Philippines Advertising Market (2025-2031) | Outlook, Share, Industry, Forecast, Companies, Value, Revenue, Trends, Analysis, Size & Growth

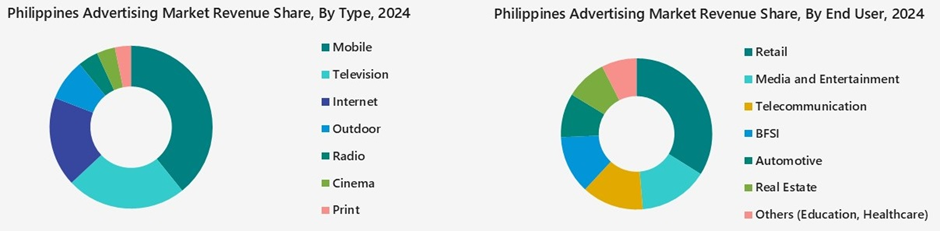

Market Forecast By Type (Mobile, Television, Internet, Outdoor, Radio, Cinema, Print), By End User (Retail, BFSI, Automotive, Media and Entertainment, Real Estate, Telecommunication, Others (Education, Healthcare), And Competitive Landscape

| Product Code: ETC420505 | Publication Date: Oct 2022 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 62 | No. of Figures: 16 | No. of Tables: 3 |

Topics Covered in Philippines Advertising Market Report

Philippines Advertising Market Report thoroughly covers the market by type and end-user. Philippines Advertising Market Outlook report provides an unbiased and detailed analysis of the ongoing Philippines Advertising Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Philippines Advertising Market Synopsis

The Philippines Advertising Market is driven by robust digital transformation, government-backed infrastructure, and a rapidly expanding e-commerce sector. Between 2021 and 2024, the Philippine government implemented major internet-focused initiatives to strengthen digital connectivity and support economic growth.

Key programs included the National Broadband Plan (NBP), which invested in 2021 to expand fiber optic networks, cellular towers, and cable landing stations across the country, the Free Public Internet Access Program (FPIAP) targeting underserved and remote areas, and the Philippine Digital Infrastructure Project (PDIP), approved in 2024 to enhance broadband connectivity and cybersecurity. These efforts contributed to the digital economy reaching more in 2024, representing more GDP, and supported over millions of jobs, highlighting the critical role of improved internet infrastructure in national development.

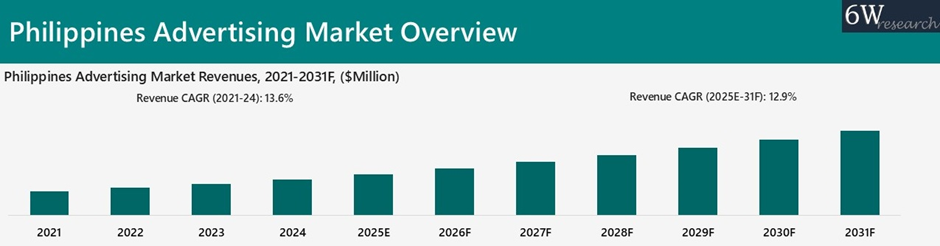

According to 6Wresearch, Philippines Advertising Market is projected to grow at a CAGR of 12.9% from 2025-2031F. The Philippines Advertising Market is poised for significant growth through 2028, propelled by government initiatives aimed at enhancing digital infrastructure and fostering innovation. Key policies including the Philippine Development Plan 2023–2028, would emphasizes the digital transformation of various sectors to improve efficiency, transparency, and innovation.

The Philippine real estate sector demonstrated resilience and growth in Q2 2025, driven by year-over-year GDP increase, and a rise in household consumption. By 2030, the Philippine Creative Industries Development Plan (PCIDP) is expected to expand the Philippines advertising market by driving demand for creative, multimedia campaigns and digital marketing services, leveraging local talent and innovative content to engage audiences nationwide.

Market Segmentation By Type

The Mobile segment is expected to experience strong growth in the Philippines advertising market by 2031, driven by rising smartphone penetration, wider mobile internet access, and increasing mobile commerce adoption. Advertisers are prioritizing in-app and video campaigns to enhance reach and engagement, creating expanding opportunities for digital advertising and media providers nationwide.

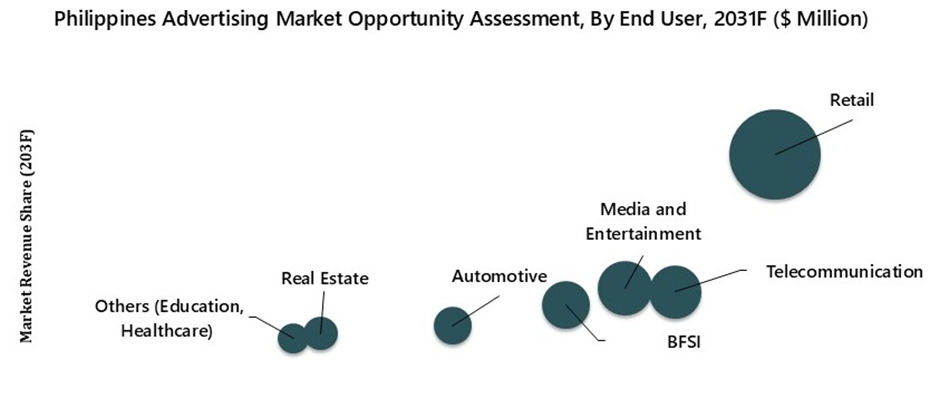

Market Segmentation By End User

Retail segment is expected to see strong opportunities in the Philippines advertising market driven by expanding consumer spending, rapid urbanization, and the growing penetration of modern trade and e-commerce platforms across the country. Additionally, retailers are increasing investments in digital and omnichannel marketing to enhance customer engagement, strengthen brand loyalty, and reach diverse audiences across urban and regional markets, creating significant opportunities for advertising and media service providers.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Advertising Market Overview

- Philippines Advertising Market Outlook

- Philippines Advertising Market Forecast

- Historical Data and Forecast of Philippines Advertising Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Philippines Advertising Market Revenues, By Service Type for the Period 2021-2031F

- Historical Data and Forecast of Philippines Advertising Market Revenues, By Product Type for the Period 2021-2031F

- Historical Data and Forecast of Philippines Advertising Market Revenues, By Logistics Type for the Period 2021-2031F

- Historical Data and Forecast of Philippines Advertising Market Revenues, By End-User for the Period 2021-2031F

- Porter’s Five Force Analysis

- Philippines Advertising Market Drivers and Restraints

- Philippines Advertising Market Trends

- Philippines Advertising Market Opportunity Assessment, By Type

- Philippines Advertising Market Opportunity Assessment, By End-User

- Philippines Advertising Market Revenue Ranking, By Top 3 Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Mobile

- Television

- Internet

- Outdoor

- Radio

- Cinema

By End User

- Retail

- BFSI

- Automotive

- Media and Entertainment

- Real Estate

- Telecommunication

- Others (Education, Healthcare)

Philippines Advertising Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Philippines Advertising Market Overview |

| 3.1. Philippines Advertising Market Revenues (2021-2031F) |

| 3.2. Philippines Advertising Market Industry Life Cycle |

| 3.3. Philippines Advertising Market Porter’s Five Forces Model |

| 4. Philippines Advertising Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Philippines Advertising Market Trends |

| 6. Philippines Advertising Market Overview, By Type |

| 6.1. Philippines Advertising Market Revenue Share and Revenues, By Type (2024 & 2031F) |

| 6.1.1. Philippines Advertising Market Revenues, By TV (2021–2031F) |

| 6.1.2. Philippines Advertising Market Revenues, By Digital (2021–2031F) |

| 6.1.3. Philippines Advertising Market Revenues, By Radio (2021–2031F) |

| 6.1.4. Philippines Advertising Market Revenues, By Print (2021–2031F) |

| 6.1.5. Philippines Advertising Market Revenues, By Outdoor (2021–2031F) |

| 6.1.6. Philippines Advertising Market Revenues, By Cinema (2021–2031F) |

| 7. Philippines Advertising Market Overview, By End User |

| 7.1. Philippines Advertising Market Revenue Share and Revenues, By End User (2024 & 2031F) |

| 7.1.1. Philippines Advertising Market Revenues, By Retail (2021–2031F) |

| 7.1.2. Philippines Advertising Market Revenues, By BFSI (2021–2031F) |

| 7.1.3. Philippines Advertising Market Revenues, By Automotive (2021–2031F) |

| 7.1.4. Philippines Advertising Market Revenues, By Media and Entertainment (2021–2031F) |

| 7.1.5. Philippines Advertising Market Revenues, By Real Estate (2021–2031F) |

| 7.1.6. Philippines Advertising Market Revenues, By Telecommunication (2021–2031F) |

| 7.1.7. Philippines Advertising Market Revenues, By Others (2021–2031F) |

| 8. Philippines Advertising Market Key Performance Indicators |

| 9. Philippines Advertising Market Opportunity Assessment |

| 9.1. Philippines Advertising Market Opportunity Assessment, By Type (2031F) |

| 9.2. Philippines Advertising Market Opportunity Assessment, By End User (2031F) |

| 10. Philippines Advertising Market Competitive Landscape |

| 10.1. Philippines Advertising Market Revenue Ranking, By Top 3 Companies (2024) |

| 10.2. Philippines Advertising Market Competitive Benchmarking, By Technical and Operating Parameters |

| 11. Company Profiles |

| 11.1. Dentsu Creative Philippines |

| 11.2. Ogilvy |

| 11.3. Publicis Groupe |

| 11.4. AXJ International Pte Ltd |

| 11.5. BBDO GUERRERO |

| 11.6. YCP Interactive Solutions |

| 11.7. GIGIL |

| 11.8. Havas Media Ortega, Inc. |

| 11.9. FCB Manila, Inc. |

| 11.10. Catalytx Advertising Inc. |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| 1. Philippines Advertising Market Revenues, 2021-2031F (USD Million) |

| 2. As of 2024, Philippines Internet Users who Discovered New Brands, Product and Services (in %) |

| 3. Philippines Daily Time Spent Using The Internet, Feb 2025 |

| 4. Philippines Number of Individuals Using Internet in Million (Jan 2021-Jan 2025) |

| 5. Philippines Share of Web Traffic by Devices, Feb 2025 |

| 6. Philippines rise in Digital Fraud Rates, (in %) |

| 7. Philippines Advertising Market Revenue Share, By Type, 2024 & 2031F |

| 8. Philippines Advertising Market Revenue Share, By End User, 2024 & 2031F |

| 9. Philippine Food Sales, By Distribution Channel, 2023 (in %) |

| 10. Philippine Sales of Retail, 2021-2024 (in US$ billion) |

| 11. Digital Advertisement Spend, Feb 2025 ( in US$ Million ) |

| 12. Average daily time spent using various media and devices in the Philippines (in hours), 2025 |

| 13. Philippines Advertising Market Opportunity Assessment, By Type, 2031F ($ Million) |

| 14. Philippines Advertising Market Opportunity Assessment, By End-User, 2031F ($ Million) |

| 15. Philippines Advertising Market Revenue Ranking, By Top 3 Companies, 2024 |

| 16. Average Time Per Month that Average Users Spent on Social Media Platforms in Philippines (in hours) |

| List of Tables |

| 1. Estimated Annual Spend in each Consumer Good Category, 2023 |

| 2 Philippines Advertising Market Revenues, By Type , 2021-2031F, ($ Millions) |

| 3. Philippines Advertising Market Revenues, By End User , 2021-2031F, ($ Millions) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero