Saudi Arabia Video Surveillance Market (2015-2021) | Revenue, Industry, Size, Growth, Companies, Forecast, Outlook, Trends, Value, Analysis & Share

Market Forecast By Surveillance Type (Analog & IP Surveillance), Software (Video Management Software, Video Analytics and Others), By Components (Cameras (Analog and IP)), DVR/NVR, Encoders/Decoders, By Verticals (Government & Transportation, Banking & Financial, Retail & Logistics, Industrial & Manufacturing, Commercial Offices, Residential, Hospitality & Healthcare, Educational Institutions) and Regions (Eastern Region, Western Region, Southern Region, and Central Region)

| Product Code: ETC000264 | Publication Date: Sep 2015 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 128 | No. of Figures: 81 | No. of Tables: 21 |

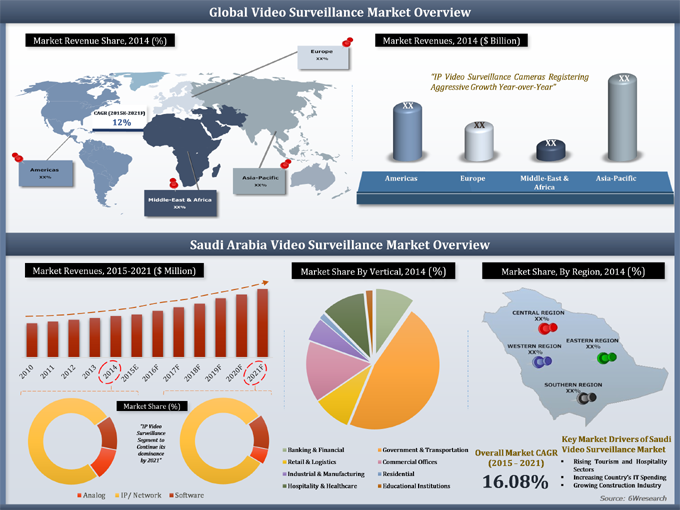

Saudi Arabia is increasingly diversifying its economy to reduce its over-dependence on oil by investing in multiple sectors. Infrastructure development in Saudi Arabia is accelerating at a rapid pace especially in the areas of hospitality, government & transportation, retail, commercial buildings, BFSI, education, etc. With the rise of these infrastructures, the need for advanced security solutions has surged, which has created the demand for video surveillance systems in the country. The video surveillance market in the KSA is the largest amongst all GCC countries and is expected to witness significant growth due to growing security concerns.According to 6Wresearch, Saudi Arabia's video surveillance market is projected to grow at a CAGR of 16.08% during 2015-21. In Saudi Arabia, the IP video surveillance market has dominated the overall video surveillance in 2014 and would maintain its market leadership through the forecast period. Increasing IT infrastructure, higher reliability, scalability, and ability to provide remote access are expected to drive the growth of the market.Amongst all the applications, the government, and transportation sector has captured the largest revenue share of the market pie in the country. Over the next six years, verticals such as banking & financial, education, commercial office are projected to grow at relatively higher CAGR during 2015-21. Saudi Arabia has planned to develop 6 new economic cities by investing more than $100 billion in the coming years, which would stimulate the growth of the video surveillance market in the country.The upcoming Haramain High-Speed Rail project also known as the Makkah-Madinah high-speed railway and Riyadh Metro project would further boost the demand for video surveillance systems during the forecast period.“Saudi Arabia Video Surveillance Market (2015-2021)” provides in-depth analysis with 81 figures and 21 tables covered in more than 120 pages. The report thoroughly covers the video surveillance market by types, components, verticals, and regions. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities/high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of Global Video Surveillance Market until 2021.

• Historical data of Saudi Arabia Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Video Surveillance Market until 2021.

• Historical data of Saudi Arabia Analog Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Analog Video Surveillance Market until 2021.

• Historical data of Saudi Arabia IP Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia IP Video Surveillance Market until 2021.

• Historical data of Saudi Arabia Video Surveillance Vertical Market for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Video Surveillance Vertical Market until 2021.

• Historical data of Saudi Arabia Video Surveillance Regional Market for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Video Surveillance Regional Market until 2021.

• Market Drivers and Restraints.

• Market and Price Trends.

• Major Players Market Share and Competitive Landscape.

• Players Market Share

• Competitive Positioning.

• Company Profiles.

• Key Strategic Pointers.

Markets Covered

The report provides a detailed analysis of the following market segments:

Video Surveillance Systems Types:

• Analog Surveillance

• IP Surveillance

• Software

Verticals:

• Government & Transportation

• Banking & Financial

• Retail & Logistics

• Industrial & Manufacturing

• Commercial Offices

• Residential

• Hospitality & Healthcare

• Educational Institutions

Regions:

• Eastern Region

• Western Region

• Southern Region

• Central Region

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Methodology Adopted

2.5 Assumptions

3 Global Video surveillance Market Overview

4 Saudi Arabia Video surveillance Market Overview

4.1 Saudi Arabia Video Surveillance Market Revenues (2010-2021F)

4.2 Saudi Arabia Video Surveillance Market Volume (2010-2021F)

4.3 Industry Life Cycle

4.4 Opportunity Matrix

4.5 Porters 5 Forces Model

4.6 Saudi Arabia Video Surveillance Market Share, By Types (2014 & 2021F)

4.7 Saudi Arabia Video Surveillance Market Share, By Verticals (2014 & 2021F)

4.8 Saudi Arabia Video Surveillance Market Share, By Regions (2014 & 2021F)

5 Saudi Arabia Video Surveillance Market Dynamics

5.1 Drivers

5.1.1 Rising Tourism and Hospitality Sectors

5.1.2 Emerging IT Sector

5.1.3 Growing Construction Industry

5.1.4 Enhanced Integration with Other Business Systems

5.1.5 Increasing Demand for High-quality Image

5.2 Restraints

5.2.1 High Initial Investment Cost

5.2.2 Complexity of Data Interpretation

6 Saudi Arabia Video Surveillance Market Trends

6.1 Increasing Demand for Intelligent video surveillance Systems

6.2 Increasing Popularity of VSaaS

6.3 Emergence of High-resolution Cameras

6.4 Increasing IT Spending

7 Saudi Arabia Video Surveillance Price Trend

8 Saudi Arabia Analog Video Surveillance Market Overview

8.1 Saudi Arabia Analog Video Surveillance Market Revenues (2010-2021F)

8.2 Saudi Arabia Analog Video Surveillance Market Volume (2010-2021F)

8.3 Saudi Arabia Analog Video Surveillance Market Share, By Vertical (2010-2021F)

9 Saudi Arabia IP Video Surveillance Market Overview

9.1 Saudi Arabia IP Video Surveillance Market Revenues (2010-2021F)

9.2 Saudi Arabia IP Video Surveillance Market Volume (2010-2021F)

9.3 Saudi Arabia Analog Video Surveillance Market Share, By Vertical (2010-2021F)

10 Saudi Arabia Video Surveillance Software Market Overview

10.1 Saudi Arabia Video Surveillance Software Market Revenue (2010-2021F)

10.2 Saudi Arabia Video Management Software Market Revenue (2010-2021F)

10.3 Saudi Arabia Video Analytics Software Market Revenue (2010-2021F)

10.4 Saudi Arabia Other Video Surveillance Software Market Revenue (2010-2021F)

10.5 Saudi Arabia video surveillance Software Market Share, By Vertical (2010-2021F)

11 Saudi Arabia Video Surveillance Vertical Market Overview

11.1 Banking & Financial

11.2 Government & Transportation

11.3 Retail & Logistics

11.4 Commercial Offices

11.5 Industrial & Manufacturing

11.6 Residential

11.7 Hospitality & Healthcare

11.8 Educational Institutions

12 Saudi Arabia Video Surveillance Regional Market Overview

12.1 Eastern Region

12.2 Southern Region

12.3 Eastern Region

12.4 Central Region

13 Competitive Landscape

13.1 Company Share

13.2 Competitive Benchmarking, By Technology

13.3 Competitive Benchmarking, By Operating Parameters

14 Company Profiles

14.1 Axis Communications AB

14.2 Bosch Security Systems, Inc.

14.3 Pelco Inc.

14.4 Honeywell International Inc.

14.5 Samsung Techwin Co. Ltd

14.6 Panasonic Corp.

14.7 MOBOTIX AG

14.8 Milestone Systems A/S

14.9 Hikvision Digital Technology Co. Ltd.

14.10 Avigilon Corp.

14.11 Arecont Vision

15 Key Strategic Pointers

16 Disclaimer

List of Figures

Figure 1 Evolution of Video Surveillance Systems

Figure 2 Global Video Surveillance Market Revenues, 2010-2021F ($ Billion)

Figure 3 Global Video Surveillance Market Revenue Share, By Region (2014)

Figure 4 Global Video Surveillance Market Volume, 2010-2021F (Million Units)

Figure 5 Saudi Arabia video surveillance Market Revenues, 2010-2014 ($ Million)

Figure 6 Saudi Arabia video surveillance Market Revenues, 2015E-2021F ($ Million)

Figure 7 Estimated Capital Investment on Surveillance Solutions By Country (2015E-2021F)

Figure 8 Saudi Arabia Video Surveillance Market Volume, 2010-2014 (Million Units)

Figure 9 Saudi Arabia Video Surveillance Market Volume, 2015E-2021F (Million Units)

Figure 10 Saudi Arabia Video Surveillance Market-industry Life Cycle (2015)

Figure 11 Market - Opportunity Matrix

Figure 12 Saudi Arabia Video Surveillance Revenue Market Share, By Type (2014-21F)

Figure 13 Saudi Arabia Video Surveillance Revenue Market Share, By Vertical (2014)

Figure 14 Saudi Arabia Video Surveillance Revenue Market Share, By Vertical (2021F)

Figure 15 Saudi Arabia Video Surveillance Revenue Market Share, By Region (2014 & 2021F)

Figure 16 Saudi Arabia Hospitality Sector Revenue, 2012-2020F ($ Billion)

Figure 17 Saudi Arabia IT Market, 2011-2021F ($ Billion)

Figure 18 Saudi Arabia Construction Market, 2013-2021F ($ Billion)

Figure 19 Saudi Arabia Development Projects, 2006-2020F ($ Billion)

Figure 20 Intelligent Video Surveillance Market CAGR By Country (2014-2020)

Figure 21 Saudi Arabia IT Spending, 2013-2020F ($ Billion)

Figure 22 Saudi Arabia Analog Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 23 Saudi Arabia Analog Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 24 Saudi Arabia Analog Video Surveillance Market Volume 2010-2014 (Million Units)

Figure 25 Saudi Arabia Analog Video Surveillance Market Volume 2015-2021 (Million Units)

Figure 26 Saudi Arabia Analog Video Surveillance Market Share By Vertical (2014)

Figure 27 Saudi Arabia Analog Video Surveillance Market Share By Vertical (2021F)

Figure 28 Saudi Arabia IP Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 29 Saudi Arabia IP Video surveillance Market Revenue 2015-2021F ($ Million)

Figure 30 Saudi Arabia IP Video Surveillance Market Volume 2010-2014 (Million Units)

Figure 31 Saudi Arabia IP Video Surveillance Market Volume 2015-2021F (Million Units)

Figure 32 Saudi Arabia IP Video Surveillance Market Share By Vertical (2014)

Figure 33 Saudi Arabia IP Video Surveillance Market Share By Vertical (2021F)

Figure 34 Saudi Arabia Video Surveillance Software Market Revenue 2010-2014 ($ Million)

Figure 35 Saudi Arabia Video Surveillance Software Market Revenue 2015-2021F ($ Million)

Figure 36 Saudi Arabia Video Management Software Market Revenue 2010-2014 ($ Million)

Figure 37 Saudi Arabia Video Management Software Market Revenue 2015-2021F ($ Million)

Figure 38 Saudi Arabia Video Analytics Software Market Revenue 2010-2014 ($ Million)

Figure 39 Saudi Arabia Video Analytics Software Market Revenue 2015-2021F ($ Million)

Figure 40 Saudi Arabia Other Video Surveillance Software Market Revenue 2010-2014 ($ Million)

Figure 41 Saudi Arabia Other Video Surveillance Software Market Revenue 2015-2021F ($ Million)

Figure 42 Saudi Arabia Video Surveillance Software Market Share By Vertical (2014)

Figure 43 Saudi Arabia Video Surveillance Software Market Share By Vertical (2021F)

Figure 44 Saudi Arabia Banking & Financial Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 45 Saudi Arabia Banking & Financial Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 46 Saudi Arabia Government & Transportation Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 47 Saudi Arabia Government & Transportation Video Surveillance Market Revenue 2015-2021 ($ Million)

Figure 48 Saudi Arabia Retail Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 49 Saudi Arabia Retail Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 50 Saudi Arabia Retail Market Revenue,2012-2020F ($ Billion)

Figure 51 Saudi Arabia Commercial Offices Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 52 Saudi Arabia Commercial Offices Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 53 Saudi Arabia Industrial Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 54 Saudi Arabia Industrial Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 55 Saudi Arabia Residential Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 56 Saudi Arabia Residential Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 57 Saudi Arabia Hospitality Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 58 Saudi Arabia Hospitality Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 59 Saudi Arabia Educational Institutions Market Revenue 2010-2014 ($ Million)

Figure 60 Saudi Arabia Educational Institutions Market Revenue 2015-2021F ($ Million)

Figure 61 Saudi Arabia Eastern Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 62 Saudi Arabia Eastern Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 63 Saudi Arabia Western Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 64 Saudi Arabia Western Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 65 Saudi Arabia Central Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 66 Saudi Arabia Central Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 67 Saudi Arabia Southern Video Surveillance Market Revenue 2010-2014 ($ Million)

Figure 68 Saudi Arabia Southern Video Surveillance Market Revenue 2015-2021F ($ Million)

Figure 69 Saudi Arabia Video Surveillance Market Revenues Share, By Company, 2014 ($ Million)

Figure 70 Axis Financials, 2011-2014 ($ Million)

Figure 71 Bosch Security Systems Financials, 2010-2013 ($ Billion)

Figure 72 Honeywell Financials, 2011-2014 ($ Billion)

Figure 73 Honeywell Sales By Region, 2013-14

Figure 74 Samsung Techwin Financials, 2012-2014 ($ Million)

Figure 75 Panasonic Financials, 2012-2014 ($ Billion)

Figure 76 Mobotix Financials, 2012-2014 ($ Million)

Figure 77 Mobotix Sales By Region 2013-14

Figure 78 Milestone Financials, 2012-2013 ($ Million)

Figure 79 Hikvision Financials, 2011-2014 ($ Million)

Figure 80 Avigilon Financials, 2011-2014 ($ Million)

Figure 81 Arecont Vision Financials, 2011-2014 ($ Million)

List of Tables

Table 1 Saudi Arabia Major Construction Activities

Table 2 Flow of FDI in Saudi Arabia (2011-2014)

Table 3 Upcoming key Skyscrapers under Construction in Saudi Arabia

Table 4 Saudi Arabia Analog Video Surveillance Price Trend ($ Per Unit)

Table 5 Saudi Arabia IP Video Surveillance Price Trend ($ Per Unit)

Table 6 Saudi Arabia Analog Video Surveillance Market Revenue By Components, 2010-2014 ($ Million)

Table 7 Saudi Arabia Analog Video Surveillance Market Revenue By Components, 2015-2021F ($ Million)

Table 8 Saudi Arabia Analog Video Surveillance Market Volume By Components, 2010-2014 (Million Units)

Table 9 Saudi Arabia Analog Video Surveillance Market Volume By Components, 2015-2021F (Million Units)

Table 10 Saudi Arabia Analog Video Surveillance Market Revenues By Vertical, 2010-2014 ($ Million)

Table 11 Saudi Arabia Analog Video Surveillance Market Revenues By Vertical, 2015-2021F ($ Million)

Table 12 Saudi Arabia IP Video Surveillance Market Revenue By Components, 2010-2014 ($ Million)

Table 13 Saudi Arabia IP Video Surveillance Market Revenue By Components, 2015-2021F ($ Million)

Table 14 Saudi Arabia IP Video Surveillance Market Volume By Components, 2010-2014 (Million Units)

Table 15 Saudi Arabia IP Video Surveillance Market Volume By Components, 2015-2021F (Million Units)

Table 16 Saudi Arabia IP Video Surveillance Market Revenues By Vertical, 2010-2014 ($ Million)

Table 17 Saudi Arabia IP Video Surveillance Market Revenues By Vertical, 2015-2021F ($ Million)

Table 18 Saudi Arabia Video Surveillance Software Market Revenue By Vertical, 2010-2014 ($ Million)

Table 19 Saudi Arabia Video Surveillance Software Market Revenue By Vertical, 2015-2021F ($ Million)

Table 20 Saudi Arabia Total Hotel Rooms, By City (2013)

Table 21 Saudi Arabia Video Surveillance Market Revenues of Top 3 Players, 2014 ($ Million)

Saudi Arabia video surveillance market is witnessing robust growth on account of rapid infrastructure development in the country. Increasing security concerns have prompted Saudi Arabia's government and business enterprises to integrate video surveillance solutions. Rapid growth in the retail and transport sector, involving the construction of malls, retail stores, supermarkets, commercial offices, metro projects, and airports have spurred the demand for video surveillance systems in the country.

During the forecast period, Saudi Arabia video surveillance market witness the highest growth rate in the Middle East on account of large-scale government projects. In 2014, IP Surveillance systems accounted for a major market share in Saudi Arabia video surveillance market, which is expected to increase further in the coming years.

Some of the major companies in the Saudi Arabia video surveillance market include- Axis Communications, Bosch Security Systems, Pelco, Honeywell, Samsung Techwin, Panasonic, Hikvision, Arecont Vision, and Avigilon.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero