India Flour Market (2025-2031) | Outlook, Revenue, Size, Share, Growth, Trends, Industry, Companies, Value, Analysis & Forecast

| Product Code: ETC039965 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

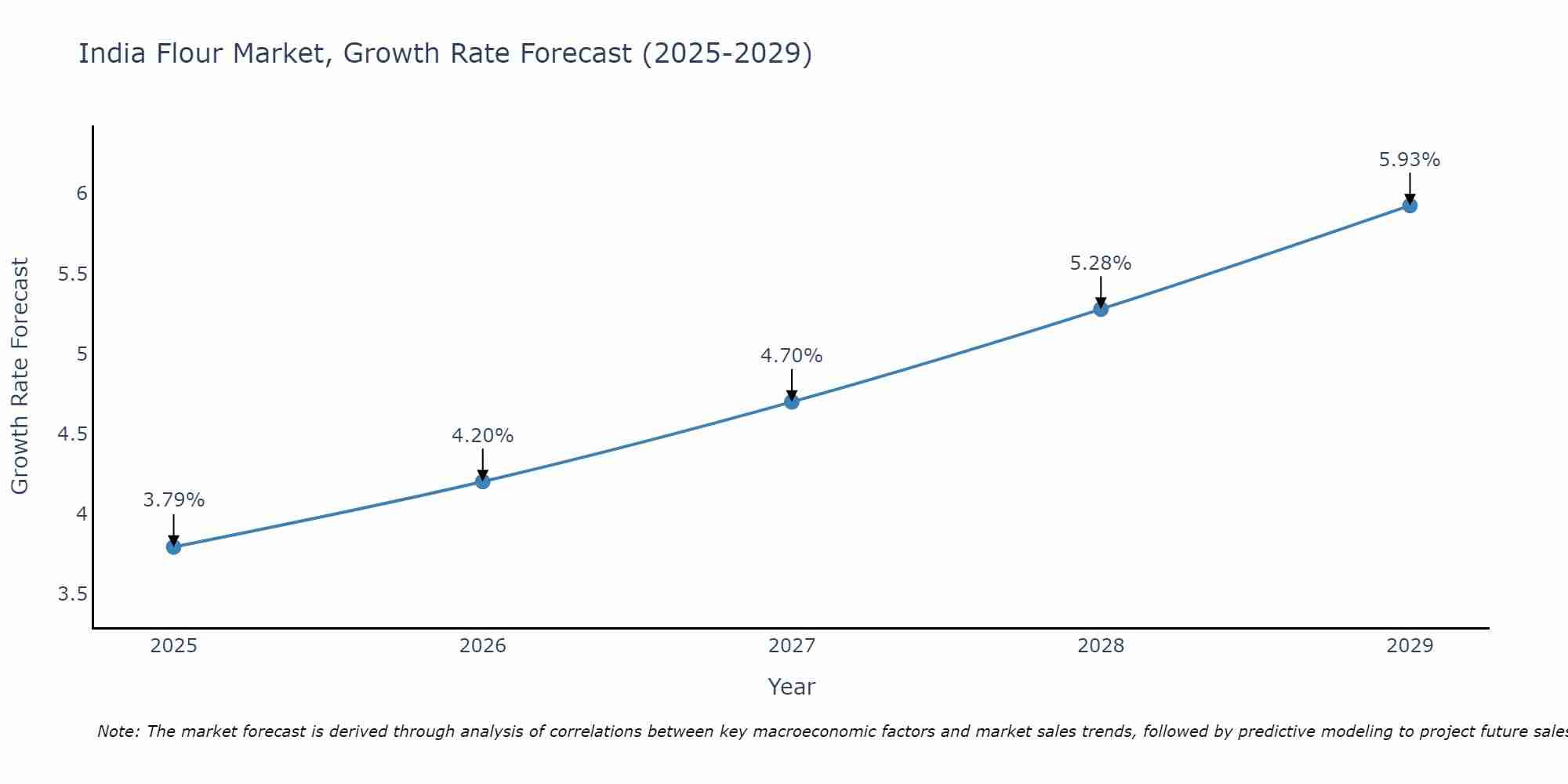

India Flour Market Size Growth Rate

The India Flour Market is poised for steady growth rate improvements from 2025 to 2029. From 3.79% in 2025, the growth rate steadily ascends to 5.93% in 2029.

India Flour Market Synopsis

India is the world`s second-largest producer of wheat and rice, which are key ingredients in flour production. As a result, the Indian flour market has been growing steadily over the past few years. The demand for wheat and other flours has significantly increased due to rising population growth and changing dietary habits of consumers. Furthermore, increasing health awareness among consumers, along with government initiatives such as National Food Security Mission (NFSM) that promotes food grain production in India are expected to drive demand for flour during 2025-2031.

Drivers of the Market:

? Growing Population & Rising Disposable Income ? With an estimated population of 1.3 billion people, India is one of the most populous countries in the world. This large population base provides ample opportunity for growth in various sectors including food products like flour. Additionally, increasing disposable incomes have resulted in higher spending on essential commodities like grains and cereals across all socio economic classes in India asserting further pressure on flour demand.

? Government Initiatives ? Many government schemes such as Pradhan Mantri Ann Yojana (PMAY) initiated by Ministry Of Consumer Affairs aim at providing low cost housing solutions to rural families leading to improved availability of essential commodities like wheat or corn used for making flours at lower prices thus driving their consumption among those living under poverty line

Challenges of the Market:

? Low Availability Of Raw Materials - Wheat remains one of the major raw materials used extensively throughout India; however its availability may be affected due to varying climatic conditions resulting from global warming leading to reduced yields per acreage posing serious challenges on supply chain management within this sector

Trends of the Market:

Innovation In Packaging & Processing Techniques - Continuous innovation related to packaging techniques is enabling manufacturers within this sector meet consumer preferences better than before while reducing costs associated with milling operations allowing them gain competitive edge through efficient storage capacity

The COVID - 19 Impact on the Market:

The COVID 19 outbreak has had a severe impact on several industries around globe including Indian Flour Market owing it?s contribution towards bakery/confectionary industry being severely hit by restrictions imposed upon movement restriction due social distancing norms followed globally resulting into sharp decline in sales volume witnessed throughout first half year 2025 . However , recent relaxation regarding same coupled with government initiative towards supporting small businesses enabled revival experienced during later quarters although still far behind pre covid levels.

Key Highlights of the Report:

- India Flour Market Outlook

- Market Size of India Flour Market, 2024

- Forecast of India Flour Market, 2031

- Historical Data and Forecast of India Flour Revenues & Volume for the Period 2021-2031

- India Flour Market Trend Evolution

- India Flour Market Drivers and Challenges

- India Flour Price Trends

- India Flour Porter's Five Forces

- India Flour Industry Life Cycle

- Historical Data and Forecast of India Flour Market Revenues & Volume By Raw Material for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Wheat for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Rice for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Maize for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Noodles & Pasta for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Animal Feed for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Non-Food Application for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Technology for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Dry Technology for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Wet Technology for the Period 2021-2031

- India Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- India Flour Top Companies Market Share

- India Flour Competitive Benchmarking By Technical and Operational Parameters

- India Flour Company Profiles

- India Flour Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Flour Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Flour Market Revenues & Volume, 2021 & 2031F |

3.3 India Flour Market - Industry Life Cycle |

3.4 India Flour Market - Porter's Five Forces |

3.5 India Flour Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

3.6 India Flour Market Revenues & Volume Share, By Applications, 2021 & 2031F |

3.7 India Flour Market Revenues & Volume Share, By Technology, 2021 & 2031F |

4 India Flour Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 India Flour Market Trends |

6 India Flour Market, By Types |

6.1 India Flour Market, By Raw Material |

6.1.1 Overview and Analysis |

6.1.2 India Flour Market Revenues & Volume, By Raw Material, 2021-2031F |

6.1.3 India Flour Market Revenues & Volume, By Wheat, 2021-2031F |

6.1.4 India Flour Market Revenues & Volume, By Rice, 2021-2031F |

6.1.5 India Flour Market Revenues & Volume, By Maize, 2021-2031F |

6.1.6 India Flour Market Revenues & Volume, By Others, 2021-2031F |

6.2 India Flour Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 India Flour Market Revenues & Volume, By Bread & Bakery Products, 2021-2031F |

6.2.3 India Flour Market Revenues & Volume, By Noodles & Pasta, 2021-2031F |

6.2.4 India Flour Market Revenues & Volume, By Animal Feed, 2021-2031F |

6.2.5 India Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2021-2031F |

6.2.6 India Flour Market Revenues & Volume, By Non-Food Application, 2021-2031F |

6.2.7 India Flour Market Revenues & Volume, By Others, 2021-2031F |

6.3 India Flour Market, By Technology |

6.3.1 Overview and Analysis |

6.3.2 India Flour Market Revenues & Volume, By Dry Technology, 2021-2031F |

6.3.3 India Flour Market Revenues & Volume, By Wet Technology, 2021-2031F |

7 India Flour Market Import-Export Trade Statistics |

7.1 India Flour Market Export to Major Countries |

7.2 India Flour Market Imports from Major Countries |

8 India Flour Market Key Performance Indicators |

9 India Flour Market - Opportunity Assessment |

9.1 India Flour Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

9.2 India Flour Market Opportunity Assessment, By Applications, 2021 & 2031F |

9.3 India Flour Market Opportunity Assessment, By Technology, 2021 & 2031F |

10 India Flour Market - Competitive Landscape |

10.1 India Flour Market Revenue Share, By Companies, 2024 |

10.2 India Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero