Pakistan Agriculture Equipment Market (2025-2031) | Analysis, Companies, Value, Trends, Share, Size, Industry, Revenue, Growth & Forecast

Market Forecast By Products (Tractors (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Harvesters (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Threshers (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Pumps (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Power Tillers (Up To 30 HP And 30.1 HP- 70 HP), Rotavators (Up To 30 HP, 30.1 HP- 70 HP And 70.1 HP- 130 HP) And Others Including Rice Transplanters, Weeders, Excavators And Farm Carriers)) And Competitive Landscape

| Product Code: ETC160078 | Publication Date: Jun 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

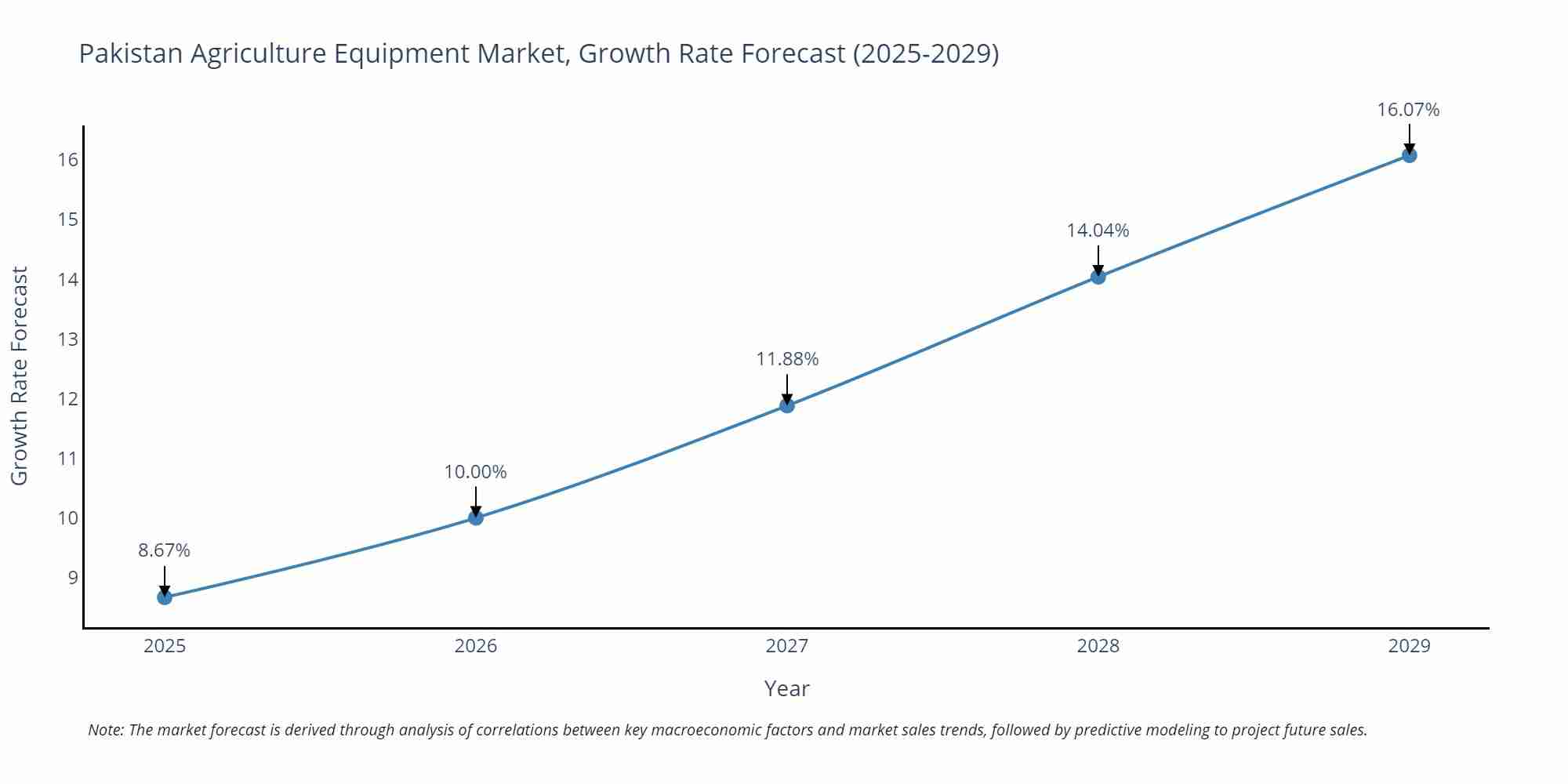

Pakistan Agriculture Equipment Market Size Growth Rate

The Pakistan Agriculture Equipment Market is poised for steady growth rate improvements from 2025 to 2029. From 8.67% in 2025, the growth rate steadily ascends to 16.07% in 2029.

Agriculture Equipment Market: Pakistan vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Agriculture Equipment market in Pakistan is projected to expand at a high growth rate of 11.88% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Pakistan Agriculture Equipment Highlights

| Report Name | Pakistan Agriculture Equipment Market |

| Forecast period | 2025-2031 |

| CAGR | 6.2% |

| Growing Sector | Agriculture |

Topics Covered in the Pakistan Agriculture Equipment Market Report

Pakistan Agriculture Equipment Market report thoroughly covers the market by product. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Pakistan Agriculture Equipment Market Synopsis

The Pakistan agriculture equipment market is projected to grow from 2025 and 2031, driven by increased use of advanced farming technologies and government initiatives. With an emphasis on mechanization, precision farming, and sustainability, the industry is likely to gain from increased demand for modern equipment. Growing food security concerns, as well as technological breakthroughs in agricultural operations, are significant causes.

According to 6Wresearch, Pakistan Agriculture Equipment Market size is expected to grow at a significant CAGR of 6.2% during 2025-2031. Pakistan's growing population has increased food consumption, necessitating a stronger emphasis on raising agricultural output. In order to supply the growing demand for food, this has led to a greater reliance on sophisticated agricultural machinery. Furthermore, the agricultural industry is changing as a result of technology breakthroughs, which allow farmers to use cutting-edge equipment and methods to stay competitive in the worldwide market. Pakistani farmers are increasingly embracing the use of cutting-edge instruments including automated equipment, effective irrigation systems, and precision farming. These factors contribute to the Pakistan's agriculture equipment market growth, which is evolving to suit the demands of a modernized and productive agricultural environment.

Notwithstanding the potential for expansion, a number of obstacles stand in the way of Pakistan's agriculture equipment market's growth. Modern agricultural equipment is nevertheless very expensive initially, especially for small-scale farmers. Furthermore, a lot of farmers do not have access to financial services or credit, which makes it hard for them to purchase sophisticated equipment. Furthermore, the effective use and maintenance of agricultural equipment is hampered by rural areas' poor infrastructure, as well as the scarcity of replacement parts and after-sales services. Resolving these problems is essential to maximizing the potential of Pakistan's agricultural equipment sector.

Pakistan Agriculture Equipment Market Trends

The Pakistan agriculture equipment industry experiences major trends, including increased usage of precision agriculture. Increasingly, farming techniques are being optimized through the use of technologies like drones and GPS. Additionally, as farmers look to lessen their environmental impact, there is a growing need for sustainable and eco-friendly farming equipment. Another factor driving market expansion is the rise of internet marketplaces for the purchase, sale, and rental of farm equipment. These platforms facilitate farmers' access to contemporary tools and services, which propels market growth. These patterns suggest that Pakistan's agricultural equipment market would grow in the upcoming years.

Investment Opportunities in the Pakistan Agriculture Equipment Market

The Pakistan agriculture equipment industry offers numerous investment prospects for both domestic and foreign firms. The production and assembly of agricultural equipment are important areas for investment in order to satisfy the growing demand in the home market. Furthermore, creative solutions that promote sustainable agricultural methods and precision agriculture have the potential to be developed, which would increase productivity and lessen their negative effects on the environment. Growth in this sector can also be fueled by funding research and development to create cutting-edge machinery that is suited to regional farming methods, such as crop-specific machinery and water-efficient tools. These initiatives will promote sectoral development and aid in Pakistan's agricultural modernization.

Leading Players in the Pakistan Agriculture Equipment Market

Al-Ghazi Tractors Limited, Millat Tractors Limited, Orient Agriculture Machinery, AGCO Corporation, and Deere & Company are a few of the major companies in the Pakistani agricultural equipment industry. To bolster their position in the expanding market, these companies are utilizing expansion strategies, strategic alliances, and product breakthroughs. While AGCO Corporation and Deere & Company concentrate on offering cutting-edge agricultural machinery solutions, including precision farming technologies, Al-Ghazi Tractors and Millat Tractors dominate the local market with their wide range of tractor options. To meet the particular requirements of Pakistan's agricultural environment, these businesses are consistently spending money on research and development.

Government Regulations

Pakistan's government has launched a number of measures to improve mechanization and increase agricultural productivity. Modernizing agriculture through greater investment in R&D, farmer capacity-building initiatives, and the encouragement of sustainable farming methods is the main goal of the Vision 2025 plan. Through financial aid and subsidies, the Agricultural Transformation Plan (ATP) seeks to equip small-scale farmers with modern equipment. Furthermore, by encouraging mechanization, precision farming, and the use of premium seeds, the Punjab Agriculture Policy 2020 aims to raise per-acre productivity. The Pakistani market for agricultural equipment is anticipated to expand as a result of these initiatives.

Future Insights of the Pakistan Agriculture Equipment Market

Pakistan's adoption of modern agricultural equipment is anticipated to increase due to the country's expanding population and rising food need. Problems like exorbitant prices and poor infrastructure in rural regions, however, need to be addressed. Government and private sector cooperation can propel the market for agricultural equipment in the direction of sustainable expansion. Additionally, technological developments offer chances to use smart farming solutions designed for small-scale farmers. Pakistan has the potential to play a big role in the global market for agriculture equipment, boosting food production and economic expansion as worries about food security and sustainable agriculture increase.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Tractors to dominate the Market - by Product

According to Ravi Bhandari, Research Head, 6Wresearch, tractors dominate the Pakistan agriculture equipment market, accounting for more than 50% of the total. Their broad use in vital farming operations like as plowing, tilling, and harvesting ensures their continuous demand, making them an important component of the country's agricultural productivity.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Pakistan Agriculture Equipment Market Outlook

- Pakistan Agriculture Equipment Market Overview

- Pakistan Agriculture Equipment Market Forecast

- Pakistan Agriculture Equipment Market Size

- Pakistan Agriculture Equipment Market Share, by-products

- Pakistan Agriculture Equipment Market Forecast of revenues until 2031

- Historical Data of Pakistan Agriculture Equipment Market Revenues and Volume, by-products for the Period 2021-2031

- Market Size & Forecast of Pakistan Agriculture Equipment Market Revenues and Volume, by-products until 2031

- Pakistan Tractor Market Revenue and Volume Share, By HP Range

- Historical Data of Pakistan Tractor Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Pakistan Tractor Market Revenues and Volume, By HP range until 2031

- Pakistan Harvester Market Revenue and Volume Share, By HP Range

- Historical Data of Pakistan Harvester Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Pakistan Harvester Revenue and Volume Share, By HP range until 2031

- Pakistan Thresher Market Revenue and Volume Share, By HP Range

- Historical Data of Pakistan Thresher Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Pakistan Thresher Market Revenues and Volume, By HP range until 2031

- Pakistan Pumps Market Revenue and Volume Share, By HP Range

- Historical Data of Pakistan Pumps Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Pakistan Pumps Market Revenues and Volume, By HP range until 2031

- Pakistan Power Tiller Market Revenue and Volume Share, By HP Range

- Historical Data of Pakistan Power Tiller Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Pakistan Power Tiller Market Revenues and Volume, By HP range until 2031

- Pakistan Rotavator Market Revenue and Volume Share, By HP Range

- Historical Data of Pakistan Rotavator Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Pakistan Rotavator Market Revenues and Volume, By HP range until 2031

- Pakistan Agriculture Equipment Market Drivers and Restraints

- Pakistan Agriculture Equipment Market Trends

- Porter’s Five Forces Analysis and Market Opportunity Assessment

- Pakistan Agriculture Equipment Market Share, by Companies

- Pakistan Agriculture Equipment Market Overview, by Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Market Covered

The Pakistan Agriculture Equipment market report provides a detailed analysis of the following market segments

By Product

- Tractors

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Harvesters

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Threshers

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Pumps

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

- Power Tillers

- Up to 30 HP

- 30.1 HP- 70 HP

- Rotavators

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- Others (Rice Transplanter, Weeders, Excavators and Farm Carriers)

Pakistan Agriculture Equipment Market (2025-2031): FAQs

|

1. Executive Summary |

|

2. Introduction |

|

2.1. Report Description |

|

2.2. Key Highlights of the Report |

|

2.3. Market Scope & Segmentation |

|

2.4. Methodology Adopted and Key Data Points |

|

2.5. Assumptions |

|

3. Pakistan Agriculture Equipment Market Overview |

|

3.1. Pakistan Agriculture Equipment Market Revenues and Volume, 2021-2031F |

|

3.2. Pakistan Agriculture Equipment Market Industry Life Cycle, 2021 |

|

3.3. Pakistan Agriculture Equipment Market Porter’s Five Forces |

|

3.4. Pakistan Agriculture Equipment Market Revenue and Volume Share, By Equipment, 2021 & 2031F |

|

4. Pakistan Agriculture Equipment Market Dynamics |

|

4.1. Impact Analysis |

|

4.2. Market Drivers |

|

4.3. Market Restraints |

|

5. Pakistan Tractor Market Overview |

|

5.1. Pakistan Tractor Market Revenues and Volume, 2021-2031F |

|

5.2. Pakistan Tractor Market Revenue Share, By HP Range, 2021 & 2031F |

|

5.3. Pakistan Tractor Market Volume Share, By HP Range, 2021 & 2031F |

|

5.4. Pakistan Tractor Market Revenues and Volume, By HP Range, 2021-2031F |

|

5.5. Pakistan Tractor Market Price Trend, By HP Range, 2021-2031F |

|

6. Pakistan Harvester Market Overview |

|

6.1. Pakistan Harvester Market Revenues and Volume, 2021-2031F |

|

6.2. Pakistan Harvester Market Revenue Share, By HP Range, 2021 & 2031F |

|

6.3. Pakistan Harvester Market Volume Share, By HP Range, 2021 & 2031F |

|

6.4. Pakistan Harvester Market Revenues and Volume, By HP Range, 2021-2031F |

|

6.5. Pakistan Harvester Market Price Trend, By HP Range, 2021-2031F |

|

7. Pakistan Thresher Market Overview |

|

7.1. Pakistan Thresher Market Revenues and Volume, 2021-2031F |

|

7.2. Pakistan Thresher Market Revenue Share, By HP Range, 2021 & 2031F |

|

7.3. Pakistan Thresher Market Volume Share, By HP Range, 2021 & 2031F |

|

7.4. Pakistan Thresher Market Revenues and Volume, By HP Range, 2021-2031F |

|

7.5. Pakistan Thresher Market Price Trend, By HP Range, 2021-2031F |

|

8. Pakistan Pumps Market Overview |

|

8.1. Pakistan Pumps Market Revenues and Volume, 2021-2031F |

|

8.2. Pakistan Pumps Market Revenue Share, By HP Range, 2021 & 2031F |

|

8.3. Pakistan Pumps Market Volume Share, By HP Range, 2021 & 2031F |

|

8.4. Pakistan Pumps Market Revenues and Volume, By HP Range, 2021-2031F |

|

8.5. Pakistan Pumps Market Price Trend, By HP Range, 2021-2031F |

|

9. Pakistan Power Tiller Market Overview |

|

9.1. Pakistan Power Tiller Market Revenues and Volume, 2021-2031F |

|

9.2. Pakistan Power Tiller Market Revenue Share, By HP Range, 2021 & 2031F |

|

9.3. Pakistan Power Tiller Market Volume Share, By HP Range, 2021 & 2031F |

|

9.4. Pakistan Power Tiller Market Revenues and Volume, By HP Range, 2021-2031F |

|

9.5. Pakistan Power Tiller Market Price Trend, By HP Range, 2021-2031F |

|

10. Pakistan Rotavator Market Overview |

|

10.1. Pakistan Rotavator Market Revenues and Volume, 2021-2031F |

|

10.2. Pakistan Rotavator Market Revenue Share, By HP Range, 2021 & 2031F |

|

10.3. Pakistan Rotavator Market Volume Share, By HP Range, 2021 & 2031F |

|

10.4. Pakistan Rotavator Market Revenues and Volume, By HP Range, 2021-2031F |

|

10.5. Pakistan Rotavator Market Price Trend, By HP Range, 2021-2031F |

|

11. Pakistan Other Agriculture Equipment Market Overview |

|

11.1. Pakistan Other Agriculture Equipment Market Revenues and Volume, 2021-2031F |

|

12. Pakistan Key Performance Indicators |

|

13. Pakistan Agriculture Equipment Market Opportunity Assessment |

|

13.1. Pakistan Agriculture Equipment Market, Opportunity Assessment, By Equipment, 2031F |

|

14. Pakistan Agriculture Equipment Market Competitive Landscape |

|

14.1. Pakistan Agriculture Equipment Market Revenue Share, By Companies, 2024 |

|

15. Company Profiles |

|

16. Strategic Recommendations |

|

17. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero