Saudi Arabia UPS Market (2017-2023) | Size, Revenue, Industry, Value, Companies, Analysis, Outlook, Trends, Forecast, Share & Growth

Market Forecast By Rating (Less than 5 KVA, 5.1 KVA - 20 KVA, 20.1 KVA - 50 KVA, 50.1 KVA - 200 KVA and 200.1 KVA & Above), By Applications (Commercials, Residential and Industrial), By Regions (Central, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC000417 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 115 | No. of Figures: 50 | No. of Tables: 4 |

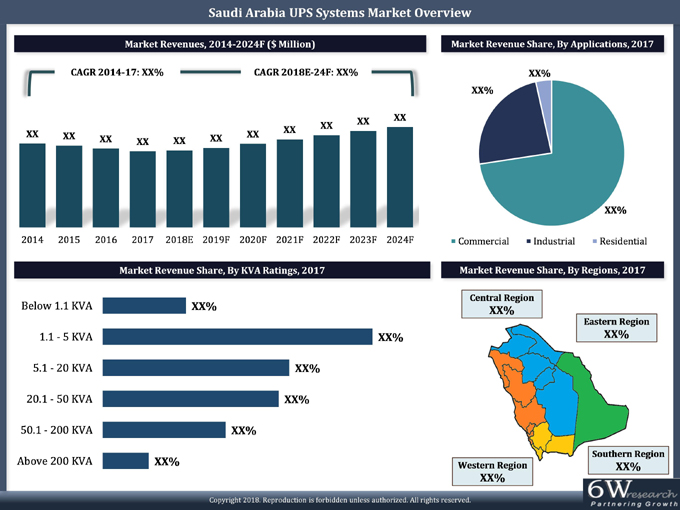

Saudi Arabia is one of the key countries in the Middle East UPS market. Growth in Saudi Arabia UPS market is buoyed by several factors such as the rising number of SMEs, growing IT spending coupled with increasing acceptance among an emerging number of data centers across the Kingdom, thus boosting Saudi Arabia UPS market revenues in the coming years.According to 6Wresearch, Saudi Arabia UPS market size is projected to grow at a CAGR of 4.0% during 2017-23. Saudi Arabia is likely to ramp up its spending on data centers. As a matter of fact, the country's data center market has been growing tremendously over the past few years reaching over $220 million in 2016. Datacenter spending is poised to grow at a CAGR of 10.3% by 2019. Additionally, growing investment in commercial applications primarily in hospitality and BFSI is anticipated to drive sales of UPS systems in Saudi Arabia.

Amongst all types, UPS systems with a rating of less than 5kVA captured a significant share in the overall Saudi Arabia UPS market share and is expected to maintain their market leadership over the forecast period as well. The commercial application was the key revenue-generating application in Saudi Arabia UPS market. Commercial offices, BFSI, and hospitality segments were the top performers in a commercial application. These commercial segments are further anticipated to drive the sales of UPS systems in Saudi Arabia over the next six years.

Some of the major players in the Saudi Arabia UPS market include ABB Ltd, Arabian Power Electronics Company, Eaton Corporation Plc, Schneider Electric SE, Socomec Middle East, and Vertiv Co.

Saudi Arabia UPS Market report thoroughly covers the UPS market by kVA rating, applications, and regions. Saudi Arabia UPS market outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia UPS market trends, opportunities/ high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia UPS Market research is based on the government effort on the country's non-oil sectors. According to the research, Saudi Arabia till 2030 construct new types of hotels, education institutes, retail outlets, industrial spaces, and power plant projects, and much more in upcoming years. In the forecast, period development takes place in different sector such as the commercial and industrial sector in the Saudi Arabia UPS Market.

Key Highlights of the Report:

• Saudi Arabia UPS Market Overview

• Saudi Arabia UPS Market Outlook

• Saudi Arabia UPS Market Forecast

• Historical data of Global UPS Market for the Period 2014-2016.

• Market Size & Forecast of Global UPS Market until 2023.

• Saudi Arabia UPS Market Size and Saudi Arabia UPS Market Forecast Revenues & Volume until 2023

• Historic data of Saudi Arabia Less Than 5 kVA UPS Market Revenues & Volume 2014-2016.

• Market Size & Forecast of Saudi Arabia Less Than 5 kVA UPS Market Revenues & Volume Market until 2023

• Historic data of Saudi Arabia 5.1 kVA - 20 kVA UPS Market Revenues & Volume 2014-2016.

• Market Size & Forecast of Saudi Arabia 5.1 kVA - 20 kVA UPS Market Revenues & Volume Market until 2023

• Historic data of Saudi Arabia 20.1 kVA - 50 kVA UPS Market Revenues & Volume 2014-2016.

• Market Size & Forecast of Saudi Arabia 20.1 kVA - 50 kVA UPS Market Revenues & Volume Market until 2023

• Historic data of Saudi Arabia 50.1 kVA - 200 kVA UPS Market Revenues & Volume 2014-2016.

• Market Size & Forecast of Saudi Arabia 50.1 kVA - 200 kVA UPS Market Revenues & Volume Market until 2023

• Historic data of Saudi Arabia 200 kVA & Above UPS Market Revenues & Volume 2014-2016.

• Market Size & Forecast of Saudi Arabia 200 kVA & Above UPS Market Revenues & Volume Market until 2023

• Historical data and Forecast of Saudi Arabia UPS Market Revenues, By Applications until 2023

• Historical data and Forecast of Saudi Arabia UPS Market Revenues, By Regions until 2023

• Saudi Arabia UPS Market Drivers and Restraints

• Saudi Arabia UPS Market Trends and Developments.

• Saudi Arabia UPS Market Overview on Competitive Benchmarking

• Saudi Arabia UPS Market Share by Players.

• Company Profiles.

• Key Strategic Pointers.

Markets Covered

Saudi Arabia UPS market report provides a detailed analysis of the following market segments:

• By Ratings:

o Less than 5 kVA

o 5.1 kVA - 20 kVA

o 20.1 kVA - 50 kVA

o 50.1 kVA - 200 kVA

o 200 kVA & Above

• By Applications:

o Commercial

o Residential

o Industrial

• By Regions:

o Central

o Western

o Southern

o Eastern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumption

3. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview

3.1 Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Revenues (2014-2024F)

3.2 Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Region (2017)

4. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview

4.1 Saudi Arabia Country Overview

4.2 Saudi Arabia Uninterruptible Power Supply Systems Market Revenues (2014-2024F)

4.3 Saudi Arabia Uninterruptible Power Supply Systems Market Volume (2014-2024F)

4.4 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By KVA Rating (2017 & 2024F)

4.5 Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By KVA Rating (2017 & 2024F)

4.6 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Applications (2017 & 2024F)

4.7 Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By Applications (2017 & 2024F)

4.8 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Regions (2017 & 2024F)

4.9 Saudi Arabia Uninterruptible Power Supply Systems Market Industry Life Cycle (2017)

4.10 Saudi Arabia Uninterruptible Power Supply Systems Market Porter's Five Forces (2017)

5. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Trends

6.1 Green UPS Systems

6.1 Modular UPS Systems

7. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview, By KVA Rating

7.1. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.1.1 Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.2 Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.2.1 Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.3. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.3.1 Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.4 Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.4.1 Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.5. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.5.1 Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.6 Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.6.1 Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.7. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.7.1 Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.8 Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.8.1 Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.9. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.9.1 Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.10 Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.10.1 Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.11. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.11.1 Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.12 Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.12.1 Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.13 Saudi Arabia Uninterruptible Power Supply Systems Market Price Trend (2014 - 2024F)

8. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview, By Applications

8.1 Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

8.1.1 Saudi Arabia Commercial Sub-Segments Uninterruptible Power Supply Systems

Market Revenues (2014 - 2024F)

8.2 Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

8.2.1 Saudi Arabia Commercial Sector Overview

8.3 Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

8.4 Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

8.4.1 Saudi Arabia Industrial Sector Overview

8.5 Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

8.6 Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

8.6.1 Saudi Arabia Residential Sector Overview

9. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview, By Regions

9.1 Saudi Arabia Central Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.2 Saudi Arabia Eastern Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.3 Saudi Arabia Southern Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.4 Saudi Arabia Western Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.5 Saudi Arabia Power Sector Overview, By Regions

10. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Key Performance Indicators

10.1 Saudi Arabia Power Sector Outlook

10.2 Saudi Arabia Government Spending Outlook

10.3 Saudi Arabia Construction Market Outlook

10.4 Major Infrastructure Projects in Saudi Arabia

11. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Opportunity Assessment

11.1 Saudi Arabia Uninterruptible Power Supply Systems Market Opportunity Assessment, By KVA Rating

11.2 Saudi Arabia Uninterruptible Power Supply Systems Market Opportunity Assessment, By Application

12. Competitive Landscape

12.1 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Company, 2017

12.2 Competitive Benchmarking, By KVA Rating

13. Company Profiles

13.1 Schneider Electric SE

13.2 Vertiv Co.

13.3 ABB Ltd.

13.4 Eaton Corporation Plc

13.5 Socomec Middle East

13.6 Arabian Power Electronics Company

13.7 Tripp Lite

13.8 Legrand SNC FZE

13.9 Riello UPS Middle East Fz-LLC

13.10 General Electric Company

14. Key Strategic Recommendations

15. Disclaimer

List of Figures

1. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Revenue, 2014-2024F ($ Billion)

2. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Region (2017)

3. Saudi Arabia Energy Sales (GWh), By Verticals (2016)

4. Actual and Projected Peak Loads, 2010-2020F (In GW)

5. Saudi Arabia Electricity Consumption, By KWh/ Capita, 2012-2016

6. Saudi Arabia Residential Electricity Consumption, By KWh/ Capita, 2012-2016

7. Saudi Arabia Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

8. Saudi Arabia Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

9. Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By KVA Rating, 2017 & 2024F

10. Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By KVA Rating, 2017 & 2024F

11. Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Applications, 2017 & 2024F

12. Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By Applications, 2017 & 2024F

13. Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Regions, 2017 & 2024F

14. Saudi Arabia Uninterruptible Power Supply Systems Market- Industry Life Cycle 2017

15. Saudi Vision 2030 - Key Targets

16. Saudi Arabia IT Services Market and Computer Hardware Sales ($ Billion)

17. Saudi Arabia Data Center Spending (2014-2019) ($ Million)

18: Upcoming Economic Cities in Saudi Arabia

19. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million)

20. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion)

21. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

22. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

23. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

24. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

25. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

26. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

27. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

28. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

29. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

30. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Units)

31. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

32. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Units)

33. Saudi Arabia Uninterruptible Power Supply Systems Market Price Trend, 2014-2024F ($)

34. Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Revenues,

2014-2024F ($ Million)

35. Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Volume,

2014-2024F (Thousand Units)

36. Saudi Arabia Number of ATMs Per 100 Thousand Adults, 2010-2016

37. Saudi Arabia Number of Commercial Bank Branches Per 100 Thousand Adults, 2010-2016

38. Riyadh Office Supply, 2014-2019F ('000 Sq. m.)

39. Jeddah Office Supply, 2014-2019F ('000 Sq. m.)

40. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.)

41. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.)

42. Riyadh Hotel Supply, 2014-2019F (No. of Rooms)

43. Jeddah Hotel Supply, 2014-2019F (No. of Rooms)

44. Major Upcoming Healthcare Projects in Saudi Arabia

45. Saudi Arabia Total Mobile Subscriptions (Million)

46. Estimated Number of Telecom Towers in GCC Countries, 2016

47. Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Volume, 2014-2024F ($ Million)

48. Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Volume,

2014-2024F (Thousand Units)

49. Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Revenues,

2014-2024F ($ Million)

50. Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Volume,

2014-2024F (Thousand Units)

51. Riyadh Residential Units, 2014-2019F (Thousand Units)

52. Jeddah Residential Units, 2014-2019F (Thousand Units)

53. Saudi Arabia Central Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

54. Saudi Arabia Eastern Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

55. Saudi Arabia Western Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

56. Saudi Arabia Southern Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

57. Saudi Arabia Transmission and Distribution Networks 2016, By Regions (ckt. km)

58. Saudi Arabia Electricity Consumers 2016, By Regions

59. Saudi Arabia Renewable Energy Contribution to Total Installed Power Capacity, 2015-2023F (GW)

60. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2021F ($ Billion)

61. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion)

62. Saudi Arabia Construction Contracts Awards, 2016-2017 ($ Million)

63. Saudi Arabia Building Construction Projects Value by Status, 2017

64. Saudi Arabia Value of Awarded Contracts, 2013-1H 2016 ($ Billion)

65. Value of Awarded Contracts by Sector During Q2'16

66. Saudi Arabia UPS Systems Market Opportunity Assessment, By KVA Rating

67. Saudi Arabia UPS Systems Market Opportunity Assessment, By Application

68. Saudi Arabia UPS Systems Market Revenue Share, By Company, 2017

69. Saudi Arabia International Visitor Arrivals (Million)

List of Tables

1. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

2. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

3. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

4. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

5. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

6. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

7. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

8. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

9. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

10. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

11. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

12. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

13. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

14. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

15. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

16. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

17. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

18. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

19. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

20. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

21. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

22. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

23. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

24. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

25. Saudi Arabia Commercial Sub-Segments Uninterruptible Power Supply Systems Market

Revenues, 2014-2017 ($ Million)

26. Saudi Arabia Commercial Sub-Segments Uninterruptible Power Supply Systems Market

Revenues, 2018E-2024F ($ Million)

27. Upcoming Hotel Projects in Saudi Arabia

28. Total Operating Industrial Units and Total Finance, 2010 & 2017 3rd Quarter

29. Saudi Arabia Upcoming Oil & Gas Projects

30. Upcoming Residential Projects in Saudi Arabia

31. Saudi Arabia Upcoming Renewable Energy Sector Projects

32. Saudi Arabia Planned Transmission Interconnection Projects (380 KV)

33. Saudi Arabia Approved Budget Per Sector and Actual Expenses Up to End of Q3 of Fiscal Year 2017 ($ Billion)

34. List of Major Infrastructure Projects in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero