Lebanon Soap Market (2025-2031) | Analysis, Forecast, Share, Outlook, Value, Growth, Revenue, Trends, Size, Industry & Companies

Market Forecast By Type (Bar Soap, Liquid Soap), By Application (Household, Commercial, Other), By Distribution Channel (Modern Trade, Traditional Trade, Online) And Competitive Landscape

| Product Code: ETC021427 | Publication Date: Jun 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

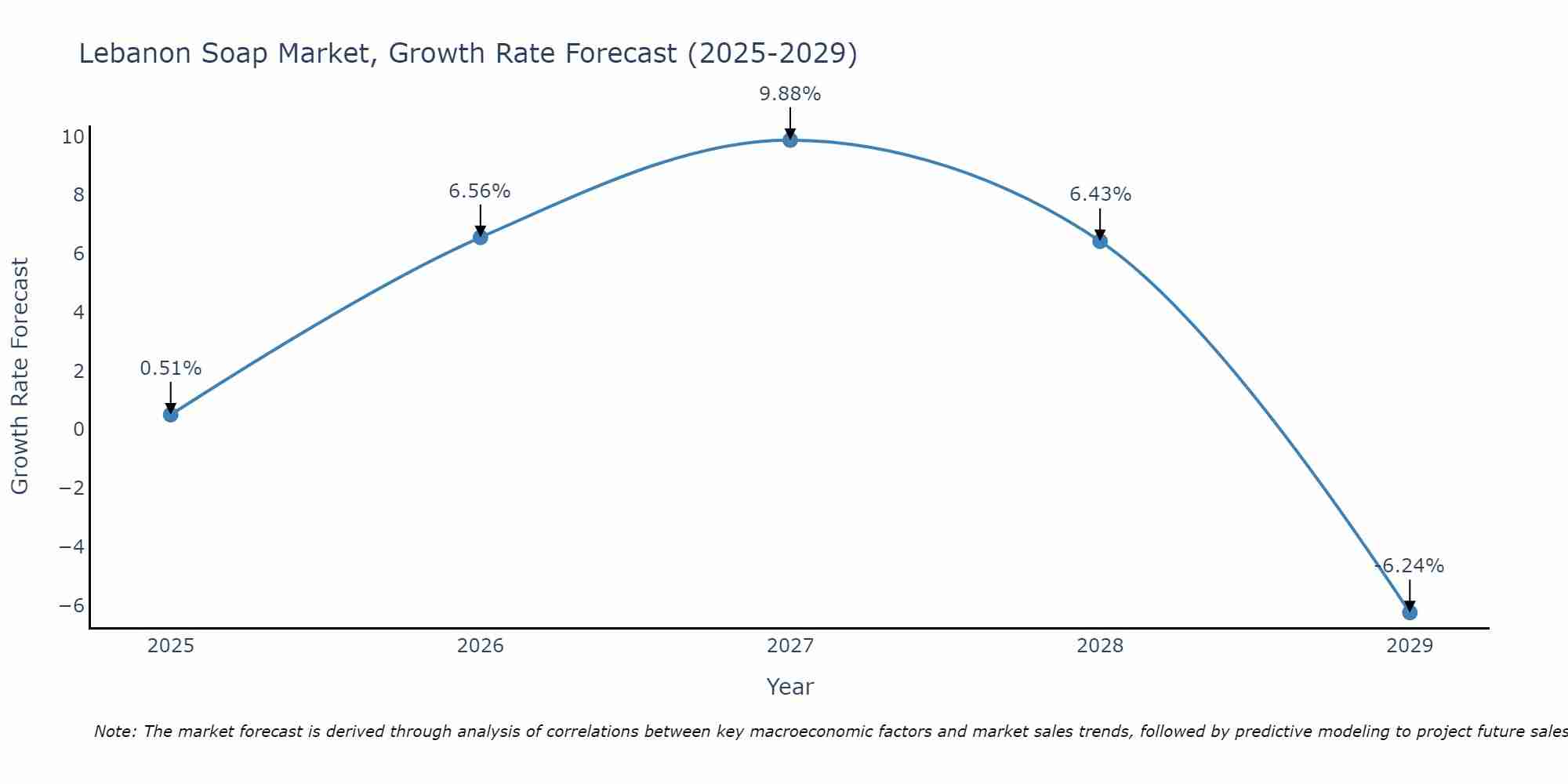

Lebanon Soap Market Size Growth Rate

The Lebanon Soap Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 0.51% in 2025, the market peaks at 9.88% in 2027, and settles at -6.24% by 2029.

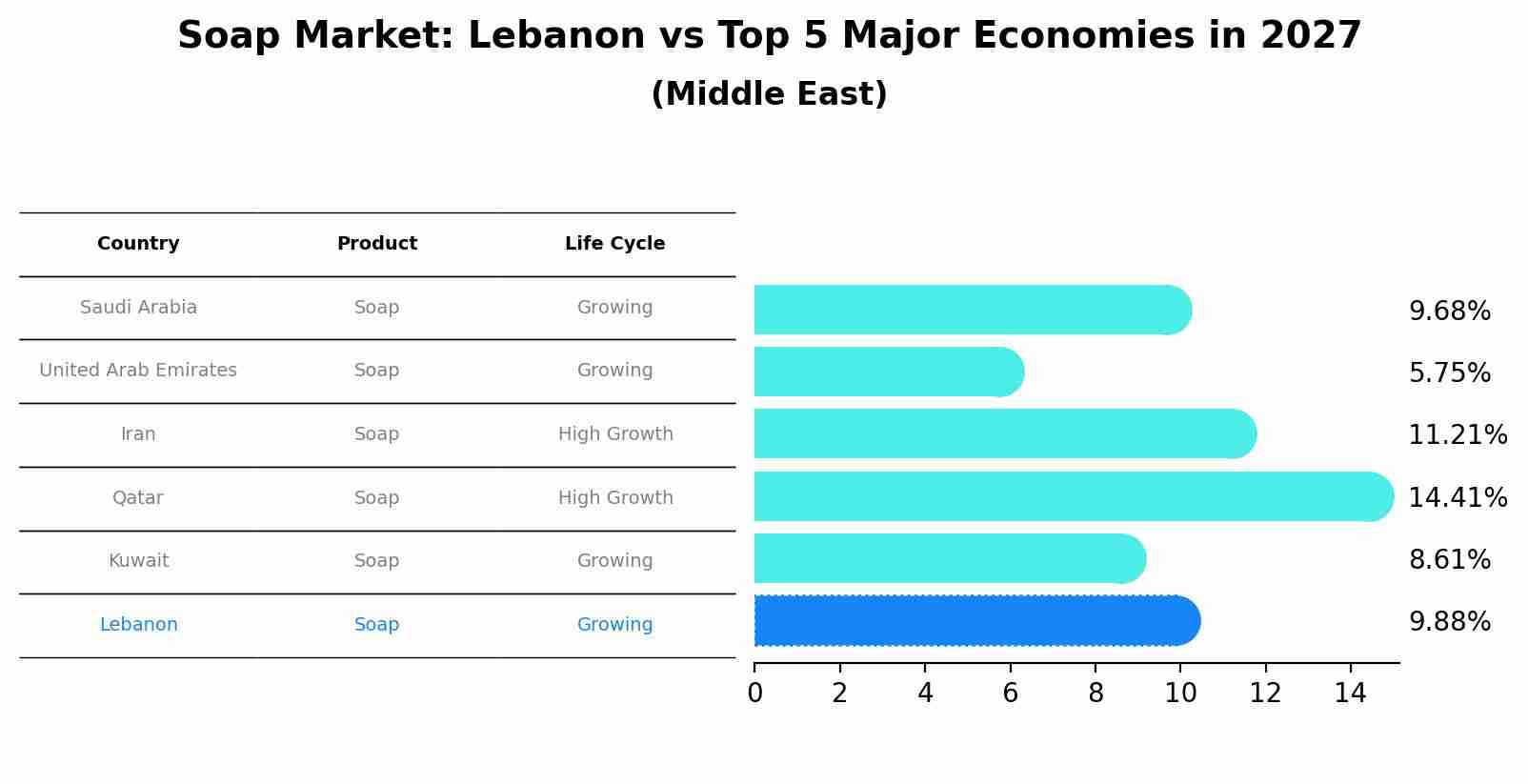

Soap Market: Lebanon vs Top 5 Major Economies in 2027 (Middle East)

By 2027, Lebanon's Soap market is forecasted to achieve a growing growth rate of 9.88%, with Saudi Arabia leading the Middle East region, followed by United Arab Emirates, Iran, Qatar and Kuwait.

Lebanon Soap Market Highlights

| Report Name | Lebanon Soap Market |

| Forecast period | 2025-2031 |

| CAGR | 6% |

| Growing Sector | Household |

Topics Covered in the Lebanon Soap Market Report

Lebanon Soap Market report thoroughly covers the market by type, by application, and distribution channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Lebanon Soap Market Synopsis

Lebanon Soap Market is evolving, characterized by a diverse range of products and growing consumer demand for hygiene products. The market encompasses various segments, including bar soap and liquid soap, catering to a wide array of applications in households and commercial settings. The overall growth of the Lebanon soap market is influenced by increasing awareness of personal hygiene, shifting consumer preferences towards liquid soaps, and a rising trend towards organic and natural products.

According to 6Wresearch, the Lebanon Soap Market is anticipated to grow at a CAGR of 6% during the forecast period 2025-2031. Lebanon Soap Market is experiencing significant growth, driven by several factors. A growing awareness of personal hygiene and the rising adoption of soap products post-pandemic have propelled the market forward. The increasing disposable income among consumers has led to higher spending on premium and natural soap products. Additionally, the trend towards organic and eco-friendly products is gaining momentum, aligning with global sustainability trends.

However, the Lebanon soap market faces several challenges that could impact its growth trajectory. Economic instability and inflation have led to fluctuations in consumer purchasing power, which can affect the demand for soap products. Furthermore, competition from imported soaps, particularly those offering lower prices or unique formulations, presents a significant challenge for local manufacturers. Additionally, ongoing supply chain issues, partly exacerbated by regional instability, may hinder the availability of raw materials, affecting production capacity.

Lebanon Soap Market Trends

Several key trends are influencing the Lebanon Soap Market Growth. First, the shift from traditional bar soap to liquid soap is becoming prominent, as consumers appreciate the convenience and variety offered by liquid formulations. The market is also seeing a rise in herbal and organic soaps due to increased consumer preference for natural ingredients and eco-friendly products. Furthermore, the use of innovative packaging and branding strategies is enhancing product appeal, allowing companies to differentiate themselves in a competitive market.

Investment Opportunities in the Lebanon Soap Market

- Growing Demand for Natural Products: There is an increasing consumer preference for organic and natural soap products. This trend opens up opportunities for investment in local production of plant-based and chemical-free soaps.

- Expanding Middle-Class Population: The expanding middle-class population in Lebanon is leading to a higher disposable income and a willingness to spend on premium soap products, which creates investment potential in high-end or specialty soap segments.

- Tourism and Handmade Soap Market: Lebanon's vibrant tourism industry offers a market for artisanal and handmade soaps that appeal to tourists looking for unique, locally made products. Investing in this niche market could yield significant returns.

- Export Potential: The high quality and unique appeal of Lebanese soaps present an opportunity for export to international markets, particularly those interested in Mediterranean and Middle Eastern products.

Leading Players in the Lebanon Soap Market

Lebanon soap market boasts a variety of key players, each contributing to the industry's innovation and growth. Khan Al Saboun is renowned for its traditional soap-making techniques, emphasizing natural and organic ingredients that appeal to eco-conscious consumers.

Senteurs d'Orient, another prominent name, is distinguished for its luxurious bath products that combine artisanal craftsmanship with modern aesthetics. Their globally recognized brand includes a wide range of soaps that are marketed both domestically and internationally. Additionally, El-Ghass Soap has carved a niche for itself by producing handmade soaps that highlight unique Lebanese scents and ingredients, attracting a loyal customer base looking for authentic experiences.

Government Regulations

The Lebanon soap industry operates under a framework of government regulations that ensure product quality, consumer safety, and environmental sustainability. The Ministry of Public Health in Lebanon sets standards for the manufacturing processes, requiring that all soap products meet specific safety and hygiene criteria before they reach the market. Additionally, the use of natural ingredients is encouraged, aligning with regulations that aim to minimize the environmental impact of industrial processes.

Labeling requirements also play a crucial role, as manufacturers must clearly indicate all ingredients to support informed consumer choices and cater to niche markets like halal or vegan. Export-oriented businesses must adhere to international regulatory standards, which may necessitate additional certifications or compliance checks. These regulations not only safeguard consumers but also enhance the reputation of Lebanese soap in global markets, promoting trust and reliability.

Future Insights of the Lebanon Soap Market

Lebanon soap market is poised for growth driven by innovation and sustainability trends. As global awareness around environmental issues increases, there is an expanding demand for eco-friendly products, boosting the popularity of soaps made with natural, biodegradable ingredients. Technological advancements in production methods will likely enhance efficiency and allow for greater experimentation with novel formulations and packaging solutions.

Additionally, the rise of e-commerce platforms presents opportunities for Lebanese soap manufacturers to reach broader international audiences, further elevating the profile of traditional and artisanal products. An emphasis on storytelling and cultural heritage, paired with modern marketing strategies, will also play a crucial role in differentiating Lebanese soap brands in a competitive global market.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Liquid Soap to Dominate the Market-By Type

According to Aashutosh, Senior Research Analyst, 6Wresearch, the liquid soap segment is witnessing the highest growth, driven by consumer preference for its convenience and hygiene benefits. Liquid soap is considered more sanitary, especially in public or shared spaces, which has led to increased demand in both household and commercial applications. While bar soap remains popular, particularly in rural areas where price sensitivity is high, liquid soap is gaining market share, especially among urban consumers.

Household to Dominate the Market-By Application

Household segment accounts for the largest share of the market, driven by consistent consumer demand for personal care products. Families prioritize hygiene, leading to higher consumption of both bar and liquid soap. The emphasis on cleanliness, especially in light of health concerns, continues to bolster sales in this segment.

Modern Trade to Dominate the Market-By Distribution Channel

Modern Trade segment encompasses supermarkets, hypermarkets, and convenience stores, where consumers can find a wide variety of soap products. The modern trade channel is the dominant distribution method, providing easy access to popular brands and new product launches.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Lebanon Soap Market Outlook

- Market Size of Lebanon Soap Market, 2024

- Forecast of Lebanon Soap Market, 2031

- Historical Data and Forecast of Lebanon Soap Revenues & Volume for the Period 2021 - 2031

- Lebanon Soap Market Trend Evolution

- Lebanon Soap Market Drivers and Challenges

- Lebanon Soap Price Trends

- Lebanon Soap Porter's Five Forces

- Lebanon Soap Industry Life Cycle

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Bar Soap for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Liquid Soap for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Household for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Distribution Channel for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Modern Trade for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Traditional Trade for the Period 2021 - 2031

- Historical Data and Forecast of Lebanon Soap Market Revenues & Volume By Online for the Period 2021 - 2031

- Lebanon Soap Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Distribution Channel

- Lebanon Soap Top Companies Market Share

- Lebanon Soap Competitive Benchmarking By Technical and Operational Parameters

- Lebanon Soap Company Profiles

- Lebanon Soap Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Type

- Bar Soap

- Liquid Soap

By Application

- Household

- Commercial

- Other

By Distribution Channel

- Modern Trade

- Traditional Trade

- Online

Lebanon Soap Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Lebanon Soap Market Overview |

| 3.1 Lebanon Country Macro Economic Indicators |

| 3.2 Lebanon Soap Market Revenues & Volume, 2021 & 2031F |

| 3.3 Lebanon Soap Market - Industry Life Cycle |

| 3.4 Lebanon Soap Market - Porter's Five Forces |

| 3.5 Lebanon Soap Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Lebanon Soap Market Revenues & Volume Share, By Application , 2021 & 2031F |

| 3.7 Lebanon Soap Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Lebanon Soap Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Lebanon Soap Market Trends |

| 6 Lebanon Soap Market, By Types |

| 6.1 Lebanon Soap Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Lebanon Soap Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Lebanon Soap Market Revenues & Volume, By Bar Soap, 2021 - 2031F |

| 6.1.4 Lebanon Soap Market Revenues & Volume, By Liquid Soap, 2021 - 2031F |

| 6.2 Lebanon Soap Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Lebanon Soap Market Revenues & Volume, By Household, 2021 - 2031F |

| 6.2.3 Lebanon Soap Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.2.4 Lebanon Soap Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.3 Lebanon Soap Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Lebanon Soap Market Revenues & Volume, By Modern Trade, 2021 - 2031F |

| 6.3.3 Lebanon Soap Market Revenues & Volume, By Traditional Trade, 2021 - 2031F |

| 6.3.4 Lebanon Soap Market Revenues & Volume, By Online, 2021 - 2031F |

| 7 Lebanon Soap Market Import-Export Trade Statistics |

| 7.1 Lebanon Soap Market Export to Major Countries |

| 7.2 Lebanon Soap Market Imports from Major Countries |

| 8 Lebanon Soap Market Key Performance Indicators |

| 9 Lebanon Soap Market - Opportunity Assessment |

| 9.1 Lebanon Soap Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Lebanon Soap Market Opportunity Assessment, By Application , 2021 & 2031F |

| 9.3 Lebanon Soap Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Lebanon Soap Market - Competitive Landscape |

| 10.1 Lebanon Soap Market Revenue Share, By Companies, 2024 |

| 10.2 Lebanon Soap Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero