Saudi Arabia Elevator and Escalator Market (2018-2024) | Value, Outlook, Industry, Revenue, Analysis, Size, Trends, Forecast, Growth, Companies & Share

Market Forecast By Segments (Elevators (Machine Room and Machine Room Less), Escalator (Moving Stairs and Moving Walkways)), By Services (New Installation, Modernization and Maintenance), By Verticals (Residential, Commercial and Industrial), By Regions (Central, Eastern, Western and Southern) and Competitive Landscape

| Product Code: ETC000510 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 173 | No. of Figures: 10 | No. of Tables: 62 |

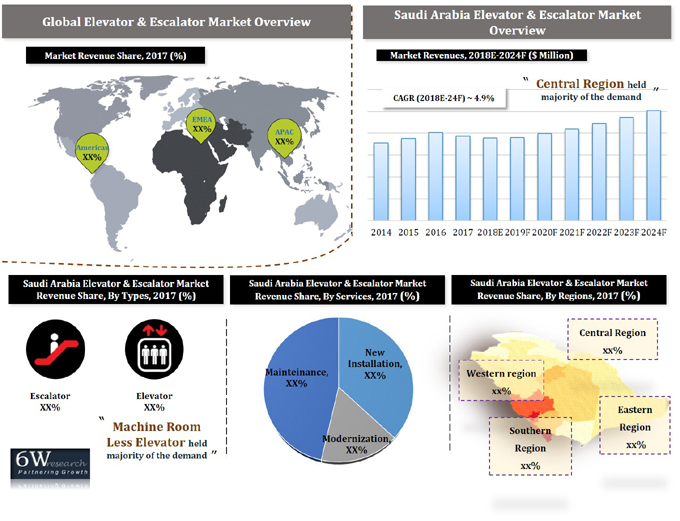

Projected growth in the construction market, especially of high-rise buildings along with upcoming new hotels & shopping malls and increasing inflow of FDI in the construction and retail sectors, would proliferate the overall growth of elevators and escalators in Saudi Arabia. In Saudi Arabia, the elevator segment captured a major share in the overall elevators & escalators market, wherein a majority of the installations were witnessed in residential, retail, transportation, and hospitality sectors. However, the escalator segment is projected to grow at a higher CAGR during 2018-24, primarily due to growing installations across airports, metros, and railway development projects in Saudi Arabia.

According to 6Wresearch, Saudi Arabia elevators and escalators market size is expected to grow at a CAGR of 4.9% during 2018-24. In 2017, the market declined due to falling government spending owing to declining oil prices. The market is anticipated to bounce back with the recovery of oil prices post 2017. The growing urbanization rate and rise in the installation of elevators in the residential sector in Saudi Arabia are forecast to boost the growth of the Elevator and Escalator market. Amongst all the elevator segments, machine room elevators acquired the highest revenue share of the market.

In Saudi Arabia, the Central region held the majority of the Saudi Arabia elevators and escalators market share, in terms of volume owing to increasing infrastructure development activities, especially in the commercial and residential verticals. During the forecast period, the western region is expected to register higher growth in the market.

Saudi Arabia elevators and escalators market report thoroughly covers the market by elevators and escalators types, sub-segments, verticals, and regions. Saudi Arabia elevators and escalators market outlook report provides an unbiased and detailed analysis of the Saudi Arabia elevators and escalators market trends, opportunities/ high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

In Saudi Arabia Elevator And Escalator Market is based on the type, service, company, region, and elevator technology. Elevators and escalators are used in various industries. Saudi Arabia Elevator And Escalator Market include Schindler Olayan Elevators Co. Ltd, Fujitec Saudi Arabia Co, Mitsubishi Electric Saudi Ltd Saudi Arabia's Elevator and escalator market is expected to grow more in the future. In Saudi Arabia booming construction there are multiple projects of high-rise buildings, rising in urbanization is the key factor of an increase in the elevator and escalator mark in Saudi Arabia. These projects improve the infrastructure of Saudi Arabia and the economy also develops. Saudi Arabia Elevator and escalator market segmented based on the end-user, region based on type, elevator technology, service, and the market is growing according to the technology of the elevator and escalator market. In Saudi Arabia elevator and escalator market, widespread use in the industries and technology of the elevator and escalator and market can be traction and machines room-less traction.

Saudi Arabia elevator and escalator market are estimated to gain momentum in the upcoming six years on the back of the rising expansion of construction projects in the country like the Red Sea, Neom, Jeddah tower, and Qiddiya are estimated to support the growth and development of the commercial and hospitality sector is estimated to instigate the installation of elevators and escalator in the coming year and would bring in opportunities for the to be investors to widen the market landscape and is estimated to secure tremendous growth of the Saudi Arabia elevator and escalator market in the forthcoming years.

Key Highlights of the Report:

• Saudi Arabia Elevators and Escalators Market Overview

• Saudi Arabia Elevators and Escalators Market Outlook

• Saudi Arabia Elevators and Escalators Market Forecast

• Historical data of Global Elevator and Escalator Market for the Period, 2014-2017

• Market Size & Forecast of Global Elevator and Escalator Market, until 2024

• Historical data of Saudi Arabia Elevator and Escalator Market Revenues & Volume for the Period, 2014-2017

• Saudi Arabia Elevators and Escalators Market Size & Saudi Arabia Elevators and Escalators Market Forecast of Revenue & Volume, until 2024

• Historical data of Saudi Arabia Elevators and Escalators Market Revenues & Volume for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Elevators and Escalators Market, By Revenues & By Volume, until 2024

• Historical data of Saudi Arabia Escalators Market Revenues & Volume for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Escalators Market Revenues & Volume, until 2024

• Historical data of Saudi Arabia Elevator and Escalator Vertical Market Revenues for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Elevators and Escalators Market Revenues, By Verticals, until 2024

• Historical data of Saudi Arabia Elevator and Escalator Regional Market Revenues for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Elevator and Escalator Regional Market Revenues, until 2024

• Historical data of Saudi Arabia Elevator and Escalator Service Market Revenues for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Elevator and Escalator Service Market Revenues, until 2024

• Market Drivers, Restraints

• Saudi Arabia Elevators and Escalators Market Trends

• Saudi Arabia Elevators and Escalators Market Share, By Players

• Saudi Arabia Elevators and Escalators Market Overview on Competitive Landscape

• Company Profiles

• Strategic Recommendations

Markets Covered

The Saudi Arabia elevators and escalators market report provide a detailed analysis of the following market segments:

• By Segments

o Elevators

? Machine Room

? Machine Room Less

o Escalator

? Moving Stairs

? Moving Walkways

• By Services

o New Installation

o Modernization

o Maintenance

• By Verticals

o Residential

o Commercial

o Industrial

• By Regions

o Central

o Eastern

o Western

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3 Global Elevator & Escalator Market Overview

3.1 Global Elevator & Escalator Market Revenues and Volume (2014-2024F)

3.2 Global Elevator & Escalator Market Revenue Share, By Regions (2017)

4 Saudi Arabia Elevator & Escalator Market Overview

4.1 Overview and Analysis

4.2 Saudi Arabia Elevator & Escalator Market Revenues and Volume (2014-2024F)

4.3 Saudi Arabia Elevator & Escalator Industry Life Cycle

4.4 Saudi Arabia Elevator & Escalator Market Porter's Five Forces Model

4.5 Saudi Arabia Elevator & Escalator Market Revenue Share, By Type (2017 & 2024F)

4.6 Saudi Arabia Elevator & Escalator Market Revenue Share, By Services (2017 & 2024F)

4.7 Saudi Arabia Elevator & Escalator Market Revenue Share, By Vertical (2017 & 2024F)

5 Saudi Arabia Elevator & Escalator Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6 Saudi Arabia Elevator & Escalator Market Trends

7 Saudi Arabia Elevator Market Overview

7.1 Overview & Analysis

7.2 Saudi Arabia Elevator Market Revenues and Volume (2014-2024F)

7.3 Saudi Arabia Elevator Market Revenues, By Types

7.3.1 Saudi Arabia Machine Room Elevator Market Revenues (2014-2024F)

7.3.2 Saudi Arabia Machine Roomless Elevator Market Revenues (2014-2024F)

7.4 Saudi Arabia Elevator Market Revenues, By Services

7.5 Saudi Arabia Elevator Market Revenue, By Verticals

7.5.1 Saudi Arabia Commercial Elevator Market Revenues (2014-2024F)

7.5.2 Saudi Arabia Residential Elevator Market Revenues (2014-2024F)

7.5.3 Saudi Arabia Industrial Elevator Market Revenues (2014-2024F)

8 Saudi Arabia Escalator Market Overview

8.1 Overview & Analysis

8.2 Saudi Arabia Escalator Market Revenues and Volume (2014-2024F)

8.3 Saudi Arabia Escalator Market Revenue Share, By Types

8.3.1 Saudi Arabia Moving Stairs Escalator Market Revenues & Volume (2014-2024F)

8.3.2 Saudi Arabia Moving Walkways Escalator Market Revenues & Volume (2014-2024F)

8.4 Saudi Arabia Escalator Market Revenue, By Services

8.5 Saudi Arabia Escalator Market Revenue, By Verticals

9 Saudi Arabia Elevator & Escalator Services Market Overview

9.1 Saudi Arabia Elevator & Escalator New Installation Market Revenues, (2014-2024F)

9.2 Saudi Arabia Elevator & Escalator Modernization Market Revenues, (2014-2024F)

9.3 Saudi Arabia Elevator & Escalator Maintenance Market Revenues, (2014-2024F)

10 Saudi Arabia Elevator & Escalator Vertical Market Overview

10.1 Saudi Arabia Elevator & Escalator Residential Vertical Market Revenues (2014-2024F)

10.2 Saudi Arabia Elevator & Escalator Industrial Vertical Market Revenues (2014-2024F)

10.3 Saudi Arabia Elevator & Escalator Commercial Vertical Market Revenues (2014-2024F)

10.3.1 Saudi Arabia Elevator & Escalator Commercial Vertical Market Revenues, By Sectors (2014-2024F)

10.4 Saudi Arabia Elevator & Escalator Market Opportunity Matrix, By Verticals (2024)

11 Saudi Arabia Elevator & Escalator Market KPI

12 Saudi Arabia Elevator & Escalator Market Current and Upcoming Skyscrapper Projects

13 Saudi Arabia Elevator & Escalator Regional Market Overview

13.1 Saudi Arabia Elevator & Escalator Market Revenue Share, By Regions (2017 & 2024F)

13.2 Saudi Arabia Western and Southern Region Elevator & Escalator Market Revenues (2014-2024F)

13.3 Saudi Arabia Eastern and Central Region Elevator and Escalator Market Revenues (2014-2024F)

14 Competitive Landscape

14.1 Saudi Arabia Elevator & Escalator Market Share, By Company

15 Company Profiles

15.1 Mitsubishi Electric Saudi Ltd.

15.2 Hyundai Elevator Co. Ltd

15.3 Kone Middle East LLC

15.4 Otis Elevator Co. Saudi Arabia Ltd.

15.5 Schindler Olayan Elevator Co. Ltd.

15.6 ThyssenKrupp Elevator Saudi Arabia LLC

16 Key Strategic Pointers

17 Disclaimer

List of Figures

Figure 1 Global Elevator and Escalator Market Revenues, 2014-2024F ($ Billion)

Figure 2 Global Elevator and Escalator Market Volume, 2014-2024F (Million Units)

Figure 3 Global Elevator and Escalator Market Revenue Share, By Regions (2017)

Figure 4 Saudi Arabia Urban Population (% of Total Population), 2010-2017

Figure 5 Gross Domestic Product, at Current Prices of Saudi Arabia, 2014-2023F ($ Billion)

Figure 6 Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion)

Figure 7 Saudi Arabia Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 8 Saudi Arabia Elevator and Escalator Market Volume, 2014-2024F (Units)

Figure 9 Saudi Arabia Elevator and Escalator Market Revenue Share, By Type (2017 & 2024F )

Figure 10 Saudi Arabia Elevator and Escalator Market Revenue Share, By Services (2017 & 2024F )

Figure 11 Saudi Arabia Elevator and Escalator Market Revenue Share, By Verticals (2017 & 2024F )

Figure 12 Saudi Arabia Construction Industry Revenues, 2016-2026F ($ Billion)

Figure 13 Saudi Arabia International Tourism, Number Of Arrivals, 2014-2018E (In Millions)

Figure 14 Number of Upcoming and Under construction Skyscrapers Projects in Saudi Arabia (2014 Onwards)

Figure 15 Saudi Arabia Elevator Market Revenues, 2014-2024F ($ Million)

Figure 16 Saudi Arabia Elevator Market Volume, 2014-2024F (Units)

Figure 17 Saudi Arabia Machine Room Elevators Market Revenues, 2014-2024F ($ Million)

Figure 18 Saudi Arabia Machine Room Less Elevators Market Revenues, 2014-2024F ($ Million)

Figure 19 Saudi Arabia Commercial Elevator Market Revenues, 2014-2017 ($ Million)

Figure 20 Saudi Arabia Commercial Elevator Market Revenues, 2018E-2024F ($ Million)

Figure 21 Saudi Arabia Residential Elevator Market Revenues, 2014-2017 ($ Million)

Figure 22 Saudi Arabia Residential Elevator Market Revenues, 2018E-2024F ($ Million)

Figure 23 Saudi Arabia Industrial Elevator Market Revenues, 2014-2017 ($ Million)

Figure 24 Saudi Arabia Industrial Elevator Market Revenues, 2018E-2024F ($ Million)

Figure 25 Saudi Arabia Retail Market Segmentation, By Types (2017)

Figure 26 Saudi Arabia Escalator Market Revenues, 2014-2024F ($ Million)

Figure 27 Saudi Arabia Escalator Market Volume, 2014-2024F (Units)

Figure 28 Saudi Arabia Moving Stair Escalator Market Revenues, 2014-2024F ($ Million)

Figure 29 Saudi Arabia Moving Stair Escalator Market Volume, 2014-2024F (Units)

Figure 30 Saudi Arabia Moving Walkways Escalator Market Revenues, 2014-2024F ($ Million)

Figure 31 Saudi Arabia Moving Walkways Escalator Market Volume, 2014-2024F (Units)

Figure 32 Saudi Arabia Government and Transportation Vertical Escalator Market Revenues, 2014-2024F ($ Million)

Figure 33 Saudi Arabia Retail Vertical Escalator Market Revenues, 2014-2024F ($ Million)

Figure 34 Saudi Arabia Elevator and Escalator New Installation Market Revenues, 2014-2024F ($ Million)

Figure 35 Saudi Arabia Elevator and Escalator New Installation Market Revenue Share, By Types (2017 & 2024F)

Figure 36 Saudi Arabia Elevator and Escalator Modernization Market Revenues, 2014-2024F ($ Million)

Figure 37 Saudi Arabia Elevator and Escalator Modernization Market Revenue Share, By Types (2017 & 2024F)

Figure 38 Saudi Arabia Elevator and Escalator Maintenance Market Revenues, 2014-2024F ($ Million)

Figure 39 Saudi Arabia Elevator and Escalator Maintenance Market Revenue Share, By Types (2017 & 2024F)

Figure 40 Saudi Arabia Elevator and Escalator Residential Vertical Market Revenues, 2014-2024F ($ Million)

Figure 41 Saudi Arabia Elevator and Escalator Industrial Vertical Market Revenues, 2014-2024F ($ Million)

Figure 42 Saudi Arabia Elevator and Escalator Commercial Vertical Market Revenues, 2014-2024F ($ Million)

Figure 43 Saudi Arabia Commercial Elevators and Escalators Market Revenue Share, By Type (2017)

Figure 44 Saudi Arabia BFSI Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 45 Saudi Arabia Government & Transportation Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 46 Saudi Arabia Healthcare & Hospitality Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 47 Saudi Arabia Commercial Offices Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 48 Saudi Arabia Educational Institutions Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 49 Saudi Arabia Retail Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 50 Saudi Arabia Elevator and Escalator Market Opportunity Matrix, By Verticals (2024F)

Figure 51 Saudi Arabia Residential Units Supply, By Key Cities, 2014-2019F (‘000 Units)

Figure 52 Saudi Arabia Number of Retail units, By Key Cities, 2014-2019E (Million sq. m)

Figure 53 Saudi Arabia Number of Commercial Office, By Key Cities, 2014-2019E (Million sq. m)

Figure 54 Saudi Arabia Value of Contracts Awarded, By Sector, 2015-2018E ($ Billion)

Figure 55 Saudi Arabia Building Construction Projects Value by Status (2017)

Figure 56 Saudi Arabia Budget Allocation (2017)

Figure 57 Average number of Metro and Railway Station to be Constructed in a year, 2014-2024F

Figure 58 Saudi Arabia Elevator and Escalator Market Revenue Share, By Regions (2017 & 2024F)

Figure 59 Saudi Arabia Western Region Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 60 Saudi Arabia Southern Region Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 61 Saudi Arabia Eastern Region Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

Figure 62 Saudi Arabia Central Region Elevator and Escalator Market Revenues, 2014-2024F ($ Million)

List of Tables

Table 1 Fees to be Paid by Saudi Arabian Company for Non-Saudi Employee (SAR)

Table 2 Saudi Arabia Dependent Fees for Foreign Nationals (SAR)

Table 3 Saudi Arabia Elevator Market Revenues, By Services, 2014-2024F ($ Million)

Table 4 Saudi Arabia Commercial Elevator Market Revenues, By Types, 2014-2024F ($ Million)

Table 5 Saudi Arabia Escalator Market Revenues, By Services, 2014-2024F ($ Million)

Table 6 List of Construction Projects in Saudi Arabia

Table 7 Under Construction Manufacturing Units in Saudi Arabia, 2017

Table 8 Upcoming Manufacturing Plants in Saudi Arabia

Table 9 List of Residential High-rise Building Construction Projects in Saudi Arabia

Table 10 List of Commercial High-rise Building Construction Projects in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero