Indonesia Video Surveillance Market (2016-2022) | Outlook, Revenue, Size, Share, Forecast, Growth, Companies, Industry, Value, Trends & Analysis

Market Forecast By Surveillance Type (Analog & IP Surveillance), Software (Video Management Software, Video Analytics and Others), By Components (Cameras (Analog and IP)), DVR/NVR, Encoders/Decoders, By Verticals (Government & Transportation, Banking & Financial, Retail & Logistics, Industrial & Manufacturing, Commercial Offices, Residential, Hospitality & Healthcare and Educational Institutions) and Regions (Sumatra, Java, Bali, Nusa Tenggara, Kalimantan, Sulawesi, Maluku and Gauteng)

| Product Code: ETC000309 | Publication Date: May 2016 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 144 | No. of Figures: 97 | No. of Tables: 25 |

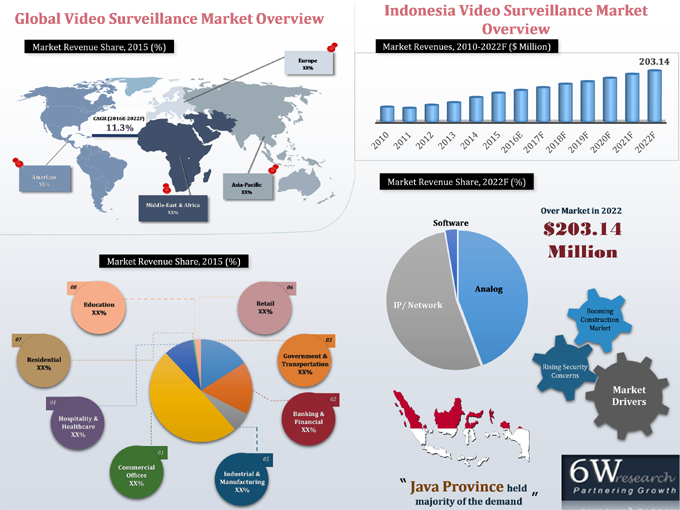

Surging real estate sector, rising security concerns predominantly terrorism & crime rate, booming tourism industry, upcoming government infrastructure and transportation projects coupled with increasing urbanization are some of the prime factors driving the overall growth of video surveillance market in Indonesia. Presently, in Indonesia video surveillance market, analog video surveillance segment accounted for majority of the market revenues and volume on account of low pricing, easy accessibility and budget constraints amongst various vertical markets primarily SMEs. Whereas, IP video surveillance systems are majorly deployed in government & transportation, banking & financial and large scale enterprises.According to 6Wresearch, Indonesia video surveillance market is projected to reach $203.14 million by 2022. Despite global financial crisis during 2008-09, Indonesia's construction market posted positive growth as a result of growing government spending towards new projects pertaining to infrastructure and construction. Indonesia further recorded growth in FDI inflows during 2010-15. Amongst all the verticals, commercial offices vertical acquired largest revenue share of the market pie in the country. Over the next six years, banking & financial and retail verticals are forecast to grow at a relatively higher CAGR from 2016 to 2022.In Indonesia video surveillance market, Java and Sumatra accounted for majority of market revenues in 2015. Java and Sumatra registered high deployment of video surveillance systems.The report thoroughly covers the market by video surveillance types, by verticals, and by regions. The report provides unbiased and detailed analysis of the on-going trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global Video Surveillance Market for the Period 2010-2015

• Market Size & Forecast of Global Video Surveillance Market until 2022

• Historical data of Indonesia Video Surveillance Market Revenue & Volume for the Period 2010-2015

• Market Size & Forecast of Indonesia Video Surveillance Revenue & Volume Market until 2022

• Historical data of Indonesia Analog Video Surveillance Market Revenue & Volume for the Period 2010-2015

• Market Size & Forecast of Indonesia Analog Video Surveillance Market Revenue & Volume until 2022

• Historical data of Indonesia IP Video Surveillance Market Revenue & Volume for the Period 2010-2015

• Market Size & Forecast of Indonesia IP Video Surveillance Market Revenue & Volume until 2022

• Historical data of Indonesia Video Surveillance Software Market Revenue for the Period 2010-2015

• Market Size & Forecast of Indonesia Video Surveillance Software Market Revenue until 2022

• Historical data of Indonesia Video Surveillance Vertical Market Revenue for the Period 2010-2015

• Market Size & Forecast of Indonesia Video Surveillance Vertical Market Revenue until 2022

• Historical & Forecast data of Indonesia Video Surveillance Regional Market Revenue for the Period 2010-2015

• Market Drivers, Restraints and Trends

• Players Market Share, Competitive Landscape and Company Profiles

Markets Covered

The report provides the detailed analysis of the following market segments:

• Video Surveillance Type

o Analog Video Surveillance

o IP/ Network Video Surveillance

o Video Surveillance Software

• Applications

o Banking & Financial

o Government & Transportation

o Retail

o Commercial Offices

o Industrial & Manufacturing

o Residential

o Hospitality & Healthcare

o Educational Institutions

• Regions

o Sumatra

o Java

o Bali & Nusa Tenggara

o Kalimantan

o Sulawesi

o Manuku

o Papua

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions & Methodology

3 Global Video Surveillance Market Overview

3.1 Global Video Surveillance Market Revenues (2010-2022F)

3.2 Global Video Surveillance Market Volume (2010-2022F)

3.3 Global Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

4 Indonesia Video Surveillance Market Overview

4.1 Indonesia Video Surveillance Market Revenues (2010-2022F)

4.2 Indonesia Video Surveillance Market Volume (2010-2022F)

4.3 Indonesia Video Surveillance Industry Life Cycle

4.4 Indonesia Video Surveillance Market Opportunistic Matrix

4.5 Indonesia Video Surveillance Market Porter's Five Forces Model Analysis

4.6 Indonesia Video Surveillance Market Revenue Share, By Types (2015 & 2022F)

4.7 Indonesia Video Surveillance Market Revenue Share, By Verticals (2015 & 2022F)

4.8 Indonesia Video Surveillance Market Revenue Share, By Regions (2015 & 2022F)

5 Indoensia Video Surveillance Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6 Indonesia Video Surveillance Market Opportunities and Trends

6.1 Growing Demand for HD Video Surveillance Cameras

6.2 Increasing Penetration of Chinese Brands

7 Indonesia Analog Video Surveillance Market Overview

7.1 Indonesia Analog Video Surveillance Market Revenues (2010-2022F)

7.1.1 Indonesia Analog Video Surveillance Market Revenues, By Components (2010-2022F)

7.2 Indonesia Analog Video Surveillance Market Volume (2010-2022F)

7.2.1 Indonesia Analog Video Surveillance Market Volume, By Components (2010-2022F)

7.3 Indonesia Analog Video Surveillance Market Revenues, By Verticals (2010-2022F)

7.4 Indonesia Analog Video Surveillance Market Price Trend (2010-2022F)

8 Indonesia IP Video Surveillance Market Overview

8.1 Indonesia IP Video Surveillance Market Revenues (2010-2022F)

8.1.1 Indonesia IP Video Surveillance Market Revenues, By Components (2010-2022F)

8.2 Indonesia IP Video Surveillance Market Volume (2010-2022F)

8.2.1 Indonesia IP Video Surveillance Market Volume, By Components (2010-2022F)

8.2.2 Indonesia IP Video Surveillance Market Revenues, By Verticals (2010-2022F)

8.3 Indonesia IP Video Surveillance Market Price Trend (2010-2022F)

9 Indonesia Video Surveillance Software Market Overview

9.1 Indonesia Video Surveillance Software Market Revenues (2010-2022F)

9.1.1 Indonesia Video Management Software Market Revenues (2010-2022F)

9.1.2 Indonesia Video Analytics Software Market Revenues (2010-2022F)

9.1.3 Indonesia Other Video Surveillance Software Market Revenues (2010-2022F)

9.2 Indonesia Video Surveillance Software Market Revenues, By Verticals (2010-2022F)

10 Indonesia Video Surveillance Market Overview, By Verticals

10.1 Indonesia Banking & Financial Video Surveillance Market Revenues (2010-2022F)

10.2 Indonesia Government & Transportation Video Surveillance Market Revenues (2010-2022F)

10.3 Indonesia Retail Video Surveillance Market Revenues (2010-2022F)

10.4 Indonesia Commercial Offices Video Surveillance Market Revenues (2010-2022F)

10.5 Indonesia Industrial & Manufacturing Video Surveillance Market Revenues (2010-2022F)

10.6 Indonesia Residential Video Surveillance Market Revenues (2010-2022F)

10.7 Indonesia Educational Institutions Video Surveillance Market Revenues (2010-2022F)

10.8 Indonesia Hospitality & Healthcare Video Surveillance Market Revenues (2010-2022F)

11 Indonesia Video Surveillance Market Overview, By Region

11.1 Sumatra and Java Regions' Video Surveillance Market Revenues (2010-2022F)

11.2 Bali & Nusa Tenggara and Kalimantan Regions' Video Surveillance Market Revenues (2010-2022F)

11.3 Sulawesi and Maluku Regions' Video Surveillance Market Revenues (2010-2022F)

11.4 Gauteng Region's Video Surveillance Market Revenues (2010-2022F)

12 Competitive Landscape

12.1 Indonesia Video Surveillance Market Revenue Share, By Company (2015)

12.2 Competitive Benchmarking, By Technology

13 Company Profiles

13.1 AVTECH Corp.

13.2 Axis Communications AB

13.3 Bosch Security Systems, Inc.

13.4 Hangzhou Hikvision Digital Technology Co. Ltd. (Hikvision)

13.5 Hanwha Techwin Co. Ltd. (Samsung)

13.6 Honeywell International Inc.

13.7 Panasonic Corporation

13.8 Pelco by Schneider Electric

13.9 Vivotek Inc.

13.10 Zhejiang Dahua Technology Co., Ltd. (Dahua)

14 Key Strategic Pointers

15 Disclaimer

List of Figures

Figure 1 Evolution of Video Surveillance System

Figure 2 Global Video Surveillance Market Revenues, 2010-2015 ($ Billion)

Figure 3 Global Video Surveillance Market Revenues, 2016E-2022F ($ Billion)

Figure 4 Video Surveillance Market Revenue Share, By Component (2015)

Figure 5 Global Video Surveillance Market Volume, 2010-2022F (Million Units)

Figure 6 Global Video Surveillance Market Revenue Share, By Region (2015)

Figure 7 Indonesia Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 8 Indonesia Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 9 Major Upcoming Government Projects in Indonesia

Figure 10 Indonesia IT Spending, 2010-2022 ($ Billion)

Figure 11 Indonesia FDI Inflows, 2010-2015 ($ Billion)

Figure 12 Indonesia Video Surveillance Market Revenues, 2010-2015 (Million Units)

Figure 13 Indonesia Video Surveillance Market Revenues, 2016E-2022F (Million Units)

Figure 14 Indonesia Video Surveillance Market Industry Life Cycle (2015)

Figure 15 Indonesia Video Surveillance Market Revenue Share, By Types (2015)

Figure 16 Indonesia Video Surveillance Market Revenue Share, By Types (2022F)

Figure 17 Indonesia Video Surveillance Market Revenue Share, By Verticals (2015)

Figure 18 Indonesia Video Surveillance Market Revenue Share, By Verticals (2022F)

Figure 19 Indonesia Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

Figure 20 Indonesia Construction Market Revenues, 2010-2022F ($ Billion)

Figure 21 Indonesia Energy Vs. Subsidy, 2011-2016E ($ Billion)

Figure 22 FDI Inflows in Construction, By Sector (2014)

Figure 23 Indonesia Crime Statistics, 2010-2014 (In Thousand)

Figure 24 Indonesia Analog Vs. IP Video Surveillance System Price Trend, 2010-2022F (In $ Per Unit)

Figure 25 Indonesia Video Surveillance Market Revenue Share, By IP Video Surveillance (2010-2022F)

Figure 26 Indonesia Analog Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 27 Indonesia Analog Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 28 Indonesia Analog Video Surveillance Market Volume, 2010-2015 (Million Units)

Figure 29 Indonesia Analog Video Surveillance Market Volume, 2016E-2022F (Million Units)

Figure 30 Indonesia Analog Video Surveillance Vertical Market Revenue Share (2015)

Figure 31 Indonesia Analog Video Surveillance Vertical Market Revenue Share (2022F)

Figure 32 Indonesia Analog Camera Market Price Trend, 2010-2022F ($ Per Unit)

Figure 33 Indonesia DVR Market Price Trend, 2010-2022F ($ Per Unit)

Figure 34 Indonesia IP Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 35 Indonesia IP Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 36 Indonesia IP Video Surveillance Market Volume, 2010-2015 (Million Units)

Figure 37 Indonesia IP Video Surveillance Market Volume, 2016E-2022F (Million Units)

Figure 38 Indonesia IP Video Surveillance Verticals Market Revenue Share (2015)

Figure 39 Indonesia IP Video Surveillance Verticals Market Revenue Share (2022F)

Figure 40 Indonesia IP Camera Market Price Trend, 2010-2022F ($ Per Unit)

Figure 41 Indonesia NVR Market Price Trend, 2010-2022F ($ Per Unit)

Figure 42 Indonesia Encoder/ Decoder Market Price Trend, 2010-2022F ($ Per Unit)

Figure 43 Indonesia Video Surveillance Software Market Revenues, 2010-2015 ($ Million)

Figure 44 Indonesia Video Surveillance Software Market Revenues, 2016E-2022F ($ Million)

Figure 45 Indonesia Video Management Software Market Revenues, 2010-2022F ($ Million)

Figure 46 Indonesia Video Analytics Software Market Revenues, 2010-2022F ($ Million)

Figure 47 Indonesia Other Video Surveillance Software Market Revenues, 2010-2022F ($ Million)

Figure 48 Indonesia Video Surveillance Verticals Market Revenue Share (2015)

Figure 49 Indonesia Video Surveillance Verticals Market Revenue Share (2022F)

Figure 50 Indonesia Video Surveillance Market Penetration, By Verticals (2022F)

Figure 51 Banking & Financial Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 52 Banking & Financial Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 53 Indonesia Number of New ATMs, 2010-2022F (In Thousand)

Figure 54 Indonesia Number of New Bank Offices, 2010-2015 (In Thousand)

Figure 55 Indonesia Number of New Bank Offices, 2010-2022F (In Thousand)

Figure 56 Government & Transportation Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 57 Government & Transportation Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 58 Indonesia's Upcoming Infrastructural Projects

Figure 59 Retail Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 60 Retail Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 61 Indonesia Retail Market, 2011-2022F ($ Billion)

Figure 62 Number of New Modern Retail Outlets and Hypermarkets in Indonesia, 2010-2022F (In Thousand)

Figure 63 Number of New Hypermarkets in Indonesia, 2010-2022F

Figure 64 Commercial Offices Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 65 Commercial Offices Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 66 Indonesia Number of New Small & Medium Enterprises, 2010-2015E (In Thousand)

Figure 67 Indonesia Number of Large Enterprises, 2010-2015E (In Thousand)

Figure 68 Industrial & Manufacturing Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 69 Industrial & Manufacturing Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 70 FDI Inflows by Countries, 2014

Figure 71 Residential Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 72 Residential Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 73 Educational Institutions Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 74 Educational Institutions Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 75 Number of Schools in Indonesia, (2010-2013)

Figure 76 Hospitality & Healthcare Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 77 Hospitality & Healthcare Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 78 Key Developments in Indonesia Hospitality Sector

Figure 79 Five Largest Hotel Markets in Indonesia, 2013 (In units)

Figure 80 Five Largest Hotel Markets in Indonesia, 2014 (In units)

Figure 81 Key Developments in Indonesia Healthcare Sector

Figure 82 Indonesia Video Surveillance Sumatra Region Market Revenues, 2010-2015 ($ Million)

Figure 83 Indonesia Video Surveillance Sumatra Region Market Revenues, 2016E-2022F ($ Million)

Figure 84 Indonesia Video Surveillance Java Region Market Revenues, 2010-2015 ($ Million)

Figure 85 Indonesia Video Surveillance Java Region Market Revenues, 2016E-2022F ($ Million)

Figure 86 Indonesia Video Surveillance Bali & Nusa Tenggara Region Market Revenues, 2010-2015 ($ Million)

Figure 87 Indonesia Video Surveillance Bali & Nusa Tenggara Region Market Revenues, 2016E-2022F ($ Million)

Figure 88 Indonesia Video Surveillance Kalimantan Region Market Revenues, 2010-2015 ($ Million)

Figure 89 Indonesia Video Surveillance Kalimantan Region Market Revenues, 2016E-2022F ($ Million)

Figure 90 Indonesia Video Surveillance Sulawesi Region Market Revenues, 2010-2015 ($ Million)

Figure 91 Indonesia Video Surveillance Sulawesi Region Market Revenues, 2016E-2022F ($ Million)

Figure 92 Indonesia Video Surveillance Maluku Region Market Revenues, 2010-2015 ($ Million)

Figure 93 Indonesia Video Surveillance Maluku Region Market Revenues, 2016E-2022F ($ Million)

Figure 94 Indonesia Video Surveillance Papua Region Market Revenues, 2010-2015 ($ Million)

Figure 95 Indonesia Video Surveillance Gauteng Province Market Revenues, 2016E-2022F ($ Million)

Figure 96 Indonesia Video Surveillance Market Revenues Share, By Companies (2015)

Figure 97 Indonesia Oil Production & Refinery Capacities, 2005-2014 (‘000 Barrels Daily & Billion Cubic Meters)

List of Tables

Table 1 Indonesia Analog Video Surveillance Market Revenues, By Components, 2010-2015 ($ Million)

Table 2 Indonesia Analog Video Surveillance Market Revenues, By Components, 2016E-2022F ($ Million)

Table 3 Indonesia Analog Video Surveillance Market Volume, By Components, 2010-2015 (Million Units)

Table 4 Indonesia Analog Video Surveillance Market Volume, By Components, 2016E-2022F (Million Units)

Table 5 Indonesia Analog Video Surveillance Market Revenues, By Verticals, 2010-2015 ($ Million)

Table 6 Indonesia Analog Video Surveillance Market Revenues, By Verticals, 2016E-2022F ($ Million)

Table 7 Indonesia IP Video Surveillance Market Revenues, By Components, 2010-2015 ($ Million)

Table 8 Indonesia IP Video Surveillance Market Revenues, By Components, 2016E-2022F ($ Million)

Table 9 Indonesia IP Video Surveillance Market Volume, By Components, 2010-2015 (Thousand Units)

Table 10 Indonesia IP Video Surveillance Market Volume, By Components, 2016E-2022F (Thousand Units)

Table 11 Indonesia IP Video Surveillance Market Revenues, By Verticals, 2010-2015 ($ Million)

Table 12 Indonesia IP Video Surveillance Market Revenues, By Verticals, 2016E-2022F ($ Million)

Table 13 Indonesia Video Surveillance Software Market Revenues, By Verticals, 2010-2015 ($ Million)

Table 14 Indonesia Video Surveillance Software Market Revenues, By Verticals, 2016E-2022F ($ Million)

Table 15 Indonesia's Upcoming Projects under PPP Scheme (2015)

Table 16 Jakarta Retail Center Development in Pipeline (2015-16)

Table 17 Projects Pertaining to Commercial Office Buildings in Jakarta (2016E-2019F)

Table 18 Jakarta Apartment Units Development in Pipeline (2016-19)

Table 19 Upcoming Residential Apartment Projects in Surabaya (2016-19)

Table 20 Number of Households, By Provinces in Java Island (000' Household)

Table 21 Key Hotel Developments in Jakarta

Table 22 Key Hotel Developments in Bali

Table 23 Indonesia Video Surveillance Market Revenue Share of Top 4 Players, 2015 ($ Million)

Table 24 Honeywell International Inc. Financial Statement, 2011-2014 ($ Billion)

Table 25 Schneider Electric SA Financial Statement, 2011-2014 ($ Billion)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero