Bangladesh Poultry Market (2025-2029) | Outlook, Industry, Trends, Forecast, Growth, Value, Companies, Revenue, Size, Share & Analysis

Market Forecast By Segments (Broiler, Eggs), By End Uses (Food Service, Household), By Distribution Channels (Traditional Retail Stores, Business To Business, Modern Retail Stores) And Competitive Landscape

| Product Code: ETC384212 | Publication Date: Aug 2022 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

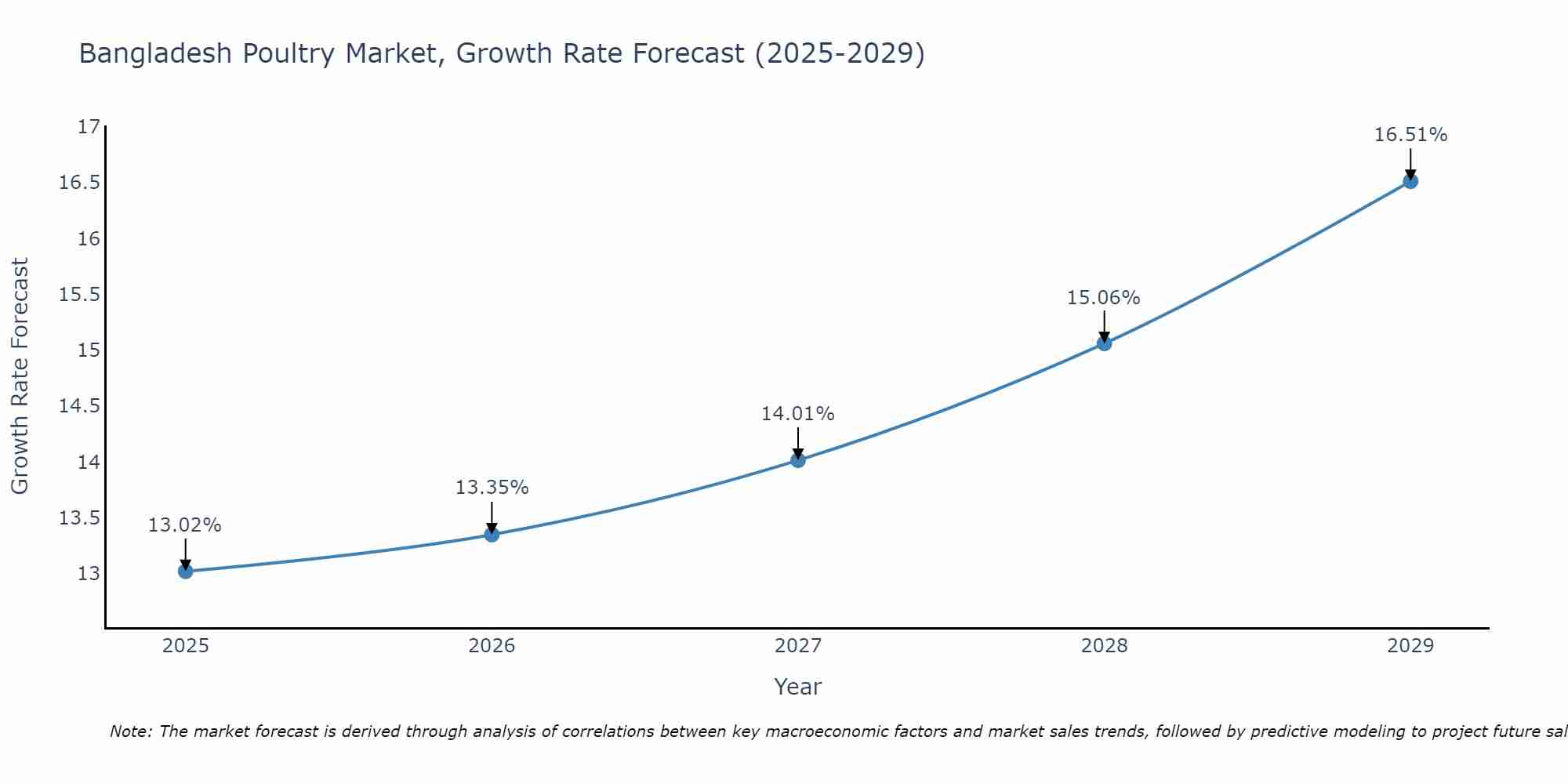

Bangladesh Poultry Market Size Growth Rate

The Bangladesh Poultry Market is poised for steady growth rate improvements from 2025 to 2029. From 13.02% in 2025, the growth rate steadily ascends to 16.51% in 2029.

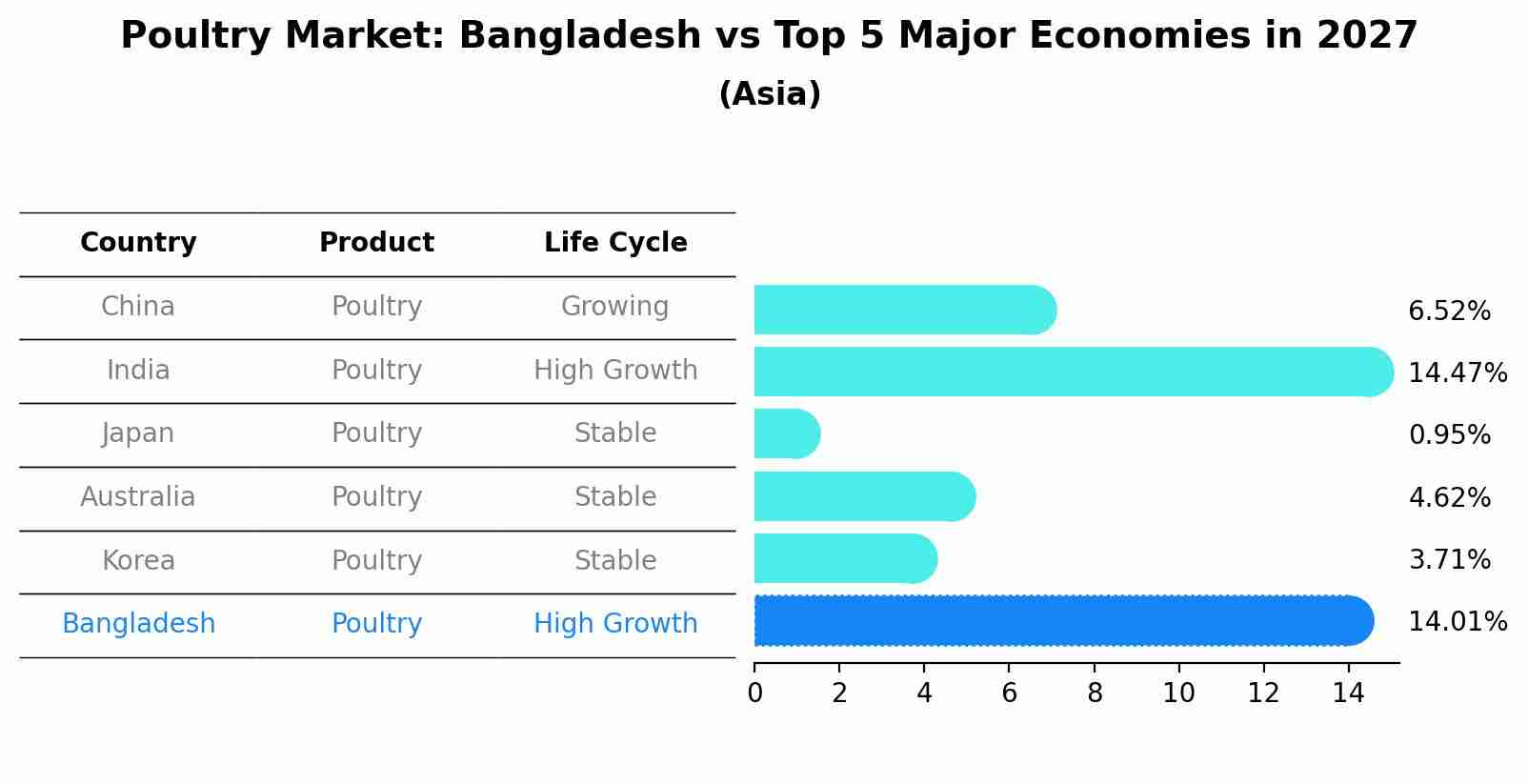

Poultry Market: Bangladesh vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Poultry market in Bangladesh is projected to expand at a high growth rate of 14.01% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Bangladesh Poultry Market Highlights

| Report Name | Bangladesh Poultry Market |

| Forecast period | 2025-2029 |

| CAGR | 16.51% |

| Growing Sector | Food |

Topics Covered in the Bangladesh Poultry Market Report

The Bangladesh Poultry Market report thoroughly covers the market by Segment, by End-Use and by Distribution channels. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Bangladesh Poultry Market Synopsis

Bangladesh Poultry Market is developing as the vital part of the food industry of country. This industry includes broiler chicken, eggs, and processed poultry products. Leading companies and modern farming practices are transforming the sector into a more organized and competitive market, supported by growing urban consumption and improvements in processing and distribution.

Bangladesh Poultry Market is expected to grow at the robust CAGR of 16.51% during the forecast period 2025-2029. Over the years, the consumption of poultry is rapidly increasing with the enormous population of 176 million in Bangladesh. There is high demand for affordable protein sources such as chicken and eggs. Rapid urbanization and changing food habits are increasing reliance on ready-to-cook and processed poultry products. The expansion of commercial farming, modern hatcheries, and feed mills has further strengthened supply capacity. Expansion of retail networks and e-commerce platforms are also making poultry products more accessible to the consumers nationwide.

On the contrary, the Bangladesh Poultry Industry deals with the numbers of the challenges such as high feed costs, which account for a major share of production expenses and directly impact the pricing. Other issue is the frequent disease outbreaks, combined with insufficient biosecurity measures, pose risks to both farmers and consumers. There is limited cold chain infrastructure hinders the efficient storage and distribution, especially in rural areas. Further, small-scale farmers struggle with access to finance and modern technology, slowing the pace of sector-wide modernization.

Bangladesh Poultry Market Trends

Bangladesh Poultry Market is expanding dynamically in the recent years as the trends are emerging strongly. Major trends include the growing demand for affordable protein sources. Broiler chicken dominates consumption, while layer farming supports egg production for both domestic and industrial use. Apart from this, processed poultry products like nuggets and frozen chicken are gaining popularity in urban centres. Further, modern retail and e-commerce is reshaping consumer access to poultry products.

Investment Opportunities in the Bangladesh Poultry Market

In Bangladesh Poultry Market, there are numbers of the investment opportunities in modern hatcheries, feed mills, and integrated poultry farming systems. Growth has noticed in value-added products such as processed meat, frozen items, and ready-to-eat meals which offers profitable prospects. Apart from this, developments in cold chain and storage facilities are critical areas for long-term investment. Export potential, particularly in halal-certified poultry, also creates a promising avenue for investors.

Leading Players of the Bangladesh Poultry Market

Major companies are playing as vital role in the Bangladesh Poultry Market which include Kazi Farms Group is one of the largest players who is known for its integrated operations from feed to processed poultry products. Aftab Bahumukhi Farms Ltd. specializes in large-scale poultry and livestock farming with strong market penetration. Paragon Group is recognized for innovation in poultry farming and value-added products. And, CP Bangladesh is a subsidiary of Charoen Pokphand who brings global expertise to the country’s poultry industry.

Government Regulations Introduced in the Bangladesh Poultry Market

According to Bangladeshi Government Data, the Bangladesh Poultry Market is regulated by the regulatory bodies of country which aim to ensure the quality. Bangladesh Livestock Development Policy 2007, which promotes modernization and disease control. The Bangladesh Food Safety Act 2013 ensures hygiene and quality in poultry production and processing. Standards are also enforced by the Department of Livestock Services (DLS) to monitor farm practices and vaccination. In addition, the BSTI regulations mandate proper labelling and packaging for consumer protection.

Future Insights of the Bangladesh Poultry Market

In the upcoming years, the trajectory of Bangladesh Poultry Market Growth is expected to be remain upward with massive demand of poultry as country has huge population. Due to rising adoption of modern farming techniques and biosecurity measures, the market will strengthen efficiency and disease prevention. Expansion of processed and frozen poultry products will reshape the urban retail landscape. With all these factors & trends, the industry is set to become more organized, with greater export readiness and higher-value offerings.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Broilers to Dominate the Market – By Segments

According to Vasu, Senior Research Analyst, 6Wresearch, broilers are expected to dominate the market as they serve as the primary source of affordable protein for most households. Eggs also remain a vital segment, widely consumed for their nutritional value and used in both household meals and food service industries.

Households to Dominate the Market – By End Uses

Households are projected to capture the largest Bangladesh Poultry Market Share, driven by everyday demand for chicken and eggs in family diets. Food service sector, including restaurants, hotels, and catering (HoReCa), also contributes significantly to demand, especially for bulk purchases.

Traditional Retail Stores to Dominate the Market – By Distribution Channels

Traditional retail stores continue to dominate poultry distribution, as fresh chicken and eggs are mostly purchased through local markets and butchers. Business-to-business (B2B) sales remain strong, especially for restaurants, hotels, and catering services requiring bulk supply. Modern retail stores are gaining momentum in urban centres.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Bangladesh Poultry Market Outlook

- Market Size of Bangladesh Poultry Market, 2024

- Forecast of Bangladesh Poultry Market, 2029

- Historical Data and Forecast of Bangladesh Poultry Revenues & Volume for the Period 2019-2029

- Bangladesh Poultry Market Trend Evolution

- Bangladesh Poultry Market Drivers and Challenges

- Bangladesh Poultry Price Trends

- Bangladesh Poultry Porter's Five Forces

- Bangladesh Poultry Industry Life Cycle

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Segments for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Broiler for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Eggs for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By End Uses for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Food Service for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Household for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Distribution Channels for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Traditional Retail Stores for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Business To Business for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Poultry Market Revenues & Volume By Modern Retail Stores for the Period 2019-2029

- Bangladesh Poultry Import Export Trade Statistics

- Market Opportunity Assessment By Segments

- Market Opportunity Assessment By End Uses

- Market Opportunity Assessment By Distribution Channels

- Bangladesh Poultry Top Companies Market Share

- Bangladesh Poultry Competitive Benchmarking By Technical and Operational Parameters

- Bangladesh Poultry Company Profiles

- Bangladesh Poultry Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Segments

- Broiler

- Eggs

By End Users

- Food Service

- Household

By Distribution Channels

- Traditional Retail Stores

- Business to Business

- Modern Retail Stores

Bangladesh Poultry Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Bangladesh Poultry Market Overview |

| 3.1 Bangladesh Country Macro Economic Indicators |

| 3.2 Bangladesh Poultry Market Revenues & Volume, 2019 & 2029F |

| 3.3 Bangladesh Poultry Market - Industry Life Cycle |

| 3.4 Bangladesh Poultry Market - Porter's Five Forces |

| 3.5 Bangladesh Poultry Market Revenues & Volume Share, By Segments, 2019 & 2029F |

| 3.6 Bangladesh Poultry Market Revenues & Volume Share, By End Uses, 2019 & 2029F |

| 3.7 Bangladesh Poultry Market Revenues & Volume Share, By Distribution Channels, 2019 & 2029F |

| 4 Bangladesh Poultry Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing population and urbanization leading to higher demand for poultry products in Bangladesh |

| 4.2.2 Growing awareness about the health benefits of poultry consumption |

| 4.2.3 Government support through policies and initiatives to boost the poultry industry |

| 4.3 Market Restraints |

| 4.3.1 Disease outbreaks affecting poultry production and supply chain |

| 4.3.2 Fluctuating feed prices impacting production costs |

| 4.3.3 Competition from imported poultry products affecting local market growth |

| 5 Bangladesh Poultry Market Trends |

| 6 Bangladesh Poultry Market Segmentations |

| 6.1 Bangladesh Poultry Market, By Segments |

| 6.1.1 Overview and Analysis |

| 6.1.2 Bangladesh Poultry Market Revenues & Volume, By Broiler, 2019 - 2029F |

| 6.1.3 Bangladesh Poultry Market Revenues & Volume, By Eggs, 2019 - 2029F |

| 6.2 Bangladesh Poultry Market, By End Uses |

| 6.2.1 Overview and Analysis |

| 6.2.2 Bangladesh Poultry Market Revenues & Volume, By Food Service, 2019 - 2029F |

| 6.2.3 Bangladesh Poultry Market Revenues & Volume, By Household, 2019 - 2029F |

| 6.3 Bangladesh Poultry Market, By Distribution Channels |

| 6.3.1 Overview and Analysis |

| 6.3.2 Bangladesh Poultry Market Revenues & Volume, By Traditional Retail Stores, 2019 - 2029F |

| 6.3.3 Bangladesh Poultry Market Revenues & Volume, By Business To Business, 2019 - 2029F |

| 6.3.4 Bangladesh Poultry Market Revenues & Volume, By Modern Retail Stores, 2019 - 2029F |

| 7 Bangladesh Poultry Market Import-Export Trade Statistics |

| 7.1 Bangladesh Poultry Market Export to Major Countries |

| 7.2 Bangladesh Poultry Market Imports from Major Countries |

| 8 Bangladesh Poultry Market Key Performance Indicators |

| 8.1 Average selling price of poultry products in the market |

| 8.2 Percentage of households consuming poultry products |

| 8.3 Number of poultry farms adopting modern technology for production |

| 8.4 Employment generation within the poultry industry |

| 8.5 Percentage of local sourcing of poultry products in the market |

| 9 Bangladesh Poultry Market - Opportunity Assessment |

| 9.1 Bangladesh Poultry Market Opportunity Assessment, By Segments, 2019 & 2029F |

| 9.2 Bangladesh Poultry Market Opportunity Assessment, By End Uses, 2019 & 2029F |

| 9.3 Bangladesh Poultry Market Opportunity Assessment, By Distribution Channels, 2019 & 2029F |

| 10 Bangladesh Poultry Market - Competitive Landscape |

| 10.1 Bangladesh Poultry Market Revenue Share, By Companies, 2024 |

| 10.2 Bangladesh Poultry Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero