Saudi Arabia Potato Chips Market (2025-2031) | Trends, Companies, Analysis, Size, Revenue, Industry, Growth, Forecast, Outlook, Share & Value

Market Forecast By Flavor (Plain/Salted, Flavored), By Type (Baked, Fried), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Specialist Stores, Online Retail Stores, Other) And Competitive Landscape

| Product Code: ETC029939 | Publication Date: Jul 2023 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

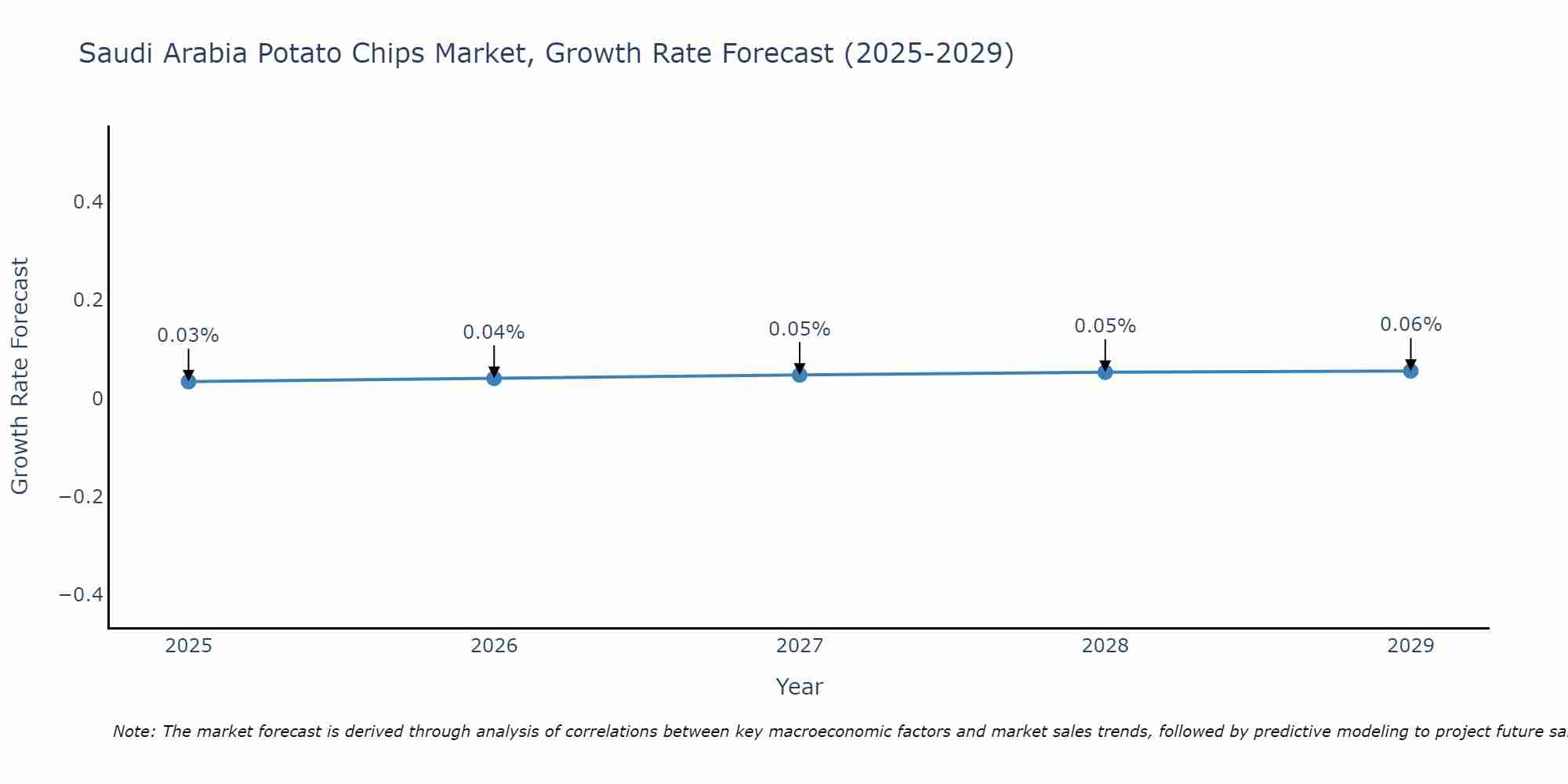

Saudi Arabia Potato Chips Market Size Growth Rate

The Saudi Arabia Potato Chips Market is likely to experience consistent growth rate gains over the period 2025 to 2029. The growth rate starts at 0.03% in 2025 and reaches 0.06% by 2029.

Saudi Arabia Potato Chips Market Highlights

| Report Name | Saudi Arabia Potato Chips Market |

| Forecast Period | 2024-2030 |

| Market Size |

USD 1.4Billion – USD 1.8Billion |

| CAGR | 6.1% |

| Growing Sector | Food and Beverage |

Topics Covered in the Saudi Arabia Potato Chips Market Report

The Saudi Arabia Potato Chips market report thoroughly covers the market by flavor, by type and by distribution channel. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Potato Chips Market Size & Analysis

In 2024, the Saudi Arabia Potato Chipsmarketis valued at approximately $ 1.4 billion, with a projected compound annual growth rate (CAGR) of 6.1% over the next five years. Additionally, by 2030, the market is expected to reach around $ 1.8billion. Thefood and beverage sector holds significant position in the overall market.

Saudi Arabia Potato Chips Market Synopsis

The potato chips market in Saudi Arabia has witnessed steady growth, driven by a rising urban population, increased disposable incomes, and shifting consumer preferences towards convenient, ready-to-eat snacks. With a strong presence of both international and local brands such as Lays, Pringles, and local brands like Al Kabeer and Baladna, the market offers a wide variety of flavors catering to diverse consumer tastes, including both traditional and spicy options. The young, urban demographic is particularly drawn to snack products like potato chips, spurred by the growing popularity of Western-style snacks and the increasing demand for on-the-go food options. Convenience stores, supermarkets, and online retail platforms play a significant role in the distribution of potato chips, making them widely accessible. Additionally, the market is evolving with an increasing demand for healthier snack alternatives, such as low-fat and baked chips, driven by growing health consciousness among consumers. Overall, the Saudi potato chips market is poised for continued expansion, driven by consumer innovation, a growing retail landscape, and evolving snack trends.

According to 6Wresearch,Saudi Arabia Potato Chips marketsize is projected to grow at a CAGR of6.1% during 2024-2030.The growth of the Saudi Arabia potato chips market is primarily driven by the increasing demand for convenient, on-the-go snacks, particularly among the young, urban population. As disposable incomes rise and the middle class expands, there is greater spending on ready-to-eat food products, including potato chips, which cater to the busy lifestyles of consumers. The influence of Western culture, coupled with the growing popularity of international snack brands like Lays and Pringles, further propels market demand. Additionally, the increasing availability of potato chips through modern retail formats, convenience stores, and e-commerce platforms makes the products more accessible. Innovations in flavors and healthier alternatives, such as baked chips or reduced-sodium options, are also helping brands meet the evolving preferences of health-conscious consumers. However, the Saudi Arabia Potato Chips industryfaces challenges such as rising competition from healthier snack options and fluctuating raw material prices, particularly for potatoes, which can affect production costs. Moreover, while health trends are on the rise, the demand for traditional, indulgent snacks like fried potato chips remains strong, making it challenging for brands to strike a balance between satisfying traditional tastes and catering to the health-conscious segment. Lastly, environmental concerns around packaging waste and sustainability are putting pressure on manufacturers to adopt eco-friendly practices, which may increase operational costs in the short term.

Saudi Arabia Potato Chips Market Trends

Health-Conscious Alternatives - Growing demand for healthier snack options, including baked chips, low-fat, and reduced-sodium varieties, driven by increasing health awareness.

Flavor Innovation - Continued introduction of new, bold, and diverse flavors, with spicy and local flavor offerings tailored to regional tastes gaining popularity.

Premium Products - Rise in demand for premium and gourmet potato chips, with consumers willing to pay a premium for higher-quality and unique snack experiences.

Convenience and On-the-Go Packaging - Increased consumer preference for smaller, single-serving, and easy-to-carry packaging formats to accommodate busy, mobile lifestyles.

E-commerce Growth - Expanding online sales channels as more consumers turn to e-commerce platforms for convenience and access to a wider range of products.

Investment Opportunities in the Saudi Arabia Potato ChipsMarket

Healthier Snack Options - Investing in the development of healthier alternatives, such as baked, low-fat, and organic potato chips, to cater to the growing health-conscious consumer base.

Flavor Innovation - Opportunities to create unique and localized flavors tailored to Saudi and regional preferences, offering products that stand out in the competitive market.

Premium Product Lines - Expanding the premium and gourmet potato chips segment, targeting affluent consumers willing to pay more for high-quality and exclusive snacks.

Sustainable Packaging Solutions - Investing in environmentally friendly and recyclable packaging to meet consumer demand for sustainability and comply with growing environmental regulations.

Key Players in the Saudi Arabia Potato Chips Market

The Saudi Arabia potato chips market is dominated by several key players, both international and local. Lays, owned by PepsiCo, is a leading global brand, offering a wide variety of flavors that cater to diverse consumer preferences. Pringles, by Kellogg's, also holds a significant market share, targeting the premium snack segment with its unique packaging and flavor variety. Local brands like Al Kabeer and Baladna are prominent players, providing regionally popular flavors and affordable options that cater to Saudi tastes. Almarai, a major food company, has also expanded its presence in the snack market, offering products like potato chips through its Bakery & Snacks division. Additionally, some of these players hold majority of the Saudi Arabia Potato Chips market share. Moreover, Savola Group, through its Al Maghribi brand, and Nadec are growing players in the Saudi snack industry. These companies continuously innovate in product offerings, flavors, and distribution channels to cater to the evolving preferences of Saudi consumers.

Government Regulationsin the Saudi Arabia Potato Chips Market

In Saudi Arabia, the potato chips market is regulated by several governmental bodies to ensure food safety, quality, and consumer protection. The Saudi Food and Drug Authority (SFDA) oversees the safety and quality of all food products, including snacks like potato chips, ensuring they meet strict standards for additives, preservatives, and contaminants. SFDA also enforces labeling regulations that require accurate nutritional information, including calorie content, fat, and sodium levels, to help consumers make informed choices. Further, these initiatives have further boosted the Saudi Arabia Potato Chips market revenues. Furthermore, the Saudi Standards, Metrology and Quality Organization (SASO) sets guidelines for food packaging, including the use of safe materials and proper hygiene practices in production. As consumer concerns about health and sustainability rise, the government is increasingly focusing on reducing the use of unhealthy ingredients like trans fats and encouraging manufacturers to adopt eco-friendlier packaging solutions. Compliance with these regulations is crucial for manufacturers to maintain market access and consumer trust in Saudi Arabia.

Future Insights of the Saudi Arabia Potato Chips Market

The future of the Saudi Arabia potato chips market looks promising, driven by a combination of evolving consumer preferences and a growing, urbanized population. As disposable incomes rise and younger generations increasingly adopt Western snacking habits, the demand for convenient, ready-to-eat snacks like potato chips is set to continue expanding. There will be a growing focus on healthier snack alternatives, such as baked chips and those with lower sodium and fat content, as consumers become more health-conscious. Innovations in flavors, packaging, and premium offerings will continue to fuel market growth, while brands are likely to focus on sustainability initiatives, including eco-friendly packaging and responsible sourcing practices. The expansion of e-commerce and modern retail channels will further enhance the availability and reach of potato chips across the country. Overall, the market is expected to thrive, with opportunities for both local and international brands to innovate and meet the diverse and evolving demands of Saudi consumers.

FriedCategory to Dominate the Market - By Type

According to Ravi Bhandari, Research Head, 6Wresearch,the fried chips category in Saudi Arabia continues to experience steady growth, driven by the enduring popularity of traditional, indulgent snacks among consumers. Despite the rising demand for healthier alternatives, fried chips remain a dominant segment in the market due to their satisfying taste, texture, and affordability. Local flavors, such as spicy and savory varieties, are particularly popular, and brands are continually innovating to meet consumer preferences with new flavor profiles. The growing availability of fried chips through modern retail formats, convenience stores, and e-commerce platforms has also expanded their reach, making them more accessible to a wide range of consumers.

Convenience Storesto Dominate the Market – By Distribution Channel

The convenience store distribution channel for potato chips in Saudi Arabia has experienced significant growth, fueled by changing consumer lifestyles and increasing demand for quick, accessible snack options. As urbanization accelerates and the number of busy, on-the-go consumers rises, convenience stores have become crucial retail outlets for potato chips, offering extended hours and strategic locations in high-traffic areas like residential neighborhoods, shopping malls, and transportation hubs. The expansion of major convenience store chains such as Al-Dawaa Pharmacies, Blue Diamond, and Al-Futtaim’s Carrefour has made potato chips more readily available across the country.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020to 2023.

- Base Year 2023.

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Potato Chips Market Overview

- Saudi Arabia Potato Chips Market Outlook

- Market Size of Saudi Arabia Potato Chips Market, 2023

- Forecast of Saudi Arabia Potato Chips Market, 2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Revenues & Volume for the Period 2020-2030

- Saudi Arabia Potato Chips Market Trend Evolution

- Saudi Arabia Potato Chips Market Drivers and Challenges

- Saudi Arabia Potato Chips Price Trends

- Saudi Arabia Potato Chips Porter's Five Forces

- Saudi Arabia Potato Chips Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Flavor for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Plain/Salted for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Flavored for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Type for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Baked for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Fried for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Distribution Channel for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Supermarket/Hypermarket for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Convenience Stores for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Specialist Stores for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Online Retail Stores for the Period 2020-2030

- Historical Data and Forecast of Saudi Arabia Potato Chips Market Revenues & Volume, By Other for the Period 2020-2030

- Saudi Arabia Potato Chips- Import Export Trade Statistics

- Market Opportunity Assessment, By Type

- Market Opportunity Assessment, By End-User Industry

- Saudi Arabia Potato ChipsMarket - Top Companies Market Share

- Saudi Arabia Potato ChipsMarket - Competitive Benchmarking, By Technical and Operational Parameters

- Saudi Arabia Potato Chips Market - Company Profiles

- Saudi Arabia Potato ChipsMarket - Key Strategic Recommendations

Markets Covered

The Saudi Arabia Potato Chips market report provides a detailed analysis of the following market segments -

By Flavor

- Plain/Salted

- Flavored

- By Type

- Baked

- Fried

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Specialist Stores

- Online Retail Stores

- Other

Saudi Arabia Potato Chips Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Saudi Arabia Potato Chips Market Overview |

| 3.1 Saudi Arabia Country Macro Economic Indicators |

| 3.2 Saudi Arabia Potato Chips Market Revenues & Volume, 2021 & 2031F |

| 3.3 Saudi Arabia Potato Chips Market - Industry Life Cycle |

| 3.4 Saudi Arabia Potato Chips Market - Porter's Five Forces |

| 3.5 Saudi Arabia Potato Chips Market Revenues & Volume Share, By Flavor, 2021 & 2031F |

| 3.6 Saudi Arabia Potato Chips Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.7 Saudi Arabia Potato Chips Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Saudi Arabia Potato Chips Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Saudi Arabia Potato Chips Market Trends |

| 6 Saudi Arabia Potato Chips Market, By Types |

| 6.1 Saudi Arabia Potato Chips Market, By Flavor |

| 6.1.1 Overview and Analysis |

| 6.1.2 Saudi Arabia Potato Chips Market Revenues & Volume, By Flavor, 2021-2031F |

| 6.1.3 Saudi Arabia Potato Chips Market Revenues & Volume, By Plain/Salted, 2021-2031F |

| 6.1.4 Saudi Arabia Potato Chips Market Revenues & Volume, By Flavored, 2021-2031F |

| 6.2 Saudi Arabia Potato Chips Market, By Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Saudi Arabia Potato Chips Market Revenues & Volume, By Baked, 2021-2031F |

| 6.2.3 Saudi Arabia Potato Chips Market Revenues & Volume, By Fried, 2021-2031F |

| 6.3 Saudi Arabia Potato Chips Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Saudi Arabia Potato Chips Market Revenues & Volume, By Supermarket/Hypermarket, 2021-2031F |

| 6.3.3 Saudi Arabia Potato Chips Market Revenues & Volume, By Convenience Stores, 2021-2031F |

| 6.3.4 Saudi Arabia Potato Chips Market Revenues & Volume, By Specialist Stores, 2021-2031F |

| 6.3.5 Saudi Arabia Potato Chips Market Revenues & Volume, By Online Retail Stores, 2021-2031F |

| 6.3.6 Saudi Arabia Potato Chips Market Revenues & Volume, By Other, 2021-2031F |

| 7 Saudi Arabia Potato Chips Market Import-Export Trade Statistics |

| 7.1 Saudi Arabia Potato Chips Market Export to Major Countries |

| 7.2 Saudi Arabia Potato Chips Market Imports from Major Countries |

| 8 Saudi Arabia Potato Chips Market Key Performance Indicators |

| 9 Saudi Arabia Potato Chips Market - Opportunity Assessment |

| 9.1 Saudi Arabia Potato Chips Market Opportunity Assessment, By Flavor, 2021 & 2031F |

| 9.2 Saudi Arabia Potato Chips Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.3 Saudi Arabia Potato Chips Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Saudi Arabia Potato Chips Market - Competitive Landscape |

| 10.1 Saudi Arabia Potato Chips Market Revenue Share, By Companies, 2024 |

| 10.2 Saudi Arabia Potato Chips Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero