Indonesia Flour Market (2024-2030) | Analysis, Revenue, Companies, Outlook, Industry, Value, Trends, Forecast, Size, Share & Growth

| Product Code: ETC039969 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Indonesia Flour Market Size Growth Rate

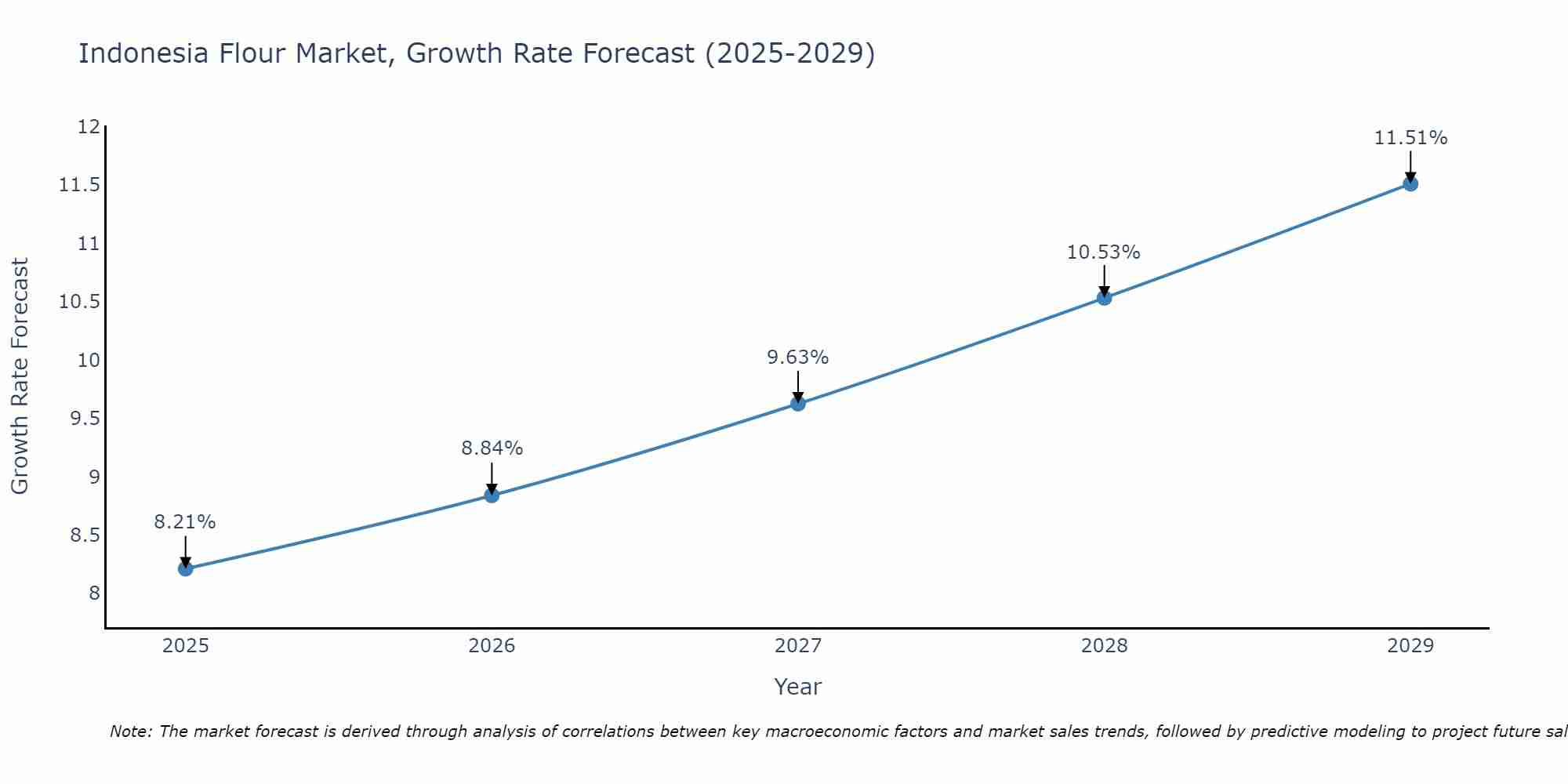

The Indonesia Flour Market is poised for steady growth rate improvements from 2025 to 2029. The growth rate starts at 8.21% in 2025 and reaches 11.51% by 2029.

Flour Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

The Flour market in Indonesia is projected to grow at a growing growth rate of 9.63% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Indonesia Flour Market Synopsis

The Indonesia flour market is estimated to witness a significant CAGR of 4.3% during theperiod 2020-2026. Indonesia populationand rising consumer demand for bakery products are factors driving the marketin this region. The rapid advancement in food processing technology has resulted in increasing penetration of automated machines which process flour from grains like wheat maize rice etc. and thus improving production volume and diversity thereby fueling the market demand for flour across various end-use industries such as bakeries confectionaries snacks manufacturers etc. Furthermore government initiatives like tax exemptions on raw materials used while manufacturing flour are further expected to drive its consumption over theperiod.

Key Factors Driving the Market

Rising investments towards automation technologies adopted by food processinghave enabled smooth operations along with ensuring higher volumes of production at lower costs which have led to enhanced efficiency within thecreating huge opportunities for flour producers over upcoming years.

Challenges Facing the Market

The unorganized sector selling low quality/ unhygienic flours poses a major challenge due to their availability at cheaper prices compared to organized ones affecting sales s generated by organized players operating within this region thus hampering overall marketrate upscaling. Increasing popularity amongst consumers regarding health benefits associated with soya-based products acts as major restraint towards adoption /consumption of traditional wheat or other cereals-based meals leading toward a shift towards healthier options posing a threat to the entire.

Key Market Players

Major players present within Indonesia Flour Market include Charoen Pokphand Group (CP Group) PT Panganmas Persada TbkAsia Maluku International Co Ltd (AMIL) PT CentralSawit Abadi among others.

Key Highlights of the Report:

- Indonesia Flour Market Outlook

- Market Size of Indonesia Flour Market, 2023

- Forecast of Indonesia Flour Market, 2030

- Historical Data and Forecast of Indonesia Flour Revenues & Volume for the Period 2020-2030

- Indonesia Flour Market Trend Evolution

- Indonesia Flour Market Drivers and Challenges

- Indonesia Flour Price Trends

- Indonesia Flour Porter's Five Forces

- Indonesia Flour Industry Life Cycle

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Raw Material for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Wheat for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Rice for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Maize for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Applications for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Noodles & Pasta for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Animal Feed for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Non-Food Application for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Technology for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Dry Technology for the Period 2020-2030

- Historical Data and Forecast of Indonesia Flour Market Revenues & Volume By Wet Technology for the Period 2020-2030

- Indonesia Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- Indonesia Flour Top Companies Market Share

- Indonesia Flour Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Flour Company Profiles

- Indonesia Flour Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Indonesia Flour Market Overview |

3.1 Indonesia Country Macro Economic Indicators |

3.2 Indonesia Flour Market Revenues & Volume, 2020 & 2030F |

3.3 Indonesia Flour Market - Industry Life Cycle |

3.4 Indonesia Flour Market - Porter's Five Forces |

3.5 Indonesia Flour Market Revenues & Volume Share, By Raw Material, 2020 & 2030F |

3.6 Indonesia Flour Market Revenues & Volume Share, By Applications, 2020 & 2030F |

3.7 Indonesia Flour Market Revenues & Volume Share, By Technology, 2020 & 2030F |

4 Indonesia Flour Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Indonesia Flour Market Trends |

6 Indonesia Flour Market, By Types |

6.1 Indonesia Flour Market, By Raw Material |

6.1.1 Overview and Analysis |

6.1.2 Indonesia Flour Market Revenues & Volume, By Raw Material, 2020-2030F |

6.1.3 Indonesia Flour Market Revenues & Volume, By Wheat, 2020-2030F |

6.1.4 Indonesia Flour Market Revenues & Volume, By Rice, 2020-2030F |

6.1.5 Indonesia Flour Market Revenues & Volume, By Maize, 2020-2030F |

6.1.6 Indonesia Flour Market Revenues & Volume, By Others, 2020-2030F |

6.2 Indonesia Flour Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 Indonesia Flour Market Revenues & Volume, By Bread & Bakery Products, 2020-2030F |

6.2.3 Indonesia Flour Market Revenues & Volume, By Noodles & Pasta, 2020-2030F |

6.2.4 Indonesia Flour Market Revenues & Volume, By Animal Feed, 2020-2030F |

6.2.5 Indonesia Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2020-2030F |

6.2.6 Indonesia Flour Market Revenues & Volume, By Non-Food Application, 2020-2030F |

6.2.7 Indonesia Flour Market Revenues & Volume, By Others, 2020-2030F |

6.3 Indonesia Flour Market, By Technology |

6.3.1 Overview and Analysis |

6.3.2 Indonesia Flour Market Revenues & Volume, By Dry Technology, 2020-2030F |

6.3.3 Indonesia Flour Market Revenues & Volume, By Wet Technology, 2020-2030F |

7 Indonesia Flour Market Import-Export Trade Statistics |

7.1 Indonesia Flour Market Export to Major Countries |

7.2 Indonesia Flour Market Imports from Major Countries |

8 Indonesia Flour Market Key Performance Indicators |

9 Indonesia Flour Market - Opportunity Assessment |

9.1 Indonesia Flour Market Opportunity Assessment, By Raw Material, 2020 & 2030F |

9.2 Indonesia Flour Market Opportunity Assessment, By Applications, 2020 & 2030F |

9.3 Indonesia Flour Market Opportunity Assessment, By Technology, 2020 & 2030F |

10 Indonesia Flour Market - Competitive Landscape |

10.1 Indonesia Flour Market Revenue Share, By Companies, 2023 |

10.2 Indonesia Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero