India LED Lighting Market (2019-2025) | industry, Trends, Forecast, Revenue, Growth, Analysis, Size, Share & Outlook

Market Report By Types (LED Lamps (Self-Ballasted LED lamps, Down Lighters LED, Street Lights LED), Luminaires (Indoor Luminaires, Outdoor Luminaires)), By End-Users (Outdoor Lighting, Indoor Lighting), By Applications (Commercial, Residential, Industrial), By Regions (Eastern, Central, Western, North Eastern, Southern) And Competitive Landscape.

| Product Code: ETC001452 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 105 | No. of Figures: 42 | |

India LED Lighting Market report is a part of the Asia Pacific LED Lightning Market and thoroughly covers the Indian LED lighting market by types, applications, wattage, end-users, and regions. The report provides an unbiased and detailed analysis of ongoing India LED Lightning Industry trends 2021, opportunities/ high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of India LED Lighting Market

India LED Lighting Market has seen swashbuckling growth over the years. The growth is primarily driven by government support and growing awareness about the energy-saving benefits of LED lights. Some of the latest developments in the LED Lighting Market are government initiatives which are aiming to promote LED lighting in the country. Several initiatives are aimed at replacing traditional lighting with energy-efficient LED lights and have helped increase the adoption of LED lighting in the country. The introduction of smart LED lighting solutions has been a major development in the India LED Lighting Industry. In general, smart LED lighting systems allow remote monitoring and resulting in more efficient energy and reduced maintenance costs.

The government’s efforts have led to an increase in domestic manufacturing of LED lighting products which makes them more affordable and accessible. The India LED lighting market is expected to continue to grow in the years to come through government initiatives and increased demand for energy-efficient lighting solutions. The continuous advancements in LED lighting technology have led to an increase in the efficiency of LED lights, thereby boosting their demand in India.

India LED Lighting Market Synopsis

India LED Lighting Market witnessed a surge in recent years on account of the growing population and subsequent urbanization. In 2018, India’s energy demand grew by 4%, which outpaced the global energy demand of 2.3%. With the increasing rate of electricity consumption, the demand for an environmentally friendly and cost-effective lighting solution is also gaining traction. Hence, in recent years, LED lighting has started to considerably penetrate the mainstream general lighting industry in India.

India LED Lightning Market is expected to gain substantial growth during the upcoming years on account of growing urbanization. Increasing initiatives are taken by the government such as surging investment in the expansion of lightning infrastructure in the country driving India LED Lightning Market Growth. A rapid growth in the automotive sector coupled with increasing development in infrastructural investment is adding to the development of the market. Increasing regulations by the government in order to promote efficient electricity is driving the growth of the industry. Rising awareness regarding the cost-effectiveness and Eco-friendliness of LED triggers the potential growth of the market.

A growing focus on increasing environmental concerns is flourishing the demand for LED Lightning. Moreover, the usage of LED Lightning in various applications such as LED lamps, automotive headlights, lighted wallpapers, and traffic signals. The growing population coupled with the surging usage of electricity and demand for environmental sustainability is driving the growth of the market. Increasing adoption of modern technology and the introduction of innovative products by the manufacturer is driving the LED Lightning Market Share.

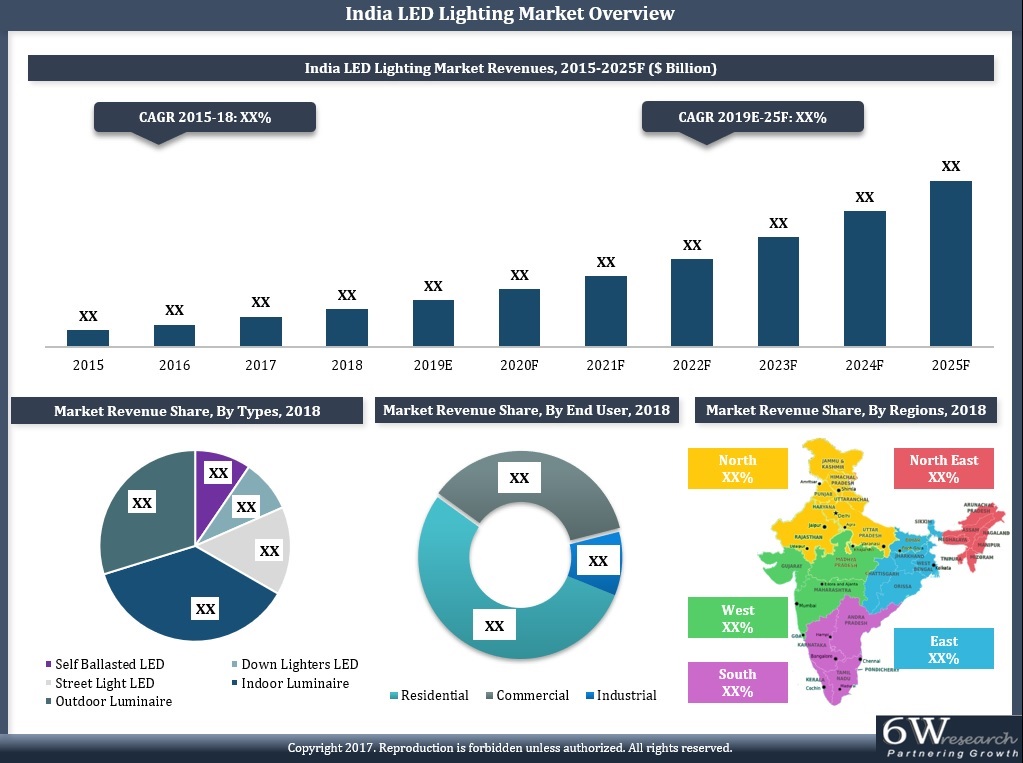

According to 6Wresearch, India LED Lighting Market size is projected to grow at a CAGR of 23.6% during 2019-2025. Several government schemes such as Unnat Jyoti by Affordable LEDs for All (UJALA) and Street Lighting National Programme (SLNP) remained the biggest demand drivers for the LED lighting market in India. The aim of such initiatives is to increase awareness among consumers regarding the adoption of LED bulbs over conventional lighting sources such as incandescent bulbs, CFL, and halogen lights. For instance, under the SLNP, the government aims to replace over 1.34 crore conventional street lights in India, out of which, around 1.04 crore street lights were already replaced as of November 2019.

There is no doubt that the power and utility sector has been outperforming in the country with increased electrification in the rural areas Backed by the continuous efforts of the country’s government toward the growth of electrification in the country. As a result of this, the light industry is experiencing enormous growth patterns and as a result, it is expected to witness significant growth in the coming timeframe as well. On the same grounds, LEDs have been performing so well in the country owing to the advanced electrification and efficient electricity usage provided by the LEDs. The cost-effective feature of the product is proving evident to make it a utility-based product. With minimal electricity usage, LEDs have been put to use in various industrial and residential domains and are gaining popularity with an increased number of sales each year registered for the product. Moreover, the increase in the concerns regarding energy efficiency and production and use of low carbon emission-based diodes in lighting elements is expected to drive significant demand projections for LEDs in the country in the coming years and benefit the makers of the same to enjoy the business ramp-up in the next five to ten years.

Surging growth in the automotive sector backed by the usage of LEDs in various industries is driving the India LED Lightning market Revenue. The factors such as infrastructure development and a decline in the prices of LED are proliferating the demand for LED lighting in India. Effective energy programs by the government are also the key drivers of the Lightning Industry. Rising disposable income coupled with surging urbanization is propelling the growth of the market.

The demand is expected to flourish as per the LED Lightning Market Forecast on the back of the rising wide scope of application in the commercial and industrial sectors. Additionally, the increasing urban population in the country at the fastest pace coupled with the rising discretionary income has led to spending high on house construction which is estimated to impact positively on the growth of the LED lighting market share owing to the increasing installation of LED lighting during the forthcoming years.

Market Analysis by Region

The Northern region accounts for the largest revenue share in overall India LED Lightning Industry, followed by the Southern region. With several upcoming infrastructural projects across the residential, industrial, and commercial domains across several parts of the country, the demand for LED lamps & luminaires is projected to witness significant growth over the coming years.

Key Players in The Market

Some of the key players in India LED Lightning Market are:

- Signify NV

- Surya

- Crompton

- Bajaj

- Halonix

- Havells

Key Highlights of the Report

- India LED Lighting Market Overview

- India LED Lighting Market Outlook

- India LED Lighting Market Size

- India LED Lighting Market Forecast

- Historical data of India LED Lighting Market Revenues for the period 2015-2018.

- India LED Lighting Market Size & India LED Lighting Market Forecast of Revenues until 2025F.

- Historical Data of India LED Lighting Market Revenues for the Period 2015-2018, By Types.

- Market Size & Forecast of India LED Lighting Market Revenues until 2025F, By Types.

- India LED Lighting Market Share, By Types, for the year 2018.

- Historical Data of India LED Lighting Market Revenues for the Period 2015-2018, By Applications.

- Market Size & Forecast of India LED Lighting Market Revenues until 2025F, By Applications.

- India LED Lighting Market Share, By Applications, for the year 2018.

- Historical Data of India LED Lighting Market Revenues for the Period 2015-2018, By End-Users.

- Market Size & Forecast of India LED Lighting Market Revenues until 2025F, By End-Users.

- India LED Lighting Market Share, By End-Users, for the year 2018.

- Historical Data of India LED Lighting Market Revenues for the Period 2015-2018, By Regions.

- Market Size & Forecast of India LED Lighting Market Revenues until 2025F, By Regions.

- India LED Lighting Market Share, By Regions, for the year 2018.

- India LED Lighting Market Drivers

- India LED Lighting Market Restraints

- India LED Lighting Market Trends and Industry Life Cycle

- India LED Lighting Market Porter’s Five Force Analysis

- India LED Lighting Market Opportunity Assessment

- India LED Lighting Market Revenue Share, By Players

- India LED Lighting Market Overview on Competitive Benchmarking

- Company Profiles.

- Strategic Recommendations.

Markets Covered:

The India LED Lighting market report provides a detailed analysis of the following market segments:

By Types

- LED Lamps

- Self-Ballasted LED lamps

- Down Lighters LED

- Street Lights LED

- Luminaires

- Indoor Luminaires

- Outdoor Luminaires

By End-Users

- Outdoor Lighting

- Indoor Lighting

By Applications

- Commercial

- Residential

- Industrial

By Regions

- Eastern

- Central

- Western

- North Eastern

- Southern

India LED Lighting Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology Adopted and Key Data Points |

| 2.5 Assumptions |

| 3 Global LED Lighting Market Overview |

| 3.1 Global LED Lighting Market Revenues, 2015-2025F |

| 4 India Lighting Market Overview |

| 4.1 India Lighting Market Revenues, 2015-2025F |

| 5 India LED Lighting Market Overview |

| 5.1 India Country Indicators |

| 5.2 India LED Lighting Market Revenues, 2015-2025F |

| 5.3 India LED Market - Value Chain |

| 5.4 India LED Lighting Market - Industry Life Cycle |

| 5.5 India LED Lighting Market - Porter’s Five Forces Model |

| 5.6 India LED Lighting Market Revenue Share, By Types, 2018 & 2025F |

| 5.7 India LED Lighting Market Revenue Share, By Applications, 2018 & 2025F |

| 5.8 India LED Lighting Market Revenue Share, By End User, 2018 & 2025F |

| 5.9 India LED Lighting Market Revenue Share, By Regions, 2018 & 2025F |

| 6 India LED Lighting Market Dynamics |

| 6.1 Impact Analysis |

| 6.2 Market Drivers |

| 6.2.1 Government initiatives promoting energy-efficient lighting solutions |

| 6.2.2 Increasing awareness about the benefits of LED lighting in terms of energy savings and environmental impact |

| 6.2.3 Growing urbanization and infrastructure development driving the demand for LED lighting solutions in India |

| 6.3 Market Restraints |

| 6.3.1 High initial costs associated with LED lighting products compared to traditional lighting options |

| 6.3.2 Lack of consumer awareness and education about the long-term cost savings of LED lighting |

| 6.3.3 Price sensitivity of the Indian market affecting adoption rates of LED lighting solutions |

| 7 India LED Lighting Market Trends |

| 8 India LED Lighting Market Overview, By Types |

| 8.1 India LED Lamps Market Revenues, 2015-2025F |

| 8.1.1 India Self Ballasted LED Lighting Market Revenues, 2015–2025F |

| 8.1.2 India Down Lighters LED Lighting Market Revenues, 2015-2025F |

| 8.1.3 India Street Light LED Lighting Market Revenues, 2015-2025F |

| 9 India Luminaire Lighting Market Overview |

| 9.1 India Luminaire Lighting Market Revenues, 2015-2025F |

| 9.1.1 India Indoor Luminaire Market Revenues, 2015-2025F |

| 9.1.2 India Outdoor Luminaire Market Revenues, 2015-2025F |

| 10 India LED Lighting Market Overview, By Wattage |

| 10.1 India Overall LED Lighting Market Revenue Share, By Wattage, 2018 |

| 10.1.1 India Self Ballasted LED Lighting Market Revenue Share, By Wattage, 2018 |

| 10.1.2 India Down Lighters LED Lighting Market Revenue Share, By Wattage, 2018 |

| 10.1.3 India Street Light LED Lighting Market Revenue Share, By Wattage, 2018 |

| 10.1.4 India Indoor Luminaire LED Lighting Market Revenue Share, By Wattage, 2018 |

| 10.1.5 India Outdoor Luminaire LED Lighting Market Revenue Share, By Wattage, 2018 |

| 11 India LED Lighting Market Overview, By Applications |

| 11.1 India LED Lighting Market Revenues, By Outdoor Applications, 2015-2025F |

| 11.2 India LED Lighting Market Revenues, By Indoor Applications, 2015-2025F |

| 12 India LED Lighting Market Overview, By End Users |

| 12.1 India LED Lighting Market Revenues, By Commercial End Users, 2015-2025F |

| 12.2 India LED Lighting Market Revenues, By Residential End Users, 2015-2025F |

| 12.3 India LED Lighting Market Revenues, By Industrial End Users, 2015-2025F |

| 13 India LED Lighting Market Overview, By Regions |

| 13.1 North India LED Lighting Market Revenues, 2015-2025F |

| 13.2 West India LED Lighting Market Revenues, 2015-2025F |

| 13.3 South India LED Lighting Market Revenues, 2015-2025F |

| 13.4 East India LED Lighting Market Revenues, 2015-2025F |

| 13.5 North East India LED Lighting Market Revenues, 2015-2025F |

| 14 India LED Lighting Market - Key Performance Indicators |

| 15 India LED Lighting Market Opportunity Assessment |

| 15.1 India LED Lighting Market Opportunity Assessment, By Regions, 2025F |

| 16 India LED Lighting Market Demand Supply Gap |

| 16.1 India LED Lighting Market Demand Supply Gap, 2015-2025F ($ Billion) |

| 17 Competitive Landscape |

| 17.1 Competitive Benchmarking, By Types |

| 17.2 India LED Lighting Market Revenue Share, By Company, 2018 |

| 18 Company Profile |

| 18.1 Ajanta Manufacturing Private Ltd. (Oreva Group) |

| 18.2 Bajaj Electricals Ltd. |

| 18.3 Crompton Greaves Consumer Electricals Ltd. |

| 18.4 Eveready Industries India Ltd |

| 18.5 Havells India Ltd |

| 18.6 Orient Electric |

| 18.7 Phillips India Ltd. |

| 18.8 Wipro Lighting |

| 18.9 Syska LED |

| 18.1 Surya Roshni Limited |

| 18.11 Osram Licht AG |

| 19 Key Strategic Recommendations |

| 20 Disclaimer |

| LIST OF FIGURES |

| Figure 1. Global LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 2. India Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 3. India LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 4. India LED Lighting Market - Value Chain |

| Figure 5. India LED Lighting Market - Industry Life Cycle |

| Figure 6. India LED Lighting Market Revenue Share, By Types, 2018 & 2025F |

| Figure 7. India LED Lighting Market Revenue Share, By Applications, 2018 & 2025F |

| Figure 8. India LED Lighting Market Revenue Share, By End User, 2018 & 2025F |

| Figure 9. India LED Lighting Market Revenue Share, By Regions, 2018 & 2025F |

| Figure 10. India New Office Supply, By Cities, 2018 - 2020F (Million sq. ft.) |

| Figure 11. India LED Lamps Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 12. India Self Ballasted LED Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 13. India Down Lighters LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 14. India Street Light LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 15. India LED Luminaires Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 16. India Indoor Luminaires LED Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 17. India Outdoor Luminaires LED Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 18. India Overall LED Lighting Market Revenue Share, By Wattage, 2018 |

| Figure 19. India Self Ballasted LED Lighting Market Revenue Share, By Wattage, 2018 |

| Figure 20. India Down Lighters LED Lighting Market Revenue Share, By Wattage, 2018 |

| Figure 21. India Street Lights LED Lighting Market Revenue Share, By Wattage, 2018 |

| Figure 22. India Indoor Luminaries LED Lighting Market Revenue Share, By Wattage, 2018 |

| Figure 23. India Outdoor Luminaries LED Lighting Market Revenue Share, By Wattage, 2018 |

| Figure 24. India Outdoor LED Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 25. India Indoor LED Lighting Market Revenues, 2015-2025F ($ Million) |

| Figure 26. India LED Lighting Market Revenues, By Residential Users, 2015-2025F ($ Million) |

| Figure 27. India LED Lighting Market Revenues, By Commercial Users, 2015-2025F ($ Million) |

| Figure 28. India LED Lighting Market Revenues, By Industrial Users, 2015-2025F ($ Million) |

| Figure 29. Northern India LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 30. Southern India LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 31. Eastern India LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 32. Western India LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 33. North-Eastern India LED Lighting Market Revenues, 2015-2025F ($ Billion) |

| Figure 34. India Actual Government Spending Vs Actual Government Revenues, 2015-2024F (INR Trillion) |

| Figure 35. India Expected Government Budget Outlook, FY2020 |

| Figure 36. India Organized Retail Space Completions, 2017-2020F (Million Sq. Ft.) |

| Figure 37. Growth of Hotel Rooms Supply in India, FY2018 & FY2023F (No. of Rooms) |

| Figure 38. Branded Hotel Rooms Supply Across Major Cities in India, FY2018 & FY2023F (No. of Rooms) |

| Figure 39. India LED Lighting Market Opportunity Assessment, By Regions, 2025F |

| Figure 40. India LED Lighting Market Revenues - Demand Supply Gap, 2015-2025F ($ Billion) |

| Figure 41. India LED Lighting Market Revenue Share, By Company, 2018 |

| Figure 42. India LED Lighting Market – Ansoff Matrix |

| LIST OF TABLES |

| Table 1. Total LEDs Distributed as of November 2019 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero