GCC Video Surveillance Storage Market (2017-2023) | Growth, Forecast, Revenue, Share, Trends, Companies, Analysis, Outlook, Size, Industry & Value

Market Forecast by Product Device (SAN, DAS, and NAS), Deployment (Cloud, Hybrid and On-Premise), Verticals (Government & Transportation, Retails, Enterprise & Data Centers, Residential, Healthcare & Hospitality, BFSI, and Others), Countries (Saudi Arabia, Bahrain, Oman, UAE, Qatar, and Kuwait) and Competitive Landscape

| Product Code: ETC000386 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 230 | No. of Figures: 130 | No. of Tables: 34 |

GCC Video Surveillance Storage Market is anticipated to register sound revenues on account of rising penetration towards safety and security. Installation of IP based video surveillance systems, increasing FDI inflow in the region as well as an improved implementation of government norms for mandatory installation of video surveillance systems with regulations for the retention of the footage for a time period in almost all the GCC countries are some of the factors contributing significantly to the growth of video surveillance storage market in this region.

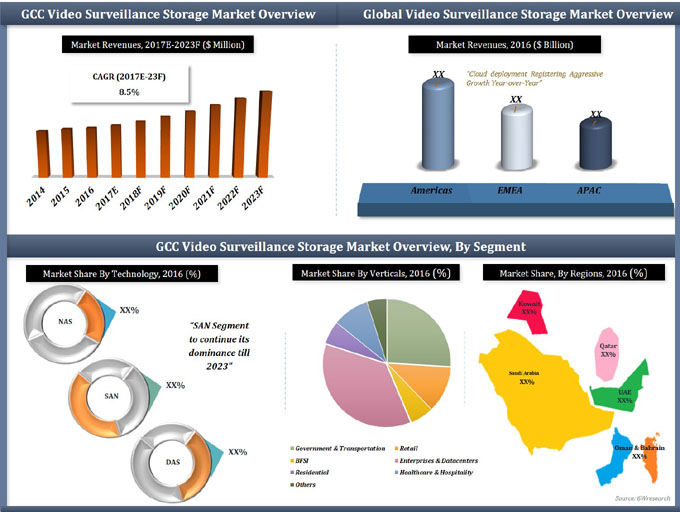

According to 6Wresearch, GCC video surveillance storage market size is projected to grow at a CAGR of 8.5% during 2017-23. Countries such as Saudi Arabia and Kuwait have experienced a setback in GCC video surveillance storage market share in the last two years due to a decline in oil prices. However, the market is expected to recover from 2017 onwards. Expansion and construction of new hotels, shopping malls, and public infrastructure across GCC countries would spur the GCC video surveillance storage market forecast revenues.

Storage Area Network (SAN) is expected to demonstrate the maximum CAGR in the GCC region over the next six years due to several key factors such as increasing demand for data centers, flexibility than other technologies, better speed, options available for cloud computing along with efficient data management solutions.

The GCC video surveillance storage market report thoroughly covers the market by product device, deployment, verticals, and countries. The GCC video surveillance storage market outlook report provides an unbiased and detailed analysis of the GCC video surveillance storage market trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

In the upcoming days, the GCC regions going to boost the growth of GCC video surveillance storage market revenues. There is some key to the GCC video surveillance storage market such as BCD video, pivot3, Fujitsu, and many more. The market report of the GCC video surveillance includes all the major factors in the report technology, verticals, countries, and deployment, and all provide a detailed analysis of the GCC market outlook.

The GCC video surveillance storage market is anticipated to witness potential growth in the coming years owing to the rising number of data centers in developed countries across the region. Video surveillance is a very common technology and has wide adoption in public transport and public areas backed by rising concerns for security purposes. With smarter transport facilities, there is a need for a smart video surveillance system also which intends a complete integrated storage solution to ensure proper shell over the safety and security of data along with increasing compliance needs for the solution. According to 6wresearch, the GCC video surveillance storage market is anticipated to garner a CAGR of 6.6% throughout the forecast period 2020-26F. Also, advancements in various factors of the video surveillance storage market such as technical flexibility, efficient storage capacity, and better speed would assist potential growth projections for the GCC video surveillance market in the years to come. Moreover, the GCC countries being a tourism hub is expected to witness a spur in the construction of hotels, malls, and complexes which would, further, initiate healthy demand projections for the video surveillance systems and simultaneously, instigate exponential growth for video surveillance storage systems across the region in the upcoming six years.

Key Highlights of the Report:

• GCC Video Surveillance Storage Market Overview

• GCC Video Surveillance Storage Market Outlook

• Historical data of Global Video Surveillance Storage Market Revenues for the Period 2014-2016

• Historical data of GCC Video Surveillance Storage Market Revenues for the Period 2014-2016

• GCC Video Surveillance Storage Market Size & GCC Video Surveillance Storage Market Forecast, until 2023

• Historical data of Saudi Arabia Video Surveillance Storage Market for the Period 2014-2016

• Market Size & Forecast of Saudi Arabia Video Surveillance Storage Revenue Market until 2023

• Historical data of UAE Video Surveillance Storage Market for the Period 2014-2016

• Market Size & Forecast of UAE Video Surveillance Storage Revenue Market until 2023

• Historical data of Qatar Video Surveillance Storage Market for the Period 2014-2016

• Market Size & Forecast of Qatar Video Surveillance Storage Revenue Market until 2023

• Historical data of Kuwait Video Surveillance Storage Market for the Period 2014-2016

• Market Size & Forecast of Kuwait Video Surveillance Storage Revenue Market until 2023

• Historical data of Bahrain & Oman Video Surveillance Storage Market for the Period 2014-2016

• Market Size & Forecast of Bahrain & Oman Video Surveillance Storage Revenue Market until 2023

• Historical data and Forecast of Saudi Arabia Video Surveillance Storage Market, By Product

Device, Deployment, Verticals, and Regions

• Historical data and Forecast of UAE Video Surveillance Storage Market, By Product Device,

Deployment, Verticals, and Regions

• Historical data and Forecast of Qatar Video Surveillance Storage Market, By Product Device,

Deployment, Verticals, and Regions

• Historical data and Forecast of Kuwait Video Surveillance Storage Market, By Product Device,

Deployment, Verticals, and Regions

• Historical data and Forecast of Bahrain & Oman Video Surveillance Storage Market, By Product

Device, Deployment, Verticals, and Regions

• GCC Video Surveillance Storage Market Drivers and Restraints

• GCC Video Surveillance Storage Market Price Analysis

• GCC Video Surveillance Storage Market Demand Analysis

• GCC Video Surveillance Storage Market Trends and Developments

• GCC Video Surveillance Storage Market Share, by Players

• GCC Video Surveillance Storage Market Overview on Competitive Landscape

• Company Profiles

• Key Strategic Pointers

Markets Covered

The GCC video surveillance storage market report provides a detailed analysis of the following market segments:

• Product Device

o SAN

o DAS

o NAS

• By Deployment

o Cloud

o Hybrid

o On-Premise

• By Verticals

o Government & Transportation

o Retail

o Enterprise & Data Centers

o Residential

o Healthcare & Hospitality

o BFSI

o Others

• By Countries

o Saudi Arabia

o UAE

o Qatar

o Kuwait

o Bahrain

o Oman

Other Key Available Reports Include:

• Saudi Arabia Video Surveillance Storage Market Report

• UAE Video Surveillance Storage Market Report

• Qatar Video Surveillance Storage Market Report

• Oman Video Surveillance Storage Market Report

• Bahrain Video Surveillance Storage Market Report

• Kuwait Video Surveillance Storage Market Report

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumption

3 Global Video Surveillance Storage Market Overview

3.1 Global Video Surveillance Storage Market Revenues (2014-2023F)

3.2 Global Video Surveillance Storage Market Revenues, By Regions (2016)

4 GCC Video Surveillance Storage Market Overview

4.1 GCC Video Surveillance Storage Market Revenues (2014-2023F)

4.2 GCC Video Surveillance Storage Market, Industry Life Cycle

4.3 GCC Video Surveillance Storage Market, Porter's Five Forces

4.4 GCC Video Surveillance Storage Market Revenue Share, By Product Device (2016 & 2023F)

4.5 GCC Video Surveillance Storage Market Revenue Share, By Deployment (2016 & 2023F)

4.6 GCC Video Surveillance Storage Market Revenue Share, By Verticals (2016 & 2023F)

4.7 GCC Video Surveillance Storage Market Revenue Share, By Countries (2016 & 2023F)

5 GCC Video Surveillance Storage Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.2.1 Adoption of IP Surveillance Systems

5.2.2 Government Regulations

5.5.3 Growing Safety & Security Threats

5.3 Market Restraints

5.3.1 Lack of Awareness

6 GCC Video Surveillance Storage Market Trends & Opportunities

6.1 Solid State Drives

6.2 VSaaS

6.3 Hybrid Storage

6.4 Smart City Project

7 Saudi Arabia Video Surveillance Storage Market Overview

7.1 Saudi Arabia Video Surveillance Storage Market, Opportunity Matrix (2023F)

7.2 Saudi Arabia Video Surveillance Storage Market Revenues (2014-2023F)

7.3 Saudi Arabia Video Surveillance Storage Market Overview, By Product Device

7.3.1 Saudi Arabia SAN Video Surveillance Storage Market Revenues (2014-2023F)

7.3.2 Saudi Arabia DAS Video Surveillance Storage Market Revenues (2014-2023F)

7.3.3 Saudi Arabia NAS Video Surveillance Storage Market Revenues (2014-2023F)

7.4 Saudi Arabia Video Surveillance Storage Market Overview, By Deployment

7.4.1 Saudi Arabia On-Cloud Video Surveillance Storage Market Revenues (2014-2023F)

7.4.2 Saudi Arabia On-Premise Video Surveillance Storage Market Revenues (2014-2023F)

7.4.3 Saudi Arabia Hybrid Video Surveillance Storage Market Revenues (2014-2023F)

7.5 Saudi Arabia Video Surveillance Storage Market Overview, By Verticals

7.5.1 Government &Transportation Market Revenues (2014-2023F)

7.5.2 Retail Market Revenues (2014-2023F)

7.5.3 Commercial Offices & Buildings Market Revenues (2014-2023F)

7.5.4 Residential Market Revenues (2014-2023F)

7.5.5 Healthcare & Hospitality Market Revenues (2014-2023F)

7.5.6 BFSI Market Revenues (2014-2023F)

7.5.6 Other Market Revenues (2014-2023F)

7.6 Saudi Arabia Video Surveillance Storage Market Overview, By Regions

8 UAE Video Surveillance Storage Market Overview

8.1 UAE Video Surveillance Storage Market, Opportunity Matrix (2023F)

8.2 UAE Video Surveillance Storage Market Revenues (2014-2023F)

8.3 UAE Video Surveillance Storage Market Overview, By Product Device

8.3.1 UAE SAN Video Surveillance Storage Market Revenues (2014-2023F)

8.3.2 UAE DAS Video Surveillance Storage Market Revenues (2014-2023F)

8.3.3 UAE NAS Video Surveillance Storage Market Revenues (2014-2023F)

8.4 UAE Video Surveillance Storage Market Overview, By Deployment

8.4.1 UAE On-Cloud Video Surveillance Storage Market Revenues (2014-2023F)

8.4.2 UAE On-Premise Video Surveillance Storage Market Revenues (2014-2023F)

8.4.3 UAE Hybrid Video Surveillance Storage Market Revenues (2014-2023F)

8.5 UAE Video Surveillance Storage Market Overview, By Verticals

8.5.1 Government &Transportation Market Revenues (2014-2023F)

8.5.2 Retail Market Revenues (2014-2023F)

8.5.3 Commercial Offices & Buildings Market Revenues (2014-2023F)

8.5.4 Residential Market Revenues (2014-2023F)

8.5.5 Healthcare & Hospitality Market Revenues (2014-2023F)

8.5.6 BFSI Market Revenues (2014-2023F)

8.5.7 Others Market Revenues (2014-2023F)

8.6 UAE Video Surveillance Storage Market Overview, By Regions

9 Qatar Video Surveillance Storage Market Overview

9.1 Qatar Video Surveillance Storage Market, Opportunity Matrix (2023F)

9.2 Qatar Video Surveillance Storage Market Revenues (2014-2023F)

9.3 Qatar Video Surveillance Storage Market Overview, By Product Device

9.3.1 Qatar SAN Video Surveillance Storage Market Revenues (2014-2023F)

9.3.2 Qatar DAS Video Surveillance Storage Market Revenues (2014-2023F)

9.3.3 Qatar NAS Video Surveillance Storage Market Revenues (2014-2023F)

9.4 Qatar Video Surveillance Storage Market Overview, By Deployment

9.4.1 Qatar On-Cloud Video Surveillance Storage Market Revenues (2014-2023F)

9.4.2 Qatar On-Premise Video Surveillance Storage Market Revenues (2014-2023F)

9.4.3 Qatar Hybrid Video Surveillance Storage Market Revenues (2014-2023F)

9.5 Qatar Video Surveillance Storage Market Overview, By Verticals

9.5.1 Government &Transportation Market Revenues (2014-2023F)

9.5.2 Retail Market Revenues (2014-2023F)

9.5.3 Commercial Offices & Buildings Market Revenues (2014-2023F)

9.5.4 Residential Market Revenues (2014-2023F)

9.5.5 Healthcare & Hospitality Market Revenues (2014-2023F)

9.5.6 BFSI Market Revenues (2014-2023F)

9.5.7 Others Market Revenues (2014-2023F)

9.6 Qatar Video Surveillance Storage Market Overview, By Regions

10 Kuwait Video Surveillance Storage Market Overview

10.1 Kuwait Video Surveillance Storage Market, Opportunity Matrix (2023F)

10.2 Kuwait Video Surveillance Storage Market Revenues (2014-2023F)

10.3 Kuwait Video Surveillance Storage Market Overview, By Product Device

10.3.1 Kuwait SAN Video Surveillance Storage Market Revenues (2014-2023F)

10.3.2 Kuwait DAS Video Surveillance Storage Market Revenues (2014-2023F)

10.3.3 Kuwait NAS Video Surveillance Storage Market Revenues (2014-2023F)

10.4 Kuwait Video Surveillance Storage Market Overview, By Deployment

10.4.1 Kuwait On-Cloud Video Surveillance Storage Market Revenues (2014-2023F)

10.4.2 Kuwait On-Premise Video Surveillance Storage Market Revenues (2014-2023F)

10.4.3 Kuwait Hybrid Video Surveillance Storage Market Revenues (2014-2023F)

10.5 Kuwait Video Surveillance Storage Market Overview, By Verticals

10.5.1 Government &Transportation Market Revenues (2014-2023F)

10.5.2 Retail Market Revenues (2014-2023F)

10.5.3 Commercial Offices & Buildings Market Revenues (2014-2023F)

10.5.4 Residential Market Revenues (2014-2023F)

10.5.5 Healthcare & Hospitality Market Revenues (2014-2023F)

10.5.6 BFSI Market Revenues (2014-2023F)

10.5.7 Others Market Revenues (2014-2023F)

10.6 Kuwait Video Surveillance Storage Market Overview, By Regions

11 Bahrain & Oman Video Surveillance Storage Market Overview

11.1 Bahrain & Oman Video Surveillance Storage Market, Opportunity Matrix (2023F)

11.2 Bahrain & Oman Video Surveillance Storage Market Revenues (2014-2023F)

11.3 Bahrain & Oman Video Surveillance Storage Market Overview, By Product Device

11.3.1 Bahrain & Oman SAN Video Surveillance Storage Market Revenues (2014-2023F)

11.3.2 Bahrain & Oman DAS Video Surveillance Storage Market Revenues (2014-2023F)

11.3.3 Bahrain & Oman NAS Video Surveillance Storage Market Revenues (2014-2023F)

11.4 Bahrain & Oman Video Surveillance Storage Market Overview, By Deployment

11.4.1 Bahrain & Oman On-Cloud Video Surveillance Storage Market Revenues (2014-2023F)

11.4.2 Bahrain & Oman On-Premise Video Surveillance Storage Market Revenues (2014-2023F)

11.4.3 Bahrain & Oman Hybrid Video Surveillance Storage Market Revenues (2014-2023F)

11.5 Bahrain & Oman Video Surveillance Storage Market Overview, By Verticals

11.5.1 Government &Transportation Market Revenues (2014-2023F)

11.5.2 Retail Market Revenues (2014-2023F)

11.5.3 Commercial Offices & Buildings Market Revenues (2014-2023F)

11.5.4 Residential Market Revenues (2014-2023F)

11.5.5 Healthcare & Hospitality Market Revenues (2014-2023F)

11.5.6 BFSI Market Revenues (2014-2023F)

11.5.7 Others Market Revenues (2014-2023F)

12 Competitive Landscape

12.1 Players' Market Revenue Share (2016)

12.2 Competitive Benchmarking, By Technology

13 Company Profiles

13.1 Hanwha Techwin Middle-East FZE

13.2 Cisco System Inc.

13.3 Seagate Technology

13.4 Pelco Inc.

13.5 Avigilon Corporation

13.6 Dell EMC

13.7 Honeywell Security

14 Key Strategy Pointers

15 Disclaimer

List of Figures

Figure 1 Global Video Surveillance Storage Market Revenues, 2014-2023F ($ Billion)

Figure 2 Evolution of Video Surveillance Storage Systems

Figure 3 Global Video Surveillance Storage Market Revenues, By Regions (2016)

Figure 4 GCC Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 5 Crude Oil Prices, Average Spot, 2014-2023F ($/Barrel)

Figure 6 GCC Video Surveillance Investment, 2014-2017E

Figure 7 GCC Video Surveillance Storage Market Revenue Share, By Product Device (2016 & 2023F)

Figure 8 GCC Video Surveillance Storage Market Revenue Share, By Deployment (2016 & 2023F)

Figure 9 GCC Video Surveillance Storage Market Revenue Share, By Verticals (2016 & 2023F)

Figure 10 GCC Video Surveillance Storage Market Revenue Share, By Countries (2016 & 2023F)

Figure 11 GCC IP Video Surveillance Market Revenues, 2014-2023F ($ Million)

Figure 12 Crime Rate of Dubai, 2016

Figure 13 Crime Index of GCC Countries, 2014-2017E

Figure 14 Saudi Arabia Video Surveillance Storage Market Opportunity Matrix, By Verticals (2023F)

Figure 15 Saudi Arabia Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 16 Saudi Arabia GDP Percentage Change, 2014-2021F

Figure 17 Saudi Arabia FDI Inflow, 2012-2015 ($ Billion)

Figure 18 Saudi Arabia SAN Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 19 Saudi Arabia DAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 20 Saudi Arabia NAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 21 Saudi Arabia Cloud Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 22 Saudi Arabia On-Premise Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 23 Saudi Arabia Hybrid Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 24 Saudi Arabia Video Surveillance Storage Market, by Verticals (2016)

Figure 25 Saudi Arabia Government & Transportation Video Surveillance Storage Market Revenues,

2014-2023F ($ Million)

Figure 26 Saudi Arabia Retail Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 27 Saudi Arabia Retail Units, 2014-2018F (Million Square Meter)

Figure 28 Saudi Arabia Commercial Offices & Buildings Video Surveillance Storage Market Revenues,

2014-2023F ($ Million)

Figure 29 Saudi Arabia Commercial Office Units, 2014-2018F (Million Square Meter)

Figure 30 Saudi Arabia Residential Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 31 Saudi Arabia Residential Units, 2014-2018F (Million Square Meter)

Figure 32 Saudi Arabia Healthcare & Hospitality Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 33 Saudi Arabia Number of Hotel Rooms, 2014-2018F (Thousand Key)

Figure 34 Saudi Arabia BFSI Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 35 Saudi Arabia Bank Branches, 2011-2015

Figure 36 Saudi Arabia Other Verticals Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 37 Saudi Arabia Central Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 38 Saudi Arabia Southern Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 39 Saudi Arabia Western Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 40 Saudi Arabia Eastern Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 41 UAE Video Surveillance Storage Market Opportunity Matrix, By Verticals (2023F)

Figure 42 UAE Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 43 UAE GDP Percentage Change, 2014-2021F

Figure 44 UAE Crude Oil Average, 2012-2017E ($/Barrel)

Figure 45 UAE SAN Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 46 UAE DAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 47 UAE NAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 48 UAE Cloud Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 49 UAE On-Premise Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 50 UAE Hybrid Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 51 UAE Video Surveillance Storage Market, By Verticals (2016)

Figure 52 UAE Government & Transportation Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 53 UAE Retail Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 54 UAE Retail Units, 2014-2018F (Million sq. m.)

Figure 55 UAE Commercial Offices & Buildings Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 56 UAE Commercial Units, 2014-2018F (Million sq. m.)

Figure 57 UAE Residential Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 58 UAE Residential Units, 2014-2018F (Thousand Units)

Figure 59 UAE Healthcare & Hospitality Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 60 UAE Number of Hotel Rooms, 2014-2018F (Thousand Keys)

Figure 61 UAE BFSI Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 62 Number of Banks in UAE, 2013-16

Figure 63 UAE Other Verticals Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 64 UAE Northern Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 65 UAE Southern Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 66 Qatar Video Surveillance Storage Market Opportunity Matrix, By Verticals (2023F)

Figure 67 Qatar Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 68 Qatar GDP Percentage Change, 2014-2021F

Figure 69 Crime Rate in Doha, 2016

Figure 70 Qatar SAN Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 71 Qatar DAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 72 Qatar NAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 73 Qatar Cloud Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 74 Qatar On-Premises Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 75 Qatar Hybrid Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 76 Qatar Video Surveillance Storage Market, by Verticals (2016)

Figure 77 Qatar Government & Transportation Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 78 Qatar Retail Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 79 Qatar Commercial Offices & Buildings Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 80 Qatar Residential Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 81 Qatar Healthcare & Hospitality Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 82 Qatar BFSI Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 83 Qatar Bank ATMs/ 100 Thousand People (2010-2015)

Figure 84 Qatar Bank Branches / 100 Thousand People (2010-2015)

Figure 85 Qatar Other Verticals Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 86 Qatar Northern Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 87 Qatar Southern Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 88 Kuwait Video Surveillance Storage Market Opportunity Matrix, By Verticals (2023F)

Figure 89 Kuwait Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 90 Kuwait GDP Percentage Change, 2014-2021F

Figure 91 Kuwait Construction Project Life Cycle, 2016

Figure 92 Kuwait SAN Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 93 Kuwait DAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 94 Kuwait NAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 95 Kuwait Cloud Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 96 Kuwait On-Premise Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 97 Kuwait Hybrid Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 98 Kuwait Video Surveillance Storage Market, By Verticals (2016)

Figure 99 Kuwait Government & Transportation Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 100 Kuwait Retail Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 101 Kuwait Commercial Offices & Buildings Video Surveillance Storage Market Revenues,

2014-2023F ($ Million)

Figure 102 Kuwait Residential Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 103 Kuwait Healthcare & Hospitality Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 104 Kuwait BFSI Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 105 Kuwait Bank ATMs/ 100 Thousand People (2010-2015)

Figure 106 Kuwait Bank Branches / 100 Thousand People (2010-2015)

Figure 107 Kuwait Other Verticals Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 108 Kuwait City Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 109 Kuwait Other Region Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 110 Bahrain & Oman Video Surveillance Storage Market Opportunity Matrix, By Verticals (2023)

Figure 111 Bahrain & Oman Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 112 Bahrain GDP Percentage Growth (2014-2021)

Figure 113 Oman GDP Percentage Growth (2014-2021)

Figure 114 Bahrain & Oman SAN Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 115 Bahrain & Oman DAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 116 Bahrain & Oman NAS Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 117 Bahrain & Oman Cloud Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 118 Bahrain & Oman On-Premise Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 119 Bahrain & Oman Hybrid Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 120 Bahrain & Oman Video Surveillance Storage Market, By Verticals (2016)

Figure 121 Bahrain & Oman Government & Transportation Video Surveillance Storage Market Revenues,

2014-2023F ($ Million)

Figure 122 Bahrain & Oman Retail Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 123 Bahrain & Oman Commercial Offices & Buildings Video Surveillance Storage Market Revenues,

2014-2023F ($ Million)

Figure 124 Bahrain & Oman Residential Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 125 Bahrain Population, 2012-2016 (In Million)

Figure 126 Oman Population, 2012-2016 (In Million)

Figure 127 Bahrain & Oman Healthcare & Hospitality Video Surveillance Storage Market Revenues,

2014-2023F ($ Million)

Figure 128 Bahrain & Oman BFSI Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 129 Bahrain & Oman Other Verticals Video Surveillance Storage Market Revenues, 2014-2023F ($ Million)

Figure 130 GCC Video Surveillance Storage Market Revenue Share (2016)

List of Tables

Table 1 GCC Construction & Transport Contracts, 2016

Table 2 Qatar Video Storage Retention Period

Table 3 Saudi Arabia Government & Transportation Projects

Table 4 Saudi Arabia Retail Building Projects

Table 5 Saudi Arabia Commercial Offices & Building Projects

Table 6 Saudi Arabia Residential Building Projects

Table 7 Saudi Arabia Upcoming Hotels

Table 8 Saudi Arabia Healthcare & Hospitality Building Projects

Table 9 UAE Government & Transportation Projects

Table 10 Dubai Under Construction Projects

Table 11 Upcoming Malls in UAE

Table 12 UAE Commercial Offices & Buildings Projects

Table 13 UAE Residential Building Projects

Table 14 UAE Upcoming Hotels

Table 15 UAE Upcoming Hotels & Hospitals

Table 16 UAE Healthcare & Hospitality Building Projects

Table 17 UAE Emirate Wise Crime Index (2016)

Table 18 Qatar World Cup 2022 Stadium Projects

Table 19 Qatar Government Projects

Table 20 Qatar Transportation Projects

Table 21 Qatar Commercial Offices & Buildings Projects

Table 22 Qatar Residential Building Projects

Table 23 Qatar Upcoming Hotels

Table 24 Qatar Healthcare & Hospitality Building Projects

Table 25 Kuwait Commercial Offices & Buildings Projects

Table 26 Kuwait Upcoming Hotels

Table 27 Kuwait Hospital Projects

Table 28 Bahrain Construction Projects

Table 29 Bahrain & Oman Airport Development Projects

Table 30 Bahrain & Oman Upcoming Malls

Table 31 Bahrain Residential Building Projects

Table 32 Oman Upcoming Hotels

Table 33 Bahrain Upcoming Hotels

Table 34 Competitive Benchmarking, By Solutions

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero