Saudi Arabia Structured Cabling Market (2018-2024) | Trends, Value, Revenue, Growth, Share, Size, Analysis, Outlook, Forecast, Industry & Companies

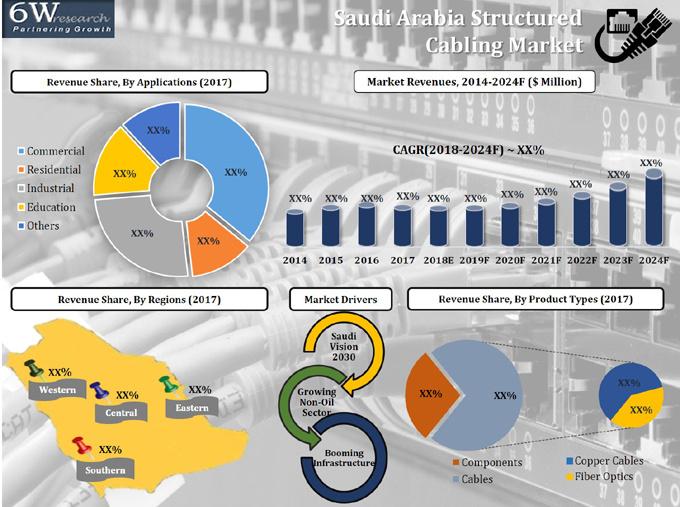

Market Forecast By Product Types (Cables (Copper and Fiber Optics), Components (Communication Outlets, Patch Panels & Cross Connects, Patch Cords & Cable Assemblies and Racks & Cabinets)), By Applications (Commercial, Residential, Industrial, Education and Others including Government, Ministries and Transportation), By Regions (Central, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC000517 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 120 | No. of Figures: 69 | No. of Tables: 11 |

Saudi Arabia structured cabling market is presently in the growing stage and posted modest growth over the last 3 years despite the oil crisis. The slowing of Saudi Arabia's economy resulted in the halting and cancellation of several projects, which impacted the market growth in 2017. The recovery of oil prices and government initiatives to make Saudi Arabia a non-oil-dependent economy would help increase the demand for structured cabling equipment in several non-oil sectors in the future.

According to 6Wresearch, Saudi Arabia structured cabling market size is projected to grow at a CAGR of 10.7% during 2018-24. The market for cables held the highest Saudi Arabia structured cabling market share, by product type, owing to the high volume of cables used in mega infrastructure projects, medium size projects, and in the retail market for home users. Additionally, due to the shorter life cycle of cabling components, the components market is expected to grow at a healthy pace in the years to come.

Saudi Arabia is a highly competitive market for structured cabling, with both international and local brands competing with each other. Some of the key players in Saudi Arabia structured cabling market include- CommScope, Belden, Legrand, Nexans, Schneider Electric, Panduit, Corning, Datwyler, Leviton, and Siemon.

The Saudi Arabia structured cabling market report thoroughly covers Saudi Arabia structured cabling market by product types, applications, and regions. The Saudi Arabia structured cabling market outlook report provides an unbiased and detailed analysis of Saudi Arabia's structured cabling market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Saudi Arabia structured cabling market is estimated to gain popularity in the coming years on the back of the rising telecommunication sector. The increased spectrum of telecom towers across the country due to rising internet subscribers, as a result, strengthening Saudi Arabia structured cabling market. Additionally, structured cabling is estimated to be designed in a flexible way and can accommodate move and change is leading to reduce installation time. Further, the rising use of digitalization and electronic products demand for better services is leading to instigate structured cabling and ensure efficient communication process and would benefit Saudi Arabia structured cabling market garner promising growth in the upcoming six years.

Key Highlights of the Report:

• Saudi Arabia Structured Cabling Market Overview

• Saudi Arabia Structured Cabling Market Outlook

• Saudi Arabia Structured Cabling Market Forecast

• Historical data of Global Structured Cabling Market Revenues, 2014-2017

• Market Size & Forecast of Global Structured Cabling Market Revenues, until 2024

• Historical data of Saudi Arabia Structured Cabling Market Revenues, 2014-2017

• Saudi Arabia Structured Cabling Market Size & Saudi Arabia Structured Cabling Market Forecast, until 2024

• Historical Data of Saudi Arabia Structured Cabling Market Revenues, By Product Types, 2014-2017

• Market Size & Forecast of Saudi Arabia Structured Cabling Market Revenues, By Product Types, until 2024

• Historical Data of Saudi Arabia Structured Cabling Market Revenues, By Applications, 2014-2017

• Market Size & Forecast of Saudi Arabia Structured Cabling Market Revenues, By Applications, until 2024

• Historical Data of Saudi Arabia Structured Cabling Market Revenues, By Regions, 2014-2017

• Market Size & Forecast of Saudi Arabia Structured Cabling Market Revenues, By Regions, until 2024

• Market Drivers and Restraints

• Saudi Arabia Structured Cabling Market Trends and Industry Life Cycle

• Porter's Five Force Analysis and Market Opportunity Assessment

• Saudi Arabia Structured Cabling Market Share, By Players

• Saudi Arabia Structured Cabling Market Overview on Competitive Landscape

• Company Profiles

• Strategic Recommendations

Markets Covered:

The Saudi Arabia structured cabling market report provides a detailed analysis of the following market segments:

• By Product Types:

o Cables

? Copper

? Fiber Optics

o Components

? Communication Outlets

? Patch Panels & Cross Connects

? Patch Cords & Cable Assemblies

? Racks & Cabinets

• By Applications:

o Commercial

o Residential

o Industrial

o Education

o Others (Govt. Ministries and Transportation)

• By Regions:

o Central

o Western

o Eastern

o Southern

Frequently Asked Questions About the Market Study (FAQs):

Table of Contents

1. Executive Summary

2. Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3. Global Structured Cabling Market Overview

3.1. Global Structured Cabling Market Revenues, 2014-2024F

3.2. Global Structured Cabling Market Revenues, By Regions, 2014-2024F

4. Saudi Arabia Structured Cabling Market Overview

4.1. Saudi Arabia Structured Cabling Market Revenues, 2014-2024F

4.2. Saudi Arabia Structured Cabling Market - Industry Life Cycle

4.3. Saudi Arabia Structured Cabling Market - Porter's Five Forces Model

4.4. Saudi Arabia Structured Cabling Market Revenue Share, By Product Types, 2017 & 2024F

4.5. Saudi Arabia Structured Cabling Market Revenue Share, By Cable Types, 2017 & 2024F

4.6. Saudi Arabia Structured Cabling Market Revenue Share, By Component Types, 2017 & 2024F

4.7. Saudi Arabia Structured Cabling Market Revenue Share, By Applications, 2017 & 2024F

4.8. Saudi Arabia Structured Cabling Market Revenue Share, By Regions, 2017 & 2024F

5. Saudi Arabia Structured Cabling Market Dynamics

5.1. Impact Analysis

5.2. Market Drivers

5.3. Market Restraints

6. Saudi Arabia Structured Cabling Market Trends

7. Saudi Arabia Structured Cabling Market Overview, By Product Types

7.1. Saudi Arabia Cables Market Revenues, 2014-2024F

7.2. Saudi Arabia Cables Market Revenue Share, By Types, 2017 & 2024F

7.2.1. Saudi Arabia Copper Cables Market Revenues, 2014-2024F

7.2.2. Saudi Arabia Fibre Optics Cables Market Revenues, 2014-2024F

7.3. Saudi Arabia Structured Cabling Components Market Revenues, 2014-2024F

7.4. Saudi Arabia Structured Cabling Components Market Revenue Share, By Types, 2017 & 2024F

7.4.1. Saudi Arabia Communication Outlets Market Revenues, 2014-2024F

7.4.2. Saudi Arabia Patch Panels & Cross Connects Market Revenues, 2014-2024F

7.4.3. Saudi Arabia Patch Cords & Cable Assemblies Market Revenues, 2014-2024F

7.4.4. Saudi Arabia Racks & Cabinets Market Revenues, 2014-2024F

8. Saudi Arabia Structured Cabling Market Overview, By Applications

8.1. Saudi Arabia Structured Cabling Market Revenues, By Commercial Application, 2014-2024F

8.2. Saudi Arabia Structured Cabling Market Revenues, By Residential Application, 2014-2024F

8.3. Saudi Arabia Structured Cabling Market Revenues, By Industrial Application, 2014-2024F

8.4. Saudi Arabia Structured Cabling Market Revenues, By Education Application, 2014-2024F

8.5. Saudi Arabia Structured Cabling Market Revenues, By Other Applications, 2014-2024F

9. Saudi Arabia Structured Cabling Market Overview, By Regions

9.1. Saudi Arabia Structured Cabling Market Revenues, By Central, 2014-2024F

9.2. Saudi Arabia Structured Cabling Market Revenues, By Eastern, 2014-2024F

9.3. Saudi Arabia Structured Cabling Market Revenues, By Western, 2014-2024F

9.4. Saudi Arabia Structured Cabling Market Revenues, By Southern, 2014-2024F

10. Saudi Arabia Structured Cabling Market - Key Performance Indicators

10.1. Saudi Arabia Government Spending Outlook

10.2. Saudi Arabia IT & Telecommunication Sector Outlook

11. Saudi Arabia Structured Cabling Market Opportunity Assessment

11.1. By Product Types

11.2. By Component Types

11.3. By Application Types

12. Saudi Arabia Structured Cabling Market - Competitive Landscape

12.1. Competitive Benchmarking, By Operating Parameters

12.2. Saudi Arabia Structured Cabling Market Revenue Share, By Company (2017)

13. Company Profiles

13.1. CommScope Holding Company, Inc.

13.2. Belden Inc.

13.3. Legrand SA

13.4. Nexans S.A.

13.5. Schneider Electric S.E.

13.6. Dätwyler Cabling Solutions AG

13.7. Panduit Corp.

13.8. Corning Incorporated.

13.9. Leviton Manufacturing Company, Inc.

13.10. The Siemon Company LLC...

14. Key Strategic Recommendations

15. Disclaimer

List of Figures

1. Global Structured Cabling Market Revenue, 2014-2024F ($ Billion)

2. Global Structured Cabling Market Revenues, By Region 2014-2024F ($ Billion)

3. Saudi Arabia Structured Cabling Market Revenues, 2014-2024F ($ Million)

4. Saudi Arabia Gross Domestic Product, Constant Price, Percentage Change, 2014-2024F ($ Million)

5. Saudi Arabia Average Crude Oil Prices in, 2012-2018 ($/Barrel)

6. Saudi Arabia Structured Cabling Market Revenue Share, By Product Types, 2017 & 2024F

7. Saudi Arabia Structured Cabling Market Revenue Share, By Cable Types, 2017 & 2024F

8. Saudi Arabia Structured Cabling Market Revenue Share, By Component Types, 2017 & 2024F

9. Saudi Arabia Structured Cabling Market Revenue Share, By Applications, 2017 & 2024F

10. Saudi Arabia Structured Cabling Market Revenue Share, By Regions, 2017 & 2024F

11. Saudi Vision 2030 - Key Targets

12. Saudi Vision 2030 Goals for Non-Oil Sector

13. Saudi Arabia Non-Oil Revenues, 2012-2017E ($ Billion)

14. Upcoming Construction Projects in Saudi Arabia

15. Upcoming Economic Cities in Saudi Arabia

16. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million)

17. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion)

18. Saudi Arabia Cables Market Revenues, 2014-2024F ($ Million)

19. Saudi Arabia Cables Market Revenue Share, 2017 & 2024F

20. Saudi Arabia Copper Cables Market Revenues, 2014-2024F ($ Million)

21. Saudi Arabia Copper Cables Market Revenue Share, 2017 & 2024F

22. Saudi Arabia Fibre Optics Market Revenues, 2014-2024F ($ Million)

23. Saudi Arabia Fiber Optics Market Revenue Share, 2017 & 2024F

24. Saudi Arabia Cabling Components Market Revenue Share, 2017 & 2024F

25. Saudi Arabia Cabling Components Market Revenue Share, 2017 & 2024F

26. Saudi Arabia Communication Outlets Market Revenues, 2014-2024F ($ Million)

27. Saudi Arabia Communication Outlets Market Revenue Share, 2017 & 2024F

28. Saudi Arabia Patch Panels & Cross Connects Market Revenues, 2014-2024F ($ Million)

29. Saudi Arabia Patch Panels & Cross Connects Market Revenue Share, 2017 & 2024F

30. Saudi Arabia Patch Cords & Cable Assemblies Market Revenues, 2014-2024F ($ Million)

31. Saudi Arabia Patch Cords & Cable Assemblies Market Revenue Share, 2017 & 2024F

32. Saudi Arabia Racks & Cabinet Revenues, 2014-2024F ($ Million)

33. Saudi Arabia Racks & Cabinet Market Revenue Share, 2017 & 2024F

34. Saudi Arabia Structured Cabling Market Revenues, By Commercial Application, 2014-2024F ($ Million)

35. Saudi Arabia Structured Cabling Market Revenue Share, By Commercial Application, 2017 & 2024F

36. Riyadh Office Supply, 2014-2019F ('000 Sq. m.)

37. Jeddah Office Supply, 2014-2019F ('000 Sq. m.)

38. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.)

39. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.)

40. Riyadh Hotel Supply, 2014-2019F (No. of Rooms)

41. Jeddah Hotel Supply, 2014-2019F (No. of Rooms)

42. Major Upcoming Healthcare Projects in Saudi Arabia

43. Upcoming Healthcare Projects in Saudi Arabia

44. Saudi Arabia Cabling Market Revenues, By Residential Application 2014-2024F ($ Million)

45. Saudi Arabia Cabling Market Revenue Share, By Residential Application 2017 & 2024F

46. Riyadh Residential Supply, 2014-2019F ('000 Units)

47. Jeddah Residential Supply, 2014-2019F ('000 Units)

48. Dammam Residential Supply, 2014-2019F ('000 Units)

49. Makkah Residential Supply, 2014-2019F ('000 Units)

50. Saudi Arabia Cabling Market Revenues, By Industrial Application, 2014-2024F ($ Million)

51. Saudi Arabia Cabling Market Revenue Share, By Industrial Application, 2017 & 2024F

52. Upcoming Power Plant Projects in Saudi Arabia

53. Total Number of Manufacturing Facilities in Saudi Arabia, Q1-Q3 2017

54. Production of Refined Products in Saudi Arabia, 2014-2016 (Million Barrels)

55. Saudi Arabia Structured Cabling Market Revenues, By Education Application, 2014-2024F ($ Million)

56. Saudi Arabia Structured Cabling Market Revenue Share, By Education Application, 2017 & 2024F

57. Saudi Arabia Cabling Market Revenues, By Other Applications, 2014-2024F ($ Million)

58. Saudi Arabia Structured Cabling Market Revenue Share, By Other Applications, 2017 & 2024F

59. Saudi Arabia Structured Cabling Market Revenues, By Central Region, 2014-2024F ($ Million)

60. Saudi Arabia Structured Cabling Market Revenue Share, By Central Region, 2017 & 2024F

61. Saudi Arabia Structured Cabling Market Revenues, By Eastern Region, 2014-2024F ($ Million)

62. Saudi Arabia Structured Cabling Market Revenue Share, By Eastern Region, 2017 & 2024F

63. Saudi Arabia Structured Cabling Market Revenues, By Western Region, 2014-2024F ($ Million)

64. Saudi Arabia Structured Cabling Market Revenue Share, By Western Region, 2017 & 2024F

65. Saudi Arabia Structured Cabling Market Revenues, By Southern Region, 2014-2024F ($ Million)

66. Saudi Arabia Structured Cabling Market Revenue Share, By Southern Region, 2017 & 2024F

67. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2023F ($ Billion)

68. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion)

69. Saudi Arabia Structured Cabling Market Revenue Share, By Company Share (2017)

List of Tables

1. Major Upcoming Infrastructure Projects

2. Saudi Arabia Bank Branches Classified By Administrative Regions, 2014-2017

3. Upcoming Hotels Projects in Saudi Arabia

4. Upcoming Residential Projects in Saudi Arabia

5. Upcoming Residential Projects in Saudi Arabia

6. Saudi Arabia Upcoming Oil & Gas Projects

7. Under Construction Manufacturing Units in Saudi Arabia, Q4 2017 & Q1 2018

8. Upcoming Manufacturing Plants in Saudi Arabia

9. Saudi Arabia Upcoming Petrochemical Projects

10. Saudi Arabia Budget 2018 Sectorwise Spending

11. Saudi Arabia Budget Expenses By Sectors, 2017 and 2018 ($ Billion)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Voluntary Carbon Credit Market (2025-2031) | Companies, Outlook, Share, Forecast, Revenue, Value, Industry, COVID-19 IMPACT, Growth, Size, Analysis & Trends

- Water Purifier Market (2025-2031) | Value, Share, Size, Growth, Industry, Outlook, Analysis, Forecast, Trends, Companies & Revenue

- UAV Market (2025-2031) | Size, Forecast, Value, Revenue, Trend, Growth, Analysis & Outlook

- Smart Speaker Market (2025-2031) | Size, Trends, Share, Outlook, Revenue, Forecast, Analysis, Value, Segmentation & Industry

- Microgrid Market (2025-2031) | Value, Share, Growth, Outlook, Industry, Companies, Trends, Revenue, Forecast, Analysis & Size

- Mobile Credential Reader Market (2025-2031) | Analysis, Industry, Size, Share, Revenue, Forecast, Trends, Growth, Value & Outlook

- North America Planting Equipment Market (2024-2030) | Outlook, Size, Growth, Companies, Revenue, Share, Analysis, Forecast, Industry, Value & Trends

- Light Fidelity (Li-Fi) Market (2025-2031) | Share, Revenue, Trends, Size, Industry, Forecast, Companies, Growth, Outlook, Analysis & Value

- UAE Ready Mix Concrete Market (2025-2031) | Industry, Segmentation, Share, Analysis, Forecast, Companies, Outlook, Competitive Landscape, Trends, Value, Growth, Size & Revenue

- Australia Bearings Market (2024-2030) | Growth, Analysis, Trends, Value, Outlook, Industry, Share, Forecast, Size, Segmentation & COVID-19 IMPACT

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines