India Video Surveillance Storage Market Outlook (2021-2027) | Size, Share, Growth, Revenue, Analysis, Outlook & COVID-19 IMPACT

Market Forecast By Storage Technology (Network Attached Storage, Storage Area Network, and Direct Attached Storage), By Direct Attached Storage, By Types (NVR, DVR, and Servers with Internal Storage), By Deployment (On-Premises and On-Cloud), By Verticals (BFSI, Government and Transportation, Retail, Commercial Office and IT/ITeS, Hospitality and Healthcare, Logistics, Hospitality and Healthcare, and Others), By Regions (Northern India, Western India, Southern India, and Eastern India) and Competitive Landscape

| Product Code: ETC003340 | Publication Date: Jul 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 100 | No. of Figures: 25 | No. of Tables: 15 |

India Video Surveillance Storage Market report comprehensively covers the market by storage technology, deployment, verticals, and regions. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high-growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Video Surveillance Storage Market Synopsis

India video surveillance storage market grew at a significant rate over the past few years owing to rising demand for IP and high-resolution surveillance cameras and increasing security concerns across the country. Additionally, technological advancements, such as face and voice recognition, HD video, and audio recording are gaining higher adoption among Indian consumers, resulting in the generation of large amounts of data, which in turn is surging the demand for video surveillance storage solutions in the country. However, the COVID-19 pandemic has slightly affected the market revenues in India due to the slowdown in economic activities along with the diversion of funds from infrastructural projects to the healthcare and social service sector.

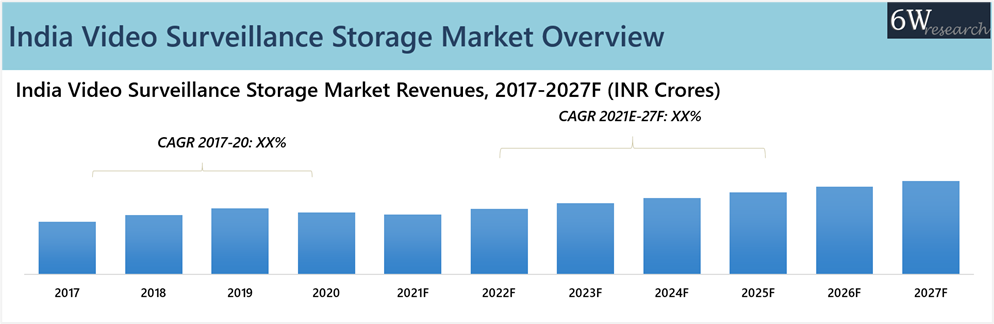

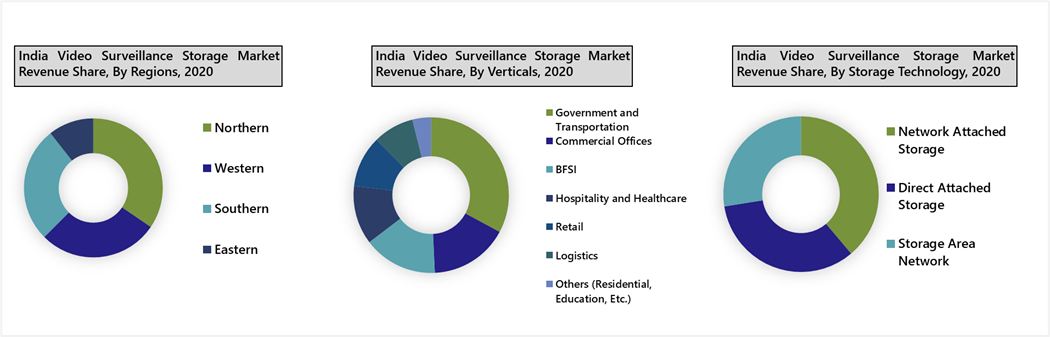

According to 6Wresearch, India Video Surveillance Storage Market size is projected to grow at a CAGR of 7.7% during 2021-2027. Over the last few years, India witnessed an increasing shift from traditional-based analog surveillance to IP-based video surveillance solutions. This, in turn, has increased the need for advanced and higher-capacity storage solutions in the country. In terms of storage technology, NAS-based video surveillance storage solutions registered the highest revenue share in the overall market in 2020 on account of the growing demand for accessing data remotely using a network connection. This serves as a private cloud for the commercial as well as a residential segment that provides utmost security. The technology is majorly being driven on account of increasing usage of wireless devices, growing demand for scalability, and strengthening IT infrastructure in the country. Moreover, the on-premises storage segment held a major revenue share in the overall India video surveillance storage market in 2020 owing to the relative price advantage with less up-front cost and the characteristic of maintaining data confidentiality. However, the exponential growth in data volumes across verticals would fuel the demand for cloud-based solutions, which in turn, would dominate the market in the forecast period. The rising risk of terrorism and surging crimes are accelerating the India Video Surveillance Storage Market Growth. Growing demand for security and surveillance across various sectors such as military and defense is adding to the development of the industry. The rising adoption of cloud-based storage is also propelling the India Video Surveillance market share.

Market by Storage Technology Analysis

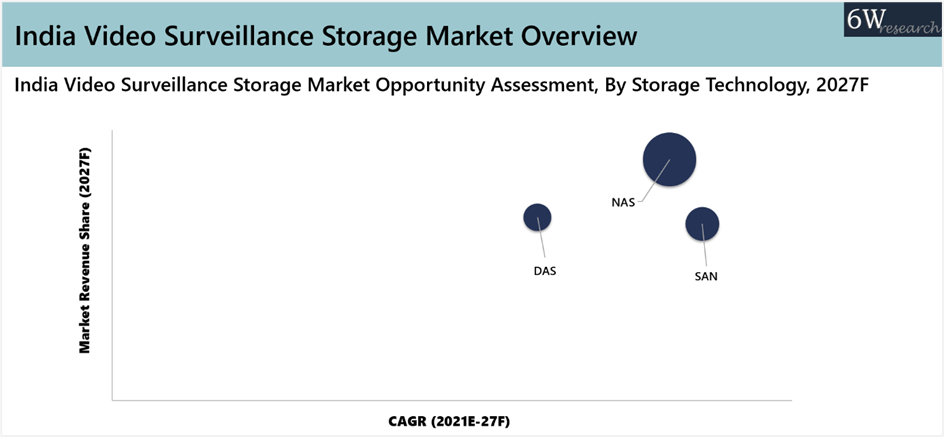

India video surveillance storage market trends are expected to be positive owing to the growing adoption of cloud-based services, increasing usage of wireless devices, and the need for continuous surveillance are complementing the growth of the NAS market in India. Increasing demand for IP cameras across various verticals is fuelling the demand for NVRs for storage purposes. However, owing to their lower ownership costs, DAS is the majorly preferred solution by small businesses instead of NAS/SAN. However, SAN is gaining popularity across data centers and large-scale enterprises owing to its high-speed access along with greater scalability, flexibility & reliability.

Market by Regions Analysis

India video surveillance storage market share was dominated by the Northern region in 2020 on account of growing investment in the accommodation/ residential spaces and commendatory government tenders in favor of CCTV camera deployment. Large-scale investment across verticals would have a positive impact on the deployment of video surveillance storage solutions in the Northern region of the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Video Surveillance Storage Market Overview

- India Video Surveillance Storage Market Outlook

- India Video Surveillance Storage Market Forecast

- Historical Data and Forecast of India Video Surveillance Storage Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of India Video Surveillance Storage Market Revenues, By Storage Technology for the Period 2017-2027F

- Historical Data and Forecast of India Video Surveillance Storage Market Revenues, By Deployment for the Period 2017-2027F

- Historical Data and Forecast of India Video Surveillance Storage Market Revenues, By Verticals for the Period 2017-2027F

- Historical Data and Forecast of India Video Surveillance Storage Market Revenues, By Regions for the Period 2017-2027F

- Market Drivers, Restraints

- India Video Surveillance Storage Market Trends and Industry Life Cycle

- India Video Surveillance Storage Market – Porter’s Five Forces

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

-

By Storage Technology

- Network Attached Video Surveillance Storage

- Storage Area Network Video Surveillance Storage

- Direct Attached Video Surveillance Storage

- HDD Based System

- SSD Based System

By Deployment

- On-Cloud

- On-Premises

By Verticals

- BFSI

- Government and Transportation

- Retail

- Commercial Office and IT/ITeS

- Hospitality and Healthcare

- Logistics

- Others

By Regions

- Northern Region

- Southern Region

- Eastern Region

- Western Region

Key States

- Maharashtra

- Delhi

- Karnataka

- Gujarat

- Tamil Nadu

- West Bengal

- Madhya Pradesh

- Telangana

- Kerela

- Andhra Pradesh

- Others

Key Cities

- Delhi NCR

- Mumbai Metropolitan

- Bangalore

- Chennai

- Hyderabad

- Ahmedabad

- Pune

- Kolkata

- Lucknow

- Surat

- Others

India Video Surveillance Storage Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Video Surveillance Storage Market Overview |

| 3.1. India Video Surveillance Storage Market Revenues, 2017-2027F |

| 3.2. India Video Surveillance Storage Market-Industry Life Cycle |

| 3.3. India Video Surveillance Storage Market-Porter’s Five Forces |

| 3.4. India Video Surveillance Storage Market Revenue Share, By Storage Technology, 2020 & 2027F |

| 3.5. India Video Surveillance Storage Market Revenue Share, By Deployment, 2020 & 2027F |

| 3.6. India Video Surveillance Storage Market Revenue Share, By Verticals, 2020 & 2027F |

| 3.7. India Video Surveillance Storage Market Revenue Share, By Regions, 2020 & 2027F |

| 3.8. India Video Surveillance Storage Market COVID-19 Impact Analysis |

| 4. India Video Surveillance Storage Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. India Video Surveillance Storage Market Trends and Evolution |

| 6. India Video Surveillance Storage Market Overview, By Storage Technology |

| 6.1. India Video Surveillance Storage Market Revenues, By Storage Technology, 2017-2027F |

| 6.1.1. India Video Surveillance Storage Market Revenues, By Network Attached Storage, 2017-2027F |

| 6.1.2. India Video Surveillance Storage Market Revenues, By Direct Attached Storage, 2017-2027F |

| 6.1.3. India Video Surveillance Storage Market Revenues, By Storage Area Network, 2017-2027F |

| 6.2. India DAS Video Surveillance Storage Market Revenues, By Storage Type, 2017-2027F |

| 6.2.1. India DAS Video Surveillance Market Revenue Share, By HDD Based System, 2020 & 2027F |

| 6.2.2. India DAS Video Surveillance Market Revenue Share, By SSD Based System, 2020 & 2027F |

| 7. India Video Surveillance Storage Market Overview, By Deployment |

| 7.1. India Video Surveillance Storage Market Revenues, By Deployment, 2017-2027F |

| 7.1.1. India Video Surveillance Storage Market Revenues, By On-Cloud, 2017-2027F |

| 7.1.2. India Video Surveillance Storage Market Revenues, By On-Premises, 2017-2027F |

| 8. India Video Surveillance Storage Market Overview, By Verticals |

| 8.1. India Video Surveillance Storage Market Revenues, By Verticals, 2017-2027F |

| 8.1.1. India Video Surveillance Storage Market Revenues, By Government and Transportation, 2017-2027F |

| 8.1.2. India Video Surveillance Storage Market Revenues, By Commercial Offices, 2017-2027F |

| 8.1.3. India Video Surveillance Storage Market Revenues, By BFSI, 2017-2027F |

| 8.1.4. India Video Surveillance Storage Market Revenues, By Hospitality and Healthcare, 2017-2027F |

| 8.1.5. India Video Surveillance Storage Market Revenues, By Retail, 2017-2027F |

| 8.1.6. India Video Surveillance Storage Market Revenues, By Logistics, 2017-2027F |

| 8.1.7. India Video Surveillance Storage Market Revenues, By Others, 2017-2027F |

| 9. India Video Surveillance Storage Market Overview, By Regions |

| 9.1. India Video Surveillance Storage Market Revenues, By Regions, 2017-2027F |

| 9.1.1. India Video Surveillance Storage Market Revenues, By Northern Region, 2017-2027F |

| 9.1.2. India Video Surveillance Storage Market Revenues, By Western Region, 2017-2027F |

| 9.1.3. India Video Surveillance Storage Market Revenues, By Southern Region, 2017-2027F |

| 9.1.4. India Video Surveillance Storage Market Revenues, By Eastern Region, 2017-2027F |

| 10. India Video Surveillance Storage Market Overview, By States and Cities |

| 10.1. India Video Surveillance Storage Market Revenues & Revenue Share, By 10 Key States, 2020 |

| 10.2. India Video Surveillance Storage Market Revenues & Revenue Share, By 10 Key Cities, 2020 |

| 11. India Video Surveillance Storage Market - Key Performance Indicators |

| 12. India Video Surveillance Storage Market - Key Upcoming Surveillance Projects Analysis |

| 13. India Video Surveillance Storage Market - Opportunity Assessment |

| 13.1. India Video Surveillance Storage Market Opportunity Assessment, By Storage Technology, 2027F |

| 13.2. India Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2027F |

| 14. India Video Surveillance Storage Market Competitive Landscape |

| 14.1. India Video Surveillance Storage Market Share, By Companies, 2020 |

| 14.1.1. India Video Surveillance Storage Market Share, By Storage Technology, 2020 |

| 14.1.2. India Video Surveillance Storage Market Share, By Deployment, 2020 |

| 14.2. India Video Surveillance Storage Market Competitive Benchmarking |

| 14.2.1. India Video Surveillance Storage Market Competitive Benchmarking, By Technical Parameters |

| 14.2.2. India Video Surveillance Storage Market Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1. NetApp, Inc. |

| 15.2. Quantum Corporation |

| 15.3. Huawei Technologies Co., Ltd. |

| 15.4. Dell Technologies Inc. |

| 15.5. Seagate Technology LLC |

| 15.6. Cisco Systems, Inc. |

| 15.7. Western Digital Corporation |

| 15.8. Lenovo Group Limited |

| 15.9. Hewlett Packard Enterprise Company |

| 15.10. Toshiba India Pvt. Ltd. |

| 15.11. Hitachi Vantara Corporation |

| 15.12. International Business Machines Corporation (IBM) |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure 1. India Video Surveillance Storage Market Revenues, 2017-2027F (INR Crores) |

| Figure 2. India Video Surveillance Storage Market Revenue Share, By Storage Technology, 2020 & 2027F |

| Figure 3. India Video Surveillance Storage Market Revenue Share, By Deployment, 2020 & 2027F |

| Figure 4. India Video Surveillance Storage Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 5. India Video Surveillance Storage Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 6. India Video Surveillance Camera Market Revenues and Volume, 2017-2027F (INR Crores, Thousand Units) |

| Figure 7. Percentages of Respondents reflecting the Top Challenges in Cloud Based Storage Solutions |

| Figure 8. India NAS Video Surveillance Storage Market, By Storage Type, 2020 |

| Figure 9. India SAN Video Surveillance Storage Market, By Storage Type, 2020 |

| Figure 10. India DAS Video Surveillance Storage Market, By Storage Type, 2020 |

| Figure 11. India Video Surveillance Storage Market Revenue Share, By 10 States, 2020 |

| Figure 12. India Video Surveillance Storage Market Revenue Share, By 10 Cities, 2020 |

| Figure 13. Real Estate Market Size in India, 2017-2023F (INR Billion) |

| Figure 14. Growth in the Bank Deposits in India, FY 2019- FY 2021 ($ Billion) |

| Figure 15. India IT & Business Services Market Size, 2016- 2021F ($ Billion) |

| Figure 16. Market Size of the Retail Industry, 2016- 2026F (INR Billion) |

| Figure 17. Market Share of the Retail Industry, 2019 & 2021E |

| Figure 18. India Video Surveillance Storage Market Opportunity Assessment, By Storage Technology, 2027F |

| Figure 19. India Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2027F |

| Figure 20. India Video Surveillance Storage Market Revenue Share, By Companies, 2020 |

| Figure 21. India NAS Video Surveillance Market Revenue Share, By Companies, 2020 |

| Figure 22. India SAN Video Surveillance Market Revenue Share, By Companies, 2020 |

| Figure 23. India DAS Video Surveillance Market Revenue Share, By Companies, 2020 |

| Figure 24. India Video Surveillance On-Premises Storage Market Revenue Share, By Deployment, 2020 |

| Figure 25. India Video Surveillance On-Cloud Storage Market Revenue Share, By Deployment, 2020 |

| List of Tables |

| Table 1. India Video Surveillance Storage Market Revenues, By Storage Technology, 2017-2027F (INR Crores) |

| Table 2. India Video Surveillance Storage Market Revenues, By Storage Type, 2017-2027F (INR Crores) |

| Table 3. India Video Surveillance Storage Market Revenues, By Deployment, 2017-2027F (INR Crores) |

| Table 4. India Video Surveillance Storage Market Revenues, By Regions, 2017-2027F (INR Crores) |

| Table 5. India Video Surveillance Storage Market Revenues, By 10 States, 2020 (INR Crores) |

| Table 6. India Video Surveillance Storage Market Revenues, By 10 Cities, 2020 (INR Crores) |

| Table 7. Bank Branches Opened Across India, 2019-2020 & 2020-2021 |

| Table 8. Major Upcoming Infrastructure Projects in India (Education and Healthcare) |

| Table 9. Major Upcoming Infrastructure Projects in India (Healthcare) |

| Table 10. Major Upcoming Infrastructure Projects in India (Metro) |

| Table 11. Major Upcoming Infrastructure Projects in India (Commercial) |

| Table 12. Major Upcoming Infrastructure Projects in India (Airports) |

| Table 13. Major Upcoming Infrastructure Projects in India (Hotels) |

| Table 14. Major Upcoming Infrastructure Projects in India (Traffic Management) |

| Table 15. Number of Colocation Data Centres in India, 2020 |

Market Forecast By Storage Technology (Network Attached Storage, Storage Area Network and Direct Attached Storage), By Direct Attached Storage, By Types (NVR, DVR, and Servers with Internal Storage), By Deployment (On-Premises and On-Cloud), By Verticals (BFSI, Government and Transportation, Retail, Commercial Office and IT/ITeS, Hospitality and Healthcare, Logistics, Hospitality and Healthcare, and Others), By Regions (Northern India, Western India, Southern India, and Eastern India) and Competitive Landscape

| Product Code: ETC003340 | Publication Date: Jan 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 100 | No. of Figures: 25 | No. of Tables: 15 |

India Video Surveillance Storage Market report thoroughly covers video surveillance storage market by storage technology, deployment, verticals, and regions. The report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers, which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

India Video Surveillance Storage Market Synopsis

India Video Surveillance Storage Market is expected to grow on the account of rapid infrastructural growth, rising demand for IP and high-resolution Surveillance Storage cameras, along with increasing security concerns. Additionally, several technological advancements, such as face and voice recognition, HD video, and audio recording are gaining higher adoption among Indian consumers, resulting in generation of large amounts of data, which in turn is surging demand for video Surveillance Storage solutions in the country. However, due to the spread of COVID-19, slowdown in economic activities along with the diversion of fund from infrastructural projects to healthcare and social service sector would have a negative impact on the market of video Surveillance Storage solutions. However, the ongoing global pandemic COVID-19 hampered the overall economic growth of India, thus, restraining the growth of the Video Surveillance Storage market as well.

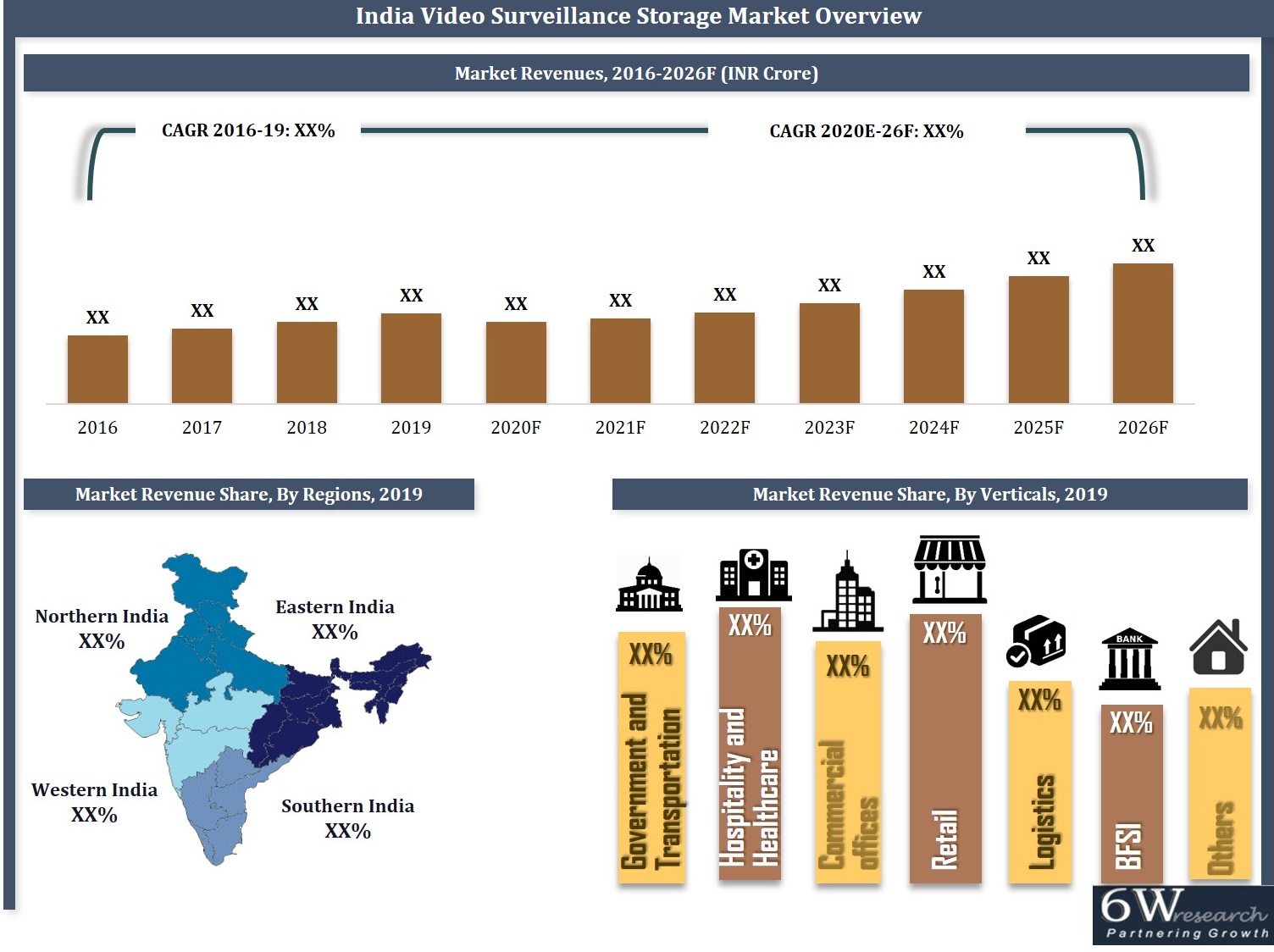

According to 6Wresearch, India Video Surveillance Storage Market size is projected to grow at CAGR of 9.4% during 2020-2026. Construction of the state universities, healthcare projects in various cities, initiatives of the state police department and rising number of residential buildings under construction and planning phase would create opportunities for new installations of video Surveillance Storage systems during the forecast period in India, which would lead to increasing demand for video Surveillance Storage systems. However, halt in construction activities due to COVID-19 would have a negative impact on the demand for Surveillance Storage solutions which would further have a negative impact on the demand for video Surveillance Storage solutions.

Market Analysis by Storage Solutions

Based on market segmentation on Storage Solutions, IP-based Surveillance Storage Cameras have captured a major chunk of the overall market revenues in 2019. Over the last few years, India recorded increasing shift from traditional based analog Surveillance Storage to IP based video Surveillance Storage solutions. This, in turn has increased the need for advanced and higher capacity storage solutions in the country. In terms of storage technology, NAS based video Surveillance Storage solutions registered highest revenue share in the overall market in 2019. The technology is majorly being driven on account of increasing usage of wireless devices, growing demand for scalability, and strengthening IT infrastructure in the country.

Market Analysis by Vertical

In 2019, government & transportation vertical held the highest revenue share in the overall market owing to higher adoption of video Surveillance Storage solutions in the sector. The segment is expected to maintain its dominance in the coming years as well on account of upcoming smart city projects along with transportation infrastructure development across the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report

- India Video Surveillance Storage Market Overview

- India Video Surveillance Storage Market Outlook

- India Video Surveillance Storage Market Trends

- India Video Surveillance Storage Market Forecast

- India Video Surveillance Storage Market Size and India Video Surveillance Storage Market Forecast Revenues until 2026

- Historical Data of India Video Surveillance Storage Market Revenues for the Period 2016-2019

- Historical Data of India Video Surveillance Storage Market Revenues, by Storage Technology, for the Period 2016-2019

- Market Size & Forecast of India Video Surveillance Storage Market Revenues, by Storage Technology, until 2026

- Historical Data of India Direct Attached Video Surveillance Storage Market Revenues, By Types, for the Period 2016-2019

- Market Size & Forecast of India Direct Attached Video Surveillance Storage Market Revenues, By Types, until 2026

- Historical Data of India Video Surveillance Storage Market Revenues, by Deployment, for the Period 2016-2019

- Market Size & Forecast of India Video Surveillance Storage Market Revenues, by Deployment, until 2026

- Historical Data of India Video Surveillance Storage Market Revenues, by Verticals, for the Period 2016-2019

- Market Size & Forecast of India Video Surveillance Storage Market Revenues, by Verticals, until 2026

- Historical Data of India Video Surveillance Storage Market Revenues, By Regions, for the Period 2016-2019

- Market Size & Forecast of India Video Surveillance Storage Market Revenues, By Regions, until 2026

- Market Drivers and Restraints

- India Video Surveillance Storage Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- India Video Surveillance Storage Market Opportunity Assessment

- India Video Surveillance Storage Market Player’s Revenue Shares

- India Video Surveillance Storage Market Overview on Competitive Benchmarking

- Company Profiles

- India Video Surveillance Storage Market Share, By Storage Technology

- India Video Surveillance Storage Market Share, By Deployment

- India Video Surveillance Storage Market Share, By Verticals

- India Video Surveillance Storage Market Share, By Regions

- India Direct Attached Video Surveillance Storage Market Share, By Types

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Storage Technology:

- Network Attached Storage

- Storage Area Network

- Direct Attached Storage

- By Types:

- NVR

- DVR

- Servers with Internal Storage

- By Deployment:

- On-Premises

- On-Cloud

- By Verticals

- BFSI

- Government and Transportation

- Retail

- Commercial Office and IT/ITeS

- Hospitality and Healthcare

- Logistics

- Others

- By Regions

- Northern

- Western

- Southern

- Eastern

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered COVID-19 impact but also current market dynamics, trends and KPIs into consideration.

- How much growth is expected in the India Video Surveillance Storage Market over the coming years?

The India Video Surveillance Storage Market revenue is anticipated to record a CAGR of 9.4% during 2020-26.

- Which segment has captured key share of the market?

IP-based Surveillance Storage Cameras has dominated the overall market revenues in the year 2020.

- Which segment is exhibited to gain traction over the forecast period?

Government and Defense vertical are expected to record key growth throughout the forecast period 2020-26.

- Who are key the key players of the market?

The key players of the market include- NetApp, Inc., Quantum Corporation, Huawei Technologies Co., Ltd., Dell Technologies Inc., Seagate Technology Public Limited Company, Cisco Systems, Inc., Western Digital Corporation, Lenovo Group Limited, Hewlett Packard Enterprise Company

- Is customization available in the market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements

- We also want to have market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero