Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market (2018-2024) | Analysis, Forecast, Companies, Trends, Outlook, Industry, Value, Share, Size, Revenue & Growth

Market Forecast By KVA Rating (Below 1.1 KVA, 1.1 KVA - 5 KVA, 5.1 KVA - 20 KVA, 20.1 KVA - 50 KVA, 50.1 KVA - 200 KVA and Above 200 KVA), By Applications (Commercial (Education, Offices, Healthcare, Hospitality, BFSI, Data Centers and Others), Industrial and Residential)), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000457 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 140 | No. of Figures: 69 | No. of Tables: 34 |

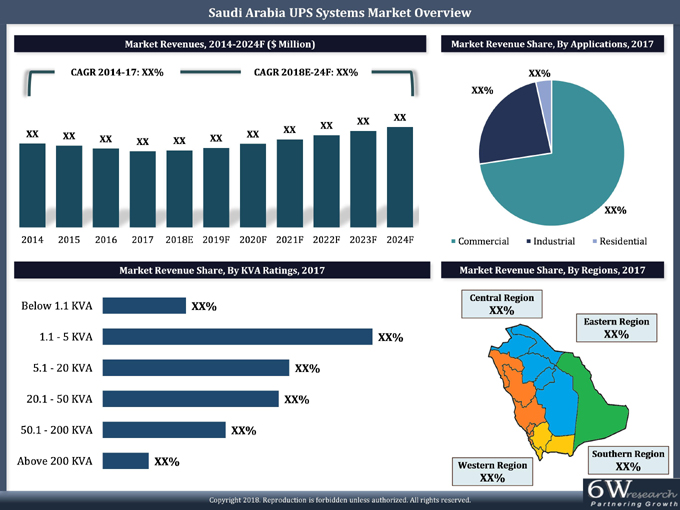

The growth of the Saudi Arabia UPS systems market in the coming years is expected to be driven by several factors such as rising IT spending, an increasing number of SMEs, and a growing number of data centers, healthcare facilities, ATMs, and hotels.

According to 6Wresearch, the Saudi Arabia UPS market size is predicted to grow with a CAGR of 4.5% during 2018-24. This growth would be aided by the government's efforts to strengthen the country's non-oil sectors. Under the Saudi Vision 2030 initiative, the construction of new hotels, education institutes, retail outlets, industrial spaces, and power plant projects are under anticipated in the coming years. As a result, Saudi Arabia UPS market forecast revenues are expected to increase due to growing demand from commercial and industrial sectors.

Amongst all applications, the commercial sector captured the highest Saudi Arabia UPS market share in 2017. In the commercial sector, data centers, BFSI, and hospitality segments were the major revenue shareholders and are expected to maintain their dominance in the coming years on account of the government's emphasis on developing the country's social infrastructure.

The Saudi Arabia UPS market report comprehensively covers the market by KVA ratings, applications, and regions. The Saudi Arabia UPS market outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia UPS market trends, opportunities/high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global UPS Market for the Period 2014-2017

• Market Size & Forecast of Global UPS Market until 2024

• Saudi Arabia UPS Market Size and Saudi Arabia UPS Market Forecast

• Saudi Arabia UPS Market Overview

• Saudi Arabia UPS Market Outlook

• Historic data of Saudi Arabia UPS Market Revenues and Volume 2014-2017

• Market Size & Forecast of Saudi Arabia UPS Revenues & Volume Market until 2024

• Historic data of Saudi Arabia Below 1.1 KVA UPS Systems Market Revenues & Volume Market 2014-2017

• Market Size & Forecast of Saudi Arabia Below 1.1 KVA UPS Systems Market Revenues & Volume Market until 2024

• Historic data of Saudi Arabia 1.1 KVA - 5 KVA UPS Systems Market Revenues & Volume Market 2014-2017

• Market Size & Forecast of Saudi Arabia 1.1 KVA - 5 KVA UPS Systems Market Revenues & Volume Market until 2024

• Historic data of Saudi Arabia 5.1 KVA - 20 KVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Saudi Arabia 5.1 KVA - 20 KVA UPS Systems Market Revenues & Volume

Market until 2024

• Historic data of Saudi Arabia 20.1 KVA - 50 KVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Saudi Arabia 20.1 KVA - 50 KVA UPS Systems Market Revenues & Volume

Market until 2024

• Historic data of Saudi Arabia 50.1 KVA - 200 KVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Saudi Arabia 50.1 KVA - 200 KVA UPS Systems Market Revenues & Volume

Market until 2024

• Historic data of Saudi Arabia Above 200 KVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Saudi Arabia Above 200 KVA UPS Systems Market Revenues & Volume Market

until 2024

• Historical data and Forecast of Saudi Arabia UPS Market Revenues, By Application

• Historical data and Forecast of Saudi Arabia UPS Market Revenues, By Region

• Saudi Arabia UPS Market Trends, Drivers and Restraints

• Saudi Arabia UPS Market Share, By Players Market Share and Saudi Arabia UPS Market Overview on

Competitive Benchmarking

• Competitive Landscape

• Company Profiles

• Strategic Recommendations

Markets Covered

The Saudi Arabia UPS Market report provides a detailed analysis of the following market segments:

• By KVA Ratings

o Upto 1 Kva KVA

o 1.1 KVA - 5 KVA

o 5.1 KVA - 20 KVA

o 20.1 KVA - 50 KVA

o 50.1 KVA - 200 KVA

o Above 200 KVA

• By Applications:

o Commercial

? Education

? Offices

? Healthcare

? Hospitality

? BFSI

? Data Centers

? Others

o Industrial

o Residential

• By Regions

o Eastern

o Western

o Central

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumption

3. Global Uninterruptible Power Supply (UPS) Systems Market Overview

3.1 Global Uninterruptible Power Supply (UPS) Systems Market Revenues (2014-2024F)

3.2 Global Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Region (2017)

4. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview

4.1 Saudi Arabia Country Overview

4.2 Saudi Arabia Uninterruptible Power Supply Systems Market Revenues (2014-2024F)

4.3 Saudi Arabia Uninterruptible Power Supply Systems Market Volume (2014-2024F)

4.4 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By KVA Rating (2017 & 2024F)

4.5 Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By KVA Rating (2017 & 2024F)

4.6 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Applications (2017 & 2024F)

4.7 Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By Applications (2017 & 2024F)

4.8 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Regions (2017 & 2024F)

4.9 Saudi Arabia Uninterruptible Power Supply Systems Market Industry Life Cycle (2017)

4.10 Saudi Arabia Uninterruptible Power Supply Systems Market Porter's Five Forces (2017)

5. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Trends

6.1 Green UPS Systems

6.1 Modular UPS Systems

7. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview, By KVA Rating

7.1. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.1.1 Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.2 Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.2.1 Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.3. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.3.1 Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.4 Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.4.1 Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.5. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.5.1 Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.6 Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.6.1 Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.7. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.7.1 Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.8 Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.8.1 Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.9. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.9.1 Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.10 Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.10.1 Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.11. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

7.11.1 Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application (2014 - 2024F)

7.12 Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

7.12.1 Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application (2014 - 2024F)

7.13 Saudi Arabia Uninterruptible Power Supply Systems Market Price Trend (2014 - 2024F)

8. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview, By Applications

8.1 Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

8.1.1 Saudi Arabia Commercial Sub-Segments Uninterruptible Power Supply Systems

Market Revenues (2014 - 2024F)

8.2 Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

8.2.1 Saudi Arabia Commercial Sector Overview

8.3 Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

8.4 Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

8.4.1 Saudi Arabia Industrial Sector Overview

8.5 Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

8.6 Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Volume (2014 - 2024F)

8.6.1 Saudi Arabia Residential Sector Overview

9. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Overview, By Regions

9.1 Saudi Arabia Central Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.2 Saudi Arabia Eastern Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.3 Saudi Arabia Southern Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.4 Saudi Arabia Western Region Uninterruptible Power Supply Systems Market Revenues (2014 - 2024F)

9.5 Saudi Arabia Power Sector Overview, By Regions

10. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Key Performance Indicators

10.1 Saudi Arabia Power Sector Outlook

10.2 Saudi Arabia Government Spending Outlook

10.3 Saudi Arabia Construction Market Outlook

10.4 Major Infrastructure Projects in Saudi Arabia

11. Saudi Arabia Uninterruptible Power Supply (UPS) Systems Market Opportunity Assessment

11.1 Saudi Arabia Uninterruptible Power Supply Systems Market Opportunity Assessment, By KVA Rating

11.2 Saudi Arabia Uninterruptible Power Supply Systems Market Opportunity Assessment, By Application

12. Competitive Landscape

12.1 Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Company, 2017

12.2 Competitive Benchmarking, By KVA Rating

13. Company Profiles

13.1 Schneider Electric SE

13.2 Vertiv Co.

13.3 ABB Ltd.

13.4 Eaton Corporation Plc

13.5 Socomec Middle East

13.6 Arabian Power Electronics Company

13.7 Tripp Lite

13.8 Legrand SNC FZE

13.9 Riello UPS Middle East Fz-llc

13.10 General Electric Company

14. Key Strategic Recommendations

15. Disclaimer

List of Figures

1. Global Uninterruptible Power Supply (UPS) Systems Market Revenue, 2014-2024F ($ Billion)

2. Global Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Region (2017)

3. Saudi Arabia Energy Sales (GWh), By Verticals (2016)

4. Actual and Projected Peak Loads, 2010-2020F (In GW)

5. Saudi Arabia Electricity Consumption, By KWh/ Capita, 2012-2016

6. Saudi Arabia Residential Electricity Consumption, By KWh/ Capita, 2012-2016

7. Saudi Arabia Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

8. Saudi Arabia Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

9. Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By KVA Rating, 2017 & 2024F

10. Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By KVA Rating, 2017 & 2024F

11. Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Applications, 2017 & 2024F

12. Saudi Arabia Uninterruptible Power Supply Systems Market Volume Share, By Applications, 2017 & 2024F

13. Saudi Arabia Uninterruptible Power Supply Systems Market Revenue Share, By Regions, 2017 & 2024F

14. Saudi Arabia Uninterruptible Power Supply Systems Market- Industry Life Cycle 2017

15. Saudi Vision 2030 - Key Targets

16. Saudi Arabia IT Services Market and Computer Hardware Sales ($ Billion)

17. Saudi Arabia Data Center Spending (2014-2019) ($ Million)

18: Upcoming Economic Cities in Saudi Arabia

19. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million)

20. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion)

21. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

22. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

23. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

24. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

25. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

26. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

27. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

28. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Thousand Units)

29. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

30. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Units)

31. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

32. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume, 2014-2024F (Units)

33. Saudi Arabia Uninterruptible Power Supply Systems Market Price Trend, 2014-2024F ($)

34. Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Revenues,

2014-2024F ($ Million)

35. Saudi Arabia Commercial Application Uninterruptible Power Supply Systems Market Volume,

2014-2024F (Thousand Units)

36. Saudi Arabia Number of ATMs Per 100 Thousand Adults, 2010-2016

37. Saudi Arabia Number of Commercial Bank Branches Per 100 Thousand Adults, 2010-2016

38. Riyadh Office Supply, 2014-2019F ('000 Sq. m.)

39. Jeddah Office Supply, 2014-2019F ('000 Sq. m.)

40. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.)

41. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.)

42. Riyadh Hotel Supply, 2014-2019F (No. of Rooms)

43. Jeddah Hotel Supply, 2014-2019F (No. of Rooms)

44. Major Upcoming Healthcare Projects in Saudi Arabia

45. Saudi Arabia Total Mobile Subscriptions (Million)

46. Estimated Number of Telecom Towers in GCC Countries, 2016

47. Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Volume, 2014-2024F ($ Million)

48. Saudi Arabia Industrial Application Uninterruptible Power Supply Systems Market Volume,

2014-2024F (Thousand Units)

49. Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Revenues,

2014-2024F ($ Million)

50. Saudi Arabia Residential Application Uninterruptible Power Supply Systems Market Volume,

2014-2024F (Thousand Units)

51. Riyadh Residential Units, 2014-2019F (Thousand Units)

52. Jeddah Residential Units, 2014-2019F (Thousand Units)

53. Saudi Arabia Central Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

54. Saudi Arabia Eastern Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

55. Saudi Arabia Western Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

56. Saudi Arabia Southern Region Uninterruptible Power Supply Systems Market Revenues, 2014-2024F ($ Million)

57. Saudi Arabia Transmission and Distribution Networks 2016, By Regions (ckt. km)

58. Saudi Arabia Electricity Consumers 2016, By Regions

59. Saudi Arabia Renewable Energy Contribution to Total Installed Power Capacity, 2015-2023F (GW)

60. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2021F ($ Billion)

61. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion)

62. Saudi Arabia Construction Contracts Awards, 2016-2017 ($ Million)

63. Saudi Arabia Building Construction Projects Value by Status, 2017

64. Saudi Arabia Value of Awarded Contracts, 2013-1H 2016 ($ Billion)

65. Value of Awarded Contracts by Sector During Q2'16

66. Saudi Arabia UPS Systems Market Opportunity Assessment, By KVA Rating

67. Saudi Arabia UPS Systems Market Opportunity Assessment, By Application

68. Saudi Arabia UPS Systems Market Revenue Share, By Company, 2017

69. Saudi Arabia International Visitor Arrivals (Million)

List of Tables

1. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

2. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

3. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

4. Saudi Arabia Below 1.1 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

5. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

6. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

7. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

8. Saudi Arabia 1.1 - 5 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

9. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

10. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

11. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

12. Saudi Arabia 5.1 - 20 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

13. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

14. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

15. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

16. Saudi Arabia 20.1 - 50 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

17. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

18. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

19. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

20. Saudi Arabia 50.1 - 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

21. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2014-2017 ($ Million)

22. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Revenues,

By Application, 2018E-2024F ($ Million)

23. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2014-2017 (Units)

24. Saudi Arabia Above 200 KVA Uninterruptible Power Supply Systems Market Volume,

By Application, 2018E-2024F (Units)

25. Saudi Arabia Commercial Sub-Segments Uninterruptible Power Supply Systems Market

Revenues, 2014-2017 ($ Million)

26. Saudi Arabia Commercial Sub-Segments Uninterruptible Power Supply Systems Market

Revenues, 2018E-2024F ($ Million)

27. Upcoming Hotel Projects in Saudi Arabia

28. Total Operating Industrial Units and Total Finance, 2010 & 2017 3rd Quarter

29. Saudi Arabia Upcoming Oil & Gas Projects

30. Upcoming Residential Projects in Saudi Arabia

31. Saudi Arabia Upcoming Renewable Energy Sector Projects

32. Saudi Arabia Planned Transmission Interconnection Projects (380 KV)

33. Saudi Arabia Approved Budget Per Sector and Actual Expenses Up to End of Q3 of Fiscal Year 2017 ($ Billion)

34. List of Major Infrastructure Projects in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines