Malaysia Agriculture Equipment Market (2025-2031) | Companies, Trends, Growth, Size, Analysis, Value, Share, Revenue, Outlook ,Forecast & Industry

Market Forecast By Products (Tractors (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Harvesters (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Threshers (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Pumps (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Power Tillers (Up To 30 HP And 30.1 HP- 70 HP), Rotavators (Up To 30 HP, 30.1 HP- 70 HP And 70.1 HP- 130 HP) And Others Including Rice Transplanters, Weeders, Excavators And Farm Carriers)) And Competitive Landscape

| Product Code: ETC160082 | Publication Date: Feb 2022 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

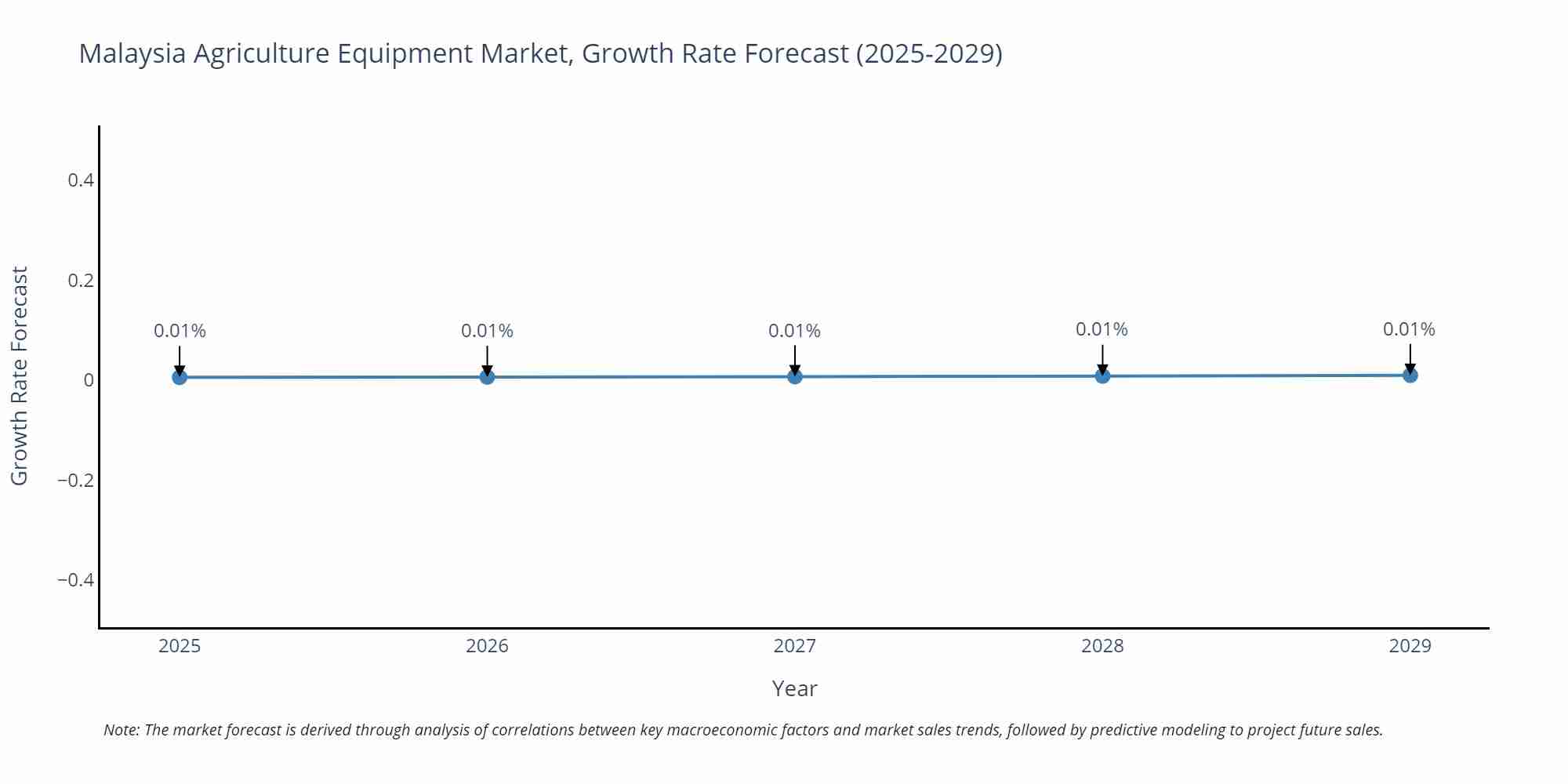

Malaysia Agriculture Equipment Market Size Growth Rate

The Malaysia Agriculture Equipment Market is poised for steady growth rate improvements from 2025 to 2029. The growth rate starts at 0.01% in 2025 and reaches 0.01% by 2029.

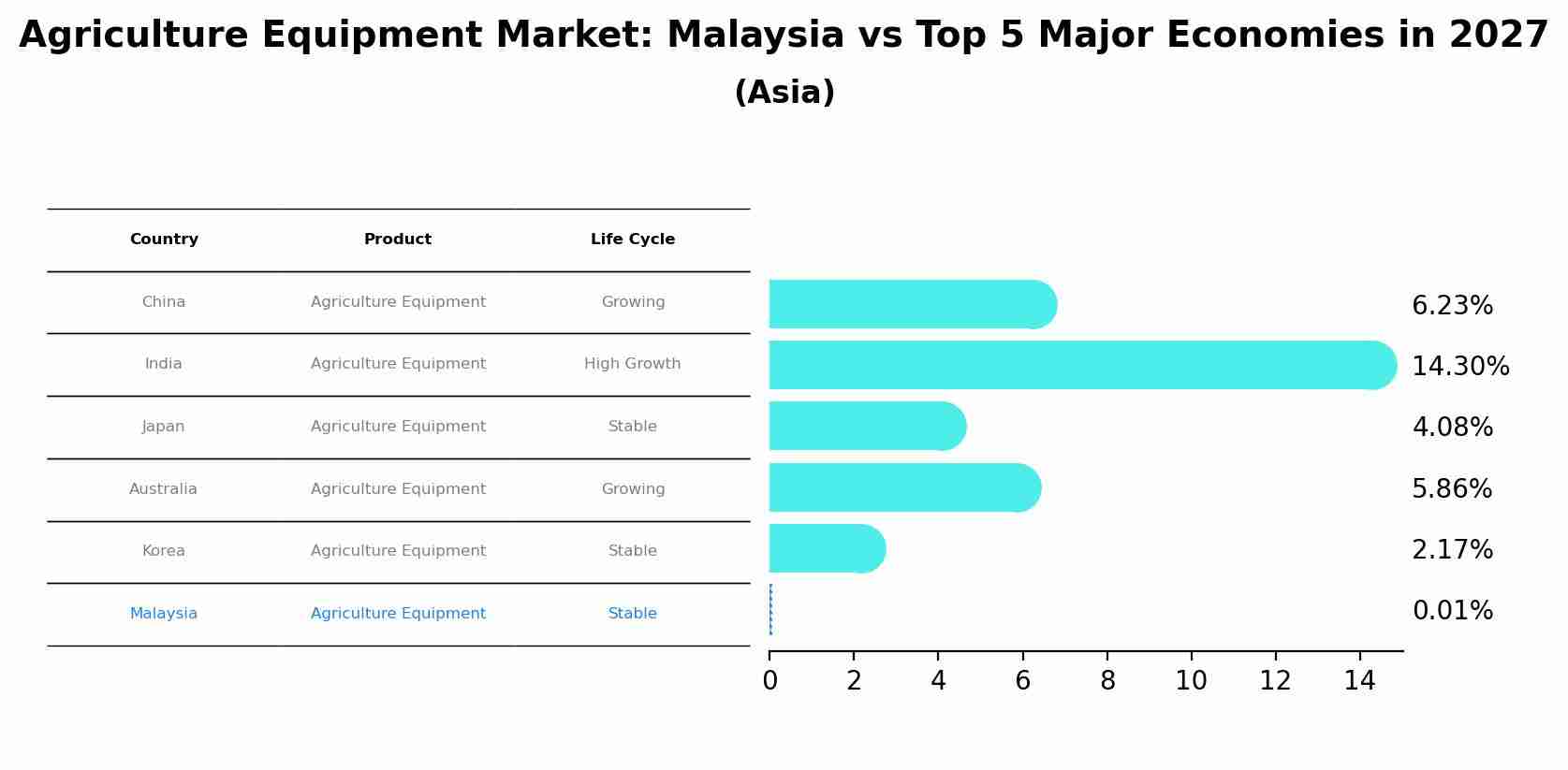

Agriculture Equipment Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

By 2027, Malaysia's Agriculture Equipment market is forecasted to achieve a stable growth rate of 0.01%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Malaysia Agriculture Equipment Market Highlights

| Report Name | Malaysia Agriculture Equipment Market |

| Forecast period | 2025-2031 |

| CAGR | 6.2% |

| Growing Sector | Agriculture |

Topics Covered in the Malaysia Agriculture Equipment Market Report

Malaysia Agriculture Equipment Market report thoroughly covers the market by product. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Malaysia Agriculture Equipment Market Synopsis

The Malaysia agriculture equipment market is projected to grow steadily from 2025 and 2031, owing to increased mechanization in farming, government support for modern agriculture, and rising need for effective crop production. Advances in precision farming technologies, as well as increased adoption of sustainable farming techniques, are all contributing to market growth and supporting Malaysia's agricultural development goals.

According to 6Wresearch, Malaysia Agriculture Equipment Market size is expected to grow at a significant CAGR of 6.2% during 2025-2031. A growing population and changing dietary habits are driving the demand for food items, which in turn is driving the Malaysian agriculture equipment industry. As a result, effective farming methods are now required to increase output. The creation of sophisticated and effective agricultural machinery has been made possible by technological breakthroughs, which have increased crop yields and decreased reliance on manpower. Modern technology that supports ecologically friendly agricultural processes is also widely used as a result of growing awareness of sustainable farming practices. The need for agriculture equipment in Malaysia is rising as a result of these factors, which also encourage innovation and progress. These factors are fuelling the Malaysia agriculture equipment market growth.

Several obstacles are limiting the expansion of the agriculture equipment market in Malaysia. Modern agriculture equipment is too expensive for any small-scale farmers to purchase, which restricts their capacity to use cutting-edge machinery. Furthermore, running and maintaining advanced technology is made extremely difficult by a lack of technical know-how and experienced workers. Farmers are further prevented from investing in essential agricultural equipment by limited access to credit and financing options. To overcome these obstacles and encourage Malaysia's use of contemporary agriculture technology, these problems must be addressed through subsidies, training initiatives, and improved financial support systems.

Malaysia Agriculture Equipment Market Trends

The Malaysia agriculture equipment industry is undergoing significant trends that will influence its future. Precision agricultural methods, like drones and GPS-guided tractors, are becoming more popular because they allow farmers to save expenses and increase productivity. Farm management and decision-making procedures are becoming better with the use of smart farming solutions, such as data analytics and IoT-enabled sensors. Additionally, the demand for specialist equipment designed for environmentally friendly agricultural processes is being driven by the growing trend toward organic and sustainable farming practices. These patterns show how Malaysia's agriculture industry is still changing and set up the market for major developments and expansion in the years to come.

Investment Opportunities in the Malaysia Agriculture Equipment Market

Malaysia's expanding demand for agriculture equipment presents a variety of investment opportunities for market participants. By creating and producing equipment specifically suited to Malaysian farmers' requirements, local issues can be successfully resolved. By making cutting-edge equipment more affordable and available to small-scale farmers, rental or leasing services can promote broader adoption. Collaboration with regional farmers, governmental organizations, and academic institutions can also encourage creativity and result in effective and long-term agriculture solutions. These tactics not only help Malaysia's agriculture industry modernize, but they also open doors for companies looking to take advantage of the market's potential for expansion.

Leading Players in the Malaysia Agriculture Equipment Market

Major participants in the Malaysian agriculture equipment market include Claas KGaA mbH, Mahindra & Mahindra Ltd., John Deere, CNH Industrial, Kubota Corporation, AGCO Corporation, and Yanmar Company Limited. These companies are making significant investments in R&D to launch cutting-edge agricultural equipment designed to satisfy the changing demands of Malaysian farmers. By concentrating on improving sustainability, efficiency, and accuracy, they hope to tackle issues in contemporary farming. They are staying competitive by implementing strategic efforts like product diversification and technical developments, which also assist the agriculture equipment market in Malaysia grow and modernize.

Government Regulations

The Malaysian government actively supports the agriculture sector through a variety of initiatives and policies. The National Agriculture Policy prioritizes increasing industry competitiveness, sustainability, and productivity. For the purchase of cutting-edge agriculture equipment and the adoption of sustainable farming methods, the government offers incentives and subsidies to promote modernization. Furthermore, research organizations like the Malaysian Agricultural Research and Development Institute (MARDI) are essential for promoting technical innovation. By ensuring the sector's growth and improving agricultural efficiency, these efforts hope to contribute to the long-term development of Malaysia's agricultural landscape.

Future Insights of the Malaysia Agriculture Equipment Market

Malaysia's agriculture equipment market appears to have a bright future, owing to government assistance, technical developments, and increased awareness of sustainable farming practices. Farmers' productivity and profitability are increasing as a result of the market's trend towards more sophisticated and effective equipment. The agriculture equipment market is expected to increase steadily due to the growing population and rising need for food. Businesses and investors now have a lot of chances to support the growth of this industry. All things considered, the market's promising future makes it a desirable place to invest, and as technology advances, the sector will continue to undergo innovation and change.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Tractor to dominate the Market - by Product

According to Ravi Bhandari, Research Head, 6Wresearch, tractors currently dominate the Malaysia agriculture equipment industry, owing to their vital role in modern farming. Tractors are essential for many operations, including plowing, planting, and harvesting, making them an important investment for increasing production and efficiency in Malaysian agriculture.

Key Attractiveness

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Malaysia Agriculture Equipment Market Outlook

- Malaysia Agriculture Equipment Market Overview

- Malaysia Agriculture Equipment Market Forecast

- Malaysia Agriculture Equipment Market Size

- Malaysia Agriculture Equipment Market Share, by-products

- Malaysia Agriculture Equipment Market Forecast of revenues until 2031

- Historical Data of Malaysia Agriculture Equipment Market Revenues and Volume, by-products for the Period 2021-2031

- Market Size & Forecast of Malaysia Agriculture Equipment Market Revenues and Volume, by-products until 2031

- Malaysia Tractor Market Revenue and Volume Share, By HP Range

- Historical Data of Malaysia Tractor Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Malaysia Tractor Market Revenues and Volume, By HP range until 2031

- Malaysia Harvester Market Revenue and Volume Share, By HP Range

- Historical Data of Malaysia Harvester Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Malaysia Harvester Revenue and Volume Share, By HP range until 2031

- Malaysia Thresher Market Revenue and Volume Share, By HP Range

- Historical Data of Malaysia Thresher Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Malaysia Thresher Market Revenues and Volume, By HP range until 2031

- Malaysia Pumps Market Revenue and Volume Share, By HP Range

- Historical Data of Malaysia Pumps Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Malaysia Pumps Market Revenues and Volume, By HP range until 2031

- Malaysia Power Tiller Market Revenue and Volume Share, By HP Range

- Historical Data of Malaysia Power Tiller Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Malaysia Power Tiller Market Revenues and Volume, By HP range until 2031

- Malaysia Rotavator Market Revenue and Volume Share, By HP Range

- Historical Data of Malaysia Rotavator Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Malaysia Rotavator Market Revenues and Volume, By HP range until 2031

- Malaysia Agriculture Equipment Market Drivers and Restraints

- Malaysia Agriculture Equipment Market Trends

- Porter’s Five Forces Analysis and Market Opportunity Assessment

- Malaysia Agriculture Equipment Market Share, by Companies

- Malaysia Agriculture Equipment Market Overview, by Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Market Covered

The Malaysia Agriculture Equipment market report provides a detailed analysis of the following market segments

By product

- Tractors

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Harvesters

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Threshers

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Pumps

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Power Tillers

- Up to 30 HP

- 30.1 HP- 70 HP

- Rotavators

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- Others (Rice Transplanter, Weeders, Excavators and Farm Carriers)

Malaysia Agriculture Equipment Market (2025-2031) : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Malaysia Agriculture Equipment Market Overview |

| 3.1. Malaysia Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 3.2. Malaysia Agriculture Equipment Market Industry Life Cycle, 2018 |

| 3.3. Malaysia Agriculture Equipment Market Porter’s Five Forces |

| 3.4. Malaysia Agriculture Equipment Market Revenue and Volume Share, By Equipment, 2021 & 2031F |

| 4. Malaysia Agriculture Equipment Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Malaysia Tractor Market Overview |

| 5.1. Malaysia Tractor Market Revenues and Volume, 2021-2031F |

| 5.2. Malaysia Tractor Market Revenue Share, By HP Range, 2021 & 2031F |

| 5.3. Malaysia Tractor Market Volume Share, By HP Range, 2021 & 2031F |

| 5.4. Malaysia Tractor Market Revenues and Volume, By HP Range, 2021-2031F |

| 5.5. Malaysia Tractor Market Price Trend, By HP Range, 2021-2031F |

| 6. Malaysia Harvester Market Overview |

| 6.1. Malaysia Harvester Market Revenues and Volume, 2021-2031F |

| 6.2. Malaysia Harvester Market Revenue Share, By HP Range, 2021 & 2031F |

| 6.3. Malaysia Harvester Market Volume Share, By HP Range, 2021 & 2031F |

| 6.4. Malaysia Harvester Market Revenues and Volume, By HP Range, 2021-2031F |

| 6.5. Malaysia Harvester Market Price Trend, By HP Range, 2021-2031F |

| 7. Malaysia Thresher Market Overview |

| 7.1. Malaysia Thresher Market Revenues and Volume, 2021-2031F |

| 7.2. Malaysia Thresher Market Revenue Share, By HP Range, 2021 & 2031F |

| 7.3. Malaysia Thresher Market Volume Share, By HP Range, 2021 & 2031F |

| 7.4. Malaysia Thresher Market Revenues and Volume, By HP Range, 2021-2031F |

| 7.5. Malaysia Thresher Market Price Trend, By HP Range, 2021-2031F |

| 8. Malaysia Pumps Market Overview |

| 8.1. Malaysia Pumps Market Revenues and Volume, 2021-2031F |

| 8.2. Malaysia Pumps Market Revenue Share, By HP Range, 2021 & 2031F |

| 8.3. Malaysia Pumps Market Volume Share, By HP Range, 2021 & 2031F |

| 8.4. Malaysia Pumps Market Revenues and Volume, By HP Range, 2021-2031F |

| 8.5. Malaysia Pumps Market Price Trend, By HP Range, 2021-2031F |

| 9. Malaysia Power Tiller Market Overview |

| 9.1. Malaysia Power Tiller Market Revenues and Volume, 2021-2031F |

| 9.2. Malaysia Power Tiller Market Revenue Share, By HP Range, 2021 & 2031F |

| 9.3. Malaysia Power Tiller Market Volume Share, By HP Range, 2021 & 2031F |

| 9.4. Malaysia Power Tiller Market Revenues and Volume, By HP Range, 2021-2031F |

| 9.5. Malaysia Power Tiller Market Price Trend, By HP Range, 2021-2031F |

| 10. Malaysia Rotavator Market Overview |

| 10.1. Malaysia Rotavator Market Revenues and Volume, 2021-2031F |

| 10.2. Malaysia Rotavator Market Revenue Share, By HP Range, 2021 & 2031F |

| 10.3. Malaysia Rotavator Market Volume Share, By HP Range, 2021 & 2031F |

| 10.4. Malaysia Rotavator Market Revenues and Volume, By HP Range, 2021-2031F |

| 10.5. Malaysia Rotavator Market Price Trend, By HP Range, 2021-2031F |

| 11. Malaysia Other Agriculture Equipment Market Overview |

| 11.1. Malaysia Other Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 12. Malaysia Key Performance Indicators |

| 13. Malaysia Agriculture Equipment Market Opportunity Assessment |

| 13.1. Malaysia Agriculture Equipment Market, Opportunity Assessment, By Equipment, 2031F |

| 14. Malaysia Agriculture Equipment Market Competitive Landscape |

| 14.1. Malaysia Agriculture Equipment Market Revenue Share, By Companies, 2024 |

| 15. Company Profiles |

| 16. Strategic Recommendations |

| 17. Disclaimer |

South Korea Agriculture Equipment Market Outlook

Philippines Agriculture Equipment Market Outlook

Vietnam Agriculture Equipment Market Outlook

Pakistan Agriculture Equipment Market Outlook

Myanmar Agriculture Equipment Market Outlook

Thailand Agriculture Equipment Market Outlook

Kazakhstan Agriculture Equipment Market Outlook

Bangladesh Agriculture Equipment Market Outlook

Azerbaijan Agriculture Equipment Market Outlook

Sri Lanka Agriculture Equipment Market Outlook

Nepal Agriculture Equipment Market Outlook

Singapore Agriculture Equipment Market Outlook

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero