Saudi Arabia Dairy Protein Market (2025-2031) Outlook | Companies, Industry, Size, Forecast, Value, Growth, Share, Revenue, Trends & Analysis

| Product Code: ETC187791 | Publication Date: May 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 | |

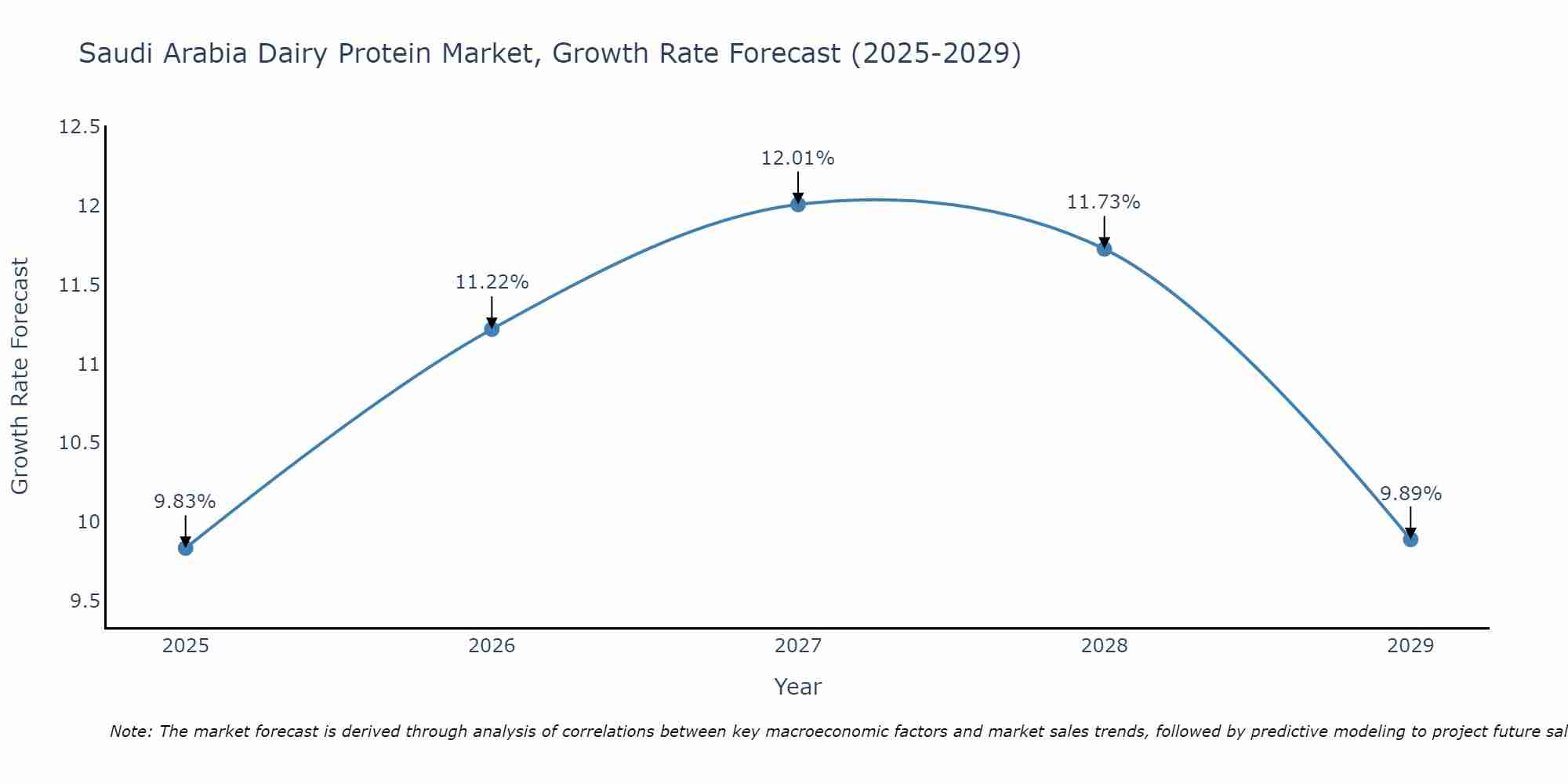

Saudi Arabia Dairy Protein Market Size Growth Rate

The Saudi Arabia Dairy Protein Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 9.83% in 2025, the market peaks at 12.01% in 2027, and settles at 9.89% by 2029.

Saudi Arabia Dairy Protein Market Synopsis

The dairy protein market in Saudi Arabia caters to the growing demand for high-quality protein sources in the country.Dairy proteins, including whey and casein, are used in various food and beverage products to enhance nutritional value.As health-conscious consumers seek protein-rich options, the dairy protein market is expected to see sustained growth.

Drivers of the Market

The Saudi Arabia dairy protein market is expected to witness growth due to the demand for protein-rich foods and beverages.Dairy proteins like whey and casein are widely used in various nutritional products.The nation`s focus on fitness and wellness, the demand for muscle-building ingredients, and the incorporation of dairy protein in sports supplements and functional foods will drive the demand for dairy protein.Additionally, the availability of different protein forms and the growth of health-conscious consumer trends will further support market growth.

Challenges of the Market

The Saudi Arabia dairy protein market faces challenges related to dairy protein sourcing, processing methods, and consumer preferences.Market players must source high-quality dairy protein and develop effective processing techniques to produce protein products with desired functionalities.Additionally, ensuring the availability of dairy protein products suitable for various food and beverage applications is crucial.Moreover, competition from plant-based protein alternatives and international dairy protein suppliers adds complexity to the market dynamics.The need for sustainable sourcing practices, protein formulation research, and consumer education on dairy protein advantages influences market growth.

COVID-19 Impact on the Market

The dairy protein market in Saudi Arabia witnessed increased demand during the COVID-19 pandemic as consumers focused on protein-rich and functional foods.Dairy proteins, such as whey and casein, are essential in various food and beverage applications.As consumer interest in protein fortification and sports nutrition continued post-pandemic, the market for dairy proteins sustained its growth.The pandemic emphasized the importance of protein as a dietary component.

Key Players in the Market

The Saudi Arabia dairy protein market features companies like Almarai and SADAFCO, known for their production of dairy protein products, including whey and casein, to meet the nutritional demands of consumers.

Key Highlights of the Report:

- Saudi Arabia Dairy Protein Market Outlook

- Market Size of Saudi Arabia Dairy Protein Market, 2024

- Forecast of Saudi Arabia Dairy Protein Market, 2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Revenues & Volume for the Period 2021-2031

- Saudi Arabia Dairy Protein Market Trend Evolution

- Saudi Arabia Dairy Protein Market Drivers and Challenges

- Saudi Arabia Dairy Protein Price Trends

- Saudi Arabia Dairy Protein Porter's Five Forces

- Saudi Arabia Dairy Protein Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Casein and Derivatives for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Whey protein for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Milk Protein Concentrate for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Food & Beverages for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Nutrition for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Personal Care & Cosmetics for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Feed for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Form for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Solid for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Dairy Protein Market Revenues & Volume By Liquid for the Period 2021-2031

- Saudi Arabia Dairy Protein Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Form

- Saudi Arabia Dairy Protein Top Companies Market Share

- Saudi Arabia Dairy Protein Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Dairy Protein Company Profiles

- Saudi Arabia Dairy Protein Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Dairy Protein Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Dairy Protein Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Dairy Protein Market - Industry Life Cycle |

3.4 Saudi Arabia Dairy Protein Market - Porter's Five Forces |

3.5 Saudi Arabia Dairy Protein Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Saudi Arabia Dairy Protein Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.7 Saudi Arabia Dairy Protein Market Revenues & Volume Share, By Form, 2021 & 2031F |

4 Saudi Arabia Dairy Protein Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Saudi Arabia Dairy Protein Market Trends |

6 Saudi Arabia Dairy Protein Market, By Types |

6.1 Saudi Arabia Dairy Protein Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Dairy Protein Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Saudi Arabia Dairy Protein Market Revenues & Volume, By Casein and Derivatives, 2021-2031F |

6.1.4 Saudi Arabia Dairy Protein Market Revenues & Volume, By Whey protein, 2021-2031F |

6.1.5 Saudi Arabia Dairy Protein Market Revenues & Volume, By Milk Protein Concentrate, 2021-2031F |

6.2 Saudi Arabia Dairy Protein Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Dairy Protein Market Revenues & Volume, By Food & Beverages, 2021-2031F |

6.2.3 Saudi Arabia Dairy Protein Market Revenues & Volume, By Nutrition, 2021-2031F |

6.2.4 Saudi Arabia Dairy Protein Market Revenues & Volume, By Personal Care & Cosmetics, 2021-2031F |

6.2.5 Saudi Arabia Dairy Protein Market Revenues & Volume, By Feed, 2021-2031F |

6.2.6 Saudi Arabia Dairy Protein Market Revenues & Volume, By Others, 2021-2031F |

6.3 Saudi Arabia Dairy Protein Market, By Form |

6.3.1 Overview and Analysis |

6.3.2 Saudi Arabia Dairy Protein Market Revenues & Volume, By Solid, 2021-2031F |

6.3.3 Saudi Arabia Dairy Protein Market Revenues & Volume, By Liquid, 2021-2031F |

7 Saudi Arabia Dairy Protein Market Import-Export Trade Statistics |

7.1 Saudi Arabia Dairy Protein Market Export to Major Countries |

7.2 Saudi Arabia Dairy Protein Market Imports from Major Countries |

8 Saudi Arabia Dairy Protein Market Key Performance Indicators |

9 Saudi Arabia Dairy Protein Market - Opportunity Assessment |

9.1 Saudi Arabia Dairy Protein Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Saudi Arabia Dairy Protein Market Opportunity Assessment, By Application, 2021 & 2031F |

9.3 Saudi Arabia Dairy Protein Market Opportunity Assessment, By Form, 2021 & 2031F |

10 Saudi Arabia Dairy Protein Market - Competitive Landscape |

10.1 Saudi Arabia Dairy Protein Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Dairy Protein Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero