UAE Elevator and Escalator Market (2015-2021) | Growth, Outlook, Analysis, Share, Revenue, Value, Forecast, Size, Industry, Trends & Companies

Market Forecast by Elevator Types (Geared and Gear Less with Machine Room Elevators, Hydraulic Elevators, and Machine Room Less Elevators) & Escalator Type (Moving Stairs Escalators and Moving Walkways Escalators), Services (New Installation, Modernization and Maintenance), Applications (Residential, Commercial and Industrial) and Regions (Northern UAE and Southern UAE)

| Product Code: ETC000240 | Publication Date: May 2015 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 149 | No. of Figures: 101 | No. of Tables: 19 |

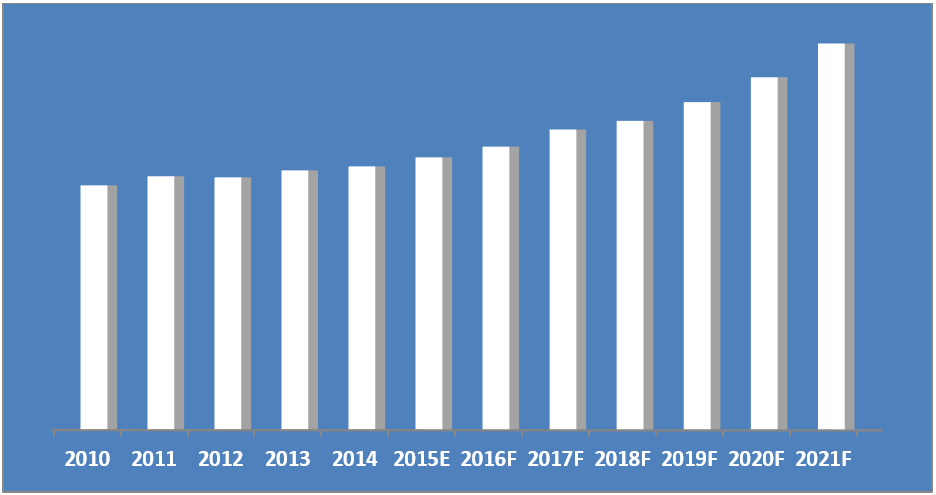

UAE is one of the key growth countries in the Middle East region after Saudi Arabia. The growing construction market, expansion of public infrastructures, and World Expo 2020 are primarily spurring the market for elevators and escalators in UAE.According to 6Wresearch, UAE Elevator and Escalator Market are projected to grow at a CAGR of 6.0% during 2015-21. In UAE's Elevator & Escalator market, the elevator market accounts for the majority of the revenue share and is most likely to lead in the forecast period as well. Maintenance and new installation segments are the major revenue-generating segments, where the maintenance segment has captured a significant share of the market pie. Some of the key players in UAE's elevator and escalator market include ThyssenKrupp, Otis, Schindler, and Kone.

The UAE elevator and escalator market are projected to gain traction in the coming years backed by the rising potential growth of the commercial sector in the country, especially in Dubai. As the growing young working population along with the rising disposable income is leading to spent high on food and shopping ad a result is set to increase in the expansion of the food courts and shopping centers and is estimated to increase the significant demand for elevators and escalator installation and is expected to boost the growth of the UAE elevator and escalator market in the years ahead.

Key Highlights of the Report:

• Historical data of Global Elevator and Escalator Market for the Period 2010-2014

• Market Size & Forecast of Global Elevator and Escalator Market until 2021

• Historical data of UAE Elevator and Escalator Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Elevator and Escalator Revenue & Volume Market until 2021

• Historical data of UAE Elevator Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Elevator Market Revenue & Volume until 2021

• Historical data of UAE Escalator Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Escalator Market Revenue & Volume until 2021

• Historical data of UAE Elevator and Escalator Application Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Elevator and Escalator Application Market Revenue & Volume until 2021

• Market Size & Forecast of UAE Elevator and Escalator Regional Market Revenue & Volume until 2021

• Historical data of UAE Elevator and Escalator Service Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Elevator and Escalator Service Market Revenue & Volume until 2021

• Market Drivers and Restraints

• Market Trends

• Players Market Share and Competitive Landscape

Markets Covered

The report provides a detailed analysis of the following market segments:

• Elevator Types:

o Geared and Gear Less with Machine Room

o Hydraulic Elevators

o Machine Room Less Elevator

• Escalator Types:

o Moving Stairs Escalators

o Moving Walkways Escalators

• Applications

o Residential

o Industrial

o Commercial

• Retail

o Hospital

o Hotel

o Commercial Offices/ Business Parks

o Banking and Financial Institutions

• Services:

o New Installation

o Modernization

o Maintenance

• Regions:

o Southern Region

o Northern Region

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Mythology Adopted & Key Data Points

2.5 Assumptions & Methodology

3 Global Elevator and Escalator Market Overview

3.1 Global Elevator and Escalator Market Revenues

3.2 Global Elevator and Escalator Market Volume

3.3 Global Elevator and Escalator New Installation Market, By Region

3.4 Global Elevator and Escalator Maintenance Market, By Region

4 UAE Elevator and Escalator Market Overview

4.1 UAE Elevator and Escalator Market Revenues (2010-2021F)

4.2 UAE Elevator and Escalator Market Volume (2010-2021F)

4.3 Industry Life Cycle

4.4 Opportunity Matrix

4.5 Porters 5 Forces Model

4.6 UAE Elevator and Escalator Market, By Types

4.7 UAE Elevator and Escalator Market, By Services

4.8 UAE Elevator and Escalator Market, By Application

4.9 UAE Elevator and Escalator Market, By Regions

5 UAE Elevator and Escalator Market Dynamics

5.1 Drivers

5.1.1 Surging Construction Market

5.1.2 Growing IT Market

5.1.3 Growing Skyscrapers

5.1.4 Growing Tourism

5.2 Restraints

5.2.1 High Cost

6 UAE Elevator and Escalator Market Trends

6.1 High-Speed Elevators

6.2 Smart Elevators

6.3 Green Elevators and Escalators

6.4 Government Spending on Infrastructure

7 UAE Elevator Market Overview

7.1 UAE Elevator Market Revenue

7.2 UAE Elevator Market Volume

7.3 UAE Elevator Market, By Types

7.3.1 Geared and Non Geared with Machine Room Elevator Market Overview

7.3.1.1 Geared and Non Geared with Machine Room Elevator Market Revenue

7.3.1.2 Geared and Non Geared with Machine Room Elevator Market Volume

7.3.2 Hydraulic Elevator Market Overview

7.3.2.1 Hydraulic Elevator Market Revenue

7.3.2.2 Hydraulic Elevator Market Volume

7.3.3 Machine Room Less Elevator Market Overview

7.3.3.1 Machine Room Less Elevator Market Revenue

7.3.3.2 Machine Room Less Elevator Market Volume

7.4 UAE Elevator Market, By Services

7.4.1 UAE Elevator Market Revenue, By Services

7.4.2 UAE Elevator Market Volume, By Services

7.5 UAE Elevator Market, By Application

7.5.1 Residential

7.5.2 Industrial

7.5.3 Commercial

7.5.3.1 Retail

7.5.3.2 Hospital

7.5.3.3 Commercial Offices/ Business Parks

7.5.3.4 Hotels

7.5.3.5 Banking and Financial Institutions

8 UAE Escalator Market Overview

8.1 UAE Escalator Market Revenue

8.2 UAE Escalator Market Volume

8.3 UAE Escalator Market, By Types

8.3.1 Moving Stairs Escalator Market

8.3.1.1 Moving Stairs Escalator Market Revenue

8.3.1.2 Moving Stairs Escalator Market Volume

8.3.1.3 Moving Stairs Escalator Market Price Trend

8.3.2 Moving Walkways Escalator Market

8.3.2.1 Moving Walkways Escalator Market Revenue

8.3.2.2 Moving Walkways Escalator Market Volume

8.3.2.3 Moving Walkways Escalator Market Price Trend

8.4 UAE Escalator Market, By Services

8.4.1 UAE Escalator Market Revenue, By Services

8.4.2 UAE Escalator Market Volume, By Services

8.5 UAE Escalator Market, By Application

8.5.1 Retail

8.5.2 Commercial Offices/ Business Park

8.5.3 Transportation

9 UAE Elevator and Escalator Market, By Services

9.1 UAE Elevator and Escalator New Installation Market Revenue

9.2 UAE Elevator and Escalator New Installation Market Volume

9.3 UAE Elevator and Escalator Modernization Market Revenue

9.4 UAE Elevator and Escalator Modernization Market Volume

9.5 UAE Elevator and Escalator Maintenance Market Revenue

9.6 UAE Elevator and Escalator Maintenance Market Volume

10 UAE Elevator and Escalator Market, By Application

10.1 Residential

10.2 Commercial

10.3 Industrial

11 UAE Elevator and Escalator Market, By Region

11.1 Northern Region

11.2 Southern Region

12 Competitive Landscape

12.1 UAE Elevator & Escalator Market Revenue Share, By Company, 2013

12.2 UAE Elevator & Escalator Market Revenue Share, By Company, 2014

13 Company Profile

13.1 Schindler Pars International Ltd

13.2 ThyssenKrupp Elevator UAE (LLC)

13.3 ETA-MELCO Elevator Co. LLC

13.4 Otis Elevator Company

13.5 Kone Middle East LLC

13.6 Fujitec Co. Ltd. UAE

13.7 Gulf Elevator and Escalator Co Ltd

13.8 Hyundai Elevators Co Ltd

13.9 Toshiba Elevator Middle East

13.10 Kleemann Group

14 Key Strategic Pointers

15 Disclaimer

List of Tables

Figure 1 Global Elevator and Escalator Market Revenue, 2010-2014 ($ Billion)

Figure 2 Global Elevator and Escalator Market Revenue, 2015-2021 ($ Billion)

Figure 3 Global Elevator and Escalator Market Volume, 2010-2014 (Million Units)

Figure 4 Global Elevator and Escalator Market Volume, 2015-2021 (Million Units)

Figure 5 Global Elevator and Escalator Market New Installation Volume, 2013-2021 (Million Units)

Figure 6 Global Elevator and Escalator Maintenance and Modernization Market Volume, 2013-2021 (Million Units)

Figure 7 Global Elevator and Escalator New Installation Market, By Region (2014)

Figure 8 Global Elevator and Escalator Maintenance Market, By Region (2014)

Figure 9 UAE Elevator and Escalator Market Revenue, 2010-2014 ($ Billion)

Figure 10 UAE Elevator and Escalator Market Revenue, 2015-211 ($ Billion)

Figure 11 GCC Construction Projects, By Countries (2014)

Figure 12 UAE Elevator and Escalator Market Volume, 2010-2014 (Million Units)

Figure 13 UAE Elevator and Escalator Market Volume, 2015-2011 (Million Units)

Figure 14 UAE Elevator and Escalator Market- Industry Life Cycle

Figure 15 Mark-tunity Matrix

Figure 16 UAE Elevator and Escalator Market Revenue Share (2014-2021)

Figure 17 UAE Elevator and Escalator Market Share, By Revenue, By Services (2014)

Figure 18 UAE Elevator and Escalator Market Share, By Application (2014)

Figure 19 UAE Elevator and Escalator Market Share, By Application (2021)

Figure 20 UAE Elevator and Escalator Market Revenue, By Region, 2014 & 2021 ($ Billion)

Figure 21 UAE Construction Industry, 2013-211 ($ Billion)

Figure 22 UAE Announced Project Composition (%)

Figure 23 UAE IT Spending 2013-2021 ($ Billion)

Figure 24 IT Spending Breakdown Per Sector in UAE (2013)

Figure 25 UAE Elevator Market Revenue, 2010-2014 ($ Billion)

Figure 26 UAE Elevator Market Revenue, 2015-2021 ($ Billion)

Figure 27 UAE Elevator Market Volume, 2010-2014 (Million Units)

Figure 28 UAE Elevator Market Volume, 2015-2021 (Million Units)

Figure 29 UAE Elevator Market Share By Types (2014)

Figure 30 UAE Geared and Non Geared with Machine Room Elevator Market Revenue, 2010-2014 ($ Billion)

Figure 31 UAE Geared and Non Geared with Machine Room Elevator Market Revenue, 2015-2021 ($ Billion)

Figure 32 UAE Geared and Gear Less with Machine Room Elevator Market Volume, 2010-2014 (Thousand Units)

Figure 33 UAE Geared and Gear Less with Machine Room Elevator Market Volume, 2015-21 (Thousand Units)

Figure 34 UAE Hydraulic Elevator Market Revenue, 2010-2014 ($ Billion)

Figure 35 UAE Hydraulic Elevator Market Revenue, 2015-2021 ($ Billion)

Figure 36 UAE Hydraulic Elevator Market Volume, 2010-2014 ( Million Units)

Figure 37 UAE Hydraulic Elevator Market Volume, 2015-2021 ( Million Units)

Figure 38 Machine Room Less Elevator Market Revenue, 2010-2014 ($ Million)

Figure 39 Machine Room Less Elevator Market Revenue, 2015-2021 ($ Million)

Figure 40 UAE Machine Room Less Elevator Market Volume, 2010-2014 ( Million Units)

Figure 41 UAE Machine Room Less Elevator Market Volume, 2015-2021 ( Million Units)

Figure 42 UAE Elevator Market Share, By Application (2014)

Figure 43 UAE Residential Elevator Market Revenue, 2010-2014 ($ Million)

Figure 44 UAE Residential Elevator Market Revenue, 2015-2021 ($ Million)

Figure 45 UAE Residential Elevator Market Volume, 2010-2014 (Thousand Units)

Figure 46 UAE Residential Elevator Market Volume, 2015-2021 (Thousand Units)

Figure 47 UAE Residential Elevator Price Point Analysis ($ Per Unit)

Figure 48 UAE Industrial Elevator Market Revenue, 2010-2014 ($ Million)

Figure 49 UAE Industrial Elevator Market Revenue, 2015-2021 ($ Million)

Figure 50 UAE Industrial Elevator Market Volume, 2010-2014 (Thousand Units)

Figure 51 UAE Industrial Elevator Market Volume, 2015-2021 (Thousand Units)

Figure 52 UAE Industrial Elevator Price Point Analysis ($ Per Unit)

Figure 53 UAE Commercial Elevator Market CAGR, By Industry, 2010-2014

Figure 54 UAE Commercial Elevator Price Point Analysis ($ Per Unit)

Figure 55 UAE Retail Elevator Market Revenue, 2010-2021 ($ Million)

Figure 56 UAE Hospital Elevator Market Revenue, 2010-2021 ($ Million)

Figure 57 UAE commercial Offices/ Business Parks Elevator Market Revenue, 2010-2021 ($ Million)

Figure 58 UAE Hotels Elevator Market Revenue, 2010-2021 ($ Million)

Figure 59 UAE Banking & Financial Institutions Elevator Market Revenue 2010-2021 ($ Million)

Figure 60 UAE Escalator Market Revenue, 2010-2014 ($ Billion)

Figure 61 UAE Escalator Market Revenue, 2015-2021 ($ Billion)

Figure 62 UAE Escalator Market Volume, 2010-2014 (Thousand Units)

Figure 63 UAE Escalator Market Volume, 2015-2021 (Thousand Units)

Figure 64 UAE Escalator Market Share, By Types

Figure 65 UAE Moving Stairs Escalator Market Revenue, 2010-2014 ($ Million)

Figure 66 UAE Moving Stairs Escalator Market Revenue, 2015-2021 ($ Million)

Figure 67 UAE Moving Stairs Escalator Market Volume, 2010-2014 (Thousand Units)

Figure 68 UAE Moving Stairs Escalator Market Volume, 2015-2021 (Thousand Units)

Figure 69 UAE Moving Stairs Escalator Price Point Analysis ($ Per Unit)

Figure 70 Moving Walkways Escalator Market Revenue, 2010-2014 ($ Million)

Figure 71 Moving Walkways Escalator Market Revenue, 2015-2021 ($ Million)

Figure 72 UAE Moving Walkways Escalator Market Volume, 2010-2014 (Thousand Units)

Figure 73 UAE Moving Walkways Escalator Market Volume, 2015-2021 (Thousand Units)

Figure 74 UAE Moving Walkways Escalator Price Point Analysis ($ Per Unit)

Figure 75 UAE Escalator Market Revenue, By Application, 2014 and 2021 (%)

Figure 76 UAE Commercial Escalator Market CCTV Market CAGR, By Industry, 2010-2014

Figure 77 UAE Retail Escalator Market Revenue, 2010-2021, ($ Million)

Figure 78 UAE commercial Offices/ Business Parks Escalator Market Revenue, 2010-2021 ( $ Million)

Figure 79 UAE Transportation Escalator Market Revenue, 2010-21 ($ Million)

Figure 80 UAE Elevator and Escalator Market Revenue, By Services, 2014 & 2021 ($ Billion)

Figure 81 UAE Elevator and Escalator New Installation Market Revenue 2010-2021 ($ Billion)

Figure 82 UAE Elevator and Escalator New Installation Market Volume 2010-2021 (Thousand Units)

Figure 83 UAE Elevator and Escalator Modernization Market Revenue 2010-2021 ($ Million)

Figure 84 UAE Elevator and Escalator Modernization Market Volume 2010-2021 (Thousand Units)

Figure 85 UAE Elevator and Escalator Maintenance Market Revenue 2010-2021 ($ Billion)

Figure 86 UAE Elevator and Escalator Maintenance Market Volume, 2010-2021 (Million units)

Figure 87 UAE Elevator and Escalator Market Revenue, By Applications, 2014 & 2021 ($ Billion)

Figure 88 UAE Residential Elevator and Escalator Market Revenue 2010-2021 ($ Million)

Figure 89 UAE Residential Elevator and Escalator Market Volume 2010-2021 (Thousand Units)

Figure 90 UAE Commercial Elevator and Escalator Market Revenue 2010-2021 ($ Billion)

Figure 91 UAE Commercial Elevator and Escalator Market Volume 2010-2021 (Million Units)

Figure 92 UAE Industrial Elevator and Escalator Market Revenue 2010-2021 ($ Billion)

Figure 93 UAE Industrial Elevator and Escalator Market Volume 2010-2021 (Thousand Units)

Figure 94 UAE Northern Elevator and Escalator Market Revenue 2010-2014 ($ Billion)

Figure 95 UAE Northern Elevator and Escalator Market Revenue 2015-2021 ($ Billion)

Figure 96 UAE Northern Elevator and Escalator Market Volume 2010-2021 (Million Units)

Figure 97 UAE Southern Elevator and Escalator Market Revenue 2010-2014 ($ Billion)

Figure 98 UAE Southern Elevator and Escalator Market Revenue 2015-2021 ($ Billion)

Figure 99 UAE Southern Elevator and Escalator Market Volume 2010-2021 (Million Units)

Figure 100 UAE Elevator & Escalator Market Revenue and Volume Share, By Company (2013)

Figure 101 UAE Elevator & Escalator Market Revenue and Volume Share, By Company (2014)

List of Tables

Table 1 List of elevator manufacturing companies with elevators speed

Table 2 UAE Elevator Market Revenue, By Services, 2010-2014 ($ Million)

Table 3 UAE Elevator Market Revenue, By Services, 2015-2021 ($ Million)

Table 4 UAE Elevator Market Volume, By Services, 2010-2014 (Thousand units)

Table 5 UAE Elevator Market Volume, By Services, 2015-2021 (Thousand units)

Table 6 Standard Moving Stairs Escalator steps width with application

Table 7 UAE Escalator Market Revenue, By Services, 2011-2014 ($ Million)

Table 8 UAE Escalator Market Revenue, By Services, 2015-2021 ($ Million)

Table 9 UAE Escalator Market Volume, By Services, 2011-2014 (Thousand Units)

Table 10 UAE Escalator Market Volume, By Services, 2015-2021 (Thousand Units)

Table 11 Schindler Olayan Elevator Co. Ltd. Financial Statement, 2011-2014 ($ Billion)

Table 12 ThyssenKrupp AG Financial Statement, 2010-2013 ($ Billion)

Table 13 Mitsubishi Electric Corp Financial Statement, 2011-2014 ($ Billion)

Table 14 Otis Elevator Company Financial Statement, 2010-2013 ($ Million)

Table 15 Kone Corp. Financial Statement, 2011-2014 ($ Billion)

Table 16 List of Installation of Fujitec Co. ltd

Table 17 List of Products of GEEC Ltd

Table 18 List of Products of Toshiba Elevator Middle East

Table 19 List of Products of Kleeman Hellas S.A.

UAE is one of the key growing elevator and escalator markets amongst all GCC countries. Though, the market witnessed sluggish demand in terms of new installations in the last few years, but the market is anticipated to attain growth over the next six years owing to World Expo 2020.

In the country, the market is primarily driven by elevators followed by escalators. However, during the forecast period, the elevator segment is expected to lose a marginal market share to the escalator due to the growing installations of the escalators in the retail and transportation sectors.

The key players in the market include Otis Elevator, Kone, ThyssenKrupp, Mitsubishi, Schindler, Hyundai, Toshiba, and Kleemann.

“UAE Elevators and Escalators Market (2015-2021)” report estimates and forecast overall UAE elevators and escalators market by revenue, by elevator and escalator types such as geared and gearless with machine room elevators, hydraulic elevators, machine room-less elevators, moving stairs escalators and moving walkways escalators, applications, and regions. The report also gives the insights on competitive landscape, market share by companies, market trends, company profiles, market drivers, and restraints.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero