Netherlands Potato Chips Market (2025-2031) | Analysis, Share, Revenue, Outlook, Segmentation, Value, Size, Companies, Forecast, Trends, Industry & Growth

Market Forecast By Flavor (Plain/Salted, Flavored), By Type (Baked, Fried), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Specialist Stores, Online Retail Stores, Other) And Competitive Landscape

| Product Code: ETC5222854 | Publication Date: Nov 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Bhawna Singh | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

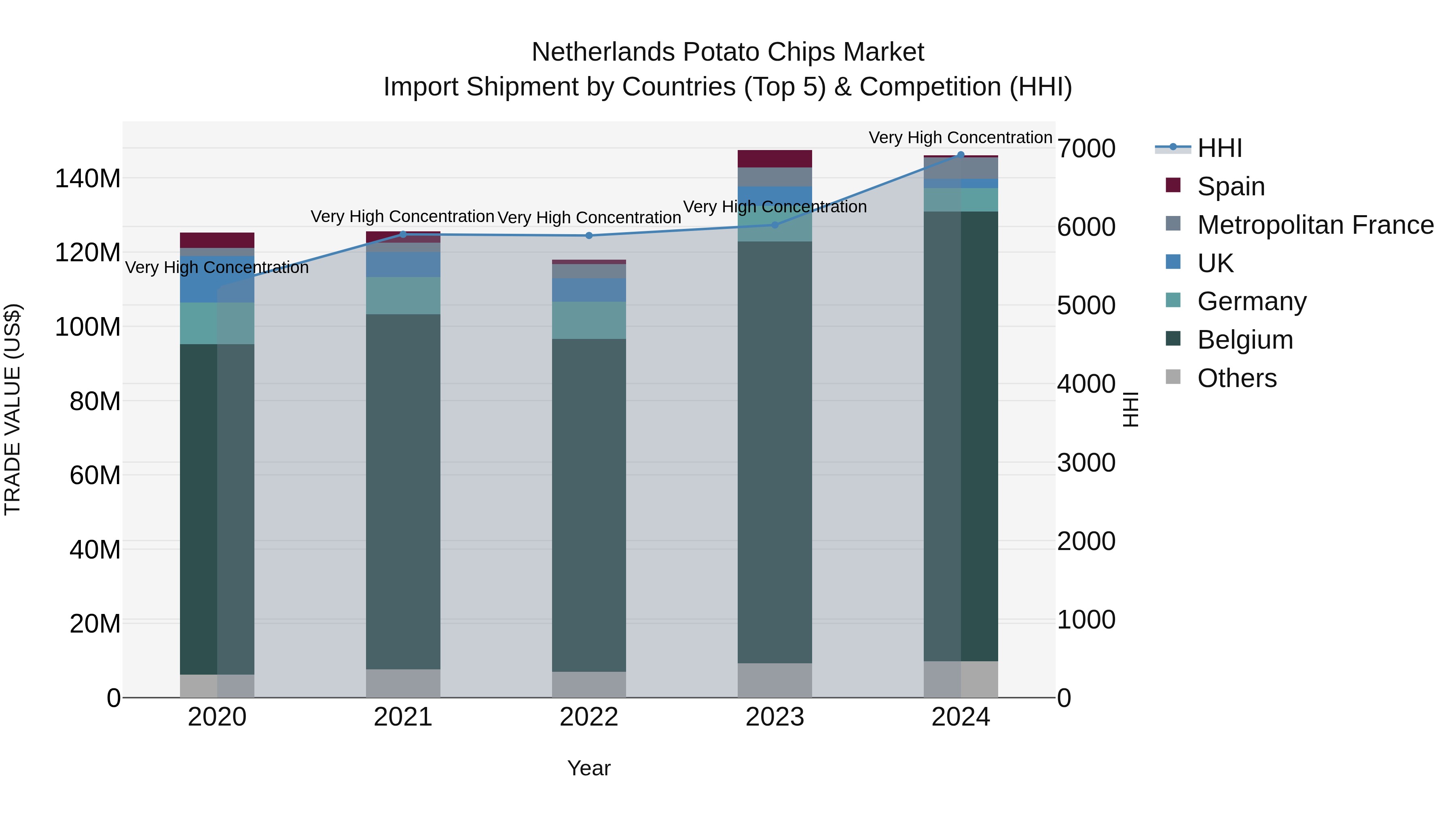

Netherlands Potato Chips Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the Netherlands saw a consistent flow of potato chips import shipments, primarily sourced from neighboring countries like Belgium and Germany, as well as other key players like Metropolitan France, Poland, and the UK. Despite the high concentration levels indicated by the Herfindahl-Hirschman Index (HHI), the industry maintained a steady growth with a Compound Annual Growth Rate (CAGR) of 3.93% from 2020 to 2024. However, there was a slight decline in growth rate from 2023 to 2024 at -0.91%, suggesting potential shifts in market dynamics that businesses should monitor closely.

Netherlands Potato Chips Market Highlights

| Report Name | Netherlands Potato Chips Market |

| Forecast Period | 2025-2031 |

| Market Size | USD 2.4Billion by 2031 |

| CAGR | 6.8% |

| Growing Sector | Food and Beverage |

Topics Covered in the Netherlands Potato ChipsMarket Report

The Netherlands Potato Chips market report thoroughly covers the market by flavor, by type and by distribution channel. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Netherlands Potato Chips Market Size & Analysis

In 2025, the Netherlands Potato Chipsmarketis valued at approximately $ 1.6 billion, with a projected compound annual growth rate (CAGR) of 6.8% over the next five years. Additionally, by 2031, the market is expected to reach around $ 2.4billion. Thefood and beverage sector holds significant position in the overall market.

Netherlands Potato Chips Market Synopsis

The Netherlands potato chips market is one of the largest and most mature in Europe, driven by the country's strong snacking culture and a long history of potato consumption. The market is characterized by a high demand for quality potato chips, with both local and international brands offering a wide range of flavors and product variations. Major players such as Lays, Pringles, and Chio dominate the market, while local companies like Haldirams also cater to regional tastes with unique, locally inspired flavors. The Dutch market is increasingly influenced by trends toward healthier snack options, leading to a growing demand for baked chips, reduced-fat products, and chips made from alternative ingredients like sweet potatoes. Additionally, there is a significant interest in eco-friendly packaging and sustainable production methods, with many companies adapting to meet these environmental concerns. The market continues to thrive, supported by a well-established retail network and increasing consumer demand for convenience and premium offerings.

According to 6Wresearch, Netherlands Potato Chips market size is projected to grow at a CAGR of 6.8% during 2025-2031.The growth of the potato chips market in the Netherlands is driven by several factors, including the country’s well-established snacking culture and the increasing preference for convenient, ready-to-eat snack options. The rise in disposable incomes, along with busy lifestyles, has fueled demand for snacks that offer both convenience and indulgence. Additionally, consumer interest in healthier snack alternatives, such as baked chips, low-fat, and organic potato chips, is pushing manufacturers to innovate and cater to health-conscious individuals.

Sustainability trends are also influencing the market, as consumers are increasingly seeking eco-friendly packaging and products made from responsibly sourced ingredients. However, the Netherlands Potato Chips industryfaces challenges such as rising raw material costs, particularly potatoes, and competition from other snack categories, including nuts and healthier snack alternatives, which could potentially slow growth in the traditional fried chips segment. Moreover, the market’s maturity means that growth is slowing, and companies must focus on differentiation through flavor innovation, premium offerings, and sustainability to stay competitive. The growing focus on health and environmental concerns also presents a challenge for companies to balance traditional indulgent snack offerings with the evolving demand for healthier and more sustainable products.

Netherlands Potato Chips Market Trends

Health-Conscious Snacking - Increased demand for baked chips, low-fat, and organic potato chips due to growing health consciousness among consumers.

Flavor Innovation - Brands are offering a variety of new, unique flavors, with a focus on local, seasonal ingredients and international flavor trends.

Sustainability - Strong consumer preference for eco-friendly packaging and sustainably sourced ingredients, prompting companies to adopt green practices.

Premium Products - Growing demand for premium and artisanal potato chips, with consumers willing to pay more for high-quality, unique products.

Plant-Based Alternatives - Rising interest in plant-based potato chips made from ingredients like sweet potatoes and other vegetables to cater to health-conscious and vegan consumers.

Investment Opportunities in the Netherlands Potato Chips Market

Healthier Snack Products - Investing in the development of baked, low-fat, and organic potato chips to cater to the increasing demand for healthier snack alternatives.

Sustainability Initiatives - Capitalizing on eco-friendly packaging and sustainable sourcing of ingredients to meet consumer demand for environmentally responsible products.

Premium and Artisanal Products - Expanding into the premium potato chips segment, offering high-quality, gourmet, and artisanal products to attract consumers seeking unique snack experiences.

E-commerce and Online Sales - Leveraging the growth of online shopping platforms to reach a broader consumer base and provide convenient purchasing options for potato chips.

Key Players in the Netherlands Potato Chips Market

The Netherlands potato chips market is dominated by both international and local brands, with Lays (PepsiCo) being the market leader, offering a wide range of flavors and maintaining a strong presence in supermarkets, convenience stores, and online platforms. Other major international players include Pringles (Kellogg's) and Chio (Intersnack), which offer a variety of traditional and innovative flavors. Local brands such as Haldirams and Zepter have also established a strong foothold, catering to regional preferences with local and premium product offerings. In addition to these established brands, private-label products from retailers such as Albert Heijn and Jumbo are gaining traction due to their affordability and competitive pricing.

Additionally, some of these players hold majority of the Netherlands Potato Chips market share. Moreover, companies like Marfo and Smit & Zoon are focusing on sustainability and eco-friendly practices, tapping into the growing consumer demand for environmentally responsible snack options. These key players continue to drive the market through flavor innovation, health-conscious alternatives, and strategic distribution partnerships.

Government Regulationsin the Netherlands Potato Chips Market

In the Netherlands, the potato chips market is regulated by several government bodies to ensure food safety, quality, and consumer protection. The Netherlands Food and Consumer Product Safety Authority (NVWA) oversees food safety regulations, ensuring that all potato chips products comply with strict standards related to additives, preservatives, and contaminants. Manufacturers must also adhere to European Union (EU) food safety standards, which set guidelines for food labeling, including clear nutritional information such as calorie count, fat, and sodium content. Additionally, there are regulations in place regarding the use of sustainable packaging, as the Netherlands is a leader in environmental policies, encouraging companies to adopt eco-friendly practices. The Dutch Ministry of Agriculture, Nature, and Food Quality supports initiatives related to sustainable sourcing and food production, which includes responsible sourcing of potatoes and other raw materials. These regulations ensure the market operates transparently, prioritizing consumer health and environmental sustainability.

Future Insights of the Netherlands Potato Chips Market

The future of the potato chips market in the Netherlands is expected to see continued growth, driven by evolving consumer preferences for healthier and more sustainable snack options. As health-conscious eating habits become more prevalent, there will be an increasing demand for low-fat, baked, and organic potato chips, alongside plant-based alternatives like sweet potato and vegetable chips. Flavor innovation will remain a key focus, with brands introducing new, bold, and locally inspired flavors to cater to the diverse tastes of Dutch consumers. Sustainability will be a major factor in shaping the market, with more companies prioritizing eco-friendly packaging and responsible sourcing of ingredients. The growth of e-commerce and convenience stores will further drive accessibility and impulse purchases, expanding the reach of potato chips to a broader audience. Overall, the market is poised for steady growth, with a continued emphasis on innovation, health, and environmental responsibility.

FriedCategory to Dominate the Market - By Type

According to Ravi Bhandari, Research Head, 6Wresearch, the fried chips category in the Netherlands is expected to continue growing, driven by the enduring popularity of traditional, indulgent snacks. Despite the rise of healthier alternatives, fried chips remain a staple in the Dutch snacking culture, particularly due to their satisfying taste, crunch, and familiarity. Leading brands like Lays and Pringles continue to innovate within the fried chips segment, offering a diverse array of flavors and premium options to cater to changing consumer preferences. While health-conscious trends push for alternatives like baked or vegetable-based chips, fried chips still hold a strong appeal, especially in the context of indulgence and snacking occasions.

Convenience Storesto Dominate the Market – By Distribution Channel

The convenience store distribution channel for potato chips in the Netherlands is experiencing significant growth, fueled by the increasing demand for quick, on-the-go snacks. With busy lifestyles and a preference for convenience, consumers are increasingly turning to convenience stores like 7-Eleven, Albert Heijn to Go, and Shell Select for easy access to a variety of snack options, including potato chips. These stores are strategically located in urban areas, transport hubs, and along main roads, providing high visibility and frequent foot traffic. The availability of single-serve and impulse-buy packaging formats makes convenience stores an attractive channel for snack sales, while the growth of online convenience store platforms is further expanding reach.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Netherlands Potato Chips Market Overview

- Netherlands Potato Chips Market Outlook

- Market Size of Netherlands Potato Chips Market, 2024

- Forecast of Netherlands Potato Chips Market, 2031

- Historical Data and Forecast of Netherlands Potato Chips Revenues & Volume for the Period 2021-2031

- Netherlands Potato Chips Market Trend Evolution

- Netherlands Potato Chips Market Drivers and Challenges

- Netherlands Potato Chips Price Trends

- Netherlands Potato Chips Porter's Five Forces

- Netherlands Potato Chips Industry Life Cycle

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Flavor for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Plain/Salted for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Flavored for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Type for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Baked for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Fried for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Supermarket/Hypermarket for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Convenience Stores for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Specialist Stores for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Online Retail Stores for the Period 2021-2031

- Historical Data and Forecast of Netherlands Potato Chips Market Revenues & Volume, By Other for the Period 2021-2031

- Netherlands Potato Chips- Import Export Trade Statistics

- Market Opportunity Assessment, By Type

- Market Opportunity Assessment, By End-User Industry

- Netherlands Potato ChipsMarket - Top Companies Market Share

- Netherlands Potato ChipsMarket - Competitive Benchmarking, By Technical and Operational Parameters

- Netherlands Potato Chips Market - Company Profiles

- Netherlands Potato ChipsMarket - Key Strategic Recommendations

Markets Covered

The Netherlands Potato Chips market report provides a detailed analysis of the following market segments

By Flavor

- Plain/Salted

- Flavored

- By Type

- Baked

- Fried

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Specialist Stores

- Online Retail Stores

- Other

Netherlands Potato Chips Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Netherlands Potato Chips Market Overview |

| 3.1 Netherlands Country Macro Economic Indicators |

| 3.2 Netherlands Potato Chips Market Revenues & Volume, 2021 & 2031F |

| 3.3 Netherlands Potato Chips Market - Industry Life Cycle |

| 3.4 Netherlands Potato Chips Market - Porter's Five Forces |

| 3.5 Netherlands Potato Chips Market Revenues & Volume Share, By Flavor, 2021 & 2031F |

| 3.6 Netherlands Potato Chips Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.7 Netherlands Potato Chips Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Netherlands Potato Chips Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing consumer demand for convenient and on-the-go snacks |

| 4.2.2 Growing trend towards healthier snack options, leading to demand for baked or low-fat potato chips |

| 4.2.3 Innovations in flavors and packaging, attracting more consumers to the market |

| 4.3 Market Restraints |

| 4.3.1 Health concerns related to high fat and salt content in potato chips |

| 4.3.2 Competition from other snack options like popcorn, nuts, and vegetable chips |

| 4.3.3 Fluctuating raw material prices impacting production costs |

| 5 Netherlands Potato Chips Market Trends |

| 6 Netherlands Potato Chips Market Segmentations |

| 6.1 Netherlands Potato Chips Market, By Flavor |

| 6.1.1 Overview and Analysis |

| 6.1.2 Netherlands Potato Chips Market Revenues & Volume, By Plain/Salted, 2021-2031F |

| 6.1.3 Netherlands Potato Chips Market Revenues & Volume, By Flavored, 2021-2031F |

| 6.2 Netherlands Potato Chips Market, By Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Netherlands Potato Chips Market Revenues & Volume, By Baked, 2021-2031F |

| 6.2.3 Netherlands Potato Chips Market Revenues & Volume, By Fried, 2021-2031F |

| 6.3 Netherlands Potato Chips Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Netherlands Potato Chips Market Revenues & Volume, By Supermarket/Hypermarket, 2021-2031F |

| 6.3.3 Netherlands Potato Chips Market Revenues & Volume, By Convenience Stores, 2021-2031F |

| 6.3.4 Netherlands Potato Chips Market Revenues & Volume, By Specialist Stores, 2021-2031F |

| 6.3.5 Netherlands Potato Chips Market Revenues & Volume, By Online Retail Stores, 2021-2031F |

| 6.3.6 Netherlands Potato Chips Market Revenues & Volume, By Other, 2021-2031F |

| 7 Netherlands Potato Chips Market Import-Export Trade Statistics |

| 7.1 Netherlands Potato Chips Market Export to Major Countries |

| 7.2 Netherlands Potato Chips Market Imports from Major Countries |

| 8 Netherlands Potato Chips Market Key Performance Indicators |

| 8.1 Consumer engagement and satisfaction levels with new flavors and packaging |

| 8.2 Number of new product launches and product innovations in the market |

| 8.3 Growth in demand for healthier potato chip options, such as baked or low-fat varieties |

| 9 Netherlands Potato Chips Market - Opportunity Assessment |

| 9.1 Netherlands Potato Chips Market Opportunity Assessment, By Flavor, 2021 & 2031F |

| 9.2 Netherlands Potato Chips Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.3 Netherlands Potato Chips Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Netherlands Potato Chips Market - Competitive Landscape |

| 10.1 Netherlands Potato Chips Market Revenue Share, By Companies, 2024 |

| 10.2 Netherlands Potato Chips Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero