Vietnam Edible Oils and Fats Market (2025-2031) Outlook | Forecast, Trends, Size, Value, Revenue, Industry, Analysis, Share, Companies & Growth

| Product Code: ETC188442 | Publication Date: May 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 | |

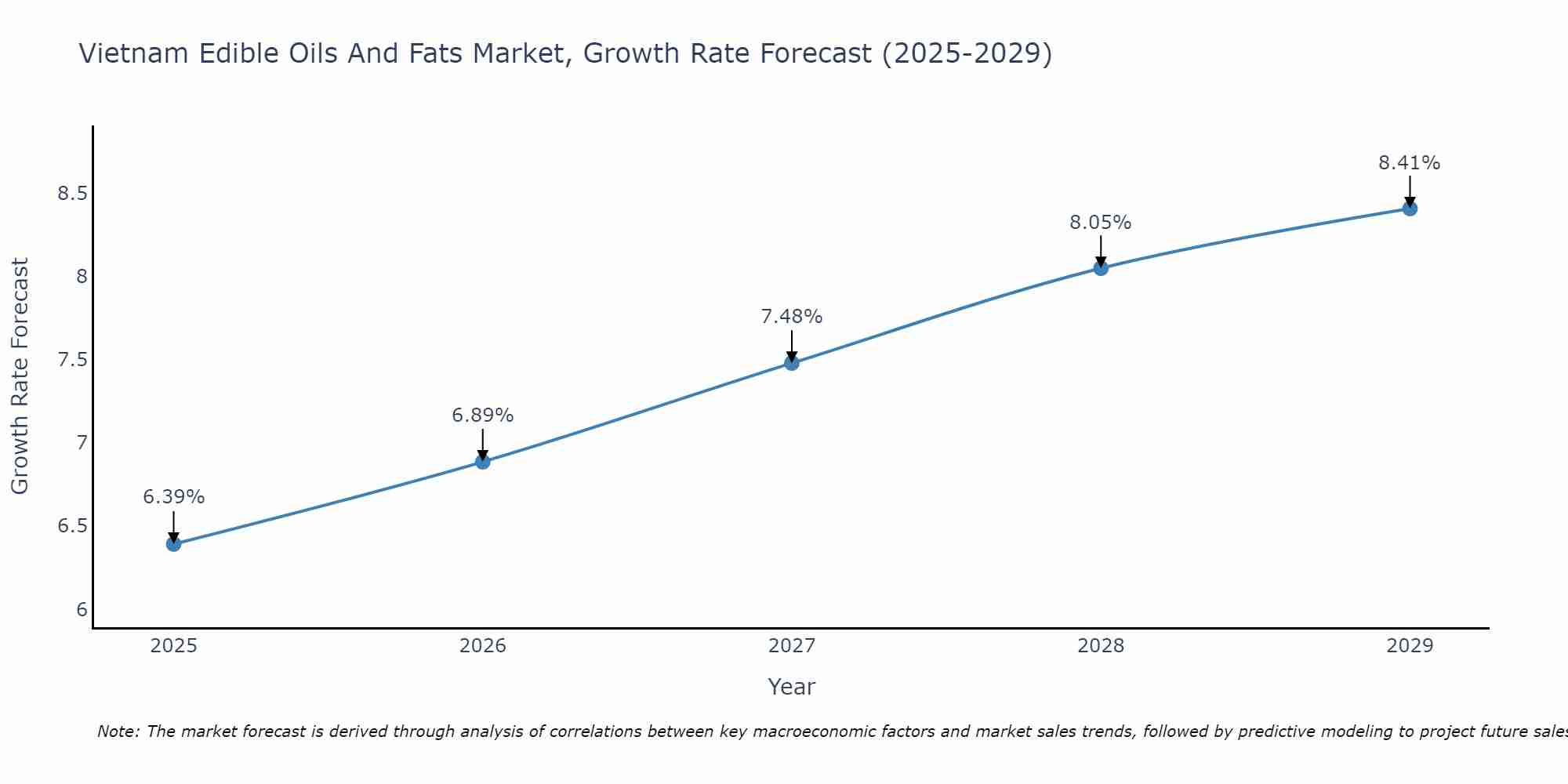

Vietnam Edible Oils And Fats Market Size Growth Rate

The Vietnam Edible Oils And Fats Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 6.39% in 2025, the growth rate steadily ascends to 8.41% in 2029.

Vietnam Edible Oils and Fats Market Overview

The Vietnam Edible Oils and Fats market play a crucial role in the country`s culinary landscape. With a diverse range of edible oils and fats available, the market caters to the varied cooking styles and preferences of consumers. The market dynamics are influenced by factors such as health consciousness, culinary traditions, and the adoption of international cuisines. Palm oil, soybean oil, and sunflower oil are among the popular choices. The market is characterized by competition among local and international players, with a focus on product quality, packaging innovations, and health-related attributes.

Drivers of the Market

The Vietnam Edible Oils and Fats market is influenced by various drivers. The growth of this market is closely tied to the overall economic development of the country. As disposable incomes rise, so does the consumption of edible oils and fats, including healthier options like vegetable oils. The growing food industry, increased urbanization, and changing dietary habits are also key drivers of this market. Additionally, government initiatives to promote healthier cooking oils and fats are impacting consumer choices and market trends.

Challenges of the Market

The Vietnam Edible Oils and Fats market grapples with several challenges. One significant issue is the competition with traditional cooking oils like soybean and palm oil. Consumers in Vietnam have long relied on these oils, and there may be resistance to adopting alternative, healthier options. Health concerns and misconceptions surrounding certain types of edible oils and fats can also be a hurdle. Additionally, ensuring the consistent quality and safety of edible oils and fats products can be a challenge in a market where food safety is a top priority.

COVID 19 Impact on the Market

The Vietnam Edible Oils and Fats market experienced the impact of the COVID-19 pandemic, marked by disruptions in the supply chain and changes in consumer preferences. With an increased focus on home cooking and health-conscious choices, there was a notable shift in demand for certain edible oils and fats. The market adapted by strengthening online distribution channels, introducing healthier product variants, and implementing promotional campaigns to engage with consumers. Despite challenges, the market demonstrated resilience by aligning with the evolving landscape of consumer choices.

Key Players in the Market

The Vietnam Edible Oils and Fats market is highly competitive, with key players shaping the industry landscape. Leading companies such as C.P. Vietnam Corporation, Wilmar International Limited, and Acecook Vietnam Joint Stock Company are prominent players in this market. Their diverse product portfolios, strong distribution networks, and focus on quality have established them as leaders in meeting the culinary needs of Vietnamese consumers.

Key Highlights of the Report:

- Vietnam Edible Oils and Fats Market Outlook

- Market Size of Vietnam Edible Oils and Fats Market, 2024

- Forecast of Vietnam Edible Oils and Fats Market, 2031

- Historical Data and Forecast of Vietnam Edible Oils and Fats Revenues & Volume for the Period 2021-2031

- Vietnam Edible Oils and Fats Market Trend Evolution

- Vietnam Edible Oils and Fats Market Drivers and Challenges

- Vietnam Edible Oils and Fats Price Trends

- Vietnam Edible Oils and Fats Porter's Five Forces

- Vietnam Edible Oils and Fats Industry Life Cycle

- Historical Data and Forecast of Vietnam Edible Oils and Fats Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of Vietnam Edible Oils and Fats Market Revenues & Volume By Edible Oils for the Period 2021-2031

- Historical Data and Forecast of Vietnam Edible Oils and Fats Market Revenues & Volume By Edible Fats for the Period 2021-2031

- Historical Data and Forecast of Vietnam Edible Oils and Fats Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Vietnam Edible Oils and Fats Market Revenues & Volume By Offline for the Period 2021-2031

- Historical Data and Forecast of Vietnam Edible Oils and Fats Market Revenues & Volume By Online for the Period 2021-2031

- Vietnam Edible Oils and Fats Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Distribution Channel

- Vietnam Edible Oils and Fats Top Companies Market Share

- Vietnam Edible Oils and Fats Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Edible Oils and Fats Company Profiles

- Vietnam Edible Oils and Fats Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Vietnam Edible Oils and Fats Market Overview |

3.1 Vietnam Country Macro Economic Indicators |

3.2 Vietnam Edible Oils and Fats Market Revenues & Volume, 2021 & 2031F |

3.3 Vietnam Edible Oils and Fats Market - Industry Life Cycle |

3.4 Vietnam Edible Oils and Fats Market - Porter's Five Forces |

3.5 Vietnam Edible Oils and Fats Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 Vietnam Edible Oils and Fats Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 Vietnam Edible Oils and Fats Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Vietnam Edible Oils and Fats Market Trends |

6 Vietnam Edible Oils and Fats Market, By Types |

6.1 Vietnam Edible Oils and Fats Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 Vietnam Edible Oils and Fats Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 Vietnam Edible Oils and Fats Market Revenues & Volume, By Edible Oils, 2021-2031F |

6.1.4 Vietnam Edible Oils and Fats Market Revenues & Volume, By Edible Fats, 2021-2031F |

6.2 Vietnam Edible Oils and Fats Market, By Distribution Channel |

6.2.1 Overview and Analysis |

6.2.2 Vietnam Edible Oils and Fats Market Revenues & Volume, By Offline, 2021-2031F |

6.2.3 Vietnam Edible Oils and Fats Market Revenues & Volume, By Online, 2021-2031F |

7 Vietnam Edible Oils and Fats Market Import-Export Trade Statistics |

7.1 Vietnam Edible Oils and Fats Market Export to Major Countries |

7.2 Vietnam Edible Oils and Fats Market Imports from Major Countries |

8 Vietnam Edible Oils and Fats Market Key Performance Indicators |

9 Vietnam Edible Oils and Fats Market - Opportunity Assessment |

9.1 Vietnam Edible Oils and Fats Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 Vietnam Edible Oils and Fats Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 Vietnam Edible Oils and Fats Market - Competitive Landscape |

10.1 Vietnam Edible Oils and Fats Market Revenue Share, By Companies, 2024 |

10.2 Vietnam Edible Oils and Fats Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero