India Crude Oil Market (2025-2031) | Industry, Share, Value, Size, Growth, Analysis, Forecast, Companies, Revenue & Trends

Market Forecast By Derivatives (Paraffin, Pentane, Octane, Naphthene, Aromatics, Asphaltic), By Composition (Hydrocarbon Compounds, Carbon, Hydrogen, Non-Hydrocarbon Compounds, Organometallic Compounds, Sodium, Calcium), By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By End Use (Light Commercial Vehicles, Passenger Vehicles, Mining, Agriculture, Residential) And Competitive Landscape

| Product Code: ETC412640 | Publication Date: Aug 2023 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

India Crude Oil Market Growth Rate

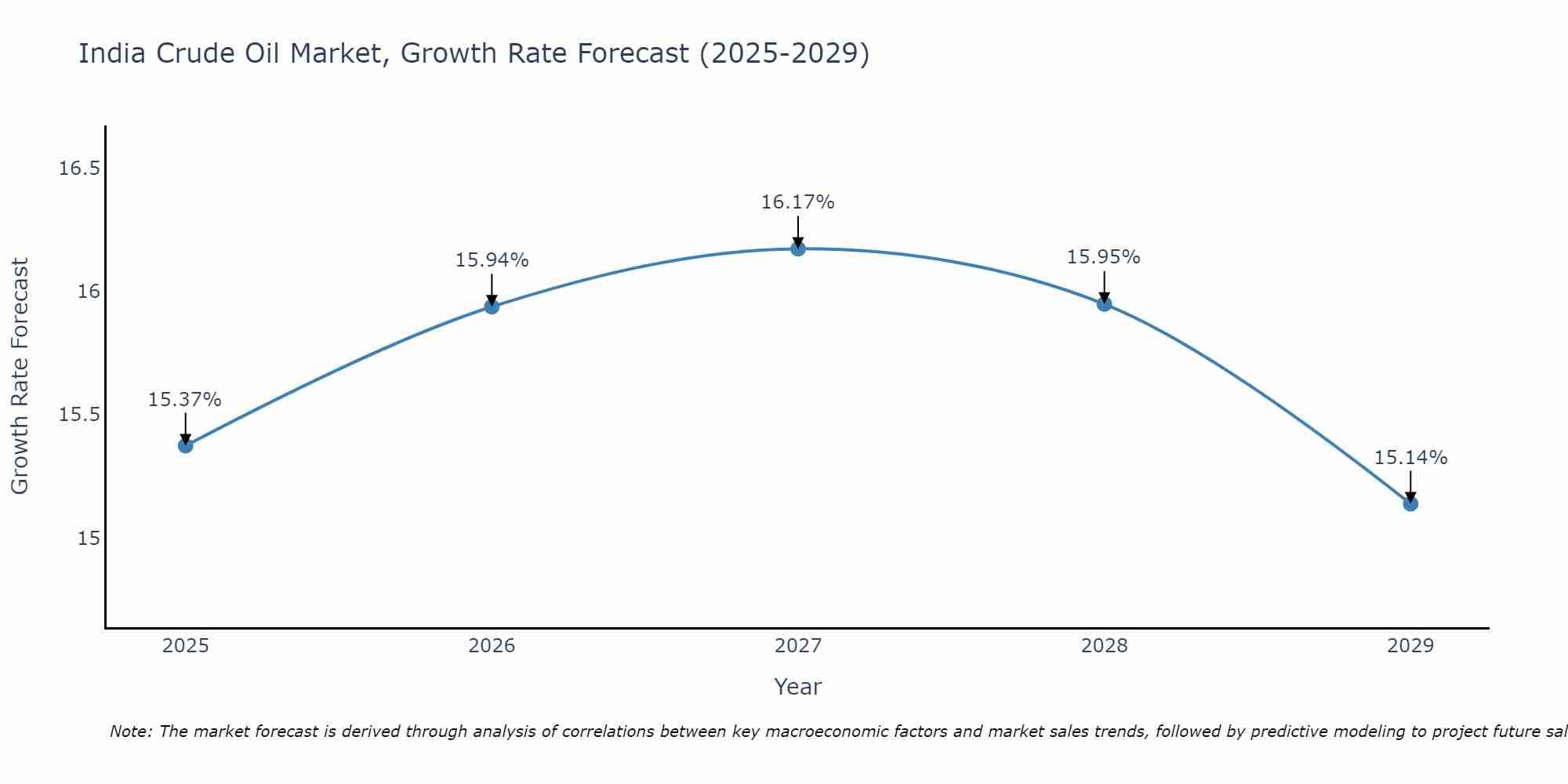

India is projected to observe a 16.17% Exponential growth in the Crude Oil market by 2027.

India Crude Oil Market Size Growth Rate

The India Crude Oil Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 15.37% in 2025, climbs to a high of 16.17% in 2027, and moderates to 15.14% by 2029.

India Crude Oil Market Highlights

| Report Name | India Crude Oil Market |

| Forecast Period | 2025-2031 |

| CAGR | 16.17% |

| Growing Sector | Refining Sector |

Topics Covered India Crude Oil Market Report

The India Crude Oil Market Report thoroughly covers the market by derivatives, composition, type, and end-use. The India Crude Oil Market Outlook report provides an unbiased and detailed analysis of the ongoing India Crude Oil Market trends, opportunities/high growth areas, and market drivers. This would help the stakeholders devise and align their market strategies according to the current and future market dynamics.

India Crude Oil Market Synopsis

India crude oil market has been attaining prominent growth and is projected to rise more in the future due to the increasing demand for petroleum products, rising population in the country as well as urbanization. The market is expected to attain major revenue share in the future since a number drivers have been driving its success.

According to 6Wresearch, the India Crude Oil Market size is anticipated to rise at a CAGR of 16.17% during 2025-2031. One of the primary drivers behind the growth of the India crude oil market is the increasing demand for petroleum products. India is the third-largest consumer of oil worldwide, following the United States and China. This demand for crude oil is fueled by the growing population, urbanization, and industrialization in the country. Another significant driver of the India crude oil market is the country’s focus on expanding its petrochemical and refining sectors. The Indian government's Ministry of Petroleum and Natural Gas has set a target of increasing the country's refining capacity to over 400 million metric tonnes by 2025. This, in turn, is expected to increase the demand for crude oil in the country which will inspire the India Crude Oil Market Growth.

One of the most significant challenges faced by the India crude oil market is its heavy reliance on imports. In fact, India imports over 80% of its crude oil requirements from countries such as Saudi Arabia, the United States, and Iraq. This reliance on imports makes the country vulnerable to supply disruptions and price spikes in the global oil markets. Another significant challenge faced by the India crude oil market is the increasing pressure to transition towards cleaner and renewable sources of energy. In recent years, the government of India has been advocating for the adoption of alternative sources of energy, such as solar and wind power, to reduce the country's carbon footprint.

Crude Oil Market in India: Leading Players

The India crude oil market is dominated by several key players, including Reliance Industries Limited, Indian Oil Corporation Limited, and Bharat Petroleum Corporation Limited. These companies are involved in various segments of the oil and gas value chain, such as exploration, refining, and marketing.

India Crude Oil Industry: Government Initiatives

To promote the growth of the India crude oil market, the government has implemented several initiatives over the years. One of the most notable initiatives is the launch of the Open Acreage Licensing Policy (OALP) in 2017. This policy allows companies to choose the blocks they want to explore and produce oil and gas from, rather than bidding for pre-defined blocks. The government has also implemented the Discovered Small Fields Policy (DSF), which aims to monetize small and marginal oil and gas fields discovered by the national oil companies. This policy has contributed to the growth of small and medium-sized companies in the industry.

Future Insights of the Market

India crude oil market faces significant challenges and uncertainties in the coming years. However, by focusing on diversification, domestic production, and renewable energy sources, India can improve its energy security and accelerate its economic growth while also taking steps towards a greener future. With careful planning and action, the India crude oil market can emerge stronger and more resilient in the years ahead.

Market Segmentation by Derivatives

According to Ravi Bhandari, Research Head, 6Wresearch, the aromatics segment is experiencing significant growth in the Indian crude oil market, mainly due to the increasing demand for petrochemical products and plastics.

Market Segmentation by Composition

According to composition, the demand for carbon and hydrogen, in particular, is increasing due to their versatility and role in producing essential products.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Crude Oil Market Outlook

- Market Size of India Crude Oil Market, 2024

- Forecast of India Crude Oil Market, 2031

- Historical Data and Forecast of India Crude Oil Revenues & Volume for the Period 2021-2031

- India Crude Oil Market Trend Evolution

- India Crude Oil Market Drivers and Challenges

- India Crude Oil Price Trends

- India Crude Oil Porter's Five Forces

- India Crude Oil Industry Life Cycle

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Derivatives for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Paraffin for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Pentane for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Octane for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Naphthene for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Aromatics for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Asphaltic for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Composition for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Carbon for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Hydrogen for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Non-Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Organometallic Compounds for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Sodium for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Calcium for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Light Distillates for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Light Oils for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Medium Oils for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Heavy Fuel Oil for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By End Use for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Light Commercial Vehicles for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Passenger Vehicles for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Mining for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Agriculture for the Period 2021-2031

- Historical Data and Forecast of India Crude Oil Market Revenues & Volume By Residential for the Period 2021-2031

- India Crude Oil Import Export Trade Statistics

- Market Opportunity Assessment By Derivatives

- Market Opportunity Assessment By Composition

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End Use

- India Crude Oil Top Companies Market Share

- India Crude Oil Competitive Benchmarking By Technical and Operational Parameters

- India Crude Oil Company Profiles

- India Crude Oil Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Derivatives

- Paraffin

- Pentane

- Octane

- Naphthene

- Aromatics

- Asphaltic

By Composition

- Hydrocarbon Compounds

- Carbon

- Hydrogen

- Non-Hydrocarbon Compounds

- Organometallic Compounds

- Sodium

- Calcium

By Type

- Light Distillates

- Light Oils

- Medium Oils

- Heavy Fuel Oil

By End Use

- Light Commercial Vehicles

- Passenger Vehicles

- Mining

- Agriculture

- Residential

India Crude Oil Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Crude Oil Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Crude Oil Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Crude Oil Market - Industry Life Cycle |

| 3.4 India Crude Oil Market - Porter's Five Forces |

| 3.5 India Crude Oil Market Revenues & Volume Share, By Derivatives, 2021 & 2031F |

| 3.6 India Crude Oil Market Revenues & Volume Share, By Composition, 2021 & 2031F |

| 3.7 India Crude Oil Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.8 India Crude Oil Market Revenues & Volume Share, By End Use, 2021 & 2031F |

| 4 India Crude Oil Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 India Crude Oil Market Trends |

| 6 India Crude Oil Market Segmentations |

| 6.1 India Crude Oil Market, By Derivatives |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Crude Oil Market Revenues & Volume, By Paraffin, 2021-2031F |

| 6.1.3 India Crude Oil Market Revenues & Volume, By Pentane, 2021-2031F |

| 6.1.4 India Crude Oil Market Revenues & Volume, By Octane, 2021-2031F |

| 6.1.5 India Crude Oil Market Revenues & Volume, By Naphthene, 2021-2031F |

| 6.1.6 India Crude Oil Market Revenues & Volume, By Aromatics, 2021-2031F |

| 6.1.7 India Crude Oil Market Revenues & Volume, By Asphaltic, 2021-2031F |

| 6.2 India Crude Oil Market, By Composition |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Crude Oil Market Revenues & Volume, By Hydrocarbon Compounds, 2021-2031F |

| 6.2.3 India Crude Oil Market Revenues & Volume, By Carbon, 2021-2031F |

| 6.2.4 India Crude Oil Market Revenues & Volume, By Hydrogen, 2021-2031F |

| 6.2.5 India Crude Oil Market Revenues & Volume, By Non-Hydrocarbon Compounds, 2021-2031F |

| 6.2.6 India Crude Oil Market Revenues & Volume, By Organometallic Compounds, 2021-2031F |

| 6.2.7 India Crude Oil Market Revenues & Volume, By Sodium, 2021-2031F |

| 6.3 India Crude Oil Market, By Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Crude Oil Market Revenues & Volume, By Light Distillates, 2021-2031F |

| 6.3.3 India Crude Oil Market Revenues & Volume, By Light Oils, 2021-2031F |

| 6.3.4 India Crude Oil Market Revenues & Volume, By Medium Oils, 2021-2031F |

| 6.3.5 India Crude Oil Market Revenues & Volume, By Heavy Fuel Oil, 2021-2031F |

| 6.4 India Crude Oil Market, By End Use |

| 6.4.1 Overview and Analysis |

| 6.4.2 India Crude Oil Market Revenues & Volume, By Light Commercial Vehicles, 2021-2031F |

| 6.4.3 India Crude Oil Market Revenues & Volume, By Passenger Vehicles, 2021-2031F |

| 6.4.4 India Crude Oil Market Revenues & Volume, By Mining, 2021-2031F |

| 6.4.5 India Crude Oil Market Revenues & Volume, By Agriculture, 2021-2031F |

| 6.4.6 India Crude Oil Market Revenues & Volume, By Residential, 2021-2031F |

| 7 India Crude Oil Market Import-Export Trade Statistics |

| 7.1 India Crude Oil Market Export to Major Countries |

| 7.2 India Crude Oil Market Imports from Major Countries |

| 8 India Crude Oil Market Key Performance Indicators |

| 9 India Crude Oil Market - Opportunity Assessment |

| 9.1 India Crude Oil Market Opportunity Assessment, By Derivatives, 2021 & 2031F |

| 9.2 India Crude Oil Market Opportunity Assessment, By Composition, 2021 & 2031F |

| 9.3 India Crude Oil Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.4 India Crude Oil Market Opportunity Assessment, By End Use, 2021 & 2031F |

| 10 India Crude Oil Market - Competitive Landscape |

| 10.1 India Crude Oil Market Revenue Share, By Companies, 2024 |

| 10.2 India Crude Oil Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero