Saudi Arabia Cable Tray Market (2018-2024) | Analysis, Value, Revenue, Outlook, Growth, Share, Forecast, Trends, Size, Companies & Industry

Market Forecast By Materials (Aluminum, Steel and Stainless Steel), By Types (Ladder, Solid Bottom, Trough & Perforated, Channel, Wire Mesh and Single Rail), By Applications (Power Utilities, Construction, Industrial and Others), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000444 | Publication Date: Dec 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 135 | No. of Figures: 75 | No. of Tables: 11 | |

Growing social infrastructure, expanding power transmission and distribution network along with ambitious transportation projects would act as a key driver for the growth of the cable tray market in Saudi Arabia. Further, initiatives such as the Saudi Vision 2030 and the $19 billion stimulus package for strengthening the private sector are expected to boost the Saudi Arabia cable tray market during 2018-24.

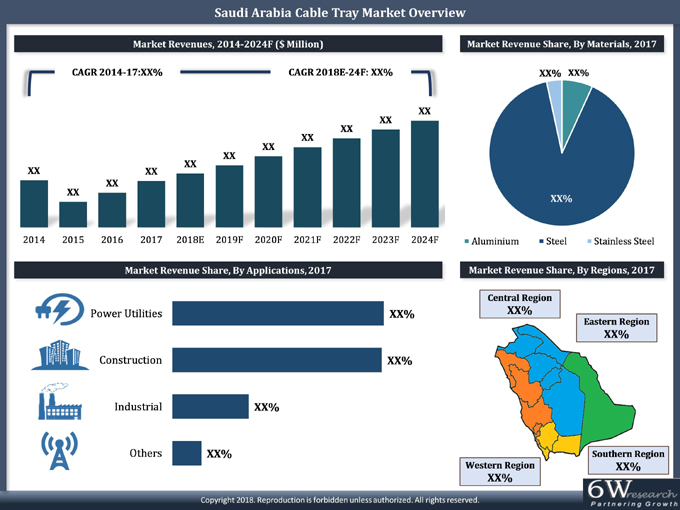

According to 6Wresearch, the Saudi Arabia Cable Tray Market size is projected to grow at a CAGR of 12.1% during 2018-24. According to the Saudi Vision 2030 initiative, the government plans to reduce the country's dependence on oil-sector-based revenues and focus on developing and strengthening its non-oil-based economy. The cable tray market is dominated by steel-based cable trays in revenue terms, while ladder cable trays hold the majority of the revenue share by type. Additionally, the Eastern region held the largest Saudi Arabia Cable Tray Market Share in terms of revenues in 2017.

The power utility segment held the largest revenue share in the overall cable tray market in 2017. Further, the construction segment is expected to exceed the power utility segment in the future in revenue terms owing to a large number of upcoming infrastructural projects in the country.

The Saudi Arabia Cable Tray Market report comprehensively covers the Saudi Arabia Cable Tray Market by materials, type, applications, and regions. The Saudi Arabia Cable Tray Market outlook report provides an unbiased and detailed analysis of the Saudi Arabia Cable Tray Market trends, opportunities, high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Saudi Arabia Cable Tray Market is ongoing construction in the country such as hospitals, offices, educational institutions; transportation infrastructure Saudi Arabia is planning huge development. In the forecast period requirement of the electrical devices, cabling demand going to increase more in the country, and moreover the demand for cable increases due to highly dependent on infrastructural projects or shelving projects. The detailed analysis of the ongoing trends, high growth areas, opportunities, and the market plan according to the current and future market of the cable tray.

Key Highlights of the Report:

• Saudi Arabia Cable Tray Market Overview

• Saudi Arabia Cable Tray Market Outlook

• Saudi Arabia Cable Tray Market Forecast

• Saudi Arabia Cable Tray Market Size and Saudi Arabia Cable Tray Market Forecast Revenues until 2024

• Historical Data of Global Cable Tray Market Revenues for the Period 2014-2017.

• Market Size & Forecast of Global Cable Tray Market Revenues until 2024.

• Historical Data of Saudi Arabia Cable Tray Market Revenues for the Period 2014-2017.

• Market Size & Forecast of Saudi Arabia Cable Tray Market Revenues Market until 2024.

• Historical Data of Saudi Arabia Cable Tray Market Revenues for the Period 2014-2017, By Material.

• Market Size & Forecast of Saudi Arabia Cable Tray Market Revenues until 2024, By Material.

• Historical Data of Saudi Arabia Cable Tray Market Revenues for the Period 2014-2017, By Type.

• Market Size & Forecast of Saudi Arabia Cable Tray Market Revenues until 2024, By Type.

• Historical Data of Saudi Arabia Cable Tray Market Revenues for the Period 2014-2017, By Applications.

• Market Size & Forecast of Saudi Arabia Cable Tray Market Revenues until 2024, By Applications.

• Market Drivers and Restraints.

• Saudi Arabia Cable Tray Market Trends and Developments.

• Saudi Arabia Cable Tray Market Share by Players Competitive Landscape.

• Saudi Arabia Cable Tray Market Overview on Competitive Landscape

• Company Profiles.

• Strategic Recommendations.

Markets Covered

The Saudi Arabia Cable Tray Market report provides a detailed analysis of the following market segments:

• By Materials:

o Aluminum

o Steel

o Stainless Steel

• By Types:

o Ladder

o Solid Bottom

o Trough & Perforated

o Channel

o Wire Mesh

o Single Rail

• By Applications:

o Power Utilities

o Construction

o Industrial

o Others

• By Regions:

o Eastern

o Western

o Central

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumption

3. Global Cable Tray Market Revenues

3.1 Global Cable Tray Market Revenues (2016-2021F)

4. Saudi Arabia Country Overview

4.1 Saudi Arabia Country Indicators

4.2 SWOT Analysis: Saudi Arabia

4.3 Saudi Arabia Power Sector Overview

5. Saudi Arabia Cable Tray Market Overview

5.1 Saudi Arabia Cable Tray Market Revenues (2014-2024F)

5.2 Saudi Arabia Cable Tray Market Revenue Share, By Materials (2017 & 2024F)

5.3 Saudi Arabia Cable Tray Market Revenue Share, By Types (2017 & 2024F)

5.4 Saudi Arabia Cable Tray Market Revenue Share, By Applications (2017 & 2024F)

5.5 Saudi Arabia Cable Tray Market Revenue Share, By Regions (2017 & 2024F)

5.6 Saudi Arabia Cable Tray Market Porter's Five Forces (2017)

5.7 Saudi Arabia Cable Tray Market Industry Life Cycle (2017)

6. Saudi Arabia Cable Tray Market Dynamics

6.1 Impact Analysis

6.2 Market Drivers

6.3 Market Restraints

7. Saudi Arabia Cable Tray Market Trends

7.1 Non-Metal Cable Trays

8. Saudi Arabia Cable Tray Market Overview, By Materials

8.1. Saudi Arabia Aluminium Cable Tray Market Revenues (2014 - 2024F)

8.2 Saudi Arabia Steel Cable Tray Market Revenues (2014 - 2024F)

8.3 Saudi Arabia Stainless Steel Cable Tray Market Revenues (2014 - 2024F)

8.4 Saudi Arabia Mining Sector Overview

9. Saudi Arabia Cable Tray Market Overview, By Types

9.1 Saudi Arabia Ladder Cable Tray Market Revenues (2014 - 2024F)

9.2 Saudi Arabia Solid Bottom Cable Tray Market Revenues (2014 - 2024F)

9.3 Saudi Arabia Trough and Perforated Cable Tray Market Revenues (2014 - 2024F)

9.4 Saudi Arabia Channel Cable Tray Market Revenues (2014 - 2024F)

9.5 Saudi Arabia Single Rail Bottom Cable Tray Market Revenues (2014 - 2024F)

9.6 Saudi Arabia Wire Mesh Cable Tray Market Revenues (2014 - 2024F)

10. Saudi Arabia Cable Tray Market Overview, By Applications

10.1 Saudi Arabia Power Utilities Application Cable Tray Market Revenues (2014 - 2024F)

10.1.1 Saudi Arabia Power Utilities Sector Overview

10.2 Saudi Arabia Construction Application Cable Tray Market Revenues (2014 - 2024F)

10.2.1 Saudi Arabia Construction Sector Overview

10.2.2 Saudi Arabia Commercial Sector Overview

10.2.3 Saudi Arabia Hospitality Sector Outlook

10.3 Saudi Arabia Industrial Application Cable Tray Market Revenues (2014 - 2024F)

10.3.1 Saudi Arabia Industrial Sector Overview

10.4 Saudi Arabia Other Applications Cable Tray Market Revenues (2014 - 2024F)

10.4.1 Saudi Arabia Telecom Sector Overview

11. Saudi Arabia Cable Tray Market Overview, By Regions

11.1 Saudi Arabia Central Region Cable Tray Market Revenues (2014 - 2024F)

11.2 Saudi Arabia Eastern Region Cable Tray Market Revenues (2014 - 2024F)

11.3 Saudi Arabia Southern Region Cable Tray Market Revenues (2014 - 2024F)

11.4 Saudi Arabia Western Region Cable Tray Market Revenues (2014 - 2024F)

11.5 Saudi Arabia Regional Power Sector Overview

12. Saudi Arabia Cable Tray Market Key Performance Indicators

12.1 Saudi Arabia Government Spending Outlook

12.2 Saudi Arabia Construction Market Outlook

12.3 Major Infrastructure Projects in Saudi Arabia

13. Saudi Arabia Cable Tray Market Opportunity Assessment

13.1 Saudi Arabia Cable Tray Market Opportunity Assessment, By Applications

14. Competitive Landscape

14.1 Competitive Benchmarking, By Materials

14.2 Saudi Arabia Cable Tray Market Revenue Share, By Company, 2017

15. Company Profiles

15.1 Wahah Electric Supply Company of Saudi Arabia Ltd.

15.2 Power Solution Industries LLC

15.3 Mideast Cable Support Solutions

15.4 Abahsain - Cope Saudi Arabia Ltd.

15.5 Khereiji Showrooms Co. Ltd.

15.6 Legrand Saudi Electric Industries Co. Ltd.

15.7 Fas Al Jazeera United Factory Co.

15.8 Adhwa Al-Rawafid Electric Industries

15.9 Cooper Industries Middle East LLC

15.10 Thomas & Betts Corporation

16. Strategic Recommendations

17. Disclaimer

List of Figures

1. Global Cable Tray Market Revenues, 2014-2024F ($ Billion)

2. Saudi Arabia Energy Sales (GWh), By Verticals (2016)

3. Actual and Projected Peak Loads, 2010-2020F (In GW)

4. Saudi Arabia Electricity Consumption, By KWh/ Capita, 2012-2016

5. Saudi Arabia Residential Electricity Consumption, By KWh/ Capita, 2012-2016

6. Saudi Arabia Cable Tray Market Revenues, 2014-2024F ($ Million)

7. Saudi Arabia Cable Tray Market Revenue Share, By Materials, 2017

8. Saudi Arabia Cable Tray Market Revenue Share, By Materials, 2024F

9. Saudi Arabia Cable Tray Market Revenue Share, By Types, 2017

10. Saudi Arabia Cable Tray Market Revenue Share, By Types, 2024F

11. Saudi Arabia Cable Tray Market Revenue Share, By Applications, 2017

12. Saudi Arabia Cable Tray Market Revenue Share, By Applications, 2024F

13. Saudi Arabia Cable Tray Market Revenue Share, By Regions, 2017 & 2024F

14. Saudi Arabia Cable Tray Market Porters' Five Forces, 2017

15. Saudi Arabia Cable Tray Market Industry Life Cycle, 2017

16. Saudi Vision 2030 - Key Targets

17. Saudi Vision 2030 Goals for Non-Oil Sector

18: Saudi Arabia Non-Oil Revenues, 2012-2017E ($ Billion)

19. Upcoming Economic Cities in Saudi Arabia

20. Upcoming Construction Projects in Saudi Arabia

21. Saudi Arabia Renewable Energy Contribution to Total Installed Power Capacity, 2015-2023F (GW)

22. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million)

23. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion)

24. Brent Crude Oil Price Projections, 2014-2024F ($ per Barrel)

25. Saudi Arabia Aluminium Cable Tray Market Revenues, 2014-2024F ($ Million)

26. Saudi Arabia Steel Cable Tray Market Revenues, 2014-2024F ($ Million)

27. Saudi Arabia Stainless Steel Cable Tray Market Revenues, 2014-2024F ($ Million)

28. Saudi Arabia Mining Contribution to GDP, 2015-2030 ($ Billion)

29. Annual Production of Minerals in Saudi Arabia, 2014-2016

30. Saudi Arabia Ladder Cable Tray Market Revenues, 2014-2024F ($ Million)

31. Saudi Arabia Solid Bottom Cable Tray Market Revenues, 2014-2024F ($ Million)

32. Saudi Arabia Trough and Perforated Cable Tray Market Revenues, 2014-2024F ($ Million)

33. Saudi Arabia Channel Cable Tray Market Revenues, 2014-2024F ($ Million)

34. Saudi Arabia Single Rail Cable Tray Market Revenues, 2014-2024F ($ Million)

35. Saudi Arabia Wire Mesh Cable Tray Market Revenues, 2014-2024F ($ Million)

36. Saudi Arabia Power Utilities Application Cable Tray Market Revenues, 2014-2024F ($ Million)

37. Saudi Arabia Transmission and Distribution Lines (In Circuit Km.)

38. Saudi Arabia Installed and Available Capacity, (in GW)

39. Saudi Arabia Number of Substations, 2011-2016 (Units)

40. Saudi Arabia Construction Application Cable Tray Market Revenues, 2014-2024F ($ Million)

41. Upcoming Transportation Projects in Saudi Arabia

42. Saudi Arabia Infrastructure Investment Forecast, 2016-2040 ($ Billion)

43. Saudi Arabia Total Infrastructure Investment Forecast, By Sector, 2016-2040 ($ Billion)

44. Riyadh Office Supply, 2014-2019F ('000 Sq. m.)

45. Jeddah Office Supply, 2014-2019F ('000 Sq. m.)

46. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.)

47. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.)

48. Riyadh Hotel Supply, 2014-2019F (No. of Rooms)

49. Jeddah Hotel Supply, 2014-2019F (No. of Rooms)

50. Major Upcoming Healthcare Projects in Saudi Arabia

51. Saudi Arabia Industrial Application Cable Tray Market Revenues, 2014-2024F ($ Million)

52. Saudi Arabia Other Applications Cable Tray Market Revenues, 2014-2024F ($ Million)

53. Saudi Arabia Total Mobile Subscriptions (Million)

54. Estimated Number of Telecom Towers in GCC Countries, 2016

55. Saudi Arabia Central Region Cable Tray Market Revenues, 2014-2017 ($ Million)

56. Saudi Arabia Central Region Cable Tray Market Revenues, 2018E-2024F ($ Million)

57. Saudi Arabia Eastern Region Cable Tray Market Revenues, 2014-2017 ($ Million)

58. Saudi Arabia Eastern Region Cable Tray Market Revenues, 2018E-2024F ($ Million)

59. Saudi Arabia Southern Region Cable Tray Market Revenues, 2014-2017 ($ Million)

60. Saudi Arabia Southern Region Cable Tray Market Revenues, 2018E-2024F ($ Million)

61. Saudi Arabia Western Region Cable Tray Market Revenues, 2014-2017 ($ Million)

62. Saudi Arabia Western Region Cable Tray Market Revenues, 2018E-2024F ($ Million)

63. Saudi Arabia Transmission and Distribution Networks 2016, By Regions (ckt. km)

64. Saudi Arabia Electricity Consumers 2016, By Regions

65. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2021F ($ Billion)

66. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion)

67. Saudi Arabia Construction Contracts Awards, 2016-2017 ($ Million)

68. Saudi Arabia Building Construction Projects Value by Status, 2017

69. Saudi Arabia Value of Awarded Contracts, 2013-1H 2016 ($ Billion)

70. Value of Awarded Contracts by Sector During Q2'16

71. Saudi Arabia Cable Tray Opportunity Assessment, By Applications

72. Saudi Arabia Cable Tray Services Market Revenue Share, By Company, 2017

73. Number of Under Construction Manufacturing Factories Till Q1 2017

74. Riyadh Industrial Cities Composition, 2014 & 2018

75. Saudi Arabia International Visitor Arrivals (Million)

List of Tables

1. 2020 Energy Sector Targets Under The National Transformation Program

2. Major Upcoming Infrastructure Projects

3. Saudi Arabia Upcoming Renewable Energy Sector Projects

4. Saudi Arabia Planned Transmission Interconnection Projects (380 KV)

5. Upcoming Power Generation Projects in Saudi Arabia

6. Upcoming Hotel Projects in Saudi Arabia

7. Total Operating Industrial Units and Total Finance, 2010 & 2017 3rd Quarter

8. Saudi Arabia Upcoming Oil & Gas Projects

9. Saudi Arabia Approved Budget Per Sector and Actual Expenses Up to End of Q3 of Fiscal Year 2017 ($ Billion)

10. List of Major Infrastructure Projects in Saudi Arabia

11. Upcoming Manufacturing Facilities in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero