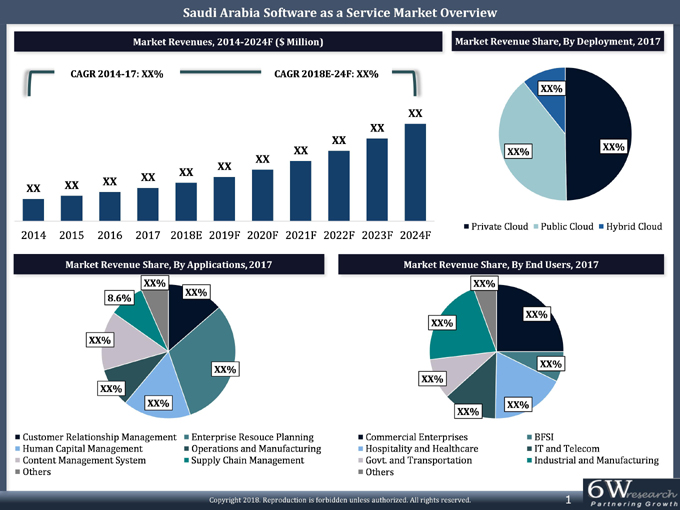

Market Forecast By Deployment (Private Cloud, Public Cloud, and Hybrid Cloud), By End Users (Commercial Enterprises, BFSI (Banking, Financial Services and Insurance), Hospitality and Healthcare, Industrial and Manufacturing, Government and Transportation, IT & Telecommunications and Others including Power Utilities and Water Treatment Plants), By Applications (Customer Relationship Management, Human Capital Management, Enterprise Resource Planning, Operations and Manufacturing, Content Management System, Supply Chain Management and Others including Security Management and Transaction Processing), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000525 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 160 | No. of Figures: 73 | No. of Tables: 16 |

The growth of the Saudi Arabia Software as a Service (SaaS) market in the coming years is expected to be driven by several factors such as an increasing number of SMEs, rising spending on IT infrastructure, and the growing number of hotels, healthcare facilities, and commercial offices in the country.

According to 6Wresearch, Saudi Arabia SaaS market size is projected to grow at a CAGR of 16.8% during 2018-24. The government of Saudi Arabia is focusing heavily on the strengthening of the non-oil sector in the country. As a result, social infrastructure development in the country is expected to witness significant growth in the coming years. Further, under the Saudi Vision 2030 initiative, special emphasis is also being put on the strengthening of the IT infrastructure in the country. Additionally, with global technological giants, such as Amazon and Google, looking to set up their data centers and expand their footprint in the Middle East in the future, the use of SaaS solutions is predicted to become more widespread in the country in the coming years.

The commercial enterprises and industrial & manufacturing end-user segments held the largest Saudi Arabia SaaS market share in 2017. Government efforts to strengthen the non-oil economy of the country would witness several sectors flourish in the coming years, including hospitality, healthcare, manufacturing, and banking, thus creating more avenues for the application of SaaS solutions during the forecast period.

The Saudi Arabia SaaS market report comprehensively covers the Saudi Arabia Software as a Service market by deployment, end-users, applications, and regions. The Saudi Arabia SaaS market outlook report provides an unbiased and detailed analysis of the Saudi Arabia SaaS market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Software As A Service (SaaS) Market for the software collective the revenue shares. The government in the coming years' efforts non-oily economy, hospitality, banking creating more avenues what are ongoing trends, high growth areas. Saudi Arabia software as a service market planned to increase the economy momentum such as hotels, healthcare facilities, small and media enterprises, and resorts. They provide the cloud service for growing interest and investment in Saudi Arabia software as a service market going to increase in the demand for software service solutions in the region in upcoming years. The government focuses to increase the strengthening of Saudi Arabia through the non-oil sector in the country. The social infrastructure development help in an increase in the growth of the country under the Saudi vision and strengthening put on the IT infrastructure in Saudi Arabia software as a service market.

There are continuous social infrastructural is the development by followed increasing emphasis in the Saudi Arabian government by strengthening the non-oil sector in the country that is the primary factor for the growth of Saudi Arabia software as a service market. Saudi Arabia executive the cloud-First Policy and making the public more aware of the cloud functionality and encourage the people to shift their work to cloud-based solutions for improvement of the work, innovation, reliability, and security. Due to this demand increase in Saudi Arabia for the software as a service market. In addition, the government also launching different projects for the development of the country such as digital initiatives in Saudi Arabia.

Key Highlights of the Report:

• Saudi Arabia SaaS Market Overview

• Saudi Arabia SaaS Market Outlook

• Saudi Arabia SaaS Market Forecast

• Historical Data of Saudi Arabia Software as a Service Market Revenues for the Period, 2014-2017

• Saudi Arabia SaaS Market Size & Saudi Arabia SaaS Market Forecast of Revenues, until 2024

• Historical Data of Saudi Arabia SaaS Market Revenues for the Period 2014-2017, By Deployment

• Market Size & Forecast of Saudi Arabia SaaS Market Revenues until 2024, By Deployment

• Historical Data of Saudi Arabia Software as a Service Market Revenues for the Period, 2014-2017, By End Users

• Market Size & Forecast of Saudi Arabia Software as a Service Market Revenues until 2024, By End Users

• Historical Data of Saudi Arabia Software as a Service Market Revenues for the Period, 2014-2017, By Applications

• Market Size & Forecast of Saudi Arabia Software as a Service Market Revenues until 2024, By Applications

• Historical & Forecast Data of Saudi Arabia Enterprise Resource Planning Software as a Service Market Revenues for the Period, 2014-2024

• Historical & Forecast Data of Saudi Arabia Enterprise Resource Planning Software as a Service Market Revenues for the Period 2014-2024, By Deployment

• Historical & Forecast Data of Saudi Arabia Enterprise Resource Planning Software as a Service Market Revenues for the Period 2014-2024, By End Users

• Historical & Forecast Data of Saudi Arabia Enterprise Resource Planning Software as a Service Market Revenues for the Period 2014-2024, By Regions

• Historical Data of Saudi Arabia SaaS Market Revenues for the Period 2014-2017, By Regions

• Market Size & Forecast of Saudi Arabia SaaS Market Revenues until 2024, By Regions

• Overview & Analysis of Saudi Arabia IT Hardware and Networking Security Market

• Overview & Analysis of Saudi Arabia Networking Security Market, By Technology

• Overview & Analysis of Saudi Arabia Networking Security Market, By Applications

• Overview & Analysis of Saudi Arabia Software as a Service Mobile Applications Market

• Market Drivers and Restraints

• Saudi Arabia SaaS Market Trends and Developments

• Saudi Arabia SaaS Market Overview on Competitive Landscape

• Saudi Arabia SaaS Market Share, By Players

• Company Profiles

• Strategic Recommendations

Markets Covered

The Saudi Arabia SaaS market report provides a detailed analysis of the following market segments:

• By Deployment:

o Private Cloud

o Public Cloud

o Hybrid Cloud

• By End Users:

o Commercial Enterprises

o BFSI (Banking, Financial Services, and Insurance)

o Hospitality and Healthcare

o Industrial and Manufacturing

o Government and Transportation

o IT & Telecommunications

o Others (Power Utilities, Water Treatment Plants)

• By Applications:

o Customer Relationship Management

o Human Capital Management

o Enterprise Resource Planning

o Operations and Manufacturing

o Content Management System

o Supply Chain Management

o Others (Security Management, Transaction Processing)

• By Regions:

o Eastern

o Western

o Central

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3. Saudi Arabia Software as a Service Market Overview

3.1 Saudi Arabia Country Overview

3.2 Saudi Arabia Software as a Service Market Revenues (2014 - 2024F)

3.3 Saudi Arabia Software as a Service Market Revenue Share, By Deployment (2017 & 2024F)

3.4 Saudi Arabia Software as a Service Market Revenue Share, By Applications (2017 & 2024F)

3.5 Saudi Arabia Software as a Service Market Revenue Share, By End Users (2017 & 2024F)

3.6 Saudi Arabia Software as a Service Market Revenue Share, By Regions (2017 & 2024F)

3.7 Saudi Arabia Software as a Service Industry Life Cycle (2017)

3.8 Saudi Arabia Software as a Service Porter's Five Forces (2017)

4. Saudi Arabia Software as a Service Market Dynamics

4.1 Impact Analysis

4.2 Market Drivers

4.3 Market Restraints

5. Saudi Arabia Software as a Service Market Trends

5.1 Custom SaaS Solutions

5.2 Mobile SaaS Solutions

5.3 Machine Learning and Artificial Intelligence

6. Saudi Arabia Software as a Service Market Overview, By Deployment

6.1 Saudi Arabia Public Cloud Software as a Service Market Revenues (2014 - 2024F)

6.2 Saudi Arabia Private Cloud Software as a Service Market Revenues (2014 - 2024F)

6.3 Saudi Arabia Hybrid Cloud Software as a Service Market Revenues (2014 - 2024F)

7. Saudi Arabia Software as a Service Market Overview, By End Users

7.1 Saudi Arabia Commercial Enterprises Software as a Service Market Revenues (2014 - 2024F)

7.1.1 Saudi Arabia Commercial Sector Outlook

7.2 Saudi Arabia Industrial and Manufacturing Software as a Service Market Revenues (2014 - 2024F)

7.2.1 Saudi Arabia Oil & Gas Sector Outlook

7.2.2 Saudi Arabia Manufacturing Sector Overview

7.3 Saudi Arabia Hospitality and Healthcare Software as a Service Market Revenues (2014 - 2024F)

7.3.1 Saudi Arabia Hospitality and Healthcare Sector Overview

7.3.2 Saudi Arabia Hospitality Sector Outlook

7.4 Saudi Arabia Banking, Financial Services, and Insurance Software as a Service Market Revenues (2014 - 2024F)

7.4.1 Saudi Arabia Banking Sector Outlook

7.5 Saudi Arabia IT and Telecommunication Software as a Service Market Revenues (2014 - 2024F)

7.5.1 Saudi Arabia IT and Telecommunication Sector Outlook

7.6 Saudi Arabia Government and Transportation Software as a Service Market Revenues (2014 - 2024F)

7.6.1 Saudi Arabia Transportation Infrastructure Sector Outlook

7.6.2 Saudi Arabia Education Sector Outlook

7.7 Saudi Arabia Other End Users Software as a Service Market Revenues (2014 - 2024F)

7.7.1 Saudi Arabia Power Sector Overview

7.7.2 Saudi Arabia Chemical & Petrochemical Sector Overview

8. Saudi Arabia Software as a Service Market Overview, By Applications

8.1 Saudi Arabia Customer Relationship Management Application Software as a Service Market

Revenues (2014 - 2024F)

8.2 Saudi Arabia Human Capital Management Application Software as a Service Market Revenues (2014 - 2024F)

8.3 Saudi Arabia Content Management System Application Software as a Service Market Revenues (2014 - 2024F)

8.4 Saudi Arabia Enterprise Resource Planning Application Software as a Service Market Revenues (2014 - 2024F)

8.5 Saudi Arabia Supply Chain Management Application Software as a Service Market Revenues (2014 - 2024F)

8.6 Saudi Arabia Operations and Manufacturing Application Software as a Service Market Revenues (2014 - 2024F)

8.7 Saudi Arabia Other Applications Software as a Service Market Revenues (2014 - 2024F)

9. Saudi Arabia Software as a Service Market Overview, By Regions

9.1 Saudi Arabia Software as a Service Market Revenues, By Regions (2014 - 2024F)

9.2 Regional Industrial and Manufacturing Opportunities

9.3 Regional Healthcare Sector Overview

10. Saudi Arabia Enterprise Resource Planning (ERP) Application Software as a Service Market Overview

10.1 Saudi Arabia ERP Application SaaS Market Drivers

10.2 Saudi Arabia ERP Application SaaS Market Restraints

10.3 Saudi Arabia ERP Application SaaS Market Trends

10.4 Saudi Arabia ERP Application Software as a Service Market Revenue Share, By Deployment (2017 & 2024F)

10.5 Saudi Arabia ERP Application Software as a Service Market Revenues, By Deployment (2014 - 2024F)

10.6 Saudi Arabia ERP Application Software as a Service Market Revenue Share, By End Users (2017 & 2024F)

10.7 Saudi Arabia ERP Application Software as a Service Market Revenues, By End Users (2014 - 2024F)

10.8 Saudi Arabia ERP Application Software as a Service Market Revenue Share, By Regions (2017 & 2024F)

10.9 Saudi Arabia ERP Application Software as a Service Market Revenues, By Regions (2014 - 2024F)

10.10 Saudi Arabia ERP Application Software as a Service Market Revenues, By Company, 2017

10.11 Saudi Arabia ERP Application Software as a Service Market Opportunity Assessment, By End Users, 2024F

11. Saudi Arabia IT Hardware and Networking Security Market Overview

11.1 Saudi Arabia IT Hardware Market Revenues (2014 - 2024F)

11.2 Saudi Arabia IT Hardware Market Drivers

11.3 Saudi Arabia IT Hardware Market Restraints

11.4 Saudi Arabia IT Hardware Market - Opportunity Assessment, By Sectors

11.5 Saudi Arabia IT Hardware Market - Competitive Positioning, 2017

11.6 Saudi Arabia Network Security Market Revenues (2014 - 2024F)

11.7 Saudi Arabia Network Security Market Revenues, By Technology (2014 - 2024F)

11.8 Saudi Arabia Network Security Market Revenues, By End Users (2014 - 2024F)

11.9 Saudi Arabia Network Security Market - Competitive Positioning, 2017

11.10 Saudi Arabia Network Security Market - Opportunity Assessment, By End Users, 2024F

12. Saudi Arabia Mobile Software as a Service Market Overview

12.1 Saudi Arabia Mobile Software as a Service Market Drivers

12.2 Saudi Arabia Mobile Software as a Service Market Restraints

12.3 Saudi Arabia Mobile Software as a Service Market Trends

12.4 Saudi Arabia Mobile Software as a Service Market - Recent Developments

13. Saudi Arabia Cloud Market Dynamics

13.1 SWOT Analysis - Software as a Service Industry

13.2 Saudi Arabia Software as a Service Market - Ecosystem and Value Chain Analysis

13.3 Saudi Arabia Cloud Services Market Revenues (2014 - 2024F)

13.4 Factors Driving Cloud Adoption in Saudi Arabia

13.5 Key Processes Being Delivered By Software as a Service Solutions

14. Saudi Arabia Software as a Service Market - Key Performance Indicators

14.1 Saudi Arabia Government Spending Outlook

14.2 Major Commercial Infrastructure Projects in Saudi Arabia

15. Saudi Arabia Software as a Service Market - Opportunity Assessment

15.1 Saudi Arabia Software as a Service Market - Opportunity Assessment, By Deployment, 2024F

15.2 Saudi Arabia Software as a Service Market - Opportunity Assessment, By Applications, 2024F

15.3 Saudi Arabia Software as a Service Market - Opportunity Assessment, By End Users, 2024F

16. Competitive Landscape

16.1 Saudi Arabia Software as a Service Market Revenues, By Company, 2017

16.2 Competitive Benchmarking, By Applications

17. Company Profiles

17.1 Microsoft Corporation

17.2 SAP SE

17.3 Oracle Corporation

17.4 Cisco Systems, Inc.

17.5 Salesforce.Com Inc

17.6 Infor Inc.

17.7 Amazon Web Services, Inc.

17.8 International Business Machines Corporation

17.9 VMware, Inc.

17.10 SolutionDots Systems Ltd.

18. Strategic Recommendations

19. Disclaimer

List of Figures

1. Saudi Arabia Software as a Service Market Revenues, 2014-2024F ($ Million)

2. Saudi Arabia Software as a Service Market Revenue Share, By Deployment, 2017 & 2024F

3. Saudi Arabia Software as a Service Market Revenue Share, By Applications, 2017 & 2024F

4. Saudi Arabia Software as a Service Market Revenue Share, By End Users, 2017 & 2024F

5. Saudi Arabia Software as a Service Market Revenue Share, By Regions, 2017 & 2024F

6. Saudi Arabia Software as a Service Market - Industry Life Cycle, 2017

7. AI Projected Global Revenue Distribution, By Verticals, 2017-2025F

8. Saudi Arabia Public Cloud Software as a Service Market Revenues, 2014-2024F ($ Million)

9. Saudi Arabia Private Cloud Software as a Service Market Revenues, 2014-2024F ($ Million)

10. Saudi Arabia Hybrid Cloud Software as a Service Market Revenues, 2014-2024F ($ Million)

11. Saudi Arabia Commercial Enterprises Software as a Service Market Revenues, 2014-2024F ($ Million)

12. Upcoming Economic Cities in Saudi Arabia

13. Riyadh Office Supply, 2014-2019F ('000 Sq. m.)

14. Jeddah Office Supply, 2014-2019F ('000 Sq. m.)

15. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.)

16. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.)

17. Saudi Arabia Industrial and Manufacturing Software as a Service Market Revenues, 2014-2024F ($ Million)

18. Total Number of Manufacturing Facilities in Saudi Arabia, Q1-Q3 2017

19. Saudi Arabia Hospitality and Healthcare Software as a Service Market Revenues, 2014-2024F ($ Million)

20. Upcoming Healthcare Projects in Saudi Arabia

21. Riyadh Hotel Supply, 2014-2019F (No. of Rooms)

22. Jeddah Hotel Supply, 2014-2019F (No. of Rooms)

23. Upcoming Medical City Projects in Saudi Arabia

24. Saudi Arabia Banking, Financial Services, and Insurance Software as a Service Market Revenues,

2014-2024F ($ Million)

25. Saudi Arabia IT and Telecommunication Software as a Service Market Revenues, 2014-2024F ($ Million)

26. Saudi Arabia Government and Transportation Software as a Service Market Revenues, 2014-2024F ($ Million)

27. Saudi Arabia Private K-12 Education Sector Market Size ($ Billion)

28. Saudi Arabia Other End Users Software as a Service Market Revenues, 2014-2024F ($ Million)

29. Upcoming Power Plant Projects in Saudi Arabia

30. Production of Refined Products in Saudi Arabia, 2014-2016 (Million Barrels)

31. Saudi Arabia Customer Relationship Management Application Software as a Service Market Revenues,

2014-2024F ($ Million)

32. Saudi Arabia Human Capital Management Application Software as a Service Market Revenues,

2014-2024F ($ Million)

33. Saudi Arabia Content Management System Application Software as a Service Market Revenues,

2014-2024F ($ Million)

34. Saudi Arabia Enterprise Resource Planning Application Software as a Service Market Revenues,

2014-2024F ($ Million)

35. Saudi Arabia Supply Chain Management Application Software as a Service Market Revenues,

2014-2024F ($ Million)

36. Saudi Arabia Operations and Manufacturing Application Software as a Service Market Revenues,

2014-2024F ($ Million)

37. Saudi Arabia Other Application as a Service Market Revenues, 2014-2024F ($ Million)

38. Central Saudi Arabia Software as a Service Market Revenues, 2014-2024F ($ Million)

39. Western Saudi Arabia Software as a Service Market Revenues, 2014-2024F ($ Million)

40. Eastern Saudi Arabia Software as a Service Market Revenues, 2014-2024F ($ Million)

41. Southern Saudi Arabia Software as a Service Market Revenues, 2014-2024F ($ Million)

42. Saudi Arabia Number of Under Construction Manufacturing Factories as on Q1, 2017

43. Riyadh Industrial Cities Composition, 2014 & 2018

44. GCC SME Sector Value, 2017 - 2022F ($ Billion)

45. Saudi Arabia SME Sector GDP Contribution, 2016 - 2030F

46. Global Cloud ERP Market Size, 2016 - 2021F ($ Billion)

47. Saudi Arabia ERP Application Software as a Service Market Revenue Share, By Deployment, 2017 & 2024F

48. Saudi Arabia ERP Application Software as a Service Market Revenue Share, By End Users, 2017 & 2024F

49. Saudi Arabia ERP Application Software as a Service Market Revenue Share, By Regions, 2017 & 2024F

50. Saudi Arabia ERP Application Software as a Service Market Revenues, By Company, 2017

51. Saudi Arabia ERP Application Software as a Service Market Opportunity Assessment, By End Users, 2024F

52. Saudi Arabia IT Hardware Market Revenues, 2014-2024F ($ Billion)

53. PCs/Desktops sold in Saudi Arabia, 2014 - 2018E (Million Units)

54. Saudi Arabia IT Hardware Use Penetration Rate By Sectors, 2017

55. Saudi Arabia IT Hardware Market Revenues, By Company, 2017

56. Saudi Arabia Network Security Market Revenues, 2014-2024F ($ Billion)

57. Saudi Arabia Firewall / IP Sec VPN Network Security Market Revenues, 2014-2024F ($ Million)

58. Saudi Arabia SSL VPN Network Security Market Revenues, 2014-2024F ($ Million)

59. Saudi Arabia IDS / IPS Network Security Market Revenues, 2014-2024F ($ Million)

60. Saudi Arabia BFSI Network Security Market Revenues, 2014-2024F ($ Million)

61. Saudi Arabia IT & Telecom Network Security Market Revenues, 2014-2024F ($ Million)

62. Saudi Arabia Government Sector Network Security Market Revenues, 2014-2024F ($ Million)

63. Saudi Arabia Other End Users Network Security Market Revenues, 2014-2024F ($ Million)

64. Saudi Arabia Network Security Market Revenues, By Company, 2017

65. Saudi Arabia Network Security Market Opportunity Assessment, By End Users, 2024F

66. Saudi Arabia Cloud Services Market Revenues, 2014-2024F ($ Million)

67. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2015-2023F (SAR Billion)

68. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion)

69. Saudi Arabia Software as a Service Market Opportunity Assessment, By Deployment, 2024F

70. Saudi Arabia Software as a Service Market Opportunity Assessment, By Applications, 2024F

71. Saudi Arabia Software as a Service Market Opportunity Assessment, By End Users, 2024F

72. Saudi Arabia Software as a Service Market Revenues, By Company, 2017

73. Saudi Arabia IT Spending, 2016 - 2018E

List of Tables

1. Saudi Arabia Under Construction Commercial Building Projects

2. Saudi Arabia Under Construction Hospitality Projects as of Q2 2018

3. Saudi Arabia Upcoming Oil & Gas Projects

4. Under Construction Manufacturing Units in Saudi Arabia, Q4 2017 & Q1 2018

5. Upcoming Manufacturing Plants in Saudi Arabia

6. Upcoming Hotel Projects in Saudi Arabia

7. Saudi Arabia Ministry of Communications & Information Technology Strategic Objectives

Under the National Transformation Program

8. Saudi Arabia Major Upcoming Infrastructure Projects

9. Saudi Arabia Upcoming Petrochemical Projects

10. Upcoming Manufacturing Facilities in Saudi Arabia

11. Saudi Arabia Healthcare Physical Resources, 2017

12. Saudi Arabia ERP Application Software as a Service Market Revenues, By Deployment, 2014-2024F ($ Million)

13. Saudi Arabia ERP Application Software as a Service Market Revenues, By End Users, 2014-2024F ($ Million)

14. Saudi Arabia ERP Application Software as a Service Market Revenues, By Regions, 2014-2024F ($ Million)

15. Saudi Arabia Budget Expenses By Sectors, 2017 and 2018 ($ Billion)

16. List of Major Commercial Infrastructure Projects in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines